Cleanaway Bundle

Can Cleanaway Continue to Dominate the Waste Management Industry?

Cleanaway Waste Management Limited, a leading Australian company, has built a strong foundation in the waste management industry. From its inception in 1979, Cleanaway has evolved to become Australia's largest waste management provider, offering a comprehensive suite of services. With a focus on sustainability, the company is strategically positioned for future growth.

This deep dive into Cleanaway SWOT Analysis will explore the company's Cleanaway growth strategy, examining its expansion initiatives, technological advancements, and financial outlook. We'll analyze the Cleanaway's sustainability report and how it plans to navigate the dynamic waste management industry, including its Cleanaway future prospects. Understanding Cleanaway's Cleanaway company analysis is crucial for investors and stakeholders alike, given the increasing demand for environmental services and sustainable practices.

How Is Cleanaway Expanding Its Reach?

The Cleanaway brief history reveals a strong focus on expansion, which is a key driver of its growth strategy. This involves strategic acquisitions, organic growth, and the development of new services and infrastructure. These initiatives are designed to enhance its market position and capabilities within the waste management industry.

Cleanaway's future prospects are closely tied to these expansion efforts. The company is actively seeking to integrate waste streams and develop resource recovery capabilities. These strategic moves are aimed at capturing new opportunities and enhancing its long-term growth potential within the environmental services sector.

Cleanaway's strategic acquisitions and infrastructure developments are central to its growth strategy. These initiatives are designed to increase its market share and enhance its service offerings. The company's focus on sustainability initiatives also supports its long-term growth prospects.

In June 2024, Cleanaway acquired Citywide Service Solutions Pty Ltd's waste and recycling business for $110 million. This strategic move is intended to expand Cleanaway's Victorian Solids business in metropolitan Melbourne. The Dynon Road facility redevelopment is planned to nearly double its capacity.

This acquisition aligns with Cleanaway's objective to integrate waste streams into its post-collection assets. It is expected to unlock earnings growth from FY26. This expansion supports future volume growth and strengthens Cleanaway's market position.

In March 2025, Cleanaway agreed to acquire Contract Resources Group Pty Ltd for $239 million. This acquisition is designed to diversify revenue streams and enhance service offerings. The company is expected to contribute approximately $12 million in annual net cost synergies.

The acquisition of Contract Resources Group is expected to provide high-single-digit EPS accretion in the first 12 months. This strategic move enhances Cleanaway's presence in the industrial and waste services sector. This demonstrates Cleanaway's commitment to growth and diversification.

Cleanaway is actively expanding its resource recovery capabilities, particularly in organics processing. The Eastern Creek Organics (ECO) Food and Garden Organics (FOGO) facility in NSW is a key example. This facility accelerates the transition to meet growing customer demand and state government policies for landfill diversion.

The ECO FOGO facility, which began processing FOGO from Sydney metropolitan councils in October 2024, has a capacity of up to 220,000 tonnes annually. It aims to reduce methane emissions and conserve landfill space by converting food waste into compost. The Western Sydney Material Recovery Facility (MRF) is expected to be commissioned in early 2025.

These initiatives underscore Cleanaway's commitment to enabling Australia's circular economy. The focus is on recovering valuable resources and reducing environmental impact. Cleanaway is investing in infrastructure and technologies to support this goal.

The expansion of resource recovery capabilities and strategic acquisitions are central to Cleanaway's long-term strategy. This approach supports the company's sustainability initiatives and enhances its competitive position in the waste management industry.

Cleanaway's expansion initiatives are focused on strategic acquisitions and organic growth. These efforts are designed to enhance its market share and service offerings. The company's commitment to sustainability is a key driver of its long-term strategy.

- Acquisition of Citywide's waste and recycling business for $110 million in June 2024.

- Acquisition of Contract Resources Group Pty Ltd for $239 million in March 2025.

- Expansion of resource recovery capabilities, including the ECO FOGO facility.

- Commissioning of the Western Sydney Material Recovery Facility (MRF) in early 2025.

