Cal-Maine Foods Bundle

Can Cal-Maine Foods Crack the Code to Continued Growth?

In the ever-evolving Cal-Maine Foods SWOT Analysis, the largest egg producer in the U.S. navigates a dynamic egg industry landscape. This article delves into the Cal-Maine Foods's strategic journey, from its founding in 1957 to its current market dominance. We'll explore how this company plans to maintain and expand its industry leadership.

Understanding the Cal-Maine prospects is crucial for investors and industry watchers. The company's proactive adaptation to consumer preferences, particularly the shift towards cage-free eggs, showcases its commitment to sustainable growth strategy. This analysis will provide a comprehensive overview of Cal-Maine Foods's expansion plans, innovation strategies, and financial outlook, offering valuable insights into its future trajectory and market analysis.

How Is Cal-Maine Foods Expanding Its Reach?

The growth strategy of Cal-Maine Foods centers on several key expansion initiatives designed to strengthen its market position and diversify its revenue streams. A primary focus is the ongoing transition to cage-free egg production, driven by increasing consumer demand and commitments from major retailers and food service providers. This strategic shift reflects the company's responsiveness to evolving market preferences and regulatory pressures within the egg industry.

Cal-Maine Foods also actively pursues growth through strategic acquisitions. This approach allows the company to consolidate its position within the fragmented egg market and expand its geographical reach. Recent acquisitions have enabled the company to optimize its distribution network and reduce transportation costs, contributing to its overall financial performance.

Furthermore, Cal-Maine Foods is focused on expanding its customer base within existing markets. This includes strengthening relationships with major retail grocers and club stores, as well as exploring new opportunities within the foodservice sector. By offering a diverse portfolio of egg products, including conventional, organic, and specialty eggs, the company aims to cater to a broader range of customer needs and preferences.

Cal-Maine Foods is heavily investing in converting its conventional laying hen capacity to cage-free systems. This is in response to rising consumer demand and commitments from major retailers. The company's capital allocation towards cage-free production reflects a strategic adaptation to market trends. This is a key component of their growth strategy.

Acquisitions have historically been a significant part of Cal-Maine Foods' growth strategy. These acquisitions help the company expand its geographical reach and production capabilities. This strategy allows the company to consolidate its position within the egg industry. You can read more about it in Competitors Landscape of Cal-Maine Foods.

Cal-Maine Foods focuses on expanding its customer base within existing markets. This includes strengthening relationships with major retail grocers and exploring new opportunities in the foodservice sector. Offering a diverse range of egg products allows the company to cater to a broader range of customer needs and preferences.

The company aims to capture higher-margin sales by offering a variety of egg products. This includes conventional, organic, and specialty eggs. This diversification strategy contributes to its growth objectives and helps meet the varied demands of the market. This supports the company's overall financial performance.

Cal-Maine Foods' expansion plans are multifaceted, focusing on both product and market growth. These strategies are designed to capitalize on emerging trends and strengthen its competitive position within the egg industry. The company's approach includes significant investments and strategic partnerships.

- Continued investment in cage-free egg production to meet growing consumer demand and regulatory requirements.

- Strategic acquisitions to expand geographical reach and production capacity, consolidating its market share.

- Strengthening relationships with existing customers and exploring new opportunities within the foodservice sector.

- Offering a diverse product portfolio, including conventional, organic, and specialty eggs, to cater to a broader customer base.

