Boqii Holding Bundle

Can Boqii Holding Company Dominate China's Booming Pet Market?

China's pet industry is experiencing explosive growth, transforming from a niche market into a multi-billion dollar sector. Boqii Holding Company, a leading online platform, is at the forefront of this revolution, offering a comprehensive range of products and services. But what is Boqii's Boqii Holding SWOT Analysis, and how does it plan to capitalize on the future?

This in-depth analysis explores Boqii Holding Company's growth strategy, examining its business model, revenue streams, and market share within the competitive Chinese pet industry. We'll delve into its expansion plans, technological innovations, and financial performance, providing actionable insights for investors and stakeholders. Understanding Boqii's future prospects requires a deep dive into its customer acquisition strategy, growth opportunities, and the challenges it faces in this dynamic market.

How Is Boqii Holding Expanding Its Reach?

Boqii Holding Company is strategically focused on expanding its footprint and offerings within the dynamic pet industry. The company's growth strategy is multifaceted, involving both geographical expansion and product diversification to capitalize on the increasing demand for pet-related goods and services. This approach aims to strengthen its market position and enhance its ability to meet the evolving needs of pet owners in China.

The company's expansion initiatives are designed to build on its existing strengths while exploring new avenues for growth. This includes enhancing its logistics and supply chain to support faster delivery times and a wider range of products. By focusing on both deepening its market presence and diversifying its offerings, Boqii Holding Company seeks to capture a larger share of the growing pet market. This strategy is crucial for sustaining its competitive edge and driving long-term financial performance.

Understanding the Target Market of Boqii Holding is essential for appreciating its expansion strategy. The company's initiatives are tailored to meet the specific needs and preferences of pet owners in China, a market characterized by rapid growth and increasing consumer sophistication. By focusing on these key areas, Boqii aims to solidify its position as a leading player in the pet industry.

Boqii is actively working to deepen its presence in existing markets within China. This includes expanding its reach in major urban centers where pet ownership is on the rise. The company is also carefully considering selective expansion into new urban areas to tap into emerging growth opportunities.

The company is broadening its offerings beyond traditional pet food and supplies. This includes a focus on premium and specialized pet products, such as organic food options and smart pet gadgets. Boqii is also enhancing its pet services segment, including grooming and healthcare, to provide a more comprehensive suite of services.

Boqii emphasizes strategic partnerships with both established and emerging pet brands. The company aims to integrate more third-party services and products onto its platform. This approach creates a more extensive ecosystem for pet owners, enhancing customer value and loyalty.

A key component of Boqii's expansion strategy involves improving its logistics and distribution networks. This enhancement ensures faster and more efficient delivery of products across China. The company is investing in its supply chain to meet the growing demand and maintain a competitive edge.

The pet industry in China continues to offer significant growth potential, driven by rising disposable incomes and a growing pet-owning population. Boqii's focus on the Chinese market allows it to capitalize on these favorable market dynamics. The company's strategic initiatives are designed to position it for long-term success in this expanding market.

- The Chinese pet market is projected to reach a value of over $80 billion by 2025, according to industry reports.

- E-commerce sales in the pet category are expected to continue growing, with a projected increase of over 15% annually.

- Boqii's focus on premium and specialized products aligns with the increasing consumer demand for higher-quality pet supplies and services.

- Partnerships with veterinary clinics and pet service providers will enhance the company's service offerings and customer value proposition.

