Coinbase Bundle

Who Are Coinbase's Customers?

In the rapidly evolving world of cryptocurrency, understanding the Coinbase SWOT Analysis is crucial. Coinbase, a pioneer in the crypto space, has experienced remarkable growth, including its S&P 500 inclusion in May 2025. But who exactly are the individuals and institutions driving this success? This analysis dives deep into the customer demographics and target market of Coinbase, exploring its evolution from early Bitcoin adopters to a broader, more diverse user base.

This exploration will help us understand the Coinbase target market and the Coinbase customer profile. We'll examine the customer demographics of Coinbase users, including their age, income, and geographic location, to understand how Coinbase has adapted to cryptocurrency adoption. By analyzing who uses Coinbase for crypto trading and their behaviors, we can gain valuable insights into the company's current and future strategies.

Who Are Coinbase’s Main Customers?

Understanding the customer demographics and target market is crucial for any business, and for Coinbase, it's key to its success. Coinbase has cultivated a diverse customer base, spanning both individual consumers (B2C) and businesses (B2B). This approach allows it to capture a broad spectrum of users, from those just starting in the crypto world to seasoned institutional investors.

The primary customer segments for Coinbase include a mix of crypto enthusiasts, individuals new to the cryptocurrency space, and institutional investors seeking to diversify their portfolios. This multifaceted approach to customer acquisition allows Coinbase to capture a wide range of users and maintain a robust trading volume. The company continues to evolve its offerings to meet the changing needs of its diverse customer base. For a look at the company's origins, check out Brief History of Coinbase.

Coinbase's ability to adapt to these shifts in the market and customer preferences is critical for its continued growth and relevance in the rapidly evolving cryptocurrency landscape. The company's focus on both retail and institutional clients highlights a strategic vision aimed at long-term sustainability and market leadership.

The retail customer base of Coinbase largely consists of millennials and Generation Z individuals. These users are typically early adopters of new technologies and are drawn to the accessibility of the platform. As of December 2024, Coinbase had 105 million registered users globally.

Coinbase also serves institutional investors, including hedge funds, asset managers, and corporate clients. The company offers specialized services and products tailored to the needs of these sophisticated investors. Institutional transaction revenues rose to $345 million in 2024 from $90 million in 2023.

In Q1 2024, Monthly Transacting Users (MTUs) reached 8 million, recovering from a low of 6.7 million in Q3 2023. New customers accounted for 5% of all deposits in December 2024, indicating a growing influx of new users. Existing customers tend to make larger deposits, averaging $1,191 in November 2024.

The launch of crypto ETFs in 2024 has further fueled momentum in institutional crypto trading, with Coinbase benefiting from this trend. The company's diversified offerings, including Coinbase Pro and custody services, aim to attract and serve this segment. The company's user acquisition strategy has been adapting to the evolving market.

Coinbase's target market is multifaceted, encompassing both retail and institutional investors. The company's success hinges on its ability to cater to a broad range of users. The company's growth is driven by market trends and strategic initiatives.

- Coinbase's customer base includes crypto users, beginners, and institutional investors.

- Cryptocurrency adoption is a key driver for Coinbase's growth.

- Coinbase customer profile is diverse, spanning millennials, Gen Z, and institutional clients.

- The company's focus on both retail and institutional clients is a strategic advantage.

