Chubb Bundle

Can Chubb Continue Its Ascent in the Global Insurance Market?

Chubb, a titan in the insurance world, is making strategic moves to solidify its position. In a clear signal of its ambitious Chubb SWOT Analysis, the company recently announced a significant acquisition in Southeast Asia, demonstrating a proactive approach to expansion. With a market capitalization of nearly $110 billion as of April 2025, Chubb's trajectory is one of keen interest to investors and industry watchers alike.

This analysis delves into the core of Chubb's growth strategy, examining its recent acquisitions and the broader insurance industry trends. We will explore the company's financial performance, its strategic initiatives for expansion, and its approach to innovation and technology. Furthermore, we'll assess Chubb's future prospects, taking into account its competitive advantages, its response to climate change, and its long-term growth potential within the dynamic property and casualty insurance sector.

How Is Chubb Expanding Its Reach?

As part of its Chubb growth strategy, the company is actively pursuing several strategic initiatives to broaden its business. These initiatives focus on both expanding its geographical reach and diversifying its product offerings. This approach aims to tap into new customer bases and diversify revenue streams, especially in rapidly growing Asian markets. The company's strategic moves are driven by a clear vision for future expansion.

The company's expansion efforts are not limited to acquisitions; it also focuses on organic growth within its existing markets and segments. The company recognizes strong growth potential across over 80% of its global property and casualty (P&C) business, including commercial and consumer segments, as well as its life business. This multifaceted strategy reflects a commitment to sustainable growth and market leadership.

In March 2025, the company announced the acquisition of Liberty Mutual's P&C insurance businesses in Thailand and Vietnam. This strategic move is expected to be finalized by the second quarter of 2025 for Thailand and late 2025/early 2026 for Vietnam. Once completed, this acquisition will add approximately $275 million in annual net premiums written. This will position the company as the fourth-largest P&C insurer in Thailand. This expansion is a key element of the Chubb future prospects.

The acquisition of Liberty Mutual's P&C businesses in Thailand and Vietnam is a significant step. This expansion into Southeast Asia is designed to capitalize on the region's growth potential. These moves are part of the company's broader strategy to increase its international footprint.

The company is focusing on both commercial and consumer P&C businesses. The company is also expanding its life insurance offerings. This diversification helps to mitigate risks and capture a wider range of market opportunities.

The company is targeting growth in its existing markets. The company is also focusing on expanding its digital business. These organic growth initiatives are crucial for maintaining momentum and increasing market share.

The company is expanding its digital business to meet evolving customer needs. The company is also focusing on its 'Climate Plus' businesses. These areas are seen as key growth drivers for 2025.

The company is also focused on organic growth within its existing markets and segments. In 2024, the company's global P&C business, excluding U.S. agriculture, grew by 9.6%, with commercial lines growing 8.7% and consumer P&C businesses growing 12.1%. The company is also targeting double-digit growth in its life insurance income through 2025. In Q1 2025, life insurance net premiums written increased by 10.3% in constant dollars. The company has also created a new North America Small & Lower Midmarket Division in March 2025 to further penetrate these segments. For more insights into the company's history, consider reading the Brief History of Chubb.

The company is prioritizing several key areas for growth. These areas include geographical expansion, product diversification, and digital transformation. These initiatives are designed to drive sustainable growth and enhance the company's market position.

