Cleanaway Bundle

How Does Australia's Leading Waste Manager, Cleanaway, Operate?

Cleanaway Waste Management Limited stands as Australia's waste management leader, a cornerstone of the nation's environmental infrastructure. From residential bins to industrial sites, Cleanaway handles a vast array of waste and recycling needs. But how does this essential service operate, and what drives its success in a world increasingly focused on Cleanaway SWOT Analysis and environmental solutions?

Understanding Cleanaway's operations is vital for investors, customers, and industry watchers alike. This exploration will unveil the mechanics behind its waste management services, from waste disposal methods to its commitment to recycling services. We'll examine how Cleanaway leverages its scale and strategic initiatives to navigate the complexities of the industry, providing a comprehensive view of its business model and sustainability initiatives.

What Are the Key Operations Driving Cleanaway’s Success?

Cleanaway's core operations are centered on providing integrated waste management solutions across Australia. The company focuses on transforming waste into valuable resources while minimizing environmental impact. They serve a wide array of customers, including local councils, commercial businesses, and large industrial clients.

The company's value proposition lies in its ability to offer comprehensive waste management services. This includes general waste collection, recycling services, liquid waste treatment, hazardous waste management, and industrial services. Cleanaway's operational processes are extensive and highly integrated, utilizing a vast fleet of specialized vehicles and a sophisticated logistics network for efficient waste collection and processing.

Cleanaway's integrated approach allows for economies of scale, optimized resource allocation, and efficient handling of complex waste streams. This translates into significant customer benefits, such as compliance with environmental regulations, reduced operational costs, and enhanced sustainability through increased recycling and resource recovery.

Cleanaway offers a wide range of services, including general waste collection, recycling, liquid waste treatment, and hazardous waste management. They also provide industrial services such as site remediation and emergency spill response. These services cater to diverse customer needs across various sectors.

The operational processes involve a vast fleet of vehicles and a sophisticated logistics network. Materials recovery facilities (MRFs) are key for recycling, employing advanced sorting technologies. Specialized treatment plants manage liquid and hazardous waste, adhering to strict environmental regulations.

Customers benefit from compliance with environmental regulations, reduced operational costs, and enhanced sustainability. Cleanaway's integrated approach provides a 'one-stop shop' for diverse waste management needs. This leads to efficient waste management and resource recovery.

Cleanaway is committed to sustainability through increased recycling and resource recovery efforts. They operate landfills designed to minimize environmental impact and, in some cases, capture landfill gas for energy generation. They are constantly working on environmental solutions.

In fiscal year 2024, Cleanaway handled approximately 11.2 million tonnes of waste and recovered materials. The company operates over 200 sites across Australia, including landfills, transfer stations, and recycling facilities. Cleanaway's revenue for the 2024 financial year was approximately $3.2 billion.

- Cleanaway's recycling facilities processed over 1.3 million tonnes of recyclable materials in 2024.

- The company has invested significantly in advanced sorting technologies to improve recycling efficiency.

- Cleanaway is focused on expanding its renewable energy initiatives, including landfill gas-to-energy projects.

- The company's commitment to sustainability is evident in its waste disposal methods.