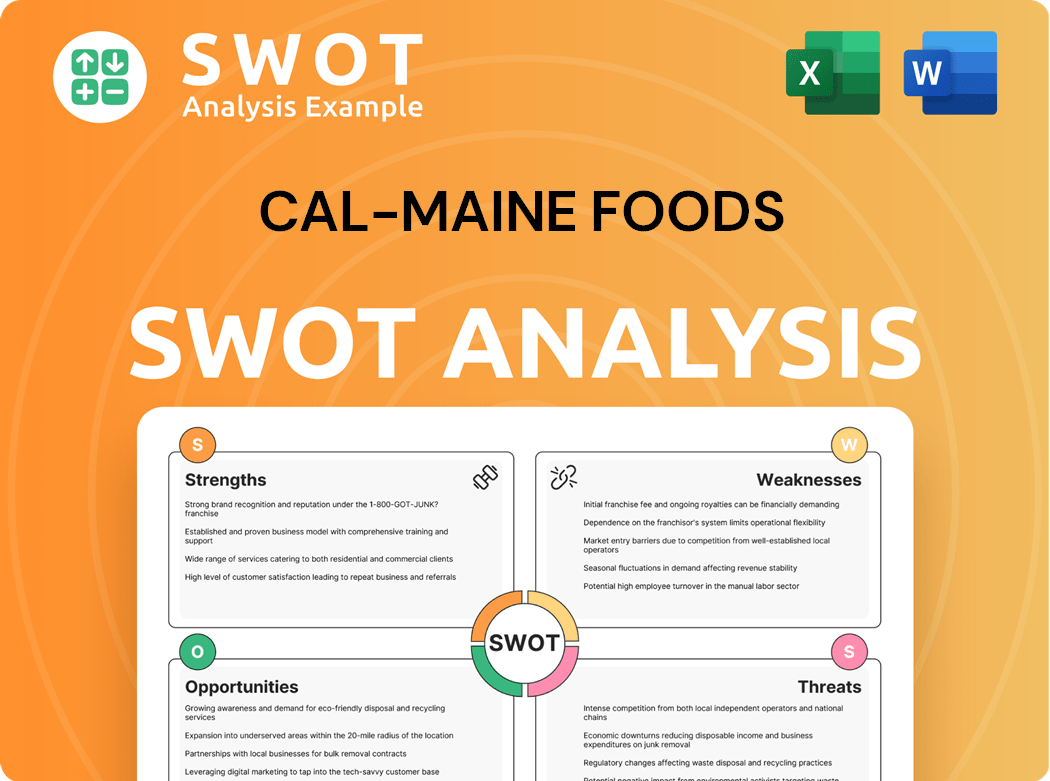

Cal-Maine Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cal-Maine Foods Invest in Innovation?

Cal-Maine Foods focuses on innovation and technology to boost efficiency, enhance product quality, and foster sustainable growth in the egg industry. Their technological strategy involves optimizing production through automation and advanced farming techniques, improving operational efficiency. This includes investments in sophisticated grading and packing equipment, which ensures product consistency and reduces labor costs.

The company's innovation also addresses evolving consumer health and dietary trends. This includes producing nutritionally enhanced eggs, like those fortified with Omega-3s. While specific R&D investments are not always detailed, the consistent introduction of specialty egg products shows their commitment to product development and market responsiveness. This allows them to cater to niche markets and achieve premium prices, contributing to revenue growth.

Furthermore, Cal-Maine Foods integrates sustainability initiatives into its operations, often using technological advancements. This includes efforts to reduce environmental impact through improved waste management, water conservation, and energy efficiency. The company's focus on sustainable practices enhances its brand reputation and appeals to environmentally conscious consumers and investors.

Cal-Maine Foods invests in automated systems for grading and packing eggs. These systems increase efficiency and reduce labor costs, contributing to improved financial performance. Automation also helps maintain consistent product quality, which is crucial for customer satisfaction and brand reputation.

The company develops and markets specialty eggs to meet consumer demand for healthier options. This includes eggs enriched with Omega-3s and other nutrients. Product innovation allows Cal-Maine Foods to capture a larger market share and command premium prices.

Cal-Maine Foods implements sustainable practices to reduce its environmental footprint. This includes waste management, water conservation, and energy efficiency measures. These initiatives are increasingly important for attracting environmentally conscious consumers and investors.

Utilizing data analytics to optimize production processes and supply chain management. This enables better decision-making, leading to improved operational efficiency and cost savings. Data-driven insights also help in anticipating market trends and consumer preferences.

