Cleanaway Bundle

How Did Cleanaway Become Australia's Waste Management Leader?

Delve into the fascinating Cleanaway SWOT Analysis and uncover the remarkable story of Cleanaway, an Australian waste management giant. From its humble beginnings in 1979 as a division of Brambles, Cleanaway has transformed the Australian waste industry. Discover the key milestones and strategic decisions that propelled this company to its current position as a leader in environmental services.

This article will explore the brief history of Cleanaway, from its founding to its present-day status. We will delve into the company's early years, key acquisitions, and how it navigated the challenges of the Australian waste industry. Learn about Cleanaway's environmental initiatives, its role in recycling programs, and its impact on waste management in Australia.

What is the Cleanaway Founding Story?

The story of Cleanaway, a key player in the Australian waste industry, began in 1979. This marked the official start of operations under the Cleanaway name, a move by Brambles, which had entered the waste management and disposal sector in 1970 through the acquisition of the Purle Group's Australian waste services.

The core of Cleanaway's founding was addressing the growing need for organized and efficient waste collection and disposal services across Australia. The initial business model was centered on providing these essential services to a variety of sectors. Cleanaway's evolution involved several ownership changes, showcasing its adaptability within the environmental services landscape.

Cleanaway's journey reflects the increasing urbanization and industrialization in Australia during the late 20th century, which fueled the demand for structured waste management solutions. This context significantly influenced Cleanaway's creation and subsequent growth, shaping its role in the waste management Australia sector.

Cleanaway's official launch was in 1979, though its roots trace back to Brambles' entry into waste management in 1970. The company quickly established itself by offering essential waste collection and disposal services.

- Cleanaway's founding was driven by the growing need for organized waste solutions in Australia.

- The company's initial focus was on providing waste management services to various sectors.

- Cleanaway's early years were marked by its ability to adapt and grow within the changing economic landscape.

- The demand for waste management solutions was significantly influenced by increasing urbanization and industrialization.

An interesting aspect of Cleanaway's history involves its ownership changes. In June 2006, Brambles sold Cleanaway to KKR, a global investment firm. KKR then sold Cleanaway to Transpacific Industries in May 2007. Transpacific Industries, established in 1987, continued to operate the Cleanaway brand separately for ten years, highlighting the value and recognition of the Cleanaway name within the industry. For more insights, explore the Competitors Landscape of Cleanaway.

Cleanaway's operations have expanded significantly over the years. The company has made substantial investments in infrastructure, including waste transfer stations, landfills, and recycling facilities. In 2023, Cleanaway handled approximately 10.9 million tonnes of waste across Australia. The company's revenue for the financial year 2023 was reported at $3.2 billion, demonstrating its substantial presence in the market. Cleanaway's commitment to sustainability includes various initiatives aimed at reducing waste and promoting recycling, with a focus on reducing greenhouse gas emissions and increasing resource recovery. Cleanaway's strategic acquisitions and organic growth have solidified its position as a leading provider of waste management and environmental services in Australia.

