Cal-Maine Foods Bundle

Who Really Owns Cal-Maine Foods?

Ever wondered who's calling the shots at the largest egg producer in the U.S.? Understanding the ownership structure of a company like Cal-Maine Foods SWOT Analysis is crucial for investors and anyone interested in the agricultural food sector. This publicly traded company, a giant in chicken farming, has a fascinating ownership story. Uncover the key players and their influence on this industry leader's future.

From its humble beginnings to its current market dominance, the Cal-Maine Foods company's evolution is a testament to strategic vision. Knowing who founded Cal-Maine Foods and understanding the dynamics of its ownership provides valuable insights. This analysis will explore the key shareholders, including institutional and insider holdings, and their impact on the company's trajectory. We'll also touch upon aspects such as Cal-Maine Foods stock price and Cal-Maine Foods investor relations.

Who Founded Cal-Maine Foods?

The story of the Cal-Maine Foods began in 1957. It was founded by Fred R. Adams, Jr., marking the start of what would become a major player in the egg industry. The early years were defined by a close-knit ownership structure, typical of family-run agricultural businesses.

Early ownership within the Cal-Maine Foods company was likely concentrated among the founding family and local investors. While the exact initial equity distribution isn't public, Fred R. Adams, Jr. was the driving force. His background in agriculture was key to the company's initial growth and expansion.

The early capital for operations and expansion came from family members and local investors. These early agreements focused on building a sustainable business model in egg production. The founding team's vision was to become a major egg producer, and this was reflected in how ownership was managed. This allowed for focused leadership and strategic development in the company's early stages.

The initial ownership of Cal-Maine Foods was a closely held family business. Fred R. Adams, Jr., played a key role in the company's inception and early growth. The company's early success was built on a foundation of family and local investor support.

- The company's early focus was on establishing a sustainable model in the egg production industry.

- There are no widely publicized records of significant early ownership disputes.

- The controlled distribution of ownership allowed for focused leadership.

- This approach was crucial for strategic development in its early stages.

