Chubb Bundle

How Does Chubb Dominate the Insurance Market?

Chubb, a global insurance giant, consistently demonstrates the power of a strong sales and marketing strategy in a rapidly evolving industry. Its recent Q4 2024 performance, marked by significant income and premium revenue growth, highlights the effectiveness of its approach. This success story, spanning over a century, showcases how Chubb has strategically adapted to remain a leader in the insurance sector.

From its origins in marine underwriting to its current status as a diversified property and casualty powerhouse, Chubb's Chubb SWOT Analysis reveals a sophisticated sales and marketing approach. This includes leveraging both traditional channels and cutting-edge digital strategies to reach its target audience. Understanding Chubb's sales process, marketing campaigns, and brand positioning offers valuable insights into its competitive advantage and customer acquisition strategies.

How Does Chubb Reach Its Customers?

The sales and marketing strategy of the insurance company, relies on a multifaceted approach to reach its diverse customer base. This strategy includes a blend of traditional and modern sales channels, ensuring broad market coverage and customer accessibility. The company's focus on both established and emerging distribution methods reflects its commitment to adapting to evolving market dynamics and customer preferences.

A key aspect of the insurance company's strategy involves a robust network of independent agents and brokers. This network is a cornerstone of their distribution model, providing a crucial link to customers and ensuring a wide reach. The company also leverages direct-to-consumer channels and strategic partnerships to enhance its market presence and customer acquisition efforts.

The evolution of the company's sales channels showcases its strategic shifts towards omnichannel integration and digital adoption. The company is actively investing in digital capabilities to improve all aspects of its operations, from marketing to underwriting and claims. This includes expanding its skills, data, analytics, and artificial intelligence capabilities.

A significant portion of the company's sales is conducted through independent agents and brokers. This channel is a long-standing and vital component of its distribution strategy. The company partners with approximately 50,000 independent brokers and agents globally, and is a top insurer with 15 of the top 20 brokers in the U.S. This extensive network is crucial for reaching a wide audience and providing localized service.

The company has expanded its direct-to-consumer capabilities, which is a key part of its sales and marketing approach. This includes hundreds of direct-to-consumer partnerships, offering access to hundreds of millions of potential customers. The company is a leading direct marketer of insurance in Asia, with over 7,000 telemarketers in its direct marketing operation as of late 2023.

The company actively forms strategic partnerships to expand its reach and acquire customers. Collaborations with entities like Hang Seng Bank, Revolut, Techcombank, InsurTech Medici, and NetSPI highlight its B2B2C approach. These partnerships have contributed to significant growth, with Asia generating net premium growth of 25% in 2023 (excluding Japan) and life premiums growing by over 80%.

The company is investing in digital capabilities to improve all aspects of its operations. A recent strategic shift in March 2025 combined its Lower Middle Market and Digital Small Business divisions into a single unit, North America Small & Lower Midmarket. This new division provides agents with options for a fully digital/automated experience or a digitally augmented service model. This digital focus is crucial for the company's Growth Strategy of Chubb.

The company's distribution strategy encompasses a variety of channels to reach its target audience effectively. These channels are designed to cater to different customer preferences and market segments. The company's sales process for commercial insurance and marketing campaigns for personal insurance are supported by these channels.

- Independent Agents and Brokers: A primary channel providing extensive market coverage.

- Direct-to-Consumer: Leveraging digital platforms and direct marketing efforts.

- Strategic Partnerships: Collaborating with banks, retailers, and other entities.

- Captive Agents and Financial Advisors: Used by Chubb Life, particularly in Asia and Latin America.

- Digital Platforms: Investing in digital tools to enhance customer experience and streamline sales.