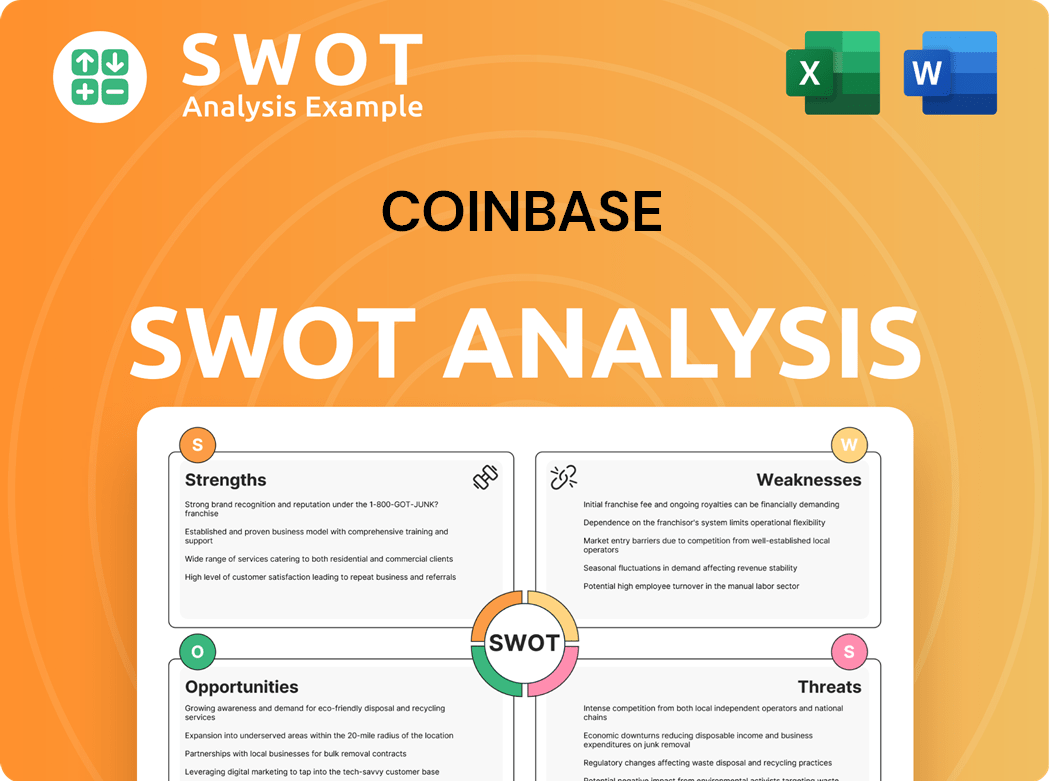

Coinbase SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Coinbase’s Customers Want?

Understanding the needs and preferences of the customer base is crucial for any business, and for Coinbase, this is particularly important in the rapidly evolving world of cryptocurrency. The platform’s success hinges on its ability to meet the demands of its users, from security and ease of use to a wide selection of digital assets and competitive fees. By focusing on these key areas, Coinbase aims to maintain a strong customer base and attract new users in the competitive crypto market.

Coinbase's customer base is driven by several key needs and preferences. Security and trust are paramount, as users must feel confident that their assets are protected against hacking and fraud. Ease of use is another critical factor, especially for those new to cryptocurrency. The platform also needs to offer a diverse range of supported assets, reliable customer support, and competitive fees to attract and retain users. These factors collectively shape the purchasing behaviors and decision-making processes of Coinbase users.

Coinbase addresses these needs through various offerings. The platform's user-friendly interface and educational resources, such as the 'Learn & Earn' campaign, attract beginners by simplifying the complex world of cryptocurrency. Simplified buying and selling options, secure storage, and quick conversion features meet user expectations. A wide range of cryptocurrencies, with over 200 available, caters to diverse user interests. These features collectively contribute to a positive user experience and encourage cryptocurrency adoption.

Coinbase continually adapts to customer feedback and market trends, expanding its product offerings to meet evolving needs. The company's subscription and services revenue, including staking and custodial fees, demonstrates the importance of diversified offerings. Coinbase personalizes its marketing and customer experiences to specific segments, enhancing user retention. For a deeper dive into the company's growth strategy, you can read more about it in this article: Growth Strategy of Coinbase.

- Security and Trust: Protection against hacking and fraud is a top priority for Coinbase users.

- Ease of Use: A user-friendly interface and straightforward processes are essential, especially for beginners.

- Variety of Assets: Access to a wide range of cryptocurrencies allows users to diversify their portfolios.

