Coinbase Bundle

Can Coinbase Conquer the Crypto Competition?

The cryptocurrency market is a whirlwind of innovation and volatility, and Coinbase has established itself as a key player. The approval of spot Bitcoin and Ethereum ETFs in 2024 signaled a new era, attracting institutional investors and boosting the legitimacy of digital assets. Founded in 2012, Coinbase aimed to make crypto accessible, and it has since become a comprehensive Coinbase SWOT Analysis platform.

Coinbase's journey from a simple Bitcoin exchange to a multifaceted platform offering custody, staking, and a crypto wallet is a testament to its adaptability. Understanding the Coinbase competitive landscape is crucial, especially with the influx of traditional financial institutions and new digital asset platforms. This analysis delves into Coinbase competitors, its crypto market share, and how it navigates regulatory challenges to maintain its position in the ever-evolving crypto world, offering insights into Coinbase market analysis and its future growth prospects.

Where Does Coinbase’ Stand in the Current Market?

Coinbase holds a strong market position within the cryptocurrency industry, particularly in the United States. As the leading U.S. cryptocurrency exchange, it benefits from a reputation for reliability and regulatory compliance. This has allowed it to establish a significant presence in the Coinbase competitive landscape.

Coinbase's core operations involve providing a platform for buying, selling, and storing various cryptocurrencies like Bitcoin and Ethereum. It also offers crypto-related services such as custody solutions, staking, and a crypto wallet. This comprehensive suite of services is designed to meet the diverse needs of its user base.

The value proposition of Coinbase centers on providing a secure, compliant, and user-friendly platform for engaging with the crypto market. This focus on security and regulatory adherence has been a key differentiator, especially in an industry where trust is paramount. For a deeper understanding of how Coinbase generates revenue, explore the Revenue Streams & Business Model of Coinbase.

In Q4 2024, Coinbase's trading volume reached $439 billion, showcasing its ability to handle diverse crypto demand. The platform held approximately 12% of the total crypto market in platform assets, with Bitcoin and Ethereum being primary drivers of activity. This demonstrates a strong position in the crypto market share.

Coinbase ended December 2024 with a robust financial position, holding over $8.5 billion in unrestricted cash and nearly $2.8 billion in cryptocurrency investments. In Q1 2025, Coinbase reported revenue of $2.03 billion, a 24% year-over-year increase, driven by higher transaction, subscription, and services income. These figures highlight the company's financial strength.

Coinbase has achieved significant growth in international markets, particularly in Asia, where demand for trusted and regulated products is surging. Its international exchange has become a cornerstone of this expansion, providing a secure and compliant venue for perpetual futures trading. This strategy has proven effective in expanding its global footprint.

In Q1 2024, Coinbase's customer safeguarded assets grew to $330 billion, securely storing over 12% of the total crypto market cap on its platform. This commitment to safeguarding assets is a key factor in maintaining user trust and confidence. This is a key factor in the overall Coinbase market analysis.

Coinbase's strengths include its strong brand recognition, regulatory compliance, and robust financial position. These factors contribute to its leading position in the cryptocurrency exchange market and help it compete effectively against its Coinbase competitors.

- Strong brand recognition and user trust.

- Focus on regulatory compliance, which builds user confidence.

- Diversified revenue streams, including transaction fees and services.

- Strategic geographic expansion, particularly in Asia.

