Celsius Holdings Bundle

How Did Celsius Holdings Revolutionize the Beverage Industry?

Celsius Holdings, Inc. has redefined the energy drink landscape, transforming how consumers approach fitness and wellness. Founded in 2004 as Elite FX, the company's journey began with a bold vision: to create a new category of beverages focused on calorie burning. This innovative approach, centered on science-backed ingredients, quickly set Celsius apart in a competitive market.

From its inception, Celsius focused on developing Celsius Holdings SWOT Analysis to boost metabolism and burn fat, targeting fitness enthusiasts and health-conscious consumers. This strategic focus has fueled impressive growth, with the company reporting record revenues and significant market share gains. Today, Celsius stands as a leading player in the functional beverage market, a testament to its innovative spirit and strategic foresight in the energy drinks sector.

What is the Celsius Holdings Founding Story?

The story of Celsius Holdings Inc. began in April 2004, in Boca Raton, Florida, originally named Elite FX. The founding team included Steve Haley, Janica Lane, and current CEO John Fieldly. This marked the inception of what would become a significant player in the fitness beverage market, with a focus on health and functionality.

The founders identified a gap in the market for beverages that catered to health-conscious consumers, particularly those seeking products to support active lifestyles. Their vision was to create innovative products that offered tangible health benefits, such as calorie burning through thermogenic properties. This led to the development of their flagship product, a soft drink designed to burn calories.

Celsius Holdings was initially funded with $2.5 million from private investors. The company's approach to product development, emphasizing science-backed ingredients and innovative formulations, quickly set it apart. Steve Haley's philosophy, 'the company that owns the category wins,' drove the creation of a unique product with a strong value proposition. Learn more about the company's core values from Mission, Vision & Core Values of Celsius Holdings.

Here's a quick look at the key points of Celsius Holdings' founding:

- Founded in April 2004 as Elite FX in Boca Raton, Florida.

- Founders: Steve Haley, Janica Lane, and John Fieldly.

- Initial funding: $2.5 million from private investors.

- Primary focus: Healthy and functional beverages for active lifestyles.

- First product: Soft drink designed to burn calories.

