Chemours Bundle

How Does Chemours Stack Up in the Chemical Industry?

The chemical industry is constantly evolving, and Chemours, a major player, is at the forefront of this transformation. With a history rooted in innovation, Chemours has carved a niche in the global market. This analysis dives deep into the Chemours SWOT Analysis, exploring its competitive position and strategic moves.

Understanding the Chemours competitive landscape is crucial for anyone assessing the company's potential. This report provides a detailed Chemours market analysis, identifying key Chemours competitors and examining their impact on Chemours' business. We'll explore Chemours' strategic positioning, assess its competitive advantages, and evaluate its future growth potential within the dynamic Chemours industry.

Where Does Chemours’ Stand in the Current Market?

The Chemours Company holds a significant position within the specialty chemicals sector, particularly in its key segments of Titanium Technologies, Thermal & Specialized Solutions (formerly Fluoroproducts), and Advanced Performance Materials. Chemours's market analysis reveals its status as a leading global producer of titanium dioxide (TiO2), a critical pigment used across various industries. Furthermore, Chemours is a key global player in fluoroproducts, including refrigerants and advanced materials, benefiting from its Opteon portfolio of low global warming potential (GWP) refrigerants.

Geographically, Chemours operates with a robust global footprint, with manufacturing facilities and sales operations spanning North America, Europe, Asia Pacific, and Latin America. The company strategically expands its presence in emerging economies to capitalize on industrial growth. Chemours serves a highly diversified customer base, including large multinational corporations and smaller specialized manufacturers across sectors such as automotive, construction, electronics, and consumer goods. Over time, Chemours has strategically shifted its focus towards higher-value, more specialized product lines, especially within its fluoroproducts and advanced materials segments.

Chemours's strategic focus on operational efficiency and portfolio management aims to maintain its financial health and competitive standing. For the full year 2023, Chemours reported net sales of $6.0 billion, demonstrating its substantial scale within the industry. Understanding the Owners & Shareholders of Chemours is crucial in analyzing the company's competitive landscape and strategic direction.

Chemours is a leading global producer of titanium dioxide (TiO2). While specific market share percentages fluctuate, Chemours consistently ranks among the top producers worldwide. The company competes with major players like Venator, Tronox, and Kronos in this segment.

In the fluoroproducts space, Chemours is a key global player, especially with its Opteon portfolio. This includes refrigerants and advanced materials. The company's focus on low GWP refrigerants positions it well in a market increasingly focused on sustainability.

Chemours has a robust global footprint with manufacturing facilities and sales operations across North America, Europe, Asia Pacific, and Latin America. North America remains a core market, but the company is expanding in emerging economies. This diversification supports its competitive positioning.

The company serves a highly diversified customer base, including large multinational corporations and smaller specialized manufacturers. These customers span automotive, construction, electronics, and consumer goods sectors. This diversification mitigates risk.

Chemours has strategically shifted its focus towards higher-value, more specialized product lines, particularly within its fluoroproducts and advanced materials segments. This move aims to improve profitability and competitiveness. The company reported net sales of $6.0 billion for the full year 2023, reflecting its substantial scale within the industry.

- Focus on higher-value products.

- Emphasis on operational efficiency.

- Strategic portfolio management.

- Financial performance is key.

