Cal-Maine Foods Bundle

How Does Cal-Maine Foods Thrive in the Egg Market?

Cal-Maine Foods, the undisputed leader in the U.S. fresh shell egg market, is more than just an Cal-Maine Foods SWOT Analysis; it's a cornerstone of the food industry. As the largest egg supplier, the company’s operations are critical to feeding millions. But how does this agricultural company navigate the complexities of egg production and distribution to maintain its dominance?

This exploration into Cal-Maine Foods company will uncover the secrets behind its success, from egg farming practices to its extensive distribution network. We'll examine its business model, including its diverse egg offerings like cage-free and organic eggs, and how it adapts to fluctuating egg prices and consumer demands. Understanding Cal-Maine Foods operations offers valuable insights into the poultry industry and the strategies required for long-term profitability.

What Are the Key Operations Driving Cal-Maine Foods’s Success?

The core operations of the Cal-Maine Foods company revolve around the vertically integrated production, grading, packing, and sale of fresh shell eggs. This model is designed to maximize efficiency and control throughout the supply chain. The Cal-Maine Foods operations encompass every stage, from egg production to distribution, ensuring a consistent supply of high-quality products to its customers. The company's focus on vertical integration allows it to manage costs and maintain quality standards effectively.

The company offers a diverse portfolio of egg products, catering to various consumer segments. This includes conventional eggs, which form the bulk of their sales, alongside a growing emphasis on specialty eggs such as cage-free, organic, and nutritionally enhanced varieties. These specialty eggs address increasing consumer demand for ethically produced and health-conscious food options, allowing Cal-Maine Foods to capture a broader market share and command premium pricing. The company serves a wide array of customers, primarily retail grocers, club stores, and foodservice distributors, establishing strong relationships with major players in the food industry.

The operational process begins with egg production, either through company-owned or contract farms. This involves meticulous management of laying hens to ensure consistent egg quality and supply. Once laid, eggs are transported to one of Cal-Maine's numerous grading and packing facilities. Here, eggs undergo rigorous inspection, cleaning, sizing, and packaging to meet strict quality and safety standards. The company's extensive network of production and processing facilities, strategically located across the U.S., minimizes transportation costs and ensures freshness. Its supply chain is highly optimized, leveraging advanced logistics and distribution networks to deliver products efficiently to customers nationwide. This extensive infrastructure and established distribution channels are key differentiators, allowing Cal-Maine to maintain a competitive edge through economies of scale and reliable delivery. The company's commitment to quality control and its ability to consistently supply a wide range of egg products translate into significant value for its customers, who rely on Cal-Maine for a stable and diverse egg supply.

The company sources eggs from both company-owned farms and contract farms. This dual approach ensures a consistent supply. In fiscal year 2023, Cal-Maine Foods produced approximately 6.6 billion eggs.

Eggs undergo rigorous grading, cleaning, and packaging processes. This ensures quality and compliance with food safety standards. The company operates multiple grading and packing facilities strategically located across the United States.

Cal-Maine offers a diverse range of egg products, including conventional, cage-free, organic, and nutritionally enhanced eggs. The company is expanding its specialty egg offerings to meet growing consumer demand. In fiscal year 2023, specialty eggs accounted for a significant portion of sales.

The company distributes its products to retail grocers, club stores, and foodservice distributors. Cal-Maine Foods maintains strong relationships with major players in the food industry. The company's distribution network ensures efficient delivery across the U.S.

The company's value proposition centers around providing a reliable supply of high-quality eggs. This is achieved through vertical integration, efficient operations, and a diverse product portfolio. Brief History of Cal-Maine Foods provides more insights into the company's evolution and strategic decisions.

- Reliable Supply: Ensures a consistent supply of eggs to customers through a vertically integrated model.

- Quality Assurance: Maintains high standards through rigorous grading, packaging, and quality control processes.

- Product Diversity: Offers a wide range of egg products, including conventional and specialty eggs, to meet varied consumer preferences.

- Efficient Operations: Leverages economies of scale and advanced logistics to minimize costs and maximize efficiency.

