Bread Financial Holdings Bundle

Unveiling Bread Financial Holdings' Customer Profile: Who Are They?

In the dynamic world of Bread Financial Holdings SWOT Analysis, understanding the "who" behind the "what" is crucial. This involves a deep dive into the company's customer demographics and target market. From its roots in retail credit to its evolution as a broader financial services provider, Bread Financial's success hinges on its ability to understand and serve its evolving customer base.

This exploration will dissect Bread Financial's target audience profile, examining factors like customer age range, income levels, and geographic distribution. We'll analyze how Bread Financial strategically segments its market, crafts ideal customer personas, and implements customer acquisition strategies to maximize customer lifetime value. This market analysis provides insights into the consumer behavior driving Bread Financial's success in the consumer finance landscape.

Who Are Bread Financial Holdings’s Main Customers?

Understanding the customer demographics and target market of Bread Financial Holdings is crucial for assessing its business model. The company primarily operates in a Business-to-Business (B2B) capacity, partnering with retailers and other businesses. This approach means that its customer base is largely defined by the customers of its partners.

The target market of Bread Financial, therefore, spans a broad demographic. This includes a wide age range, reflecting the diverse clientele of its retail partners. The company's offerings, such as private-label credit cards, often attract consumers seeking loyalty rewards and financing options for everyday purchases. For more information about the company, you can read about the Owners & Shareholders of Bread Financial Holdings.

Bread Financial serves both B2C customers through its partners and B2B customers directly through its partnerships. The company’s strategy focuses on providing financial services that meet the needs of a wide range of consumers. The fastest-growing segment is likely tied to its digital payment and lending solutions, reflecting a broader market trend towards convenient and accessible financial technology.

Bread Financial's customer base is diverse, mirroring the demographics of its retail partners. This includes a wide age range, from younger shoppers to more established consumers. Income levels and education backgrounds vary, depending on the partner's target demographic.

The company segments its market based on the needs of its partners and their customers. This includes segmentation by age, income, and spending habits. Bread Financial's offerings, such as private-label credit cards and installment loans, cater to different segments.

Bread Financial acquires customers through its partnerships with retailers and other businesses. These partnerships allow the company to offer its financial products directly to the partners' customer base. Digital marketing and targeted promotions also play a role.

Market share analysis for Bread Financial involves evaluating its performance within the financial services sector. This includes assessing its position in the private-label credit card market and the growth of its digital payment solutions. The company's market share is influenced by its partnerships and the success of its products.

Bread Financial's customer base includes a mix of consumers seeking financing options and rewards programs. Consumer behavior is influenced by the specific products offered, such as private-label credit cards and installment loans. The company's focus on digital solutions caters to evolving consumer preferences.

- Loyalty Program Users: Customers who actively use rewards and loyalty programs offered through co-branded cards.

- Financing Seekers: Consumers looking for installment loans to finance purchases.

- Digital Payment Users: Customers who prefer convenient digital payment and lending solutions.

- Retail Partner Customers: The diverse customer base of Bread Financial's retail partners.

