CBRE Group Bundle

Can CBRE Group Maintain its Dominance in the Ever-Changing Real Estate Services Sector?

The commercial real estate market is a complex arena, constantly reshaped by economic shifts and technological advancements. CBRE Group SWOT Analysis reveals its position as a major player, but what does the competitive landscape really look like for this industry giant? Understanding CBRE Group's position requires a deep dive into its rivals and the strategies that will define its future.

This analysis will provide a comprehensive market analysis, identifying CBRE Group's key competitors and examining their competitive advantages within the real estate services industry. We'll explore CBRE Group's strategies to stay competitive, its global presence, and the challenges it faces, offering insights into its financial performance compared to its rivals and its long-term position in the commercial real estate market. This exploration is crucial for anyone seeking to understand the dynamics of this critical sector.

Where Does CBRE Group’ Stand in the Current Market?

CBRE Group, Inc. holds a commanding market position as the world's largest commercial real estate services and investment firm. In 2023, the company reported revenues of $31.8 billion, highlighting its substantial scale within the industry. CBRE operates across multiple segments of the commercial real estate market, including property leasing, sales, valuation, property management, and project management.

The company's extensive global footprint serves clients in over 100 countries through more than 530 offices worldwide as of early 2024. CBRE's primary offerings cater to a diverse clientele, including commercial real estate owners, investors, and occupiers. The Global Workplace Solutions (GWS) segment has been a key growth area, reflecting a strategic shift towards comprehensive client solutions. CBRE Investment Management manages over $140 billion in assets as of late 2023.

Over time, CBRE has strategically diversified its offerings and expanded its digital capabilities, moving beyond traditional brokerage to provide data analytics, technology solutions, and sustainability consulting. This diversification solidifies its premium market position. For a deeper understanding of the company's origins, explore the Brief History of CBRE Group.

CBRE consistently ranks at the top or among the top players in most major commercial real estate markets globally. Its strong presence in major financial hubs and emerging markets underscores its robust market standing. The company's ability to outperform industry averages in revenue and profitability further demonstrates its leadership.

CBRE offers a wide array of services, including property leasing, sales, valuation, property management, and project management. The Global Workplace Solutions (GWS) segment provides integrated facilities management and advisory services. CBRE Investment Management manages significant assets, contributing to its market presence.

CBRE operates in over 100 countries with more than 530 offices worldwide. This extensive global presence allows CBRE to serve a diverse client base. The company's international reach is a key factor in its competitive advantage within the commercial real estate services market.

In 2023, CBRE reported revenues of $31.8 billion, demonstrating its financial strength. The company's investment management services manage over $140 billion in assets. CBRE's financial performance reflects its strong market position and effective strategies.

CBRE's competitive advantages include its global presence, diversified service offerings, and strong financial performance. The company's ability to adapt to market changes and invest in technology further enhances its position. CBRE's focus on client solutions and strategic acquisitions also contribute to its success.

- Global Reach: Operating in over 100 countries.

- Diversified Services: Offering a wide range of real estate services.

- Financial Strength: Reporting $31.8 billion in revenue in 2023.

- Strategic Investments: Expanding digital capabilities and client solutions.

