CBRE Group Bundle

Who Does CBRE Group Serve in the World of Real Estate?

In the ever-evolving landscape of commercial real estate, understanding CBRE Group SWOT Analysis and its customer base is key. For a global giant like CBRE, knowing its customer demographics and target market is not just beneficial—it's essential for sustained success. Recent strategic moves, such as CBRE's full acquisition of Industrious in January 2025, underscore this commitment to adapting to shifting market demands.

From its humble beginnings in 1906 to its current status as a global leader, CBRE's journey highlights the importance of a clear target market. This market analysis will delve into who CBRE's clients are, exploring the diverse range of businesses and investors that rely on its services. We'll examine the commercial real estate giant's customer demographics and how it strategically caters to their needs in an increasingly complex global environment, including insights into CBRE's target market segments.

Who Are CBRE Group’s Main Customers?

Understanding the customer demographics and target market of CBRE Group is crucial for appreciating its business model. CBRE, a leading commercial real estate services and investment firm, primarily serves businesses (B2B). Its client base is diverse, encompassing commercial real estate owners, investors, and occupiers across various industries.

As of April 2025, CBRE's client base includes nearly 90% of Fortune 100 companies, demonstrating its strong presence among large corporations. While specific demographic breakdowns like age, gender, or income level are less relevant for a B2B company, the characteristics of its customer groups are defined by their organizational size, industry sector, and real estate portfolio needs.

The company's services are categorized into several key segments: Advisory Services (including property leasing, capital markets, mortgage servicing, valuation, and property management), Global Workplace Solutions (GWS), and Real Estate Investments. Starting in January 2025, CBRE introduced two new segments: Project Management and Building Operations & Experience, which includes flexible workplace solutions following the acquisition of Industrious.

CBRE's services are broadly segmented into Advisory Services, Global Workplace Solutions (GWS), and Real Estate Investments. These segments cater to different needs within the commercial real estate market. Understanding these segments helps in a thorough market analysis.

CBRE's target market includes commercial real estate owners, investors, and occupiers. These groups have varying needs, from property management to investment strategies. The firm's ability to serve these diverse needs is a key aspect of its success.

CBRE operates globally, serving clients in various geographic locations. The firm's international presence allows it to cater to multinational corporations and investors with diverse real estate needs. The geographic location is a key factor in understanding CBRE's target market.

CBRE serves clients across various industries, including technology, finance, and healthcare. This diversification helps the firm mitigate risks and maintain a broad customer base. Understanding the industry verticals is critical for assessing CBRE's target market.

The Global Workplace Solutions (GWS) segment has been a significant growth driver, benefiting from the increasing trend of corporations outsourcing their real estate operations to optimize portfolios and enhance employee experiences. This segment, which includes facilities management, project management, and transaction management services, continues to expand due to heightened demand for outsourced workplace solutions. In Q4 2024, the GWS segment delivered an 18.5% year-over-year net revenue growth. The Real Estate Investments segment also contributes to overall growth, driven by increased capital flows into real estate assets and demand for industrial and logistics properties.

CBRE has been strategically shifting its focus towards a more diversified and contractual revenue base. This shift is driven by the increasing outsourcing of services by property owners and occupiers, as well as the consolidation of service providers.

- Increased Outsourcing: Property owners and occupiers are increasingly outsourcing services to reduce costs and improve efficiency.

- Consolidation of Service Providers: The trend towards consolidating service providers to achieve consistent global service.

- Growing Institutional Ownership: The increasing allocation of capital to real estate by institutional investors.

- Diversified Revenue Base: CBRE's strategy is to diversify its revenue streams and reduce reliance on any single client or service.

Over time, CBRE has observed a shift in its target segments, moving towards a more diversified and contractual revenue base. This is evidenced by the fact that in 2022, 80% of its top 100 clients purchased four or more services, a significant increase from less than 25% in 2012. This shift is prompted by structural trends such as increased outsourcing by property owners and occupiers seeking cost reduction and efficiency, as well as the consolidation of service providers to achieve consistent global service. The growing institutional ownership of commercial real estate also represents a key segment, as these investors increasingly allocate capital to real estate through various vehicles, requiring comprehensive management and transaction services. For more insights into CBRE's strategic growth, explore the Growth Strategy of CBRE Group.