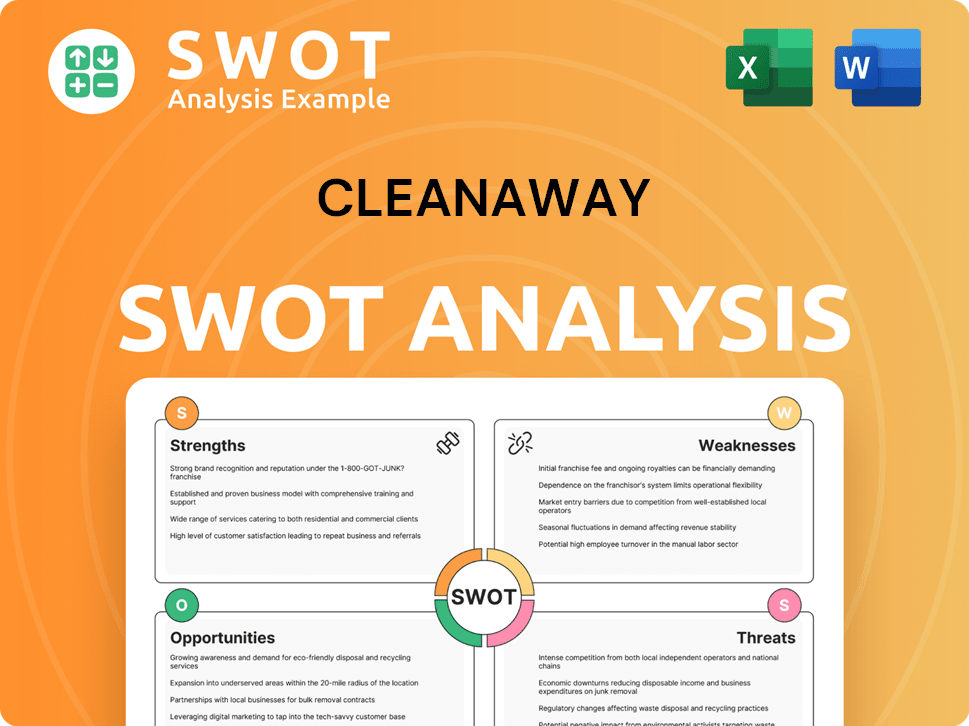

Cleanaway SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cleanaway Make Money?

Cleanaway's revenue streams are diverse, reflecting its comprehensive approach to waste management. The company generates income from collection services, post-collection services, and industrial and waste services. For the first half of the 2024 financial year (1H FY24), Cleanaway reported revenue of approximately AUD 1,933.7 million, marking a 13.9% increase compared to the previous year.

Collection services, including general waste, recycling, and organics collection, form a significant portion of its revenue, serving municipal, commercial, and industrial clients. Post-collection services, such as processing recyclables and landfill operations, also contribute substantially. Cleanaway monetizes these services through various pricing models, including contractual agreements and volume-based pricing.

Industrial and waste services, encompassing hazardous waste management and specialized cleaning services, represent another key revenue source. These services often involve project-based contracts, which command higher margins. Cleanaway also generates revenue from the sale of recovered resources like recycled paper and plastics.

Cleanaway employs various strategies to monetize its services and maximize revenue. These strategies include contractual agreements, volume-based pricing, and gate fees. The company focuses on cross-selling services and providing bundled solutions to enhance customer relationships.

- Collection Services: Revenue is generated through contracts with municipalities and volume-based pricing for commercial and industrial clients.

- Post-Collection Services: Income comes from processing recyclables and landfilling, with pricing based on gate fees.

- Industrial and Waste Services: Revenue is earned through project-based contracts and specialized recurring services, often at higher margins.

- Resource Recovery: Cleanaway sells recovered materials like paper, plastics, and metals, though revenue can fluctuate with commodity prices.