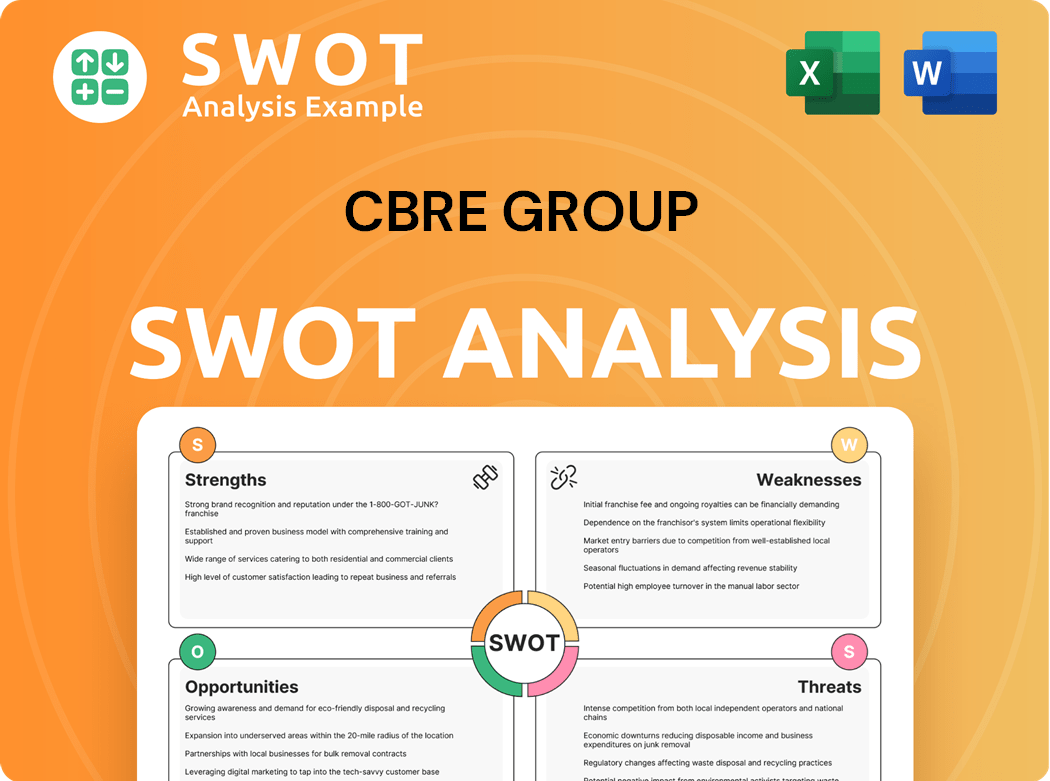

CBRE Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CBRE Group?

The CBRE Group operates within a dynamic and fiercely contested global commercial real estate market. The competitive landscape is shaped by a mix of established giants and emerging players, all vying for market share in a sector that is constantly evolving. Understanding the key competitors and their strategies is crucial for assessing CBRE Group's position and future prospects.

Market analysis reveals that CBRE Group faces both direct and indirect challenges. Direct competitors offer similar services, while indirect competitors include technology platforms and corporate real estate departments. This multifaceted competition requires CBRE Group to continually innovate and adapt to maintain its competitive edge.

CBRE Group's most significant direct competitors are other global commercial real estate services firms. These firms offer a comprehensive suite of services, including leasing, capital markets, property management, and project development, competing across various geographic markets.

JLL is a close rival, providing services similar to CBRE Group. In 2023, JLL reported revenues of $20.9 billion, highlighting its substantial scale and direct competition with CBRE Group across various service lines and geographic markets.

Cushman & Wakefield is another prominent player in the commercial real estate sector. Cushman & Wakefield reported revenues of $9.5 billion in 2023. It competes directly with CBRE Group in brokerage, property management, and valuation services, particularly in North America and Europe.

Colliers International has a strong global presence and competes with CBRE Group across various segments. It often leverages its strong local market expertise to gain an advantage.

Indirect competition comes from technology-driven real estate platforms, co-working space providers, and in-house corporate real estate departments. These entities challenge traditional service models through innovation and specialized offerings.

The competitive landscape includes new players focusing on PropTech solutions. These firms leverage data analytics, AI, and blockchain to challenge traditional service models, creating further competition.

Beyond the global players, CBRE Group faces competition from regional and local brokerage firms, property management companies, and specialized real estate consultancies. These entities may have deeper expertise or stronger relationships in specific niches or geographies. High-profile battles for market share often occur in major capital markets transactions and large-scale corporate outsourcing contracts. CBRE Group must constantly adapt to these dynamics to maintain its position. For more insights into the company's ownership and financial structure, you can explore Owners & Shareholders of CBRE Group.

Several factors determine success in the commercial real estate market. These include global reach, expertise in various service lines, and the ability to leverage technology.

- Global Reach: The ability to serve clients across multiple geographic markets is a significant advantage.