- Acquisitions in Southeast Asia

- Expansion of digital business

- Focus on commercial and consumer P&C

- Growth in life insurance

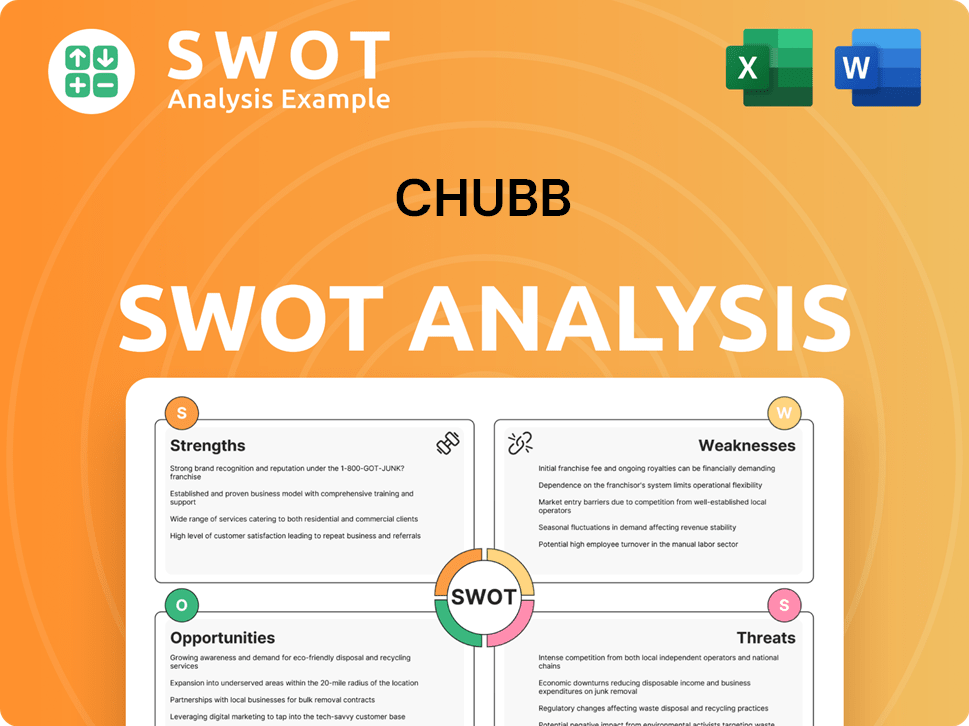

Chubb SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Chubb Invest in Innovation?

As part of its Chubb growth strategy, the company is heavily investing in innovation and technology to maintain a competitive edge. This focus is crucial in the dynamic insurance industry trends, where technological advancements are reshaping operations and customer expectations. The company's approach to digital transformation and sustainability initiatives highlights its forward-thinking approach, crucial for its Chubb future prospects.

Chubb's commitment to innovation is evident in its substantial investment in technology, with an annual expenditure of $1.1–$1.2 billion. This investment is directed towards modernizing legacy systems and enhancing AI-driven analytics. These efforts aim to improve operational efficiency and enhance underwriting accuracy. This strategic investment has helped maintain one of the lowest expense ratios in the P&C sector, demonstrating the effectiveness of its technology integration.

The integration of data and visualization creates a powerful network effect, uncovering opportunities that drive and enhance underwriting excellence, which is a key component of Chubb's competitive advantages in the insurance market. The company's strategy also includes exploring cutting-edge technologies to stay ahead of the curve. This proactive stance is essential for adapting to the rapidly changing landscape of the property and casualty insurance sector.

Chubb is actively pursuing digital transformation to streamline processes and enhance customer experiences. This includes initiatives like Chubb Studio, designed to simplify digital insurance integration for partners. These efforts are aimed at improving efficiency and expanding market reach.

The company is leveraging AI and advanced analytics to improve underwriting accuracy and risk assessment. With 79% of companies implementing AI within their risk management operations, Chubb is at the forefront of using technology to enhance its services. However, the company is also aware of the risks associated with AI, such as deepfakes, which have impacted over 50% of executives.

Chubb is committed to sustainability, particularly through its Chubb Climate+ business unit. Launched in January 2023, this unit focuses on supporting the global transition to a low-carbon economy. This initiative aligns with the growing importance of ESG factors in the insurance industry trends.

Chubb Climate+ offers global insurance products and services to support clients' climate transition plans. It focuses on expanding the company's position in natural resources and climate technology industries. This initiative is a key part of Chubb's response to climate change.

Chubb has set underwriting criteria for clients with over $1 billion in revenue to achieve a methane emissions intensity of 0.2% or less by 2030 across global operations. This demonstrates Chubb's commitment to environmental sustainability and responsible business practices.

The company's significant investment in technology, with annual spending of $1.1–$1.2 billion, is a cornerstone of its strategy. This investment is aimed at modernizing systems and enhancing AI-driven analytics, contributing to Chubb's financial performance and operational efficiency.

Chubb's approach to technology and innovation is multifaceted, focusing on digital transformation, AI integration, and sustainability. These strategies are designed to enhance its market position and drive long-term growth. For more insights into the competitive landscape, check out the Competitors Landscape of Chubb.

- Digital Transformation: Implementing platforms like Chubb Studio to simplify digital insurance integration.

- AI and Data Analytics: Utilizing AI to improve underwriting accuracy and risk assessment.

- Sustainability Initiatives: Launching Chubb Climate+ to support the transition to a low-carbon economy.

- Strategic Investments: Allocating $1.1–$1.2 billion annually to technology and innovation.

