Cal-Maine Foods Bundle

How Did Cal-Maine Foods Crack the Code to Egg Industry Dominance?

From a small feed supplier in 1957 to the largest egg producer in the U.S., Cal-Maine Foods' Cal-Maine Foods SWOT Analysis reveals a compelling story of strategic growth. This journey, marked by key mergers and a relentless focus on expansion, transformed a local operation into a national powerhouse. Discover the pivotal moments that shaped Cal-Maine history and its enduring influence on the US egg market.

This brief history of Cal-Maine Foods explores the company's evolution, from its founding by Fred R. Adams, Jr., to its present-day status. Understanding Cal-Maine Company's strategic moves, including key acquisitions and its response to challenges within the poultry industry, provides valuable insights. Explore how Cal-Maine Foods navigated the complexities of egg production and market dynamics to achieve its leading position.

What is the Cal-Maine Foods Founding Story?

The story of Cal-Maine Foods, a major player in the

US egg market

, began in 1957. Fred R. Adams, Jr., a Mississippi native, launched his entrepreneurial journey in Jackson, Mississippi. This marked the start of what would become a significant force in thepoultry industry

.The initial venture involved Adams purchasing a used truck to deliver feed, followed by establishing his first chicken farm. By 1958, the company had already begun commercial layer operations in Mendenhall, Mississippi, focusing on

egg production

. This early focus set the stage for future growth and expansion within the egg industry.Adams likely identified a need for a more organized approach to egg production and distribution. His business model centered on producing fresh shell eggs. While specific details on initial funding are scarce, the start with a used truck suggests a resourceful beginning. This early strategy proved successful, laying the groundwork for the company's future trajectory.

The name 'Cal-Maine' emerged from a significant merger in 1969.

- Adams Foods, Incorporated merged with Dairy Fresh Products Company of California and Maine Egg Farms.

- A contest was held to choose the new name.

- 'Cal-Maine' was selected, reflecting the company's broader geographic reach.

- This merger was crucial for expanding nationally in the fragmented egg market.

The 1969 merger of Adams Foods, Incorporated, with Dairy Fresh Products Company of California and Maine Egg Farms of Lewiston, Maine, was a pivotal moment. A contest was held to choose a new name, and 'Cal-Maine' was the winning entry. This name reflected the company's expanded reach from California to Maine. This merger was a key step in establishing a national presence in the fragmented egg market. The company's growth has been marked by strategic acquisitions and expansions, helping it become a leading player in the industry.

