Chemours Bundle

Can Chemours Company Navigate the Future of the Chemical Industry?

Spun off from DuPont in 2015, The Chemours Company has quickly become a global force in performance chemicals, but what does its future hold? Facing a dynamic Chemours SWOT Analysis is crucial for understanding its position. This exploration will examine Chemours's Growth Strategy and its potential to thrive in an evolving market. The company's strategic moves and long-term vision are key to its success.

Chemours's Future Prospects are heavily influenced by its ability to adapt and innovate within the Chemical Industry. Understanding its Business Strategy and anticipated Financial Performance is essential for investors and stakeholders. This analysis will delve into Chemours's Growth Strategy, evaluating its expansion plans, innovation strategy, and sustainability efforts to provide a comprehensive view of its investment potential and long-term goals.

How Is Chemours Expanding Its Reach?

The Chemours Company is actively pursuing several expansion initiatives to drive future growth within the chemical industry. These efforts are strategically designed to capitalize on emerging market opportunities and strengthen its position in key sectors. The company's focus is on sustainable growth and innovation, aligning its business strategy with global trends and customer needs.

A core element of Chemours' growth strategy involves entering new markets and product categories. This includes a strong emphasis on high-growth regions and segments that demand advanced performance materials. By expanding its presence in developing economies, Chemours aims to benefit from the increasing industrialization and infrastructure development in these areas. This strategic approach is supported by targeted investments and partnerships.

Chemours is also committed to expanding its fluoroproducts portfolio for applications in electric vehicles and advanced electronics. This move reflects the company's responsiveness to global megatrends and its commitment to innovation. The company's strategic planning includes enhancing its existing product lines and developing new solutions to meet evolving market demands.

Chemours is focusing on expanding its presence in developing economies. This strategy leverages the increasing demand for specialized chemicals driven by industrialization and infrastructure development. The company aims to capitalize on growth opportunities in regions with high potential for expansion.

The company is enhancing its fluoroproducts portfolio to meet the needs of the electric vehicle and advanced electronics markets. This expansion aligns with global megatrends and customer demands for innovative solutions. Chemours is investing in research and development to support these initiatives.

Chemours actively pursues strategic partnerships to broaden its market reach and access new technologies. These collaborations help the company accelerate innovation and expand its product offerings. The company is focused on building strong relationships with key industry players.

Chemours is increasing the adoption of its Opteon™ refrigerants, which have a lower global warming potential. This initiative supports sustainability efforts and meets the growing demand for environmentally friendly products. The company is expanding the use of Opteon™ in various applications globally.

Chemours continues to invest in its titanium technologies, particularly in sustainable pigment production. This focus is designed to meet the growing demand in paints and coatings, supporting the company's long-term goals. The company's financial performance is closely tied to its ability to innovate and adapt.

- Investment in sustainable pigment production to meet growing demand.

- Focus on paints and coatings to leverage market opportunities.

- Strategic planning for long-term growth and market leadership.

- Emphasis on innovation and environmental sustainability.

