Coinbase Bundle

How Did Coinbase Conquer the Crypto World?

Coinbase, a titan in the cryptocurrency exchange arena, has been a driving force in the digital asset revolution since 2012. From its humble beginnings, the company set out to democratize financial systems, aiming to make cryptocurrencies accessible to everyone. This ambition fueled Coinbase's vision of a future where crypto reshapes financial services, positioning it as a global leader.

Coinbase's journey began in San Francisco, simplifying access to Coinbase SWOT Analysis, Bitcoin, and Ethereum. Today, it's the largest U.S.-based cryptocurrency exchange, boasting over 108 million users and managing over $400 billion in assets as of 2024. This growth highlights Coinbase's resilience and ability to capitalize on the long-term potential of the crypto market, even amid market volatility and regulatory challenges. The Coinbase company has shown significant growth in the cryptocurrency exchange market.

What is the Coinbase Founding Story?

The story of Coinbase begins in June 2012, when Brian Armstrong and Fred Ehrsam came together in San Francisco, California, to create what would become a leading cryptocurrency exchange. Their mission was ambitious: to foster economic freedom worldwide by establishing an open and accessible financial system based on crypto assets. This vision drove them to build a platform where anyone could easily interact with digital currencies.

Their initial focus was on providing a secure and user-friendly way to buy, sell, and store cryptocurrencies, beginning with Bitcoin. This approach filled a crucial gap in the market, making cryptocurrencies accessible to a broader audience. The early days were marked by a commitment to simplifying the complex world of digital assets, which helped pave the way for mass adoption.

Coinbase's original business model centered on being a cryptocurrency exchange platform. This allowed users to buy and sell digital assets using traditional payment methods. A key early product was the U.S.-based Bitcoin exchange, launched in January 2015 as Coinbase Exchange. The name itself, 'coin base,' reflected the company's goal of providing a fundamental platform for digital currencies. Early financial backing was critical, with a notable $75 million investment in January 2015, led by Draper Fisher Jurvetson, the New York Stock Exchange, and USAA. This investment was the largest in a Bitcoin company at the time, signaling strong confidence in the future of Coinbase and the cryptocurrency market.

Coinbase's early days were focused on creating a user-friendly platform for buying, selling, and storing cryptocurrencies, starting with Bitcoin. The company aimed to simplify the complex world of digital assets.

- Coinbase founder: Brian Armstrong and Fred Ehrsam.

- Coinbase headquarters location: San Francisco, California.

- Coinbase early days: Focused on providing a secure and user-friendly platform for buying, selling, and storing cryptocurrencies.

- Coinbase trading platform: Initially focused on Bitcoin, later expanding to other cryptocurrencies.

The Marketing Strategy of Coinbase has been pivotal in its growth. Coinbase expanded its support to include Ethereum and other cryptocurrencies, responding to market demand and technological advancements. By 2024, Coinbase had a user base in the tens of millions, demonstrating significant user base growth. The platform's security features, including two-factor authentication and cold storage for digital assets, were crucial in building trust. Coinbase has navigated numerous regulatory challenges, adapting to evolving legal landscapes in various jurisdictions. The company's market capitalization has fluctuated significantly, reflecting the volatility of the cryptocurrency market.