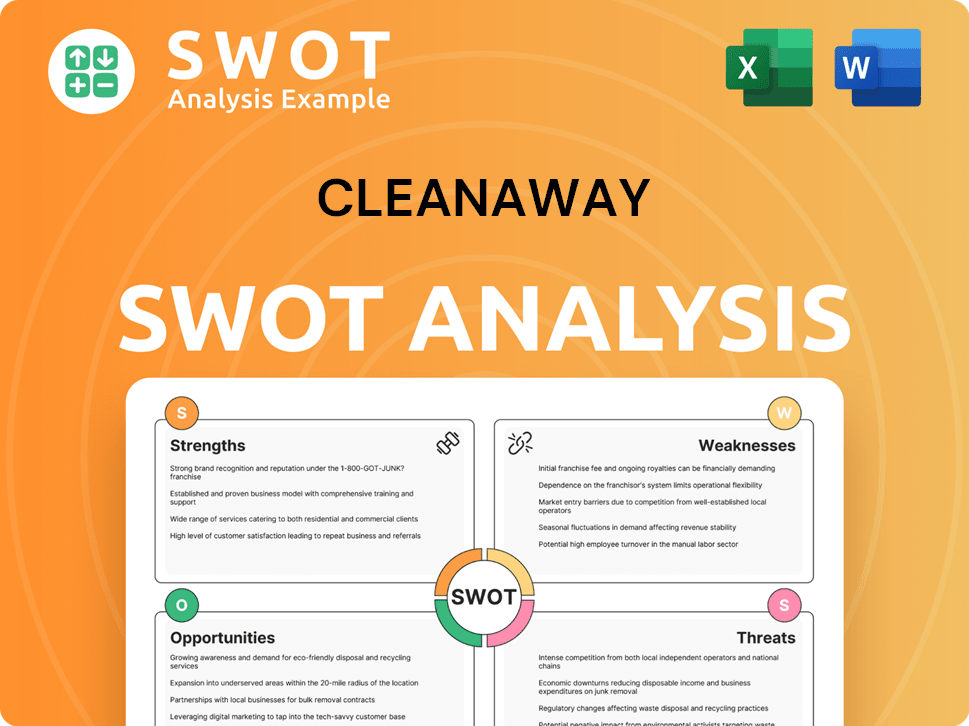

Cleanaway SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cleanaway Invest in Innovation?

The company strategically integrates technology and innovation to boost operational effectiveness, improve customer service, and foster sustainable expansion, aligning with its Blueprint 2030 strategy. This approach is crucial for maintaining its position in the competitive waste management industry.

A key aspect of the company's strategy involves significant investments in digital transformation and cutting-edge technologies. These initiatives are designed to enhance its environmental services and drive long-term growth. This focus is critical for the company's future prospects and market share analysis.

The company's commitment to innovation is evident in its ongoing projects and strategic partnerships. By leveraging data analytics, optimizing operations, and investing in environmental solutions, the company aims to achieve its financial goals and contribute to a circular economy.

The company is undertaking a $100 million, four-year CustomerConnect digital transformation program. This program is at its halfway point as of August 2024.

The CustomerConnect program involves upgrading IT infrastructure and digitizing the 'call-to-cash' process. This creates a foundation for advanced analytics and AI initiatives.

CustomerConnect is expected to deliver over $5 million in EBIT in FY26. This figure is projected to more than double in FY27.

Data and analytics tools are actively used to optimize operations and pricing. Labor dashboards and route optimization are examples.

In FY24, data-enabled tools were implemented in Queensland solid waste operations. This led to improved service levels and enabled price increases.

The Health Services business utilized data-driven tools to expand its EBIT margin.

The company invests in cutting-edge technologies to enhance its environmental solutions. This includes a focus on landfill gas capture and monetization, a key part of its Operational Excellence program. These advancements are crucial for the company's Mission, Vision & Core Values of Cleanaway.

- A joint venture announced in December 2024 is expected to contribute approximately $5 million in incremental EBIT in FY25.

- The joint venture is projected to contribute $10 million in FY26, with $15 million annually beyond FY26.

- The company is working on commissioning a PFAS wastewater treatment plant at Campbellfield, Victoria, in FY25.

- The company is expanding into decommissioning and remediation services.