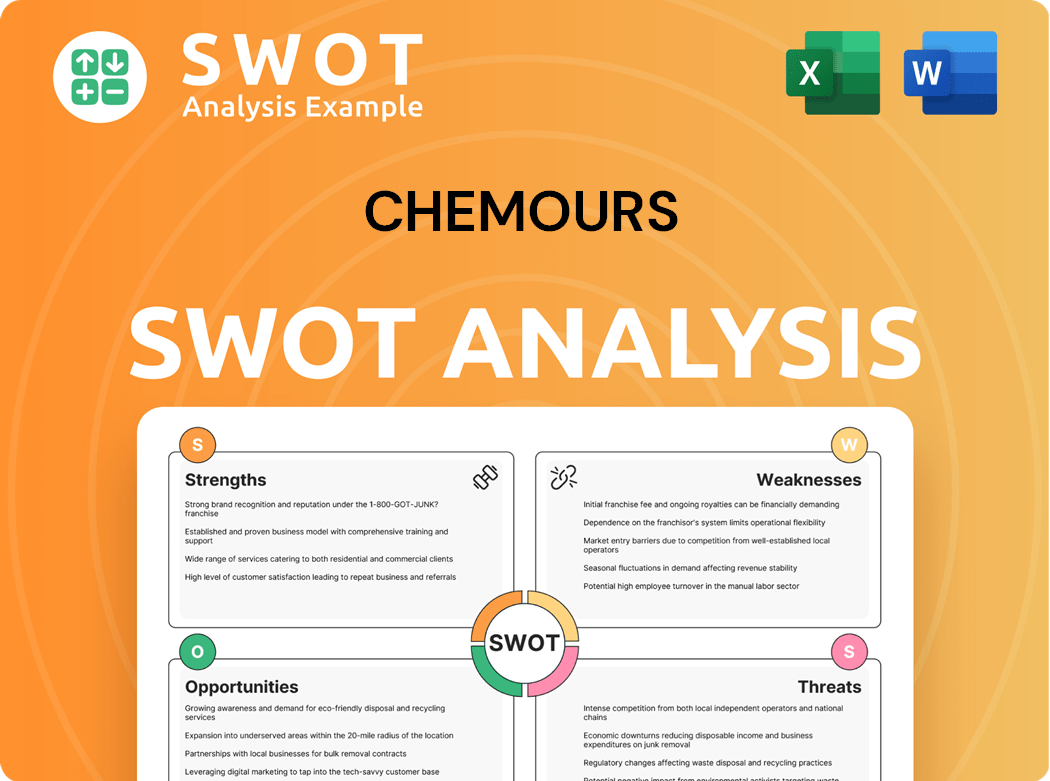

Chemours SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Chemours Invest in Innovation?

The Chemours Company heavily invests in technology and innovation to fuel its growth strategy. This approach is crucial for developing high-performance materials and sustainable solutions that meet the evolving demands of the chemical industry. Their commitment to research and development is a key driver of their future prospects.

A significant aspect of Chemours' strategy involves developing environmentally friendly products. For instance, their Opteon™ portfolio of low global warming potential (GWP) refrigerants and foam blowing agents is designed to address climate change concerns. This focus on sustainability not only aligns with global environmental goals but also enhances their business strategy by providing competitive, eco-conscious alternatives.

Innovation at Chemours also extends to their titanium technologies, where they are exploring advanced manufacturing processes. These efforts aim to improve product performance and reduce environmental impact. The company's digital transformation initiatives, including automation and data analytics, further enhance operational efficiency and responsiveness, contributing to their financial performance.

Chemours consistently invests in research and development. The company's R&D spending is a key indicator of its commitment to innovation. These investments support the development of new products and technologies.

A major focus is on sustainable solutions, such as the Opteon™ portfolio. These products are designed to have a lower environmental impact. This aligns with the growing demand for eco-friendly products.

Chemours is actively pursuing digital transformation across its operations. This involves using automation and data analytics. The goal is to improve efficiency and responsiveness.

Innovation also includes advancements in titanium technologies. The company is exploring new manufacturing processes. This aims to enhance product performance and reduce environmental impact.

Chemours engages in strategic collaborations to foster innovation. These partnerships help accelerate the development of new technologies. They also provide access to specialized expertise and resources.

The company actively participates in industry forums and reports. This showcases their progress in developing next-generation chemical solutions. It also helps to build brand awareness.

Chemours' innovation strategy focuses on several key areas to drive its growth strategy and improve its financial performance. These include sustainable products, advanced manufacturing, and digital transformation. These initiatives are central to the company's long term goals.

- Sustainable Products: Development of low-GWP refrigerants and other environmentally friendly materials.

- Advanced Manufacturing: Exploration of new processes for titanium technologies to improve performance and reduce environmental impact.