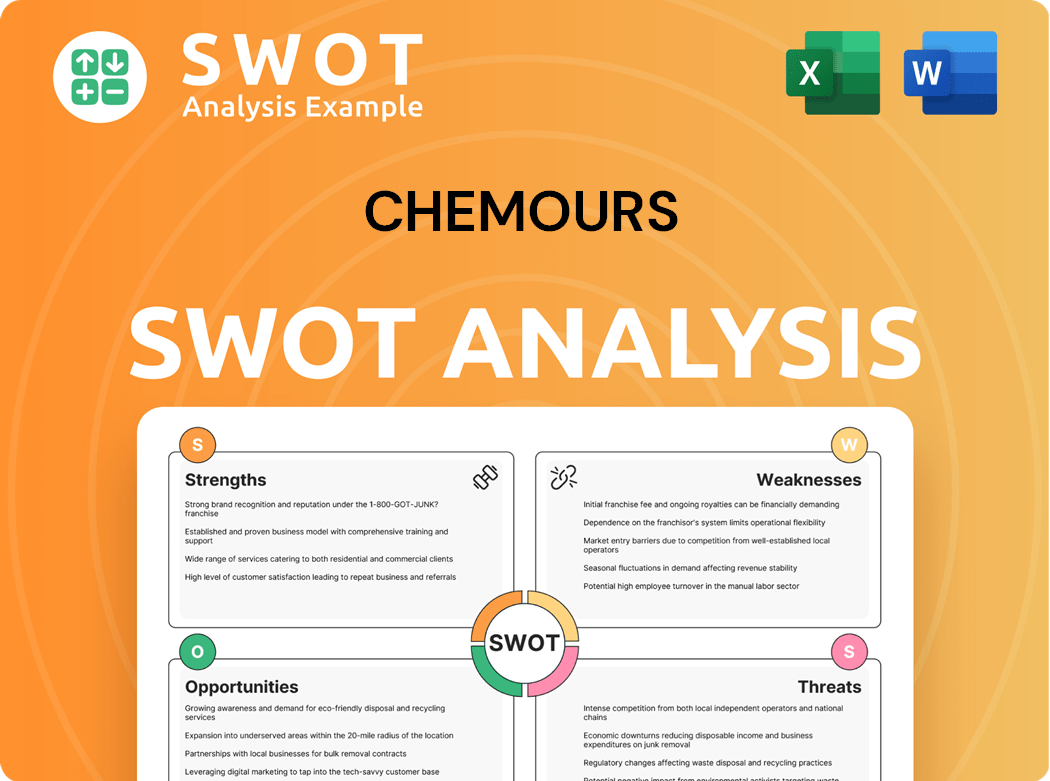

Chemours SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Chemours?

The Brief History of Chemours reveals a company navigating a complex and dynamic competitive environment. Understanding the Chemours competitive landscape is crucial for assessing its market position and future prospects. This analysis delves into the key players and competitive dynamics shaping its various business segments.

Chemours operates in several key segments, each with its own set of competitors. The company's success depends on its ability to differentiate its products, manage costs, and adapt to evolving market demands. A thorough Chemours market analysis is essential for investors and stakeholders to understand the challenges and opportunities facing the company.

The Chemours industry is characterized by intense competition, technological advancements, and regulatory changes. Analyzing Chemours competitors provides insights into the company's strengths, weaknesses, and strategic positioning. This competitive landscape report offers a detailed examination of the key rivals and the factors driving their success.

In the Titanium Technologies segment, Chemours faces strong competition. Key rivals include Tronox Holdings plc, Venator Materials PLC, and Kronos Worldwide, Inc. These companies compete on product quality, pricing, and distribution.

The Thermal & Specialized Solutions segment sees competition from Honeywell International Inc., Daikin Industries, Ltd., and Arkema S.A. Honeywell's Solstice brand and Daikin's range of fluorochemicals are significant competitors.

In the Advanced Performance Materials segment, Chemours competes with companies like Daikin and 3M. These competitors offer specialized materials for demanding applications.

Indirect competition comes from companies developing alternative materials. Mergers and acquisitions in the chemical industry also reshape the competitive landscape. New entrants from Asia pose a cost-based challenge.

Market share fluctuates based on product demand and supply. For instance, in 2024, Tronox held a significant share in the titanium dioxide market. Honeywell's refrigerant business also holds a substantial market position.

Chemours' financial performance is directly impacted by its competitive position. Comparing Chemours' financial performance vs competitors, such as Tronox or Honeywell, reveals key insights. In 2024, industry revenue trends showed varying performances across competitors.

Chemours' competitive advantages include its product portfolio and global presence. However, the company faces challenges from cost pressures and evolving regulations. Understanding Chemours' strategic positioning in the market is critical for assessing its long-term viability.

- Cost Efficiency: Tronox, with its integrated mining operations, presents a cost advantage in titanium dioxide production.

- Technological Innovation: Honeywell's Solstice brand and Daikin's offerings in fluorochemicals highlight the importance of innovation.

- Regulatory Compliance: The transition to lower GWP refrigerants impacts the competitive landscape.

- Market Dynamics: Fluctuations in raw material costs and global demand affect all players.