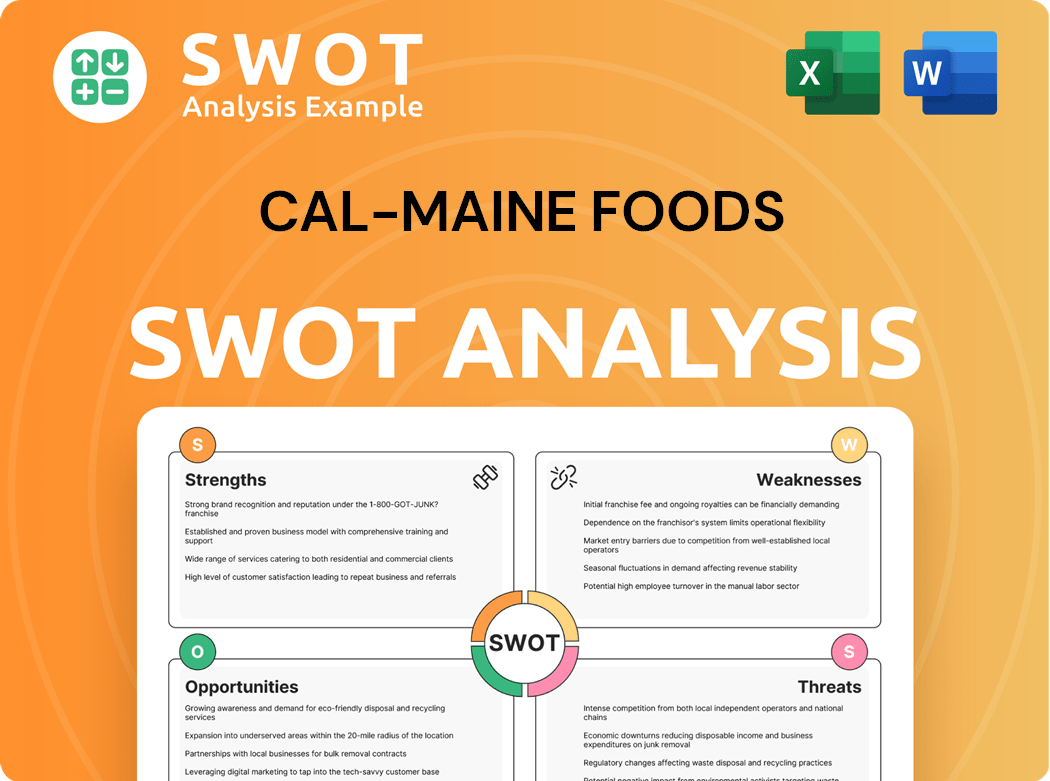

Cal-Maine Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Cal-Maine Foods?

The early years of Cal-Maine Foods were marked by substantial growth and strategic expansion within the poultry industry. This phase involved increasing production capabilities and making key acquisitions to solidify its market position. The company's commitment to growth was evident from the start, setting the stage for its future success in the US egg market.

In 1963, Cal-Maine Foods expanded its operations by constructing what was then considered the world's largest egg farm in Edwards, Mississippi. This expansion showcased the company's ambition and its early focus on scaling its egg production capabilities. This early investment set a precedent for future growth within the poultry industry.

Following its incorporation in 1969, Cal-Maine Foods, Inc. adopted a disciplined acquisition strategy to fuel further growth. In fiscal year 1989, the company acquired Egg City, Inc., adding 1.3 million laying hens. This was followed by the acquisition of Sunny Fresh Foods, Inc. in 1990, which controlled 7.5 million layers across multiple states.

The early 1990s saw Cal-Maine Foods continue to expand. In 1991, it acquired Sunnyside Eggs, Inc., adding 1.8 million laying hens. Investments in new facilities, such as a $10 million egg production facility in Louisiana in 1992, further increased capacity. These expansions helped drive net sales to $235.9 million by fiscal 1993.

A significant milestone occurred in December 1996 when Cal-Maine Foods became a public company, trading on NASDAQ under the ticker 'CALM'. The initial public offering raised $10.6 million, providing capital for further acquisitions. In April 1997, the company acquired Southern Egg Farm, Inc., adding 1.3 million laying hens. By 1998, the egg market was consolidating, with a few companies controlling the majority of the laying hen flock.

