Cleanaway Bundle

Who Really Owns Cleanaway?

Understanding the Cleanaway SWOT Analysis is essential for investors and stakeholders. Cleanaway Waste Management Limited, a leader in waste management, has a fascinating ownership story. Tracing the evolution of Cleanaway's ownership reveals critical insights into its strategic direction and financial performance.

From its beginnings in 1989 to its listing on the Australian Stock Exchange (ASX) in 2005, Cleanaway's ownership structure has undergone significant changes. This exploration will uncover who owns Cleanaway, detailing the influence of key investors and the shift from private to public ownership. Discover how these changes have shaped Cleanaway's trajectory and its position as a major player in the waste management industry in Australia.

Who Founded Cleanaway?

The story of Cleanaway's ownership begins in 1989, although its roots trace back further. While the exact details of the original founders' equity splits aren't readily available, the company's early history is tied to Brambles.

Cleanaway emerged as the name for Brambles' waste management division in 1979. Later, Transpacific Industries played a crucial role in the company's evolution, acquiring Cleanaway in 2005.

The evolution of Cleanaway's ownership structure reflects a series of strategic moves and acquisitions over the years, shaping it into the major player it is today.

Brambles established Cleanaway's waste management division in 1979. This marked the initial phase of Cleanaway's development within a larger corporate structure.

Transpacific Industries was formed in 1987 and later acquired the Cleanaway business in 2005. This acquisition was a significant step in consolidating Cleanaway's position in the waste management sector.

In May 2005, Transpacific Industries (ASX: TPI) was listed on the ASX. The initial offering price was $2.40, resulting in a market capitalization of $480 million.

Brambles sold Cleanaway (Australia) to KKR & Co., a private equity company, between April and July 2006. This sale marked a shift in ownership.

In May 2007, Cleanaway (Australia) was acquired for a total of $1,148 million by KKR & Co.. This transaction highlighted the value of Cleanaway's operations.

Additional equity was raised in August 2009 ($801 million) and November 2011 ($309 million) to pay down debt. These capital raises were crucial for financial stability.

The journey of Cleanaway's ownership involves several key players and significant financial transactions. Understanding the evolution of Cleanaway Waste Management helps to grasp its current structure and market position.

- 1979: Cleanaway emerges as Brambles' waste management division.

- 1987: Transpacific Industries is formed.

- 2005: Transpacific Industries lists on the ASX; Brambles sells Cleanaway (Australia) to KKR & Co.

- 2007: KKR & Co. acquires Cleanaway (Australia) for $1,148 million.

- 2009 and 2011: Further equity raises to reduce debt.

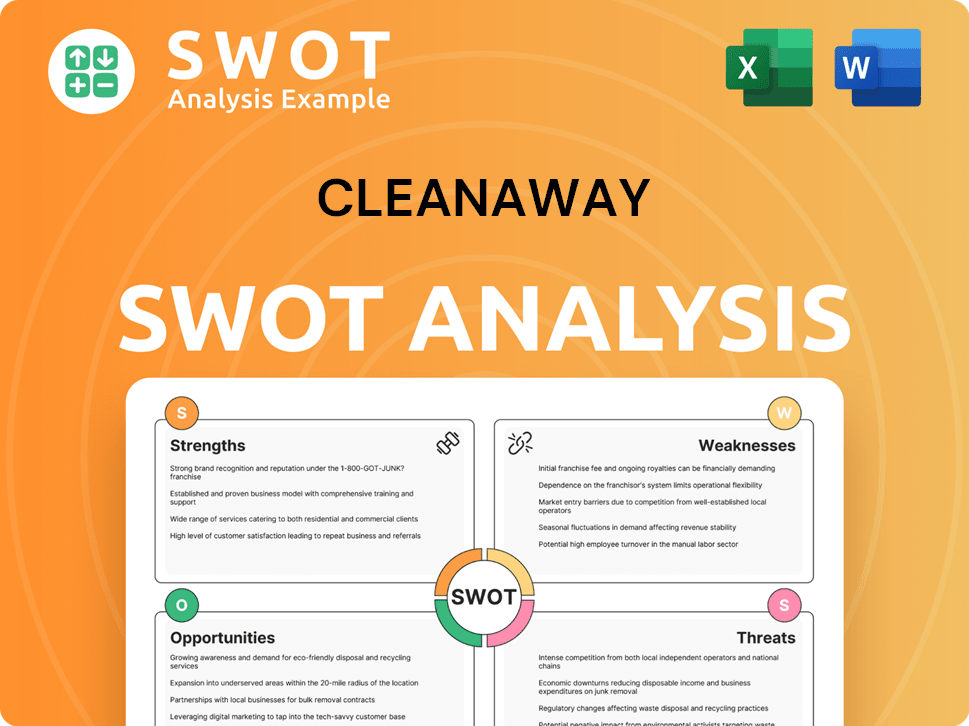

Cleanaway SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Cleanaway’s Ownership Changed Over Time?

