Celsius Holdings Bundle

Can Celsius Holdings Conquer the Energy Drink Realm?

The energy drink market is a battlefield, and Celsius Holdings SWOT Analysis reveals a company that's not just surviving, but thriving. With the beverage industry constantly evolving, understanding the Celsius competitive landscape is critical for anyone seeking to capitalize on emerging trends. This analysis dives deep into Celsius's market position, its rivals, and the strategies fueling its impressive growth.

Celsius Holdings' remarkable financial performance review, including a massive 95% revenue surge in 2023, underscores its potent market presence. This detailed examination will explore the Celsius market analysis, including its product portfolio, distribution channels, and consumer demographics to provide a comprehensive competitive analysis. We'll also delve into the Celsius Holdings competitors 2024, comparing Celsius Holdings vs Red Bull, and assessing its growth potential and future outlook in the dynamic energy drink market.

Where Does Celsius Holdings’ Stand in the Current Market?

Celsius Holdings has established a strong foothold within the functional energy drink sector, rapidly expanding its presence and challenging established competitors. The company's core operations revolve around its line of functional energy drinks, which are offered in various flavors and formulations. These drinks are formulated around their proprietary MetaPlus blend, designed to boost metabolism and aid in burning body fat.

The value proposition of Celsius lies in its focus on health and wellness, differentiating it from traditional energy drinks. By emphasizing functional benefits, Celsius targets health-conscious consumers seeking a beverage that offers more than just a temporary energy boost. This approach has allowed the company to successfully position itself as a lifestyle beverage, broadening its appeal within the competitive energy drink market.

In 2023, Celsius's revenue surged by 95% to $1.32 billion, demonstrating significant market penetration and increasing consumer adoption. This growth propelled Celsius to become the third-largest energy drink brand in the U.S. convenience store channel, holding an 11.2% market share as of December 2023, a substantial increase from its 4.9% share in December 2022. This performance highlights Celsius's strong market position and its ability to capture market share within the beverage industry.

Celsius has shown significant growth in market share, particularly in the U.S. convenience store channel. The company's market share increased from 4.9% in December 2022 to 11.2% by December 2023. This growth indicates a strong consumer preference for Celsius products and effective market strategies.

Celsius demonstrated robust financial health in 2023, with a net income of $226.7 million, a significant improvement from a net loss of $199.6 million in 2022. This financial strength supports the company's expansion and competitive positioning within the energy drink market.

Celsius utilizes a multi-channel distribution approach, including direct store delivery (DSD) through strategic partnerships, e-commerce platforms, and a wide network of retailers. This multi-channel strategy enables Celsius to reach a broad customer base, enhancing its market reach and accessibility.

The primary target audience for Celsius includes health-conscious individuals, athletes, and consumers seeking functional benefits beyond a simple energy boost. This focus allows Celsius to differentiate itself and capture a specific segment within the energy drink market.

Celsius's success is driven by its strong revenue growth, expanding market share, and effective distribution strategies. The company's focus on health and wellness has resonated with consumers, contributing to its rapid expansion within the energy drink market. To learn more about the company's strategic approach, consider reading about the Growth Strategy of Celsius Holdings.

- Strong Revenue Growth: Celsius experienced a 95% increase in revenue in 2023.

- Market Share Gains: The company significantly increased its market share in the U.S. convenience store channel.

- Financial Health: Celsius reported a net income of $226.7 million in 2023.

- Strategic Positioning: Celsius has successfully positioned itself as a mainstream lifestyle beverage.

Celsius Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Celsius Holdings?

The competitive landscape for Celsius Holdings is highly dynamic, shaped by the presence of established beverage giants and emerging players. This environment demands continuous innovation and strategic adaptation to maintain and grow market share. Understanding the key competitors and their strategies is crucial for Celsius Holdings to navigate the challenges and capitalize on opportunities within the energy drink market.

The Celsius competitive landscape is defined by intense competition, requiring a deep understanding of both direct and indirect rivals. The energy drink market is constantly evolving, with new products, marketing tactics, and distribution strategies. This necessitates a proactive approach to competitive analysis to stay ahead.

The energy drink market, and the broader beverage industry, is characterized by a mix of large, established companies and smaller, more agile brands. Competitive analysis involves assessing strengths, weaknesses, opportunities, and threats (SWOT) for each key player. This helps in formulating effective strategies to differentiate and gain a competitive edge.

Direct competitors include major players in the energy drink market. These companies compete directly with Celsius Holdings for shelf space, consumer attention, and market share.

Monster is a significant direct competitor. In Q1 2024, Monster reported net sales of approximately $1.9 billion, demonstrating its substantial market presence. The company's diverse portfolio and extensive distribution network pose a strong challenge.

Red Bull maintains a dominant global presence. Red Bull's iconic branding and strategic sponsorships contribute to its consistent sales. The company's global revenue in 2023 was approximately €11.07 billion.

Indirect competitors include companies that offer alternative beverages. These companies target similar consumer needs or preferences, impacting Celsius Holdings' market share.