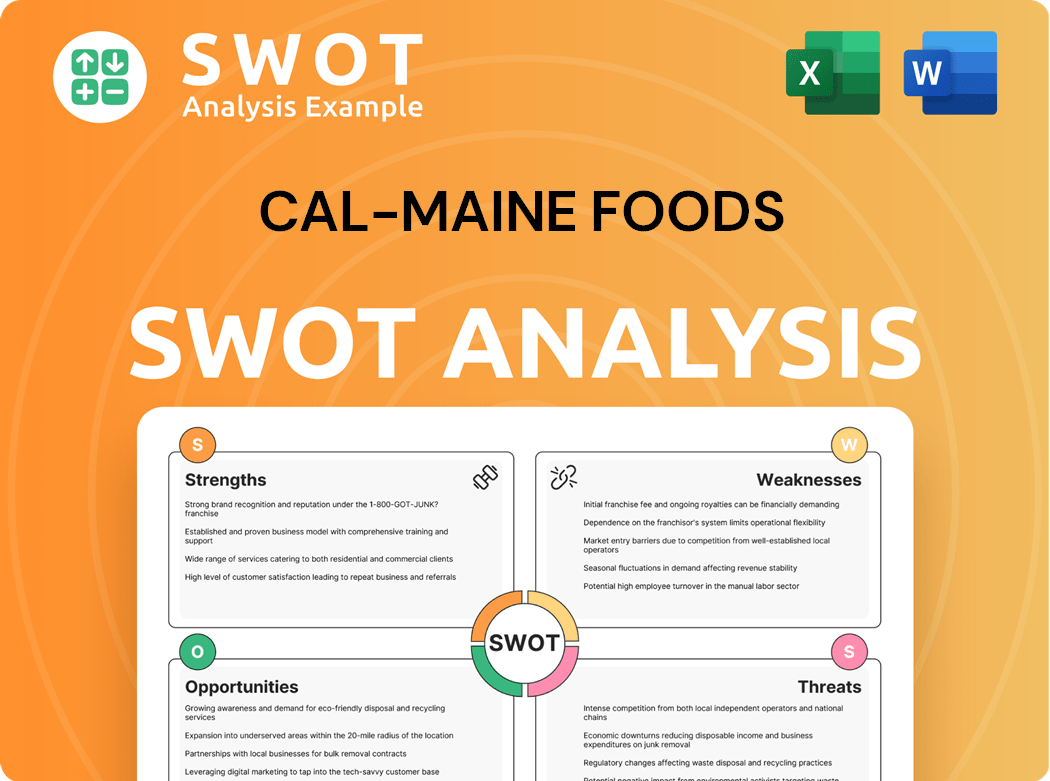

Cal-Maine Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Cal-Maine Foods’s Ownership Changed Over Time?

The ownership structure of the leading egg producer, has shifted significantly since its inception. Initially a privately held enterprise, the company transitioned to a publicly traded company, which led to a broader distribution of shares. This transition opened the door for institutional investors and other entities to acquire stakes in the company, changing the dynamics of ownership.

As of March 2024, a substantial portion of the shares of the company is held by institutional investors. These include investment management firms, mutual funds, and index funds. The presence of large institutional investors often influences the company's strategic direction, pushing for greater transparency and a focus on shareholder value. Family ownership, particularly from the Adams family, has remained a significant element, though diluted over time due to public offerings and market activities. For instance, individuals linked to the company's founding and management, such as descendants of Fred R. Adams, Jr., may still hold considerable individual stakes, as reported in proxy statements and SEC filings.

| Ownership Type | Details | Impact |

|---|---|---|

| Institutional Investors | BlackRock, Inc. and The Vanguard Group are often among the top institutional holders. | Influence on corporate strategy, emphasis on shareholder value. |

| Family Ownership | Descendants of the founders, such as the Adams family, maintain significant individual stakes. | Continuity of legacy, potential influence on company direction. |

| Public Offering | Transition from private to public ownership. | Broader share distribution, increased market visibility. |

The evolution of ownership has shaped the company's approach to corporate governance and financial reporting. The increasing presence of institutional investors has driven a greater emphasis on transparency and adherence to best practices. For a deeper understanding of the company's strategic moves, consider exploring the Growth Strategy of Cal-Maine Foods.

The shift from private to public ownership has broadened the shareholder base of the egg producer.

- Institutional investors hold a significant portion of shares, influencing strategy.

- Family ownership remains a notable component, ensuring some continuity.

- The company's focus has evolved towards greater transparency and shareholder value.

- Understanding the ownership structure offers insights into the company's direction.