Cleanaway Waste Management Limited (ASX: CWY), a prominent player in the waste management sector, has a publicly listed ownership structure. The company has been listed on the Australian Securities Exchange since May 3, 2005. This listing marked a significant shift in the company's ownership, opening it up to public investment and institutional involvement. The evolution of Cleanaway's ownership structure reflects the broader trends in the Australian market, where institutional investors play a crucial role in shaping corporate governance and strategic direction.

The ownership of Cleanaway has evolved over time, with institutional investors holding a significant portion of the shares. As of February 20, 2025, institutional investors held approximately 56% of the company's shares, while the general public, including individual investors, held about 43%. This distribution indicates a strong influence from institutional investors, who often have a significant say in board decisions and company strategy. Understanding the dynamics of Cleanaway's ownership is essential for investors and stakeholders interested in the company's performance and future prospects.

| Shareholder | Stake | Notes |

|---|---|---|

| Challenger Limited | 8.53% | One of the largest institutional shareholders. |

| State Street Corporation and subsidiaries | 6.04% | Significant institutional investor. |

| United Super Pty Ltd | 6.06% | Major institutional shareholder. |

| The Capital Group Companies, Inc. | 5.25% | Holds a substantial stake in Cleanaway. |

| Australian Retirement Trust Pty Ltd | 5.04% | Another key institutional investor. |

As of May 2025, the major shareholders of Cleanaway include several institutional investors. Key players include Challenger Limited with 8.53%, State Street Corporation and subsidiaries with 6.04%, United Super Pty Ltd with 6.06%, The Capital Group Companies, Inc. with 5.25%, and Australian Retirement Trust Pty Ltd with 5.04%. Other significant institutional owners filing with the SEC include SMALLCAP WORLD FUND INC Class A, Vanguard Total International Stock Index Fund Investor Shares, and Vanguard Developed Markets Index Fund Admiral Shares. The top 15 shareholders collectively own 50% of the company, showing that no single shareholder has absolute control. These figures highlight the importance of understanding the Cleanaway ownership structure for anyone interested in the company. For further insights into Cleanaway's strategic direction, consider reading about the Growth Strategy of Cleanaway.

Cleanaway is a publicly traded company, making it accessible to a wide range of investors.

- Institutional investors hold a majority stake, influencing company decisions.

- Major shareholders include Challenger Limited, State Street Corporation, and others.

- The ownership structure reflects the dynamics of the Australian stock market.

- Understanding the Cleanaway owner and Who owns Cleanaway is crucial for investors.

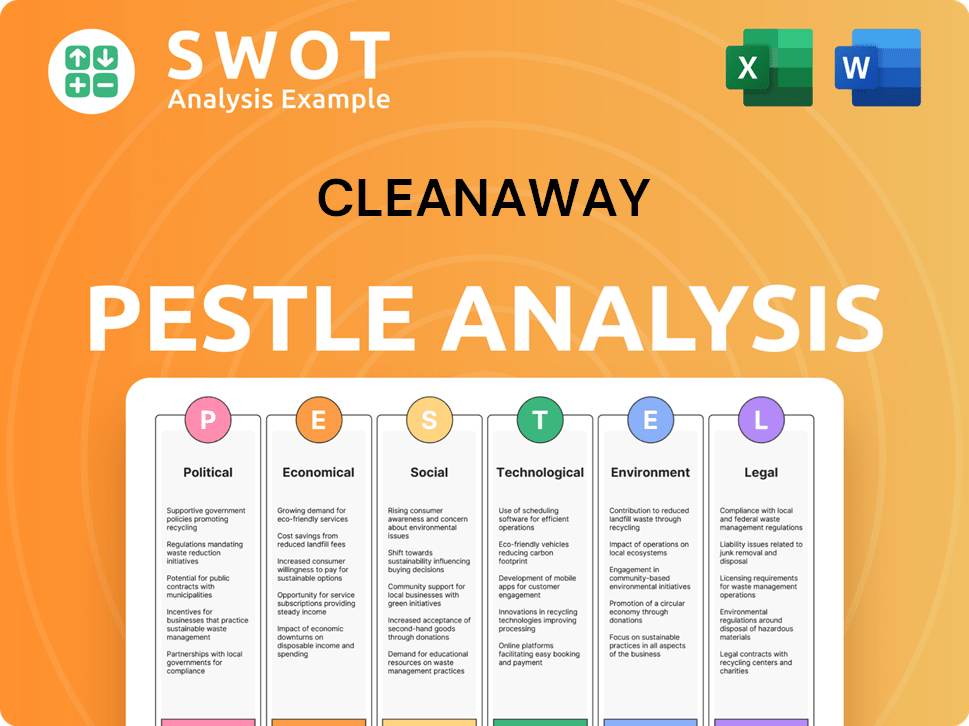

Cleanaway PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Cleanaway’s Board?

