Boqii Holding Bundle

Who Really Owns Boqii Holding Company?

Unraveling the ownership structure of a company is key to understanding its future. Boqii Holding Company, a prominent player in China's booming pet industry, presents a fascinating case study in evolving ownership dynamics. From its origins as a privately held venture to its current status, the story of Boqii's ownership reveals much about its strategic direction and potential.

This deep dive into Boqii Holding SWOT Analysis will explore the shifts in Boqii ownership, detailing the influence of early investors and the impact of its public listing. Understanding who controls Boqii company, including its major shareholders and the distribution of Boqii stock, is crucial for anyone evaluating its financial performance and long-term prospects. We'll also examine key aspects such as Boqii's business model and its position within the competitive landscape, providing valuable insights for investors and stakeholders alike.

Who Founded Boqii Holding?

The genesis of Boqii Holding Company traces back to 2008, with Heidi Huanhuan Liang and Hao Liang at the helm as its founders. Their initial vision was to establish a comprehensive online platform tailored to the needs of pet owners in China. The early ownership structure, while not fully detailed in public records, clearly positioned the founders as the primary shareholders and driving force behind the company's initial development.

From its inception, Boqii company likely secured early-stage funding from angel investors, and possibly from friends and family, a common practice for startups seeking to gain momentum. The specific equity distribution among the founders and early investors is not extensively publicized. However, the founders’ deep understanding of the pet market and e-commerce in China was central to the company's early strategic direction.

Early agreements among the founders would have included standard startup provisions such as vesting schedules, which tie equity ownership to continued service over time, ensuring commitment. Buy-sell clauses are also typical, outlining conditions under which founders can sell their shares or how shares are handled in the event of a founder's departure. While no major public disputes or buyouts among the founders have been widely reported, the initial distribution of control would have directly reflected their shared vision for Boqii's growth and market penetration.

The founders, Heidi Huanhuan Liang and Hao Liang, were the key figures behind the establishment of Boqii Holding Company in 2008. Their vision was to create an online platform for pet owners in China. Early funding likely came from angel investors and potentially friends and family.

- The founders' early agreements would have included vesting schedules.

- Buy-sell clauses were likely part of the initial agreements.

- The founders' deep understanding of the pet market and e-commerce in China was central to the company's early strategic direction.

- The exact equity split among founders and early investors is not extensively detailed in public records.

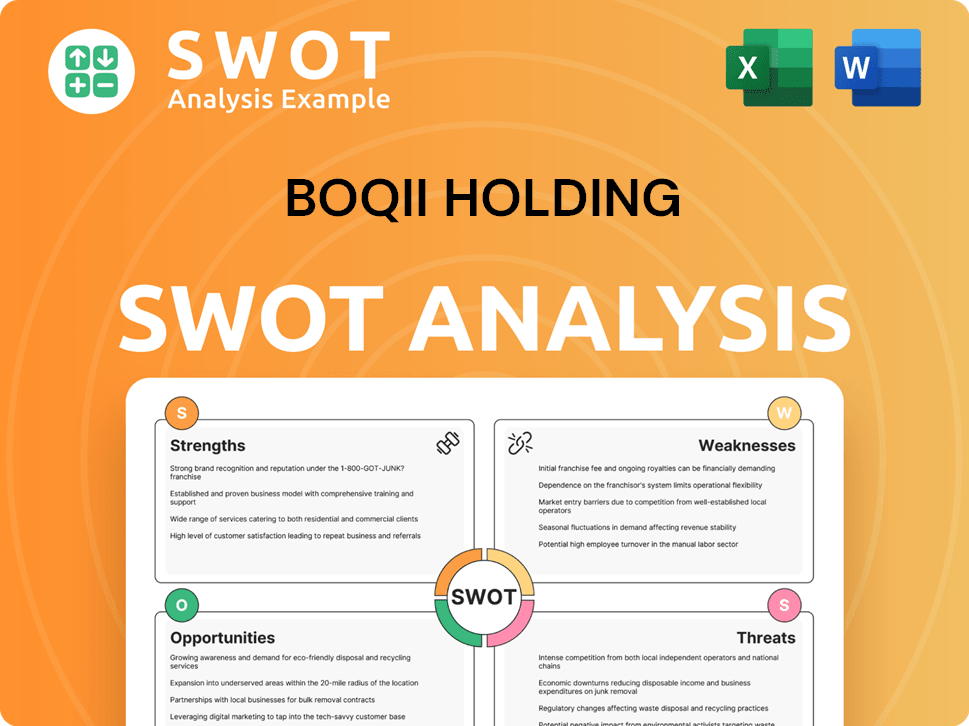

Boqii Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Boqii Holding’s Ownership Changed Over Time?