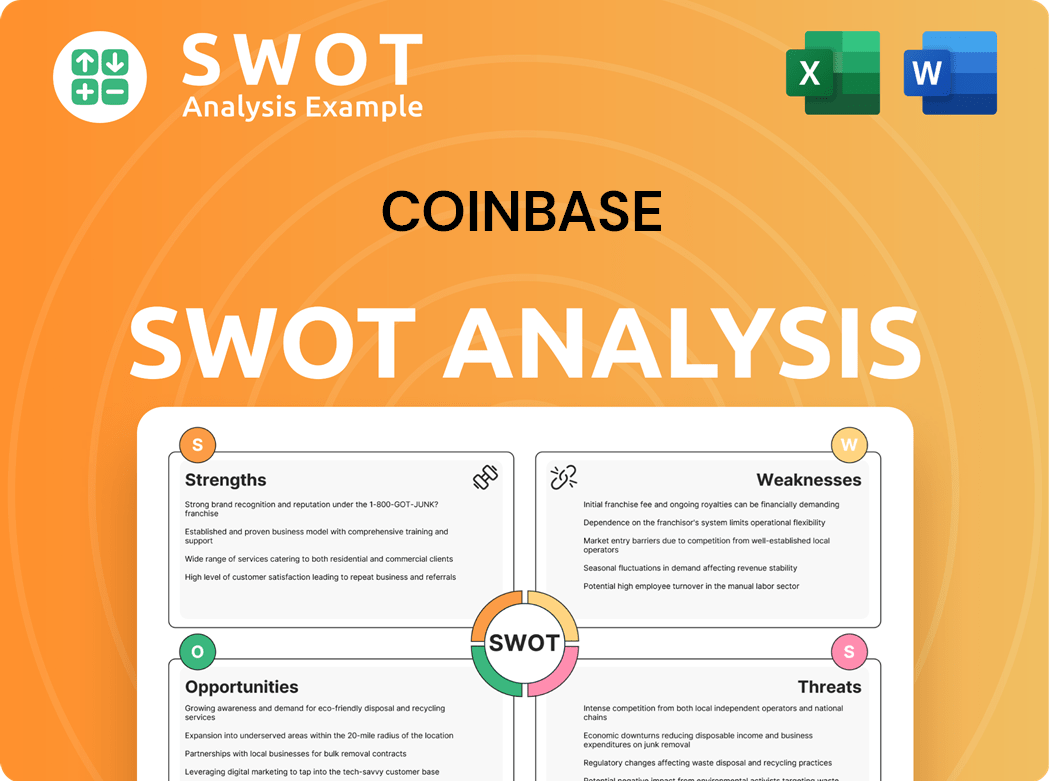

Coinbase SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Coinbase?

The Coinbase competitive landscape is shaped by a dynamic mix of direct and indirect rivals. These competitors vie for market share in the rapidly evolving cryptocurrency sector. Understanding these players is crucial for assessing Coinbase's position and future prospects.

Direct competitors primarily include other centralized cryptocurrency exchanges. Indirect competition comes from traditional financial institutions and decentralized platforms. This multifaceted environment requires constant adaptation and strategic innovation from Coinbase to maintain and grow its user base and market share.

The competitive landscape for Coinbase is complex and multifaceted, encompassing a range of players vying for market share in the cryptocurrency space. A thorough Coinbase market analysis reveals a dynamic environment shaped by both direct and indirect competitors.

Direct competitors are primarily other centralized cryptocurrency exchanges. These platforms offer similar services, including buying, selling, and trading cryptocurrencies. Competition often centers on fees, the variety of supported cryptocurrencies, and the availability of advanced trading features.

Binance is a major global exchange, frequently offering lower trading fees and a wider range of features, particularly for international users. Binance's extensive global reach and diverse product offerings make it a formidable competitor. In 2024, Binance processed billions of dollars in daily trading volume, highlighting its significant market presence.

Crypto.com is another key competitor, known for its comprehensive crypto ecosystem, competitive trading fees, and flexible staking programs. Crypto.com's focus on building a complete crypto ecosystem, including a Visa card and other financial products, sets it apart. The platform has a strong user base, especially in regions where it has invested heavily in marketing and partnerships.

Other exchanges, both domestic and international, compete on price, innovation, and the variety of supported cryptocurrencies and services. These platforms continuously introduce new features and promotions to attract and retain users. The competitive landscape includes both established and emerging exchanges, each striving to capture a share of the market.

Indirect competitors include traditional financial institutions and decentralized platforms. These entities present different challenges and opportunities for Coinbase. The increasing convergence of traditional finance and decentralized finance is reshaping the competitive dynamics.

