Bread Financial Holdings Bundle

How Does Bread Financial Stay Ahead in the Financial Services Game?

Bread Financial Holdings Company, formerly Alliance Data Systems, has undergone a remarkable transformation, evolving from a back-end service provider to a consumer-facing financial powerhouse. This evolution, marked by a strategic rebranding in 2022, reflects a keen understanding of the digital financial landscape and a commitment to innovation. This analysis delves into the core of Bread Financial's approach, revealing the intricacies of its sales and marketing strategies.

This exploration will uncover the Bread Financial Holdings SWOT Analysis, examining how the company builds its sales strategies and executes its marketing plan. We'll dissect its digital marketing approach, including customer acquisition strategies and marketing channel mix, alongside its brand positioning strategy within the competitive financial services marketing environment. Understanding Bread Financial's journey offers valuable insights for anyone interested in credit card marketing strategy, retail partnerships, and the broader financial services industry.

How Does Bread Financial Holdings Reach Its Customers?

The sales and marketing strategy of Bread Financial Holdings centers on a B2B2C model, using partnerships with retailers and other businesses to reach consumers. This approach allows Bread Financial to offer financial products like private label credit cards and installment loans through established channels. Their strategy focuses on integrating payment solutions within their partners' ecosystems, both online and in-store, enhancing the consumer's purchasing experience.

Bread Financial's sales channels have evolved, with a significant shift towards digital integration. This includes providing co-branded credit cards and installment loans at the point of sale. The company leverages its retail partners' storefronts and e-commerce platforms, ensuring a seamless experience for customers. The company's emphasis on digital adoption and strategic partnerships is a key element of their growth plan.

Key partnerships with major retailers are central to Bread Financial's strategy, contributing significantly to its market share. This approach allows Bread Financial to tap into the existing customer bases of its retail partners, scaling its reach effectively. The focus on these relationships enables the company to integrate its offerings directly into the consumer's purchasing journey, driving sales and brand awareness.

Bread Financial relies heavily on its partnerships with major retailers to distribute its financial products. These partnerships offer co-branded credit cards and installment loans directly to consumers at the point of sale. This strategy allows Bread Financial to leverage the existing customer bases of its partners, increasing its market reach without the need for extensive direct-to-consumer infrastructure.

Digital adoption is a key focus for Bread Financial, with an emphasis on providing integrated payment solutions within its partners' online and in-store ecosystems. This includes offering co-branded credit cards and installment loans directly at the point of sale, both online and offline. This approach enhances the consumer experience and streamlines the purchasing process.

Bread Financial primarily uses a B2B2C sales model, reaching consumers through strategic partnerships with retailers and other businesses. Their core offerings, including private label credit cards and installment lending, are distributed indirectly via these established relationships. This model allows Bread Financial to tap into existing customer bases and scale its reach efficiently.

The company's sales channels have evolved, moving beyond traditional private label credit card programs to incorporate more seamless digital integration. This shift has been a key strategic move, with an increased focus on providing integrated payment solutions within their partners' online and in-store ecosystems. This includes offering co-branded credit cards and installment loans directly at the point of sale, both online and offline.

Bread Financial's sales strategy focuses on leveraging retail partnerships and digital integration to reach consumers. This approach allows the company to offer financial products seamlessly through its partners' existing channels. The company's focus on these strategies has allowed it to maintain a strong position in the financial services market.

- Partnership-Driven Growth: Bread Financial relies heavily on its partnerships with major retailers to distribute its financial products, which is a key aspect of its Competitors Landscape of Bread Financial Holdings.

- Digital Transformation: The company is actively integrating digital payment solutions, including co-branded credit cards and installment loans, to enhance the consumer experience.

- B2B2C Model: Bread Financial uses a B2B2C sales model to reach consumers through strategic partnerships, which allows it to tap into existing customer bases and scale its reach efficiently.

- Focus on Point of Sale: Offering financial products directly at the point of sale, both online and offline, streamlines the purchasing process and increases accessibility.