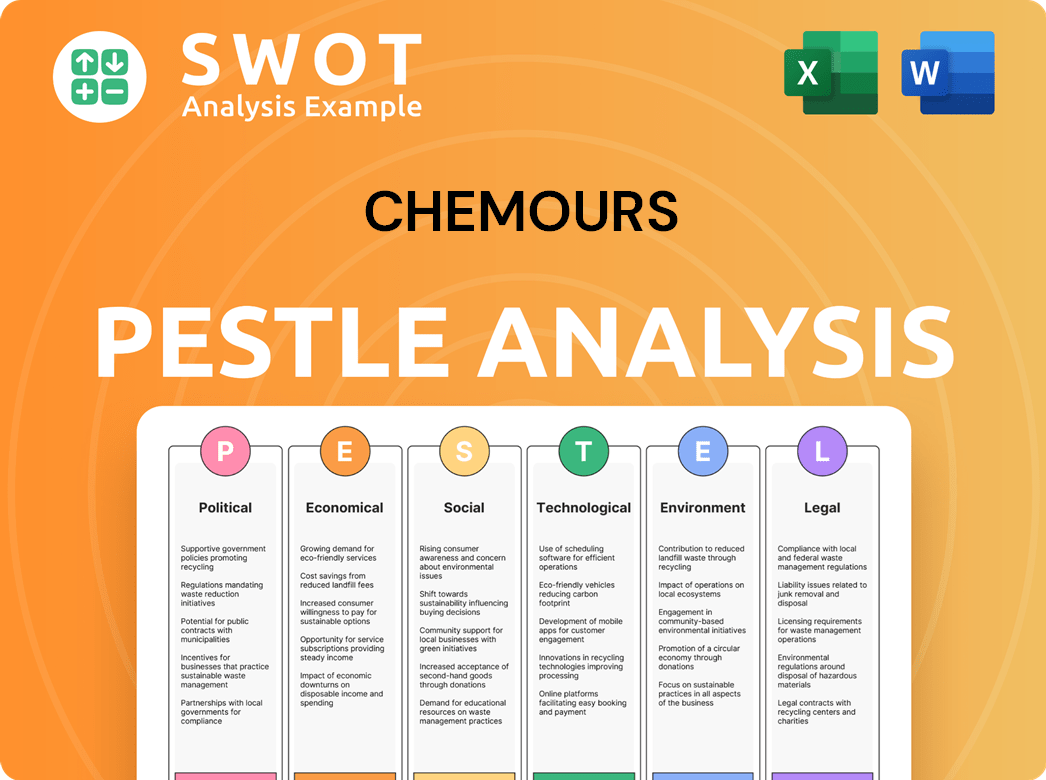

Chemours PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Chemours a Competitive Edge Over Its Rivals?

Understanding the Chemours competitive landscape requires a deep dive into its core strengths. The company has carved out a significant position in the chemical industry by leveraging several key competitive advantages. These advantages are crucial for its strategic positioning and sustained performance in the market.

Chemours' competitive edge is built on a foundation of proprietary technologies and strong brand equity. Its intellectual property, particularly in fluoroproducts and titanium technologies, acts as a barrier to entry, allowing the company to offer differentiated products. Furthermore, Chemours benefits from economies of scale and a global distribution network, ensuring broad market reach and efficient operations. These factors contribute to its ability to compete effectively.

The company's focus on research and development also fuels its competitive advantage. Continuous innovation allows Chemours to adapt to evolving industry demands and introduce new products. Strong customer relationships, often built over decades, further solidify its market position. Despite these strengths, Chemours faces challenges, including aggressive R&D from competitors and the need to maintain cost competitiveness.

Chemours holds a robust portfolio of patents, particularly in fluoroproducts and titanium technologies. This intellectual property provides a significant barrier to entry. Chemours' focus on innovation and R&D is evident in its commitment to developing sustainable solutions, which is crucial for meeting evolving industry demands.

The company benefits from strong brand recognition, especially with its Ti-Pure and Opteon brands, which are synonymous with quality. Customer loyalty is fostered by these established brands. Chemours' legacy from DuPont has allowed it to build strong relationships with key customers.

Chemours' large-scale manufacturing operations enable cost efficiencies. The company's extensive global distribution network ensures broad market reach. This allows for timely delivery to customers worldwide.

Chemours is strategically focused on higher-value products and sustainability. The company's R&D investments support continuous product improvements. This helps Chemours adapt to changing market needs.

Chemours' competitive advantages are multifaceted, encompassing technological prowess, brand strength, and operational efficiency. These strengths are essential for understanding Chemours' market position. The company's ability to innovate and adapt is a key driver of its long-term success. Chemours faces challenges from competitors, but its strategic focus on high-value products and sustainability gives it a solid foundation.

- Intellectual Property: Chemours holds a significant portfolio of patents, particularly in fluoroproducts and titanium technologies.

