CBRE Group Bundle

How Did CBRE Group Become a Global Real Estate Powerhouse?

From a small San Francisco firm to a global leader, the CBRE Group SWOT Analysis reveals a fascinating journey. Discover how this company, founded in 1906, transformed the commercial real estate landscape. Explore the pivotal moments and strategic decisions that propelled CBRE to its current status as a Fortune 500 giant.

This article delves into the brief history of CBRE Group, examining its evolution from a local real estate firm to a global commercial real estate services and investment powerhouse. Understanding the CBRE company's past is crucial for investors and business strategists alike. We'll explore key milestones, including significant CBRE acquisitions and its impact on the real estate market.

What is the CBRE Group Founding Story?

The story of what is now known as CBRE Group begins in the early 20th century. It's a tale of growth and adaptation in the world of commercial real estate. Understanding the Revenue Streams & Business Model of CBRE Group gives you a good overview of the company.

The roots of CBRE Group can be traced back to August 27, 1906, when Tucker, Lynch & Coldwell was established in San Francisco, California. Colbert Coldwell founded the firm, with Benjamin Arthur Banker becoming a partner in 1913. The firm was renamed Coldwell, Kern & Banker in 1918. Coldwell's vision focused on integrity and prioritizing clients' interests.

Initially, the company was a residential real estate firm. The early focus was on providing real estate services in San Francisco. The rebuilding efforts after the 1906 earthquake likely provided opportunities for the new firm. The company's name evolved over time, eventually becoming 'Coldwell Banker,' which later became associated with its commercial real estate operations.

The founding of CBRE Group marked the beginning of a long journey in the commercial real estate sector.

- The company started as a residential real estate firm in San Francisco.

- The early focus was on ethical practices and client-centered services.

- The firm's name changed over time, reflecting its growth and partnerships.

- The 1906 San Francisco earthquake created opportunities for the firm.

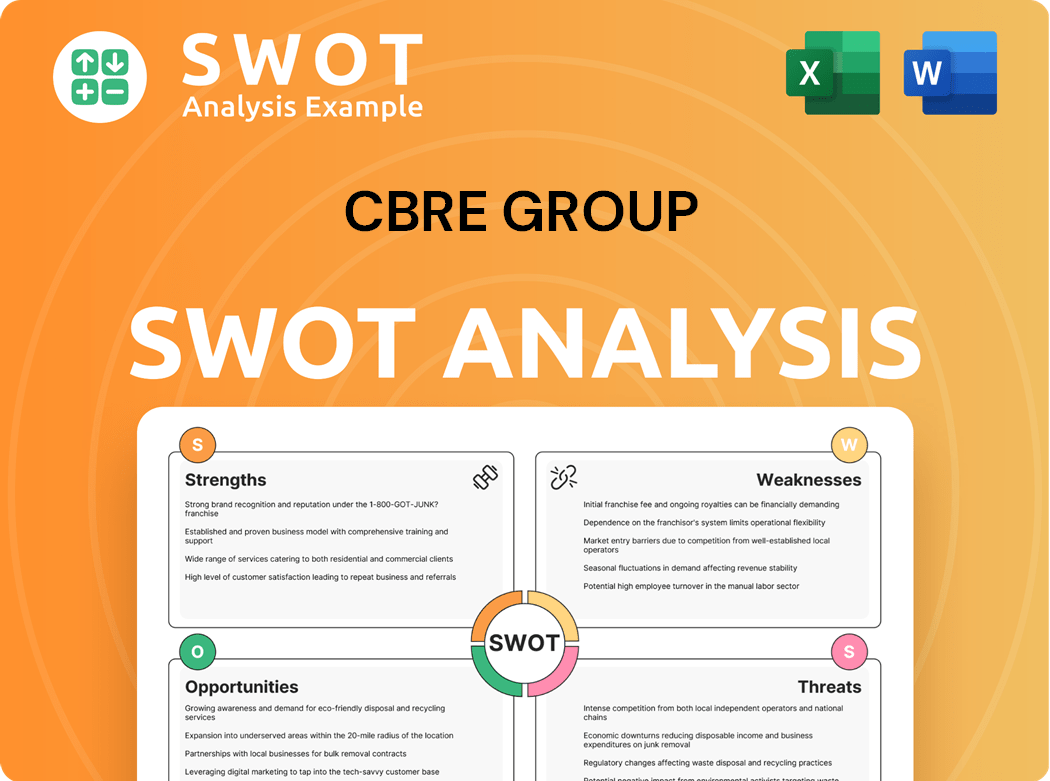

CBRE Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CBRE Group?

The early years of the firm, now known as CBRE Group, saw consistent expansion, evolving into a major commercial real estate services provider in the Western United States by the 1940s. The company's growth trajectory continued through the 1960s and 1970s, marked by its public listing and the broadening of its service offerings and geographic reach. This transformation established it as a comprehensive service provider with a growing footprint across the United States.