Coca-Cola and PepsiCo are indirect competitors. Coca-Cola distributes Monster products. PepsiCo's product offerings and distribution networks provide significant competition.

Emerging brands focusing on natural ingredients and health benefits are also competitors. These brands cater to consumers seeking healthier beverage options.

The competitive landscape is influenced by various factors, including distribution agreements, retail promotions, and marketing strategies. Understanding these dynamics is critical for Celsius Holdings' strategic planning and market positioning. Celsius Holdings' market share analysis must consider these aspects.

- Distribution Agreements: Alliances, such as Keurig Dr Pepper's agreement with Nutrabolt, strengthen distribution networks.

- Retail Promotions: The fight for cooler space in stores is a constant area of competition.

- Marketing and Branding: Endorsement deals and social media marketing are crucial for brand visibility.

- Product Innovation: Continuous innovation and adaptation are essential to meet consumer demands.

- Direct-to-Consumer (DTC) Models: Smaller brands leveraging DTC models disrupt the market.

Celsius Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Celsius Holdings a Competitive Edge Over Its Rivals?

The competitive landscape for Celsius Holdings is shaped by its unique advantages in the energy drink market. The company distinguishes itself through its focus on 'healthy energy' and a proprietary formulation, setting it apart from competitors. A strong distribution network and brand recognition further bolster its position, driving significant revenue growth.

Key strategic moves, such as the partnership with PepsiCo in 2022, have significantly enhanced Celsius's distribution capabilities. This alliance has expanded its reach across various retail channels, allowing it to compete more effectively with established players. The company's financial performance reflects its success, with substantial revenue increases in recent years.

Celsius Holdings's competitive edge is built on a blend of product innovation, strategic partnerships, and effective marketing. The company's ability to maintain this edge will depend on its continuous investment in research and development, brand building, and adapting to evolving consumer preferences within the beverage industry.

Celsius's MetaPlus blend, designed to boost metabolism and burn fat, offers a unique selling proposition. This functional benefit, supported by clinical studies, appeals to health-conscious consumers. This differentiation helps Celsius Holdings's marketing strategy stand out in the competitive energy drink market.

The partnership with PepsiCo provides access to an extensive direct-store-delivery (DSD) network. This alliance significantly broadens Celsius's reach across various retail channels. This robust distribution capability is a key competitive advantage against larger rivals in the beverage industry.

Celsius has built strong brand recognition through targeted marketing campaigns and endorsements. This brand loyalty is evident in its continued sales growth. The company benefits from a positive consumer perception as a healthier energy drink alternative.

Celsius has demonstrated impressive financial performance, with a 95% revenue increase in 2023, reaching $1.32 billion. This growth highlights the effectiveness of its strategies. The company's strong financial results underscore its competitive advantages and growth potential in the energy drink market.

Celsius Holdings leverages its unique formulation, strategic partnerships, and strong brand recognition to maintain a competitive edge. These factors contribute to its success in the energy drink market. Understanding these advantages is crucial for a comprehensive Celsius market analysis.

- Proprietary MetaPlus blend for unique functional benefits.

- Strategic partnership with PepsiCo for extensive distribution.

- Strong brand recognition and positive consumer perception.

- Significant revenue growth and financial performance.