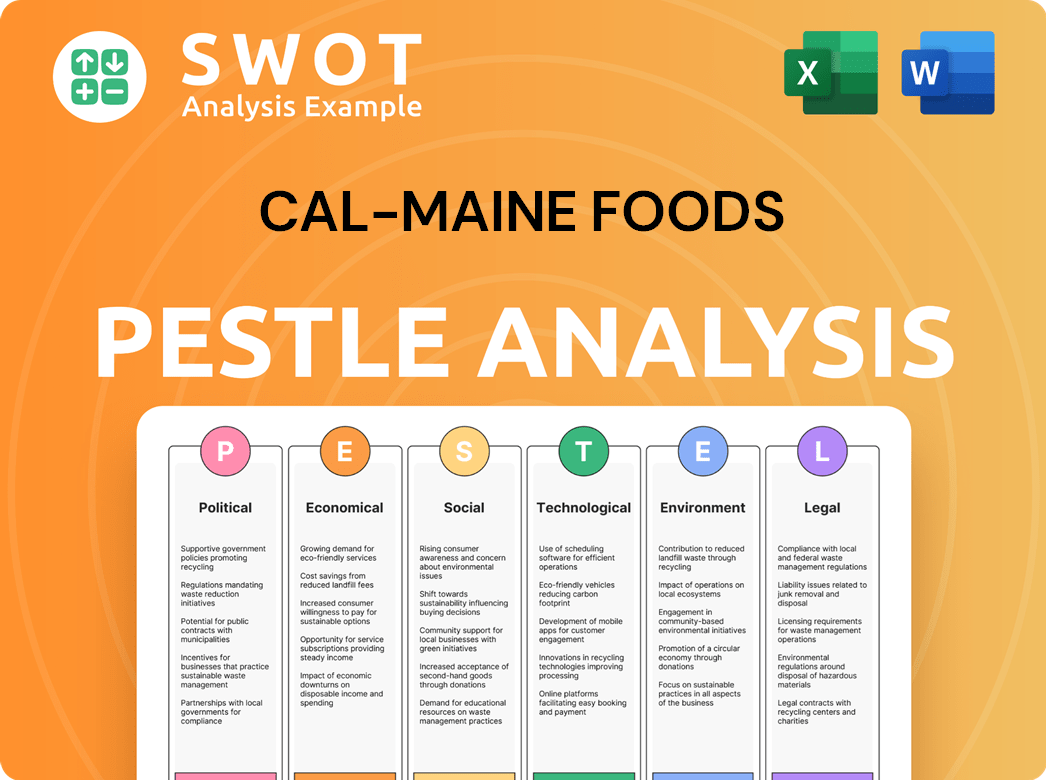

Cal-Maine Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Cal-Maine Foods’s Board?

As of early 2025, the Board of Directors for the Cal-Maine Foods, a leading egg producer, includes a mix of executive officers and independent directors. This structure is typical for a publicly traded company, aiming to balance internal leadership with external oversight. Key figures like Sherman L. Miller, the President and CEO, and Max P. Bowman, the CFO, are part of the board, representing the company's executive management. Independent directors bring diverse expertise from various industries, contributing to well-rounded decision-making.

The composition of the board ensures that decisions consider both the operational aspects and broader strategic perspectives. The presence of independent directors is crucial for maintaining corporate governance standards and providing an objective viewpoint on significant matters. This structure is designed to protect the interests of all shareholders and ensure the long-term success of the Cal-Maine Foods company.

| Director | Title | Affiliation |

|---|---|---|

| Sherman L. Miller | President and CEO | Cal-Maine Foods |

| Max P. Bowman | CFO | Cal-Maine Foods |

| Independent Directors | Various | External Professionals |

The voting structure at Cal-Maine Foods generally follows a one-share-one-vote principle, common among publicly held companies. This means each share of common stock grants one vote on shareholder matters, such as electing directors or approving corporate actions. While there are no reports of special voting rights or dual-class share structures, significant ownership by specific individuals or institutional investors can still influence outcomes. As of March 2024, insider ownership, including directors and executive officers, held a notable percentage of outstanding shares, aligning their interests with public shareholders. There have been no major public proxy battles or activist investor campaigns recently that have significantly altered the company's governance.

The voting structure at Cal-Maine Foods is straightforward, with each share of common stock carrying one vote. This structure is designed to ensure fairness and transparency in decision-making. Significant insider ownership helps align the interests of management with those of the shareholders.