A significant event in CBRE's history occurred in 1981 when Sears, Roebuck acquired Coldwell Banker. In 1989, Sears sold the commercial unit of Coldwell Banker to a management-led buyout group, including The Carlyle Group, for around $300 million. Following this buyout, the commercial entity was rebranded as CB Commercial Real Estate Group, while the residential division retained the Coldwell Banker name.

Throughout the 1990s, CB Commercial aggressively pursued growth, developing global capabilities to meet client needs. Key CBRE acquisitions during this period included Westmark Realty Advisors (now CBRE Global Investors) in 1995, L.J. Melody & Company (mortgage banking) in 1996, and Koll Real Estate Services in 1997. The company went public through an initial public offering in 1996, raising approximately $80 million.

A pivotal moment in its global expansion was the 1998 acquisition of REI Limited, the international arm of Richard Ellis, leading to the company's name change to CB Richard Ellis (CBRE). This move, along with the acquisition of London-based Hillier Parker, solidified CBRE's position as the first real estate services firm to offer integrated services globally. For further insights, consider exploring the Marketing Strategy of CBRE Group.

As of 2024, CBRE Group reported revenues of approximately $30.8 billion. The company's market capitalization is around $29 billion, reflecting its strong position in the commercial real estate services sector. These figures highlight CBRE's significant financial strength and its leading role in the global real estate market.

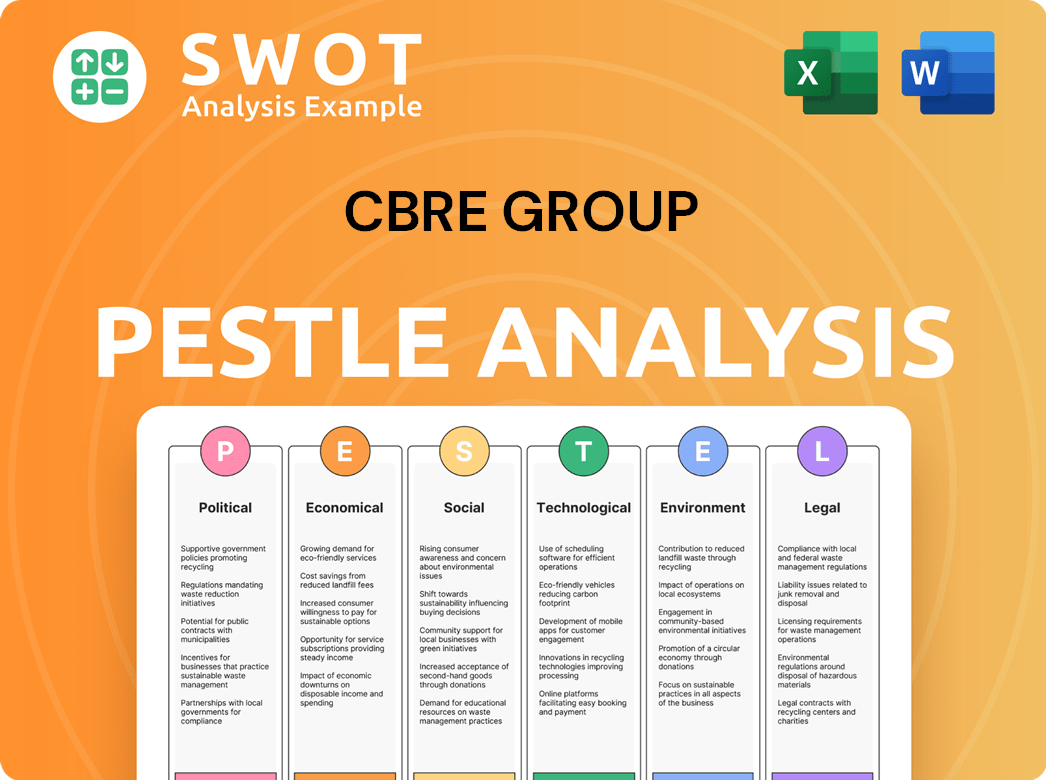

CBRE Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CBRE Group history?

The CBRE Group has a rich history marked by strategic moves and significant growth in the commercial real estate sector. From its early beginnings to its current status as a global leader, CBRE has consistently adapted and expanded its services to meet evolving market demands.

| Year | Milestone |

|---|---|

| 2001 | CBRE was acquired in a leveraged buyout by an investment group led by Blum Capital for $800 million. |

| 2004 | CBRE became a public company through an initial public offering. |

| 2006 | CBRE acquired Trammell Crow Company for $2.2 billion, significantly expanding its outsourcing service offerings. |

| 2006 | CBRE's shares were added to the S&P 500 Index. |

| 2011 | The company acquired the majority of the real estate investment management business of ING Group for $940 million and changed its name to CBRE Group Inc. |

Innovations have been central to CBRE's strategy, especially in leveraging technology and data analytics to provide cutting-edge solutions. The company has consistently been recognized for its ethical practices, earning a spot on the World's Most Ethical Companies list for the 11th consecutive year in 2024 and for the 12th consecutive year in 2025.