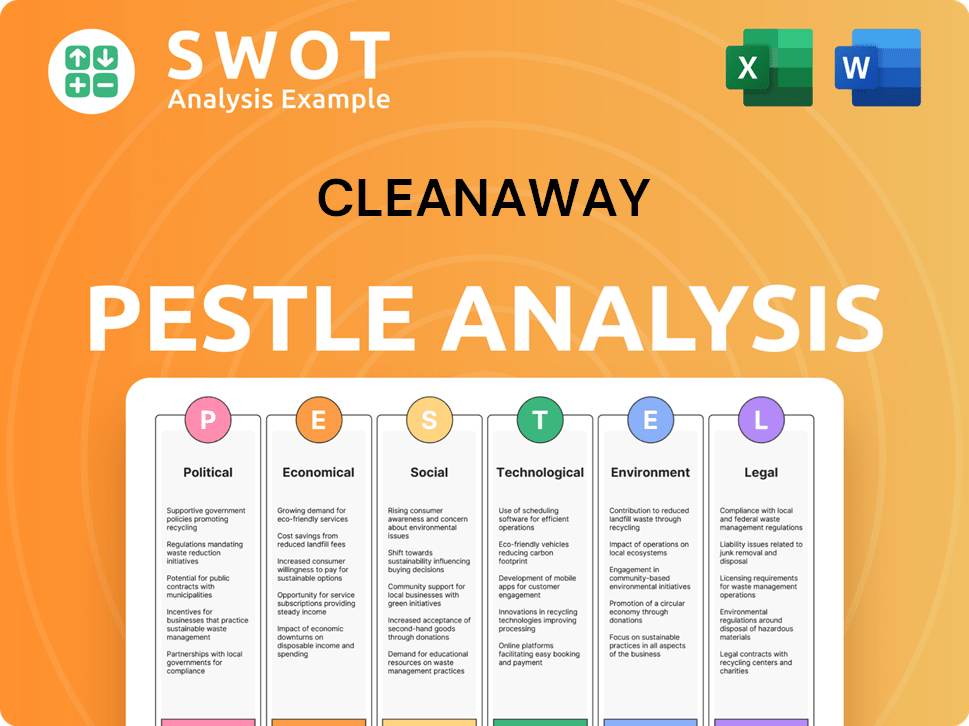

Cleanaway PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Cleanaway’s Growth Forecast?

The financial outlook for Cleanaway is robust, supported by strong recent performance and ambitious targets. The company's Cleanaway growth strategy focuses on sustainable expansion within the waste management industry. Recent financial results demonstrate the effectiveness of these strategies, positioning the company for continued success.

Cleanaway's Cleanaway future prospects are promising, driven by its strategic initiatives and operational efficiencies. The company's commitment to sustainability and the circular economy further enhances its long-term value proposition. Investors and stakeholders can expect continued growth and value creation.

For the fiscal year ending June 30, 2024 (FY24), Cleanaway reported a statutory net profit of $158.2 million, a significant increase from $23.5 million in FY23. This performance underscores the company's strong financial position and effective operational strategies. The company's underlying net profit after tax (NPAT) grew by 14.8% to $170.6 million.

Net revenue increased by 7.7% to $3,194.5 million. Underlying EBIT grew by 18.9% to $359.2 million. The underlying EBIT margin expanded by 100 basis points to 11.2%.

Cleanaway is on track to achieve its third consecutive year of underlying double-digit EBIT growth in FY25. The company expects its underlying EBIT for FY25 to be in the range of $395 million to $425 million.

Total capital expenditure for FY25 is forecast to be approximately $400 million. Cleanaway remains confident in delivering its mid-term EBIT ambition of over $450 million by FY26.

Gross revenue up 3.7% to $1,940.2 million and net revenue up 4.6% to $1,659.4 million. Underlying EBIT increased by 12.2% to $195.2 million, with an EBIT margin expansion of 80 basis points to 11.8%.

The company's return on invested capital (ROIC) improved by 60 basis points to 5.5% in FY24, supporting the Blueprint 2030 mid-term ambition. Cleanaway's balance sheet is conservatively positioned, providing flexibility for further capital investment in post-collection infrastructure assets. Analysts forecast Cleanaway's earnings and revenue to grow by 17.4% and 5.7% per annum, respectively.