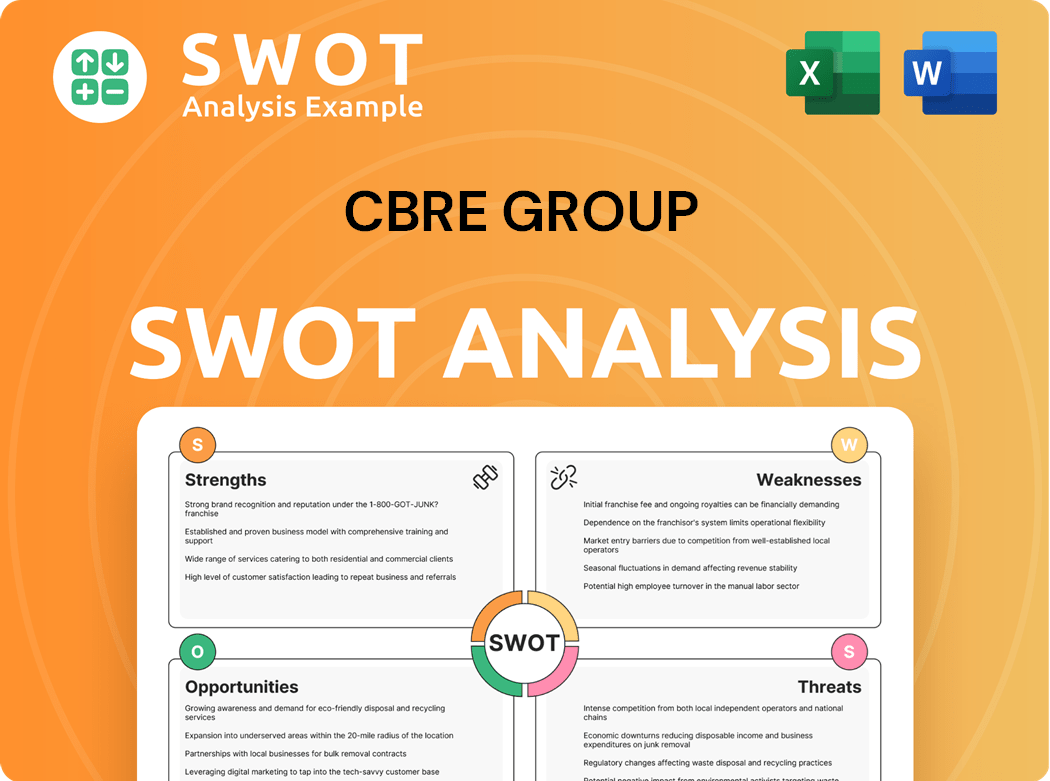

CBRE Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do CBRE Group’s Customers Want?

Understanding the customer needs and preferences is crucial for companies like CBRE Group. Their clients, primarily businesses, have multifaceted requirements that drive their decisions regarding real estate and related services. These needs range from practical considerations like cost reduction and operational efficiency to strategic goals such as enhancing employee experience and aligning with sustainability objectives.

The demand for integrated services, such as those offered by CBRE's Global Workplace Solutions (GWS), reflects a core customer need: optimizing real estate portfolios. Businesses increasingly seek external expertise to streamline processes and improve their physical work environments. This focus on efficiency and employee experience is a key driver in the commercial real estate market.

CBRE's ability to provide tailored, comprehensive solutions and its extensive global network are significant decision-making factors for clients. The company continually adapts to evolving market trends and customer preferences, as demonstrated by strategic acquisitions and service expansions. This responsiveness is vital in meeting the dynamic needs of its target market.

CBRE's target market prioritizes several key aspects when selecting real estate services. These include cost optimization, operational efficiency, and the ability to provide tailored solutions. Clients increasingly value sustainability and environmentally friendly options. The company's ability to adapt to changing work models and provide flexible workplace solutions is also important.

- Cost Reduction and Operational Efficiency: Businesses seek to reduce real estate costs and improve operational efficiency through optimized property portfolios and facilities management.

- Comprehensive and Tailored Solutions: Clients need expert advice, global reach, and integrated service offerings to meet their specific needs across diverse geographies.

- Sustainability and ESG Compliance: There's a growing demand for eco-friendly real estate solutions and sustainable investment options, reflecting the focus on Environmental, Social, and Governance (ESG) factors.