- Customer Support: Reliable and responsive customer support is crucial for addressing user issues.

- Competitive Fees: Users seek competitive fees for trading and other services.

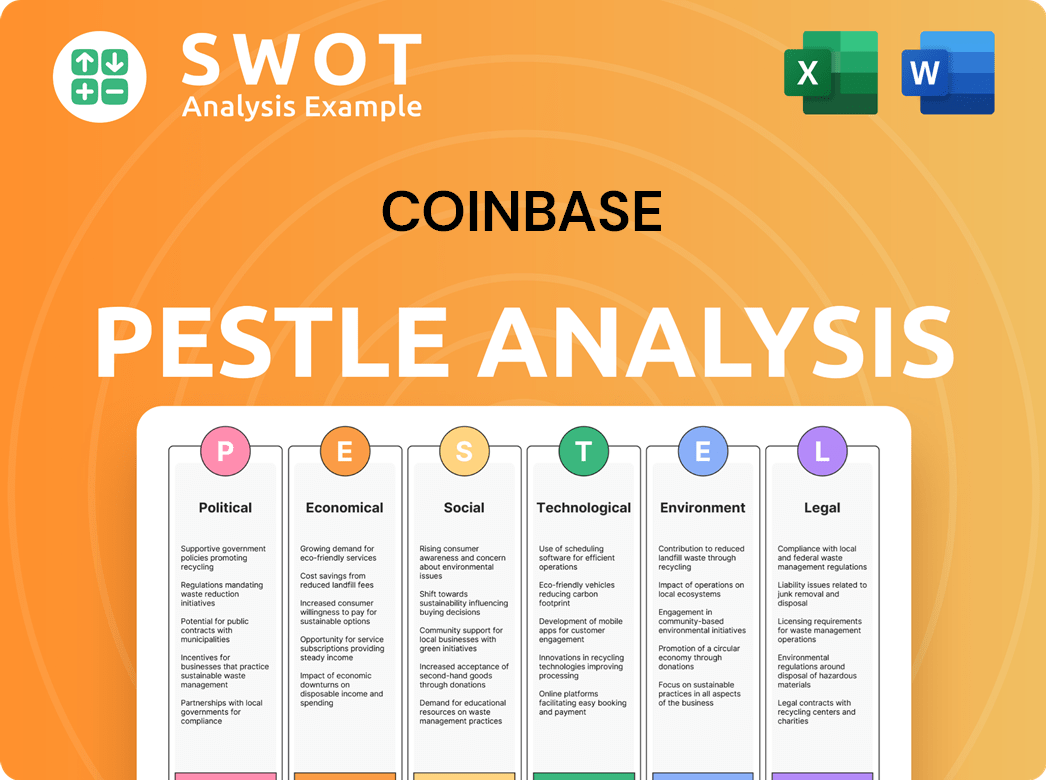

Coinbase PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Coinbase operate?

The geographical market presence of Coinbase is extensive, with operations spanning over 100 countries. The United States remains its primary market, generating a significant portion of its revenue. However, Coinbase is actively expanding its reach globally, investing in international markets to diversify its revenue streams and increase its user base.

In 2024, the U.S. accounted for 83% of Coinbase's total revenue, highlighting the dominance of the North American market. Projections indicate that North America will continue to lead the crypto exchange market, holding a 37.2% share in 2025. This growth is fueled by a robust regulatory environment and strong institutional participation, positioning Coinbase as a key player in the region.

Coinbase's international expansion strategy, known as 'Go Broad, Go Deep,' focuses on strengthening its presence in existing markets while entering new ones. This approach includes localization efforts, streamlined onboarding processes, and improved platform reliability. These initiatives have driven growth in various regions, such as Brazil, where Coinbase achieved the top position in the crypto app category and ranked third among all financial apps in the App Store during Q4 2024.