The Boqii Holding Company, a key player in the pet industry, experienced a pivotal shift in its ownership structure with its Initial Public Offering (IPO). The company began trading on the New York Stock Exchange (NYSE) on September 30, 2020, under the ticker symbol 'BQ'. This transition from a private to a public entity broadened its ownership base, introducing institutional investors and individual shareholders.

Post-IPO, the ownership of Boqii diversified. Key stakeholders include the founders, Heidi Huanhuan Liang and Hao Liang, who likely retained significant stakes, although these have been subject to dilution. Venture capital and private equity firms, such as Goldman Sachs and CMBC International, which invested in earlier funding rounds, also became significant shareholders. Recent data from March 2024 indicates a substantial role for institutional investors, with various investment management firms holding a notable percentage of Boqii's shares. This ownership structure influences the company's strategic direction, including its expansion into pet services.

| Event | Date | Impact on Ownership |

|---|---|---|

| IPO on NYSE | September 30, 2020 | Transition from private to public; broadened ownership. |

| Subsequent Offerings | Ongoing | Potential dilution of founder and early investor stakes. |

| Institutional Investment | Ongoing | Increased influence of institutional investors on strategy and governance. |

Understanding the Boqii ownership structure is crucial for investors. The company's stock symbol is 'BQ'. As of March 2024, institutional ownership plays a substantial role in the company's financials and strategic decisions. Changes in these holdings can significantly influence the company's direction. Investors interested in Boqii stock should monitor these shifts and review the latest news and annual reports for insights into the company's financial performance and major shareholders.

The IPO marked a significant change, opening up ownership to the public.

- Founders and early investors remain key stakeholders.

- Institutional investors have a significant influence.

- Monitoring ownership changes is vital for investment decisions.

- Keep an eye on Boqii's financials and stock performance.

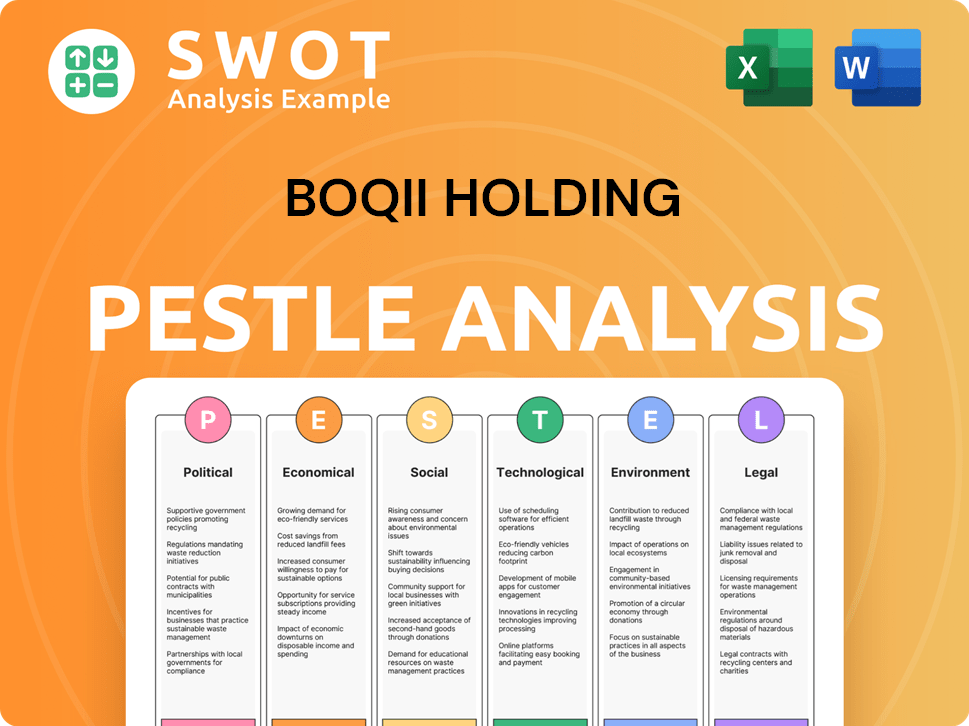

Boqii Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Boqii Holding’s Board?