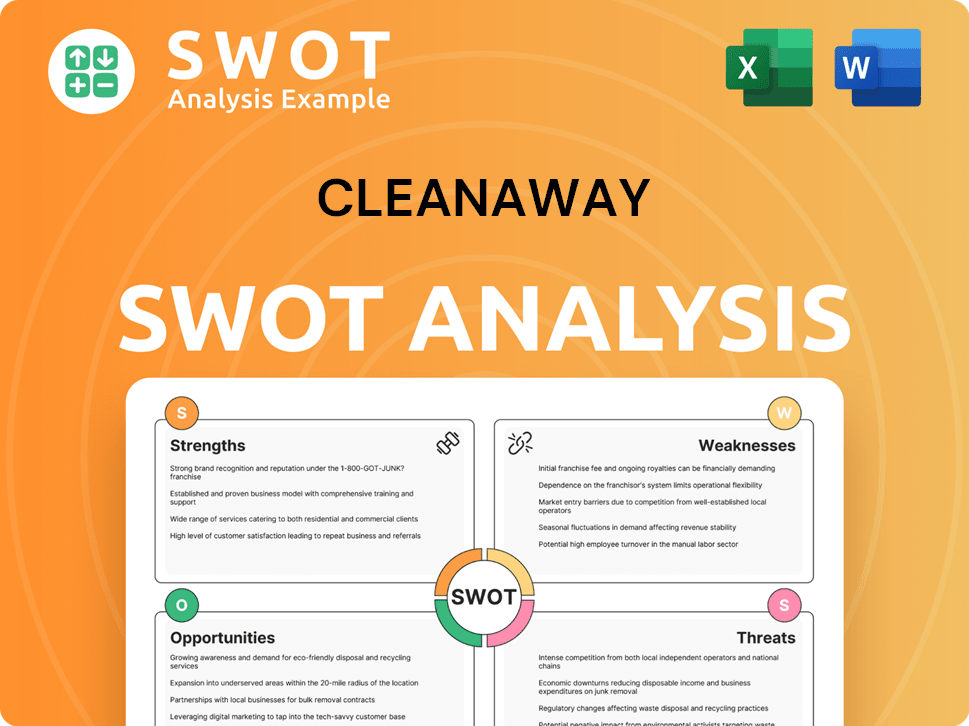

Cleanaway SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Cleanaway?

The early growth and expansion of the company, now known as Cleanaway, involved strategic acquisitions and the establishment of a strong operational base. After its acquisition by Transpacific Industries in 2007, the combined entity continued to use the Cleanaway brand. A significant step was the 2007 joint venture with Veolia, leading to the acquisition of EarthPower, an organic food waste processing facility. This facility was an early move towards resource recovery.

The company continued to expand its capabilities through strategic acquisitions. In May 2018, Cleanaway acquired Tox Free Solutions, including its subsidiary Daniels Health, further strengthening its market leadership, particularly in the medical waste and health services sector. This acquisition was on track to achieve a $35 million synergy target by June 2020. In 2019, Cleanaway also acquired assets from the SKM Recycling Group for $66 million, restoring and reopening these facilities by February 2020. These acquisitions were crucial in building Cleanaway's network of over 300 sites and 115 infrastructure assets, including transfer stations and resource recovery facilities.

Leadership transitions also played a role in shaping the company's trajectory. Vik Bansal, who became CEO and Managing Director in July 2015, was instrumental in rebranding the company to Cleanaway Waste Management Limited in February 2016, moving away from the Transpacific name. This rebranding was part of a strategic review aimed at cutting operating costs and simplifying the organizational structure, with a target of $30 million in cost savings by June 2017. Under Bansal's leadership, Cleanaway also launched its first mobile app in August 2016 to make household recycling and waste management easier for residents. For more insights, explore the Target Market of Cleanaway.

The company's growth efforts were underpinned by a focus on operational excellence and customer service, contributing to its strong market position and an increase in market capitalization from less than $1 billion to over $5 billion. Cleanaway's early years demonstrate a commitment to expanding its services and infrastructure. The company focused on building a comprehensive network of sites and assets. This expansion was supported by strategic acquisitions and operational improvements.

Cleanaway's financial performance reflects its strategic goals. The company aimed for significant cost savings through rebranding and organizational restructuring. The acquisitions, such as Tox Free Solutions and assets from the SKM Recycling Group, were critical in expanding Cleanaway's service offerings. These moves helped strengthen its position in the Australian waste industry. The focus on operational excellence and customer service has been key to its success.