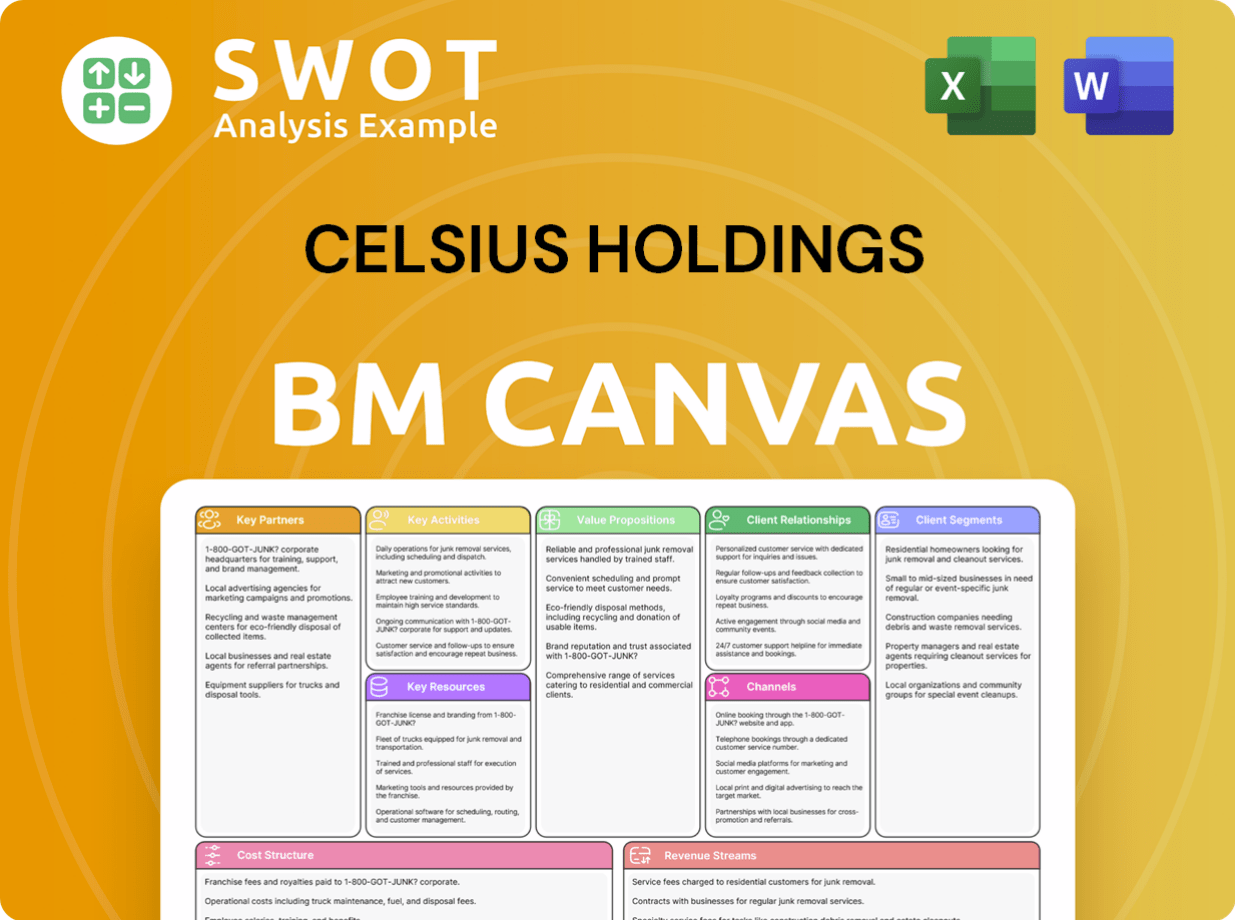

Celsius Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Celsius Holdings’s Competitive Landscape?

The competitive landscape for Celsius Holdings is significantly shaped by industry trends, presenting both opportunities and challenges. The company operates within the dynamic energy drink market and broader beverage industry, where consumer preferences and economic factors play critical roles. Understanding these elements is crucial for evaluating Celsius Holdings' growth potential and future outlook.

Celsius Holdings' market position is influenced by its unique functional benefits and the evolving demands of its consumer base. A comprehensive analysis of its competitive advantages, challenges, and strategic initiatives is essential for investors and stakeholders. This analysis needs to consider factors such as Celsius Holdings' recent acquisitions, financial performance, and stock performance to assess its overall trajectory.

The energy drink market is experiencing a shift towards healthier and functional beverages. Consumers are increasingly seeking products with clean labels and added health benefits. Technological advancements are driving innovation in ingredients and formulations, leading to new product development. The focus on health and wellness is a primary driver.

Intensified competition from established players and new entrants poses a significant challenge. Economic downturns and inflation could impact consumer spending on premium beverages. Regulatory changes regarding health claims and ingredient transparency may increase compliance costs and affect product development. Maintaining market share requires continuous innovation.

The growing demand for functional beverages aligns with Celsius's core offering, creating substantial growth opportunities. Expanding into emerging international markets offers significant potential. Continuous innovation in flavors and functional ingredients can attract new consumers. Strategic partnerships can enhance distribution and brand presence.

Celsius Holdings should focus on continuous product innovation and expanding its product lines. Leveraging its strong distribution network is crucial for market penetration. Expanding its brand presence globally is essential for long-term growth. The company must adapt to changing consumer preferences and regulatory environments.

The energy drink market's growth is robust, with an estimated global value of $61.05 billion in 2023, and projections indicate a rise to $86.01 billion by 2028, according to Statista. Celsius Holdings, a key player in this market, has demonstrated strong financial performance. In Q1 2024, Celsius reported a revenue increase of 93% year-over-year, reaching $653.6 million. This growth highlights the company's ability to capitalize on market trends. For further insights into the ownership structure and financial performance, explore Owners & Shareholders of Celsius Holdings.

- Market Growth: The global energy drink market is expanding rapidly, creating opportunities for companies like Celsius.

- Competitive Landscape: Celsius faces competition from established brands like Red Bull and Monster, as well as emerging players.

- Product Innovation: Continuous innovation in flavors and functional ingredients is crucial for maintaining a competitive edge.

- Strategic Partnerships: Collaborations with distributors and retailers are essential for expanding market reach.

Celsius Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Celsius Holdings Company?

- What is Growth Strategy and Future Prospects of Celsius Holdings Company?

- How Does Celsius Holdings Company Work?

- What is Sales and Marketing Strategy of Celsius Holdings Company?

- What is Brief History of Celsius Holdings Company?

- Who Owns Celsius Holdings Company?

- What is Customer Demographics and Target Market of Celsius Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.