The Board of Directors of Boqii Holding Company oversees the company's strategic direction and represents shareholder interests. While specific details on the current board members and their affiliations require the most recent SEC filings, it's common for founders to retain board seats after an IPO. Heidi Huanhuan Liang, a co-founder, likely holds a significant position, representing the founding vision. Understanding the board's composition is crucial for investors interested in Boqii ownership and the company's future.

The board's composition reflects a balance between insider knowledge (founders, executives) and independent oversight, aiming to ensure accountability to all shareholders. Details of specific arrangements for Boqii would be outlined in their Articles of Association and IPO prospectus. This is a critical aspect to consider for understanding true control and the influence of major institutional shareholders. For more insights into the company's approach, consider reading about the Marketing Strategy of Boqii Holding.

| Board Member | Title | Affiliation |

|---|---|---|

| Heidi Huanhuan Liang | Director | Co-founder |

| To be updated with latest filings | To be updated with latest filings | To be updated with latest filings |

| To be updated with latest filings | To be updated with latest filings | To be updated with latest filings |

The voting structure of Boqii Holding Company generally follows a one-share-one-vote principle for ordinary shares. However, it's common for Chinese companies listed in the U.S. to have dual-class share structures or other arrangements that grant founders or early investors disproportionate voting power. Specific classes of shares might carry more voting rights per share. While there haven't been widely reported proxy battles or governance controversies recently, the influence of major institutional shareholders can subtly shape governance.

The Board of Directors guides Boqii's strategy. Founders often retain board seats, influencing Boqii investors. Voting structures can vary; understanding share classes is key.

- Board composition balances insiders and independent oversight.

- Voting rights may differ across share classes.

- Major shareholders can influence governance.

- Review SEC filings for the latest details on Boqii stock.

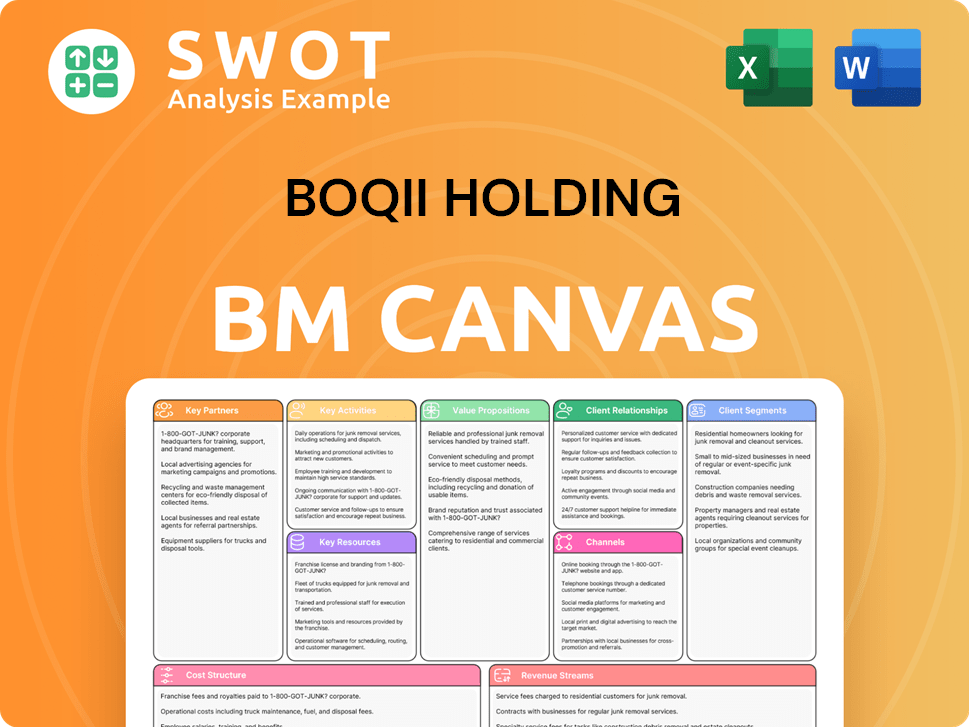

Boqii Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Boqii Holding’s Ownership Landscape?

Over the past few years, the ownership structure of Boqii Holding Company has seen fluctuations, mirroring broader trends in the e-commerce and pet industries. Analyzing Boqii ownership requires examining recent financial reports for detailed insights into share buybacks and secondary offerings. However, the general trend shows dynamic institutional investment, with some investors increasing their stakes while others adjust their positions. This is a typical pattern in the market.