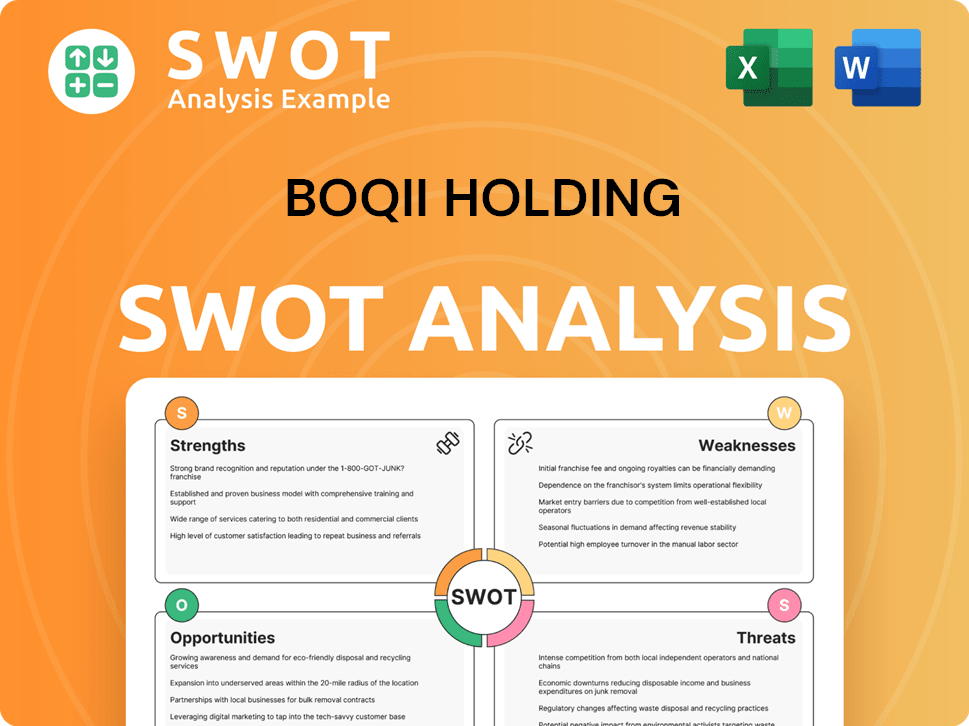

Boqii Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Boqii Holding Invest in Innovation?

Boqii Holding Company's Owners & Shareholders of Boqii Holding growth strategy is heavily reliant on innovation and technology. The company continuously invests in research and development to enhance its e-commerce platform, improve user experience, and streamline its supply chain. This approach is crucial for maintaining a competitive edge in the dynamic pet industry.

The company focuses on digital transformation to refine its mobile applications and web platform, ensuring a seamless user experience. Advanced analytics are used to understand consumer behavior, allowing for targeted marketing and product curation. This strategy is designed to boost customer engagement and drive sales within the online pet store market.

Boqii also explores integrating cutting-edge technologies like artificial intelligence (AI) to improve customer service and product search capabilities. The potential for using the Internet of Things (IoT) in smart pet devices presents future innovation opportunities. These technological advancements are vital for future prospects and market share growth in China.

Continuous improvements to the e-commerce platform are essential for attracting and retaining customers. This includes optimizing the website and mobile app for ease of use and providing a smooth shopping experience. These enhancements directly impact customer acquisition strategy.

Implementing AI and machine learning to personalize product recommendations and improve customer service. AI-powered chatbots can provide instant support, enhancing customer satisfaction. These technologies are key for competitive landscape.

Optimizing supply chain efficiency through automation and data analytics to reduce costs and improve delivery times. This includes using predictive analytics for inventory management. Efficient supply chains are vital for financial performance.

Exploring the integration of IoT devices, such as smart pet trackers and health monitors, to expand product offerings. This innovation can create new revenue streams and enhance customer engagement. IoT integration is a key element of expansion plans.

Leveraging data analytics to gain insights into customer behavior, market trends, and product performance. This data-driven approach informs marketing strategies and product development. Data analytics is crucial for investment analysis.

Focusing on mobile app development to provide a convenient and user-friendly shopping experience. A well-designed mobile app can drive sales and increase customer loyalty. Mobile apps are essential for e-commerce strategy.

Boqii's technology strategy focuses on enhancing its platform, improving user experience, and optimizing operational efficiency. The company invests in several key areas to maintain a competitive edge and drive sustained growth. These initiatives are central to its future growth objectives.

- Personalized Recommendations: Using algorithms to suggest products based on user preferences and purchase history.

- Automated Warehousing: Implementing automation in warehousing and order fulfillment to reduce costs and improve delivery times.

- Customer Service Chatbots: Deploying AI-powered chatbots to provide instant customer support and enhance user experience.

- Inventory Management: Utilizing predictive analytics to optimize inventory levels and reduce waste.

- Mobile App Optimization: Regularly updating and improving the mobile app to ensure a seamless and user-friendly shopping experience.