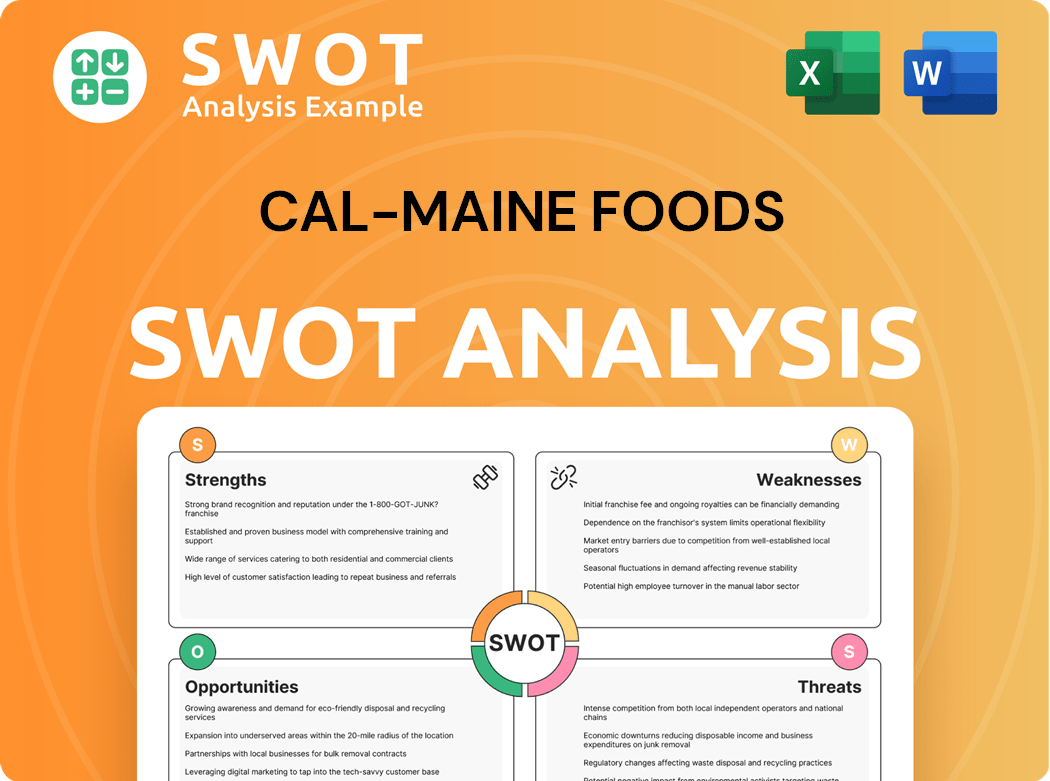

Cal-Maine Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cal-Maine Foods Make Money?

The primary revenue stream for the Cal-Maine Foods company is the sale of fresh shell eggs, encompassing a variety of types. This includes conventional, cage-free, organic, and nutritionally enhanced eggs, catering to diverse consumer preferences. The company's financial performance is significantly influenced by its ability to manage its product mix and respond to market demands.

The company's monetization strategy centers on volume-based sales to major retail and foodservice channels. This direct-to-customer approach allows for greater control over pricing and product delivery. The company's expansion into specialty egg categories is a key strategic move to diversify revenue streams.

In the third quarter of fiscal year 2024, net sales were $435.5 million, demonstrating the scale of the Cal-Maine Foods operations. While specific breakdowns for the current fiscal year ending May 2025 are not yet fully available, historical data and industry trends indicate that conventional eggs typically constitute the largest portion of sales volume.

The Cal-Maine Foods company generates revenue through the sale of various egg products. The company strategically manages its flock sizes and production levels to optimize profitability. The company's ability to adapt to market dynamics is crucial for financial success.

- Conventional Eggs: These typically form the largest portion of sales volume.

- Specialty Eggs: Cage-free and organic eggs contribute significantly to revenue growth due to higher price points.

- Volume-Based Sales: Sales to major retail and foodservice channels are a core strategy.

- Market Dynamics: The company benefits from fluctuating egg prices influenced by supply and demand.

