CF Industries Holdings Bundle

How Did CF Industries Grow Into an Industry Leader?

Ever wondered how a fertilizer cooperative transformed into a global industrial giant? CF Industries Holdings, Inc., a key player in nitrogen and hydrogen production, boasts a fascinating history. From its humble beginnings in 1946, this CF Industries Holdings SWOT Analysis reveals a story of strategic growth and adaptation. Explore the pivotal moments that shaped CF Industries' journey.

This article delves into the CF Industries history, tracing its evolution from a farmer-focused cooperative to a publicly traded powerhouse. We'll examine the company's expansion in ammonia production and nitrogen fertilizers, highlighting key milestones and its impact on the fertilizer company landscape. Discover the CF Industries Holdings company profile and its remarkable journey.

What is the CF Industries Holdings Founding Story?

The story of CF Industries Holdings, Inc. begins on November 5, 1946, when it was established as Central Farmers Fertilizer Company. This marked the start of a journey to address the critical need for a dependable supply of fertilizers for American farmers in the post-World War II era. The company's founding was a direct response to the agricultural boom, driven by the need to increase food production.

The initiative was spearheaded by a group of regional agricultural cooperatives. Their aim was to collectively secure and produce essential plant nutrients. This collaborative approach aimed to reduce supply chain vulnerabilities and stabilize costs. The core issue identified by these founders was the inconsistent and often unreliable access to fertilizers, which was negatively impacting agricultural productivity and farmer profitability.

The initial business model centered on cooperative purchasing and manufacturing of fertilizers, enabling member cooperatives to pool resources and achieve economies of scale.

- The first product was the collective procurement and distribution of various fertilizer types.

- The name 'Central Farmers Fertilizer Company' clearly stated its mission and cooperative structure.

- Initial funding came from the capital contributions of its founding member cooperatives, reflecting a grassroots initiative.

- The cultural and economic context, with a focus on agricultural output and cooperative movements, significantly influenced the company's creation.

The original business model revolved around cooperative purchasing and manufacturing of fertilizers. This strategy enabled member cooperatives to pool their resources, achieve economies of scale, and gain greater control over the quality and availability of their essential inputs. The initial 'product' was the collective procurement and distribution of various fertilizer types to its member organizations. While specific details about the company name selection are not widely publicized, the name 'Central Farmers Fertilizer Company' clearly communicated its mission and cooperative structure. Initial funding primarily came from the capital contributions of its founding member cooperatives, reflecting a grassroots, farmer-driven initiative. The cultural and economic climate of the time, characterized by a renewed focus on agricultural output and cooperative movements, significantly influenced the company's creation, emphasizing self-reliance and collective strength among farmers. For more insights into the company's market, consider reading about the Target Market of CF Industries Holdings.

CF Industries Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CF Industries Holdings?

The early development of CF Industries, initially known as Central Farmers Fertilizer Company, centered on strengthening its cooperative model and broadening its reach among agricultural cooperatives. A crucial early step involved shifting from simply purchasing to actually manufacturing fertilizers. This strategic move began in the 1960s with the acquisition and construction of its own production facilities, marking a pivotal transition from a procurement entity to an integrated manufacturer.

The company acquired its first nitrogen plant in 1965 in Tyner, Indiana, and subsequently built new production complexes. These early product launches included various nitrogen, phosphate, and potash fertilizers, directly serving the growing needs of its member cooperatives. This expansion was key to establishing CF Industries' foundation in the fertilizer industry.

The initial team expansion mirrored the growth in manufacturing capabilities, with a focus on engineers, chemists, and plant operators. Geographically, early expansion concentrated on key agricultural regions within the United States. A major capital raise occurred in 1971 when the company issued its first public bonds, signaling a move towards broader financial market engagement while still maintaining its cooperative structure.

A significant strategic shift occurred in 2005 when CF Industries transitioned from a cooperative to a publicly traded company, listed on the New York Stock Exchange. This move provided access to a wider pool of capital, enabling more aggressive expansion and diversification. Following this transition, the company engaged in key acquisitions and mergers, notably the acquisition of Terra Industries Inc. in 2010 for approximately $4.7 billion. This acquisition significantly expanded CF Industries' nitrogen production capacity and solidified its position as a global leader in the industry.

The market reception to these strategic moves was generally positive, as they demonstrated the company's commitment to growth and its ability to adapt to changing market dynamics, while navigating competitive landscapes that included both domestic and international fertilizer producers. As of early 2024, CF Industries reported net earnings of $2.49 billion and adjusted EBITDA of $3.97 billion, reflecting its continued strong financial performance and market position.