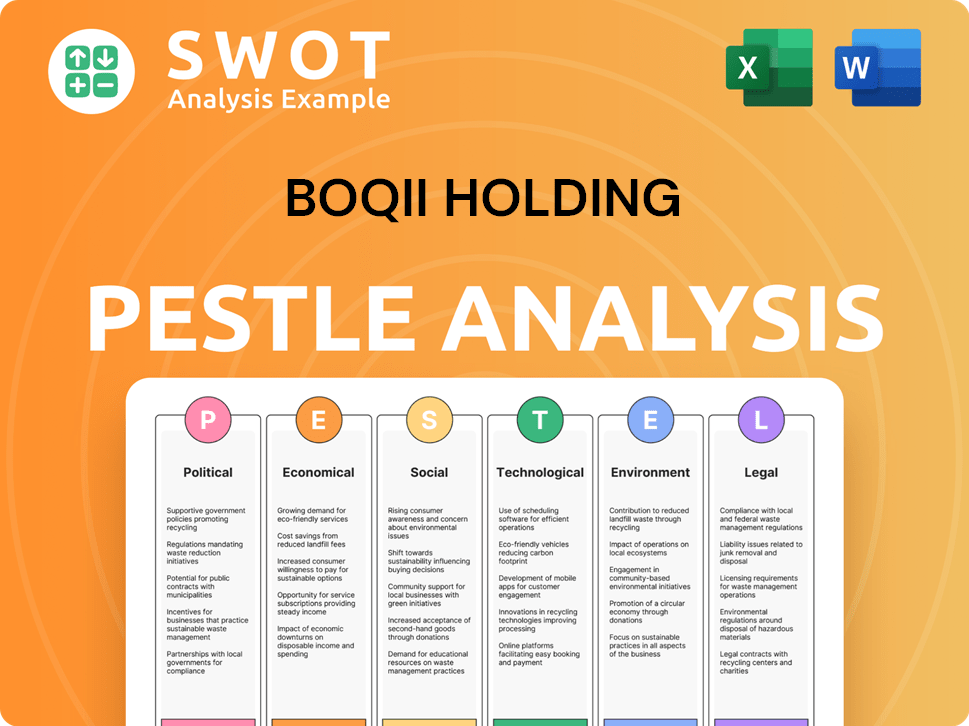

Boqii Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Boqii Holding’s Growth Forecast?

The financial outlook for Boqii Holding Company is closely tied to the trajectory of the Chinese pet industry. As the market continues to expand, driven by increasing pet ownership and consumer spending, Boqii's Growth Strategy and future prospects are significantly influenced by its ability to capitalize on these trends. The company's financial performance will depend on its ability to effectively manage its operations, expand its market share, and adapt to the evolving demands of the Pet Industry.

Boqii's strategic initiatives, including platform enhancements, supply chain optimization, and service expansions, are expected to impact its financial results. While investments in these areas may affect short-term profitability, they are crucial for securing long-term growth and maintaining a competitive edge. The company's success will hinge on its capacity to balance investment in growth with efficient cost management.

Market Analysis indicates that the Chinese e-commerce and pet sectors are poised for continued expansion. This growth is fueled by a growing number of pet owners and their willingness to spend more on their pets. Boqii's ability to leverage its existing infrastructure and expand its reach will be critical. For a deeper dive into how Boqii approaches its market, consider exploring the Marketing Strategy of Boqii Holding.

Specific revenue projections for 2025 are subject to market dynamics and company performance. However, the company's historical focus on Gross Merchandise Volume (GMV) growth suggests a continued emphasis on increasing both its user base and purchase frequency. The Boqii Holding Company business model is designed to capture a significant share of the growing pet market.

Profitability will be influenced by Boqii's ability to manage operating expenses while scaling its business. Investments in technology, supply chain, and customer acquisition are vital. The Boqii Holding Company revenue streams are diversified, including product sales, services, and potentially advertising revenue, all of which contribute to its financial outlook.

Boqii has previously utilized capital raises to fuel its expansion. Future funding rounds or changes in financial strategy will likely support further expansion, technology investments, and potential mergers or acquisitions. Any Boqii Holding Company expansion plans are expected to be supported by appropriate financial strategies.