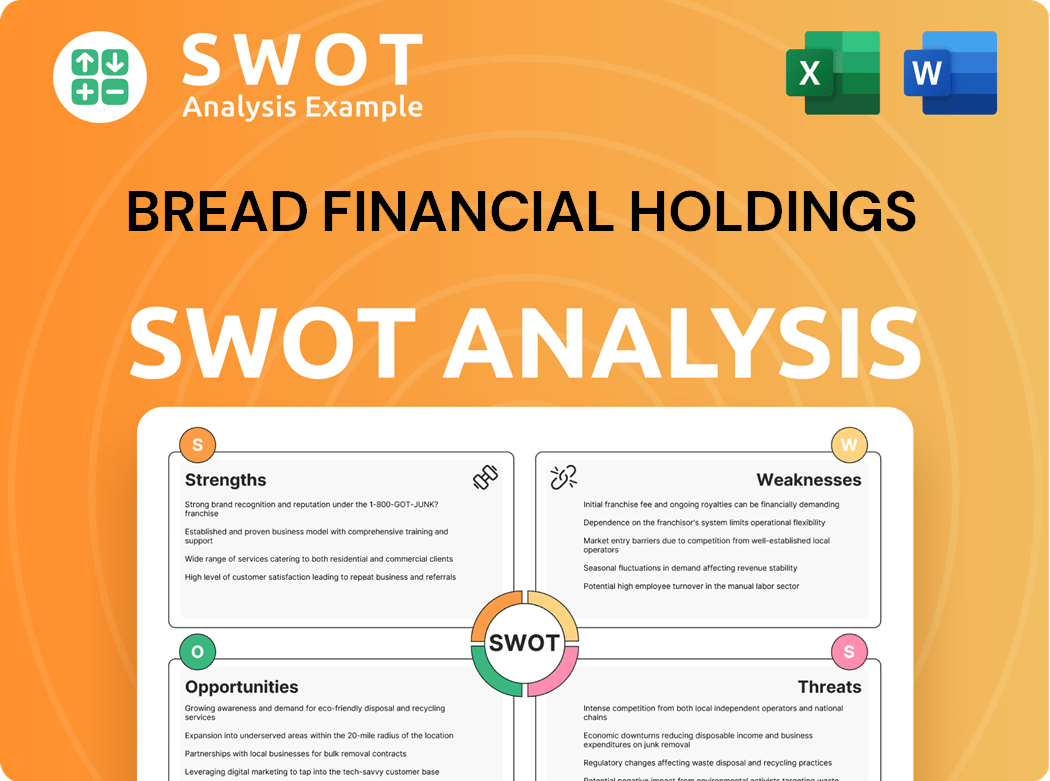

Bread Financial Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Bread Financial Holdings Use?

The marketing tactics employed by Bread Financial, a key player in financial services marketing, are primarily designed to support its business-to-business-to-consumer (B2B2C) model. Their sales and marketing Bread Financial strategy focuses on enhancing brand awareness within its partner ecosystems. This approach emphasizes digital channels and data-driven insights to reach both partners and consumers effectively.

A core element of the Bread Financial marketing plan involves collaboration with partners, often co-creating campaigns that highlight the benefits of their financial products. This strategy is supported by a strong emphasis on digital marketing, including content creation and targeted advertising. Through these efforts, Bread Financial aims to build strong relationships with partners and provide rewarding experiences for customers.

The company's marketing efforts are heavily influenced by data analytics, allowing for personalized promotions and improved customer experiences. This data-driven approach enables Bread Financial to optimize its marketing spend and refine its overall marketing mix. The company also leverages technology platforms to track campaign performance and measure key metrics.

Bread Financial heavily utilizes digital marketing tactics. This includes content marketing to educate partners and consumers, and targeted digital advertising to promote co-branded offerings. This strategy is central to their overall Bread Financial strategy.

A significant part of their approach involves supporting partners' marketing efforts. They often co-create campaigns to highlight the advantages of their private label credit cards and lending solutions. This collaborative approach is key to their sales and marketing Bread Financial initiatives.

Data-driven marketing is a cornerstone of Bread Financial's strategy. They use analytics to understand consumer behavior. This allows them to tailor product offerings and marketing messages effectively. This approach is crucial for their credit card marketing strategy.