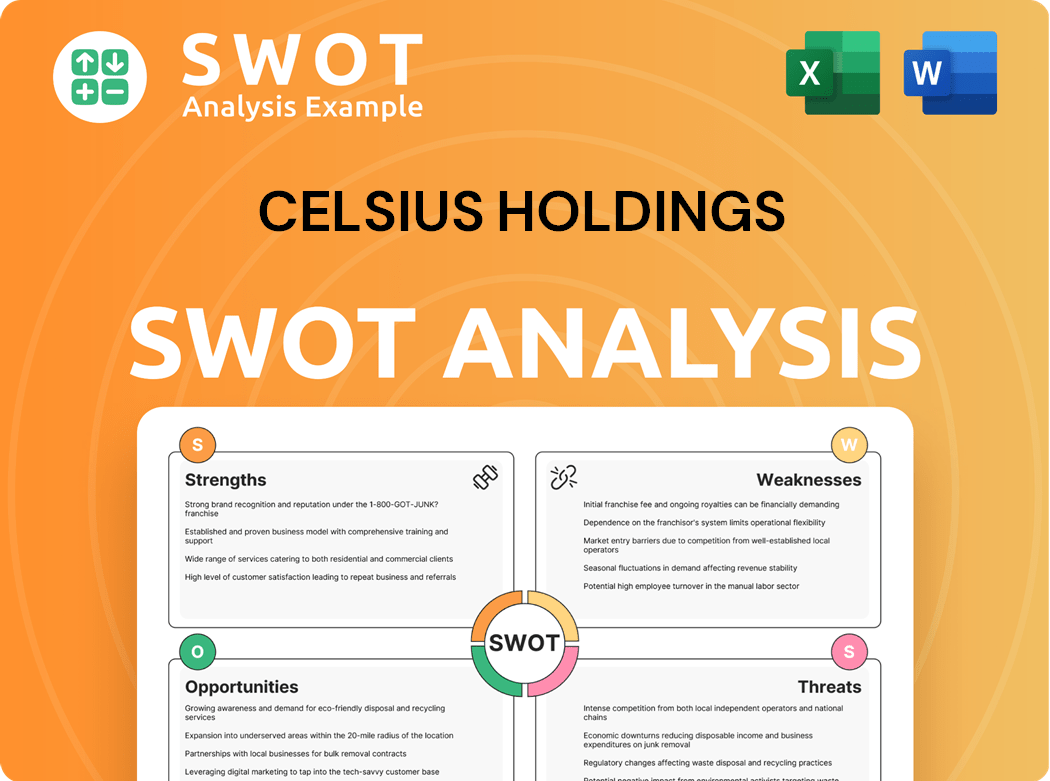

Celsius Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Celsius Holdings?

The early growth of Celsius Holdings focused on establishing itself within the health and wellness sector. Following the launch of its initial product line in 2005, the company secured significant investments around 2007. These early investments helped propel Celsius into its growth trajectory, setting the stage for its future expansion and market presence.

Around 2007, Celsius secured investments from individuals, including entrepreneurs from the vitamin industry. These investments were crucial for product development and marketing. This early support helped Celsius gain momentum in the competitive energy drinks market.

International expansion began between 2010 and 2012, with Celsius distributing its products to Sweden and other European markets. These early international ventures laid the groundwork for broader global reach. This expansion tested the global appeal of its functional beverages.

A pivotal leadership transition occurred in 2015 when John Fieldly became CEO. This leadership change was followed by a rebranding effort and formula enhancements between 2016 and 2017. These changes aimed to improve the effectiveness and taste of its beverages.

The company's turnaround efforts led to its return to Nasdaq in 2017. From 2017 to 2023, Celsius experienced substantial growth, with revenue increasing at a compound annual growth rate (CAGR) of 82%, from $36 million to $1.32 billion. This period marked significant financial success for Celsius Holdings.

A significant milestone was the strategic distribution agreement with PepsiCo in 2022, which substantially broadened Celsius' reach in North America and Canada. This partnership was instrumental in increasing Celsius' market share and securing shelf space, allowing its products to be stocked in approximately 95% of stores across the U.S.

In the first nine months of 2024, growth slowed due to PepsiCo reducing inventories and a deceleration in market share gains, with Celsius holding an 11.6% domestic retail market share. Despite this, Celsius' retail sales grew 22% year-over-year in 2024, and its category market share increased by 160 basis points to 11.8%. Celsius acquired Big Beverages in 2024, gaining a manufacturing facility and warehouse to enhance domestic production capabilities.