- Service Diversification: Offering a comprehensive suite of services, from leasing to capital markets, helps attract and retain clients.

- Technology Adoption: Leveraging data analytics, AI, and other technologies to improve service delivery and gain a competitive edge.

- Local Market Expertise: Strong local market knowledge and relationships are crucial for success in specific regions.

- Pricing and Value: Providing competitive pricing while delivering high-quality services is essential for winning and retaining business.

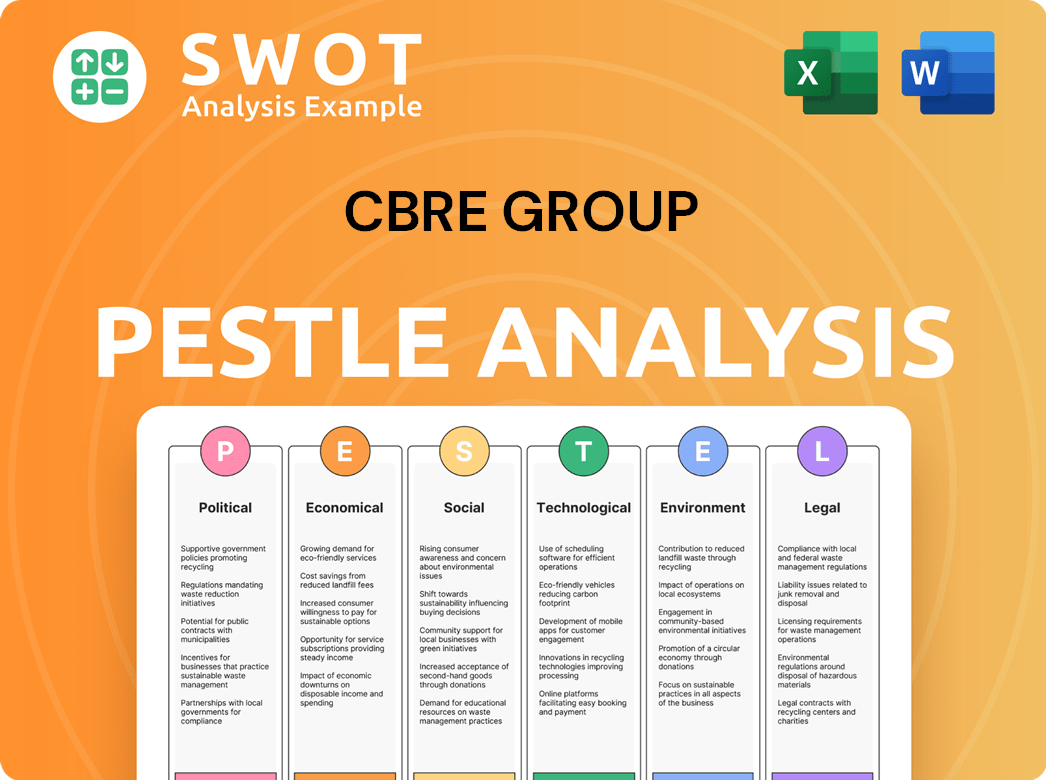

CBRE Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CBRE Group a Competitive Edge Over Its Rivals?

The competitive landscape for CBRE Group (CBRE) is shaped by its significant scale, comprehensive service offerings, and deep-rooted client relationships. CBRE's global presence and integrated service model create a 'one-stop shop' for clients, fostering client loyalty and cross-selling opportunities. This approach allows CBRE to serve multinational corporations with complex commercial real estate needs, a capability that few rivals can match, solidifying its position in the commercial real estate market.

CBRE's competitive advantages are further enhanced by its proprietary data and technology platforms. Investments in data analytics, artificial intelligence, and PropTech solutions provide clients with superior market insights, optimizing property performance and streamlining operations. The company's brand equity, built over more than a century, instills trust and confidence among clients, contributing to strong customer loyalty. This focus on innovation and client service helps CBRE maintain a leading edge in the real estate services industry.