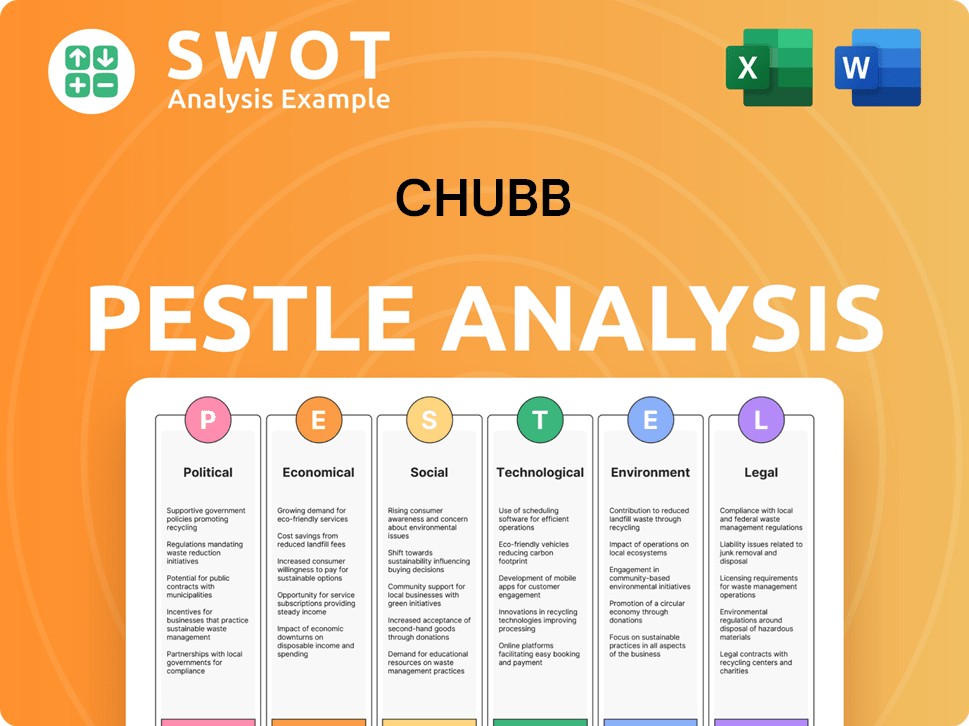

Chubb PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Chubb’s Growth Forecast?

In 2024, the financial landscape for the company was exceptionally strong, marking its best year in history. This success was highlighted by record-breaking net income and core operating income. The company's performance underscores its robust position within the insurance industry.

The company's strategic focus on growth, particularly in the property and casualty (P&C) and life insurance sectors, has been a key driver of its success. The company's ability to navigate market challenges while maintaining strong financial results demonstrates its resilience and strategic foresight. This positions the company well for sustained growth in the coming years.

Looking ahead, the company anticipates continued growth, supported by its strategic initiatives and market positioning. The company's ability to adapt to evolving market conditions and capitalize on opportunities will be crucial for maintaining its positive trajectory. The company's financial outlook remains positive, reflecting confidence in its ability to achieve its strategic goals.

The company achieved record net income of $9.27 billion, up 2.7% for the full year 2024. Core operating income reached $9.20 billion, or $22.51 per share. Global P&C net premiums written increased by 9.6%.

Life insurance premiums increased by 15.7% in constant dollars in 2024. In Q1 2025, total company premiums grew by 5.7% in constant dollars, indicating continued growth momentum.

P&C underwriting income reached a record $5.9 billion in 2024. Adjusted net investment income increased by 12.7% to $1.67 billion in Q1 2025, demonstrating strong investment performance.

The company returned $751 million to shareholders in Q1 2025 through share repurchases and dividends. The company's annualized core operating return on tangible equity (ROTE) stood at 13.0% in Q1 2025.

Despite significant catastrophe losses, particularly from California wildfires impacting Q1 2025 by approximately $1.64 billion pre-tax, the company demonstrated resilience. The company's ability to manage risks and maintain profitability is a key factor in its success. For fiscal 2025, analysts project the company to report a profit of $20.88 per share, although this is a decrease of 7.2% from fiscal 2024. However, EPS is expected to rebound in fiscal 2026 and grow by 20.7% year-over-year to $25.21. The company's strategic initiatives for expansion and its focus on Chubb's future prospects are crucial for long-term growth potential.

Net income was $1.33 billion, or $3.29 per share. Core operating income was $1.49 billion, or $3.68 per share, showcasing strong underlying profitability despite challenges.

