CF Industries Holdings Bundle

Can CF Industries Holdings Revolutionize Agriculture and Energy?

CF Industries Holdings, a titan in nitrogen and hydrogen products, is aggressively navigating the clean energy transition. Its growth strategy is not just about fertilizers; it's about fueling a sustainable future. Founded in 1946, the company has evolved from a cooperative to a global powerhouse, playing a crucial role in both food security and the burgeoning clean energy economy.

From its roots supplying American farmers with vital nitrogen fertilizers, CF Industries Holdings SWOT Analysis reveals how the company now produces approximately 10 million tons of ammonia annually. Its extensive network spans the United States, Canada, and the United Kingdom, solidifying its position in the Fertilizer Market. The company's future prospects are intrinsically linked to its strategic initiatives, particularly in green ammonia and its ability to capitalize on the growing demand for low-carbon solutions and Nitrogen Production.

How Is CF Industries Holdings Expanding Its Reach?

CF Industries Holdings is actively pursuing several expansion initiatives, focusing on clean energy solutions and strategic acquisitions to drive growth. These initiatives are designed to capitalize on the increasing demand for low-carbon ammonia and expand the company's capabilities in both traditional and emerging markets. The company's strategic moves reflect a commitment to sustainability and a proactive approach to adapting to the evolving needs of the fertilizer and energy sectors.

A key element of CF Industries' growth strategy involves significant investments in low-carbon ammonia production. This includes a major joint venture and strategic acquisitions to enhance its production capacity and integrate carbon capture technologies. These expansions aim to strengthen its market position and meet the growing global demand for sustainable products.

These strategic initiatives are part of CF Industries' broader plan to diversify its revenue streams and maintain a leadership position in the industry. By focusing on both traditional fertilizer production and innovative clean energy solutions, CF Industries is positioning itself for long-term growth and resilience in a changing market environment. For more insights, check out the Competitors Landscape of CF Industries Holdings.

CF Industries is collaborating with JERA Co., Inc., and Mitsui & Co., Ltd., to build a low-carbon ammonia production facility at its Blue Point Complex in Louisiana. The Autothermal Reforming (ATR) facility is expected to cost approximately $4 billion. CF Industries will hold a 40% ownership stake and will manage the plant's operations and maintenance.

In December 2023, CF Industries acquired Incitec Pivot Limited's (IPL) ammonia production complex in Waggaman, Louisiana, for around $1.675 billion. This acquisition is intended to boost immediate profitable growth by incorporating a new, energy-efficient ammonia production unit. The company plans to implement carbon capture and sequestration (CCS) technologies at the Waggaman site.

The Donaldsonville Complex Carbon Capture and Sequestration Project is in the advanced commissioning phase and is expected to capture up to 2 million metric tons of CO2 annually, with a start-up in 2025. CF Industries has also signed an agreement with ExxonMobil in July 2024 for the transport and sequestration of up to 500,000 metric tons of CO2 annually at the Yazoo City Complex, with start-up expected in 2028. This project involves an investment of approximately $100 million.

These expansion initiatives aim to access new clean energy markets, diversify revenue streams, and maintain a leadership position in the industry. The company is committed to decarbonizing its production network and adapting to the changing demands of the fertilizer and energy sectors.

CF Industries is making strategic investments to expand its production capacity and incorporate sustainable practices. These initiatives are designed to enhance its market position and meet the growing demand for low-carbon products. The company's focus on both traditional and emerging markets reflects its commitment to long-term growth.

- Joint Venture: Collaboration with JERA and Mitsui to build a low-carbon ammonia plant at Blue Point Complex, Louisiana, with a capacity of 1.4 million metric tons per year.

- Acquisition: Purchase of IPL's ammonia production complex in Waggaman, Louisiana, for approximately $1.675 billion.

- CCS Projects: Implementing carbon capture and sequestration at Donaldsonville and Yazoo City Complexes, with the Donaldsonville project capturing up to 2 million metric tons of CO2 annually.

