CF Industries Holdings Bundle

Can CF Industries Maintain Its Dominance in a Changing World?

As global demands shift towards sustainable solutions, CF Industries, a leader in nitrogen products, finds itself at a pivotal juncture. The company's strategic focus on green and blue ammonia positions it at the forefront of the clean energy transition. But how does CF Industries navigate the complex CF Industries Holdings SWOT Analysis?

This exploration of the CF Industries' competitive landscape will dissect its market position within the fertilizer market, identify key rivals, and analyze its competitive advantages. We'll delve into industry trends, challenges, and opportunities shaping its future, providing a comprehensive market analysis. Understanding CF Industries' strategic initiatives and how it compares to its rivals is crucial for anyone seeking insights into this dynamic sector and its role in sustainable agriculture.

Where Does CF Industries Holdings’ Stand in the Current Market?

CF Industries Holdings, Inc. is a significant player in the global hydrogen and nitrogen products sector. Its core operations involve manufacturing and distributing nitrogen fertilizers and other nitrogen-based products. These products are essential for agriculture, industrial applications, and the burgeoning clean energy market. The company's value proposition centers on providing essential products to support global food production and contribute to the decarbonization of various industries.

The company's strategic focus includes the production of ammonia, urea, urea ammonium nitrate (UAN), and ammonium nitrate. These products are vital for both agricultural and industrial applications. CF Industries has a strong presence in North America and the United Kingdom, operating large-scale manufacturing complexes to serve key markets efficiently. The company is also increasingly emphasizing its role in the clean energy transition through the production of green and blue ammonia.

CF Industries' market position is robust within the global fertilizer market. It is consistently recognized as a top producer, particularly in North America. The company's financial health and strategic investments highlight its adaptability and reinforce its standing in a dynamic global market. In 2023, CF Industries reported net earnings of $1.56 billion and net sales of $6.9 billion, demonstrating its substantial scale and financial performance.

While specific global market share figures fluctuate, CF Industries maintains a leading position in the nitrogen fertilizer market. The company is a major producer in North America and has a significant presence in the United Kingdom. This strong market position is supported by its large-scale manufacturing capabilities and strategic geographic footprint.

CF Industries' primary product lines include ammonia, urea, UAN, and ammonium nitrate. These products serve critical roles in agriculture and various industrial applications. The company's diversification into green and blue ammonia further expands its product portfolio, supporting the clean energy transition. This diversification supports the Growth Strategy of CF Industries Holdings.

CF Industries operates primarily in North America (United States and Canada) and the United Kingdom. These locations provide access to key agricultural markets and industrial customers. The strategic placement of its manufacturing complexes allows for efficient distribution and service to its customer base. This geographic focus supports its market position.

In 2023, CF Industries reported net earnings of $1.56 billion and net sales of $6.9 billion. These figures reflect the company's financial strength and its ability to generate significant revenue in the fertilizer market. Strong financial performance supports ongoing investments in clean energy initiatives and reinforces its market leadership.

CF Industries is strategically focusing on the clean energy transition by producing green and blue ammonia. This diversification helps the company adapt to changing market demands and reduce its environmental impact. These initiatives include investments in carbon capture and storage technologies.

- Expansion into clean energy markets.

- Investments in sustainable production methods.

- Focus on reducing carbon emissions.

- Strategic partnerships for technology and distribution.

CF Industries Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CF Industries Holdings?

The competitive landscape for CF Industries Holdings, Inc. within the fertilizer market and industrial nitrogen sectors is complex, characterized by a mix of established global players, regional producers, and emerging companies. This environment is significantly influenced by factors such as global demand for nitrogen-based fertilizers, natural gas prices (a key feedstock), production efficiency, and evolving environmental regulations. Understanding the competitive dynamics is crucial for assessing the company's market position and future prospects.

CF Industries faces competition from both direct rivals in the nitrogen fertilizer and industrial markets and indirect competitors related to alternative agricultural practices and the emerging clean energy sector. The competitive dynamics are constantly shifting due to mergers, acquisitions, and strategic alliances within the industry. Furthermore, the company's financial performance is heavily influenced by its ability to secure advantageous natural gas feedstock prices and optimize its production and distribution networks.

The analysis of CF Industries' competitive landscape involves assessing the strengths, weaknesses, opportunities, and threats (SWOT) posed by its main competitors. This includes evaluating their market share, production capacity, geographic reach, product offerings, and financial performance. The competitive analysis also considers the impact of industry trends, such as the growing demand for sustainable agriculture practices and the increasing focus on clean energy solutions.