- One-share-one-vote principle

- Insider ownership influences decision-making

- No recent major proxy battles

- Independent directors provide oversight

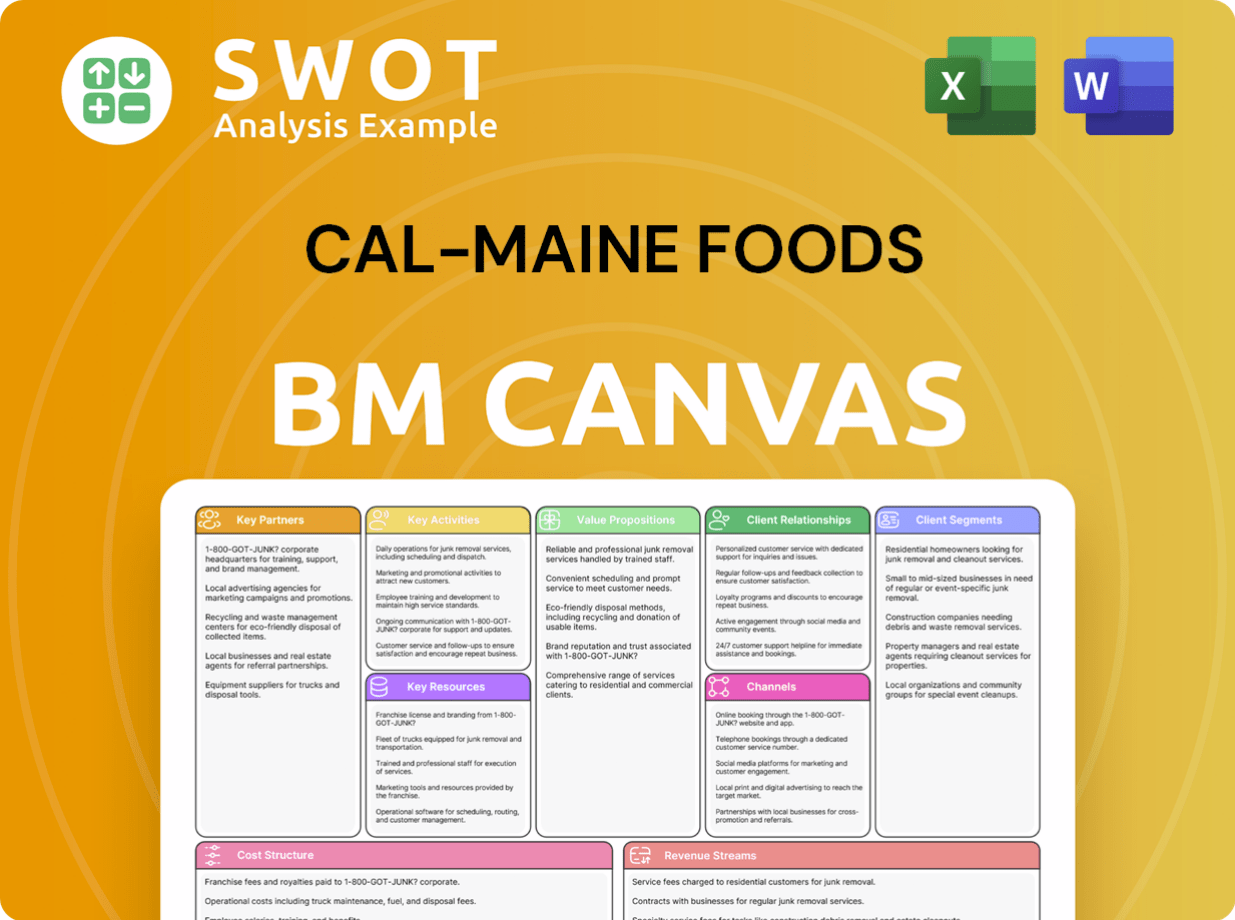

Cal-Maine Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Cal-Maine Foods’s Ownership Landscape?

Over the past few years (2022-2025), the ownership structure of Cal-Maine Foods, a leading egg producer, has shown stability. The company has not engaged in significant share buybacks or secondary offerings. Instead, it has focused on organic growth and strategic acquisitions within the chicken farming industry to expand its market reach. These acquisitions, such as purchasing assets from various egg producers, indirectly influence the ownership landscape by affecting market capitalization and investor interest.

Industry trends, such as increased institutional ownership, are evident in Cal-Maine Foods. Large investment firms continue to hold substantial stakes in the publicly traded company. The Adams family, the founders, still maintain a significant minority interest, reflecting a continued legacy connection. The company has not made any public statements about planned succession impacting ownership or potential privatization, suggesting a stable outlook for its current public listing. Analysts' reports in early 2025 continue to focus on market conditions for eggs, feed costs, and consumer demand as key drivers for the company's performance and investor appeal.

| Metric | Data | Year |

|---|---|---|

| Market Capitalization | Approximately $4.5 billion | Early 2025 |

| Institutional Ownership | Around 80% | Early 2025 |

| Adams Family Ownership | Significant minority stake (around 10-15%) | Early 2025 |

For more details on the company's financial performance and market position, you can refer to a detailed Cal-Maine Foods company profile.