CBRE is at the forefront of using technology and data analytics. This includes tools like Host Core, a comprehensive computerized maintenance management system.

In August 2024, CBRE launched Capital AI, an artificial intelligence tool designed to expand investor pools. This tool analyzes billions of proprietary data points.

CBRE has been recognized for its ethical practices. It has earned a spot on the World's Most Ethical Companies list for the 11th consecutive year in 2024 and the 12th consecutive year in 2025.

Fortune has named CBRE the Most Admired real estate company for multiple consecutive years. This includes recognitions in 2020, 2021, and 2025.

Despite its successes, CBRE has faced challenges, including market volatility and economic downturns. The company has adapted its strategies to remain competitive, including shifting towards a more diversified revenue base.

CBRE has had to navigate periods of economic uncertainty and market downturns. This has required adapting strategies to remain competitive in the commercial real estate market.

In response to evolving market dynamics, CBRE has strategically shifted towards a more diversified and contractual revenue base. This enhances resilience against market disruptions.

CBRE has demonstrated its ability to adapt and innovate during periods of crisis, such as the COVID-19 pandemic. This included leveraging technology and digital solutions.

These experiences have led to restructuring efforts and strategic acquisitions like Industrious and Turner & Townsend. The focus remains on cost efforts and contract profitability.

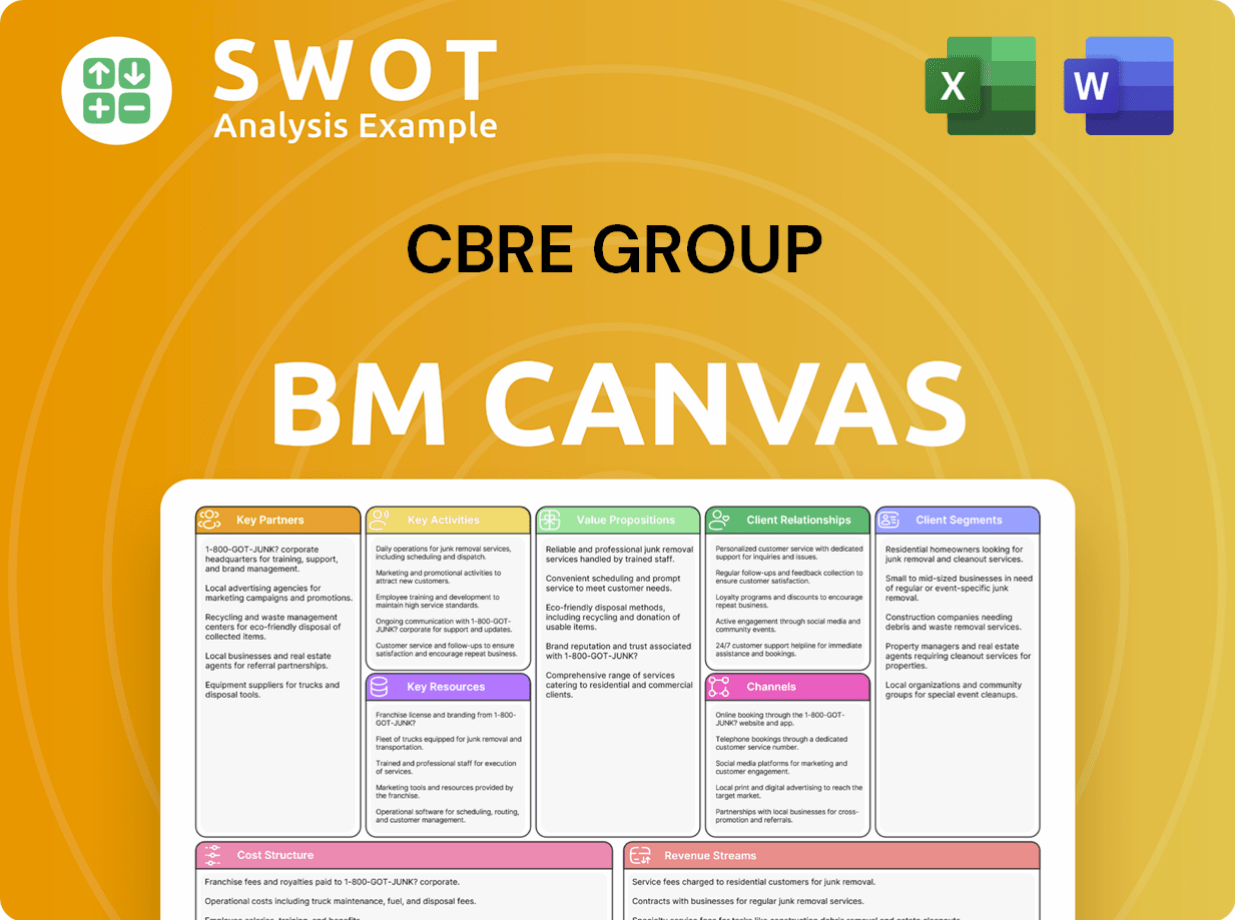

CBRE Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CBRE Group?

The CBRE Group, a leading player in the commercial real estate sector, has a rich history marked by strategic acquisitions and global expansion. Founded in 1906, the company has evolved significantly, transforming from its early days to become a publicly traded entity and a global real estate services leader. Through mergers, acquisitions, and organic growth, CBRE has solidified its position in the market, adapting to changing economic landscapes and client needs. The company's journey reflects its commitment to innovation and its ability to anticipate and capitalize on emerging opportunities within the commercial real estate industry.

| Year | Key Event |

|---|---|

| 1906 | Founded as Tucker, Lynch & Coldwell in San Francisco, California. |

| 1918 | Renamed Coldwell, Kern & Banker. |

| 1989 | Commercial real estate operations acquired from Sears, forming CB Commercial Real Estate Group. |

| 1996 | Became a publicly traded company via an initial public offering. |

| 1998 | Merged with Richard Ellis International, changing its name to CB Richard Ellis (CBRE). |

| 2006 | Acquired Trammell Crow Company for $2.2 billion and was added to the S&P 500 Index. |

| 2011 | Acquired the real estate investment business of ING Group for $940 million and changed its name to CBRE Group Inc. |

| 2015 | Acquired Global Workplace Solutions from Johnson Controls. |

| 2020 | Moved its corporate headquarters to Dallas, Texas. |

| 2021 | Acquired a 60% stake in Turner & Townsend, a multidisciplinary professional services firm. |