California wildfires in Q1 2025 caused approximately $1.64 billion pre-tax in losses. The company's risk management approach helped to mitigate the impact.

Adjusted net investment income increased by 12.7% to $1.67 billion in Q1 2025. This increase highlights the company's effective investment strategies.

The company returned $751 million to shareholders in Q1 2025. This demonstrates the company's commitment to shareholder value.

Annualized core operating return on tangible equity (ROTE) was 13.0% in Q1 2025. This indicates efficient use of shareholder equity.

Analysts project an EPS of $20.88 for fiscal 2025, with a rebound to $25.21 in fiscal 2026. The company's Chubb growth strategy is focused on long-term value creation.

The company's financial performance reflects strong fundamentals and strategic execution. The Chubb company analysis reveals a robust and resilient business model.

- Record net income in 2024.

- Double-digit growth expected in operating income and EPS.

- Strong premium growth across various segments.

- Effective risk management and investment strategies.

- Commitment to returning value to shareholders.

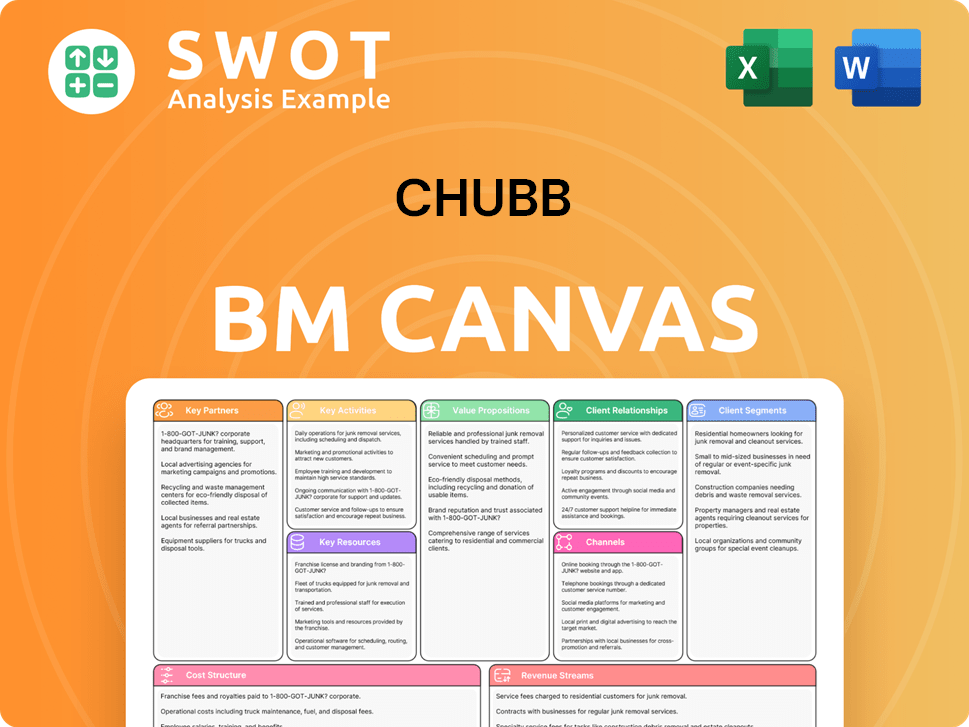

Chubb Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Chubb’s Growth?

The path forward for Chubb, despite its strong position, is not without its challenges. Several risks and obstacles could impact its Chubb growth strategy and overall Chubb future prospects. These factors range from environmental to economic and technological, requiring proactive and adaptive strategies for sustained success in the insurance industry trends.

Catastrophe volatility, economic uncertainties, and increasing competition are significant hurdles. Moreover, the rapid evolution of technology, especially in cybersecurity, introduces new dimensions of risk. These challenges underscore the importance of robust risk management and strategic foresight for Chubb to maintain its Chubb financial performance.

One of the primary risks facing Chubb is catastrophe volatility. In Q1 2025, the company reported pre-tax net catastrophe losses of $1.64 billion, significantly influenced by the California wildfires. While the company has decreased its exposure in wildfire-prone areas by over 50%, the increasing frequency and severity of natural disasters due to climate change remain a persistent threat. This highlights the need for continuous adaptation in underwriting and risk management practices to mitigate the impact of such events on Property and casualty insurance portfolios.

Economic uncertainties pose another significant risk. Concerns about a rise in recession odds and the impact of trade policies, including tariffs and geopolitical tensions, could dampen demand for insurance and slow premium growth. Inflation, cited by 56% of executives as a growth obstacle, also affects loss costs and investment returns.