The current leadership of Cleanaway includes Mr. Mark Schubert, who serves as the Chief Executive Officer & Managing Director. Mr. Philippe Etienne holds the position of Independent Non-Executive Chairman. The board of directors is responsible for releasing financial results and other company documents, ensuring transparency in the company's operations.

Understanding the board's composition is crucial for investors and stakeholders interested in Cleanaway's target market and overall strategic direction. While specific details on the voting structure, such as dual-class shares or special voting rights, are not explicitly provided in the search results, the significant institutional ownership (56% as of February 2025) suggests that the board's decisions are likely to be heavily influenced by the preferences of these major shareholders.

| Position | Name | Details |

|---|---|---|

| Chief Executive Officer & Managing Director | Mr. Mark Schubert | Leads the company's overall strategy and operations. |

| Independent Non-Executive Chairman | Mr. Philippe Etienne | Oversees the board's activities and ensures effective governance. |

| Board of Directors | Various | Responsible for financial results and company documents. |

There is no recent information regarding proxy battles, activist investor campaigns, or governance controversies that have significantly shaped decision-making within Cleanaway. This stability indicates a relatively consistent approach to corporate governance and shareholder relations. The board's decisions are likely influenced by the preferences of major shareholders, who hold a significant portion of the company's shares.

Cleanaway's ownership structure involves a board of directors led by key executives. The board oversees financial reporting and company communications. Institutional investors significantly influence the board's decisions.

- Mr. Mark Schubert is the CEO & Managing Director.

- Mr. Philippe Etienne is the Independent Non-Executive Chairman.

- Institutional ownership is at 56% as of February 2025.

- No recent governance controversies were reported.

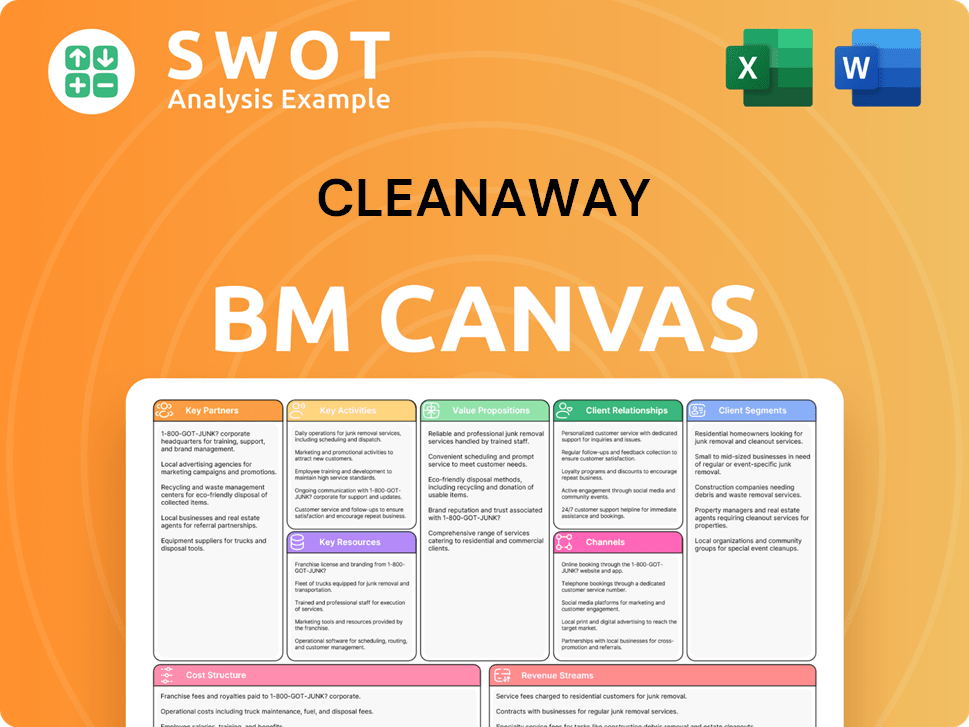

Cleanaway Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Cleanaway’s Ownership Landscape?

