Bread Financial Holdings Bundle

How Does Bread Financial Holdings Navigate the Competitive Financial Services Arena?

The financial services sector is a battlefield of innovation, where companies constantly vie for consumer attention and market share. Bread Financial Holdings, a prominent player in this dynamic landscape, has strategically positioned itself to capitalize on evolving industry trends. Understanding the Bread Financial Holdings SWOT Analysis is crucial to grasping its strengths and weaknesses.

This exploration into the Bread Financial Holdings' competitive landscape will delve into its market position, examining its key rivals and the strategies it employs to maintain a competitive edge. We'll conduct a thorough market analysis, assessing its financial performance and growth potential within the broader context of the financial services industry. Ultimately, this analysis aims to provide actionable insights for investors, analysts, and anyone interested in understanding the company's future outlook and investment analysis.

Where Does Bread Financial Holdings’ Stand in the Current Market?

Bread Financial Holdings maintains a strong market position within the consumer finance sector. They are particularly prominent in private label credit cards and installment lending. Their services cater to a wide range of retail partners, positioning them as a leading provider in these specialized areas.

The company's main offerings include co-brand and private label credit cards, installment loans, and Bread Savings products. Their geographical focus is primarily the United States, serving diverse customer segments. This includes everyone from mass-market consumers to more affluent individuals through various retail partnerships.

Bread Financial has strategically embraced digital transformation to enhance its offerings and customer experience. This includes an increased focus on online and mobile platforms for account management and payment solutions. Growth Strategy of Bread Financial Holdings includes a look at how they are adapting to industry trends.

While specific market share figures for 2024-2025 are subject to ongoing market analysis, Bread Financial is acknowledged as a leading provider in private label credit cards and installment loans. The company’s strong position is supported by its extensive retail partnerships.

Bread Financial's financial health indicates a stable and growing enterprise. For the first quarter of 2024, the company reported a net income of $88 million, or $1.90 per diluted share. This demonstrates its financial resilience and strong competitive stance.

Bread Financial emphasizes digital transformation, enhancing its offerings and customer experience. This includes a greater focus on online and mobile platforms for account management and payment solutions, reflecting current industry trends.

The company holds a particularly strong position in partnering with mid-to-large-sized retailers. They leverage their expertise in loyalty programs and data analytics to drive customer engagement and sales for their partners, which is a key competitive advantage.

Bread Financial's strengths include its strong market position in private label credit and installment loans, its financial performance, and its strategic focus on digital transformation. These elements contribute to its competitive advantages within the financial services sector.

- Leading provider in private label credit cards and installment loans.

- Consistent profitability, with a net income of $88 million in Q1 2024.

- Strategic investments in technology and digital platforms.

- Strong partnerships with mid-to-large-sized retailers.