The company's talent pool, comprising thousands of experienced real estate professionals globally, is a critical asset, offering specialized expertise across various property types and service lines. CBRE continuously leverages these advantages in its marketing, product development, and strategic partnerships to maintain its leadership position and defend against imitation, ensuring sustained financial performance compared to competitors. For a deeper dive, you can read more about the company's strategies in this article discussing CBRE Group market share analysis.

CBRE's extensive global network allows it to serve multinational corporations with complex real estate needs. This reach facilitates economies of scale and provides unparalleled market intelligence across diverse geographies. CBRE operates in over 100 countries, offering a broad spectrum of services.

The integrated service model of CBRE, encompassing transaction services, property management, investment management, and strategic consulting, creates a 'one-stop shop'. This approach fosters greater client stickiness and cross-selling opportunities. This model is a key differentiator in the competitive landscape.

CBRE invests heavily in data analytics, AI, and PropTech solutions to provide clients with superior market insights. These tools optimize property performance and streamline operations. This technological edge is crucial for maintaining a competitive advantage.

CBRE's brand equity, built over more than a century, instills trust and confidence among clients. This contributes to strong customer loyalty and repeat business. These relationships are a cornerstone of CBRE's success.

CBRE's competitive advantages include its global scale, integrated service model, proprietary data and technology, and strong client relationships. These factors contribute to its leading position in the commercial real estate market. These advantages are crucial for navigating the challenges faced by CBRE Group in the competitive landscape.

- Global Presence: Operates in over 100 countries.

- Integrated Services: Offers a comprehensive suite of real estate services.

- Technological Innovation: Invests heavily in PropTech solutions.

- Client Loyalty: Built on a century of brand trust and strong relationships.

