Chemours Bundle

What's the Story Behind Chemours?

Ever wondered how a global chemical giant like Chemours came to be? The Chemours Company, a major player in the chemical industry, has a fascinating origin story. It all began in July 2015, when it spun off from DuPont, setting the stage for a new chapter. This pivotal moment allowed Chemours to focus on its core strengths.

Chemours, a Chemours SWOT Analysis, quickly established itself as a leader in fluoroproducts, titanium technologies, and chemical solutions. From its Wilmington, Delaware headquarters, Chemours has built on the legacy of its predecessor. Its products, like Teflon and Ti-Pure, are essential in various industries, contributing to advancements in energy efficiency and electronics. This overview will explore Chemours' journey, highlighting its strategic evolution and impact on the chemical industry, including its financial results and market performance.

What is the Chemours Founding Story?

The Chemours Company, a prominent chemical company, has a history rooted in a strategic spin-off. Its formation on July 1, 2015, marked a significant shift in the chemical industry landscape. This spin-off from DuPont allowed the new entity to establish its own identity and focus.

The decision to separate the 'performance chemicals' business from DuPont was announced in October 2013. This move was designed to enable DuPont to concentrate on high-growth sectors such as biotechnology and agriculture. The name 'The Chemours Company' was derived from 'chemical' and 'Nemours,' a nod to DuPont's full name, E. I. du Pont de Nemours & Co.

Chemours inherited various liabilities from DuPont, reflecting the complexities involved in its establishment. Mark P. Vergnano, who had led DuPont's performance chemicals unit since 2009, became the first CEO of Chemours. The company's initial focus was on three main segments: Titanium Technologies, Fluoroproducts, and Chemical Solutions. These segments included products like titanium dioxide, which accounted for 46% of sales, and fluoroproducts, which made up 36% of sales in the first nine months of 2014, for the businesses that would become Chemours. The spin-off was finalized with DuPont shareholders receiving one share of Chemours common stock for every five shares of DuPont common stock held. For more information about the company, consider exploring the Target Market of Chemours.

The Chemours Company emerged as a spin-off from DuPont, focusing on performance chemicals. This strategic move allowed DuPont to concentrate on other areas.

- Chemours was established on July 1, 2015.

- The spin-off announcement was made in October 2013.

- The company's name combines 'chemical' and 'Nemours'.

- Mark P. Vergnano was the first CEO.

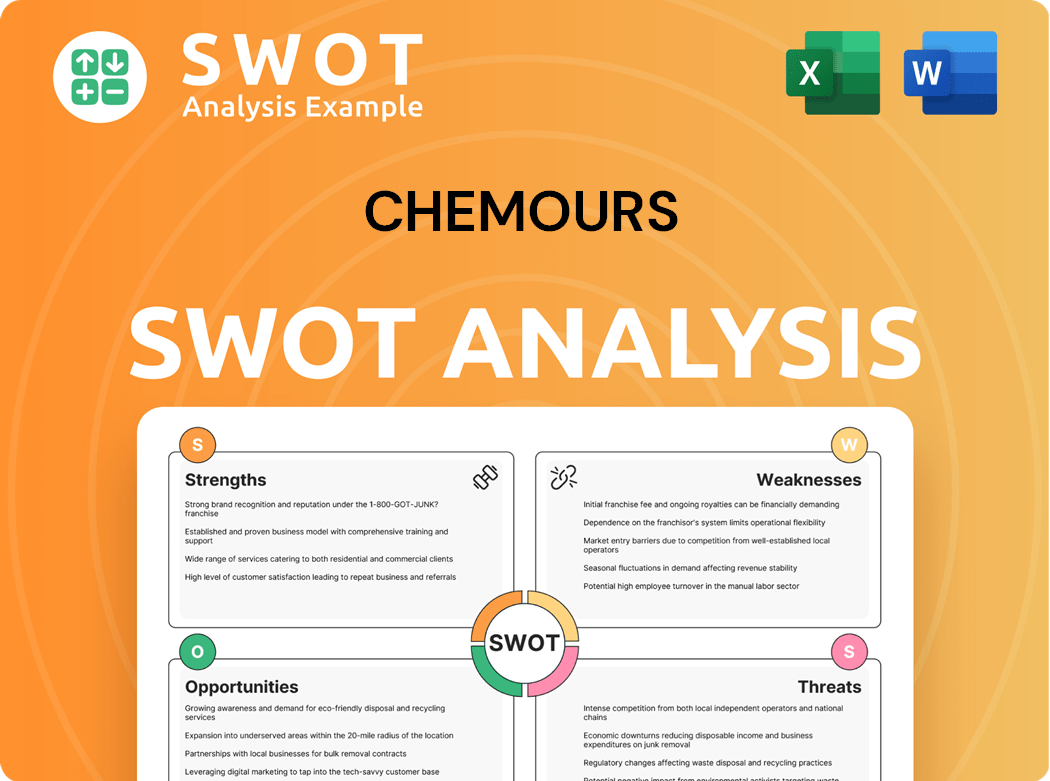

Chemours SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Chemours?

