Bread Financial Holdings Bundle

How well do you know Bread Financial Holdings?

Journey back in time to uncover the Bread Financial Holdings SWOT Analysis and the evolution of a financial services company that has reshaped the payment landscape. From its roots in the merger of retail credit operations, Bread Financial has transformed into a tech-forward powerhouse. Explore the pivotal moments that have shaped this financial institution, and discover the strategies that have fueled its growth.

This brief overview of Bread Financial Holdings will delve into its founding as Alliance Data Systems (ADS) and trace its trajectory through strategic acquisitions and rebranding efforts. Understanding the Bread Financial history, including key milestones and the company's business model, is crucial for investors and analysts alike. Learn about the company's leadership, its competitive landscape, and the factors that contribute to its market capitalization.

What is the Bread Financial Holdings Founding Story?

The story of Bread Financial Holdings, a significant player in the financial services company landscape, officially began in December 1996 with the formation of Alliance Data Systems (ADS). This marked a strategic merger, rather than a typical startup, bringing together J.C. Penney's credit card processing unit (BSI Business Services, Inc.) and The Limited's credit card bank operation (World Financial Network National Bank).

The merger's leadership emerged from these combined entities, setting out to build a strong platform in private label credit and loyalty programs. The aim was to capitalize on the growing retail sector and the increasing emphasis on customer loyalty, a trend that defined the mid-1990s. This strategic move positioned the company to leverage existing customer bases and transaction data effectively.

The initial focus of ADS was on offering private label credit cards and managing loyalty programs. The services initially included credit card processing and the operation of the AIR MILES Reward Program, following the 1998 acquisition of Loyalty Group Canada. While specific initial funding figures for the 1996 merger are not publicly detailed, the consolidation of existing business operations was a key aspect. This strategic approach allowed the company to quickly establish a strong presence in the market. To learn more about the company's strategic growth, you can read about the Growth Strategy of Bread Financial Holdings.

Bread Financial Holdings, formerly Alliance Data Systems (ADS), was formed in December 1996.

- The founding involved a merger of J.C. Penney's and The Limited's credit operations.

- The initial business model focused on private label credit cards and loyalty programs.

- The company aimed to leverage existing customer bases and transaction data.

- The acquisition of Loyalty Group Canada in 1998 expanded its services.

