Chegg Bundle

How has the Chegg Company Transformed Education?

Dive into the fascinating Chegg SWOT Analysis to understand the complexities of this ed-tech giant. From its roots as a simple online message board, the Chegg platform has revolutionized how students access academic resources. This is a brief overview of Chegg's history, exploring its journey from a textbook rental service to a comprehensive provider of online learning tools.

The History of Chegg company is a story of innovation and adaptation. Initially focused on textbook rentals, the vision of the Chegg founder quickly expanded to meet the evolving needs of students. Today, Chegg services include online tutoring and homework help. Despite recent financial challenges, understanding Chegg's evolution provides valuable insights into the dynamic ed-tech landscape and its impact on the future of learning.

What is the Chegg Founding Story?

The story of the Chegg company began with an entrepreneurial vision at Iowa State University. The journey from a student message board to a leading online education platform showcases a significant evolution in the education technology sector. This Chegg history provides insights into its early days and the strategic shifts that shaped its current form.

The initial concept, known as Cheggpost, emerged in October 2000, serving as a Craigslist-style platform for Iowa State students. This early venture laid the groundwork for what would become a major player in the educational landscape. The name 'Chegg' itself is a clever combination of 'chicken' and 'egg,' reflecting the challenge of gaining experience to secure employment.

The formal incorporation of Chegg, Inc. took place in 2005. Key founders included Josh Carlson, Osman Rashid, and Aayush Phumbhra. Osman Rashid, an Iowa State MBA, saw an opportunity to transform the expensive textbook market. Carlson and Rashid collaborated to develop the business, with Phumbhra also playing a crucial role.

Initially, Chegg offered services like scholarship searches and internship matching. The company then shifted its focus to textbook rentals, inspired by Netflix's model. This strategic pivot was critical for Chegg's growth.

- Josh Carlson, Mike Seager, and Mark Fiddleke launched Cheggpost in October 2000.

- Chegg, Inc. was officially incorporated in 2005 with Josh Carlson, Osman Rashid, and Aayush Phumbhra as founders.

- The company initially offered services such as scholarship searches and internship matching.

- The business model pivoted to textbook rentals, launching 'textbookflix.com' in mid-2007, which later became Chegg.com.

Carlson departed in February 2006. Phumbhra and Rashid then rebranded and officially launched Chegg, Inc. in December 2007, with Rashid as CEO. The company's original business model was inspired by Netflix's online rental approach. The company launched 'textbookflix.com' in mid-2007, which later evolved into Chegg.com, focusing on affordable textbook rentals.

The transition to textbook rentals marked a significant change for the Chegg platform. This shift allowed the company to address the high costs of textbooks, a common issue for college students. This strategic move helped establish Chegg services as a valuable resource for students.

To learn more about the company's journey, you can refer to the detailed overview of Chegg's evolution over time.