The main competitors include Yara International ASA, Nutrien Ltd., and OCI N.V. These companies have significant market shares and global reach, presenting substantial competition to CF Industries.

Yara, based in Norway, is a major player in crop nutrition with a vast product portfolio and extensive distribution network. Its global presence and scale pose a significant challenge to CF Industries.

Nutrien, a Canadian company, is a strong competitor, especially in North America, offering a wide range of crop inputs and services. Nutrien's retail distribution network gives it a direct channel to farmers.

OCI, based in the Netherlands, is a global producer of nitrogen fertilizers and methanol with a strong presence in Europe and North America. OCI is increasingly focused on clean ammonia and methanol production.

CF Industries also competes with smaller regional producers and state-owned enterprises. These entities can influence pricing and market share in specific geographic areas.

Indirect competition comes from alternative agricultural practices that reduce the need for synthetic fertilizers. The emerging clean energy sector introduces new competitive dynamics.

The fertilizer market is influenced by global events, including geopolitical tensions, trade policies, and environmental regulations. Demand for nitrogen fertilizers is driven by agricultural practices and crop yields. CF Industries' financial performance and market share are directly impacted by these factors. For more details, you can review a comprehensive CF Industries financial performance review.

- Market Share Analysis: CF Industries' market share is constantly evolving, influenced by competitor strategies and global demand.

- Competitive Advantages: Key advantages include efficient production, strategic geographic locations, and strong distribution networks.

- Industry Trends: The industry is seeing a shift towards sustainable agriculture and clean energy, impacting CF Industries' strategic initiatives.

- Production Capacity: CF Industries' production capacity is a critical factor in meeting market demand and maintaining its competitive position.

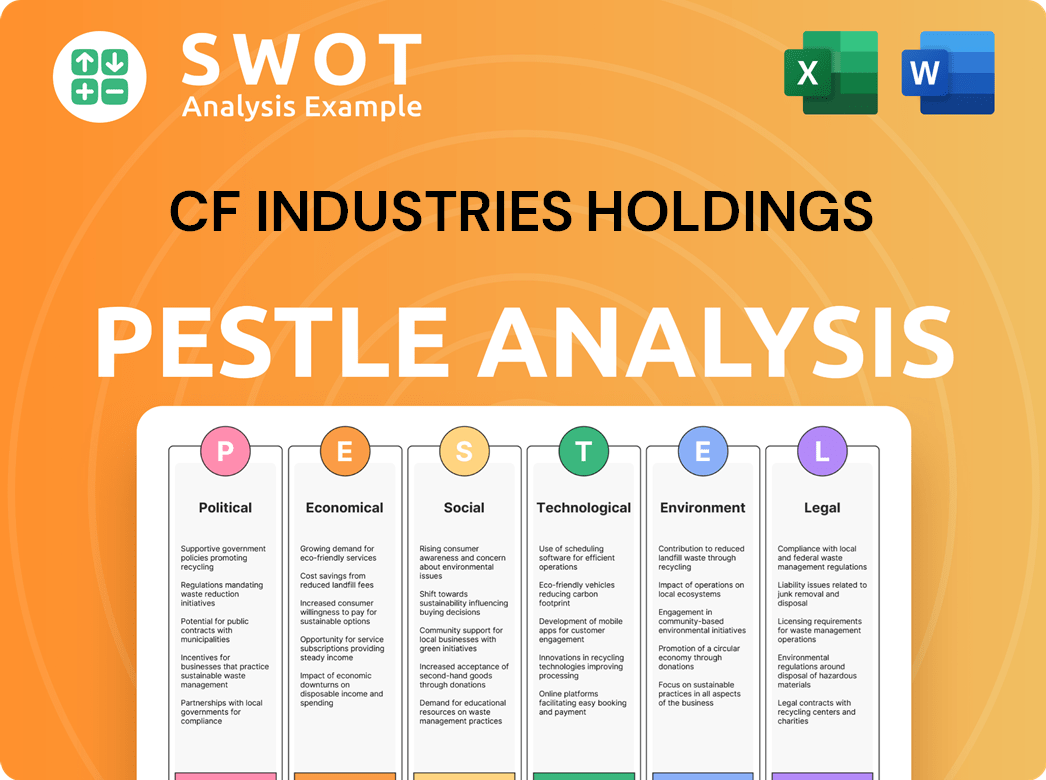

CF Industries Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CF Industries Holdings a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of CF Industries is crucial for anyone analyzing the fertilizer market. CF Industries, a major player in the nitrogen fertilizer industry, holds several competitive advantages that set it apart. These strengths are vital when conducting market analysis and assessing industry trends. The company's strategic moves and operational efficiencies directly impact its financial performance review and overall market share analysis.