The financial narrative centers on sustained investment in market share expansion and ecosystem development. These efforts are expected to translate into improved Financial Performance and shareholder value over the long term. Investors should closely monitor the company's quarterly and annual reports for updates.

Several factors will influence Boqii's financial outlook. These include the competitive landscape, the growth of the Boqii Holding Company pet food market, and the effectiveness of its Boqii Holding Company e-commerce strategy.

- Market Share: Boqii's ability to maintain and grow its Boqii Holding Company market share China is crucial.

- Competitive Dynamics: The Boqii Holding Company competitive landscape includes both established and emerging players.

- Operational Efficiency: Managing costs and optimizing the Boqii Holding Company supply chain are essential for profitability.

- Customer Acquisition: Implementing an effective Boqii Holding Company customer acquisition strategy is key to expanding the user base.

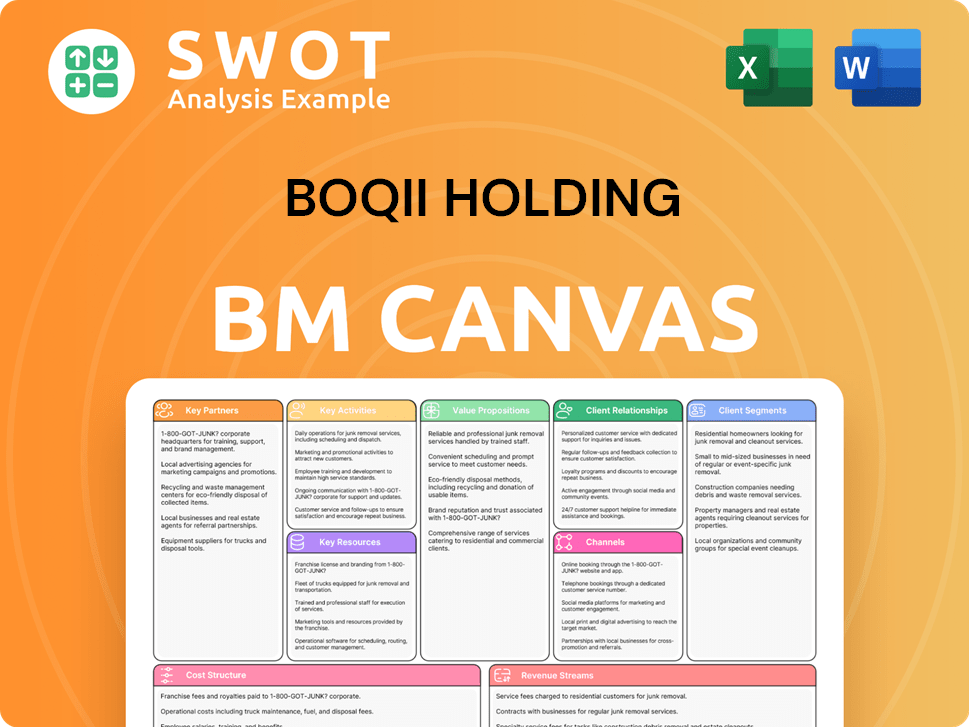

Boqii Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Boqii Holding’s Growth?

Boqii Holding Company faces several potential risks and obstacles that could impact its Growth Strategy and Future Prospects in the Chinese pet market. These challenges range from intense competition to regulatory changes and technological disruptions. Understanding these risks is crucial for assessing the company's long-term viability and investment potential.

The Chinese pet industry is highly competitive, with numerous online and offline retailers vying for market share. Compliance with evolving regulations, particularly concerning product safety and data privacy, can also be a significant burden. Furthermore, supply chain vulnerabilities and global economic fluctuations could indirectly impact the cost of goods or consumer spending habits, adding to the complexity.

Technological advancements and internal resource constraints present additional hurdles. Rapid advancements in e-commerce and logistics mean that Boqii must continuously innovate. Attracting and retaining top talent in a competitive job market can also be challenging, potentially hindering the execution of Growth Strategy. A detailed Competitors Landscape of Boqii Holding can provide deeper insights into the competitive environment.

