Chubb Bundle

How Did Chubb Become a Global Insurance Powerhouse?

Journey back to 1882, when a father-son duo launched a marine underwriting business in New York City, setting the stage for a global insurance giant. From insuring ships to becoming a world leader, the Chubb SWOT Analysis reveals a history of strategic evolution and market dominance. Discover how Chubb, now a global force in the insurance industry, transformed from its humble beginnings.

The story of Chubb insurance company is a testament to adaptability and foresight, evolving from a specialized marine insurer to a comprehensive provider. This brief history of Chubb insurance company will explore key milestones, including the merger with ACE Limited, and how it navigated the complexities of the insurance industry. Understanding the Chubb corporation's journey provides valuable insights into its enduring success and its impact on the global market.

What is the Chubb Founding Story?

The story of the Chubb Corporation, a significant player in the insurance industry, began in 1882. Thomas Caldecot Chubb and his son Percy launched a marine underwriting business in New York City. This marked the genesis of what would become a global insurance giant.

Their initial capital came from a group of merchants. Each contributed $1,000, amassing a total of $100,000. This funding allowed them to focus on insuring ships and their cargo, essential for maritime trade. This was the foundation of the Chubb company history.

The founders saw an opportunity in the growing shipping industry. They aimed to offer financial protection against the unpredictable nature of the sea. Their business model was built on expert underwriting and proactive risk management. This approach helped policyholders prevent potential disasters.

Chubb's early success stemmed from a clear vision and strategic partnerships.

- Founded in 1882 by Thomas Caldecot Chubb and Percy Chubb.

- Initial focus on marine insurance.

- Raised $100,000 from merchants to start the business.

- Strong relationships with independent insurance agents and brokers.

Chubb & Son quickly established strong relationships with independent insurance agents and brokers. These partners were crucial in connecting clients with Chubb's underwriters. In 1901, the New York Marine Underwriters (NYMU), a key property and casualty affiliate, was reorganized as Federal Insurance Company. This move further solidified Chubb's organizational structure in its early years. This is a crucial element of the Chubb insurance story.

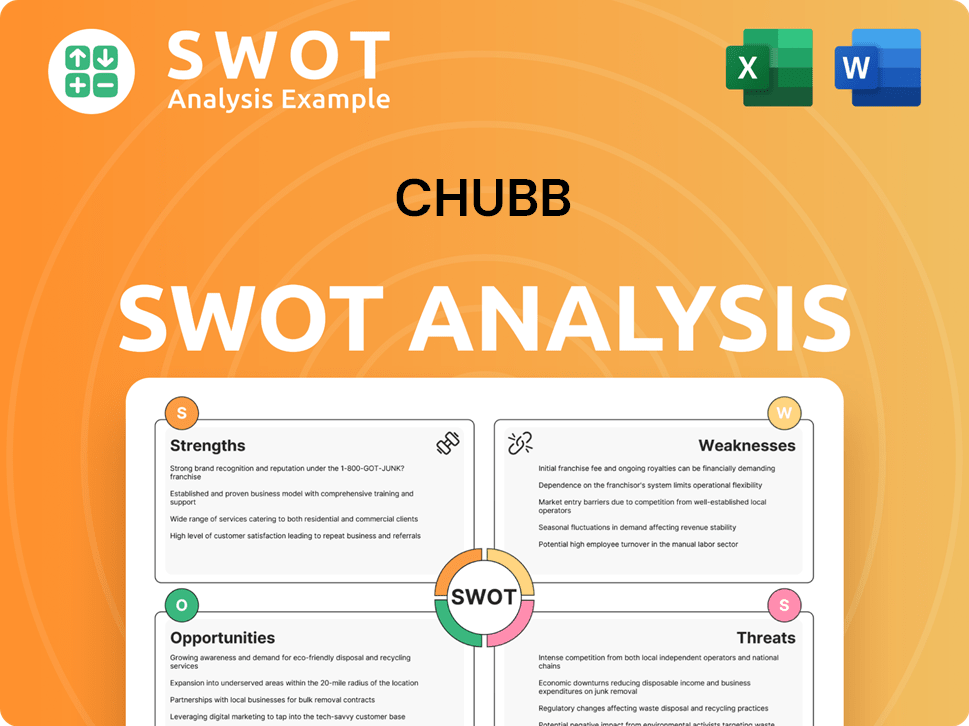

Chubb SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Chubb?

The early growth of the company, now known as Owners & Shareholders of Chubb, was marked by strategic diversification and expansion within the insurance market. Initially focused on marine insurance, the company broadened its scope in the 1920s, venturing into fidelity, surety, and casualty insurance. This period also saw the establishment of its first branch office in Chicago, setting the stage for broader national reach.