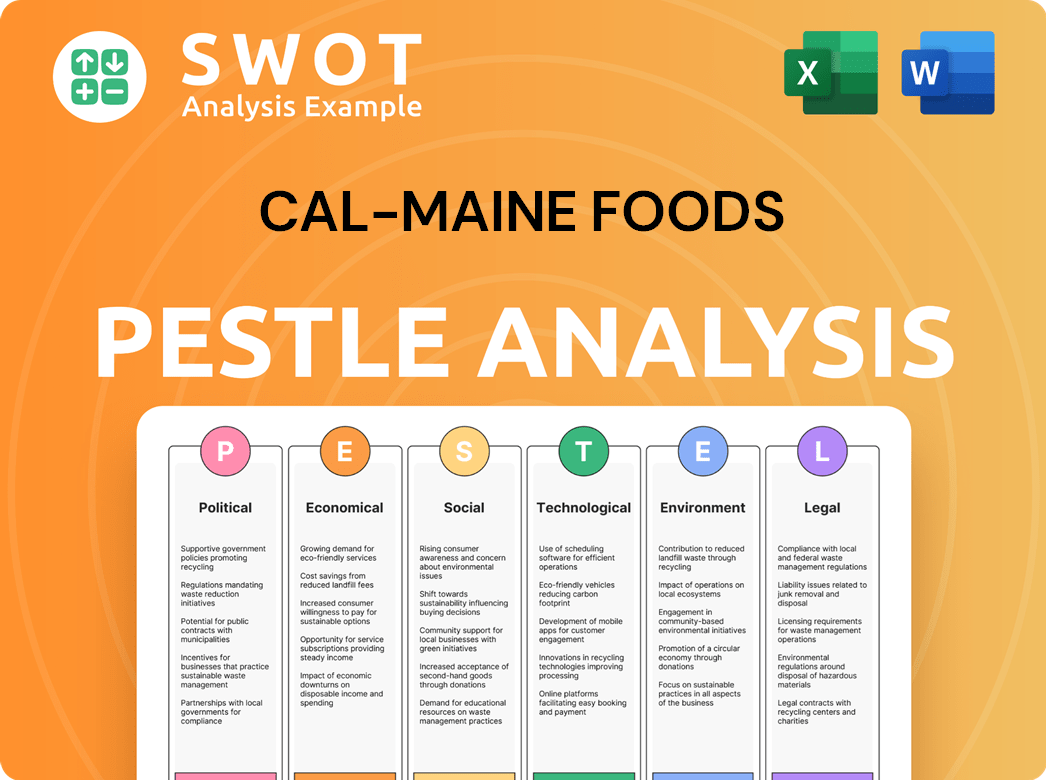

Cal-Maine Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Cal-Maine Foods’s Business Model?

The journey of the Cal-Maine Foods company has been marked by strategic expansions and adaptations. These moves have solidified its position as the largest fresh shell egg producer in the U.S. Significant milestones include consistent growth through strategic acquisitions. These acquisitions have expanded its production capacity and geographic reach. This has allowed Cal-Maine Foods to achieve significant economies of scale, which is a critical competitive advantage in a commodity-driven market.

The company has effectively navigated operational challenges. These include volatile feed costs, which are a major expense, and periodic outbreaks of avian influenza, which can severely impact supply and production. Cal-Maine Foods mitigates these risks through diversified production facilities, stringent biosecurity measures, and strategic purchasing of feed ingredients. Its competitive edge stems from its unparalleled economies of scale, extensive distribution network, and strong relationships with major retailers and foodservice providers.

Furthermore, Cal-Maine Foods has strategically invested in expanding its production of specialty eggs, such as cage-free and organic varieties. This move addresses evolving consumer preferences and regulatory pressures, positioning the company to capitalize on higher-margin product segments. The company's ability to adapt to changing market demands, coupled with its operational efficiency and robust supply chain, continues to sustain its business model against competitive threats and market fluctuations.

The company's growth strategy has heavily relied on acquisitions. In May 2024, Cal-Maine Foods announced the acquisition of a commercial egg production complex in Texas. This included approximately 1.6 million laying hens and associated pullet capacity. These strategic moves have expanded the company's footprint and production capabilities.

Operational efficiency is a cornerstone of Cal-Maine Foods operations. The company's focus on maintaining a robust supply chain and efficient production processes allows them to manage costs effectively. This efficiency is crucial in the competitive egg production market, helping them maintain profitability even with fluctuating egg prices.

Adapting to market changes is essential for Cal-Maine Foods to thrive. The company has strategically invested in cage-free eggs and organic eggs to meet consumer demand. This diversification into higher-margin specialty egg segments has strengthened their position in the poultry industry.

Strong relationships with major retailers are vital for egg distribution. Cal-Maine Foods has cultivated extensive distribution networks and partnerships. This ensures efficient delivery of products nationwide. This is a critical factor in maintaining their market share in the retail eggs sector.

The competitive advantages of Cal-Maine Foods are multifaceted. They include economies of scale, a vast distribution network, and strong relationships with major retailers. These factors enable efficient production and reliable product delivery. They also allow the company to manage risks effectively.

- Economies of Scale: Large-scale operations result in lower per-unit costs.

- Distribution Network: An extensive network ensures efficient delivery across the U.S.

- Retail Relationships: Strong partnerships with major retailers ensure product placement.

- Specialty Egg Production: Expansion into cage-free eggs and organic eggs caters to market demands.