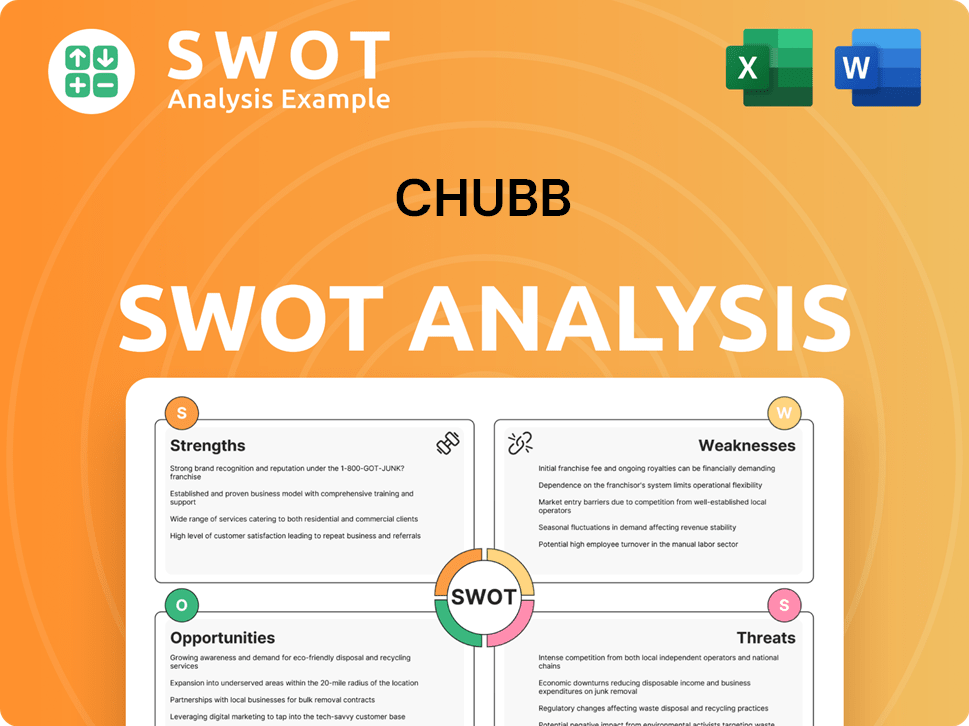

Chubb SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Chubb Use?

The marketing tactics employed by the company are multifaceted, blending digital and traditional strategies to enhance brand awareness, generate leads, and boost sales. This comprehensive approach includes a strong emphasis on digital initiatives, data-driven marketing, and significant investments in technology and analytics. The company’s strategies are designed to adapt to evolving market trends and customer preferences, ensuring a robust and effective marketing approach.

The company's approach to marketing is centered on understanding and engaging with its target audience through various channels. They leverage digital platforms, such as search engine optimization (SEO), social media, and mobile applications, to connect with customers. Furthermore, the company tailors its marketing efforts through customer segmentation and personalization, delivering customized campaigns and content that address specific needs.

To understand the competitive landscape, it's also important to analyze the Competitors Landscape of Chubb. This helps in identifying key differentiators and strategic advantages.

The company utilizes a robust SEO strategy, boasting over 336,000 organic keywords to enhance online visibility. They actively engage on social media platforms like Facebook, Instagram, LinkedIn, and Twitter.

The company segments its customer market into three main categories: Individuals and Families, Businesses, and Life and Health Insurance. This segmentation allows for tailored marketing efforts.

The company is rapidly expanding its skills, data, analytics, and artificial intelligence (AI) capabilities to improve marketing, underwriting, and claims processes. In 2024, they invested an estimated $1.1-$1.2 billion annually in technological advancements.

AI is being used across various functions, from customer service chatbots and predictive analytics for underwriting to AI-powered claims processing and fraud detection systems. The company is exploring various AI uses and preparing to roll out AI tools at scale.

The company participates in industry events to network, learn about the competitive landscape, and connect with the market ecosystem, such as Money 20/20 Asia.

This focus on technology and data analytics plays a significant role in optimizing conversion rates and effectively allocating resources. The company recognizes the power of AI in areas like underwriting, claims, marketing, analytics, customer interface, and customer service.

The company’s marketing strategy is built on several key components designed to drive customer engagement and sales. This includes a blend of digital and traditional marketing, a strong emphasis on data-driven insights, and significant investments in technology and analytics.

- Digital Marketing: Extensive use of SEO, social media, and mobile applications.

- Customer Segmentation: Tailoring marketing efforts to Individuals and Families, Businesses, and Life and Health Insurance.

- Technology and AI: Investing heavily in AI to improve marketing, underwriting, and claims processes.

- Traditional Marketing: Participation in industry events for networking and market insights.

- Data-Driven Approach: Utilizing data analytics to optimize conversion rates and resource allocation.