- Brand Recognition: The Ti-Pure and Opteon brands are well-regarded in their respective industries.

- Operational Efficiency: Economies of scale and a global distribution network contribute to cost efficiencies and broad market reach.

- Customer Relationships: Strong relationships with key customers, often developed over decades, enhance customer loyalty.

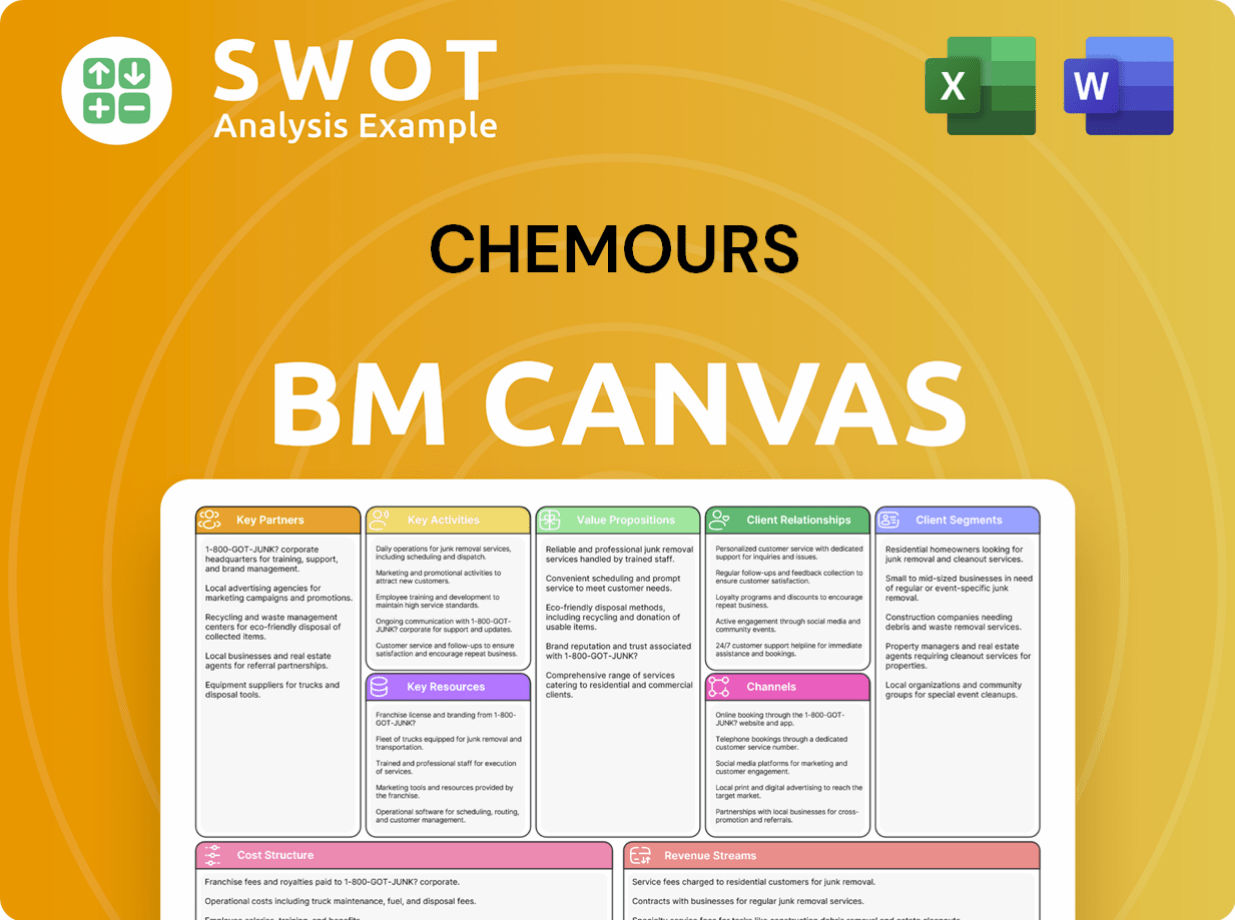

Chemours Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Chemours’s Competitive Landscape?

The Chemours competitive landscape is currently shaped by industry trends and future challenges. The company faces both opportunities and risks in a dynamic market. Understanding these elements is crucial for assessing its strategic positioning and potential for growth.