The company's ability to adapt to global events and government regulations is also key. CF Industries' strategic initiatives and business model analysis reveal its commitment to maintaining a strong position. The company's focus on production capacity and recent acquisitions and mergers further shape its competitive edge. Analyzing how CF Industries compares to its rivals provides valuable insights into the industry's dynamics.

Exploring the challenges faced by CF Industries in the market and its future outlook is essential. The company's approach to sustainable agriculture and its response to evolving market conditions are critical. For more details, you can explore the Target Market of CF Industries Holdings.

CF Industries operates large-scale manufacturing complexes in North America and the United Kingdom. These facilities have significant production capacities, allowing for lower per-unit production costs, particularly for ammonia, urea, and UAN. This scale provides resilience against market fluctuations and supports efficient distribution to agricultural markets. In 2024, the company's production capacity reached approximately 17 million tons of ammonia and related products.

CF Industries benefits from access to abundant and competitively priced natural gas, the primary raw material for nitrogen fertilizer production. Facilities in the U.S. have a significant advantage due to lower energy costs compared to regions with higher energy prices. This feedstock advantage contributes to lower operating costs and higher profitability. In 2024, natural gas costs represented approximately 30% of the company's total production costs.

CF Industries is actively investing in and developing capabilities for blue and green ammonia production, crucial for decarbonization efforts. This forward-looking approach allows CF Industries to tap into new markets and align with global environmental goals. The company's focus on sustainable product offerings provides a significant differentiator. The company has invested over $1 billion in clean energy projects as of early 2024.

CF Industries utilizes proprietary technologies and operational expertise in ammonia production and logistics. This contributes to efficiency and product quality, enhancing its competitive position. These advantages have evolved over time, with the company increasingly focusing on optimizing production processes and expanding its clean energy footprint. The company's operational efficiency has resulted in a 5% reduction in production costs over the last year.

CF Industries' competitive advantages are substantial, but they face potential threats. These include volatile natural gas prices, technological breakthroughs by competitors, and shifts in global trade policies. The company leverages its strengths through strategic investments and operational excellence.

- Economies of scale and strategic asset base.

- Advantaged access to natural gas feedstock.

- Strategic positioning in the clean energy economy.

- Proprietary technologies and operational expertise.