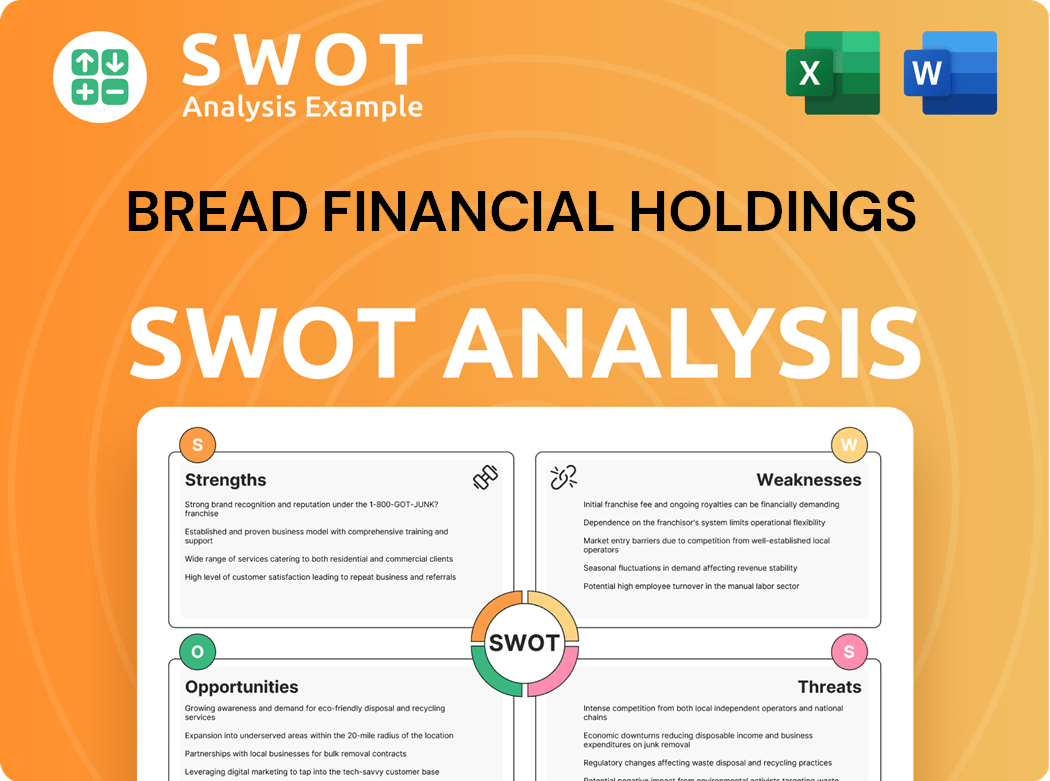

Bread Financial Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Bread Financial Holdings?

The Competitive Landscape for Bread Financial Holdings is complex, encompassing both direct and indirect rivals in the financial services sector. Market Analysis reveals that the company faces significant competition in its core areas of private label credit cards and installment lending. Understanding this competitive environment is crucial for assessing Bread Financial Holdings' industry position and growth potential.

Bread Financial Holdings must navigate a landscape shaped by established players and emerging fintech companies. The rise of buy now, pay later (BNPL) services adds another layer of competition, forcing the company to innovate and adapt to changing consumer preferences. Analyzing the competitive advantages and strategies of key rivals is essential for Bread Financial Holdings' long-term success.

For a deeper dive into the ownership structure and shareholder information, consider reading Owners & Shareholders of Bread Financial Holdings.

Direct competitors offer similar financial products and services, primarily in private label credit cards and installment loans. These companies often have established partnerships with retailers and a strong market presence.

Synchrony Financial is a major player in the private label credit card market. Its extensive partnerships and large scale pose a significant challenge to Bread Financial Holdings. Synchrony's financial performance and strategic moves directly impact the competitive dynamics.

Alliance Data, despite its historical connection to Bread Financial Holdings, remains a direct competitor. It focuses on loyalty programs and marketing services, operating in similar spaces. The competitive strategies of Alliance Data are a key factor in the market.

Capital One and Citibank compete in the co-branded credit card market. They leverage their vast customer bases and brand recognition. These institutions' financial strength and market strategies are significant competitive factors.

Indirect competitors offer alternative financial solutions, including traditional banks and fintech companies. These competitors can disrupt the market with innovative products and services. Industry Trends show a shift towards digital financial solutions.

Traditional banks offer personal loans and credit cards, competing with Bread Financial Holdings in the broader consumer finance market. Their established customer base and financial resources are key competitive advantages. Banks' strategies influence the competitive landscape.

Fintech companies specializing in buy now, pay later (BNPL) services are rapidly gaining market share. These companies offer flexible payment options, attracting younger consumers. This disruption challenges traditional credit models, influencing Bread Financial Holdings' business strategy.

- Affirm, Klarna, and Afterpay are key players in the BNPL space.

- The BNPL market is projected to continue growing, impacting the competitive environment.

- These companies' innovative payment solutions attract digitally-native consumers.

- The rise of BNPL services necessitates strategic adaptations from Bread Financial Holdings.

Bread Financial Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Bread Financial Holdings a Competitive Edge Over Its Rivals?