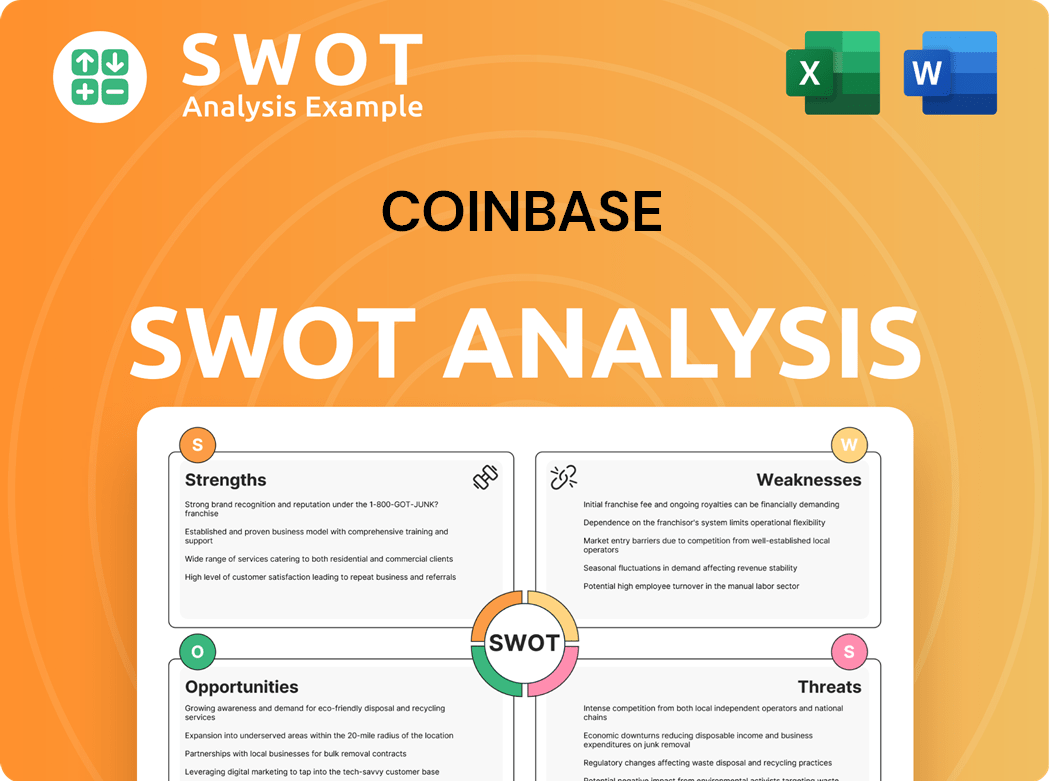

Coinbase SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Coinbase?

The early years of Coinbase witnessed remarkable growth and expansion. From its inception, the company quickly established itself as a leading platform in the cryptocurrency space. This period was marked by strategic moves, significant user base expansion, and substantial capital raises, shaping Coinbase into a major player in the digital asset market. Learn more about the Owners & Shareholders of Coinbase.

In its early days, Coinbase quickly gained recognition as the highest-funded Bitcoin startup and the largest cryptocurrency exchange platform. The company expanded its services rapidly. In 2016, it began accepting Ethereum transactions. The rebranding of Coinbase Exchange to Global Digital Asset Exchange (GDAX) in May 2016, and then to 'Coinbase Pro' in 2018, was a strategic move to differentiate the trading platform.

Coinbase expanded geographically, offering services in Canada and Singapore by September 2015. The company's user base grew significantly, reaching over 35 million users by February 2024 and 105 million registered users by 2024. By Q1 2024, there were 10.8 million active monthly users.

Major capital raises continued, including the $75 million investment in 2015. Coinbase also engaged in strategic partnerships, notably with Circle and Bitmain to launch the USDCoin stablecoin. In 2024, the company's revenue reached $6.2 billion, a 113% increase from the previous year, driven by increased trading activity and higher cryptocurrency prices.

Institutional transaction revenues rose to $345 million in 2024 from $90 million in 2023, fueled by increased institutional adoption. As of Q1 2024, assets on the Coinbase platform reached a record high of $334.71 billion, indicating growing investor confidence. The company transitioned to a remote-first company during the COVID-19 pandemic, adapting its operational model.