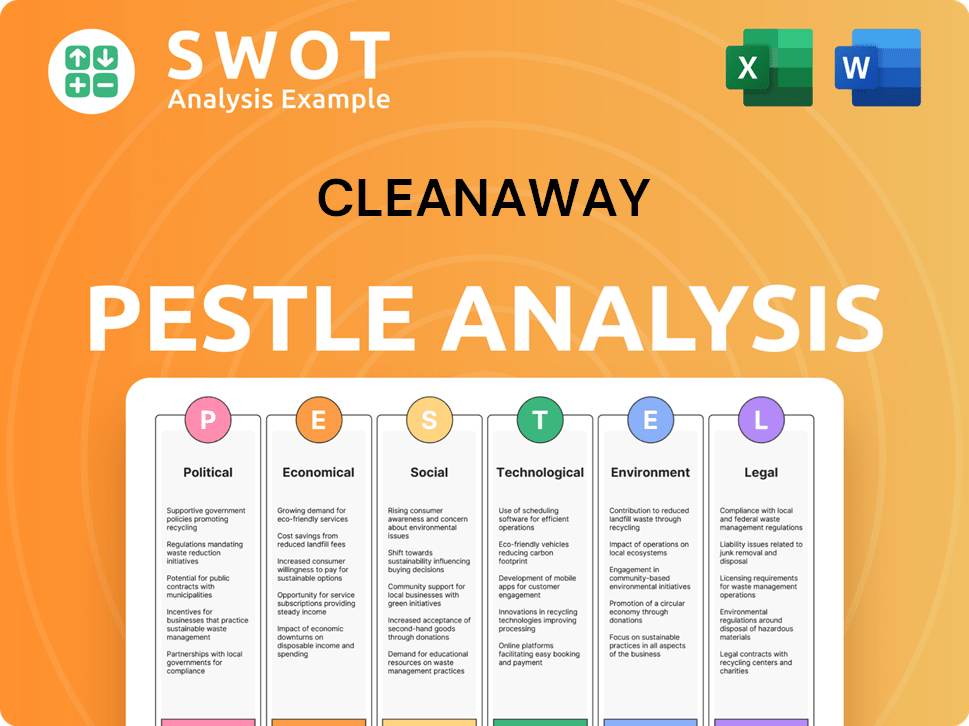

Cleanaway PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Cleanaway’s Business Model?

The journey of Cleanaway, a key player in the Australian waste management sector, has been marked by strategic initiatives and significant milestones. A notable move was the acquisition of assets from Suez in 2021, which significantly expanded its operational footprint and capabilities. This strategic expansion enhanced its capacity in recycling services and municipal collections across the nation.

Cleanaway's operational approach includes addressing challenges such as fluctuating commodity prices for recycled materials and navigating evolving environmental regulations. The company has focused on operational efficiencies and diversifying its service offerings to overcome these hurdles. Its commitment to innovation is evident through investments in advanced technologies aimed at improving resource recovery rates and reducing reliance on landfilling.

Cleanaway's competitive advantages stem from its extensive national network and strong brand reputation. The company's comprehensive service offerings, combined with its focus on sustainability, position it favorably in a market increasingly focused on circular economy principles. Cleanaway consistently adapts to new trends by investing in innovative technologies and expanding its service portfolio to meet evolving customer and regulatory requirements.

The acquisition of assets from Suez in 2021 was a pivotal moment, significantly expanding Cleanaway's operational scale. The Energy-from-Waste facility in Western Sydney represents a significant investment in sustainable waste management. These moves have helped to solidify its position in the industry.

Cleanaway focuses on operational efficiencies and service diversification to navigate market challenges. Investments in advanced technologies are key to improving resource recovery. These strategic decisions help the company adapt to evolving market needs and regulatory changes.

Cleanaway's extensive national network provides significant economies of scale and geographic reach. The company benefits from a strong brand reputation and a focus on environmental responsibility. This positions Cleanaway favorably in the waste management market.

Fluctuating commodity prices and evolving environmental policies pose ongoing challenges. Cleanaway responds by focusing on operational efficiencies and service diversification. These strategies are crucial for maintaining profitability and compliance.

In the financial year 2023, Cleanaway reported a revenue of $3.35 billion. The company's focus on environmental solutions is reflected in its investments in advanced sorting technologies and resource recovery infrastructure. Cleanaway's commitment to sustainability is evident in its ongoing projects and initiatives.

- Cleanaway operates across a vast network of locations, including collection vehicles, transfer stations, and landfills.

- The company has been actively involved in various sustainability initiatives, aiming to reduce waste and promote recycling.

- Cleanaway's commitment to innovation and expansion is evident in its strategic acquisitions and infrastructure investments.