- Investment: Approximately $4 billion for the Blue Point Complex, $1.675 billion for the Waggaman acquisition, and $100 million for the Yazoo City project.

CF Industries Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CF Industries Holdings Invest in Innovation?

The innovation and technology strategy of CF Industries Holdings is centered on leveraging advanced solutions to drive sustained growth. A key focus is on decarbonization and developing low-carbon products, reflecting a strategic shift towards sustainability and environmental responsibility within the fertilizer market.

This approach is crucial for meeting evolving customer needs and preferences, as well as addressing regulatory pressures and investor demands for environmentally friendly products. The company's initiatives aim to reduce its carbon footprint and provide clean energy solutions, positioning it favorably in a changing market landscape.

CF Industries' strategic initiatives are primarily driven by the need to reduce emissions and produce cleaner energy products. This involves significant investments in technologies like carbon capture and sequestration (CCS) and green ammonia production. The company's commitment to sustainability is evident in its ambitious emissions reduction targets and strategic collaborations.

CF Industries is heavily investing in CCS technologies to capture and store carbon dioxide emissions. The Donaldsonville Complex project is expected to capture up to 2 million metric tons of CO2 annually starting in 2025.

The Yazoo City Complex project is projected to capture up to 500,000 metric tons of CO2 annually from 2028. These projects are designed to qualify for tax credits under Section 45Q of the Internal Revenue Code.

CF Industries is investing in green ammonia production through electrolysis. The Donaldsonville Complex has a 20MW electrolyzer. This facility is expected to produce approximately 20,000 tons of green ammonia annually.

The company is collaborating with NextEra Energy to develop a 100 MW electrolysis plant at its Verdigris Complex in Oklahoma. This project aims to produce up to 100,000 tonnes of renewable ammonia annually.

CF Industries is a founding manufacturing member of the Low Carbon Fertilizer Alliance. The company is committed to a nitric acid plant emissions abatement project at its Verdigris facility.

The Verdigris project is expected to reduce CO2-equivalent emissions by approximately 600,000 metric tons annually beginning in 2025. CF Industries aims to reduce Scope 1 carbon dioxide equivalent emissions intensity by 25% by 2030 (compared to a 2015 baseline).

These technological advancements and strategic collaborations highlight CF Industries' commitment to innovation, with the goal of providing products with a lower carbon intensity for traditional agricultural uses and new clean energy applications. The company's long-term vision includes achieving net zero carbon emissions by 2050. For more information on the company's financial performance, you can read about the Owners & Shareholders of CF Industries Holdings.

CF Industries is focused on several key areas to drive its innovation and technology strategy. These initiatives are critical for the company's future prospects and its ability to compete in the fertilizer market. The company’s investments in nitrogen production and agricultural chemicals are also significant.

- Carbon Capture and Sequestration (CCS): Implementing CCS projects to capture and store CO2 emissions.

- Green Ammonia Production: Utilizing electrolysis to produce carbon-free hydrogen for green ammonia.

- Renewable Hydrogen Partnerships: Collaborating on projects to develop renewable hydrogen and ammonia.

- Emissions Abatement: Participating in projects to reduce emissions in agricultural supply chains.

- Sustainability Goals: Committing to reducing carbon emissions and achieving net-zero emissions by 2050.