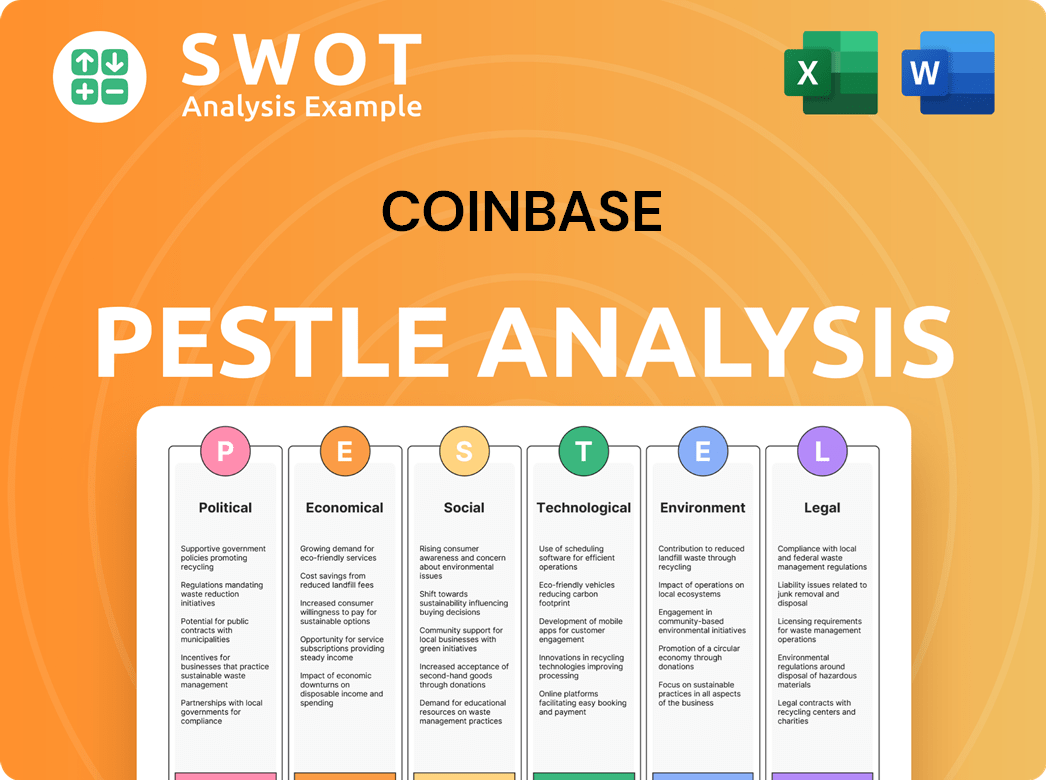

Coinbase PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Coinbase history?

The history of the Coinbase company is marked by significant milestones, including becoming the first crypto company to go public. In 2024, it achieved another first by joining the S&P 500 index.

| Year | Milestone |

|---|---|

| April 2021 | Coinbase became the first cryptocurrency company to go public. |

| May 19, 2025 | Coinbase was the first crypto company to join the S&P 500 index, replacing Discover Financial Services. |

Coinbase has consistently introduced new products and services, expanding its offerings to include staking services, where users can earn interest on their locked crypto. Innovations also include the co-founding of the USDC stablecoin.

Coinbase has expanded its offerings to include staking services, allowing users to earn interest on their locked cryptocurrency holdings. This diversification provides additional value to users and generates new revenue streams for the company.

Coinbase co-founded the USDC stablecoin, a significant innovation in the cryptocurrency space. This stablecoin offers a reliable and regulated digital currency option, enhancing the stability and usability of the platform.

Coinbase has focused on building trust and security within the crypto market, notably never experiencing a direct hacking incident that led to wallet theft. This commitment to security has been a cornerstone of its operations, building user trust.

Despite its achievements, Coinbase has faced challenges like market volatility and regulatory uncertainty. The company also dealt with a data breach in May 2025, impacting approximately 69,461 accounts.

The inherent volatility of the cryptocurrency market directly impacts Coinbase's trading volumes and stock performance. For instance, Coinbase's stock experienced its worst quarterly performance since the FTX collapse, dropping 33% in Q1 2025.

Regulatory uncertainty has been a persistent hurdle, with varying approaches by regulatory agencies creating inconsistencies. Coinbase has actively engaged with regulators to advocate for clear rules, and a positive development was the SEC's agreement in principle to dismiss charges against Coinbase on February 21, 2025.

Coinbase faced a data breach in May 2025, resulting from insider manipulation and an extortion attempt, impacting sensitive personal data of approximately 69,461 accounts. Coinbase responded by refusing to pay the $20 million ransom and committing to reimburse affected customers, with estimated costs ranging from $180 million to $400 million.

Competitive pressure from new entrants and established players in the cryptocurrency exchange sector is another ongoing challenge. This requires Coinbase to continuously innovate and adapt to maintain its market position.

In response to these challenges, Coinbase has strategically diversified its revenue streams beyond transaction fees. This focus on subscription and services revenue, which grew by 64% in 2024 compared to 2023, demonstrates the company's adaptability.

Coinbase Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Coinbase?

The story of the Coinbase history began in June 2012 when Brian Armstrong and Fred Ehrsam founded the company. It quickly grew to become a leading cryptocurrency exchange, marked by significant milestones like its initial funding and expansion. Coinbase's journey includes navigating regulatory landscapes, technological advancements, and market fluctuations, all while striving to broaden the adoption of cryptocurrencies.

| Year | Key Event |

|---|---|

| June 2012 | Coinbase is founded by Brian Armstrong and Fred Ehrsam. |

| 2013 | Recognized as the highest-funded Bitcoin startup and largest crypto exchange platform. |

| January 2015 | Receives a $75 million investment; launches Coinbase Exchange for professional traders. |

| September 2015 | Expands services to Canada and Singapore. |

| May 2016 | Coinbase Exchange rebranded to Global Digital Asset Exchange (GDAX). |

| July 2016 | Adds retail support for Ether. |

| 2018 | GDAX rebranded to Coinbase Pro; Coinbase Custody and Wallet launched. |

| September 2018 | Partners with Circle and Bitmain to launch USDCoin. |

| May 2019 | Coinbase Prime launched. |

| April 2021 | Becomes the first crypto company to go public. |

| February 2022 | Shuts San Francisco HQ to promote a decentralized office strategy. |

| May 23, 2024 | U.S. Supreme Court affirms a decision in Coinbase, Inc. v. Suski. |

| Late April 2024 | Unusual login behavior detected from internal dashboards, leading to a data breach. |

| February 13, 2025 | Coinbase reports Q4 and full-year 2024 financial results, with annual revenue of $6.56 billion, a 111.17% increase from 2023. |

| February 21, 2025 | SEC agrees in principle to dismiss charges against Coinbase. |

| May 19, 2025 | Coinbase is included in the S&P 500 index. |

| May 28, 2025 | Details of the 2025 data breach, including a $20 million ransom refusal and customer reimbursement commitment, are reported. |

| May 29, 2025 | Coinbase Financial Markets announces 24/7 trading for BTC and ETH futures, and plans for perpetual-style futures in the US. |

Coinbase aims to become the world's leading financial services app within the next 5-10 years. This vision is fueled by the belief that cryptocurrency is reshaping financial services.