Traditional financial institutions are increasingly entering the crypto space, presenting a growing challenge to Coinbase. The approval of spot Bitcoin and Ethereum ETFs in the U.S. in 2024, for which Coinbase serves as a custodian for many, highlights this trend. This convergence could lead to increased competition and pressure on fees.

The Coinbase competitors continually adapt to changes in the crypto market. The rise of decentralized exchanges (DEXs) offers an alternative for users seeking greater control over their assets and lower fees. Innovations in DeFi and the increasing integration of AI in crypto trading are also transforming the market. Mergers and alliances within the crypto industry represent strategic moves to expand offerings and solidify market positions.

- Decentralized Exchanges (DEXs): DEXs offer greater user control and lower fees, attracting a segment of users seeking alternatives to centralized platforms.

- DeFi Innovation: Innovations in decentralized finance are pushing the boundaries of blockchain technology, providing new opportunities and challenges for existing exchanges.

- AI Integration: The increasing integration of AI in crypto trading is transforming the market, with AI-powered tools offering advanced trading capabilities.

- Strategic Acquisitions: Coinbase's $2.9 billion acquisition of Deribit, a leading global crypto derivatives exchange, is the largest in the cryptocurrency industry, showing industry consolidation.

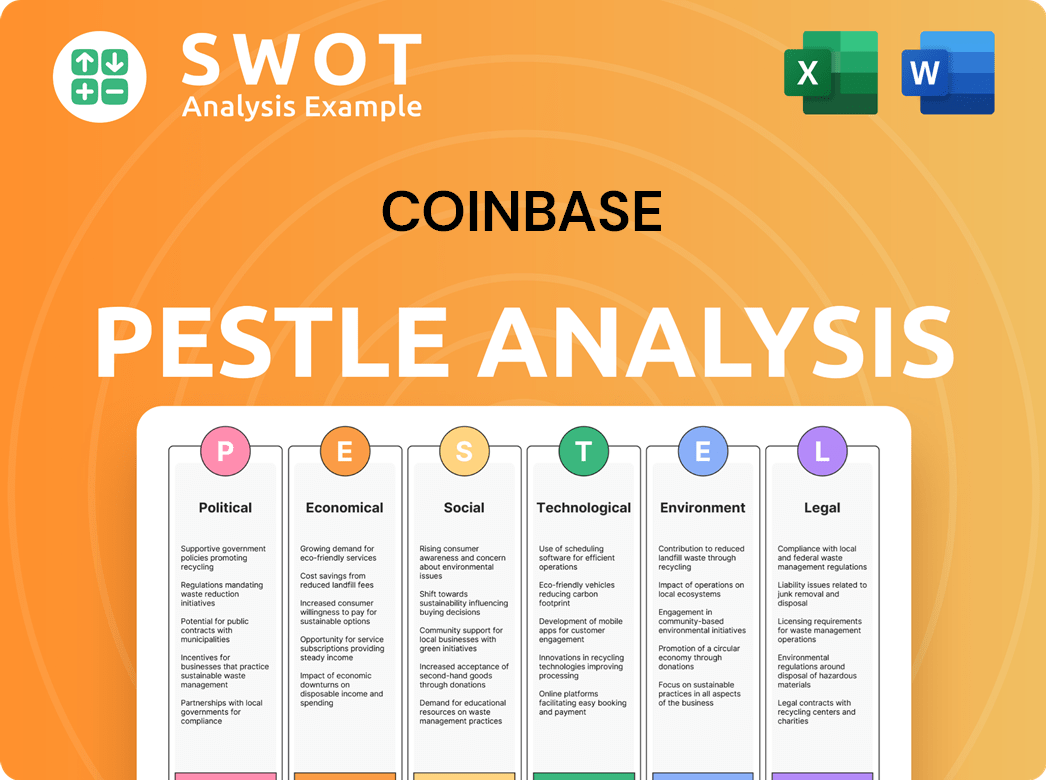

Coinbase PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Coinbase a Competitive Edge Over Its Rivals?

The Marketing Strategy of Coinbase is significantly shaped by its competitive advantages in the dynamic cryptocurrency exchange market. These advantages include a strong brand reputation, user-friendly platform design, robust financial health, and strategic global expansion efforts. Understanding these factors is crucial for a comprehensive Coinbase market analysis and assessing its position among Coinbase competitors.