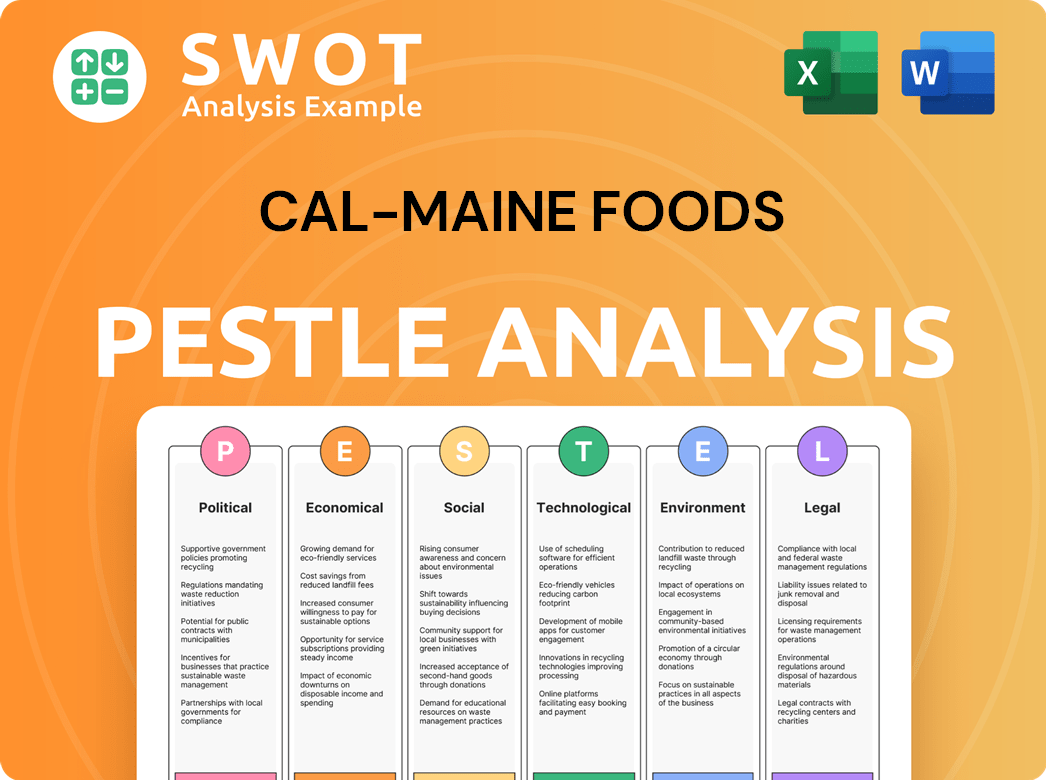

Cal-Maine Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Cal-Maine Foods history?

The brief history of Cal-Maine Foods is marked by significant achievements in the US egg market and the poultry industry. A key moment was reached in 2014 when the company surpassed one billion dozen eggs sold annually, demonstrating its substantial scale.

| Year | Milestone |

|---|---|

| 2014 | Cal-Maine Foods sold over one billion dozen eggs annually for the first time. |

| 2024 | Announced a $40 million investment in new capital projects to expand cage-free capabilities. |

| 2024 | Acquired former Tyson Foods facilities in Dexter, Missouri, to add 1.2 million free-range hens. |

Cal-Maine Foods has consistently focused on innovation, particularly in expanding its product portfolio beyond conventional eggs. This expansion includes specialty eggs like cage-free, organic, and nutritionally enhanced varieties, aligning with evolving consumer preferences.

Cal-Maine Foods has broadened its offerings to include cage-free, organic, and nutritionally enhanced eggs. This diversification strategy meets changing consumer demands for specialty egg products.

The company has invested heavily in cage-free production, with plans to add approximately 1.0 million cage-free layer hens by late summer 2025. These investments demonstrate a commitment to adapting to industry trends.

Cal-Maine Foods is implementing mobile app solutions to address operational inefficiencies, such as labor-intensive manual data entry for hen-house inspections. This improves data collection efficiency.

Despite its achievements, Cal-Maine Foods has faced challenges, including market downturns and competitive threats. A significant ongoing challenge is the outbreak of highly pathogenic avian influenza (HPAI), which has impacted egg supply and market prices.

HPAI outbreaks have posed a significant challenge, affecting both egg supply and market prices. Cal-Maine Foods has responded by increasing production and purchasing eggs from outside suppliers.

In March 2024, Cal-Maine Foods cooperated with a U.S. Department of Justice investigation regarding egg price increases following HPAI outbreaks. This reflects broader industry challenges.

The company navigates the inherent volatility of the agricultural sector, including fluctuations in feed costs and consumer demand. These factors influence the Cal-Maine Foods financial history.

For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of Cal-Maine Foods.