The company plans to expand its offerings, including staking, lending, and DeFi integrations. Geographic expansion, especially into emerging economies like India, is also a key part of its strategy.

Coinbase plans to onboard approximately 1,000 new team members by 2025, demonstrating its commitment to growth and talent acquisition. Analyst predictions indicate a consensus 12-month price target of $327.61 as of March 2025.

Some projections reach $732 by the end of 2025 and $1,446 per share by 2030. Institutional trading is expected to grow further, with a 2023 survey showing 64% of crypto investors planning to increase allocations.

CEO Brian Armstrong's goal is to make USDC the world's top stablecoin, further solidifying its role in the global financial system.

Ongoing regulatory clarity in the U.S. is expected to boost institutional confidence and encourage broader participation in the digital asset economy, significantly benefiting Coinbase.

The company's future is tied to the broader adoption of cryptocurrencies by individuals, businesses, and institutions. Coinbase's commitment to innovation and expansion positions it for continued growth.

The company's annual revenue reached $6.56 billion in 2024, a substantial increase of 111.17% from the previous year, demonstrating strong financial performance.

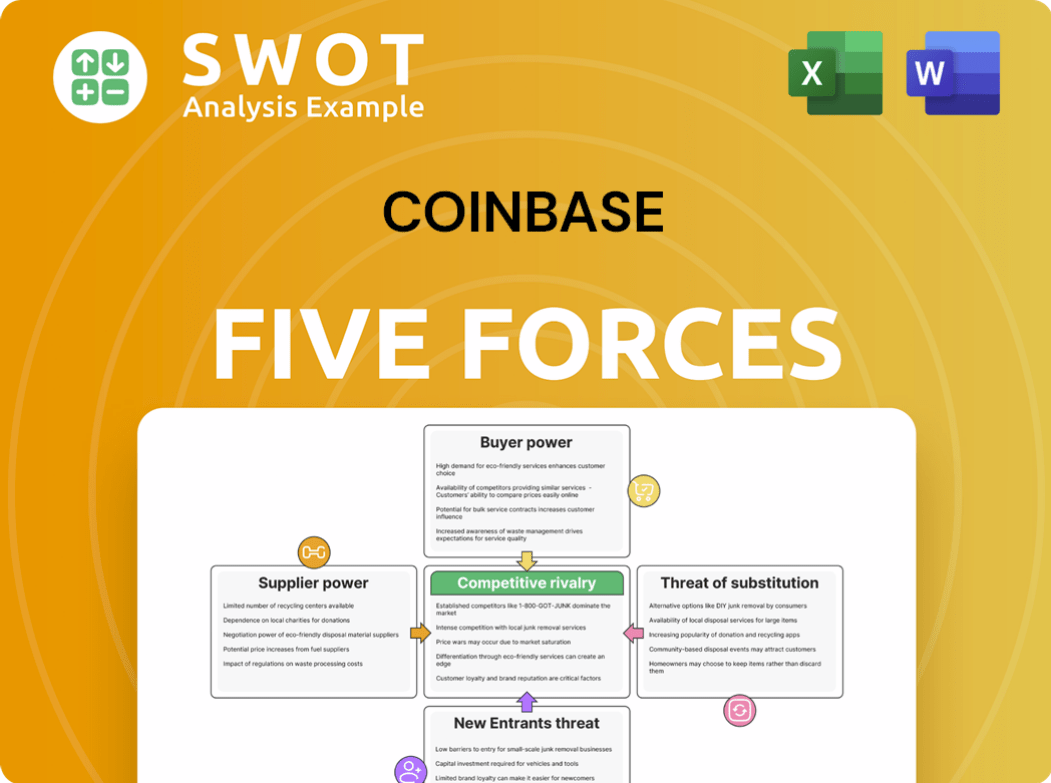

Coinbase Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Coinbase Company?

- What is Growth Strategy and Future Prospects of Coinbase Company?

- How Does Coinbase Company Work?

- What is Sales and Marketing Strategy of Coinbase Company?

- What is Brief History of Coinbase Company?

- Who Owns Coinbase Company?

- What is Customer Demographics and Target Market of Coinbase Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.