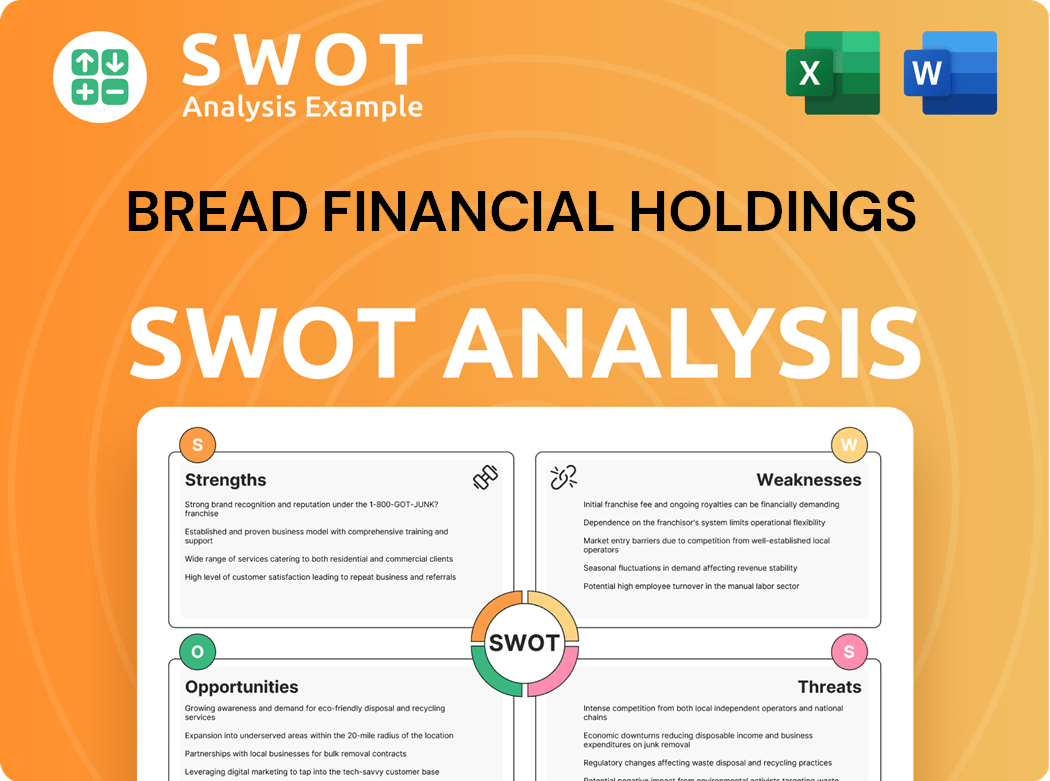

Bread Financial Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Bread Financial Holdings’s Customers Want?

Understanding the customer needs and preferences is crucial for success. For Bread Financial Holdings, this means focusing on what drives their diverse customer base. This involves analyzing the motivations behind using their financial products, from credit cards to installment loans and savings accounts.

The company's approach is centered on providing convenience, flexibility, and value. By understanding these core needs, Bread Financial Holdings can tailor its products and services to better meet customer expectations and maintain a competitive edge in the financial services market. This customer-centric strategy is key to driving growth and fostering customer loyalty.

The core needs of Bread Financial Holdings' customers center around convenience, flexibility, and value in their financial transactions. Customers using private-label credit cards are often drawn by loyalty programs, exclusive discounts, and accessible financing options offered by their favorite retailers. Decision-making factors often include competitive interest rates, ease of application, and the perceived benefits of store-specific rewards.

These customers are attracted by loyalty programs, exclusive discounts, and financing options. They value competitive interest rates, easy application processes, and store-specific rewards.

Customers using products like Bread Pay seek to spread payments for larger purchases. They aim to manage budgets and avoid traditional credit card interest. This is a key aspect of consumer finance.

These customers prioritize competitive interest rates and a secure platform for their deposits. They also seek financial control and the ability to save for future goals.

Customers are motivated by a sense of financial control and the ability to save for future goals. This influences their choices in the financial services sector.

Bread Financial Holdings addresses needs like flexible payment solutions and accessible savings accounts. They use customer feedback and market trends to guide product development.

The company responds to the growing demand for digital financial experiences. The expansion of Bread Pay to include BNPL options shows their adaptation to changing consumer behavior.

Bread Financial Holdings leverages customer feedback and market trends to drive product development. For instance, the expansion of Bread Pay to offer various buy now, pay later (BNPL) options demonstrates their responsiveness to evolving consumer purchasing behaviors. This approach is further detailed in Growth Strategy of Bread Financial Holdings.

The primary needs driving Bread Financial Holdings' customers are convenience, flexibility, and value. This applies across various product lines, from credit cards to installment loans and savings accounts, influencing their target market.

- Convenience: Easy application processes and user-friendly digital platforms.

- Flexibility: Payment options like BNPL and installment plans.

- Value: Competitive interest rates, rewards programs, and exclusive discounts.

- Security: Secure platforms for deposits and financial transactions.

- Accessibility: Easy access to financing and savings options.

Bread Financial Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Bread Financial Holdings operate?

Bread Financial Holdings primarily operates within the United States, establishing a strong market presence through extensive partnerships with retailers and businesses. While specific geographic sales breakdowns aren't publicly detailed, their collaborations with national retailers suggest a broad reach across all major U.S. markets. This widespread accessibility supports a diverse customer base across various states, aligning with their customer demographics.

The company's strategy focuses on leveraging technology to offer seamless financial solutions across different regions, rather than tailoring offerings to regional preferences. However, the varying demographics and buying power across states and between urban and rural areas indirectly influence the retail partners Bread Financial engages with. This approach helps in understanding the target market dynamics.

Recent strategies focus on deepening penetration within the U.S. market by forming new partnerships and expanding its product range. The company aims to capture a larger share of the domestic financial services market. This focus on the U.S. market is a key aspect of their geographic target market strategy.

Bread Financial's primary focus is on the U.S. market, leveraging its partnerships to reach a wide audience. Their strategy emphasizes broad accessibility rather than regional customization, which aligns with their approach to consumer finance.