The company's evolution included strategic moves such as entering fidelity, surety, and casualty insurance. The formation of Associated Aviation Underwriters in partnership with another transportation insurance agent in March 1929, marked a significant step into aviation insurance. These expansions were key to establishing a more comprehensive insurance portfolio.

In 1956, the company formed a personal lines department and adopted its first computer, an IBM 705, showcasing an early embrace of technology. This was a forward-thinking move, integrating technology into its operations. This technological investment set the stage for improved efficiency and data management.

The formal incorporation of The Chubb Corporation in 1967 and the acquisition of Pacific Indemnity Companies in the same year were pivotal. A strategic shift in 1976 saw the company concentrating on select markets and specialties, particularly serving high-net-worth clients in personal lines. This focus helped in refining its market approach.

In 2016, ACE Limited acquired The Chubb Corporation for $28.3 billion in cash and ACE stock. ACE, established in 1985, brought a global network and a history of growth through strategic acquisitions. Following the acquisition, the combined entity adopted the renowned Chubb name, with its headquarters in Zürich, Switzerland, creating the world's largest publicly traded property and casualty insurance company.

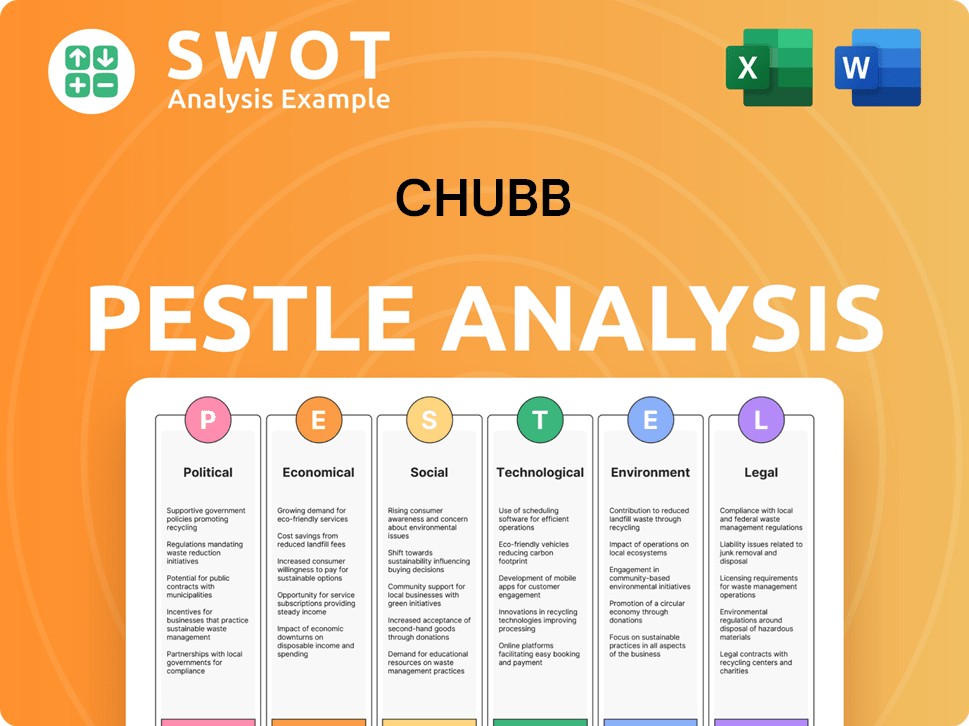

Chubb PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Chubb history?

The Chubb company history is marked by significant achievements and strategic moves. From pioneering insurance products to adapting to market changes, the company has demonstrated resilience and a commitment to innovation. This evolution has positioned it as a key player in the insurance industry.

| Year | Milestone |

|---|---|

| 1950 | INA, later part of ACE and then Chubb, pioneered the definitive multiple-line homeowners policy. |

| 1956 | Chubb installed its first computer, marking an early entry into technology. |

| 2004 | The sale of The Chubb Institute, a chain of technical schools, occurred. |

| 2016 | ACE Limited acquired Chubb, creating the new Chubb. |

Chubb insurance has consistently been at the forefront of innovation, particularly in specialized insurance offerings. Its early adoption of technology and strategic product development have set it apart in the insurance industry. The company's history showcases a proactive approach to meeting evolving market demands.

Chubb, through INA, introduced the first multiple-line homeowners policy, simplifying insurance coverage. This innovation streamlined the process for customers, offering comprehensive protection under a single policy.

Chubb's early investment in computer technology in 1956 improved efficiency. This technological advancement helped streamline operations and enhance customer service.

Chubb has been a leader in specialized insurance, such as directors and officers liability insurance. This focus on niche markets has allowed Chubb to offer tailored solutions and maintain a strong market position.