- Digital Transformation: Implementation of automation and data analytics to optimize operations and supply chain efficiency.

- Strategic Partnerships: Collaborations with other companies and research institutions to accelerate innovation.

- Market Analysis: Continuous assessment of market trends to identify opportunities for new products and services.

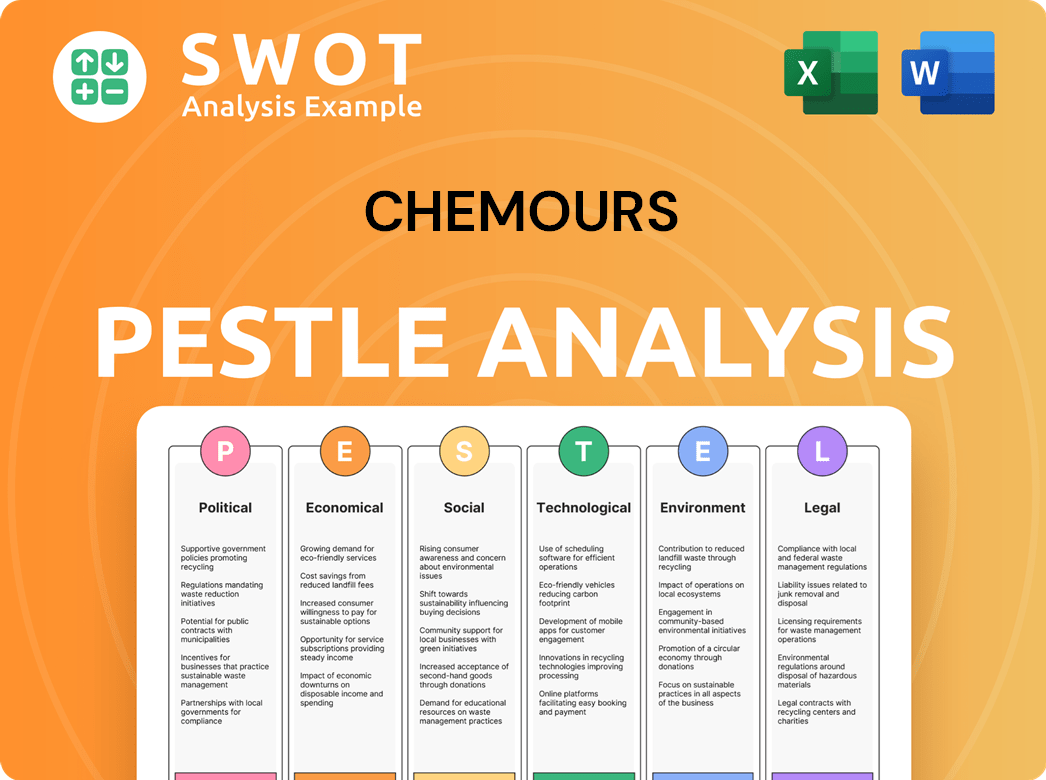

Chemours PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Chemours’s Growth Forecast?

The financial outlook for the Chemours Company reflects a strategic focus on sustainable growth and profitability within the chemical industry. For 2024, the company anticipates adjusted EBITDA to be in the range of $1.175 billion to $1.325 billion. This projection indicates a stable financial trajectory, driven by strong demand in key end-markets and continued operational efficiencies. Chemours's commitment to disciplined capital allocation and strategic investments supports its long-term financial goals.

Chemours aims to maintain healthy profit margins and generate substantial free cash flow to support strategic investments, debt reduction, and shareholder returns. The company's financial strategy also involves prioritizing investments in high-growth areas like advanced electronics and clean energy solutions within its fluoroproducts segment. This approach is designed to leverage its strong market position in titanium technologies and ensure consistent revenue streams. Understanding the Owners & Shareholders of Chemours is crucial for assessing the company's financial health and future prospects.