Implementing technology to enhance the efficiency of the supply chain. This includes real-time tracking of eggs from production to distribution. Optimized supply chains reduce waste and ensure product freshness, which is critical for maintaining customer satisfaction.

Investing in R&D to explore new egg varieties and production methods. This includes research into animal welfare and sustainable farming practices. Ongoing R&D efforts are essential for staying competitive and meeting evolving consumer demands.

Cal-Maine Foods' growth strategy relies heavily on technological advancements and product innovation to maintain its leadership in the egg industry. These strategies are crucial for enhancing efficiency, meeting consumer demands, and ensuring long-term sustainability. The company's focus on automation, product development, and sustainable practices positions it well for future success.

- Automation in Production: Implementing advanced grading and packing systems to reduce labor costs and improve efficiency.

- Product Innovation: Developing and marketing specialty eggs, such as Omega-3 enriched varieties, to meet consumer preferences.

- Sustainability Initiatives: Utilizing technology to improve waste management, conserve water, and enhance energy efficiency.

- Data Analytics: Using data to optimize production processes and supply chain management.

- Supply Chain Optimization: Implementing real-time tracking to reduce waste and ensure product freshness.

- Research and Development: Investing in R&D to explore new egg varieties and sustainable farming practices.

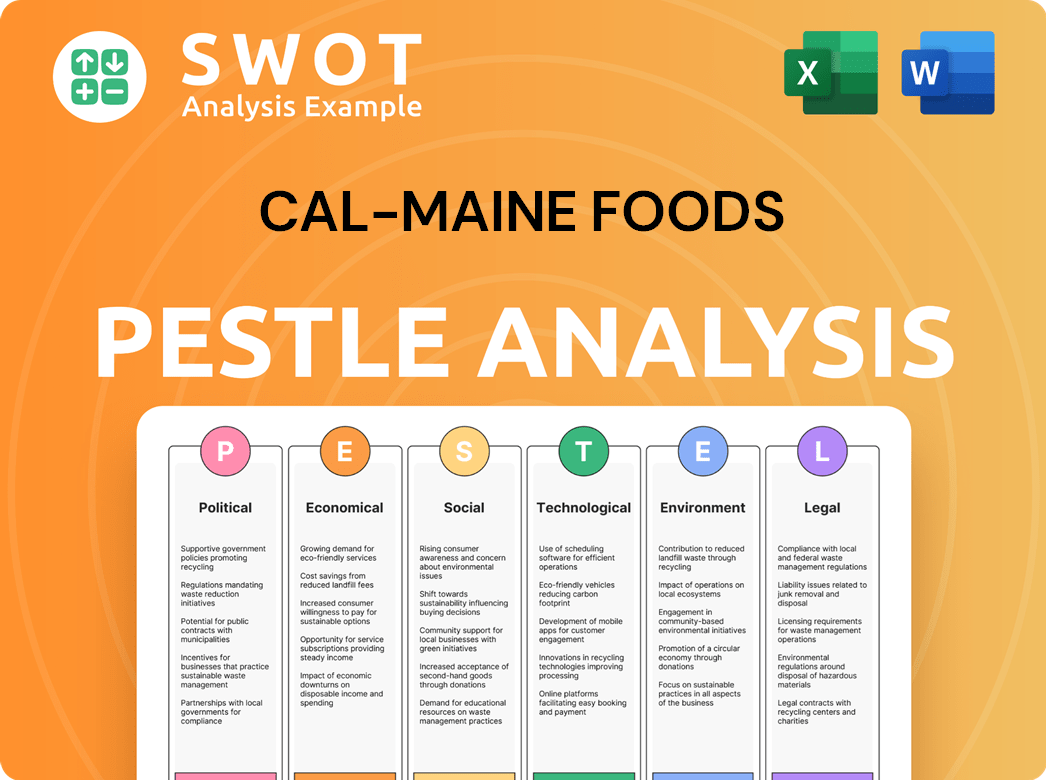

Cal-Maine Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Cal-Maine Foods’s Growth Forecast?