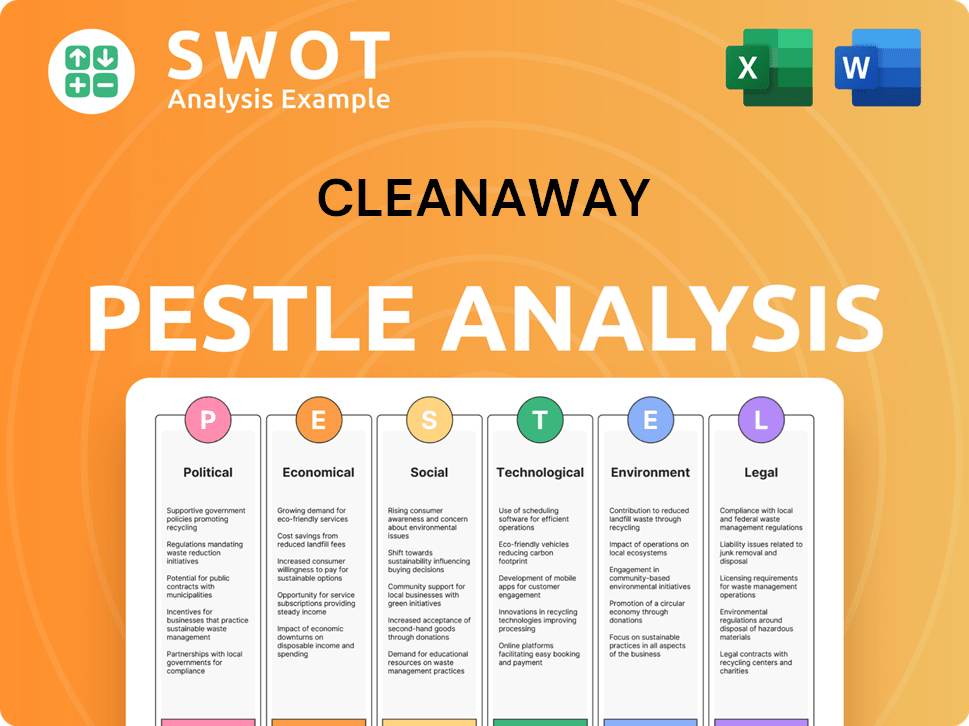

Cleanaway PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Cleanaway history?

Throughout its history, Cleanaway has achieved significant milestones, demonstrating its growth and impact within the Australian waste industry. These achievements reflect its evolution and commitment to waste management and environmental services.

| Year | Milestone |

|---|---|

| 2015 | Launched the 'Footprint 2025' strategy, a long-term plan to build a strategic network of infrastructure assets. |

| 2016 | Rebranded from Transpacific Industries to Cleanaway Waste Management Limited, streamlining the organizational structure. |

| 2020 | Announced a joint venture with Pact Group and Asahi Breweries to develop a plastic pelletizing facility in Albury, NSW. |

| 2024 | Continued focus on safety, with the Total Recordable Injury Frequency Rate (TRIFR) decreasing to 4.6. |

Cleanaway has consistently pursued innovative solutions in waste management. These innovations have positioned the company at the forefront of sustainable practices and resource recovery.

The 'Footprint 2025' strategy has been a key innovation, driving the expansion of facilities and infrastructure. This expansion includes new waste transfer stations and resource recovery facilities to support Australia's waste management efforts.

The joint venture with Pact Group and Asahi Breweries to develop a plastic pelletizing facility in Albury, NSW, is a significant step. This facility is designed to process up to 28,000 tonnes of plastic bottles annually, creating a closed-loop recycling solution.

Cleanaway has formed a joint venture with LMS Energy to monetize landfill gas. This initiative generates renewable electricity and reduces greenhouse gas emissions, contributing to sustainability.

Despite its successes, Cleanaway has faced various challenges. These challenges have tested its resilience and prompted strategic adjustments.

The company has navigated market downturns and faced competitive pressures within the waste management sector. These conditions require continuous adaptation and strategic planning.

Cleanaway has addressed issues such as the rectification and write-off of the New Chum landfill and an outage at a medical waste facility. These events required focused management and resource allocation.

IT transformation costs have been a factor, impacting financial results. Managing these costs is crucial for maintaining operational efficiency and competitiveness.

In August 2014, a major road traffic accident impacted the company's reputation and led to the grounding of its fleet. This necessitated a strong focus on safety and operational improvements.

Cleanaway has significantly reduced its Total Recordable Injury Frequency Rate (TRIFR). The TRIFR decreased from 12.6 in 2014 to 4.6 in 2024, demonstrating a strong commitment to safety.