Over the past few years, Cleanaway has been focused on its 'Blueprint 2030' strategy, designed for sustainable growth. This strategy has led to consistent financial improvements. For the half-year that ended December 31, 2024, Cleanaway reported net revenue of $1,659.4 million, which is a 4.6% increase from the same period the year before. The underlying EBIT reached $195.2 million, marking a 12.2% increase. The company is projecting an underlying EBIT of over $450 million for FY26.

Cleanaway has been actively involved in strategic acquisitions to expand its business. The proposed acquisition of Citywide's waste collection and recycling assets received clearance from the ACCC in May 2025. In March 2025, the company acquired Contract Resources for $377 million, which supports its growth plans in Australia. Institutional ownership remains significant, with 57% as of November 2024, showing continued confidence from major investors. Cleanaway's 2024 Annual Report, released in September 2024, highlighted its dedication to sustainability and respect for Indigenous communities. These moves indicate a trend toward consolidation and expansion within the waste management industry.

| Metric | Value | Year |

|---|---|---|

| Net Revenue | $1,659.4 million | December 31, 2024 |

| Underlying EBIT | $195.2 million | December 31, 2024 |

| Institutional Ownership | 57% | November 2024 |

The ownership structure of Cleanaway reflects its position as a major player in the waste management sector, with significant institutional backing and a strategic focus on growth through acquisitions. To learn more about the company's operations, check out this article on Revenue Streams & Business Model of Cleanaway.

Cleanaway demonstrated solid financial performance in 2024, with increased revenue and EBIT. The company is on track to achieve ambitious financial targets. These results reflect the effectiveness of its strategic initiatives.

Acquisitions like Citywide and Contract Resources are key to Cleanaway's growth strategy. These moves strengthen its market position and expand its service offerings. Such acquisitions are part of a broader industry trend towards consolidation.

High institutional ownership indicates strong investor confidence in Cleanaway. This support provides a solid foundation for future growth. Investors see value in the company's long-term strategy.

Cleanaway's commitment to sustainability is highlighted in its annual reports. The company actively engages with Indigenous communities. This approach is increasingly important for investors.

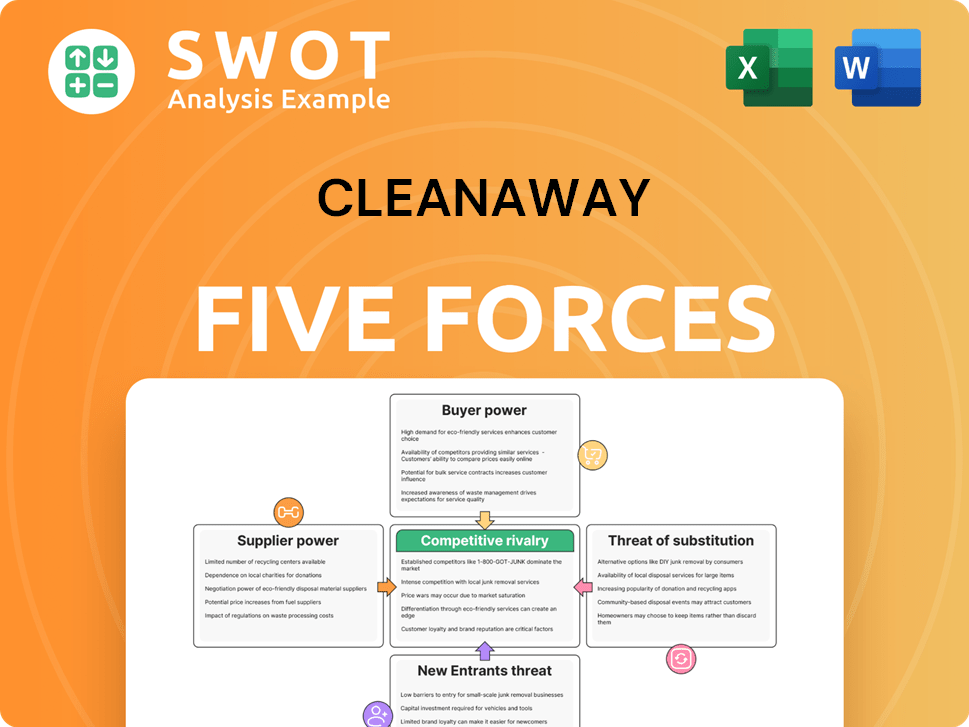

Cleanaway Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cleanaway Company?

- What is Competitive Landscape of Cleanaway Company?

- What is Growth Strategy and Future Prospects of Cleanaway Company?

- How Does Cleanaway Company Work?

- What is Sales and Marketing Strategy of Cleanaway Company?

- What is Brief History of Cleanaway Company?

- What is Customer Demographics and Target Market of Cleanaway Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.