- The company's focus on operational efficiency and service diversification has helped it navigate market challenges.

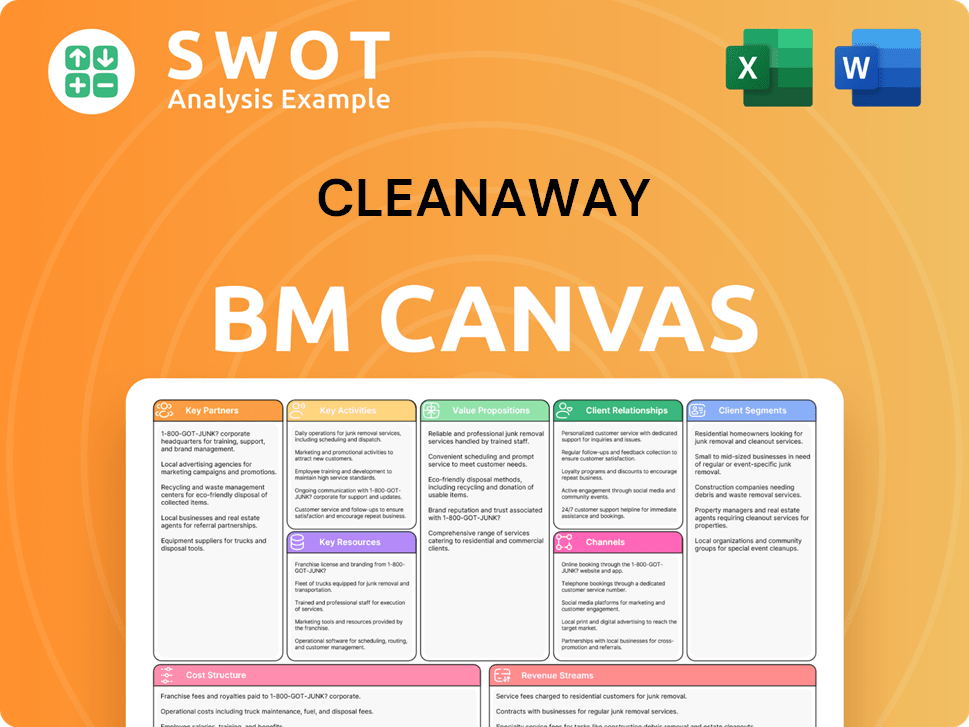

Cleanaway Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Cleanaway Positioning Itself for Continued Success?

In the Australian waste management sector, Cleanaway holds a leading position. It has a significant market share across municipal, commercial, and industrial sectors. Its extensive infrastructure and service offerings contribute to strong customer loyalty. This is especially true with long-term municipal contracts and integrated solutions for commercial and industrial clients. The company's national reach gives it a competitive edge over regional players.

However, Cleanaway faces several risks and headwinds. These include regulatory changes impacting operational costs and revenue. New competitors, particularly those with sustainable solutions, could pose a threat. Technological advancements and changes in consumer preferences also influence waste volumes and service needs. Economic downturns can affect industrial waste generation and commercial activity, impacting revenue.

Cleanaway is a major player in the Australian waste management industry. It has a substantial market share across different sectors. Its broad service offerings and national reach provide a strong competitive advantage. Strong customer relationships are a key factor in its success.

Regulatory changes, such as those related to waste levies and recycling targets, can impact operations. Competition from companies offering sustainable solutions poses a threat. Technological advancements and shifting consumer preferences also present challenges. Economic downturns can affect revenue.

Cleanaway aims to expand its profitability by leveraging its integrated network. It plans to invest in innovation and capitalize on the growing demand for sustainable waste management solutions. The company is focused on resource recovery infrastructure and operational efficiency improvements.

Cleanaway is investing in resource recovery infrastructure, such as advanced sorting facilities. It is also developing energy-from-waste projects to enhance its sustainability credentials. The company is focused on improving operational efficiency through technology and optimizing its logistics network.