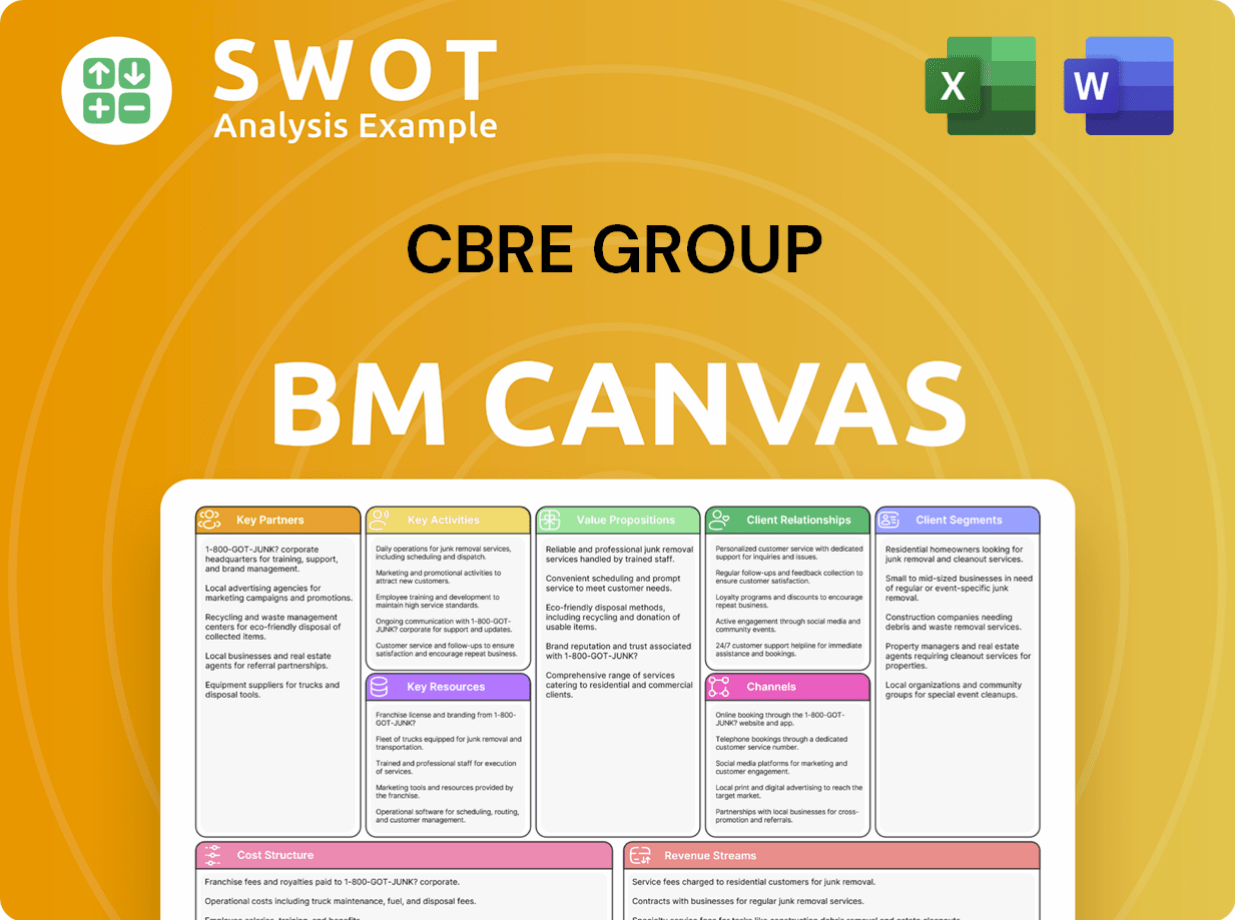

CBRE Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CBRE Group’s Competitive Landscape?

The competitive landscape for CBRE Group (CBRE) is shaped by dynamic industry trends, presenting both challenges and opportunities in the commercial real estate market. Understanding these factors is crucial for assessing CBRE's position and future prospects. The real estate services sector is experiencing significant shifts due to technological advancements, regulatory changes, and evolving market demands, influencing CBRE's strategic direction and competitive advantages.

CBRE's position in the commercial real estate market is robust, but it must navigate several risks and capitalize on emerging opportunities. The company faces competition from both established rivals and new entrants leveraging technology. Economic fluctuations and geopolitical uncertainties also pose challenges. However, CBRE can leverage its global presence, diverse service offerings, and strategic investments to maintain its competitive edge and drive growth. For a deeper dive into CBRE's strategic initiatives, consider exploring the Growth Strategy of CBRE Group.

The commercial real estate industry is undergoing a transformation driven by technology, sustainability, and changing work patterns. PropTech innovations, including AI and blockchain, are reshaping property management and transactions. Sustainability and ESG factors are increasingly important, leading to a focus on green building practices. Hybrid work models are influencing demand for office spaces.

CBRE faces challenges from increased competition, especially from tech-focused firms. Economic downturns and interest rate fluctuations can impact investment volumes. Shifting consumer preferences, such as the rise of hybrid work, may affect demand for traditional office spaces. Geopolitical uncertainties add to the complexity.

CBRE can capitalize on growth opportunities in emerging markets, particularly in Asia-Pacific. Product innovations, such as smart buildings and sustainable developments, offer avenues for expansion. Strategic partnerships with technology providers and niche specialists are crucial. The Global Workplace Solutions division can expand advisory services.

CBRE's global presence and diverse service offerings provide a strong foundation. The company's investments in technology and data analytics enhance its capabilities. Strong client relationships and a reputation for expertise are key assets. Strategic acquisitions and partnerships strengthen its market position.

CBRE’s competitive landscape is influenced by several key factors. These include technological advancements, which drive the need for PropTech integration and data analytics. Regulatory changes, particularly those related to ESG, require a focus on sustainability. Economic conditions, such as interest rates and global economic growth, also play a significant role.

- Technological Innovation: Adoption of AI, blockchain, and big data to improve services.

- Sustainability and ESG: Prioritizing green building practices and transparent reporting.

- Market Dynamics: Adapting to hybrid work models and global economic shifts.

- Strategic Partnerships: Collaborating with technology providers and niche specialists.

CBRE Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CBRE Group Company?

- What is Growth Strategy and Future Prospects of CBRE Group Company?

- How Does CBRE Group Company Work?

- What is Sales and Marketing Strategy of CBRE Group Company?

- What is Brief History of CBRE Group Company?

- Who Owns CBRE Group Company?

- What is Customer Demographics and Target Market of CBRE Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.