- Adaptability to Changing Work Models: The rise of remote and hybrid work necessitates flexible and adaptable office environments, addressed through services like flexible workplace solutions.

- Data Center Services: The surge in demand in the data center sector, driven by advancements in AI and cloud computing, has led to CBRE capitalizing on this growth by offering specialized development, leasing, and management services.

CBRE's customer base is diverse, spanning various industries and geographic locations. The Brief History of CBRE Group highlights the company's evolution and its ability to adapt to changing market dynamics. Understanding these diverse needs and preferences is essential for CBRE to maintain its market position and drive future growth.

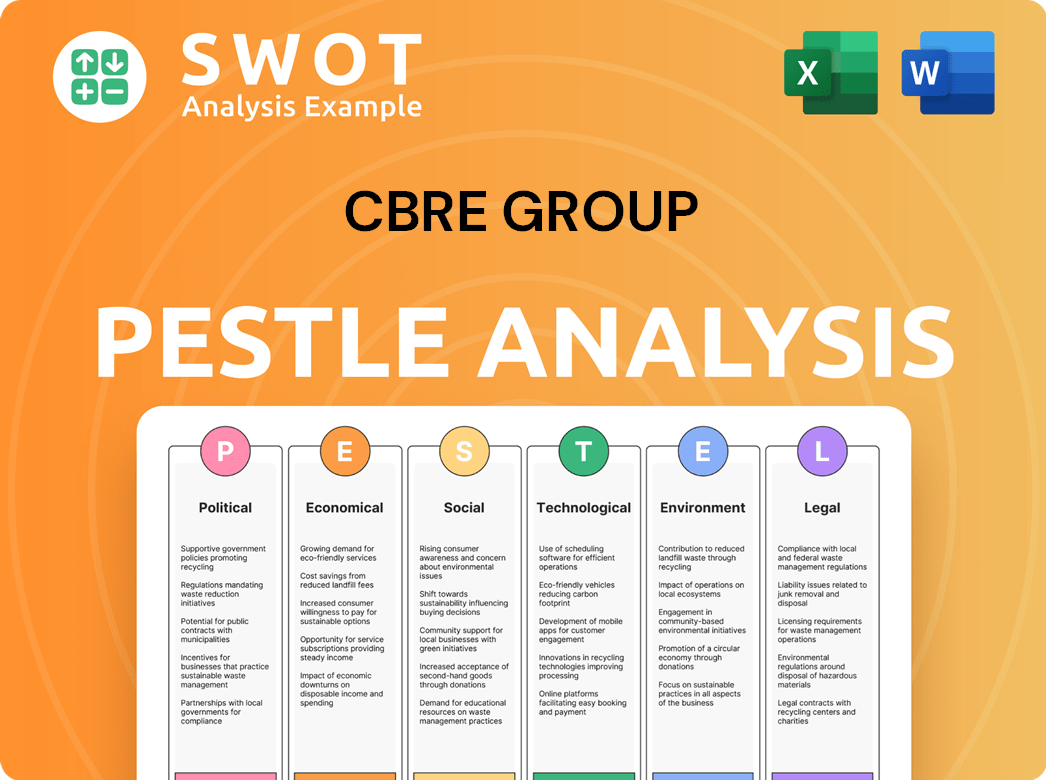

CBRE Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does CBRE Group operate?

CBRE Group maintains a substantial global presence, operating in over 100 countries. This widespread reach allows the company to serve clients across various regions, capitalizing on diverse growth opportunities within the commercial real estate sector.

The company's diversified business model supports its ability to adapt to local market dynamics. Strong market share and brand recognition are evident in the Americas, Europe, the Middle East & Africa (EMEA), and Asia Pacific (APAC). This global footprint is a key factor in understanding CBRE's customer demographics and target market.

In 2024, global leasing revenue saw significant growth across these regions. For instance, in Q1 2025, global leasing revenue increased by 18%, with the United States leading with a 24% increase. EMEA leasing revenue also saw a 9% increase in Q1 2025, demonstrating the company's strong performance in key markets. These figures are essential for a comprehensive market analysis.

In Q1 2025, global property sales revenue rose by 11%. The United States saw a 26% growth, particularly in industrial and multifamily assets. EMEA grew by 10% (13% in local currency), highlighting the company's robust performance in key markets.