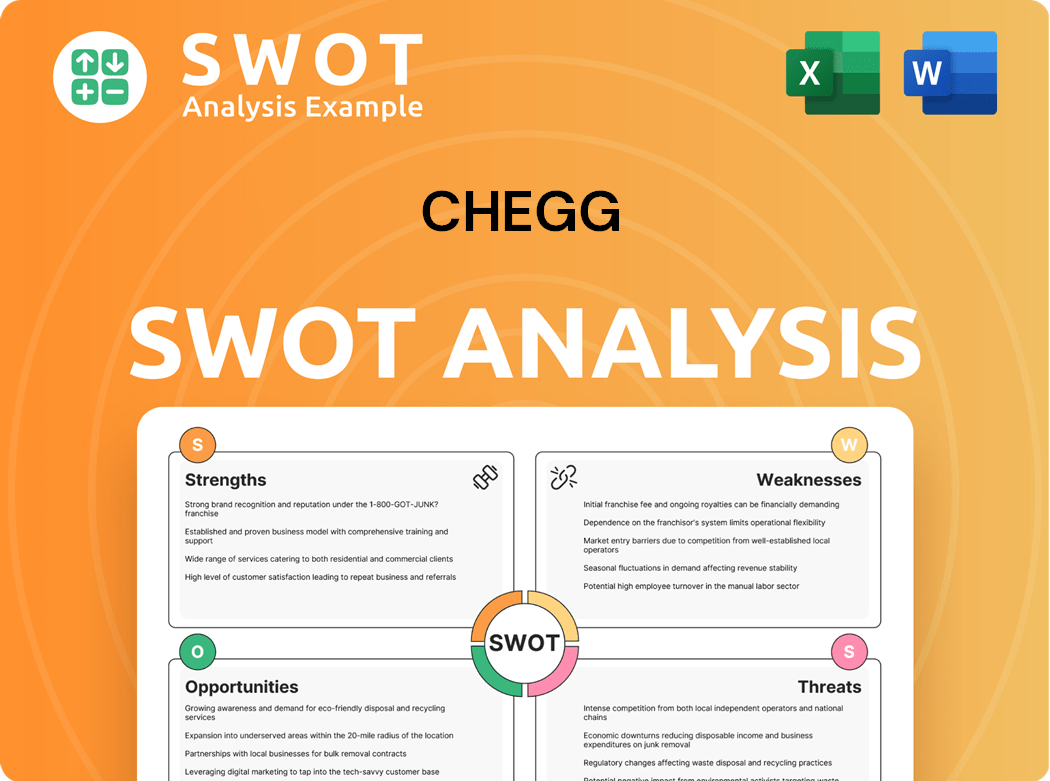

Chegg SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Chegg?

The early growth of the Chegg company was marked by a strategic shift. Initially, the company focused on classifieds and career services before transitioning to a textbook rental model. This change, inspired by the success of Netflix, proved pivotal in its early expansion. The history of Chegg reflects a journey of adaptation and innovation within the education sector.

Following its rebranding in December 2007, Chegg's revenue reached $10 million by 2008. By the end of January 2009, the company had surpassed this figure, indicating strong early growth. This financial performance set the stage for further expansion and investment in the Chegg platform.

In 2010, Dan Rosensweig, former Yahoo COO, became CEO, bringing a renewed focus on education. Rosensweig's leadership was key to expanding Chegg services beyond textbook rentals. This transition signaled a commitment to broader educational offerings.

The company launched an eReader in 2012 to enhance eTextbook accessibility. In November 2013, Chegg went public on the New York Stock Exchange. The initial market capitalization was approximately $1.1 billion, raising $187.5 million.

A partnership with Ingram Content Group in 2014 supported physical textbook distribution. Chegg's acquisitions included Zinch, 3D3R, InstaEDU (renamed Chegg Tutors), and Internships.com. These moves broadened the Chegg platform and moved the company toward a 'student-first' connected learning platform. For more insights, consider reading about the Target Market of Chegg.