Understanding the Competitive Landscape of Bread Financial Holdings involves examining its key strengths and how it positions itself within the financial services sector. A deep dive into its competitive advantages reveals a strategy focused on data-driven insights and long-term partnerships. This approach allows the company to offer tailored financial solutions, setting it apart from competitors. For a comprehensive look at the company's revenue model, consider reading about Revenue Streams & Business Model of Bread Financial Holdings.

Bread Financial's success hinges on its ability to leverage proprietary data analytics. These capabilities enable the company to refine its customer acquisition and retention strategies, which is critical in today's competitive market. The company's focus on technology and digital platforms, including offerings like Bread Pay and Bread Savings, further strengthens its position by providing seamless customer experiences, aligning with modern consumer preferences. This is a key factor in its market analysis and industry trends.

The company's established partnerships with a diverse portfolio of retailers also provide a strong competitive moat, as these relationships are built on trust and a proven track record of driving sales and customer loyalty for its partners. The company's ability to adapt its offerings to various retail sectors, from fashion to home goods, showcases its flexibility and deep understanding of different market segments. While these advantages are substantial, they face threats from rapidly evolving fintech innovations and the potential for imitation by well-funded competitors.

Bread Financial uses advanced data analytics to create highly personalized payment and lending solutions. This enables targeted marketing and risk assessment, leading to more effective customer acquisition and retention. This strategy is a cornerstone of its business strategy.

Long-standing relationships with a diverse portfolio of retailers provide a strong competitive advantage. These partnerships are built on trust and a proven track record. This network is difficult for competitors to replicate, bolstering Bread Financial's industry position.

Investments in technology and digital platforms, such as Bread Pay and Bread Savings, provide seamless customer experiences. These digital tools align with modern consumer preferences for convenience and accessibility, enhancing the customer journey. This focus on digital solutions is a key aspect of the company overview.

Bread Financial adapts its offerings to various retail sectors, showcasing its flexibility and understanding of different market segments. This adaptability allows the company to maintain relevance and drive growth across diverse industries. This adaptability is crucial for its financial performance.

Bread Financial's competitive edge is built on data-driven personalization, strategic partnerships, and digital innovation. These advantages are critical for its long-term success. Understanding these elements is crucial for any Bread Financial Holdings competitor analysis.

- Proprietary data analytics for personalized solutions.

- Strong partnerships with a diverse network of retailers.

- Investment in digital platforms for seamless customer experiences.

- Adaptability across various retail sectors.