Coinbase has cultivated a reputation for security and regulatory compliance, particularly within the United States, which has allowed it to maintain a premium pricing strategy and attract a large user base. This is a key differentiator in the cryptocurrency exchange landscape. Furthermore, the company's focus on product expansion and operational discipline has driven revenue and utility in a fast-evolving market.

As of December 2024, Coinbase reported over $8.5 billion in cash and significant cryptocurrency investments, providing a strong financial foundation. Its role as a custodian for spot Bitcoin and Ethereum ETFs approved in 2024 further highlights the trust placed in its institutional-grade custody solutions. Coinbase's ability to support a wide variety of cryptocurrencies, with around 75% of its total trading volume in 2024 coming from crypto assets other than Bitcoin or Ethereum, also gives it a competitive edge.

Coinbase has established a strong brand reputation for security and regulatory compliance. This is especially true in the United States. This reputation is a key factor in attracting and retaining users, and it allows Coinbase to maintain a premium pricing strategy.

Coinbase offers a user-friendly interface, making it accessible for beginners to enter the cryptocurrency market. It also provides advanced trading features through Coinbase Advanced. This dual approach caters to both new and experienced investors, enhancing its platform features.

Coinbase's robust financial health, including over $8.5 billion in cash as of December 2024, provides stability. It also serves as a custodian for spot Bitcoin and Ethereum ETFs, highlighting its institutional-grade custody solutions. This increases trust and attracts institutional investors.

Coinbase is actively expanding internationally, particularly in Asia. Its international exchange saw a 6200% increase in average daily trading volume from January to December 2024. This growth demonstrates its ability to scale globally and capture new market opportunities.

Coinbase's competitive advantages are built on a foundation of trust, user-friendliness, financial strength, and global expansion. These elements are critical for its success in the competitive cryptocurrency exchange market. The company's strategic focus on product expansion and operational discipline continues to drive revenue and utility, helping it maintain its market position.

- Strong brand reputation for security and compliance.

- User-friendly interface for beginners and advanced traders.

- Robust financial health and institutional-grade custody solutions.

- Strategic global expansion, particularly in Asia.

- Support for a wide variety of cryptocurrencies.

Coinbase Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Coinbase’s Competitive Landscape?

The cryptocurrency industry in 2025 is experiencing significant shifts, driven by technological advancements, regulatory changes, and evolving consumer behavior. This dynamic environment presents both opportunities and challenges for major players like Coinbase. Understanding the Coinbase competitive landscape is crucial for investors and strategists aiming to navigate the volatile yet promising crypto market.

Coinbase faces a complex scenario. On one hand, increased regulatory clarity can legitimize the industry and attract institutional investors. On the other, it intensifies competition from traditional financial institutions entering the crypto space. The company must balance its position as a leader in compliance with the need to innovate and maintain its market share in a rapidly evolving digital asset market. This analysis delves into the Coinbase market analysis, exploring the trends, challenges, and opportunities shaping its future.

Technological advancements, such as the integration of AI and crypto, along with the tokenization of real-world assets (RWAs), are reshaping the industry. Stablecoins are expanding beyond trading to include digital payments and cross-border transactions. These trends are driving the evolution of cryptocurrency exchange platforms, influencing how users interact with digital assets.

Market volatility remains a significant challenge, potentially leading to revenue fluctuations. Dependence on transaction fees makes Coinbase vulnerable to market downturns. Maintaining user trust and addressing security concerns are also critical. The company must navigate international regulatory uncertainties and maintain its premium pricing strategy.

The growing mainstream adoption of cryptocurrencies, with approximately 28% of American adults owning crypto in 2025 and 67% of current owners planning to buy more, provides a significant growth avenue. Increasing institutional adoption and expansion into new international markets offer substantial potential. Product innovation and the introduction of new financial products can help Coinbase differentiate itself.