The merger with ACE Limited in 2016 significantly expanded Chubb's global footprint and capabilities. This strategic move enhanced Chubb's ability to serve a broader range of clients and markets.

Chubb has implemented proactive risk management strategies, including reducing exposure in high-risk areas. This approach helps mitigate potential losses and maintain financial stability.

Chubb consistently focuses on strong underwriting performance, as demonstrated by its combined ratio. This focus ensures profitability and long-term sustainability in the insurance industry.

Despite its successes, Chubb corporation has faced challenges, including significant catastrophe losses and market fluctuations. The company has responded by strategically adjusting its risk exposure and focusing on strong financial management. For more insights into the company's values, read about the Mission, Vision & Core Values of Chubb.

In the first quarter of 2025, Chubb reported a net income of $1.33 billion, a 37% decrease compared to Q1 2024, largely impacted by $1.47 billion in catastrophe losses from the California wildfires. This financial impact underscores the challenges posed by natural disasters.

Chubb, like other insurers, faces challenges from market downturns. These economic shifts can affect investment returns and overall financial performance.

Chubb has strategically reduced its exposure in high-risk areas, such as wildfire-prone regions in California, by over 50%. This proactive measure helps mitigate potential losses from natural disasters.

Economic fluctuations influence the Chubb insurance company's financial performance. Changes in interest rates and investment returns can impact profitability.

The insurance industry is highly competitive, requiring Chubb to constantly innovate and adapt. This competition puts pressure on pricing and customer service.

Changes in regulations can create challenges for Chubb. Compliance with new rules requires adjustments to business practices and operations.

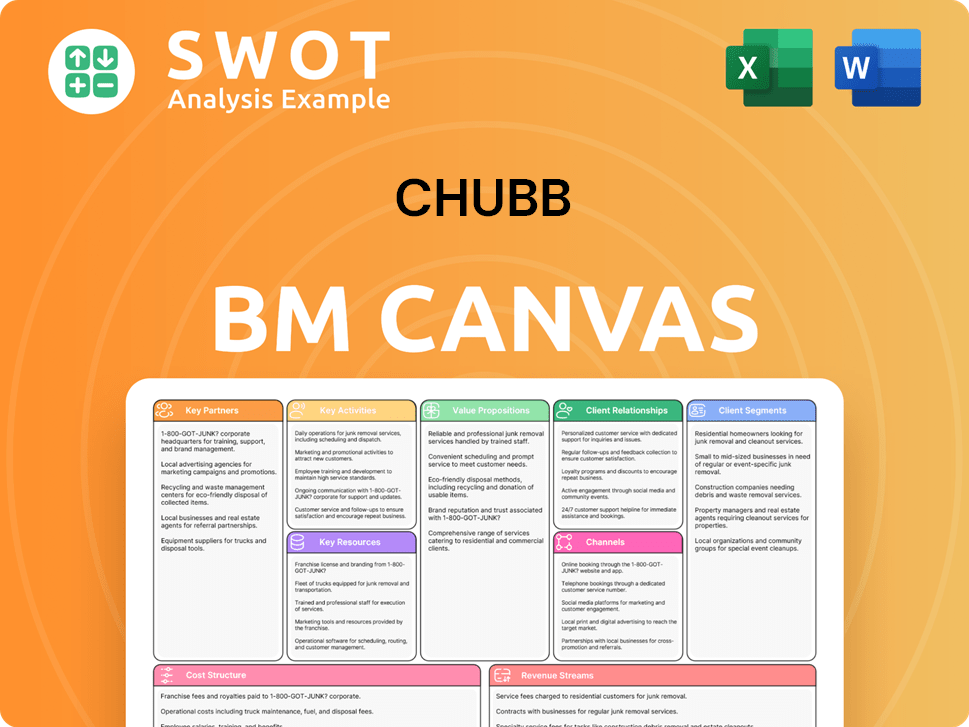

Chubb Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Chubb?

The Chubb company history is marked by significant milestones, from its marine underwriting origins to its current global presence. Thomas Caldecot Chubb and his son Percy established a marine underwriting business in New York City in 1882, laying the foundation for what would become a global insurance leader. The company evolved through several key stages, including the reorganization of New York Marine Underwriters into Federal Insurance Company in 1901 and the incorporation of The Chubb Corporation in 1967. A strategic focus on select markets and high-net-worth clients, initiated in 1976, further solidified its position within the insurance industry. The merger with ACE Limited in 2016, which then adopted the Chubb name, was a pivotal moment, creating a larger, more diversified insurance entity.