Following its spin-off from DuPont in July 2015, the Chemours Company quickly established its operational base. The company's initial strategy focused on leveraging its established product lines, including Teflon, Ti-Pure, and Freon refrigerants. Early growth was driven by the continued demand for these essential chemicals across various industries.

Chemours set up its corporate headquarters in Wilmington, Delaware. The company's early focus was on its established product lines, like Teflon, Ti-Pure (titanium dioxide), and Freon refrigerants. These chemicals were crucial across different industries, driving early growth.

A significant aspect of Chemours' early years involved addressing environmental liabilities inherited from DuPont. This undertaking significantly shaped the company's financial and operational strategies. Managing these liabilities was a key focus during its initial phase.

As Chemours matured, it broadened its portfolio and geographic reach, serving customers in approximately 120 countries. Key developments included continuous product innovation, particularly in its Thermal & Specialized Solutions segment. The company has been investing in research capabilities.

For the full year 2024, Chemours reported net sales of $5.8 billion, a 5% decrease from the prior year. The company's net income attributable to Chemours was $86 million. Chemours introduced its 'Pathway to Thrive' strategy in 2024 to drive shareholder value.

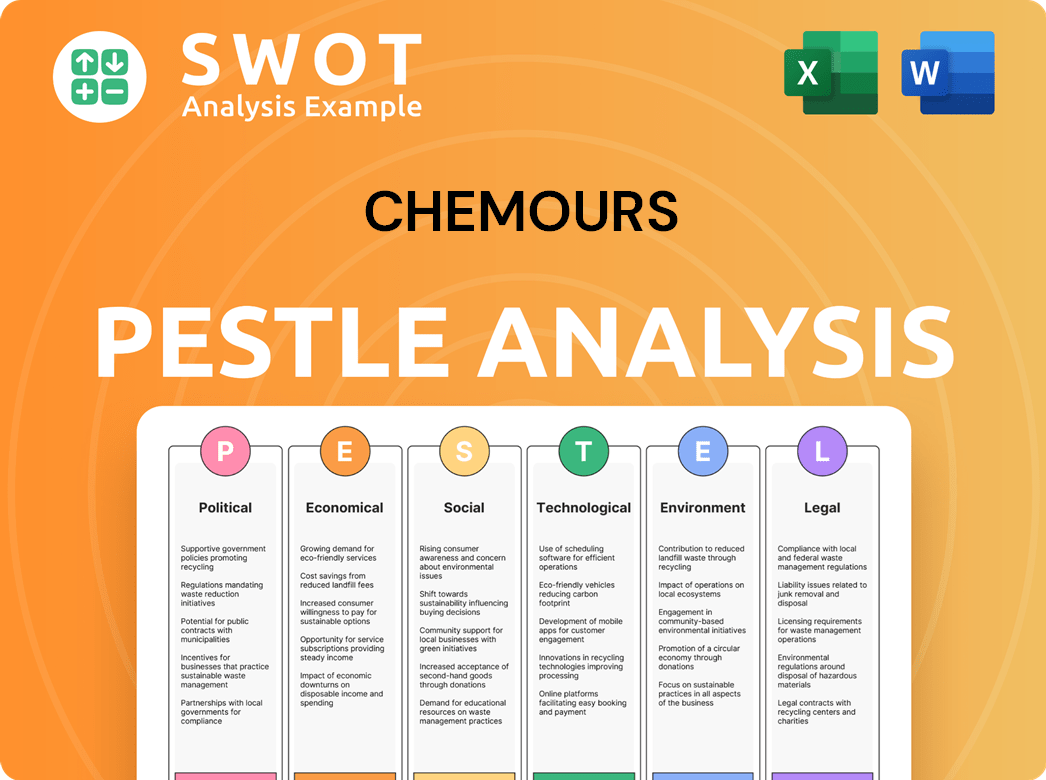

Chemours PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Chemours history?