The rebranding from Transpacific Industries to Cleanaway Waste Management Limited was a strategic pivot. This change aimed to simplify the organizational structure and enhance customer service.

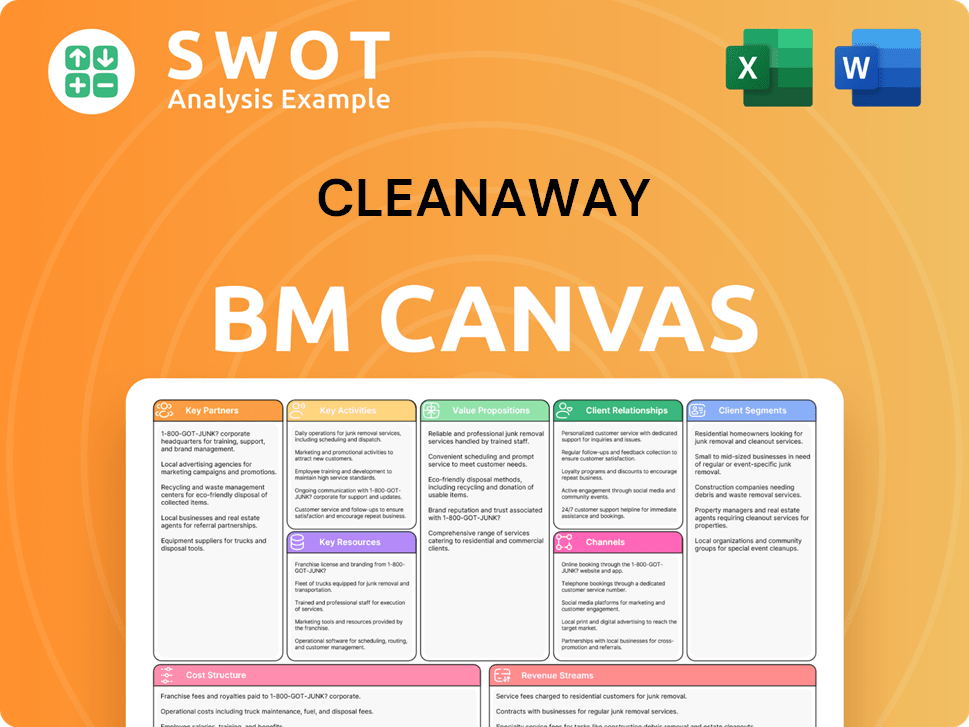

Cleanaway Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Cleanaway?

The Cleanaway history is marked by significant milestones, from its origins within Brambles to its current status as a leading player in the Australian waste management industry. Here’s a look at the key events in the

| Year | Key Event |

|---|---|

| 1979 | Brambles began trading its waste management division as Cleanaway, marking the company's initial foray into the waste industry. |

| 2005 | Transpacific Industries (TPI) was listed on the ASX, with a market capitalization of $480 million, signaling a significant step in its corporate journey within the |

| June 2006 | Brambles sold Cleanaway to KKR, which led to a change in ownership and strategic direction for the company. |

| May 2007 | KKR sold Cleanaway to Transpacific Industries, re-integrating the company under its previous ownership. |

| 2007 | Cleanaway formed a joint venture with Veolia and acquired EarthPower, enhancing its capabilities in organic waste processing. |

| Late 2015 | The company began rebranding to Cleanaway Waste Management, dropping the Transpacific name, reflecting a strategic shift. |

| February 1, 2016 | The company officially launched its new unifying brand and name, Cleanaway Waste Management Limited, solidifying its identity. |

| August 2016 | Cleanaway launched its first mobile app for household recycling and waste management, enhancing customer engagement. |

| 2017 | Cleanaway launched its 'Footprint 2025' roadmap, outlining its sustainability and growth targets. |

| May 2018 | Cleanaway acquired Tox Free Solutions, including Daniels Health, expanding its service offerings. |

| 2019 | Cleanaway acquired assets from the SKM Recycling Group for $66 million, strengthening its market position. |