The company's focus on portfolio optimization is expected to enhance overall financial performance. Chemours's strategic planning involves a balanced approach to capital allocation, ensuring resources are directed toward areas with the highest growth potential. This includes continued investment in innovation and sustainability efforts. The company's financial outlook for 2024 also includes adjusted EPS between $1.02 and $1.50, and a projected free cash flow exceeding $225 million.

Chemours projects adjusted EBITDA to be between $1.175 billion and $1.325 billion for the full year 2024. This range reflects the company's expectations for continued operational efficiency and strong demand.

The company anticipates adjusted earnings per share (EPS) to be in the range of $1.02 to $1.50 for 2024. This projection indicates the company's profitability and financial stability.

Chemours projects free cash flow to exceed $225 million for 2024. This indicates the company's ability to generate cash to support strategic investments and shareholder returns.

Chemours is prioritizing investments in high-growth areas such as advanced electronics and clean energy solutions within its fluoroproducts segment. These investments are key to the company's growth strategy.

Chemours's long-term financial goals include maintaining healthy profit margins and generating substantial free cash flow.

- Maintaining healthy profit margins

- Generating substantial free cash flow

- Supporting strategic investments

- Debt reduction

- Shareholder returns

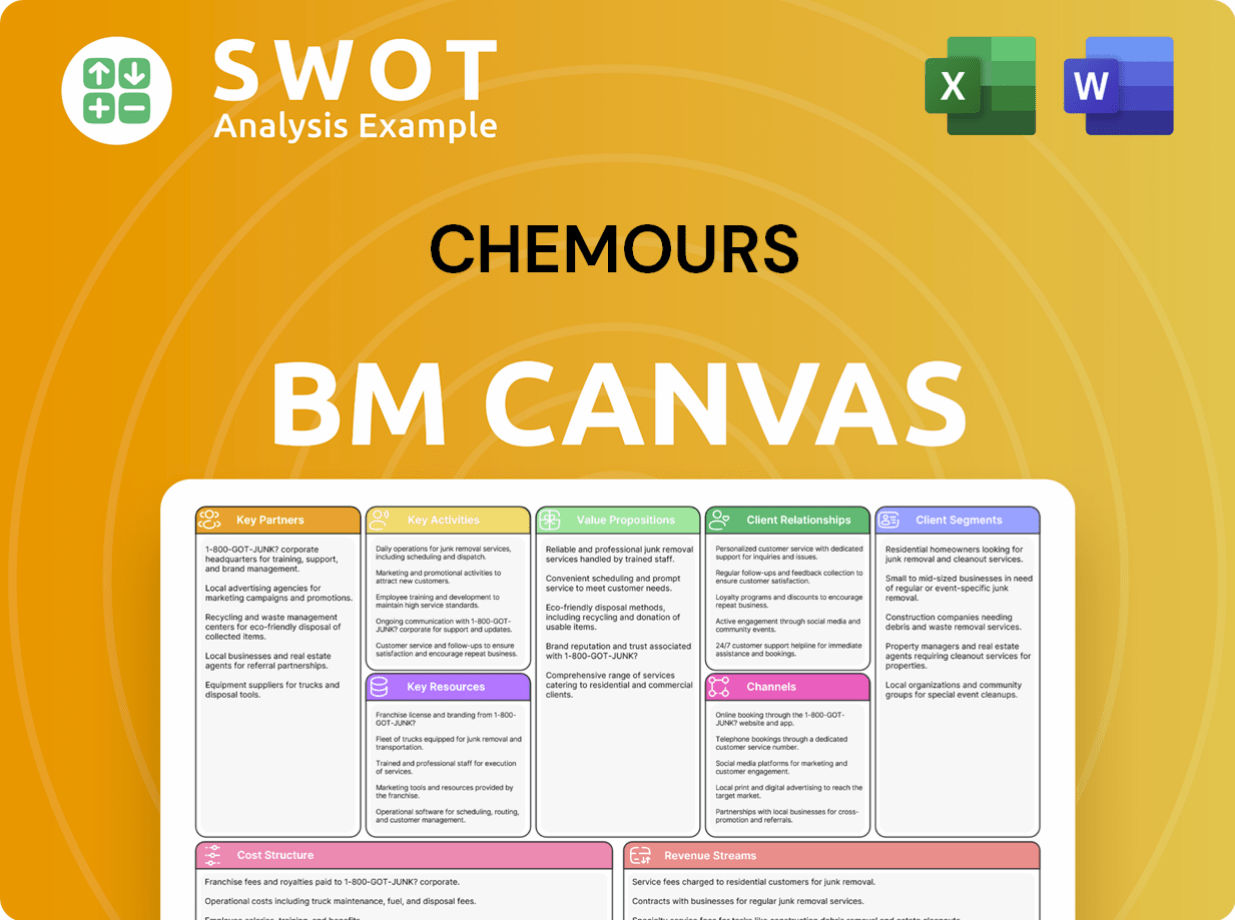

Chemours Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Chemours’s Growth?

The Chemours Company faces several potential risks and obstacles that could affect its future prospects. The chemical industry is highly competitive, and Chemours must navigate this landscape effectively to maintain and grow its market share. Furthermore, regulatory changes and supply chain disruptions present ongoing challenges that require proactive management.

Environmental regulations, especially those related to PFAS, are a significant concern. Compliance costs, product restrictions, and potential litigation could impact the company's financial performance. Supply chain vulnerabilities, including raw material price volatility and geopolitical issues, also pose risks to production and profitability.

To mitigate these risks, Chemours employs various strategies. These include diversification across its product portfolio and end-markets, robust risk management frameworks, and investments in sustainable solutions. These efforts are aimed at ensuring long-term financial performance and strategic growth.