The financial outlook for Cal-Maine Foods is significantly shaped by its strategic moves, especially its ongoing shift towards cage-free egg production. This strategic direction is a key element in its overall growth strategy. The company's ability to navigate the volatile egg market is also crucial for its financial performance.

In the third quarter of fiscal year 2024, which concluded on March 2, 2024, Cal-Maine Foods reported net sales of $723.5 million. This figure highlights the company's substantial revenue generation capabilities, even amidst fluctuating egg prices. The financial performance is closely tied to the company's ability to adapt to market dynamics.

For the same period, the company reported a net income of $149.2 million, translating to $3.05 per diluted share. This profitability underscores the effectiveness of Cal-Maine Foods' operational strategies and its ability to capitalize on market opportunities. The focus on specialty eggs is a key driver of this financial success.

Sales of specialty eggs, including cage-free, organic, and nutritionally enhanced varieties, represented 48.7% of total shell egg dozens sold in the third quarter of fiscal year 2024. These eggs also accounted for 62.4% of total shell egg sales revenue during the same period. This shift indicates a successful focus on higher-value products.

Cal-Maine Foods continues to invest substantially in capital expenditures to support its growth plans, especially the expansion of cage-free facilities. For the nine months ending March 2, 2024, capital expenditures amounted to approximately $128.0 million. This investment highlights the company's commitment to enhancing its production capabilities and meeting future demand.

Analyst forecasts often consider the volatility of egg prices as a key factor when assessing the Cal-Maine prospects. However, the company's strong market position and emphasis on specialty eggs are expected to provide stability and support long-term financial goals. Maintaining a robust balance sheet is also a key part of the company's financial strategy to support these investments and navigate market cycles.