Cleanaway has resumed payment of 100% franked dividends. A final franked dividend of 2.55 cents per share was declared for FY24. The company's financial health is reflected in its strong revenue growth and profitability.

- Robust financial performance in FY24.

- Positive outlook for FY25 with continued EBIT growth.

- Strategic focus on capital investment and infrastructure.

- Strong ROIC and a conservative balance sheet.

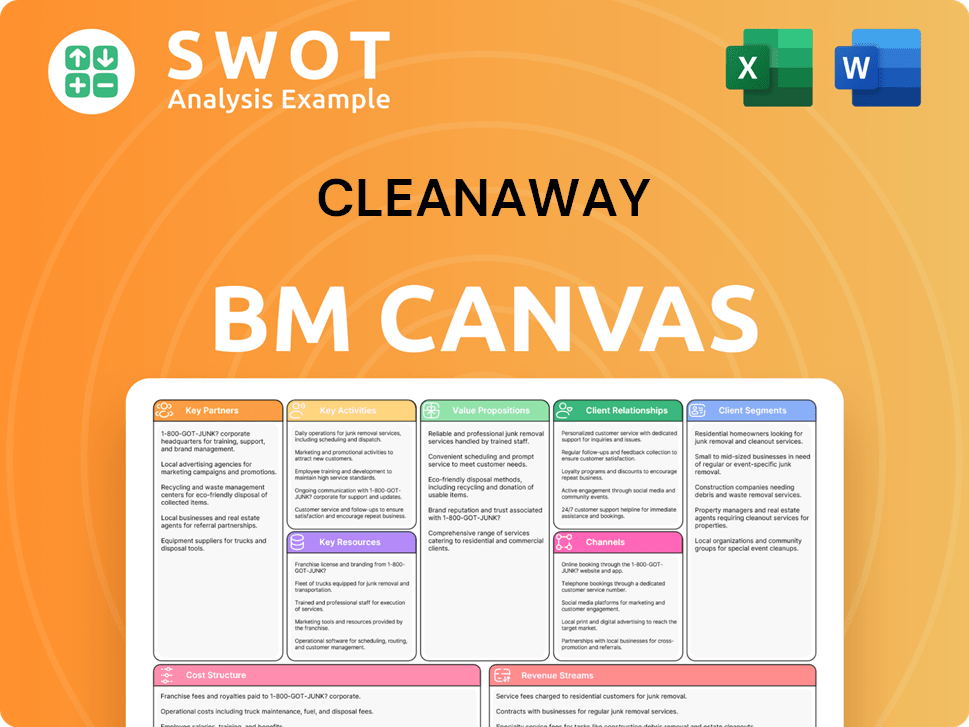

Cleanaway Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Cleanaway’s Growth?

The path to growth for Cleanaway is not without its challenges. Several factors could potentially hinder its strategic objectives and impact its financial performance. Understanding these risks is crucial for assessing the company's overall outlook and investment potential. This Cleanaway company analysis highlights key areas of concern.

The waste management industry is complex, and Cleanaway's future prospects are intertwined with several external and internal factors. These range from competitive pressures to regulatory changes and operational risks. A thorough understanding of these elements is essential for investors and stakeholders.

Cleanaway's strategic plan for expansion and its ability to navigate these obstacles will significantly influence its success. This assessment provides insights into the potential roadblocks that Cleanaway must address to achieve its goals.

The waste management industry is highly competitive, with major players like Veolia and Suez. These competitors have strategically located post-collection assets, offering cost advantages. This intense competition could impact Cleanaway's revenue and market share gains. Cleanaway's competitive landscape includes established firms with significant resources.

The waste management industry is heavily regulated, and changes in government policies pose ongoing challenges. Landfill diversion targets and levies, such as Victoria's waste levy of $132.76 per tonne for 2024-2025, can affect operational costs. Cleanaway's ability to adapt to these regulatory changes is critical for its financial performance review.

Supply chain issues and inflationary pressures, including higher labor and fuel costs, can impact profitability. While Cleanaway uses pricing strategies to recover costs, these remain a significant factor. Labor efficiency and workforce stability are also vital, with the company aiming to reduce vacancies and turnover to improve productivity.