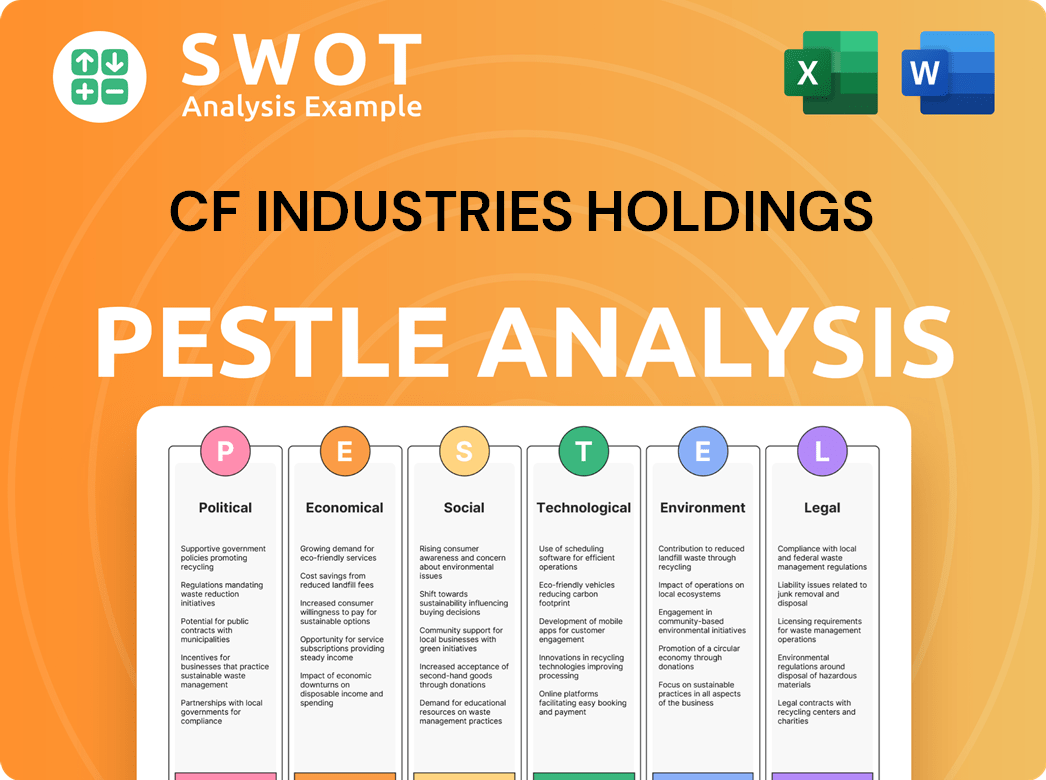

CF Industries Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is CF Industries Holdings’s Growth Forecast?

CF Industries Holdings, Inc. (CF) has demonstrated robust financial performance, reflecting a strong position in the fertilizer market. The company's growth strategy is centered on capitalizing on the increasing demand for nitrogen-based fertilizers and expanding its clean energy initiatives. This approach is supported by strategic investments and a commitment to returning value to shareholders, positioning CF Industries for sustained growth.

The company's future prospects are bright, driven by its focus on nitrogen production and strategic investments in green and low-carbon ammonia. CF Industries' financial performance analysis indicates strong revenue growth and profitability, supported by favorable market conditions in the global nitrogen industry. The company's commitment to sustainability and innovation further strengthens its long-term growth potential.

For the full year 2024, CF Industries reported net earnings attributable to common stockholders of $1.22 billion, or $6.74 per diluted share. The adjusted EBITDA for the same period was $2.28 billion. In the first quarter of 2025, the company reported net earnings of $312 million, or $1.85 per diluted share, and an adjusted EBITDA of $644 million, a significant increase from $194 million in Q1 2024. Net sales for Q1 2025 rose to $1.66 billion, up from $1.47 billion in Q1 2024, driven by higher selling prices and production volumes.

CF Industries anticipates gross ammonia production of approximately 10 million tons for the full year 2025. This highlights the company's significant capacity in nitrogen production and its ability to meet the growing demand in the agricultural chemicals sector. This production volume is crucial for supporting global food supply.

Capital expenditures for the full year 2025 are projected to be approximately $800-$900 million. A significant portion of these investments will be directed towards the Blue Point joint venture and other strategic initiatives. In 2024, capital expenditures totaled $518 million, with $441 million allocated to green and low-carbon ammonia projects.

CF Industries is committed to returning capital to shareholders. In Q1 2025, the company repurchased 5.4 million shares for $434 million. The Board of Directors has authorized a new $2 billion share repurchase program through 2029. Additionally, a dividend of $0.50 per share was declared, payable on May 30, 2025.