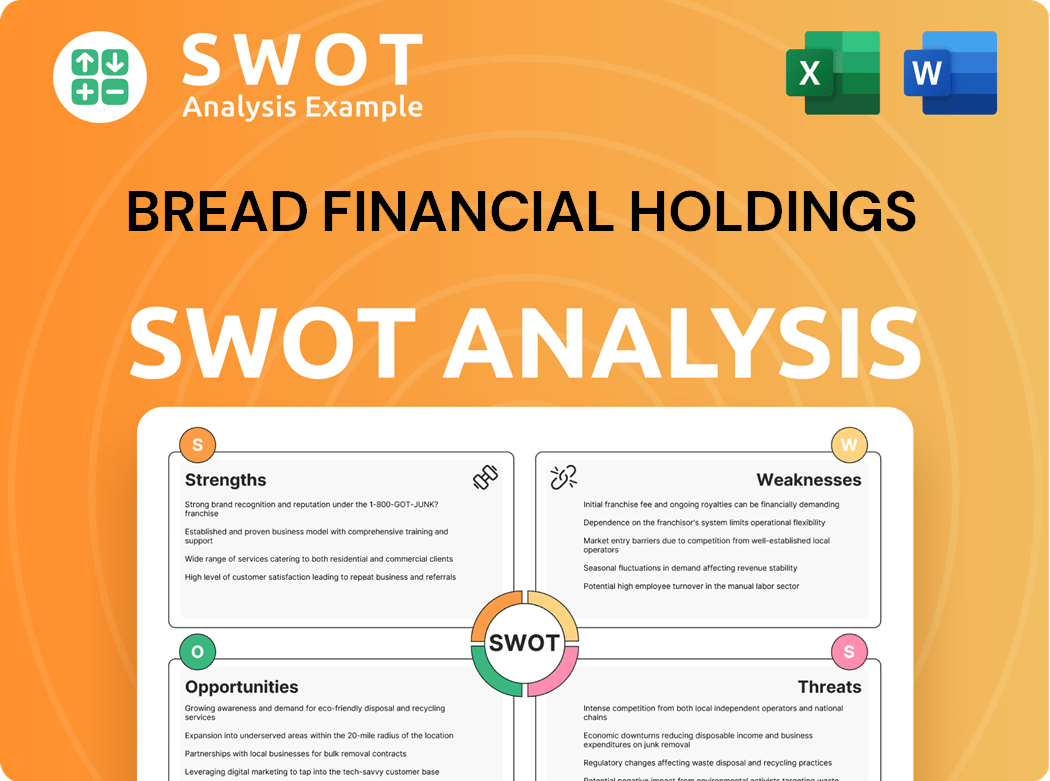

Bread Financial Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Bread Financial Holdings?

The early growth of Bread Financial Holdings, formerly known as Alliance Data Systems (ADS), was marked by strategic expansions and acquisitions. Initially, ADS focused on enhancing its loyalty program capabilities. The company's journey included a significant public offering in 2001, which fueled further growth and expansion.

A key move in ADS's early expansion was the acquisition of Loyalty Group Canada in August 1998. This acquisition brought the AIR MILES Reward Program into its portfolio, significantly boosting its loyalty program offerings. This strategic move helped broaden its market reach and customer base.

The company went public in 2001, which was a pivotal moment in its growth trajectory. ADS continued to expand its service offerings through strategic acquisitions. One notable acquisition was Epsilon in 2004, which expanded its direct marketing capabilities.

ADS continued to evolve its portfolio through acquisitions and divestitures. The acquisition of Conversant in 2014 strengthened its affiliate marketing business. Later, in 2019, Epsilon was sold to Publicis for $4.4 billion. A key development was the 2019 acquisition of Lon Operations Inc., operating under the 'Bread' trademark, a digital payments company, which closed in December 2020.

Leadership transitions also played a role in shaping the company. Ralph Andretta became president and CEO, and the company's headquarters were effectively moved to Columbus, Ohio. These strategic shifts, including investments in digital technologies, have significantly shaped Bread Financial's trajectory. For more insights, explore the Competitors Landscape of Bread Financial Holdings.

Bread Financial Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Bread Financial Holdings history?

The history of Bread Financial Holdings, formerly known as Alliance Data Systems, is marked by significant milestones in the financial services company sector. From its early days to its current status, Bread Financial has navigated the complexities of the credit card and financial services landscape, adapting to market changes and technological advancements. For a deeper dive into the company's ownership structure, you can explore Owners & Shareholders of Bread Financial Holdings.

| Year | Milestone |

|---|---|

| October 2020 | Launched the Enhanced Digital Suite, showcasing a commitment to digital innovation. |

| 2021 | Invested $100 million in digital technologies, further enhancing its tech-forward solutions. |

| April 2022 | Partnered with American Express to launch the Bread Cashback American Express Credit Card, expanding its offerings. |

| 2022 | Completed the transition of its credit card processing services to Fiserv. |

| Late 2023 | Introduced the Bread Rewards American Express Credit Card, diversifying its product portfolio. |

Bread Financial has consistently focused on innovation to stay competitive in the financial services industry. The company has invested heavily in digital technologies, as demonstrated by the launch of its Enhanced Digital Suite and significant financial investments in digital infrastructure. These moves have allowed Bread Financial to improve its service offerings and adapt to the evolving needs of its customers.

The Enhanced Digital Suite launch in October 2020 and the $100 million investment in digital technologies in 2021 highlight Bread Financial's commitment to digital innovation.