Technological advancements in waste processing and resource recovery can disrupt the industry. Failure to keep pace with these innovations presents a risk. Cleanaway's innovation in waste management is essential to maintain a competitive edge and capitalize on new opportunities.

Environmental, Social, and Governance (ESG) risks, particularly concerning greenhouse gas emissions, introduce uncertainty. While Cleanaway has set targets for reducing carbon dioxide and methane emissions by 2030, the lack of clear plans for electrifying its fleet and potential investments in waste-to-energy facilities introduce environmental considerations. Cleanaway's sustainability report is crucial.

Operational risks, such as fire incidents at facilities, can lead to significant costs and disruptions. For example, the financial impact of a fire at St Marys in February 2025 is estimated to be between $20 million and $40 million, net of insurance recoveries. Cleanaway addresses these risks through diversification, risk management frameworks, and a five-year Health, Safety, and Environment (HSE) strategy.

Cleanaway is committed to a Critical Risk Program to raise awareness of high-consequence events. The company focuses on initiatives to improve operational efficiency and reduce costs. Its long-term business strategy includes investments in infrastructure and technology to enhance its waste management solutions. For more information about Cleanaway's target market, see Target Market of Cleanaway.

Investors should consider the potential impact of regulatory changes and market competition on revenue growth. Supply chain disruptions and inflationary pressures can affect profitability. The company's ability to manage operational risks and adapt to technological advancements is also critical. Understanding these factors provides insights into Cleanaway's investment opportunities.

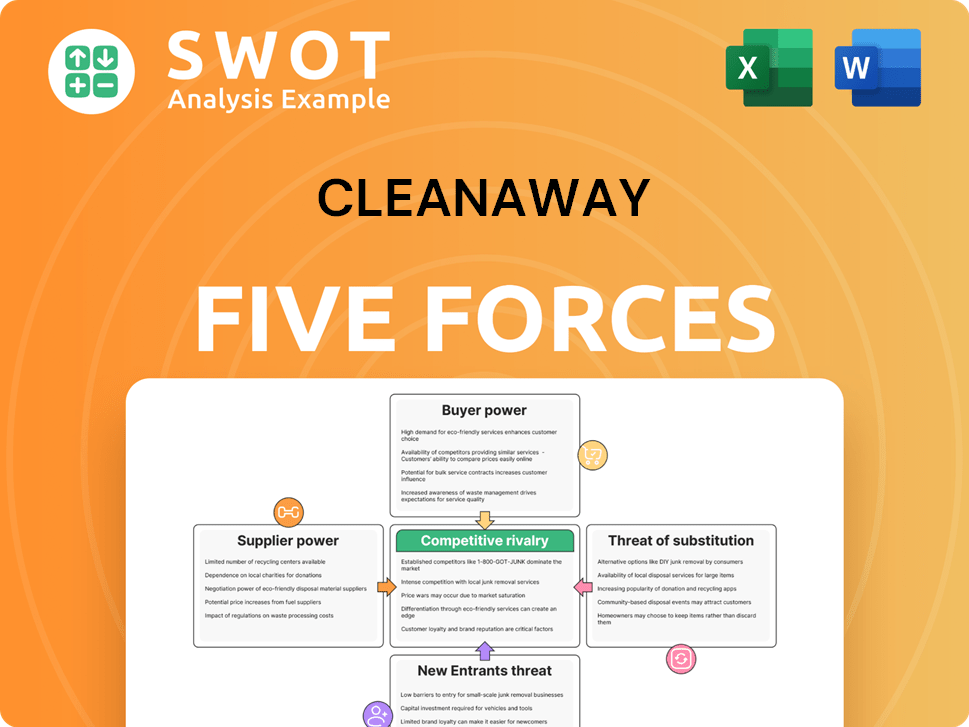

Cleanaway Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cleanaway Company?

- What is Competitive Landscape of Cleanaway Company?

- How Does Cleanaway Company Work?

- What is Sales and Marketing Strategy of Cleanaway Company?

- What is Brief History of Cleanaway Company?

- Who Owns Cleanaway Company?

- What is Customer Demographics and Target Market of Cleanaway Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.