The company plans to invest $442 million in 2025 for the Donaldsonville green ammonia project. This investment underscores CF Industries' sustainability goals and its commitment to reducing its environmental impact. This project is a key component of CF Industries' strategic initiatives.

These financial strategies, combined with favorable market conditions, position CF Industries for continued strong cash generation and long-term shareholder value creation. Further insights into the company's revenue streams and business model can be found in this article: Revenue Streams & Business Model of CF Industries Holdings.

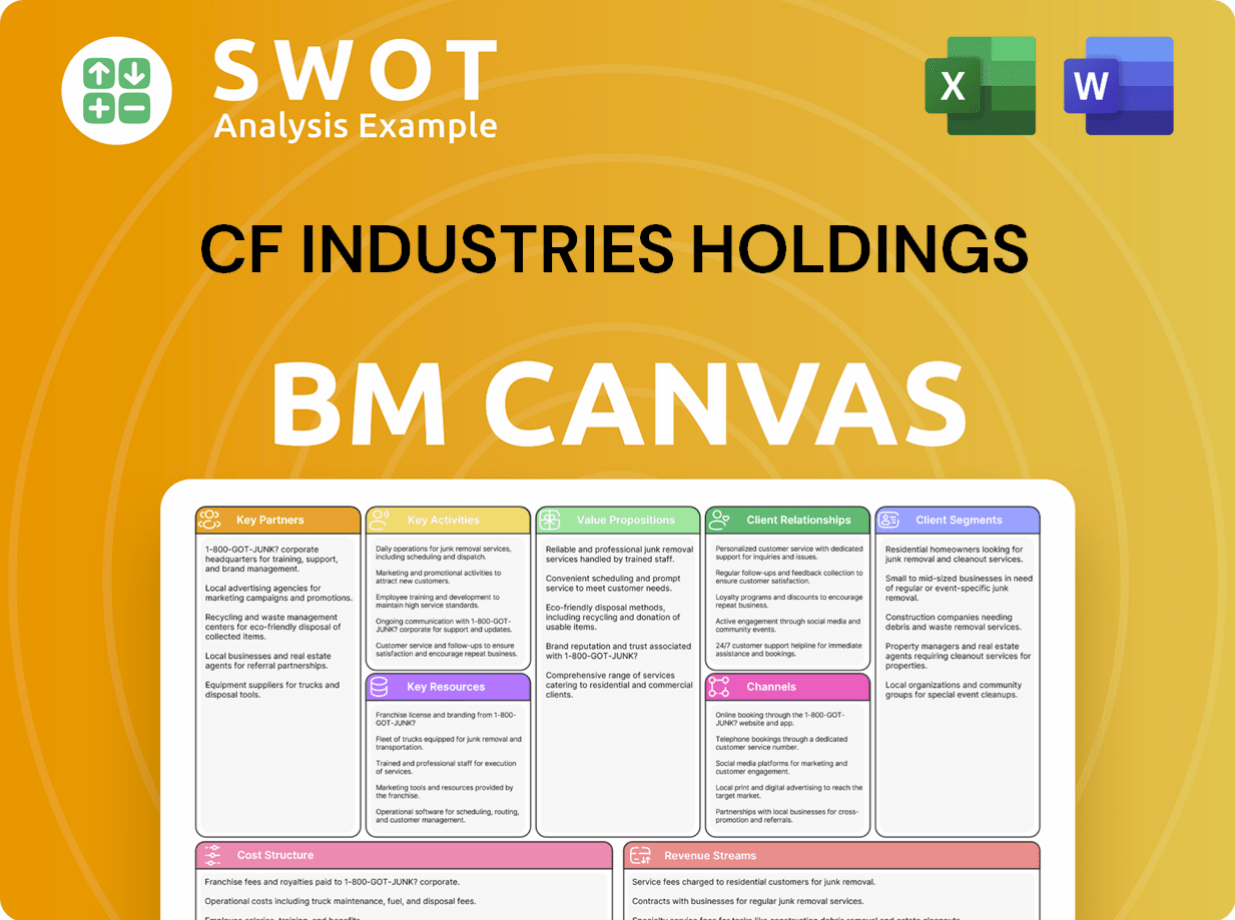

CF Industries Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow CF Industries Holdings’s Growth?