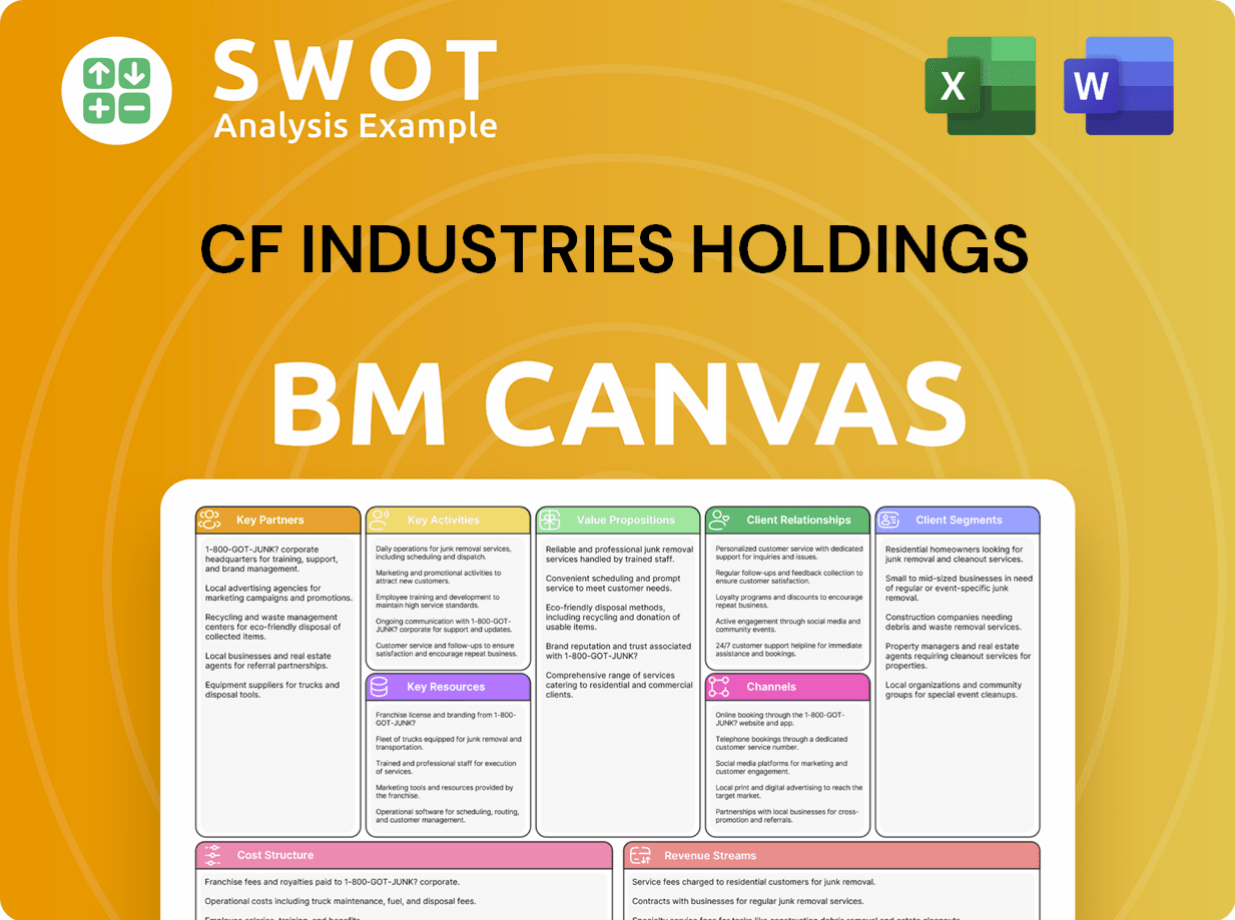

CF Industries Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CF Industries Holdings’s Competitive Landscape?

The competitive landscape for CF Industries Holdings is shaped by industry trends, presenting both challenges and opportunities. Key factors include decarbonization efforts, natural gas price volatility, and the growing demand for food. The company must navigate these dynamics to maintain and improve its market position.

Risks include fluctuating natural gas prices, regulatory changes, and the emergence of new competitors. Opportunities stem from the growing demand for clean energy solutions, population growth, and advancements in sustainable agriculture. CF Industries' future outlook depends on its ability to adapt and innovate within this evolving landscape, while maintaining a focus on operational excellence and strategic investments.

The fertilizer market is influenced by global decarbonization, which creates opportunities for clean energy production. Natural gas price volatility and regulatory changes also shape the industry. Population growth and demand for food will continue to drive the need for nitrogen fertilizers.

Challenges include the need for significant capital investment in new technologies and competition from other clean energy solutions. Fluctuations in natural gas prices and regional supply disruptions pose threats to profitability. Regulatory changes related to emissions, agricultural practices, and trade policies also represent ongoing challenges.

Opportunities include expanding clean ammonia production capacity and forming strategic partnerships. The growing demand for clean fuels, industrial feedstocks, and hydrogen carriers is a major opportunity. Precision agriculture and sustainable farming practices create further opportunities.

CF Industries is focused on operational excellence and disciplined capital allocation. The company aims to maintain a leading position in the clean energy transition. Strategic initiatives include exploring new applications for hydrogen and nitrogen products.

The fertilizer market faces changes due to global events and evolving agricultural practices. CF Industries must adapt to these changes to maintain its competitive edge. The company's strategic initiatives and market position will determine its future performance.

- Nitrogen fertilizer demand is expected to remain robust, driven by population growth.

- Market analysis suggests increasing focus on sustainable agriculture.

- Industry trends point towards the adoption of precision farming.

- CF Industries is investing in clean energy solutions, particularly in blue and green ammonia production.

CF Industries Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CF Industries Holdings Company?

- What is Growth Strategy and Future Prospects of CF Industries Holdings Company?

- How Does CF Industries Holdings Company Work?

- What is Sales and Marketing Strategy of CF Industries Holdings Company?

- What is Brief History of CF Industries Holdings Company?

- Who Owns CF Industries Holdings Company?

- What is Customer Demographics and Target Market of CF Industries Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.