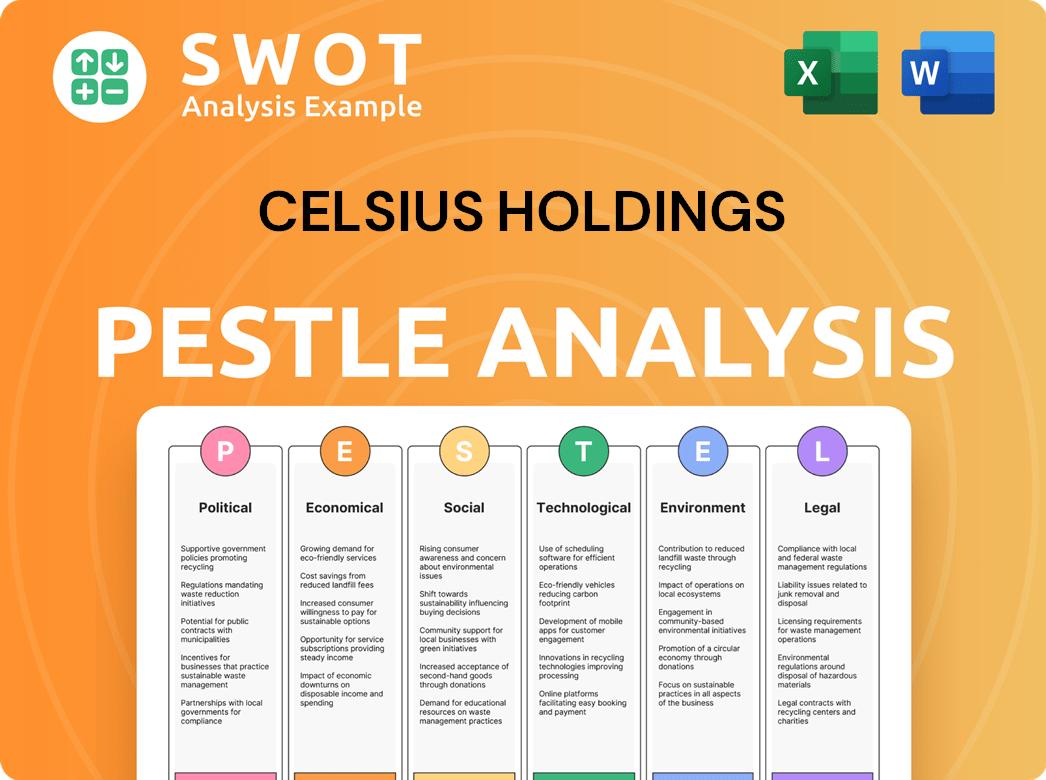

Celsius Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Celsius Holdings history?

The journey of Celsius Holdings has been marked by significant milestones, reflecting its evolution and strategic growth in the competitive beverage industry. From its inception to its recent acquisitions and product expansions, the company has consistently adapted to market demands and consumer preferences, establishing a strong presence in the energy and fitness drink sectors.

| Year | Milestone |

|---|---|

| 2004 | Celsius Holdings, Inc. was founded, marking the beginning of its venture into the health and wellness beverage market. |

| 2010 | The company launched its initial product line, focusing on beverages designed to boost metabolism and burn body fat. |

| 2017 | Celsius Holdings began to expand its distribution network, increasing its market reach across the United States. |

| 2020 | Celsius experienced a surge in popularity, driven by increased consumer interest in health and fitness products. |

| 2022 | The company entered into a strategic distribution agreement with PepsiCo, significantly expanding its distribution capabilities. |

| 2024 | Celsius introduced the CELSIUS ESSENTIALS line of 16-ounce performance energy drinks, expanding its product offerings. |

| 2025 | Celsius launched CELSIUS Hydration, a line of zero-sugar hydration powders, entering the $1.4 billion hydration powder market. |

| 2025 | Celsius completed the acquisition of Alani Nu, a fast-growing energy drink brand, for $1.8 billion. |

Celsius Holdings has consistently focused on innovation to differentiate itself in the market. A key innovation has been its development of functional beverages designed to boost metabolism and burn body fat, setting it apart in the energy drink sector. The company's commitment to introducing new products and flavors, like the CELSIUS ESSENTIALS line and CELSIUS Hydration, demonstrates its dedication to meeting evolving consumer demands and expanding its market presence.

Celsius's primary innovation lies in its functional beverages, which are designed to boost metabolism and aid in fat burning. This focus on health and wellness distinguishes Celsius from traditional energy drink competitors.

The company continuously introduces new products and flavors, such as the CELSIUS ESSENTIALS line of 16-ounce performance energy drinks in 2024. This strategy helps attract new consumers and maintain market relevance.

In 2025, Celsius launched CELSIUS Hydration, a line of zero-sugar hydration powders. This move allowed Celsius to enter the $1.4 billion hydration powder market.

Celsius has formed strategic partnerships, such as the distribution deal with PepsiCo, to enhance its market reach and distribution capabilities. These partnerships are crucial for expanding its consumer base.

The acquisition of Alani Nu in late 2024 (closed April 1, 2025) is a significant strategic move. This acquisition transformed Celsius's market footprint and positioned it to capture new demographics.