The Chemours Company has a history marked by significant milestones, including its separation from DuPont and subsequent developments in fluoroproducts and other chemical solutions. Its journey showcases both strategic achievements and the challenges inherent in the chemical industry.

| Year | Milestone |

|---|---|

| 2015 | Spin-off from DuPont, becoming an independent, publicly traded company. |

| 2024 | Announced a program to reduce the carbon footprint of its glycolic acid grades by up to 80% against a 2023 baseline. |

| Q1 2025 | Opteon refrigerant sales surged by 40% year-over-year. |

Innovations have been central to the growth of the Chemours Company, particularly in the development of sustainable products. The company has focused on expanding its Opteon low-GWP refrigerants to meet regulatory demands and market needs.

The development and expansion of Opteon low-GWP refrigerants to replace HFCs is a key innovation. This is driven by regulations like the F-Gas regulation in Europe and the A2L transition in the United States.

Focus on reducing the carbon footprint of its products, such as the glycolic acid grades. Renewable energy credits are expected to be fully available by mid to late 2025.

Entering the expanding market for data center liquid cooling solutions, especially for AI applications. Manufacturing agreements for new liquid cooling products are in place.

Implementing a cost savings program targeting approximately $250 million, with about $125 million in run-rate savings expected by year-end 2025. This helps improve financial flexibility.

Exiting unprofitable lines, such as the Surface Protection Solutions (SPS) Capstone business. This strategic move focuses on core profitable areas.

The Titanium Technologies (TT) segment has improved adjusted EBITDA through cost-saving measures. This is a key focus area for improving profitability.

Despite these advancements, the Chemours Company has faced considerable challenges. Managing liabilities from PFAS-related lawsuits and market downturns have significantly impacted the company's performance.

Managing liabilities arising from lawsuits related to per- and polyfluoroalkyl substances (PFAS) is a major challenge. These liabilities were transferred from DuPont upon the spin-off.

Contending with market downturns, competitive pressures, and macroeconomic headwinds. This has impacted the company's financial results.

A 5% decrease in net sales for the full year 2024 compared to 2023. In Q1 2025, Chemours reported a net loss of $4 million.

Reduced its quarterly dividend by 65% to $0.0875 per share. This was done to enhance financial flexibility and address immediate pressures.

The Titanium Technologies (TT) segment has seen a decline in net sales. This impacts overall financial performance.

Implementing strategic initiatives, including a cost savings program targeting approximately $250 million. This is a key part of the company's response to challenges.

For a deeper dive into the company's strategic approach, consider exploring the Marketing Strategy of Chemours.