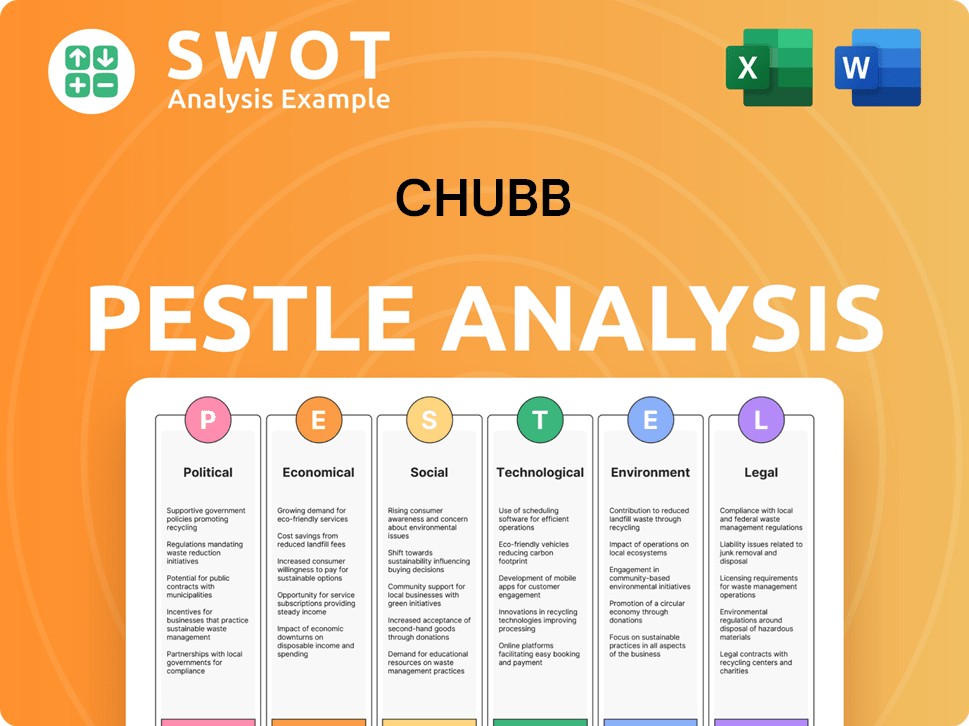

Chubb PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Chubb Positioned in the Market?

The brand positioning of the insurance company, is carefully constructed to stand out in the competitive insurance market. It emphasizes the company's global leadership, financial strength, and superior claims handling. The core message is centered on helping businesses, individuals, and society manage risk through a wide range of insurance products and risk-related services.

The company's strong financial health supports its brand positioning, with core operating insurance companies rated 'AA' for financial strength by S&P and 'A++' by AM Best. This solid financial foundation is crucial for maintaining trust and confidence among its diverse customer base. The company's commitment to providing tailored and customizable coverage options further enhances its appeal to its target audience, which includes individuals, small businesses, large corporations, and high-net-worth individuals.

The company's brand consistency is maintained across its extensive global presence, with insurance professionals and operating subsidiaries in 54 countries and territories. This global reach allows the company to serve a wide range of clients and adapt to various market conditions. The company's focus on specialized and emerging risks, such as cyber insurance, environmental liability, and health insurance, allows it to address niche markets more effectively. This proactive approach to risk management, as exemplified by its decision to reduce exposure in wildfire-prone areas in California by over 50% in 2024, further solidifies its reputation for sustainability and resilience.

The company's sales strategy focuses on building strong relationships with brokers and agents, who serve as key distribution channels. It also emphasizes direct sales to large corporations and high-net-worth individuals. The company's sales team is structured to provide specialized expertise and tailored solutions to meet the diverse needs of its clients.

The company's marketing strategy involves a combination of traditional and digital marketing efforts. It utilizes advertising, public relations, and social media to build brand awareness and engage with its target audience. The company also focuses on thought leadership and content marketing to establish itself as an expert in the insurance industry.

The company conducts thorough market analysis to understand the evolving needs of its customers and the competitive landscape. This includes monitoring industry trends, assessing emerging risks, and evaluating the performance of its products and services. The company uses this data to refine its strategies and identify new opportunities.