Despite its growth and innovations, Celsius Holdings has faced several challenges. In the first nine months of 2024, the company experienced a slowdown in growth, partly due to PepsiCo reducing its inventory levels. Intense competition from established players and other health-conscious brands has also posed a threat, impacting its margins.

In the first nine months of 2024, Celsius experienced a slowdown in growth due to PepsiCo reducing its inventory levels after the initial ramp-up of their distribution deal. This led to a 31% drop in third-quarter revenue for 2024, falling to $265.7 million.

Third-quarter revenue for 2024 fell to $265.7 million compared to $384.8 million in the same period of 2023, with North American revenues decreasing by 33%. Gross profit also declined by 37% in Q3 2024.

Gross profit margin contracted to 46.0% from 50.4% in Q3 2023, attributed to promotional allowances, incentives, and deductions related to PepsiCo's inventory reduction. This put pressure on the company's profitability.

Intense competition from established players like Monster Beverage and Red Bull, as well as other health-conscious brands, has posed a threat. This competition has led to aggressive promotional pricing that impacted Celsius' margins.

The acquisition of Alani Nu, while strategic, presents integration challenges. Successfully integrating Alani Nu's operations and brand into Celsius's existing structure will be crucial for achieving the expected synergies and revenue growth.

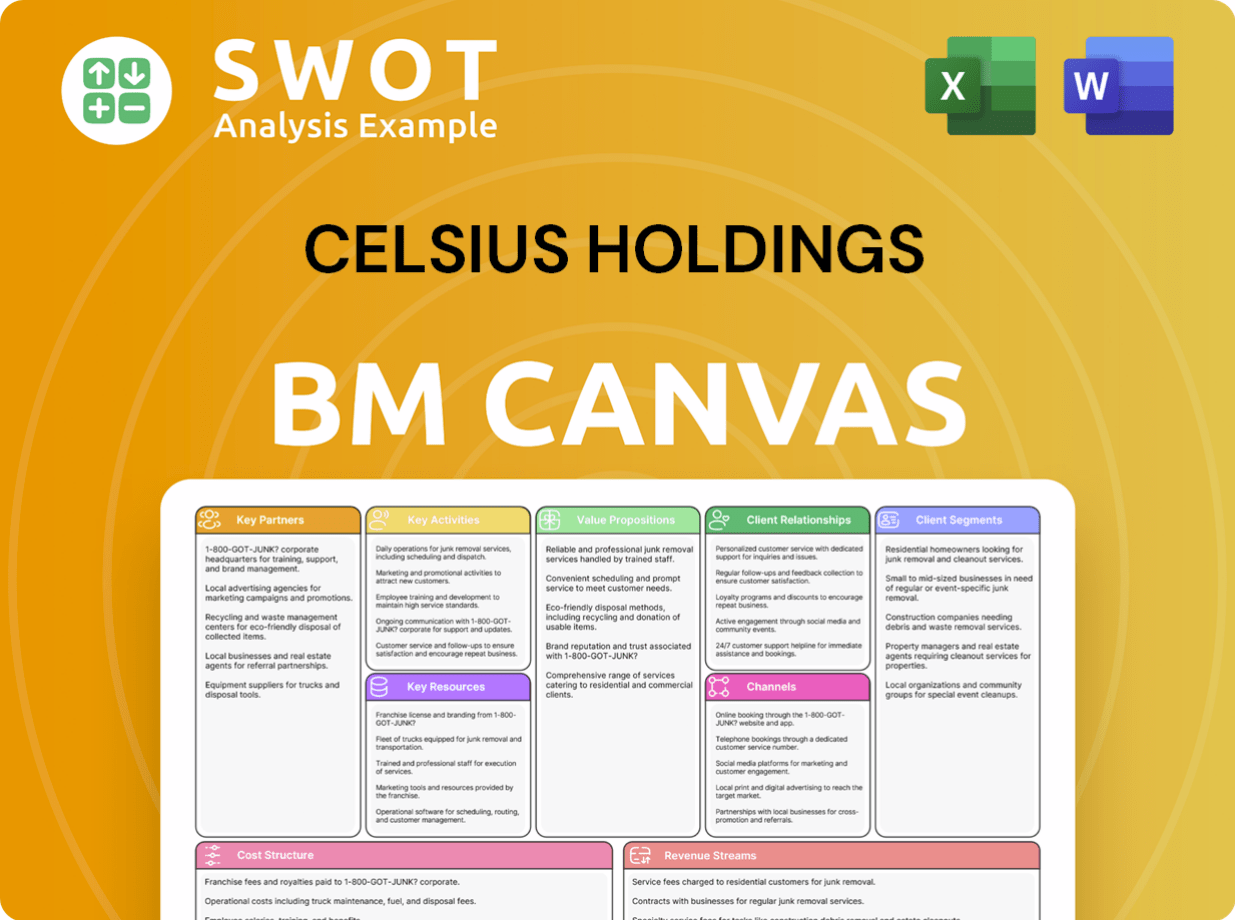

Celsius Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Celsius Holdings?

The journey of Celsius Holdings began in 2004 as Elite FX, evolving into a prominent player in the energy drink market. The company's history is marked by strategic expansions, innovative product launches, and significant partnerships that have propelled its growth. From its initial focus on fitness enthusiasts to its current global presence, Celsius Holdings has consistently adapted to market trends, achieving notable milestones in the competitive beverage industry. For more insights, check out the target market of Celsius Holdings.

| Year | Key Event |

|---|---|

| 2004 | Founded as Elite FX in Boca Raton, Florida. |

| 2005 | Launched its first product line, targeting fitness enthusiasts. |