Cleanaway's future appears strong, driven by increasing population, stricter environmental regulations, and a societal shift towards greater resource recovery. The company plans to sustain and expand its profitability by leveraging its integrated network, investing in innovation, and capitalizing on the growing demand for sustainable waste management solutions, including potential expansion into emerging areas like plastics reprocessing and advanced recycling technologies. The company's financial performance shows resilience, with revenue and earnings demonstrating a positive trend. For example, the company's revenue in FY23 was over $3.2 billion, reflecting a solid performance in the waste management and recycling services sector. This growth is supported by strategic investments in infrastructure and a focus on operational efficiency. The company's commitment to environmental solutions and sustainability initiatives further strengthens its position in the market. Cleanaway's dedication to a circular economy model also positions it well for future growth.

Cleanaway's success is driven by its strong market position, strategic initiatives, and focus on sustainability. The company's integrated network and investment in innovation are key to its growth. It benefits from increasing demand for sustainable waste management solutions.

- Dominant market share in Australia.

- Investment in resource recovery infrastructure.

- Focus on operational efficiency and technology.

- Commitment to a circular economy model.

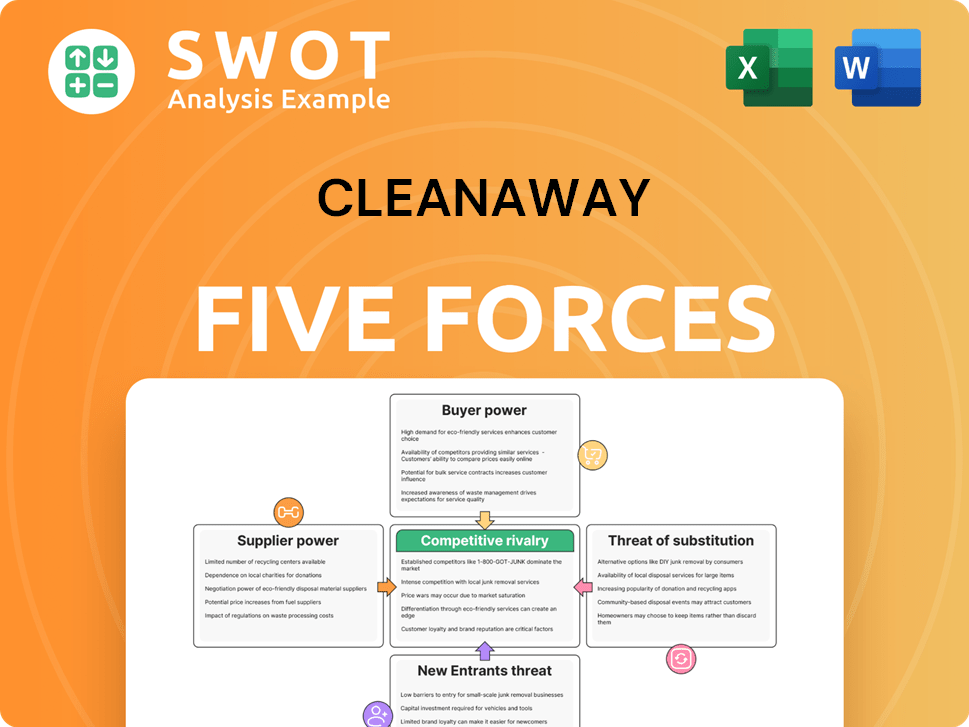

Cleanaway Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cleanaway Company?

- What is Competitive Landscape of Cleanaway Company?

- What is Growth Strategy and Future Prospects of Cleanaway Company?

- What is Sales and Marketing Strategy of Cleanaway Company?

- What is Brief History of Cleanaway Company?

- Who Owns Cleanaway Company?

- What is Customer Demographics and Target Market of Cleanaway Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.