The company's partnerships with national retailers are crucial for its market reach. These collaborations enable Bread Financial to offer its financial services to a broad customer base across the United States. This approach is a key element of their customer acquisition strategies.

Bread Financial utilizes technology to provide seamless financial solutions across different regions. This technological approach allows them to cater to a diverse customer base without the need for localized offerings. This is a key element of their operational efficiency and market analysis.

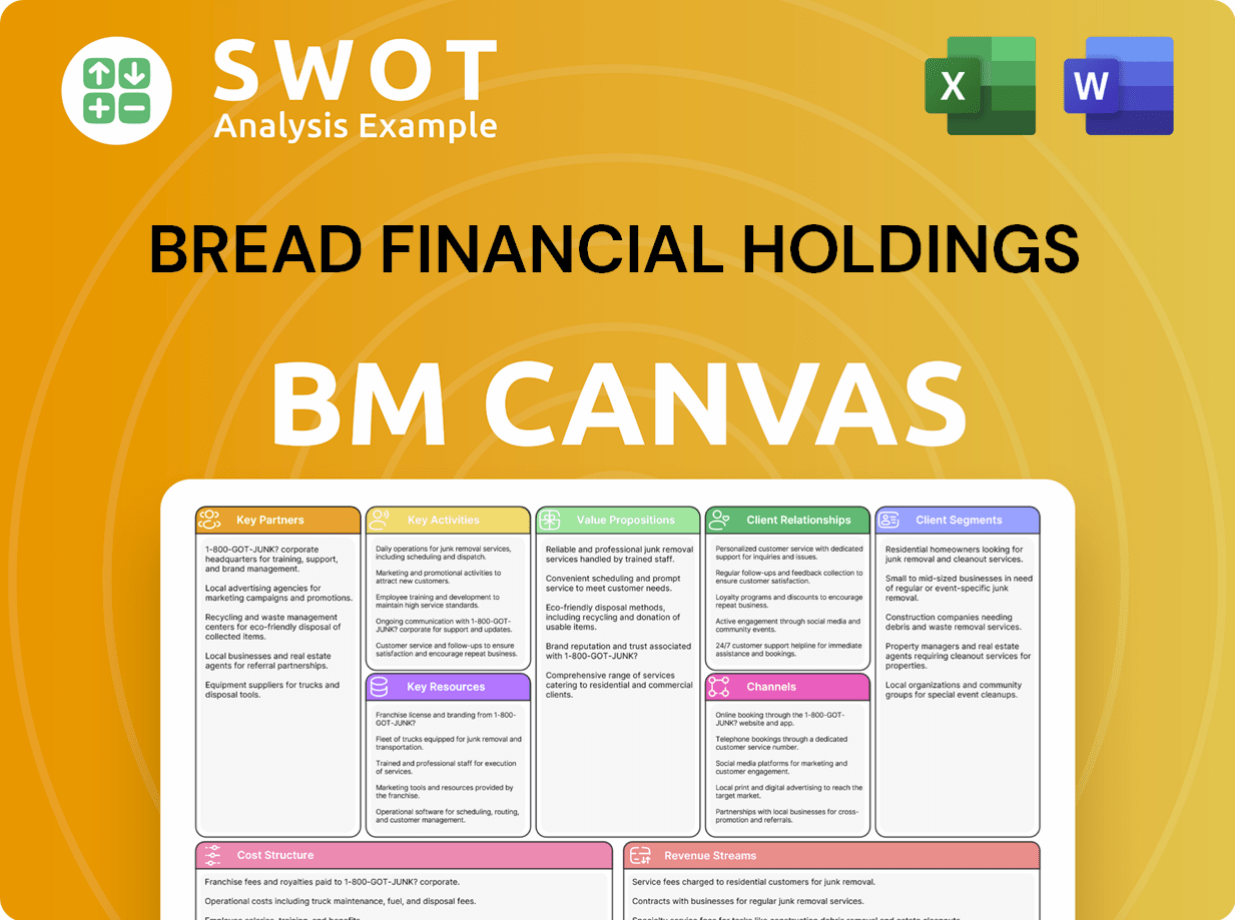

Bread Financial Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Bread Financial Holdings Win & Keep Customers?

Understanding the customer acquisition and retention strategies of companies like Bread Financial is crucial for a comprehensive market analysis. These strategies are central to how they build and maintain their customer base within the competitive financial services sector. A deep dive into these methods reveals how they attract, engage, and retain customers, impacting their overall market share and financial performance.

Bread Financial's approach to customer acquisition and retention provides valuable insights into the dynamics of the consumer finance industry. By examining their specific tactics, we can better understand their market positioning and long-term growth strategies. This analysis is particularly relevant when considering the broader landscape of financial services and consumer behavior.

