Compass Bundle

How Did Compass Conquer the Real Estate Market?

Born from a vision to revolutionize real estate, Compass, initially known as Urban Compass, disrupted the industry with a tech-forward approach. Founded in 2012 in New York City, the Compass SWOT Analysis reveals the strategic decisions that propelled its rapid expansion. This journey, from a rental-focused platform to a national brokerage leader, is a testament to its innovative spirit.

From its Compass invention, the company quickly evolved, setting its sights on a larger market share. Today, Compass stands as the largest residential real estate brokerage in the U.S. by sales volume, a remarkable feat achieved through strategic investments and a commitment to agent empowerment. This brief history of the compass company provides a glimpse into the evolution of a real estate giant.

What is the Compass Founding Story?

The story of the Compass company began on October 4, 2012, when it was founded as Urban Compass, Inc., in New York City. This marked the start of a real estate venture aiming to transform the industry. The founders brought together expertise in technology, finance, and real estate to address specific market challenges.

The founders, Ori Allon, Robert Reffkin, and Avi Dorfman, identified problems in the New York real estate market, such as high prices and a complex process. Their goal was to create a company that provided verified listings and employed salaried real estate agents. The initial funding of $8 million from investors helped launch their vision.

Initially focused on rentals, the company launched its service in May 2013. However, recognizing the larger opportunity in sales, Compass shifted its strategy in January 2014. This pivot involved contracting independent agents and developing sales tools, a crucial step in their growth. If you want to learn more about the core values of the company, you can read about the Mission, Vision & Core Values of Compass.

Compass was founded in 2012 with a focus on improving the real estate experience.

- The founders included Ori Allon, Robert Reffkin, and Avi Dorfman.

- The company initially focused on rentals before shifting to sales.

- Early funding of $8 million supported the launch and initial operations.

- The shift to independent agents was a key strategic move.

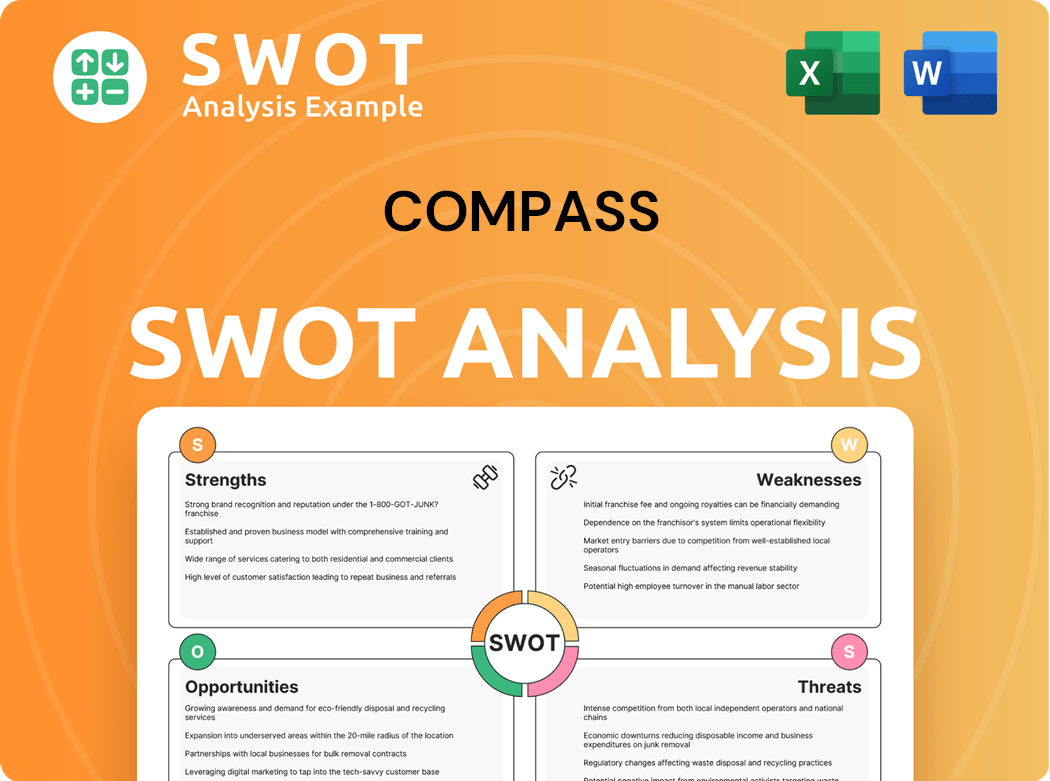

Compass SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Compass?

The early growth of the company, marked by strategic expansions and significant funding rounds, showcases its ambition in the real estate market. Following its initial launch, the company quickly expanded, demonstrating its commitment to growth. This rapid expansion was fueled by substantial investments and acquisitions, solidifying its position in the industry.

In 2014, the company expanded to Miami and Boston. A Series C funding round in 2015 raised $50 million, boosting further expansion and technology development. By 2016, the company acquired real estate firms and entered major markets like Chicago, Los Angeles, and San Francisco.

By January 2017, the company operated in nine U.S. markets and had 1,300 agents. The launch of the Compass Concierge program in 2017 enhanced the experience for home sellers. The company aimed to achieve a 20% market share in the top 20 cities by 2020.