CBRE localizes its offerings, marketing, and partnerships to succeed in diverse markets. For example, in the Netherlands, the commercial real estate market outlook for 2025 anticipates a return to market dynamics. In Korea, the commercial real estate transaction volume in 2024 reached approximately 22 trillion won, driven by office transactions.

Strategic investments in 2024 totaled approximately $1.8 billion, including $1.1 billion directed towards mergers and acquisitions to enhance capabilities and expand market presence. The acquisition of full ownership of Industrious in January 2025 further enhances its offerings in flexible workplace solutions globally.

CBRE has focused on expanding its presence in high-growth markets like Japan and emerging markets such as Asia and Latin America. These expansions are part of CBRE's adaptive market entry strategies, demonstrating its commitment to growth.

CBRE's geographical market presence is characterized by its ability to adapt to local market conditions, as seen in its approach to customer demographics and target market segments. The company’s strategic investments and expansions are key to understanding its client base breakdown and acquisition strategy.

- CBRE operates in over 100 countries.

- Global leasing revenue increased by 18% in Q1 2025.

- The United States led with a 24% increase in leasing revenue.

- Strategic investments in 2024 totaled approximately $1.8 billion.

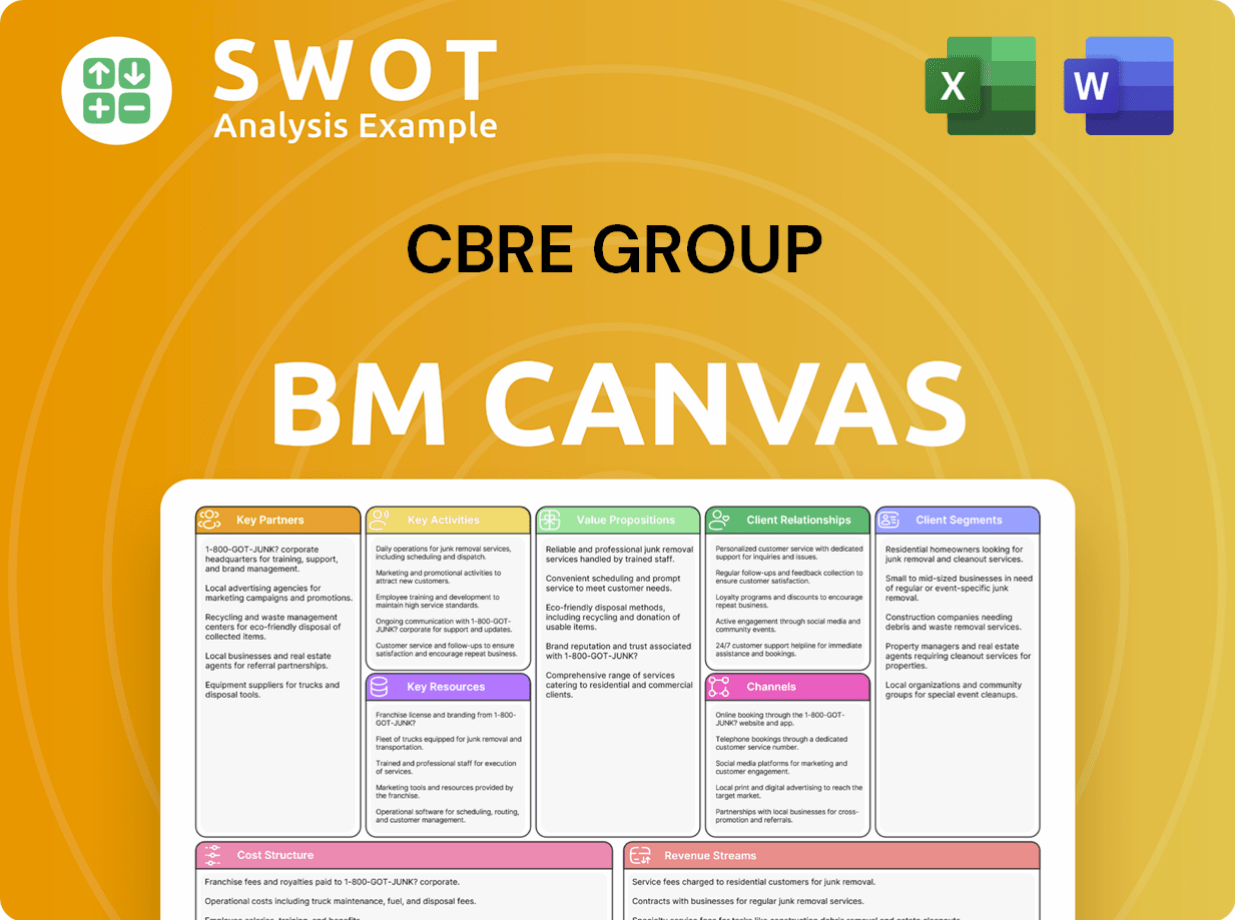

CBRE Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does CBRE Group Win & Keep Customers?