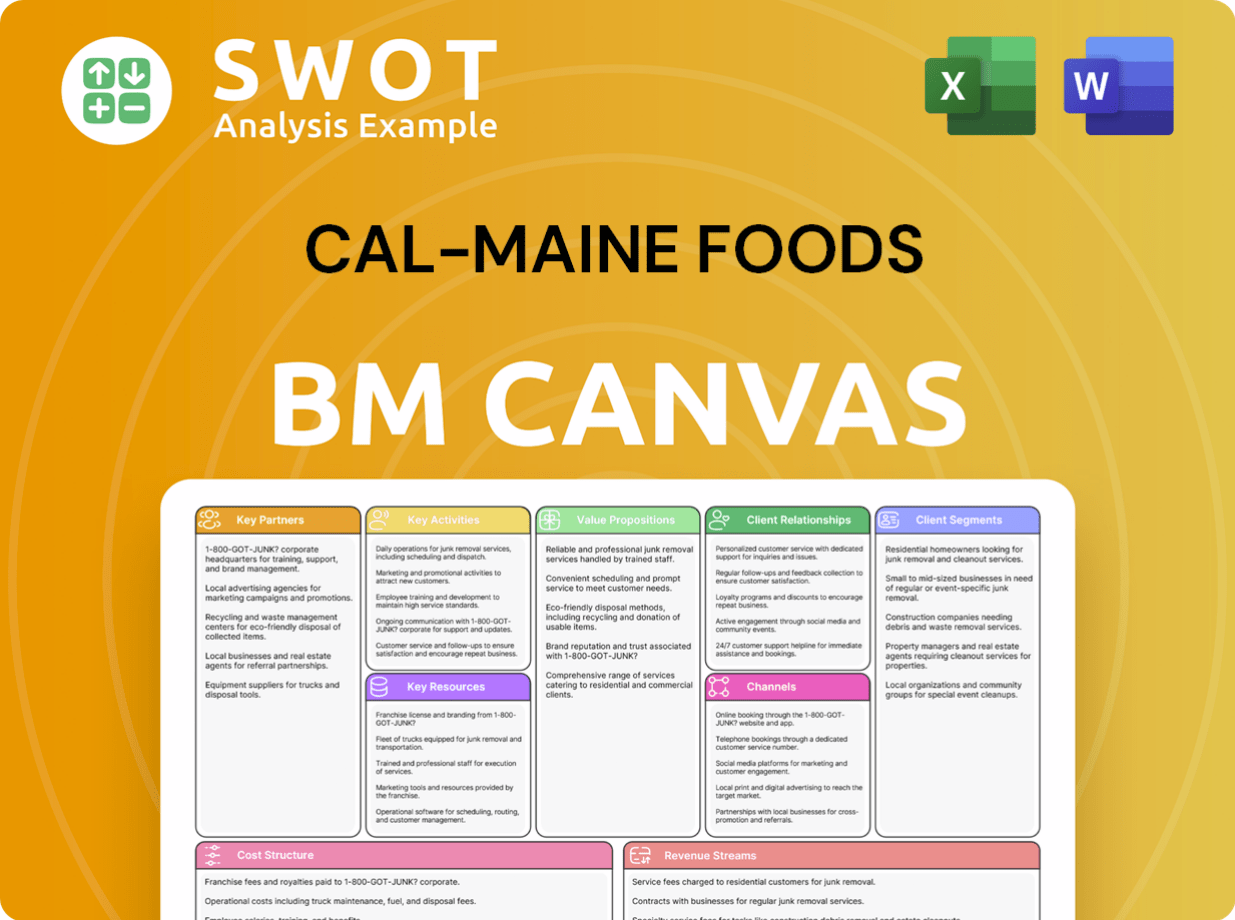

Cal-Maine Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Cal-Maine Foods?

The Cal-Maine Foods story began in 1957 when Fred R. Adams, Jr. started his egg operation in Jackson, Mississippi. Over the years, it has grown significantly through strategic acquisitions and expansions, becoming a major player in the US egg market. From its early commercial layer operations to its Initial Public Offering (IPO) and subsequent acquisitions, the company has consistently adapted to market demands, including the shift towards cage-free egg production. The company's financial performance, particularly in recent years, reflects this growth and strategic positioning within the poultry industry.

| Year | Key Event |

|---|---|

| 1957 | Fred R. Adams, Jr. begins his egg operation in Jackson, Mississippi. |

| 1958 | First commercial layer operation starts in Mendenhall, Mississippi. |

| 1963 | Expands to build the world's largest egg farm in Edwards, Mississippi. |

| 1969 | Adams Foods merges with Dairy Fresh Products and Maine Egg Farms to form Cal-Maine Foods, Inc. |

| 1990 | Acquires Sunny Fresh Foods for $21.6 million, almost doubling its size. |

| 1992 | Becomes an Egg-Land's Best franchisee. |

| 1996 | Initial Public Offering (IPO) on NASDAQ under ticker 'CALM'. |

| 2008 | Acquired egg production assets of Tampa Farm Service, Inc. and Zephyr Egg Company, adding 6.0 million layers. |

| 2014 | Sells over one billion dozen eggs annually for the first time. |

| 2023 | Achieved record sales of $3.15 billion with over 1.15 billion dozens sold; operating income surged by 575% compared to fiscal 2022. |

| 2024 (March) | Acquired a broiler processing plant, hatchery, and feed mill from Tyson Foods in Dexter, Missouri, for repurposing to shell egg production. |

| 2024 (September) | Invested $6.75 million in Crepini LLC joint venture, expanding into value-added egg products like wraps and crepes, acquiring a 51% interest. |

| 2024 (October) | Approved $40 million in new capital projects for additional cage-free production capabilities, adding approximately 1.0 million cage-free layer hens by late summer 2025. |

| 2025 (February) | Acquired certain assets of Deal-Rite Feeds, Inc. and its affiliated entities. |

| 2025 (April) | Entered into an agreement to acquire Echo Lake Foods, Inc. for approximately $258 million, expanding into ready-to-eat egg products and breakfast foods. Family shareholders convert Class A stock to common shares, and the company intends to repurchase $50 million worth of stock. |

The company is significantly increasing its cage-free egg production. They plan to add approximately 1.0 million cage-free layer hens by late summer 2025 through new capital projects. Conversion of the Dexter, Missouri, facility will add 1.2 million free-range hens by fall 2025, increasing its capacity to meet growing demand.