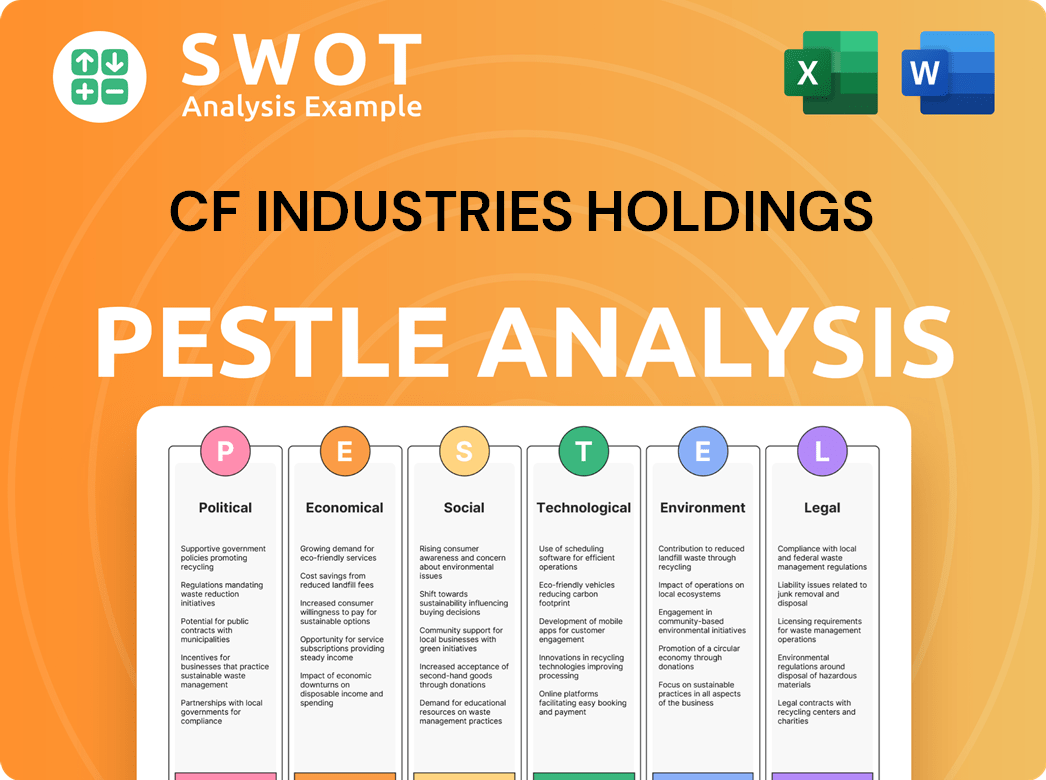

CF Industries Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CF Industries Holdings history?

The history of CF Industries Holdings is marked by significant milestones, including its early integration into fertilizer manufacturing and its ongoing efforts in sustainable ammonia production. These achievements highlight the company's evolution and its adaptation to the changing demands of the agricultural and energy sectors. For more insights into the ownership structure and financial performance, consider exploring Owners & Shareholders of CF Industries Holdings.

| Year | Milestone |

|---|---|

| 1960s | Early integration into fertilizer manufacturing, moving beyond distribution to direct production. |

| 2005 | Transitioned from a cooperative to a public company, enabling greater access to capital. |

| 2023 | Announced an agreement with ExxonMobil for carbon capture and storage at its Louisiana complex, aiming to reduce emissions by 2 million tons per year. |

| 2023 | Secured a grant of up to $90 million from the U.S. Department of Energy for its green ammonia production facility in Donaldsonville, Louisiana. |

| 2024 | Agreement with NextEra Energy Resources to develop a large-scale electrolysis project for green hydrogen production at its Donaldsonville complex. |

CF Industries has consistently pursued innovations, particularly in sustainable ammonia production. The company is at the forefront of developing 'blue' and 'green' ammonia production technologies, which are crucial for the clean energy transition.

This move in the 1960s was a significant step, transitioning from mere distribution to direct production of fertilizers. This strategic shift allowed for greater control over the supply chain and production processes.

CF Industries has invested in 'blue' ammonia production, which involves capturing carbon dioxide emissions from the manufacturing process. This technology significantly reduces the carbon footprint of ammonia production.

The company is developing 'green' ammonia production facilities, using renewable energy sources to power the process. This approach further minimizes environmental impact.