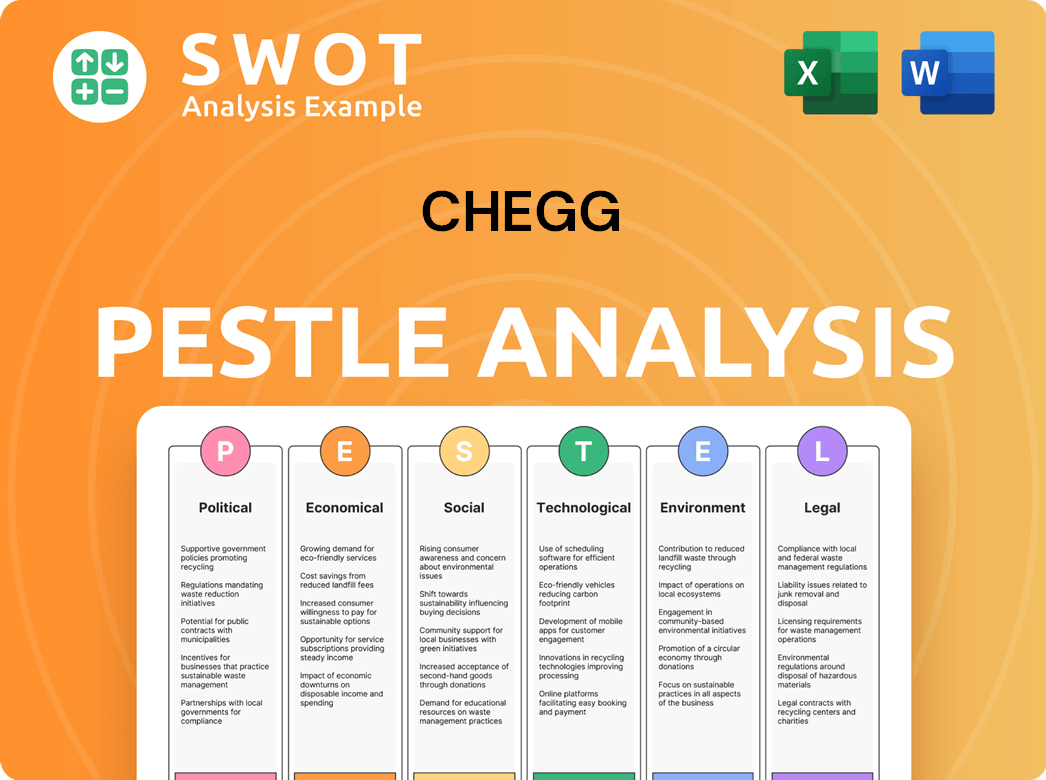

Chegg PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Chegg history?

The Chegg company has experienced significant milestones throughout its history, shaping its journey from a textbook rental service to a comprehensive online learning platform. This brief overview of Chegg's history highlights key moments that have defined its trajectory.

| Year | Milestone |

|---|---|

| 2005 | Chegg founder, Osman Rashid, and Aayush Phumbhra launched Chegg as an online textbook rental service. |

| 2012 | Chegg introduced its eReader, expanding into digital textbooks. |

| 2013 | Chegg went public in November, raising $187.5 million. |

| 2014 | Chegg acquired InstaEDU, enhancing its Chegg services with online tutoring. |

| 2019 | Chegg launched Chegg Writing to assist students with writing and citations. |

| 2021 | Chegg acquired Busuu for $436 million, integrating language learning into its offerings. |

Chegg has consistently innovated to meet the evolving needs of students. The eReader launch in 2012 was a pivotal move, making digital textbooks more accessible. Furthermore, the acquisition of Busuu in 2021 and its subsequent integration into the Chegg platform demonstrated a commitment to expanding its educational offerings, with Busuu showing 7% year-over-year revenue growth in Q1 2025.

The introduction of the eReader in 2012 marked a significant step in making digital textbooks more accessible to students. This innovation helped to modernize the way students accessed course materials.

The acquisition of InstaEDU in 2014 expanded Chegg's services, adding online tutoring to its offerings. This allowed Chegg to provide more comprehensive academic support.

In 2019, Chegg launched Chegg Writing, which aided students with plagiarism detection and citation assistance. This service enhanced the support provided for academic writing.

The acquisition of Busuu in 2021 for $436 million integrated language learning into Chegg's platform. This strategic move broadened Chegg's educational offerings.

Chegg introduced Chegg Math in 2017 to help students with problem-solving in mathematics. This addition provided targeted support for students in STEM fields.

Chegg has faced several challenges, particularly with the rise of generative AI. The company's stock price plummeted by 48% in May 2023 after concerns about ChatGPT. By November 2024, the stock price had fallen 99%, leading to significant financial losses and restructuring efforts.