| Year | Key Event |

|---|---|

| 1882 | Thomas Caldecot Chubb and Percy Chubb establish a marine underwriting business in New York City. |

| 1901 | New York Marine Underwriters (NYMU) reorganizes as Federal Insurance Company. |

| 1956 | Chubb forms a personal lines department and installs its first computer. |

| 1967 | The Chubb Corporation is incorporated and acquires Pacific Indemnity Companies. |

| 1976 | Chubb develops a successful focus on select markets and high-net-worth clients in personal lines. |

| 2004 | The Chubb Institute, a chain of technical schools, is sold. |

| 2015 | ACE Limited announces its acquisition of Chubb Corporation for $28.3 billion. |

| 2016 | The acquisition of Chubb Corporation by ACE Limited is completed, and the combined company adopts the Chubb name. |

| 2024 | Chubb reports a record net income of $9.27 billion, with P&C underwriting income reaching a record $5.9 billion. |

| 2025 Q1 | Chubb reports net income of $1.33 billion, impacted by $1.47 billion in California wildfire catastrophe losses. |

| May 2025 | Chubb Limited shareholders approve the 32nd consecutive annual dividend increase. |

Chubb's financial performance in recent years reflects a strong position within the insurance industry. The company achieved a record net income of $9.27 billion in 2024, and P&C underwriting income reached a record $5.9 billion. Despite challenges like the $1.47 billion in California wildfire losses in Q1 2025, Chubb maintains a positive outlook.

The company is focused on achieving double-digit growth in operating earnings and earnings per share (EPS). This growth is planned to be driven by its primary income sources: P&C underwriting, investment income, and life insurance. Chubb aims to achieve double-digit growth in life insurance income through 2025.

Strategic initiatives include a continued focus on disciplined underwriting, leveraging data and visualization for enhanced underwriting excellence, and expanding its global footprint. Chubb recently announced the creation of a new North America Small & Lower Midmarket Division in March 2025.

Chubb is actively pursuing expansion through acquisitions. The company plans to acquire Liberty Mutual's P&C insurance businesses in Thailand and Vietnam, with the Thailand acquisition closing in April 2025 and Vietnam expected by early 2026. These moves support Chubb's long-term growth strategy.

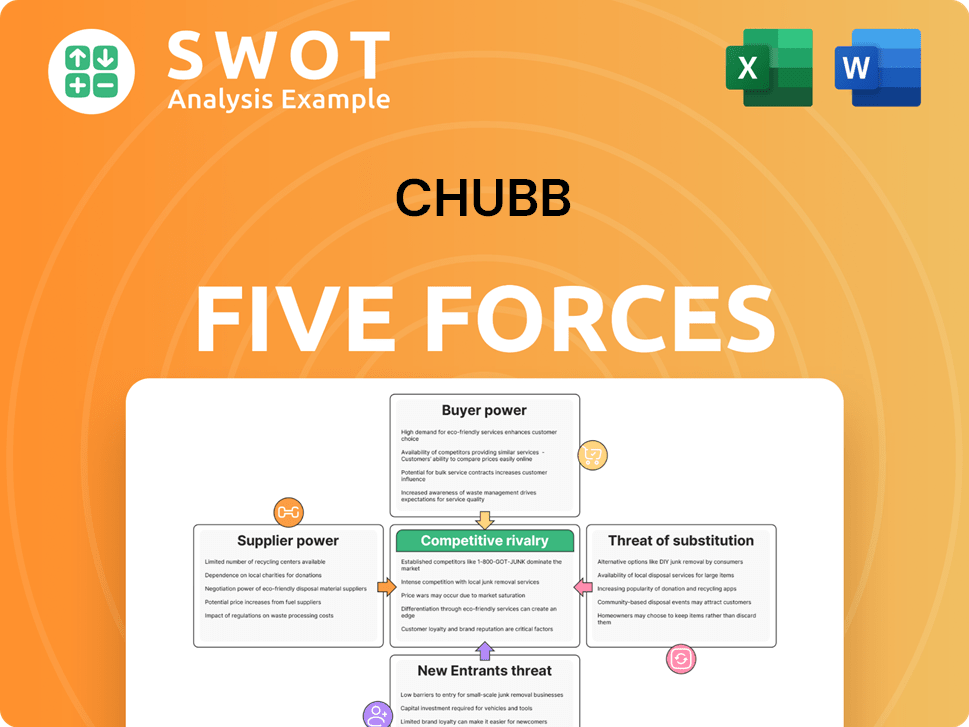

Chubb Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Chubb Company?

- What is Growth Strategy and Future Prospects of Chubb Company?

- How Does Chubb Company Work?

- What is Sales and Marketing Strategy of Chubb Company?

- What is Brief History of Chubb Company?

- Who Owns Chubb Company?

- What is Customer Demographics and Target Market of Chubb Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.