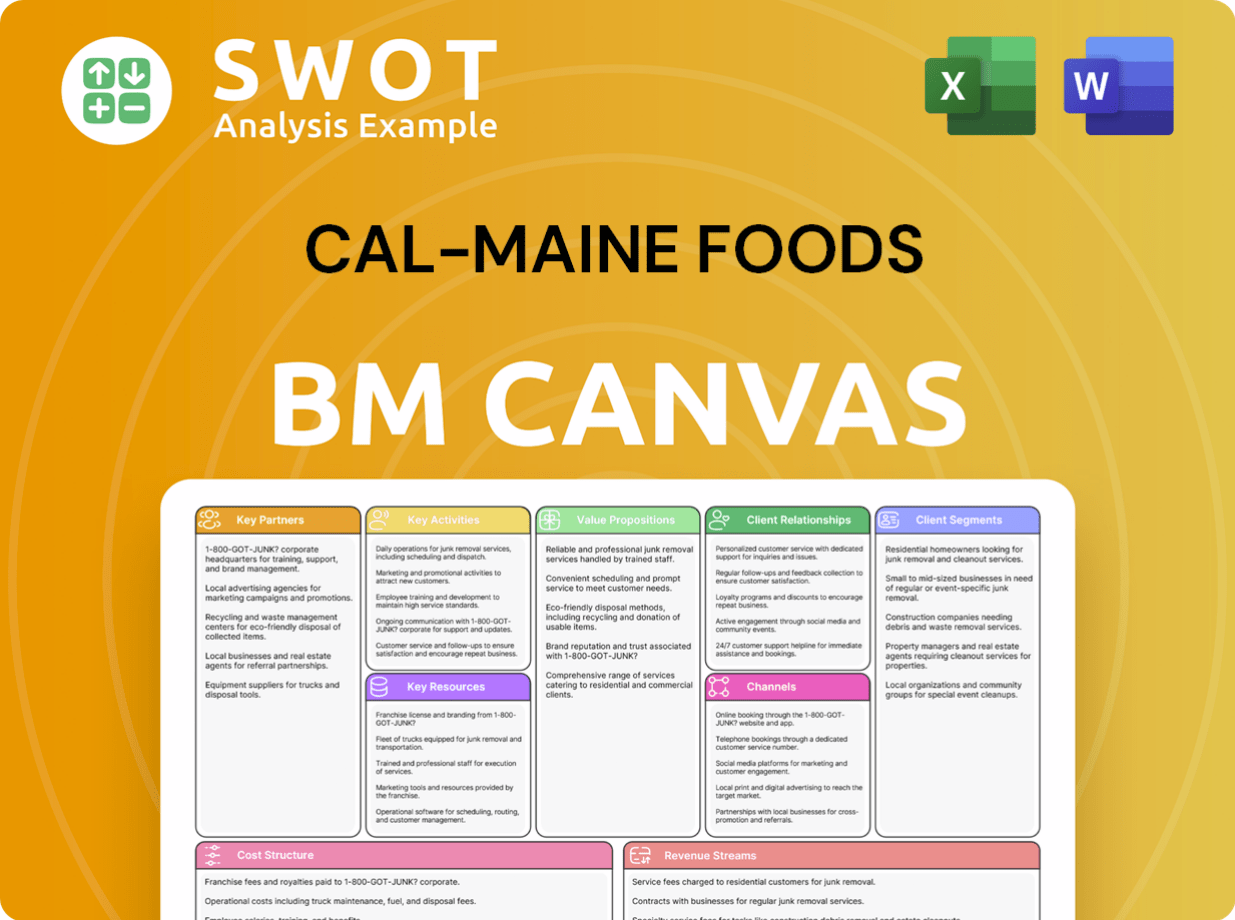

Cal-Maine Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Cal-Maine Foods Positioning Itself for Continued Success?

The Cal-Maine Foods company holds a leading position in the U.S. fresh shell egg market, primarily due to its extensive distribution network and considerable scale. The Cal-Maine Foods operations are designed to serve a broad customer base, including major retail grocers, club stores, and foodservice distributors, which contributes to strong customer loyalty. The structure of the U.S. egg market, with a few large producers, gives the company a distinct advantage over smaller competitors.

However, the company faces various risks, including commodity price volatility, particularly for feed ingredients. Disease outbreaks, like avian influenza, and regulatory changes related to animal welfare standards pose significant challenges. Changing consumer preferences also present risks if the company fails to adapt quickly enough to shifts in demand, such as the growing preference for cage-free eggs. For more information about how the company approaches marketing, see this Marketing Strategy of Cal-Maine Foods.