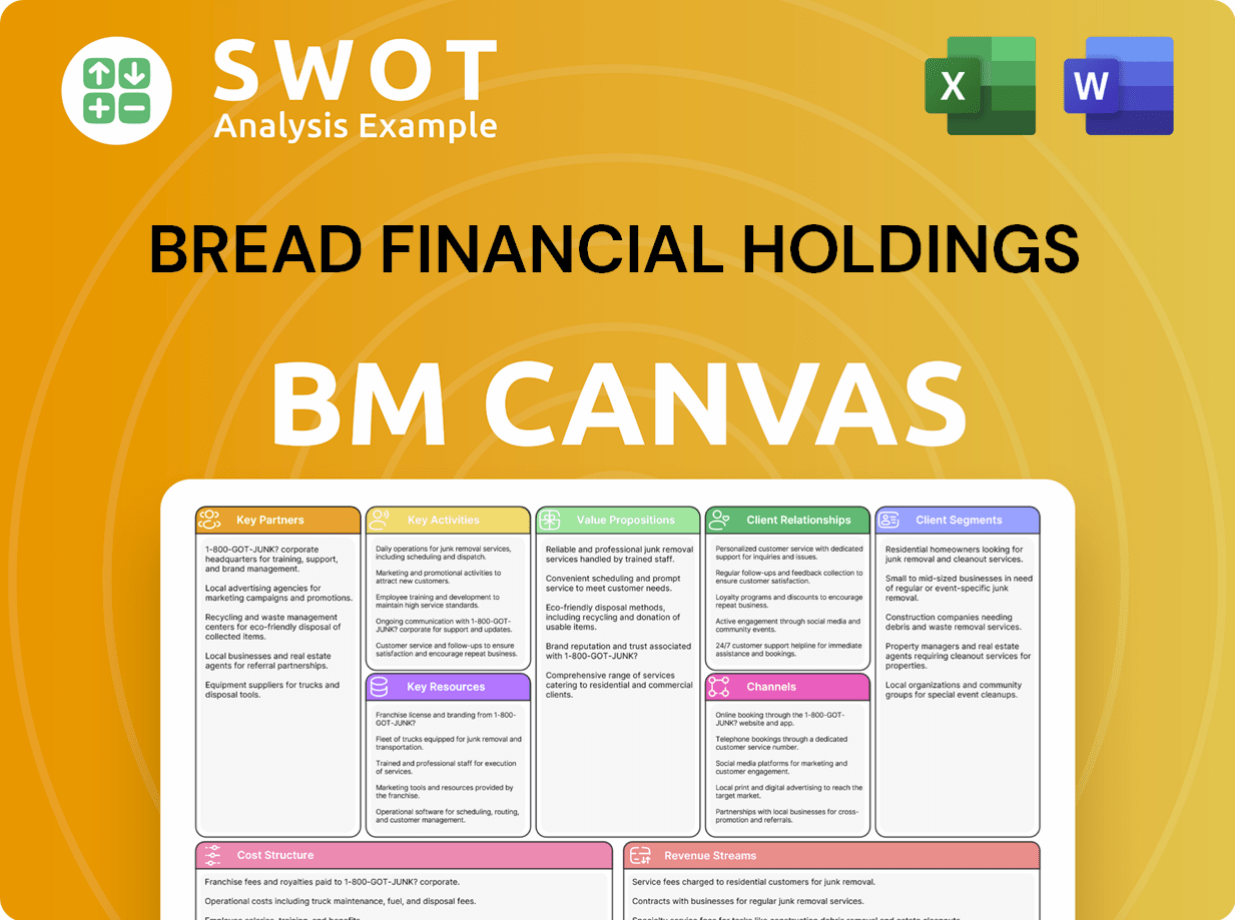

Bread Financial Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Bread Financial Holdings’s Competitive Landscape?

Understanding the Competitive Landscape of Bread Financial Holdings requires a deep dive into Industry Trends, potential challenges, and emerging opportunities within the Financial Services sector. This analysis provides a comprehensive Company Overview, assessing its Market Analysis and strategic positioning to navigate the evolving financial landscape. The aim is to offer actionable insights for stakeholders interested in the Bread Financial Holdings and its future trajectory.

Bread Financial Holdings faces a dynamic environment, shaped by technological advancements, regulatory changes, and shifting consumer preferences. The company's ability to adapt to these forces will be crucial for maintaining its Industry Position and achieving sustainable growth. This assessment includes a review of Bread Financial Holdings's Financial Performance, its competitive advantages, and a look at the Bread Financial Holdings business strategy.

The consumer finance industry is experiencing significant shifts driven by technology, regulatory pressures, and changing consumer behaviors. Artificial intelligence and machine learning are transforming credit assessment and fraud detection. Regulations regarding consumer lending and data privacy are increasing. Consumers now prefer seamless digital experiences and flexible payment options, like BNPL services.

Bread Financial Holdings confronts challenges such as increased competition from fintech companies offering innovative BNPL solutions, potentially eroding market share. Continuous investment in technology and compliance with evolving regulations puts pressure on operating costs. Economic downturns or rising interest rates could impact consumer spending, potentially increasing delinquencies.

The demand for personalized financial products and digital-first solutions aligns with Bread Financial Holdings' tech-forward strategy. Expanding its offerings and diversifying into new consumer segments represents key growth avenues. Strategic partnerships with fintech companies can integrate new technologies and expand reach. Leveraging data analytics can identify new market niches and improve risk management.