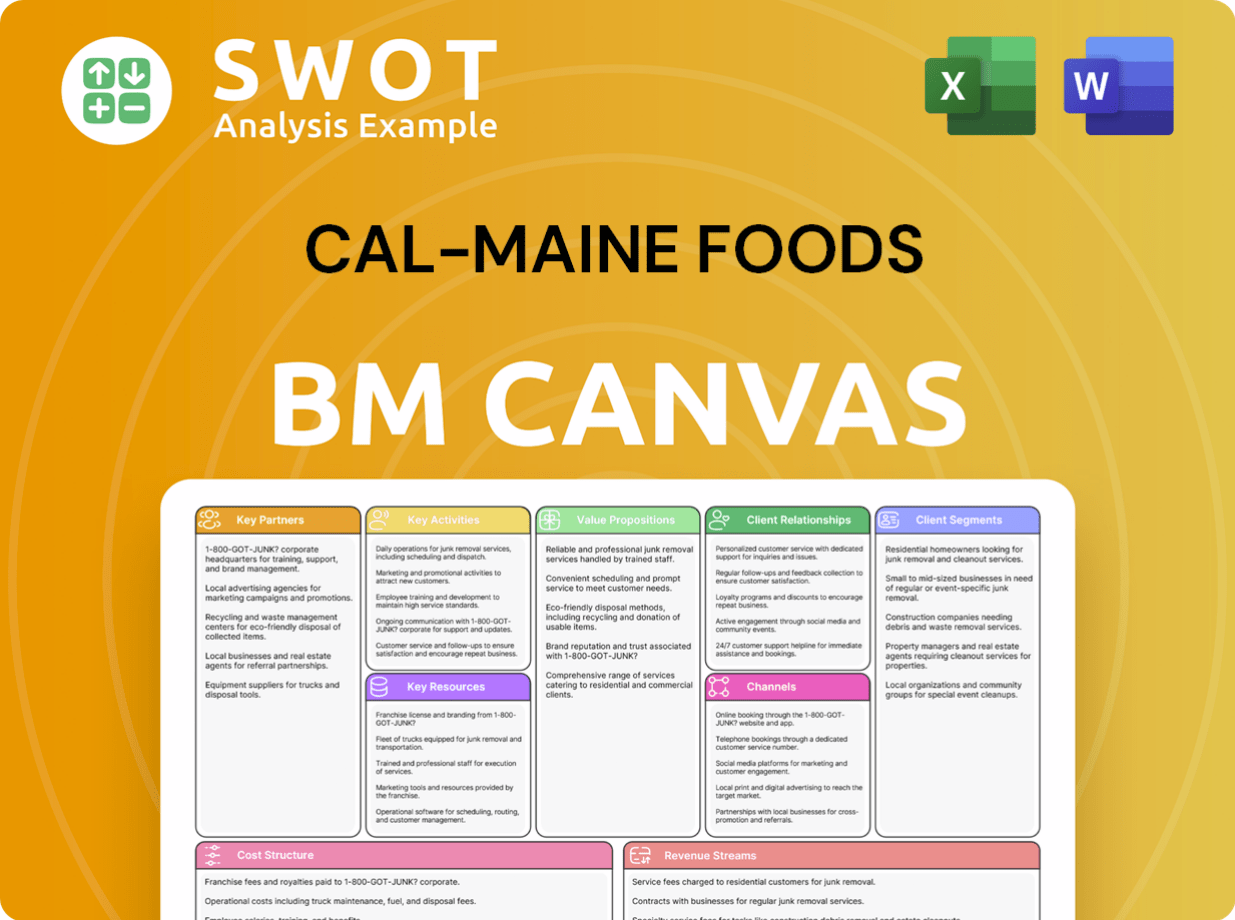

Cal-Maine Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Cal-Maine Foods’s Growth?

The future of Cal-Maine Foods is subject to several risks and obstacles that could affect its growth. These challenges include volatile egg prices, competition within the egg industry, and the rising costs of production. The company's ability to navigate these issues will be crucial for maintaining its market position and achieving its strategic goals.

One of the most significant risks is the volatility of egg prices. These prices are influenced by supply and demand, feed costs, and disease outbreaks. The company must also manage the ongoing threat of Highly Pathogenic Avian Influenza (HPAI), which can lead to substantial flock losses and operational disruptions. Furthermore, changing consumer preferences, such as the growing demand for cage-free eggs, require significant capital investments and strategic adjustments.

In addition to these factors, Cal-Maine Foods faces risks related to its supply chain, particularly the prices of feed ingredients like corn and soybeans. The company also needs to manage internal operational risks, including labor availability and efficient distribution across its facilities. These challenges require proactive strategies to ensure sustained financial performance and market competitiveness.

Egg prices are highly susceptible to fluctuations caused by supply and demand dynamics and external factors. The 2022 HPAI outbreak significantly impacted egg prices, highlighting the vulnerability of the egg industry. Feed costs, which account for a large portion of production expenses, also contribute to price volatility.

Outbreaks of HPAI pose a severe threat, leading to flock losses, supply chain disruptions, and increased costs. The 2022 HPAI outbreak resulted in the culling of millions of birds, significantly affecting egg production and market prices. Effective biosecurity measures and rapid response plans are essential to mitigate these risks.

The egg industry is competitive, with both regional and local producers vying for market share. Changes in consumer preferences, such as the demand for cage-free eggs, require significant capital investments. Failure to adapt to these changing demands can lead to a loss of market share for Cal-Maine Foods.

Regulatory changes concerning animal welfare, environmental standards, and food safety can increase compliance costs. These regulations can add complexity to operations and require significant investment in infrastructure and practices. Compliance with these standards is crucial for maintaining consumer trust and market access.

Supply chain disruptions, especially related to feed ingredients like corn and soybeans, can impact the cost of goods sold. Fluctuations in commodity prices and logistical challenges can directly affect profitability. Managing these vulnerabilities requires strategic sourcing and diversification of supply chains.