The company maintains the largest market share in the U.S. egg market, with a significant presence in retail and foodservice channels. Its extensive distribution network and brand recognition support strong customer relationships. The company's scale allows for efficient operations and competitive pricing within the poultry industry.

The company is exposed to fluctuations in feed costs, which directly impact egg production expenses. Outbreaks of diseases, such as avian influenza, can disrupt supply and impact profitability. Regulatory changes, including those related to cage-free egg production, necessitate capital investments. Consumer preferences and shifts in demand also pose risks if not effectively addressed.

The company is focused on expanding cage-free egg production to meet rising consumer demand. It aims to improve operational efficiencies and explore strategic acquisitions for growth. The company's ability to manage costs and capitalize on market trends will be crucial for maintaining its market leadership in the egg farming sector.

In fiscal year 2024, the company reported net sales of approximately $2.9 billion. The company's focus on cage-free egg production has led to significant capital expenditures. The company's financial results are directly influenced by egg prices and feed costs.

The company is actively investing in cage-free egg production to meet growing consumer demand and regulatory requirements. This includes converting existing facilities and building new ones. The company is also exploring strategic acquisitions and focusing on operational efficiencies to manage costs and improve profitability in the egg production sector.

- Investment in cage-free production to meet demand.

- Focus on operational efficiencies and cost management.

- Strategic acquisitions to expand market presence.

- Adaptation to changing consumer preferences and market trends.

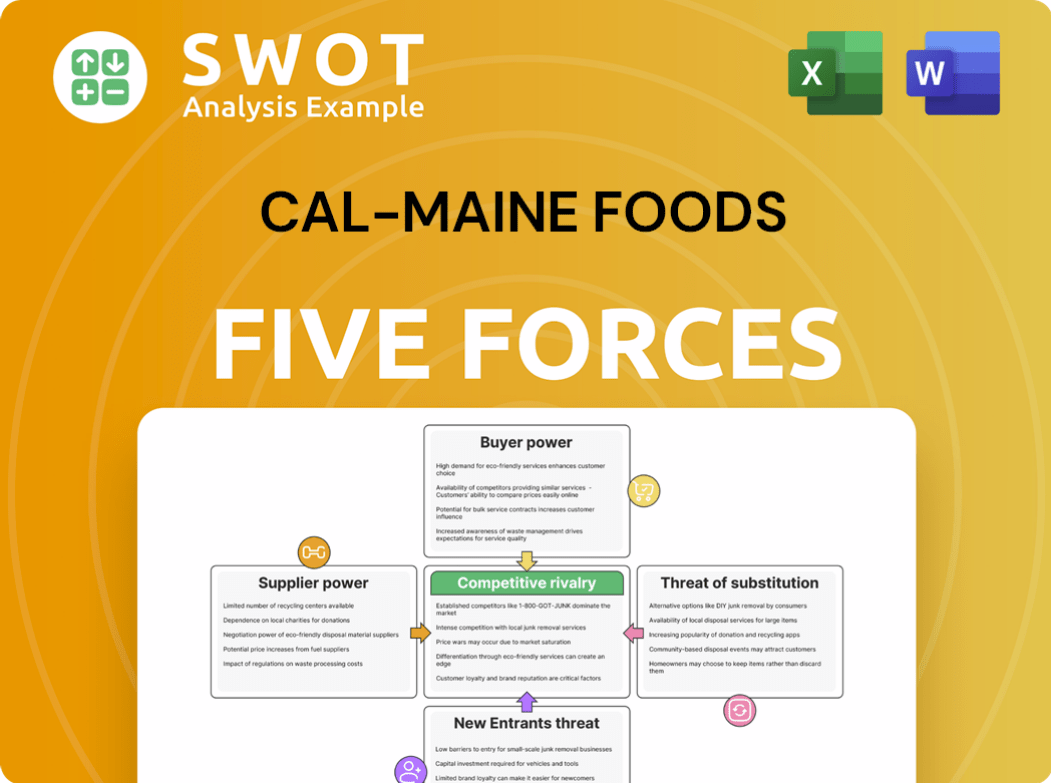

Cal-Maine Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cal-Maine Foods Company?

- What is Competitive Landscape of Cal-Maine Foods Company?

- What is Growth Strategy and Future Prospects of Cal-Maine Foods Company?

- What is Sales and Marketing Strategy of Cal-Maine Foods Company?

- What is Brief History of Cal-Maine Foods Company?

- Who Owns Cal-Maine Foods Company?

- What is Customer Demographics and Target Market of Cal-Maine Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.