Coinbase operates in over 100 countries, showcasing a broad global presence. This widespread availability is crucial for attracting a diverse range of crypto users and expanding its market share. By offering services across numerous regions, Coinbase aims to cater to the growing demand for cryptocurrency trading and investment worldwide.

In 2024, the United States generated 83% of Coinbase's revenue, indicating a strong reliance on the domestic market. However, the company is actively working to diversify its revenue streams. International revenue share reached 19% in Q4 2024, demonstrating progress in global expansion efforts.

Coinbase employs a 'Go Broad, Go Deep' strategy, focusing on both market penetration and geographical expansion. This involves strengthening its position in existing markets while entering new ones. The strategy includes localization, streamlined onboarding, and improved platform reliability to enhance the user experience and drive growth.

Coinbase localizes its offerings and marketing to succeed in diverse markets. This includes using translation management systems and centralized glossaries to standardize the translation of crypto concepts into 21 languages. User segmentation is also performed to understand each user's journey, which forms the basis of their localization strategy.

North America is expected to dominate the crypto exchange market, holding a share of 37.2% in 2025. Coinbase's strong presence in the U.S. positions it favorably to capitalize on this growth. The region's well-established regulatory framework and strong institutional participation further support market expansion.

Coinbase is actively expanding its international presence, with international revenue reaching 19% in Q4 2024. This growth is driven by strategic investments in localization, streamlined onboarding, and improved platform reliability. The company is focused on increasing its Coinbase user base growth in key international markets.

Coinbase is committed to regulatory compliance and has announced Ireland as its EU MiCA entity location. This strategic move will allow Coinbase to serve the European Union market of 450 million inhabitants under a unified regulatory framework. This is a key factor in their Growth Strategy of Coinbase.

In Brazil, Coinbase was the number one crypto app in Q4 2024 and the number three financial app in the App Store. This success highlights the effectiveness of Coinbase's localization efforts and its ability to gain traction in emerging markets. This demonstrates the potential for further expansion in Latin America.

Coinbase One subscription is now available in 38 countries, and staking and USDC are offered in over 110 countries. This expansion of services reflects Coinbase's commitment to providing a comprehensive platform for Coinbase users worldwide, increasing its appeal to a global audience and improving cryptocurrency adoption.

Coinbase performs user segmentation for different markets to understand each user's journey, which forms the basis of their localization strategy. This approach enables the company to tailor its offerings and marketing efforts to specific regions, increasing its effectiveness in acquiring and retaining Coinbase customer profile.

Coinbase Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Coinbase Win & Keep Customers?

Understanding the customer acquisition and retention strategies is crucial for the success of any platform, especially in the dynamic world of cryptocurrency. The company, a leading cryptocurrency exchange, employs a multifaceted approach to attract and keep its users. This involves a blend of marketing tactics, user-friendly features, and loyalty programs designed to foster a strong customer base.

The company's strategies have evolved over time, adapting to the ever-changing cryptocurrency landscape. The company focuses on building trust and emphasizing security as competition intensifies. This approach has proven effective, as evidenced by the significant growth in its user base and trading activity. The company's commitment to customer satisfaction and platform improvement is a key driver behind its ongoing success in the competitive crypto market.

The company's strategies are designed to appeal to a broad spectrum of users while also catering to the specific needs of both novice and experienced traders. The company's focus on customer acquisition and retention is a key factor in its long-term success. The company's strategies are constantly being refined to stay ahead of the curve and meet the evolving needs of its users.

Referral programs are a core element of the company's user acquisition strategy. These programs incentivize existing users to invite new customers by offering rewards like free trades or security upgrades. These efforts have been shown to generate over 10% of new user acquisitions for the company.

The company focuses on loyalty programs to encourage active trading and build user loyalty. These programs offer benefits like reduced fees or exclusive access to new assets. They are designed to reward frequent users and keep them engaged with the platform.

The company's dashboard offers personalized investment recommendations, which has led to higher retention among casual investors. This focus on personalization helps to tailor the user experience to individual needs and preferences, increasing user satisfaction.