The company's target audience includes individuals, small businesses, large corporations, and high-net-worth individuals. It tailors its products and services to meet the specific needs of each segment. The company also focuses on specialized markets, such as cyber insurance and environmental liability, to address niche customer needs.

The company's competitive advantages include its strong financial strength, underwriting excellence, and superior claims handling. It also benefits from its global presence, diverse product portfolio, and commitment to customer service. The company's focus on specialized and emerging risks further differentiates it from its competitors.

- The company's proactive approach to risk management, as exemplified by its decision to reduce exposure in wildfire-prone areas in California by over 50% in 2024, further solidifies its reputation for sustainability and resilience.

- The company's partnership with the National Center for the Middle Market (NCMM) to support the Middle Market Indicator (MMI) survey highlights its dedication to understanding and serving the specific needs of middle market companies, which showed a 12.1% revenue growth in 2024.

- In Q1 2025, the company was ranked #1 for Homeowners Insurance Customer Satisfaction, according to a report related to the Middle Market Indicator.

- For more insights into the company's strategies, consider reading the Growth Strategy of Chubb article.

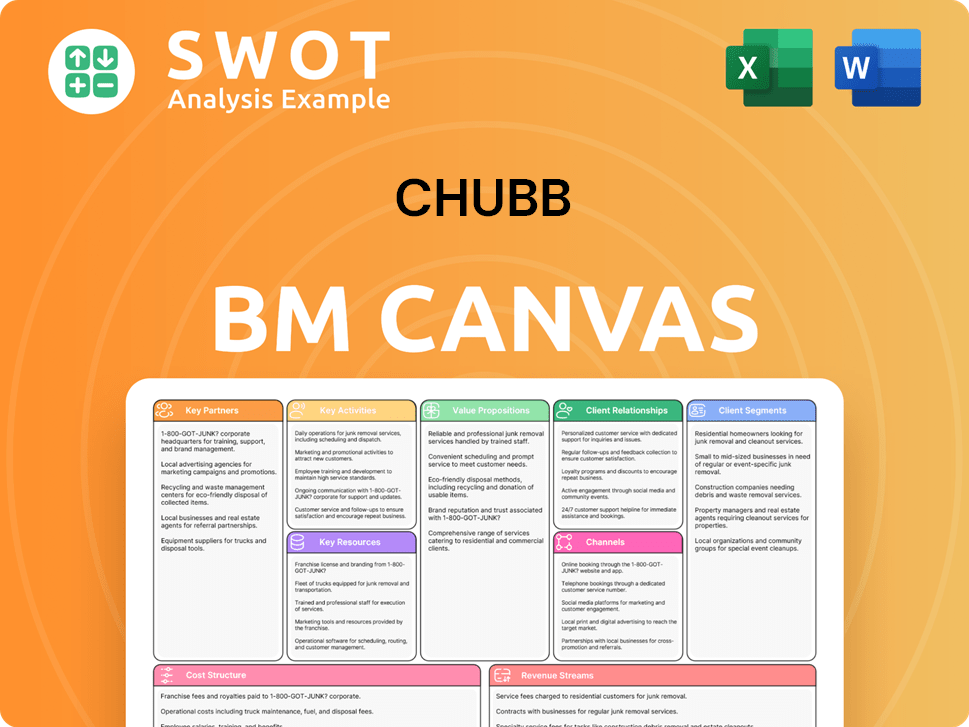

Chubb Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Chubb’s Most Notable Campaigns?

The sales and marketing strategy of the insurance company revolves around several key campaigns designed to drive growth and enhance its market position. These initiatives are multifaceted, focusing on digital transformation, geographic expansion, and targeted market segments. Understanding these campaigns is crucial for grasping the company's approach to customer acquisition, retention, and overall market strategy.

The company's approach to sales and marketing is dynamic and data-driven, adapting to changing market conditions and customer needs. The firm's success is closely tied to its ability to execute these campaigns effectively. These campaigns demonstrate the company's commitment to innovation, customer-centricity, and strategic partnerships, ensuring it remains competitive in the insurance industry.

One of the key campaigns is the company's focus on digital transformation. This ongoing initiative aims to enhance customer experience and streamline operations. It involves significant investment in technology, including AI-driven tools, to personalize insurance products and improve efficiency. This aligns with the company's goal of leveraging technology to gain a competitive advantage in the market.