Bread Financial Holdings is focusing on innovation, strategic partnerships, and adapting to evolving consumer behaviors to strengthen its competitive standing. Recent acquisitions and partnerships are aimed at expanding its market reach and enhancing its technological capabilities. For example, the company is investing in AI-driven fraud detection systems and expanding its digital payment options.

Bread Financial Holdings's ability to navigate the competitive landscape depends on several factors. These include its capacity to innovate, form strategic partnerships, and adapt to changing consumer needs. The company's Competitive Advantages are its existing customer base, established brand, and technological infrastructure. For more details, see Brief History of Bread Financial Holdings.

- Market Share: Assessing Bread Financial Holdings's Market Share in the BNPL and installment lending markets compared to key rivals.

- Financial Performance: Analyzing key financial metrics such as revenue growth, profitability, and return on equity.

- Technological Advancement: Evaluating the company's investments in AI, machine learning, and digital platforms.

- Regulatory Compliance: Monitoring the company's adherence to evolving consumer finance regulations.

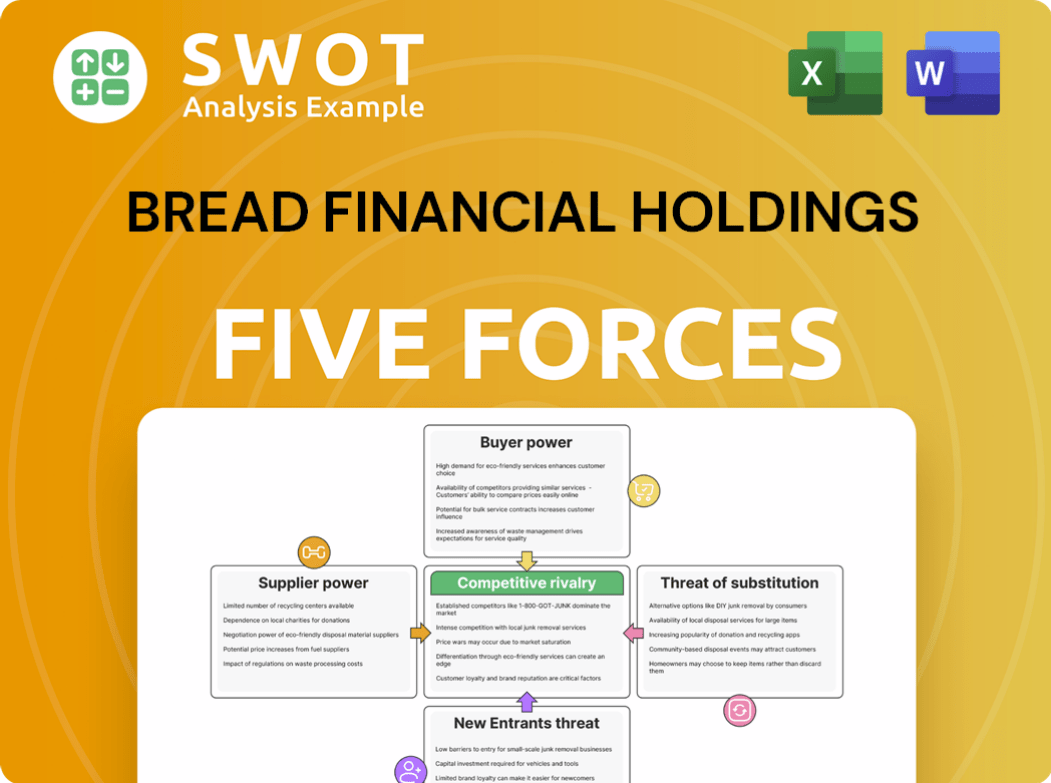

Bread Financial Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bread Financial Holdings Company?

- What is Growth Strategy and Future Prospects of Bread Financial Holdings Company?

- How Does Bread Financial Holdings Company Work?

- What is Sales and Marketing Strategy of Bread Financial Holdings Company?

- What is Brief History of Bread Financial Holdings Company?

- Who Owns Bread Financial Holdings Company?

- What is Customer Demographics and Target Market of Bread Financial Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.