The chemical industry's focus on sustainability and environmental regulations significantly impacts Chemours. Technological advancements and global economic shifts also play crucial roles. Addressing volatile raw material costs and intense price competition are key challenges. The company's strategic responses to these factors will determine its long-term success within the competitive landscape.

Sustainability and environmental regulations are major drivers, influencing product development and manufacturing processes. Technological advancements in material science and process optimization are fostering innovation. The shift towards a circular economy presents opportunities for recyclable and renewably sourced products.

Volatile raw material costs and intense price competition can squeeze profitability. Geopolitical uncertainties and trade tensions may disrupt supply chains and market access. Aggressive R&D from competitors and new market entrants pose threats to Chemours' market share.

Chemours can capitalize on its Opteon portfolio of low GWP refrigerants. Expansion into emerging markets, particularly for titanium technologies and advanced performance materials, offers growth potential. Strategic partnerships and acquisitions could broaden its market reach and product portfolio.

Investing in R&D for sustainable solutions is crucial. Exploring new applications for core technologies and seeking strategic partnerships are important. The company is likely to focus on specialty, high-value, and sustainable chemical solutions.

The Chemours market analysis reveals a competitive landscape dominated by established players and emerging challengers. The company's ability to innovate and adapt will be key to maintaining its position. The focus on sustainable solutions is expected to drive future growth.

- DuPont and other major chemical companies are key competitors.

- Price competition and raw material costs significantly impact profitability.

- Strategic partnerships and acquisitions could expand market reach.

- R&D investments in sustainable solutions are a priority.

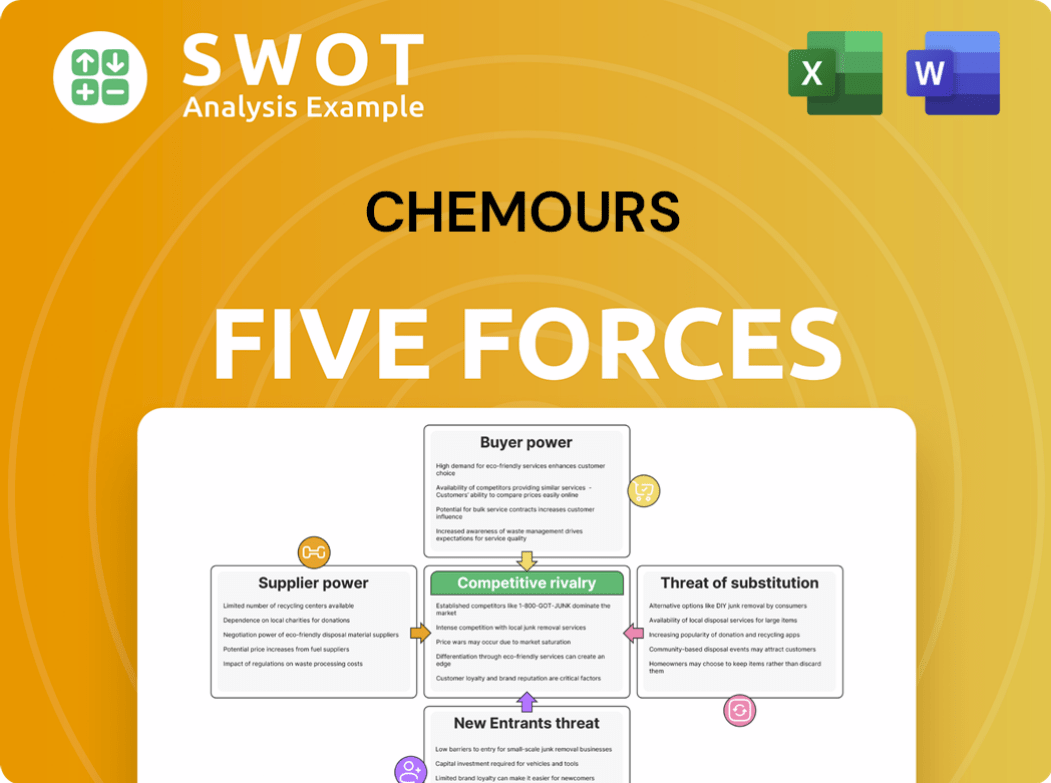

Chemours Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Chemours Company?

- What is Growth Strategy and Future Prospects of Chemours Company?

- How Does Chemours Company Work?

- What is Sales and Marketing Strategy of Chemours Company?

- What is Brief History of Chemours Company?

- Who Owns Chemours Company?

- What is Customer Demographics and Target Market of Chemours Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.