The emergence of generative AI, such as ChatGPT, has significantly impacted Chegg's business model. This new technology has presented a major challenge to the company's services.

Chegg's stock price experienced a sharp decline, falling by 48% in May 2023, and by November 2024, the stock price had fallen 99%. This decline reflects the challenges posed by new competitors and market shifts.

Chegg reported a significant net loss of $837.1 million in 2024, coupled with a 14% decrease in subscribers. In response, the company initiated restructuring plans, including workforce reductions affecting 23% of its global workforce.

Chegg filed a complaint against Google and Alphabet in February 2025, alleging unfair competition due to Google's AI Overviews impacting traffic and revenue. This highlights the competitive pressures the company faces.

Chegg announced a strategic review process and is integrating AI into its platform to enhance its services. The company is also exploring new revenue streams, such as content licensing deals with AI companies, which generated $4 million in Q1 2025.

For more insights into Chegg's business model and revenue streams, you can explore Revenue Streams & Business Model of Chegg. This provides a deeper understanding of how Chegg generates income and operates within the education sector.

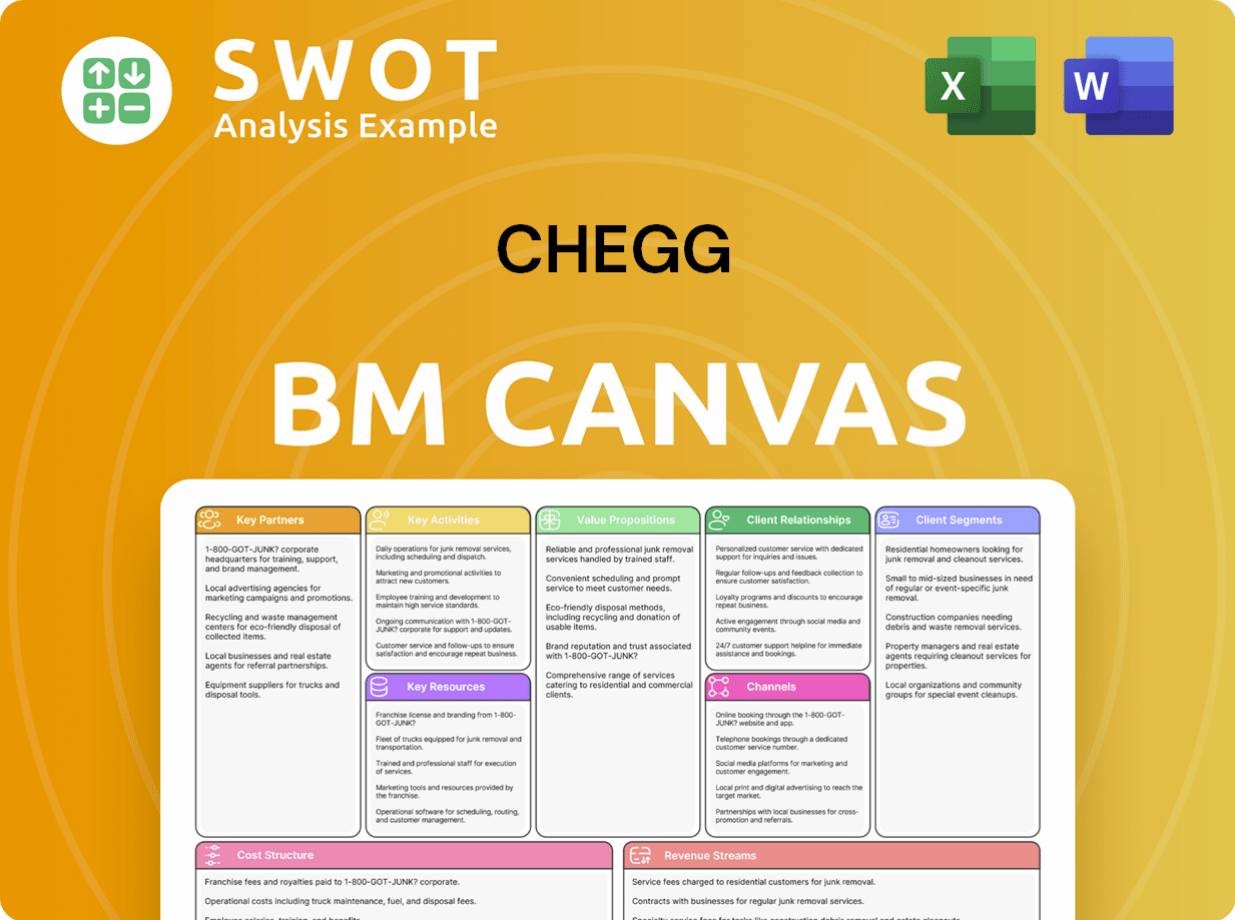

Chegg Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Chegg?

The History of Chegg began in October 2000, with Cheggpost, a message board. It officially launched in December 2007, shifting its focus to textbook rentals and has since evolved into a comprehensive online learning platform. The company has made several acquisitions, expanded its services, and navigated significant challenges in the educational technology landscape.

| Year | Key Event |

|---|---|

| October 2000 | Cheggpost, a Craigslist-style message board, was launched by Iowa State University students. |

| 2005 | Chegg, Inc. was incorporated. |

| December 2007 | Chegg, Inc. officially launched, focusing on textbook rentals. |

| 2010 | Dan Rosensweig became CEO. |

| 2011 | Acquired Zinch and 3D3R. |

| 2012 | Launched eReader for digital textbooks. |

| November 2013 | Chegg went public on the New York Stock Exchange. |

| June 2014 | Acquired InstaEDU (later Chegg Tutors). |