The collaboration with American Express to introduce the Bread Cashback and Rewards American Express Credit Cards broadened its product offerings and customer reach.

The transition of credit card processing services to Fiserv in 2022 aimed to enhance speed to market and digital integration.

Bread Financial has focused on co-branded cards to navigate competitive pressures, particularly from Buy Now, Pay Later (BNPL) providers.

Bread Financial has undertaken strategic pivots, including significant debt reduction efforts since the LoyaltyOne spinoff in 2021, strengthening its balance sheet.

The introduction of new credit card products, such as the Bread Cashback and Rewards American Express Credit Cards, indicates a strategic move to diversify its offerings.

Bread Financial has faced several challenges, including the loss of key partners and regulatory pressures. The company has historically served a higher proportion of nonprime borrowers, leading to increased credit costs. Addressing these challenges has required strategic adjustments and a focus on risk management.

The departure of major partners like Wayfair and Meijer to Citi in 2020, and BJ's Wholesale Club to Capital One in 2022, has posed a persistent competitive threat.

Potential regulations limiting late fees, a significant revenue source, have presented challenges, though the likelihood has decreased due to legal and election outcomes as of February 2025.

Serving a higher proportion of nonprime borrowers historically led to higher relative losses and credit costs compared to peers.

The rise of Buy Now, Pay Later (BNPL) providers aggressively targeting its partner base has increased competitive pressures.

Significant debt reduction efforts since the LoyaltyOne spinoff in 2021 have been a key strategic response to strengthen the balance sheet.

Disciplined risk management and operational excellence have become crucial in adapting to evolving industry trends and mitigating potential losses.