For those interested in a broader perspective on the industry, consider exploring the Competitors Landscape of Bread Financial Holdings to gain a deeper understanding of the competitive environment.

Bread Financial primarily uses B2B partnerships to acquire customers. They work with retail and business partners to offer their financial products directly to the partners' customer base. This indirect approach leverages existing customer traffic and brand loyalty.

Key marketing channels include in-store promotions, online advertisements on partner websites, and direct marketing using partners' customer lists. This multi-channel strategy helps reach a wide audience. The focus is on integrating financial products seamlessly into the partners' existing customer experience.

Bread Financial focuses on providing seamless and rewarding customer experiences to encourage retention. User-friendly digital platforms, personalized offers, and strong customer service are key. They aim to increase customer lifetime value through these initiatives.

Successful retention efforts include integrating Bread Pay into online and in-store checkouts. Expanding the product line to include savings accounts also helps retain customers by offering a broader financial relationship. This diversification strategy aims to meet more of the customer's financial needs.

Bread Financial's customer retention strategies are designed to build long-term relationships. These strategies focus on providing value and convenience to customers.

- User-Friendly Digital Platforms: Investing in easy-to-use digital tools for account management.

- Personalized Offers: Tailoring promotions and rewards based on customer behavior and preferences.

- Customer Service Excellence: Providing responsive and helpful customer support.

- Product Integration: Integrating Bread Pay into various payment systems for convenience.

- Product Diversification: Offering a range of financial products, including savings accounts, to meet different customer needs.

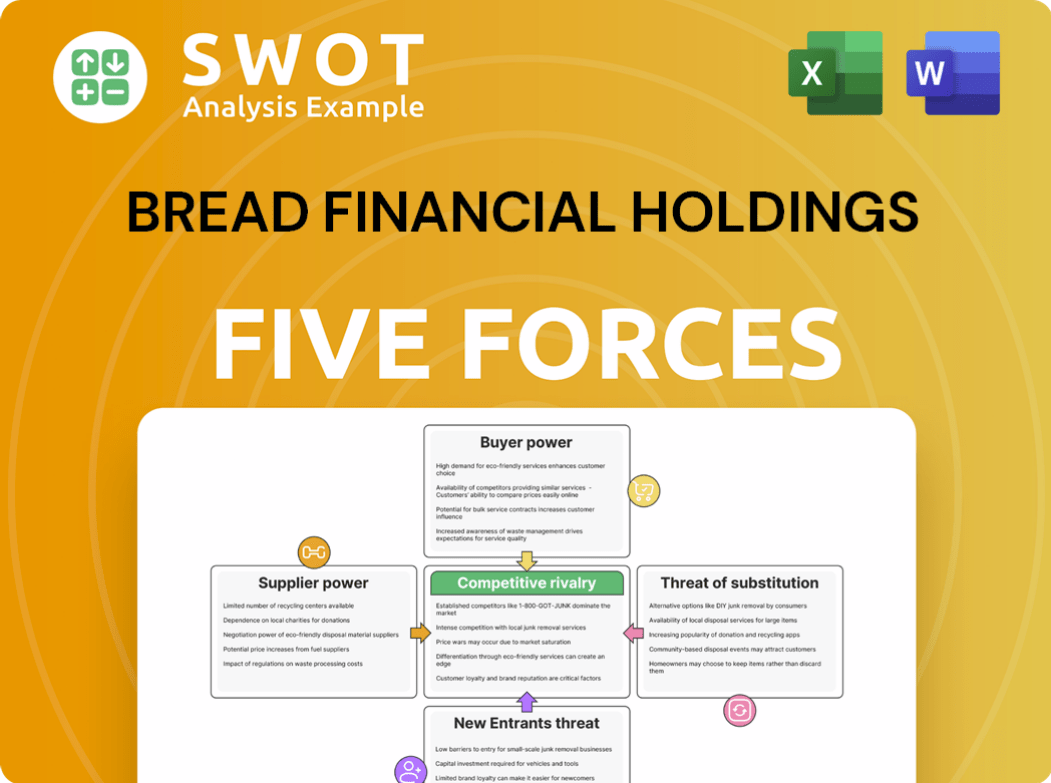

Bread Financial Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bread Financial Holdings Company?

- What is Competitive Landscape of Bread Financial Holdings Company?

- What is Growth Strategy and Future Prospects of Bread Financial Holdings Company?

- How Does Bread Financial Holdings Company Work?

- What is Sales and Marketing Strategy of Bread Financial Holdings Company?

- What is Brief History of Bread Financial Holdings Company?

- Who Owns Bread Financial Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.