The chemical industry is intensely competitive, with established companies and new entrants constantly vying for market share. This competition can pressure pricing and margins, affecting Chemours' financial performance. The company must continually innovate and differentiate its products to stay ahead.

Changes in environmental regulations, particularly those concerning PFAS, pose a significant risk. Increased compliance costs, product restrictions, and potential litigation could negatively impact Chemours. The company must proactively manage these risks through strategic planning and adaptation.

Supply chain disruptions, including raw material price volatility and geopolitical events, can affect production and profitability. Chemours needs robust supply chain management strategies to mitigate these risks. Diversification of suppliers and proactive risk assessment are crucial.

Litigation related to PFAS and other environmental liabilities presents a financial risk. While Chemours has made strides in managing these liabilities, ongoing legal challenges and potential settlements could impact its financial outlook. The company's settlement in 2023 aims to provide more financial certainty.

Economic downturns can reduce demand for Chemours' products, affecting revenue and profitability. The company must be prepared to adapt to changing economic conditions. Diversification across various end-markets can help mitigate the impact of economic fluctuations.

Rapid technological advancements in the chemical industry can lead to the obsolescence of existing products. Chemours needs to invest in innovation and research and development to stay competitive. Adapting to new technologies is crucial for long-term success.

Chemours employs several strategies to mitigate risks. These include diversifying its product portfolio and end-markets to reduce reliance on any single segment. The company also implements robust risk management frameworks and conducts scenario planning to anticipate and prepare for potential disruptions.

Investing in sustainable solutions and technologies is a key aspect of Chemours' strategy. This approach helps the company stay ahead of evolving regulatory landscapes and consumer preferences. Innovation is crucial for maintaining a competitive advantage and ensuring long-term growth.

Chemours Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Chemours Company?

- What is Competitive Landscape of Chemours Company?

- How Does Chemours Company Work?

- What is Sales and Marketing Strategy of Chemours Company?

- What is Brief History of Chemours Company?

- Who Owns Chemours Company?

- What is Customer Demographics and Target Market of Chemours Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.