Email marketing is utilized to engage customers, particularly existing cardholders. They use this channel to promote responsible financial habits and introduce new features. Email marketing is a key component of their marketing campaign examples.

The company uses technology platforms and analytics tools to track campaign performance. This enables them to optimize spending and refine their marketing mix continually. This is essential for effective Bread Financial marketing plan execution.

While direct-to-consumer advertising is less prevalent, their partners may use traditional media. Their marketing channel mix is designed to reach their target audience effectively. This approach supports their overall brand positioning strategy.

Bread Financial's marketing tactics are designed to support its B2B2C model, focusing on digital channels and partner collaboration. The company leverages data analytics to personalize customer experiences and optimize marketing spend. These strategies are critical for customer acquisition strategies and overall success.

- Digital Advertising: Targeted campaigns on various digital platforms to promote co-branded offerings.

- Content Marketing: Creating educational content for partners and consumers about financial products.

- Partner Marketing: Co-creating marketing campaigns with partners to highlight product benefits.

- Email Marketing: Engaging existing cardholders with promotions and financial education.

- Data Analytics: Utilizing data to understand consumer behavior and personalize marketing messages.

- Performance Tracking: Using technology to track campaign performance and optimize the marketing mix.

For more insights into the company's background, you can refer to the Brief History of Bread Financial Holdings.

Bread Financial Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Bread Financial Holdings Positioned in the Market?

Bread Financial's brand positioning centers on being a tech-forward financial services provider. They aim to simplify payment, lending, and saving solutions, primarily through personalized experiences. This approach is a key element of their Bread Financial strategy, focusing on ease of use and tailored financial products to meet customer needs.

The company differentiates itself through strong retail partnerships, embedding financial products directly into the customer journey. This financial services marketing strategy allows them to reach consumers seeking convenient payment and lending options through trusted retail brands. Their focus is on value and convenience, aiming to provide accessible financial solutions.

A key aspect of their Bread Financial marketing plan involves a B2B2C approach. They partner with retailers to offer financial products at the point of sale. This strategic move enhances the customer experience and drives sales. Their rebranding in 2022 aimed to unify the brand and increase recognition.

Bread Financial targets consumers looking for convenient payment and lending options. Their approach is designed to appeal to a broad audience through trusted retail partnerships. They focus on delivering value and ease of use.

The core message emphasizes 'simple, personalized payment, lending, and saving solutions.' This message is consistently communicated across all touchpoints. This reinforces the company's commitment to customer-centric financial products.

Bread Financial leverages retail partnerships to integrate financial products seamlessly. This strategy allows them to reach customers directly at the point of sale. The B2B2C model is a key component of their credit card marketing strategy.

They strive for brand consistency across all interactions, from partner integrations to customer service. This ensures a cohesive and positive customer experience. Consistent branding helps build trust and recognition.

Bread Financial's competitive advantage lies in its strategic partnerships and tech-forward approach. Their focus on personalized experiences and ease of use sets them apart. They continuously innovate to adapt to market changes.

- Emphasis on value and convenience.

- Strong partnerships with retailers.

- Commitment to a consistent brand experience.

- Continuous innovation in product offerings.

To learn more about the company's ownership structure and financial performance, you can refer to Owners & Shareholders of Bread Financial Holdings.