Industry trends indicate that as companies like Boqii company mature, they often attract increased institutional investment. Founder dilution can also occur over time due to capital raising through various funding rounds or public offerings. While activist investors haven't been prominently reported for Boqii, the potential for their influence on governance and ownership structures remains a consideration. For more information, you can also check out this article about Target Market of Boqii Holding.

| Metric | Data (as of early 2024) | Source |

|---|---|---|

| Stock Symbol | BQ | NASDAQ |

| Market Capitalization | Fluctuating, check latest reports | Financial News Outlets |

| Share Price | Fluctuating, check latest reports | Financial News Outlets |

As of early 2025, there haven't been any major public announcements regarding privatization or secondary listings that would significantly alter the current ownership structure of Boqii Holding Company. The company continues to focus on its operational growth within the Chinese pet market, which indirectly influences investor sentiment and ownership trends. Moreover, the ongoing consolidation within the broader pet industry could lead to strategic investments or mergers and acquisitions, impacting the ownership landscape.

Boqii stock performance is subject to market fluctuations. Investors should monitor the stock symbol BQ on the NASDAQ for the latest updates. Financial news outlets provide real-time data on share prices and market capitalization. Always consult recent financial reports.

Boqii investors include both institutional and retail investors. Institutional ownership percentages can shift. Tracking the major shareholders and their investment strategies is crucial. Detailed information is available in SEC filings and company reports.

Boqii financials are essential for evaluating the company's performance. The annual report provides comprehensive financial data. Key metrics include revenue, profit margins, and debt levels. Investors should assess the company's financial health.

Ownership changes are often announced through official channels. Keep an eye on earnings calls and press releases. Market dynamics and industry trends can influence ownership structures. Monitor any significant shifts.

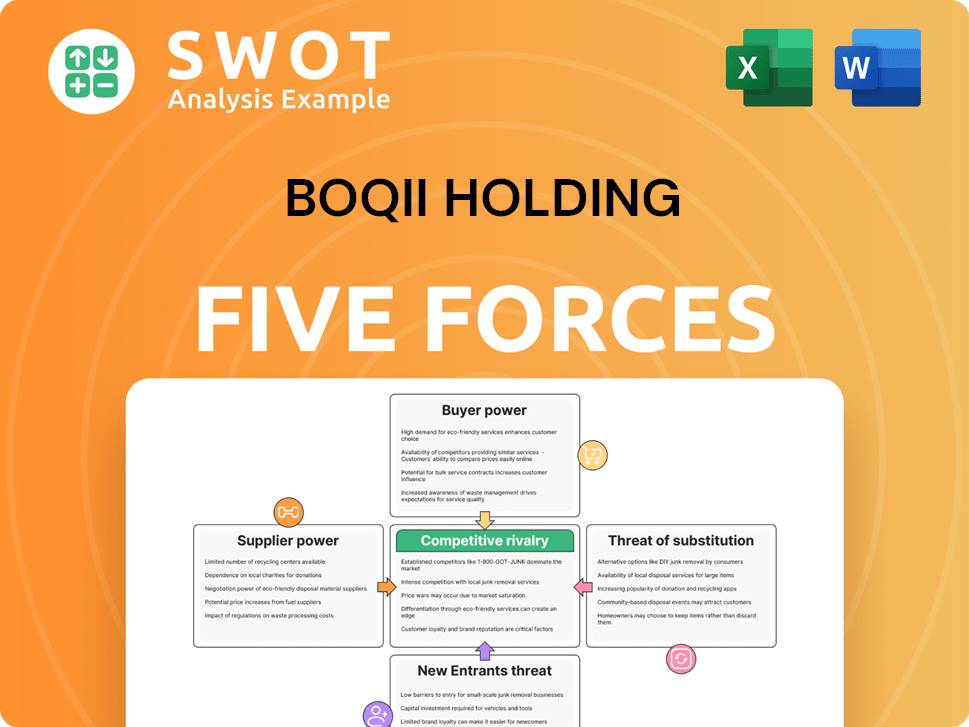

Boqii Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Boqii Holding Company?

- What is Competitive Landscape of Boqii Holding Company?

- What is Growth Strategy and Future Prospects of Boqii Holding Company?

- How Does Boqii Holding Company Work?

- What is Sales and Marketing Strategy of Boqii Holding Company?

- What is Brief History of Boqii Holding Company?

- What is Customer Demographics and Target Market of Boqii Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.