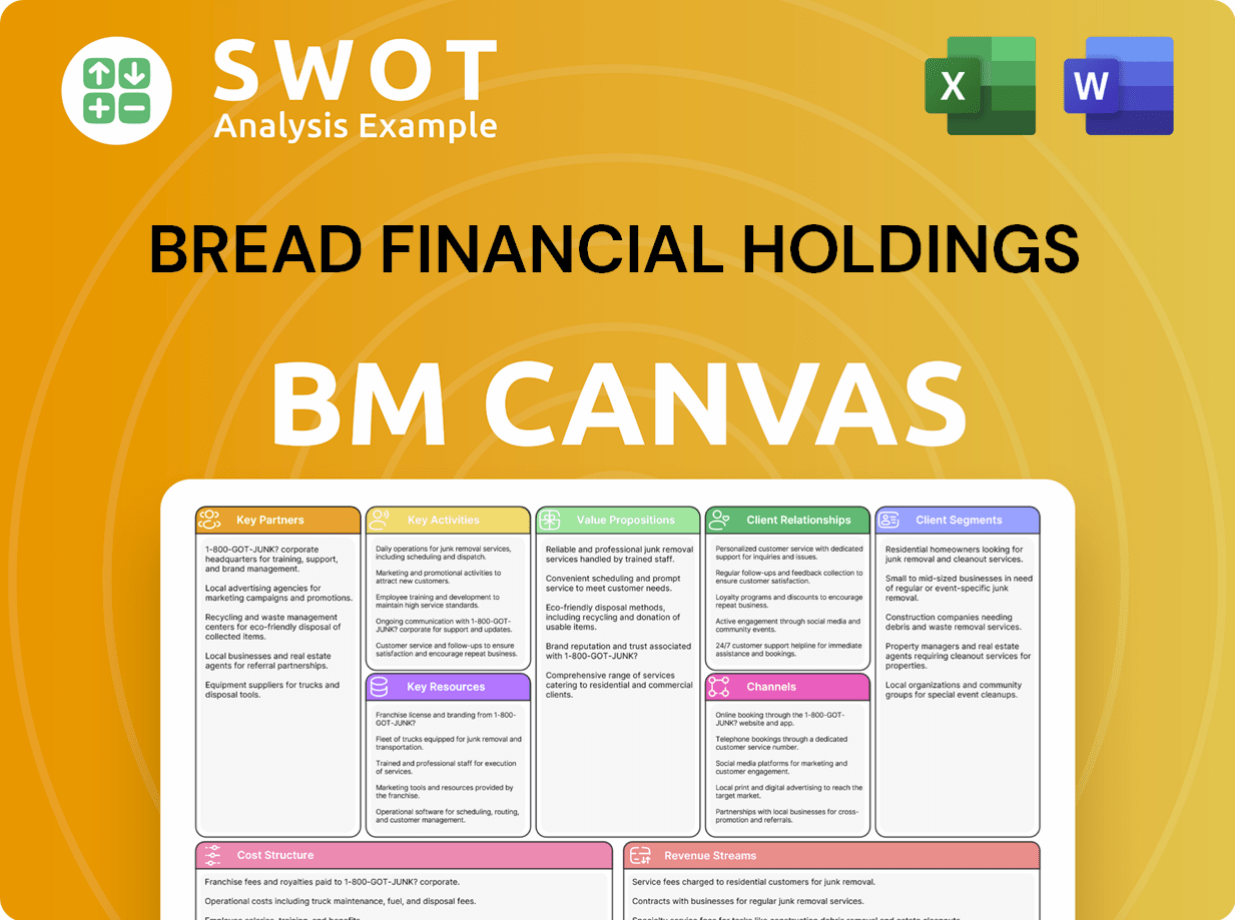

Bread Financial Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Bread Financial Holdings?

The Marketing Strategy of Bread Financial Holdings has evolved significantly since its inception. The company's journey from its roots as Alliance Data Systems (ADS) to its current form as Bread Financial Holdings reflects a series of strategic acquisitions, divestitures, and rebrandings. This financial services company has navigated the market through various changes, adapting to new technologies and consumer demands. The following timeline highlights key milestones in the Bread Financial history.

| Year | Key Event |

|---|---|

| 1996 | Formation of Alliance Data Systems (ADS) through the merger of J.C. Penney's transaction services and The Limited's credit card bank operations. |

| 1998 | Acquisition of Loyalty Group Canada, including the AIR MILES Reward Program. |

| 2001 | Alliance Data Systems goes public. |

| 2004 | Acquisition of Epsilon. |

| 2019 | Sale of Epsilon for $4.4 billion; acquisition of Lon Operations Inc. (Bread). |

| 2020 | Alliance Data closes the Bread deal; launches Enhanced Digital Suite. |

| 2021 | Divestiture of LoyaltyOne segment; investment of $100 million in digital technologies. |

| March 2022 | Alliance Data rebrands as Bread Financial. |

| April 2022 | Partnership with American Express and launch of the Bread Cashback American Express Credit Card. |

| Q4 2023 | Introduction of the Bread Rewards American Express Credit Card. |

| October 26, 2023 | Corporate Asset Purchase with Dell (Consumer credit portfolio). |

| Q4 2024 | Reported average loans of $18.2 billion and revenue of $926 million. |

| January 30, 2025 | Bread Financial reports Q4 and full year 2024 results, showing increased capital flexibility and financial resilience. |

| March 5, 2025 | S&P Global Ratings assigns 'B' debt rating to Bread Financial Holdings Inc.'s $400 million subordinated unsecured notes due 2035. |

| April 24, 2025 | Bread Financial reports Q1 2025 results, with net income of $138 million and credit sales growth of 1% year-over-year to $6.1 billion. |

| May 13, 2025 | Bread Financial provides a performance update for April 2025, reporting end-of-period credit card and other loans of $17.72 billion. |

Bread Financial's Q1 2025 results show a net income of $138 million. Credit sales grew by 1% year-over-year to $6.1 billion. The company reported average loans of $18.2 billion and revenue of $926 million in Q4 2024. These figures highlight the company's financial resilience and growth.