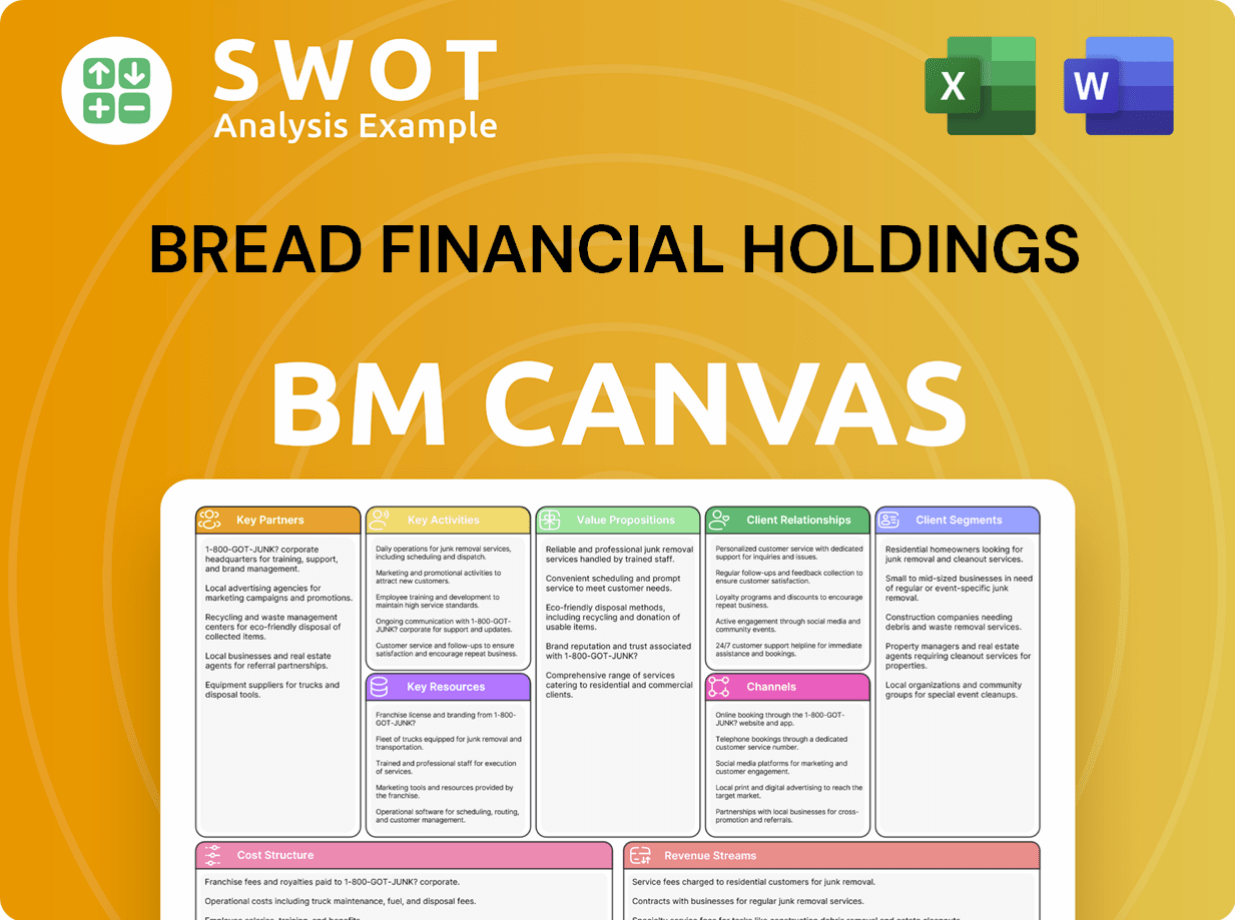

Bread Financial Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Bread Financial Holdings’s Most Notable Campaigns?

The core of the Growth Strategy of Bread Financial Holdings centers on its key marketing campaigns. These initiatives are designed to enhance brand recognition, integrate financial products seamlessly, and drive customer engagement. The company's approach is multifaceted, focusing on both overarching brand strategies and specific product integrations.

A significant element of Bread Financial's strategy involves continuous refinement of its marketing efforts. This includes adapting to market changes and leveraging data to improve customer acquisition and retention. The campaigns are often tailored to specific retail partners, ensuring that the financial products align with the partners' brands and customer bases.

The company's campaigns are data-driven, with an emphasis on measuring performance and optimizing strategies. This approach allows Bread Financial to make informed decisions about resource allocation and refine its marketing efforts over time. The goal is to create a cohesive brand experience that resonates with both partners and consumers, ultimately driving business growth.

In 2022, Bread Financial underwent a comprehensive rebranding from Alliance Data Systems. This strategic move aimed to unify its diverse business lines under a single brand. The rebranding included a complete overhaul of visual identity, messaging, and digital presence.

Ongoing integration of financial products within retail partners' ecosystems is a key campaign. This focuses on seamless user experiences at the point of sale, both online and in physical stores. Success is measured by continued partner relationships and the growth of private label credit card and installment lending programs.