The growth trajectory of CF Industries Holdings is subject to a variety of risks that could influence its strategic and operational outcomes. These risks span market dynamics, regulatory changes, supply chain vulnerabilities, and internal resource constraints. Understanding and proactively managing these challenges is crucial for the company to achieve its long-term goals and maintain its competitive position in the fertilizer market.

Market competition and fluctuations in key input costs, such as natural gas prices, pose significant challenges. Regulatory changes, including environmental standards and trade policies, add another layer of complexity. Supply chain disruptions and internal operational issues further contribute to the risk profile, necessitating robust risk management strategies.

CF Industries' strategic initiatives and financial performance are closely tied to its ability to navigate these obstacles effectively. The company's focus on sustainable practices and investment in green ammonia production are key steps in mitigating some of these risks, showcasing a proactive approach to future challenges.

The global nitrogen market is influenced by supply and demand dynamics. Production rates from different regions create competitive pressures. The willingness of countries like the United States and Brazil to purchase Russian fertilizer also impacts market dynamics, influencing CF Industries' market share in North America.

Fluctuations in natural gas prices significantly affect CF Industries' operating margins. Natural gas is a major input cost for nitrogen fertilizer production. While the company employs hedging strategies, their effectiveness can vary, impacting CF Industries' financial performance analysis.

CF Industries faces regulations related to environmental standards and trade policies. Environmental regulations, such as EPA greenhouse gas emission standards requiring a mandatory 22% reduction by 2025, necessitate investments in pollution control technologies. These changes can impact CF Industries' expansion plans in Europe.

Trade policies, including tariffs and import quotas, can affect the company's ability to export products. Geopolitical tensions also contribute to volatility in international fertilizer trade. Ongoing trade restrictions and sanctions directly impact global supply chains and CF Industries' long-term growth potential.

Disruptions in the supply of raw materials or transportation can impact production and distribution. While not explicitly detailed in recent reports as a current obstacle, these vulnerabilities are an inherent risk for a global manufacturer. This impacts the company's ability to meet demand and maintain its competitive edge.

Internal resource constraints can impact project timelines and operational efficiency. For example, the fourth quarter of 2024 saw the suspension of commissioning for the 20-megawatt alkaline water electrolysis plant at its Donaldsonville complex. Such issues can affect CF Industries' quarterly earnings reports.

CF Industries is actively investing in new technologies, like carbon capture and green ammonia production. The company is also committed to achieving net zero carbon emissions by 2050 and reducing Scope 1 carbon dioxide equivalent emissions intensity by 25% by 2030 (compared to a 2015 baseline). These actions demonstrate a proactive approach to environmental risks and support CF Industries' sustainability goals.

The acquisition of the Waggaman ammonia production facility in 2023 highlights a strategy for immediate profitable growth and accelerated implementation of CCS technologies. CF Industries' investment in green ammonia aligns with increasing environmental regulations and growing demand for sustainable products. These initiatives influence the company’s competitive landscape.

For more insights into the company's core values, mission, and vision, you can refer to the information provided at Mission, Vision & Core Values of CF Industries Holdings.

CF Industries Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CF Industries Holdings Company?

- What is Competitive Landscape of CF Industries Holdings Company?

- How Does CF Industries Holdings Company Work?

- What is Sales and Marketing Strategy of CF Industries Holdings Company?

- What is Brief History of CF Industries Holdings Company?

- Who Owns CF Industries Holdings Company?

- What is Customer Demographics and Target Market of CF Industries Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.