The Pet Industry in China is highly fragmented, with many online and offline retailers. New entrants and aggressive strategies from existing competitors can pressure Boqii's market share. Competition includes both domestic and international players, increasing the need for differentiation and customer loyalty to drive Financial Performance. According to recent reports, the pet market in China is expected to continue growing, but at a potentially slower pace than in previous years, intensifying competition.

The Chinese government frequently introduces new regulations related to e-commerce, consumer protection, and pet ownership. Compliance with these evolving regulations, particularly concerning product safety, data privacy, and animal welfare, could necessitate operational adjustments and increased costs. These changes can impact Boqii Holding Company's business model and require continuous adaptation to maintain compliance and avoid penalties. The regulatory environment is dynamic, requiring constant monitoring and proactive measures.

Boqii Holding Company relies on specific suppliers and logistics partners, which could lead to disruptions in product availability or increased operational expenses. Global economic fluctuations or trade tensions can indirectly impact the cost of goods or consumer spending habits. These factors could affect the Boqii Holding Company's Financial Performance. The company needs robust risk management frameworks to mitigate these supply chain and economic vulnerabilities.

Rapid advancements in e-commerce platforms, AI, and logistics technologies mean that Boqii Holding Company must continuously innovate to avoid becoming obsolete. Failure to adopt new technologies or to keep pace with industry trends could erode its competitive advantage. Attracting and retaining top talent in a competitive job market could hinder the company's ability to execute its Growth Strategy effectively. The ability to adapt to technological changes and manage internal resources is critical for sustained success.

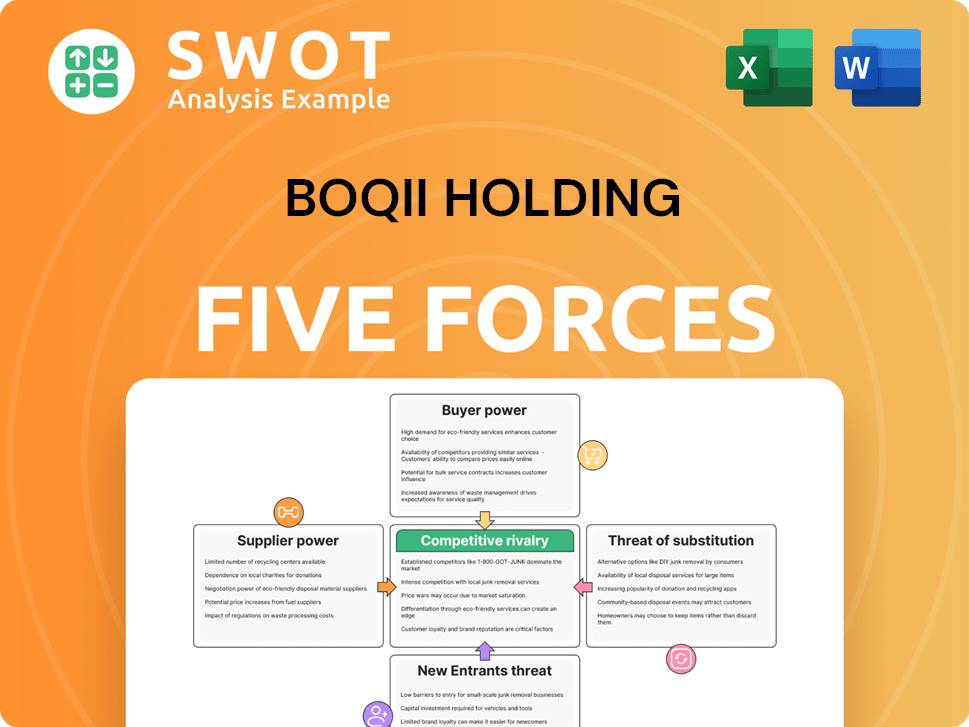

Boqii Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Boqii Holding Company?

- What is Competitive Landscape of Boqii Holding Company?

- How Does Boqii Holding Company Work?

- What is Sales and Marketing Strategy of Boqii Holding Company?

- What is Brief History of Boqii Holding Company?

- Who Owns Boqii Holding Company?

- What is Customer Demographics and Target Market of Boqii Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.