The rebranding initiative aimed to enhance brand clarity and market perception. This involved a complete overhaul of visual identity, messaging, and digital presence. The rebranding was a strategic move to streamline its identity after significant divestitures.

A key aspect of the rebranding was the overhaul of Bread Financial's digital presence. This included updates across its digital platforms and partner networks. The focus was on creating a consistent and modern brand experience.

The success of retail integrations is evidenced by continued partner relationships. These partnerships are crucial for distributing financial products within retail ecosystems. The goal is to provide seamless user experiences.

The growth of private label credit card and installment lending programs indicates success. These programs are central to Bread Financial's financial services offerings. The growth is a key metric of campaign effectiveness.

The rebranding allowed Bread Financial to more effectively communicate its value proposition. It positioned the company as a modern financial services provider. This strategic move aimed to streamline its identity.

Bread Financial employs a data-driven approach to refine its marketing efforts. This includes measuring performance and optimizing strategies. The company uses data to make informed decisions about resource allocation.

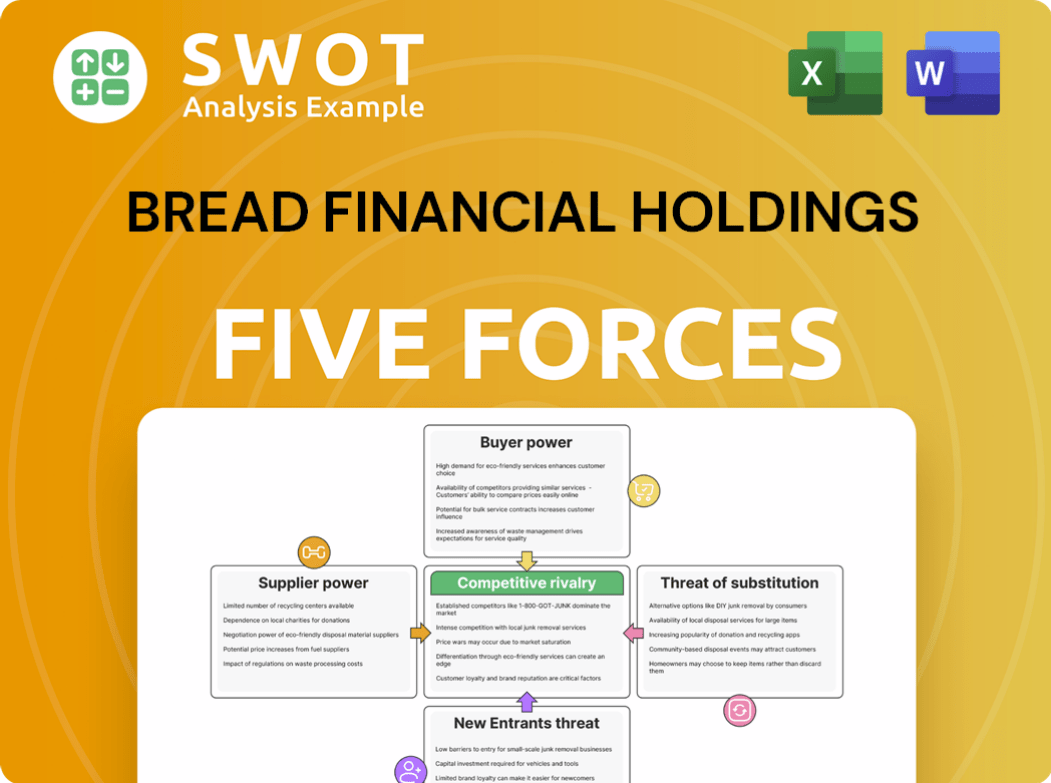

Bread Financial Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bread Financial Holdings Company?

- What is Competitive Landscape of Bread Financial Holdings Company?

- What is Growth Strategy and Future Prospects of Bread Financial Holdings Company?

- How Does Bread Financial Holdings Company Work?

- What is Brief History of Bread Financial Holdings Company?

- Who Owns Bread Financial Holdings Company?

- What is Customer Demographics and Target Market of Bread Financial Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.