The agreement with ExxonMobil for CCS at its Louisiana complex is a major initiative to reduce emissions. This project aims to capture and store carbon dioxide, contributing to a lower carbon footprint.

CF Industries is embracing hydrogen and ammonia as clean fuel sources, expanding its role beyond traditional nitrogen fertilizers. This strategic shift aligns with the growing demand for sustainable energy solutions.

The 2024 agreement with NextEra Energy Resources to develop a large-scale electrolysis project for green hydrogen production at its Donaldsonville complex. This project will further enhance ammonia production.

CF Industries has faced challenges such as volatile natural gas prices and fluctuating agricultural commodity prices. Competitive pressures from global producers have also necessitated continuous operational improvements.

Natural gas is a key input for nitrogen production, and price fluctuations can significantly impact production costs. This volatility requires careful financial management and hedging strategies.

Changes in agricultural commodity prices directly affect fertilizer demand, impacting CF Industries' revenue. The company must adapt to market shifts to maintain profitability.

Competition from global producers necessitates continuous operational efficiency improvements. The company must constantly innovate and optimize its processes to stay competitive.

Internal crises, including operational challenges at manufacturing sites, have required significant investment in safety protocols and facility upgrades. These investments are crucial for maintaining operational integrity.

The transition from a cooperative to a public company in 2005 enabled greater capital access for expansion. This strategic move supported the company's growth and diversification efforts.

The shift towards clean energy solutions, including hydrogen and ammonia, represents a significant strategic pivot. This move positions CF Industries to capitalize on the growing demand for sustainable energy sources.