Another significant campaign is the expansion into the Asian market, particularly for life insurance and consumer-focused businesses. This initiative capitalizes on the growing middle class and increasing insurance awareness in these markets. Strategic partnerships, such as those with banks and fintech companies, are utilized to broaden reach and embed insurance products.

The company is also focusing on the middle market and small business segments. This campaign aims to capitalize on growth opportunities within these segments. The launch of new divisions and the provision of digital and digitally augmented service models are key components of this strategy, aiming to streamline product distribution and cater to evolving distribution landscapes.

The success of these campaigns is measured by specific metrics. For digital transformation, the focus is on improved customer experience, better underwriting, and reduced cycle times. For Asian expansion, premium growth and market share are key indicators. For middle market and small business segments, continued revenue growth and improved service efficiency are critical.

The company's sales and marketing strategies, including its digital transformation, Asian market expansion, and focus on the middle market, are driving substantial results. In 2024, the company invested between $1.1 and $1.2 billion in technology. Asia accounted for approximately 20% of the company's total premiums in 2024, with net premium growth of 25% in 2023 (excluding Japan), and life premiums growing by over 80%. The middle market and small business segments reported strong revenue growth, averaging 12.4% in 2024.

- Digital transformation is enhancing customer experience and streamlining operations.

- Expansion in Asia is driving significant premium growth, particularly in life insurance.

- Targeting the middle market and small business segments is yielding strong revenue growth.

- Strategic partnerships and technological advancements are key drivers of these successes.

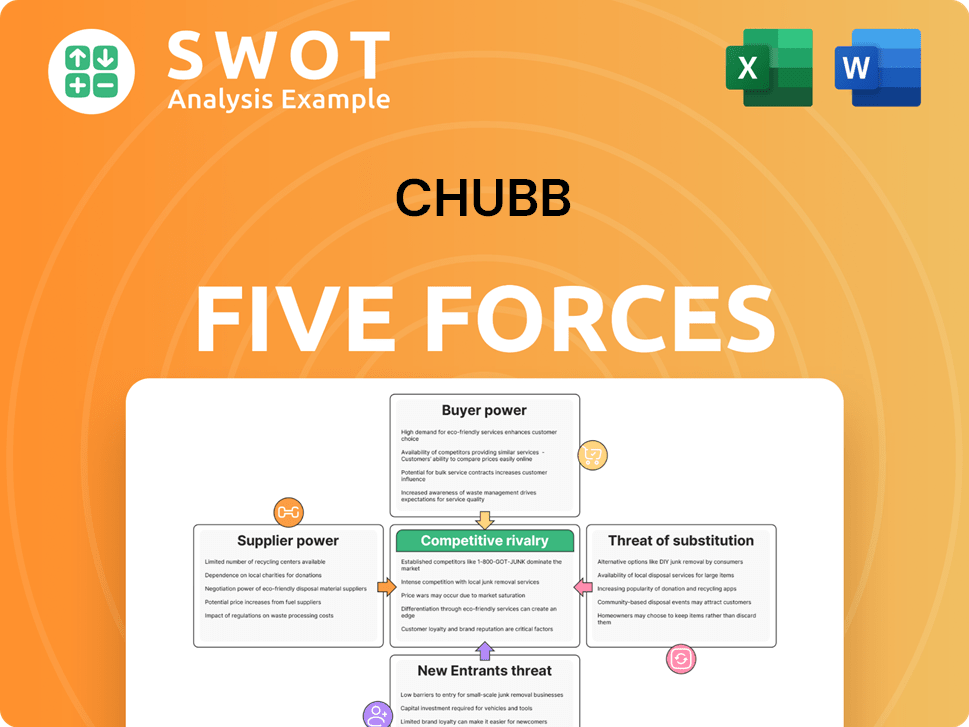

Chubb Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Chubb Company?

- What is Competitive Landscape of Chubb Company?

- What is Growth Strategy and Future Prospects of Chubb Company?

- How Does Chubb Company Work?

- What is Brief History of Chubb Company?

- Who Owns Chubb Company?

- What is Customer Demographics and Target Market of Chubb Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.