For 2025, Bread Financial anticipates relatively flat to slightly down average loans compared to 2024, with revenue also expected to remain flat to slightly up. The company projects a net loss rate in the range of 8.0% to 8.2% for 2025. Strategic initiatives include a focus on responsible growth and operational excellence.

Bread Financial is focusing on responsible growth, disciplined capital allocation, risk management, and operational excellence. The company aims to scale its product suite and expand revenue opportunities. They are also proactively managing the macroeconomic and regulatory environment.

Analysts project an average EPS of $6.71 for FY2025, with target prices ranging from $33 to $88. The company's commitment to technology modernization and customer service enhancements is expected to support its market position. The future outlook emphasizes a digital-first approach.

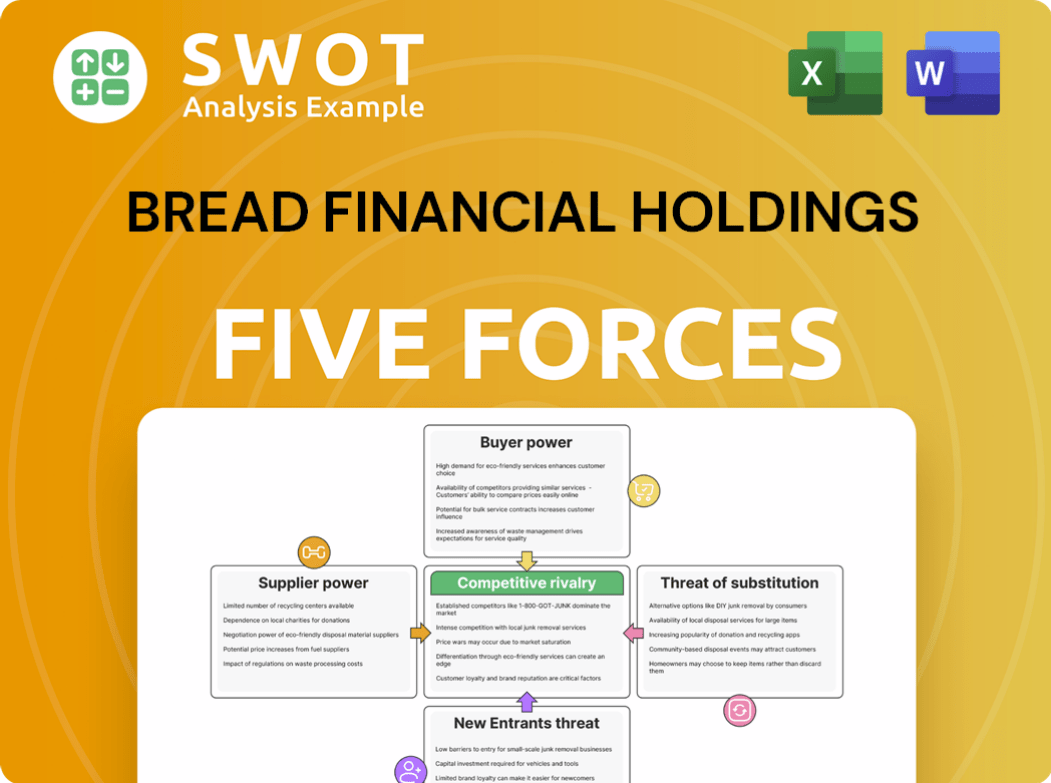

Bread Financial Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Bread Financial Holdings Company?

- What is Growth Strategy and Future Prospects of Bread Financial Holdings Company?

- How Does Bread Financial Holdings Company Work?

- What is Sales and Marketing Strategy of Bread Financial Holdings Company?

- What is Brief History of Bread Financial Holdings Company?

- Who Owns Bread Financial Holdings Company?

- What is Customer Demographics and Target Market of Bread Financial Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.