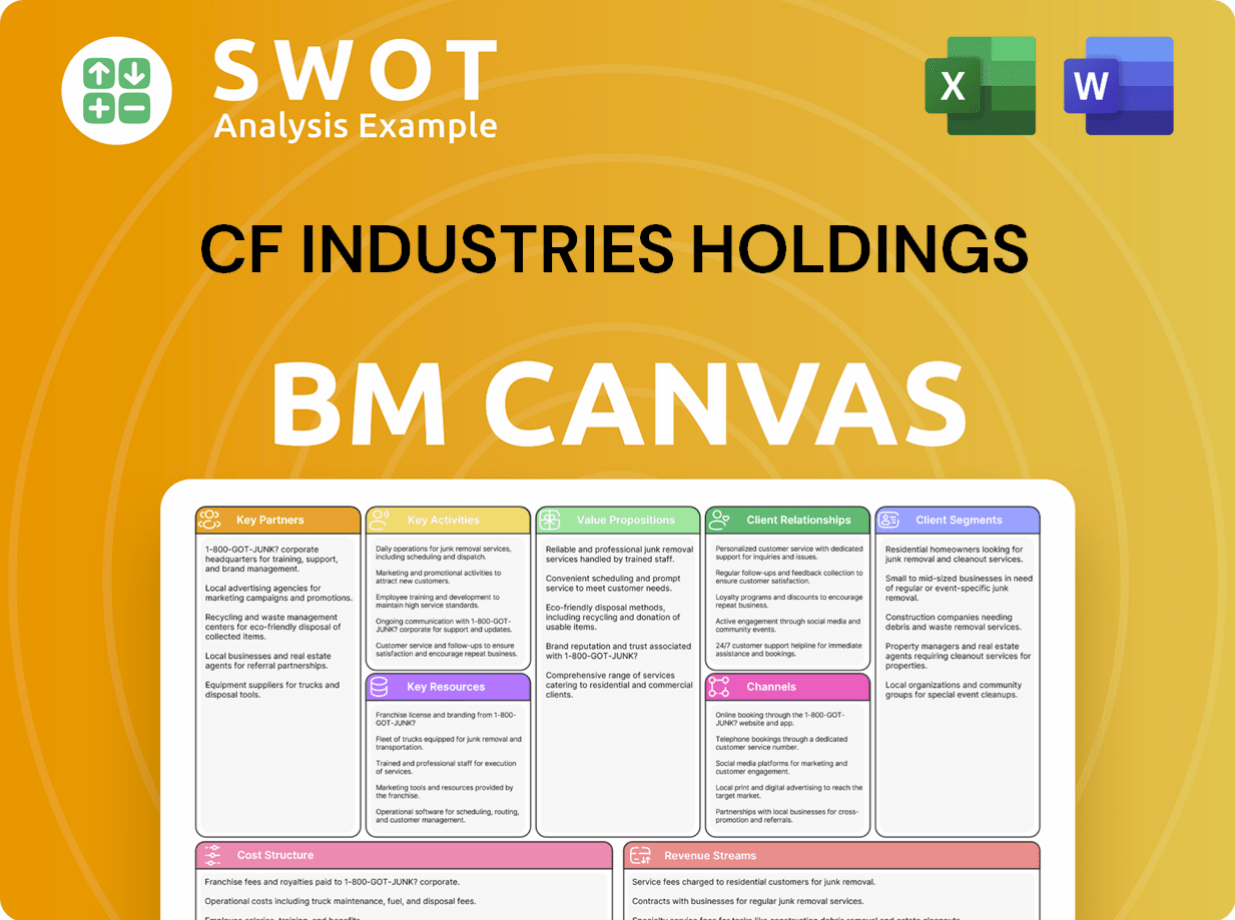

CF Industries Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CF Industries Holdings?

The history of CF Industries Holdings is marked by significant milestones, evolving from a cooperative to a global leader in nitrogen fertilizer and clean energy solutions. Founded in 1946 as a cooperative, the company initially focused on providing essential resources for agriculture. The acquisition of its first nitrogen plant in 1965 signaled its entry into manufacturing. A pivotal moment came in 2005 when it transitioned to a publicly traded company, listed on the NYSE. Further expansion occurred in 2010 with the acquisition of Terra Industries Inc., significantly increasing its production capacity. More recently, the company has strategically positioned itself in the clean energy sector, with initiatives in carbon capture, green ammonia production, and partnerships for large-scale hydrogen projects.

| Year | Key Event |

|---|---|

| 1946 | Central Farmers Fertilizer Company founded as a cooperative. |

| 1965 | Acquired first nitrogen plant in Tyner, Indiana, marking entry into manufacturing. |

| 1971 | Issued first public bonds, indicating initial engagement with broader financial markets. |

| 2005 | Transitioned from a cooperative to a publicly traded company, listed on the NYSE as CF Industries Holdings, Inc. |

| 2010 | Acquired Terra Industries Inc. for approximately $4.7 billion, significantly expanding nitrogen production capacity and global footprint. |

| 2015 | Completed expansion projects at its North American nitrogen complexes, increasing production capacity. |

| 2020 | Began exploring opportunities in clean hydrogen and ammonia production. |

| 2023 | Announced agreement with ExxonMobil for carbon capture at its Louisiana facility, targeting 2 million tons of CO2 abatement annually. |

| 2023 | Received up to $90 million grant from the U.S. Department of Energy for green ammonia production at Donaldsonville. |

| 2024 | Partnered with NextEra Energy Resources for large-scale green hydrogen project at Donaldsonville. |

| 2024 | Reported strong financial results with net earnings of $2.49 billion and adjusted EBITDA of $3.97 billion. |

CF Industries is strategically positioned to capitalize on the growing demand for clean energy solutions and sustainable agricultural practices. The company's long-term strategic initiatives are heavily focused on expanding its clean ammonia production capabilities, with a particular emphasis on blue and green ammonia. They aim to leverage their existing infrastructure and expertise to become a leader in the global clean hydrogen and ammonia market.

Market expansion plans include further development of international partnerships and exploring new applications for their products in industrial decarbonization. The company is actively participating in discussions about the Inflation Reduction Act's impact on clean energy tax credits, which could further accelerate their clean energy projects. This expansion is crucial for the future of the CF Industries and the fertilizer industry.

Innovation roadmaps prioritize continued investment in carbon capture technologies and electrolysis for green hydrogen production. The company is focused on integrating sustainable practices to meet the growing demand for sustainable solutions. The company's commitment to innovation is evident in its ongoing investments in technologies that support both agricultural and energy sectors.

Industry trends such as the global push for decarbonization, increasing adoption of sustainable agricultural practices, and the rising demand for hydrogen as a clean fuel source are likely to significantly impact CF Industries' future. Analyst predictions suggest continued growth in the clean energy sector, with ammonia playing a crucial role in hydrogen transport and direct use as a fuel. The future outlook ties back to the founding vision of providing essential resources, now expanded to encompass not only agricultural sustenance but also a sustainable energy future.

CF Industries Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CF Industries Holdings Company?

- What is Growth Strategy and Future Prospects of CF Industries Holdings Company?

- How Does CF Industries Holdings Company Work?

- What is Sales and Marketing Strategy of CF Industries Holdings Company?

- What is Brief History of CF Industries Holdings Company?

- Who Owns CF Industries Holdings Company?

- What is Customer Demographics and Target Market of CF Industries Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.