| October 2014 | Acquired Internships.com. |

| 2017 | Acquired RefME and launched Chegg Math. |

| 2019 | Launched Chegg Writing and acquired Thinkful. |

| 2021 | Acquired Busuu for $436 million. |

| May 2023 | Stock price collapsed by 48% due to concerns about ChatGPT. |

| June 2024 | Initiated a restructuring plan, reducing headcount by 23%. |

| November 2024 | Stock price fell 99% due to ChatGPT competition. |

| February 2025 | Announced a strategic review process. |

| May 2025 | Reported Q1 2025 earnings with significant revenue and subscriber decreases. |

The company is undergoing significant restructuring and cost-saving initiatives. Chegg anticipates non-GAAP savings of $165-$175 million in 2025 from the restructuring announced in 2024 and 2025. This is a key part of Chegg's strategy to adapt to market challenges and achieve financial stability. The focus is on streamlining operations and reducing expenses.

Chegg is diversifying its revenue streams through content licensing deals with AI companies. These deals generated $4 million in Q1 2025. This diversification is crucial for adapting to the changing educational technology landscape. Chegg is also expanding institutional pilot programs to reach more students.

The company is investing in its Busuu language learning unit, which is projected to generate $48 million in revenue in 2025 and achieve positive adjusted EBITDA by Q1 2026. Chegg Skills is also positioned for growth with new pilot programs. These units are key to Chegg's long-term strategy.

Leadership is committed to integrating AI to enhance learning experiences. Chegg aims to become a 'student-first connected learning platform'. While challenges remain, the company is optimistic about strategic acquisitions or going private. Chegg reported a 30% year-over-year decrease in total net revenues to $121.4 million in Q1 2025, and a 31% decrease in subscribers to 3.2 million.

Chegg Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Chegg Company?

- What is Growth Strategy and Future Prospects of Chegg Company?

- How Does Chegg Company Work?

- What is Sales and Marketing Strategy of Chegg Company?

- What is Brief History of Chegg Company?

- Who Owns Chegg Company?

- What is Customer Demographics and Target Market of Chegg Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.