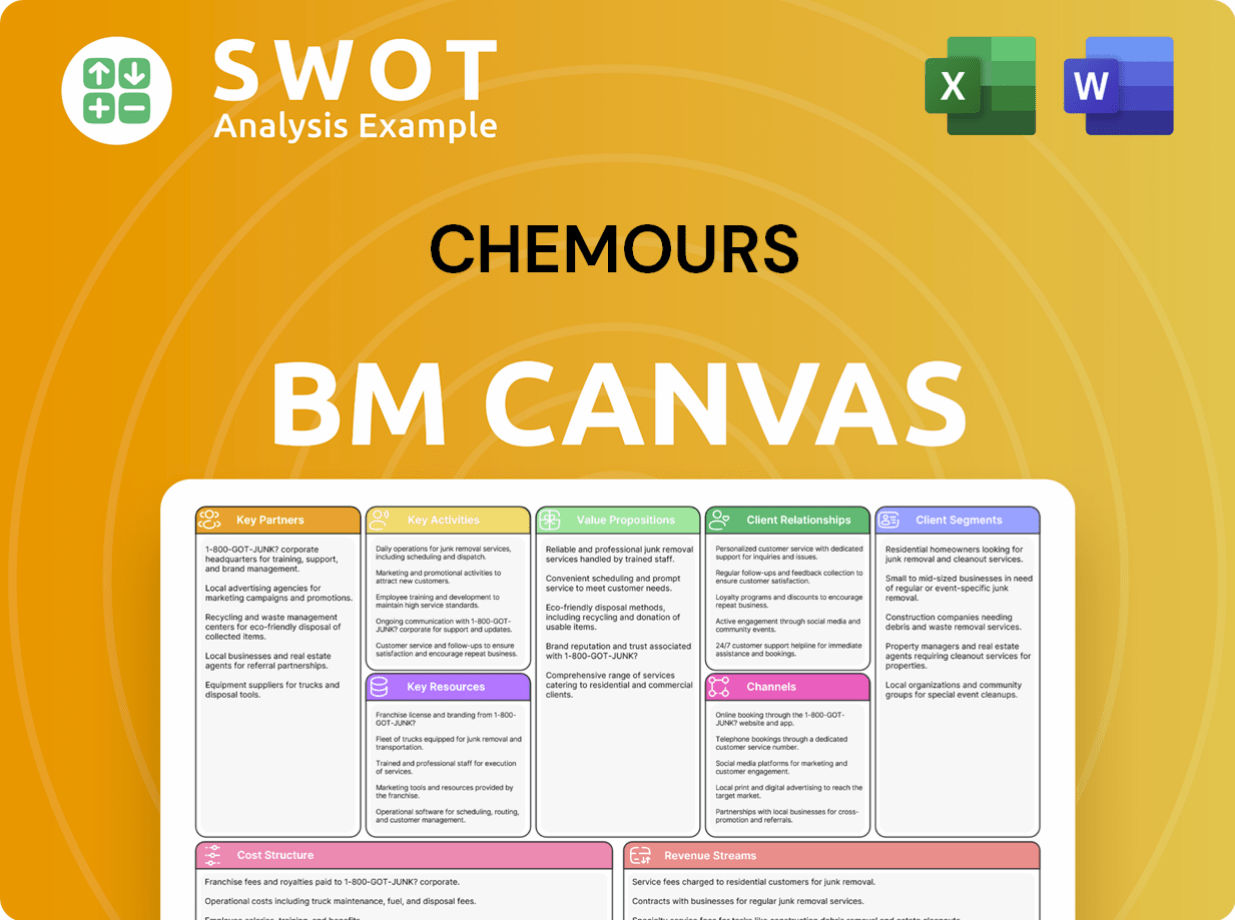

Chemours Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Chemours?

The Chemours Company has a relatively short but dynamic history, marked by its spin-off from DuPont and subsequent evolution as a leading chemical company. This journey includes significant strategic shifts, financial milestones, and a focus on sustainability and innovation. Chemours' story is one of transformation, from its origins within a well-established corporation to its current position as an independent entity navigating the complexities of the chemical industry.

| Year | Key Event |

|---|---|

| October 2013 | DuPont announced plans to spin off its 'performance chemicals' business. |

| December 2014 | DuPont filed initial Form 10 with the SEC and announced the new company would be called 'The Chemours Company.' |

| July 1, 2015 | The Chemours Company officially spun off from DuPont and began trading on the New York Stock Exchange under the symbol 'CC.' |

| 2017-2020 | Development of The Chemours Discovery Hub, a $150 million research facility at the University of Delaware's STAR Campus. |

| 2024 | Chemours established a new executive leadership team and announced its 'Pathway to Thrive' strategy. |

| Full Year 2024 | Reports net sales of $5.8 billion and net income of $86 million. |

| Q4 2024 | Thermal & Specialized Solutions (TSS) segment achieves record net sales, driven by 23% year-over-year growth in Opteon™ Refrigerants. |

| Q1 2025 | Reports net sales of $1.4 billion and a net loss of $4 million, leading to a 65% reduction in quarterly dividend to $0.0875 per share. |

Chemours is focused on its 'Pathway to Thrive' strategy, aiming to drive long-term shareholder value. This strategy emphasizes innovation, operational efficiency, and sustainable development. The company is investing in growth areas and focusing on cost reduction to enhance profitability and create value for stakeholders.

Chemours anticipates sequential improvement across all segments in Q2 2025. Consolidated net sales are projected to increase in the low-to-mid teens percentage range, and adjusted EBITDA is anticipated to grow 40-45% compared to Q1 2025. The company projects adjusted EBITDA guidance between $825 million and $950 million for the full year 2025.

Chemours is committed to sustainability, with plans to reduce Scope 1 and 2 GHG emissions by 60% and Scope 3 emissions by 25% per ton of production by 2030. Renewable energy credits for its glycolic acid sustainability program are expected to be fully available by mid-to-late 2025, aiming to reduce the carbon footprint by up to 80%.

Chemours is investing in growth areas, such as Opteon™ refrigerant expansion, which has completed a $1 billion capacity expansion in Texas. The company is also positioning itself to capitalize on the increasing power density requirements of AI processors for data center liquid cooling solutions. By the end of 2025, Chemours aims to achieve approximately $125 million in run-rate cost savings.

Chemours Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Chemours Company?

- What is Growth Strategy and Future Prospects of Chemours Company?

- How Does Chemours Company Work?

- What is Sales and Marketing Strategy of Chemours Company?

- What is Brief History of Chemours Company?

- Who Owns Chemours Company?

- What is Customer Demographics and Target Market of Chemours Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.