The company provides 24/7 multi-channel customer support, including phone, chat, and social media, serving over 115 countries in five languages, with plans for further expansion. This commitment makes users 40% more likely to stay on a platform.

Digital marketing plays a crucial role in the company's strategy, with the platform utilizing social media, forums, and educational content to engage users. The 'Learn and Earn' campaign, for instance, attracts users by offering educational incentives in cryptocurrency. Partnerships with major financial players like PayPal and Visa also enhance user convenience and expand reach. The company also uses creative campaigns, like its QR Code Super Bowl ad, to drive brand awareness and user engagement. To learn more about the company's financial performance, consider checking out the insights on Owners & Shareholders of Coinbase.

- The company saw a 123% increase in existing customers making deposits in 2024.

- New customer acquisition surged, with increases over 700% in November and over 475% in December.

- Product diversification, like staking and the Coinbase One subscriptions, aims to improve customer loyalty and lifetime value.

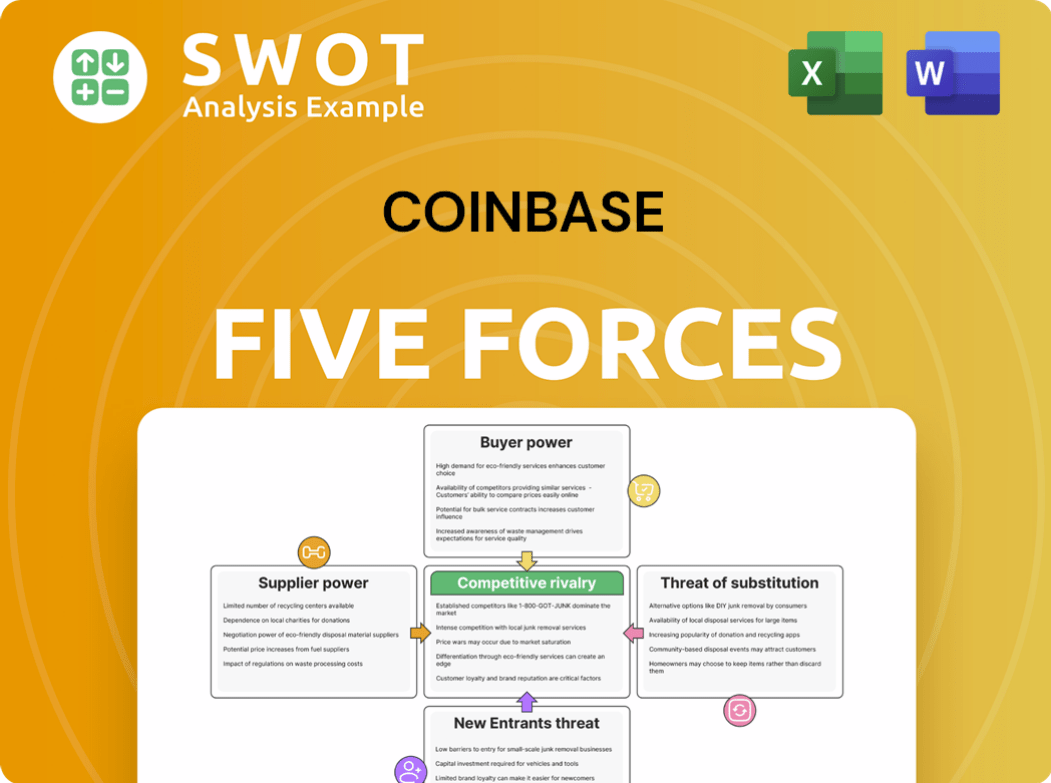

Coinbase Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Coinbase Company?

- What is Competitive Landscape of Coinbase Company?

- What is Growth Strategy and Future Prospects of Coinbase Company?

- How Does Coinbase Company Work?

- What is Sales and Marketing Strategy of Coinbase Company?

- What is Brief History of Coinbase Company?

- Who Owns Coinbase Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.