| February 2020 | Cleanaway, Pact Group, and Asahi Breweries announced a joint venture to develop a plastic pelletizing facility, promoting circular economy initiatives. |

| 2023 | Cleanaway set an FY26 EBIT ambition of more than $450 million, showcasing its financial growth targets. |

| March 19, 2025 | Cleanaway acquired Contract Resources Pty Ltd for $377 million, boosting its industrial services division. |

| May 15, 2025 | Cleanaway's acquisition of Citywide's waste collection and recycling assets received ACCC Clearance, expanding its operational footprint. |

| June 4, 2025 | Cleanaway Waste Management's market capitalization stood at AUD 6.20 billion, reflecting its market value. |

Cleanaway's 'Blueprint 2030' strategy builds on its 'Footprint 2025' plan, aiming to enhance shareholder value through integrated infrastructure and sustainable solutions. This strategy focuses on strategic infrastructure expansion and operational excellence.

The company plans strategic investments in areas like energy from waste, construction and demolition waste, and organics to grow its infrastructure and service platforms. This approach supports the

Cleanaway is on track for its third consecutive year of underlying double-digit EBIT growth in FY25, with an expected range of $395 million to $425 million. Analysts anticipate earnings growth of 17.4% per year.

Cleanaway is integrating a data and analytics framework to become data and AI-driven by 2030, enhancing operational efficiency and profitability. This focus will optimize operations.

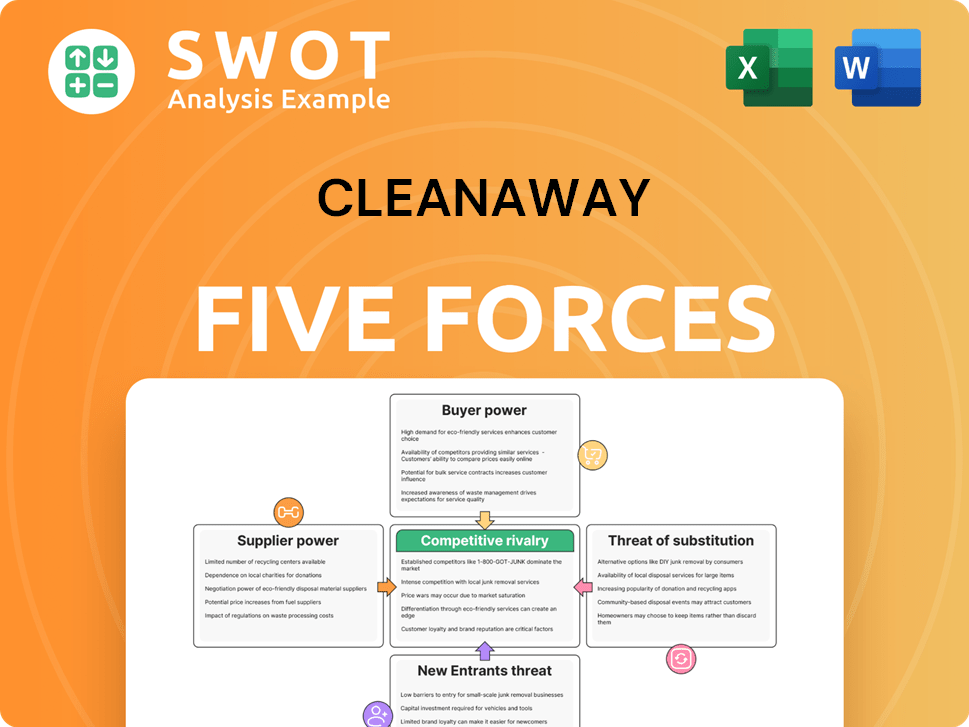

Cleanaway Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Cleanaway Company?

- What is Growth Strategy and Future Prospects of Cleanaway Company?

- How Does Cleanaway Company Work?

- What is Sales and Marketing Strategy of Cleanaway Company?

- What is Brief History of Cleanaway Company?

- Who Owns Cleanaway Company?

- What is Customer Demographics and Target Market of Cleanaway Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.