The strategies employed by CBRE Group to acquire and retain customers are multifaceted, leveraging its global presence, diverse service offerings, and strategic technology investments. These strategies are crucial for success in the competitive real estate market. Understanding the customer demographics and target market is essential for tailoring these strategies effectively.

CBRE focuses on providing comprehensive commercial real estate services, aiming to be a single point of contact for clients. This integrated approach helps optimize clients' real estate assets, attracting a broad spectrum of clients, from individual investors to a significant portion of Fortune 100 companies. The company's ability to adapt and innovate is key to maintaining its market position.

CBRE's approach to customer acquisition and retention is closely linked to its ability to deliver consistent, high-quality service and adapt to evolving client needs. The company's success is evident in its long-standing relationships with major corporations and its ability to cross-sell multiple services to existing clients.

CBRE acquires customers by offering a full suite of commercial real estate services, including leasing, sales, valuation, property management, and project management. By acting as a one-stop shop, CBRE simplifies the process for clients, optimizing their real estate assets. This approach targets a wide range of clients, from individual investors to large corporations.

CBRE uses digital platforms, industry events, and thought leadership to reach potential clients. They publish detailed market outlooks, such as the U.S. Real Estate Market Outlook 2025 and the Netherlands Real Estate Market Outlook 2025. Their website serves as a central hub for information on services, properties, and market insights.

CBRE often bundles services to optimize client assets, particularly in its Advisory Services segment. The Global Workplace Solutions (GWS) segment benefits from corporations outsourcing their real estate operations. This approach allows CBRE to meet diverse client needs effectively.

Customer data and CRM systems are crucial for targeting campaigns and personalizing experiences. While specific CRM systems aren't detailed publicly, CBRE emphasizes data analytics and technology integration to enhance services and provide valuable client insights. This enables more efficient and personalized solutions.

CBRE focuses on delivering consistent, high-quality service to retain clients. This is evident in its long-standing relationships with Fortune 100 companies. The ability to adapt to client needs is a key factor in maintaining these relationships.

A significant indicator of successful retention is the increased adoption of multiple services by top clients. In 2022, 80% of the top 100 clients purchased four or more services, up from less than 25% in 2012. This demonstrates successful cross-selling and strengthened client relationships.

CBRE expands its service offerings through strategic acquisitions to meet evolving market demands. The acquisition of Industrious in January 2025, for flexible office solutions, enhances client loyalty by providing adaptable real estate options. This helps CBRE to provide an even broader range of services to its clients.

In the hotel sector, CBRE's analysis shows that hotel loyalty program membership in the U.S. rose by nearly 15% in 2024, surpassing 675 million members. This highlights the importance of such programs in driving occupancy and stabilizing demand. Although these are loyalty programs of hotel brands, CBRE's analysis highlights the value placed on retention strategies within the broader real estate ecosystem.

CBRE has shifted towards a more diversified and contractual revenue base, enhancing its resilience to market disruptions. This focus on 'resilient businesses' has contributed to strong financial performance, with net revenue from these businesses up 14% in Q1 2025 (17% in local currency). This strategic adjustment directly impacts customer loyalty and lifetime value.

To effectively acquire and retain customers, CBRE must understand the specific needs of its clients. This involves analyzing market trends and tailoring services to meet those demands. The company's ability to adapt and innovate is key to maintaining its market position.

For a deeper dive into CBRE’s financial structure and operational model, consider exploring the Revenue Streams & Business Model of CBRE Group.

CBRE Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CBRE Group Company?

- What is Competitive Landscape of CBRE Group Company?

- What is Growth Strategy and Future Prospects of CBRE Group Company?

- How Does CBRE Group Company Work?

- What is Sales and Marketing Strategy of CBRE Group Company?

- What is Brief History of CBRE Group Company?

- Who Owns CBRE Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.