Managing a large-scale agricultural operation involves risks related to labor availability, biosecurity across numerous facilities, and distribution. Efficient operations and effective risk management are crucial for maintaining profitability. The company's ability to manage these risks directly impacts its financial performance.

To mitigate risks, Cal-Maine Foods employs several strategies. These include diversification of production facilities, continuous investments in biosecurity measures, and strategic sourcing of feed ingredients. These measures aim to enhance resilience and stability in the face of market fluctuations and unforeseen events. The company's proactive approach is essential for its growth strategy.

The company is investing in adapting to changing consumer preferences, notably the growing demand for cage-free eggs. This involves significant capital expenditure for converting existing facilities and building new ones. These investments are critical for maintaining market share and aligning with evolving consumer demands. The company's ability to adapt is key to its future outlook.

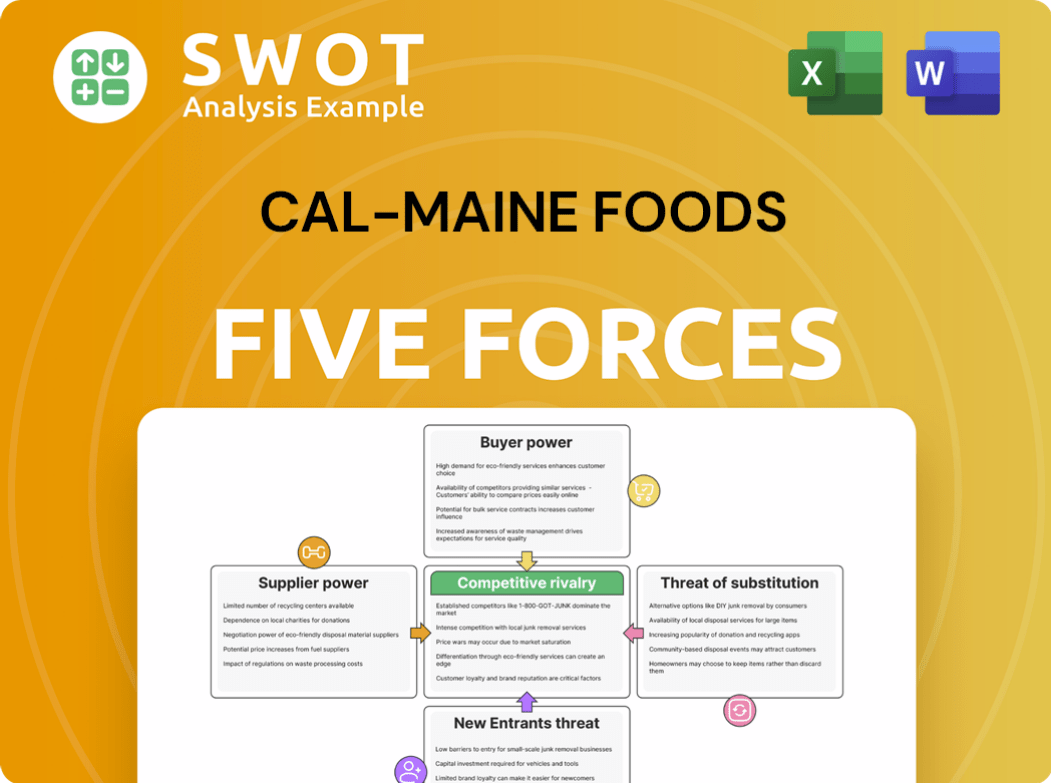

Cal-Maine Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cal-Maine Foods Company?

- What is Competitive Landscape of Cal-Maine Foods Company?

- How Does Cal-Maine Foods Company Work?

- What is Sales and Marketing Strategy of Cal-Maine Foods Company?

- What is Brief History of Cal-Maine Foods Company?

- Who Owns Cal-Maine Foods Company?

- What is Customer Demographics and Target Market of Cal-Maine Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.