Coinbase's strategic moves include continued product expansion, operational discipline, and leveraging its strong financial position. The company's role as a custodian for spot Bitcoin and Ethereum ETFs highlights its importance to institutional investors. These strategies aim to solidify its position within the Coinbase competitive landscape and drive long-term growth.

Coinbase's future success hinges on several factors. These include navigating regulatory challenges, maintaining user trust, and innovating in a rapidly changing market. Strategic decisions around geographic expansion and product offerings will be critical to maintaining and growing its crypto market share.

- Regulatory Compliance: Proactively adapting to evolving regulations, especially in the US, where almost two-thirds of companies anticipate stricter rules in 2025.

- Product Innovation: Developing new financial products and enhancing existing offerings, such as derivatives and the COIN50 index, to attract and retain users.

- Geographic Expansion: Targeting international markets with favorable regulatory environments to tap into new growth opportunities.

- Security and Trust: Prioritizing robust security measures and transparent communication to maintain user confidence and address concerns.

For a deeper understanding of the demographics and preferences of Coinbase's user base, and how they can be targeted, consider exploring the Target Market of Coinbase article.

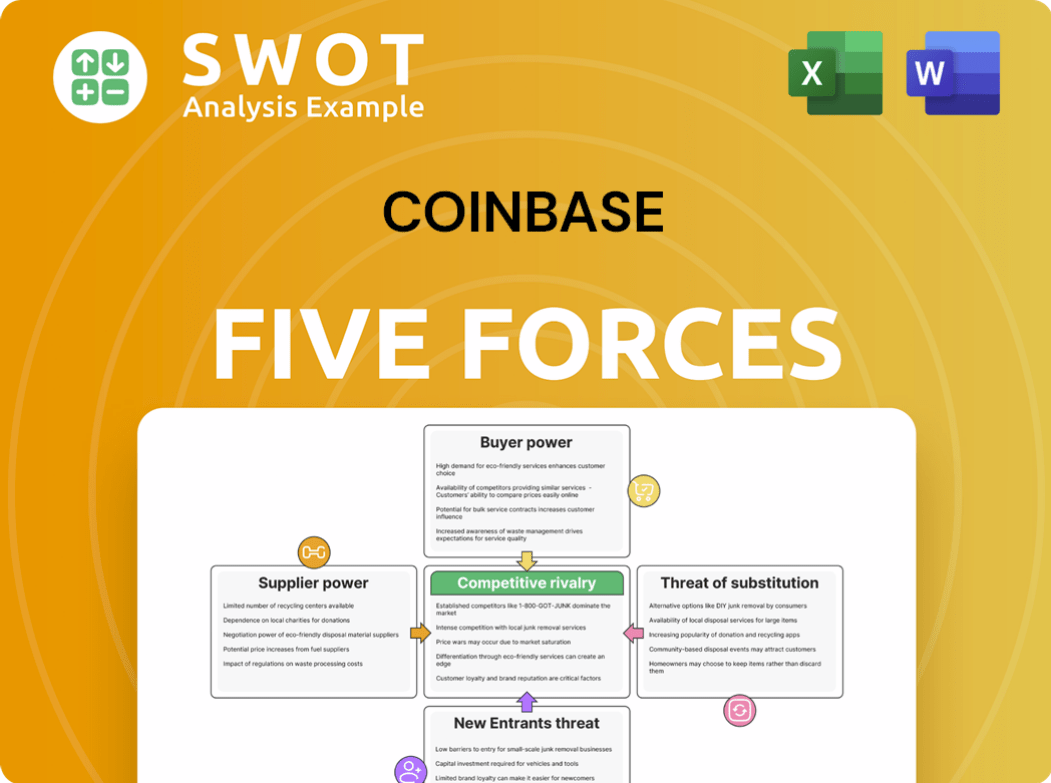

Coinbase Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Coinbase Company?

- What is Growth Strategy and Future Prospects of Coinbase Company?

- How Does Coinbase Company Work?

- What is Sales and Marketing Strategy of Coinbase Company?

- What is Brief History of Coinbase Company?

- Who Owns Coinbase Company?

- What is Customer Demographics and Target Market of Coinbase Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.