| 2024 | Reported record revenue of $35.77 billion, up 12% from 2023; Global property sales revenue grew by 35% in Q4 2024; Completed nine in-fill business acquisitions for approximately $315 million. |

| June 2024 | Announced plans to merge its project management businesses into Turner & Townsend, increasing its stake to 70%. |

| August 2024 | Introduced Capital AI, an artificial intelligence tool for real estate investment strategies. |

| January 2025 | Established a new global financial headquarters in Midtown Manhattan; Fully acquired Industrious National Management Company LLC, a flexible workplace solutions provider, and created a new business segment: Building Operations & Experience (BOE); Also established a new Project Management segment following the integration of its legacy project management business into Turner & Townsend. |

| Q1 2025 | Reported revenue of $8.9 billion (up 12%) and net revenue of $5.1 billion (up 15%); Core EPS increased by 10% to $0.86; Global leasing revenue increased by 18%, and global property sales revenue rose by 11%. |

CBRE anticipates continued growth, with analysts projecting core EPS of $5.80 to $6.10 for 2025, reflecting mid-teens growth at the midpoint. The company expects strong performance in the real estate market, with an estimated 5% earnings growth globally in 2025, approximately double that of 2024. CBRE is focused on specialization through the Turner & Townsend integration and expansion into flexible workspaces with the Industrious acquisition.

CBRE is capitalizing on the surging demand in the data center sector, driven by AI and cloud services, and anticipates record data center capacity expansion in Europe in 2025. The company also expects increased demand for U.S. healthcare real estate, particularly for medical office buildings (MOBs), in 2025. These sectors represent significant growth opportunities for CBRE.

CBRE is focused on technology integration, including AI, to enhance its competitive edge and drive future gains. The company aims to continue its global expansion and enhance client services, aligning with its founding vision. This strategic approach is designed to solidify CBRE's position as a leading real estate services provider.

With a strong financial performance in Q1 2025, including a 12% increase in revenue to $8.9 billion and a 15% increase in net revenue to $5.1 billion, CBRE is well-positioned for future success. The company's strategic investments in acquisitions and technology, combined with a focus on key growth sectors, support its continued leadership in the commercial real estate market. CBRE’s global leasing revenue increased by 18%, and global property sales revenue rose by 11% in Q1 2025.

CBRE Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CBRE Group Company?

- What is Growth Strategy and Future Prospects of CBRE Group Company?

- How Does CBRE Group Company Work?

- What is Sales and Marketing Strategy of CBRE Group Company?

- What is Brief History of CBRE Group Company?

- Who Owns CBRE Group Company?

- What is Customer Demographics and Target Market of CBRE Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.