Intensifying competition within the global insurance market and regulatory changes in various operating jurisdictions add further complexity. These factors require Chubb to continually refine its strategies to maintain market share and ensure compliance across diverse regions.

Technological disruption, particularly from cybersecurity threats and malicious AI manipulation, is a major risk. Cybersecurity breaches and data leaks are identified as top man-made disruptors by 40% of executives. Moreover, AI-related risks, such as deepfakes, have already impacted over 50% of companies.

Chubb addresses these risks through diversification, risk management frameworks, and proactive measures. Expanding cyber insurance coverage is a key strategy, with over 89% of executives planning to increase their cyber insurance coverage. The company's underlying underwriting results and disciplined risk management practices help mitigate these challenges.

To navigate these challenges, Chubb focuses on Chubb's strategic initiatives for expansion, which include strengthening its cyber insurance offerings and adapting to market dynamics. A deep dive into the specifics of Chubb's operations can be found in this article for Owners & Shareholders of Chubb.

The company's ability to manage these risks will determine its Chubb's financial outlook for the next 5 years. While the Chubb's market share analysis suggests a strong position, the evolving landscape requires continuous adaptation. The company's focus on innovation and risk management is crucial for sustaining its Chubb's long-term growth potential.

Chubb's risk management approach involves a proactive strategy to mitigate the impact of climate change and economic fluctuations. The company's response to climate change includes reducing exposure in high-risk areas and developing insurance products that address emerging risks. Adapting to Chubb's customer acquisition strategies and technological advancements is also crucial for maintaining a competitive edge.

Chubb's investment in technology and innovation is critical to addressing cybersecurity threats and enhancing operational efficiency. By focusing on digital transformation, Chubb aims to improve customer experience and streamline processes. How Chubb is adapting to digital transformation is a key aspect of its strategy for long-term success.

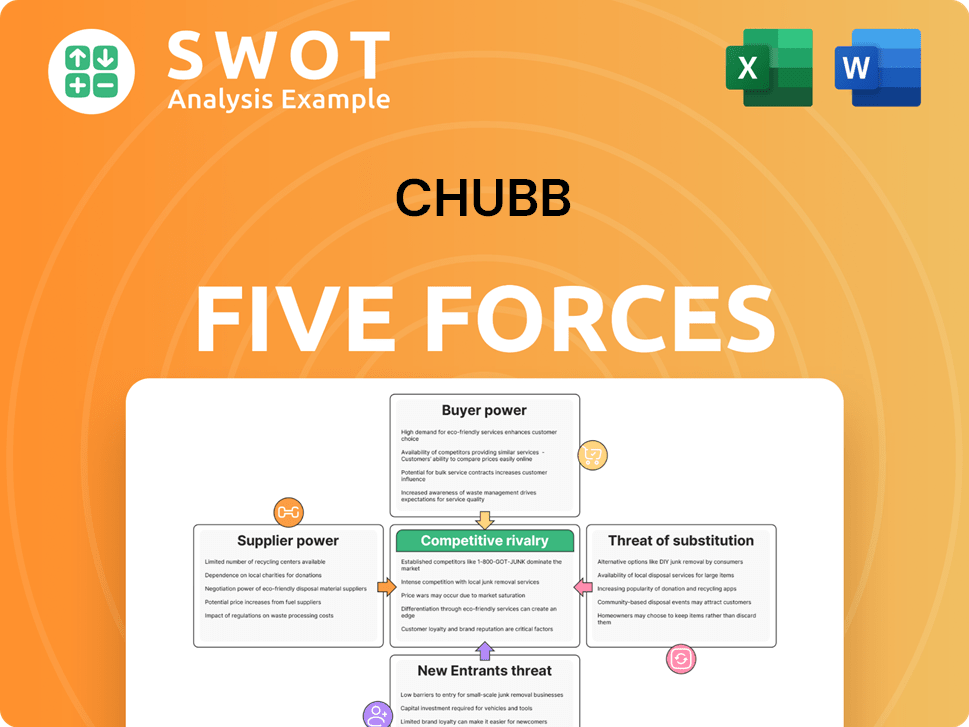

Chubb Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Chubb Company?

- What is Competitive Landscape of Chubb Company?

- How Does Chubb Company Work?

- What is Sales and Marketing Strategy of Chubb Company?

- What is Brief History of Chubb Company?

- Who Owns Chubb Company?

- What is Customer Demographics and Target Market of Chubb Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.