Yes, Cal-Maine Foods is a publicly traded company. This means its shares are available for purchase on the open market. Investors can buy and sell shares through a stock exchange.

To invest in Cal-Maine Foods, you need to open a brokerage account. Then, you can purchase shares of the company using its stock symbol. Researching the company's financials is crucial before investing.

The CEO of Cal-Maine Foods is Dolph Baker. He has been leading the company and making strategic decisions. His role is key in the company's performance.

Cal-Maine Foods is known for being the largest producer and distributor of fresh shell eggs in the United States. It is a major player in the chicken farming industry. The company supplies a wide variety of egg products.

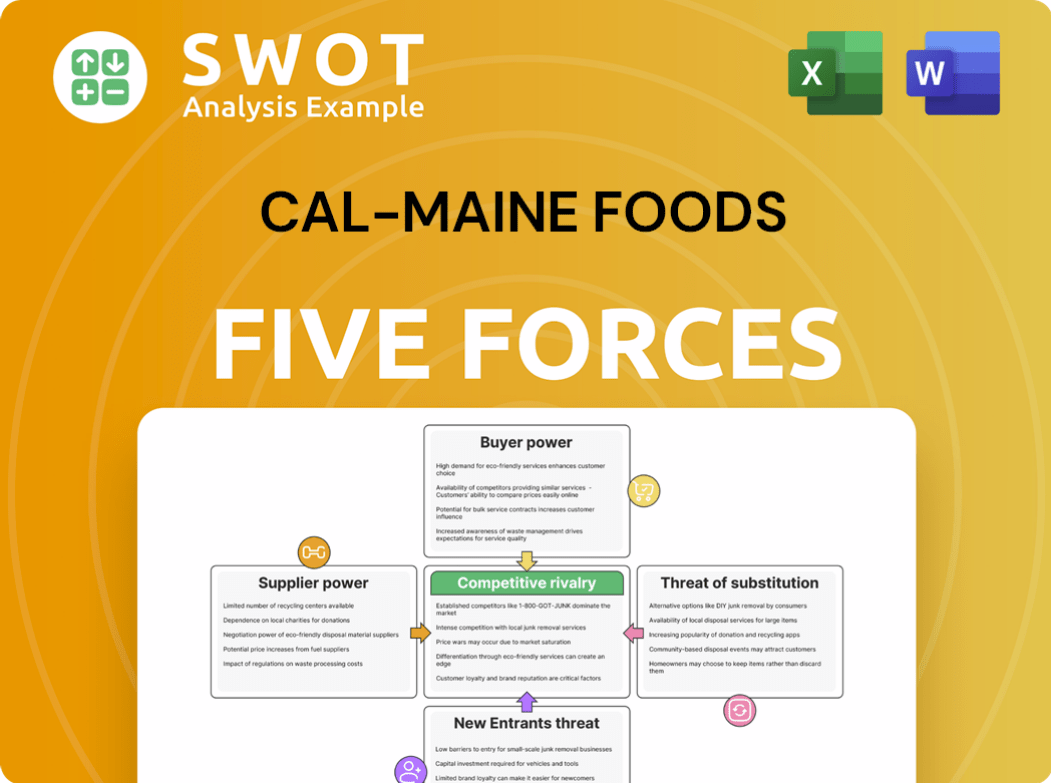

Cal-Maine Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cal-Maine Foods Company?

- What is Competitive Landscape of Cal-Maine Foods Company?

- What is Growth Strategy and Future Prospects of Cal-Maine Foods Company?

- How Does Cal-Maine Foods Company Work?

- What is Sales and Marketing Strategy of Cal-Maine Foods Company?

- What is Brief History of Cal-Maine Foods Company?

- What is Customer Demographics and Target Market of Cal-Maine Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.