Strategic investments are a key component of the company's growth strategy. This includes a $15 million upgrade to its Blackshear, Georgia, facility to enhance extended shelf-life liquid egg products. Additionally, the acquisition of Echo Lake Foods, Inc. for around $258 million expands their product offerings into ready-to-eat egg products.

The company anticipates a sustained or improved market position. Higher egg prices, influenced by reduced supply from HPAI outbreaks, are expected to benefit the company. The company's strategic initiatives are designed to capitalize on market dynamics and consumer preferences.

The company is actively diversifying its product range. The investment in Crepini LLC and the planned acquisition of Echo Lake Foods, Inc. show a move into value-added egg products and ready-to-eat breakfast options. This diversification aligns with evolving consumer preferences for convenience and varied egg-based products.

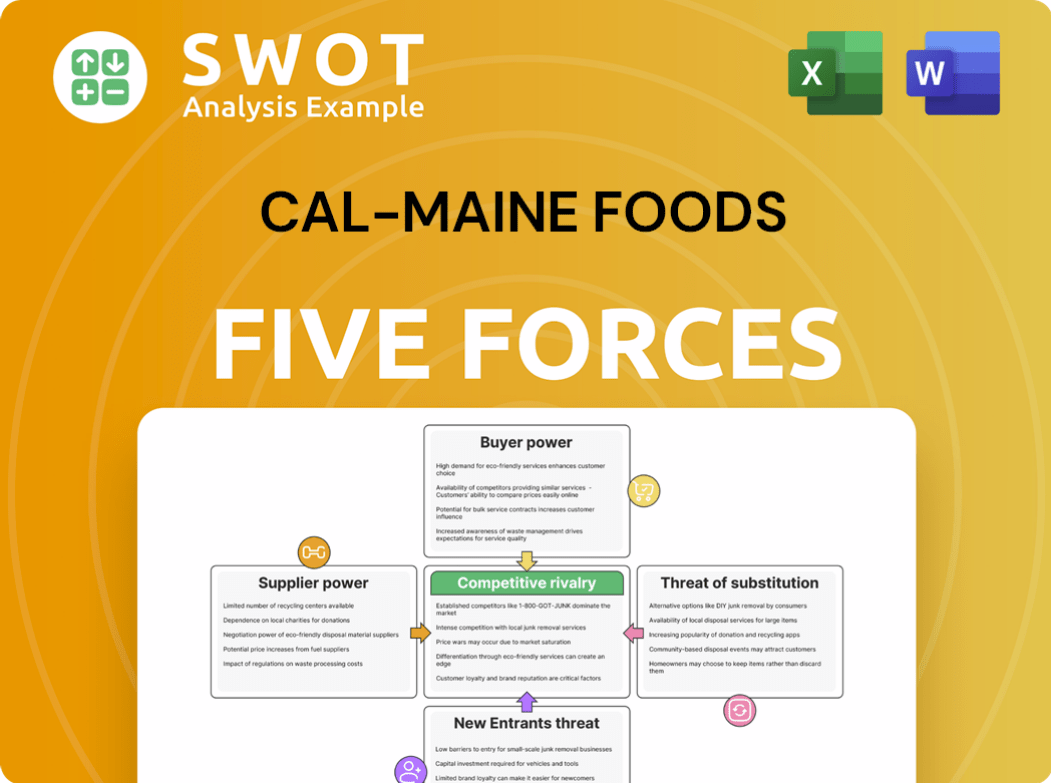

Cal-Maine Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Cal-Maine Foods Company?

- What is Growth Strategy and Future Prospects of Cal-Maine Foods Company?

- How Does Cal-Maine Foods Company Work?

- What is Sales and Marketing Strategy of Cal-Maine Foods Company?

- What is Brief History of Cal-Maine Foods Company?

- Who Owns Cal-Maine Foods Company?

- What is Customer Demographics and Target Market of Cal-Maine Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.