| 2007 | Received strategic investment from vitamin industry entrepreneurs. |

| 2009 | Released its first energy drink in Sweden. |

| 2010-2012 | Expanded distribution to Sweden and other European markets. |

| 2015 | John Fieldly appointed interim CEO, later becoming permanent CEO. |

| 2016-2017 | Undertook rebranding efforts and formula enhancements. |

| 2017 | Celsius listed on Nasdaq. |

| 2022 | Signed a strategic distribution agreement with PepsiCo. |

| 2024 (Q1) | Reported record first quarter revenue of $355.7 million, up 37% year-over-year. |

| 2024 (Q2) | Achieved record second quarter revenue of $402.0 million, up 23% year-over-year. |

| 2024 (November 1) | Acquired Big Beverages, a manufacturing facility. |

| 2024 (Late) | Entered an agreement to acquire Alani Nu for $1.8 billion. |

| 2025 (Q1) | Reported first quarter revenue of $329.3 million, with international revenue up 41% to $22.8 million. |

| 2025 (April 1) | Closed the acquisition of Alani Nu. |

| 2025 (May) | Continued international expansion into the Netherlands. |

| 2025 (June) | Launched the 'LIVE. FIT. GO.' marketing campaign. |

Celsius Holdings anticipates revenue between $1.6 and $1.7 billion for 2025, potentially doubling its 2024 performance. This growth is fueled by strategic initiatives and market expansion.

The company plans to expand shelf space by 15-20% in 2025, and aims to replicate its U.S. success in Europe and Asia-Pacific. Celsius targets a 10% market share in international markets within three to five years.

The acquisition of Alani Nu is a key focus, with expectations of realizing $50 million in synergies and matching Celsius' margin profile within two years. This integration is crucial for overall growth.

Celsius is exploring new product opportunities in hydration and protein categories. A limited-time offer (LTO) is planned for later in 2025, indicating continued innovation.

Celsius Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Celsius Holdings Company?

- What is Growth Strategy and Future Prospects of Celsius Holdings Company?

- How Does Celsius Holdings Company Work?

- What is Sales and Marketing Strategy of Celsius Holdings Company?

- What is Brief History of Celsius Holdings Company?

- Who Owns Celsius Holdings Company?

- What is Customer Demographics and Target Market of Celsius Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.