In 2018, a Series F funding round led by SoftBank raised $400 million, valuing the company at $4.4 billion. This funding supported expansion into markets like Washington, D.C., in 2019. The company's strategy included recruiting top agents, costing an estimated $55,000 per agent through acquisitions.

By 2018, the company had completed approximately 35,000 transactions valued at $45 billion. The company's revenue consistently doubled over several years, positioning it as the third-largest U.S. brokerage by sales volume. In 2024, the company acquired Latter & Blum, Parks Real Estate, Christie's International Real Estate, and @properties for a total of $444 million in cash and stocks in late 2024 and early 2025. Learn more about the Revenue Streams & Business Model of Compass.

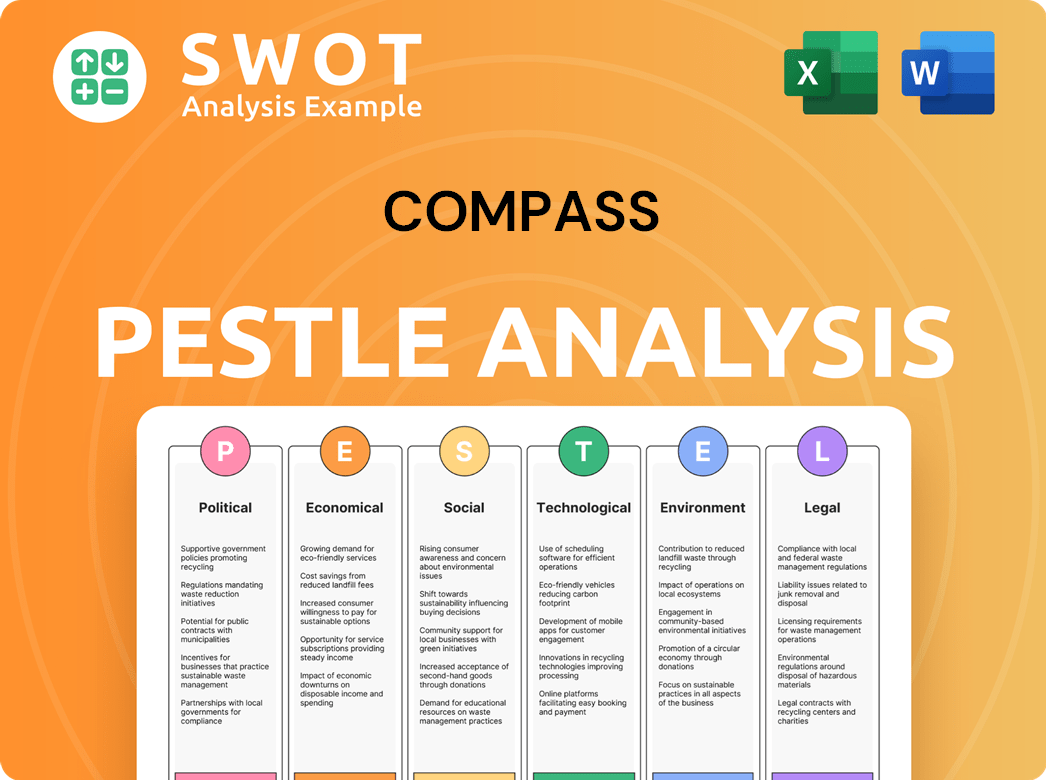

Compass PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Compass history?

The history of the Compass company is marked by significant milestones, reflecting its growth and adaptation in the real estate market. This journey includes strategic pivots, technological advancements, and responses to market dynamics, shaping its current position.

| Year | Milestone |

|---|---|

| 2012 | Founded with a focus on providing agents with a technology platform to streamline real estate transactions. |

| 2017 | Launched the Compass Concierge program, offering services like staging and renovations to home sellers. |

| 2020 | Navigated the COVID-19 pandemic, adapting to market downturns while maintaining revenue growth. |

| 2024 | Internal analysis showed the Compass Private Exclusive and Compass Coming Soon marketing strategies were associated with a 2.9% higher average close price for pre-marketed listings. |

| Q1 2025 | Maintained a strong agent retention rate of 96.6%, demonstrating the company's ability to retain top talent. |

The company has consistently focused on innovation, particularly in its technology platform, to empower agents. This commitment is evident in the development of tools for marketing, client management, and transaction processing, aiming to enhance the real estate experience for both agents and clients.

Designed to provide agents with tools for marketing, client management, and transaction processing, streamlining the real estate experience.

Launched in 2017, this program assists home sellers with services such as staging and renovations to enhance property value.

These strategies, according to a 2024 internal analysis, are associated with a 2.9% higher average close price for pre-marketed listings.

Continuous development of new products and features to support agents in various aspects of their business, from marketing to client interactions.

Shifting from rentals with salaried agents to a focus on sales with independent agents, demonstrating flexibility in response to market feedback.

Maintaining a strong agent retention rate, with 96.6% in Q1 2025, attributed to the comprehensive platform and value proposition.

Despite its growth, the company has faced challenges, including market downturns and competitive pressures. These challenges have led to strategic adjustments and the need to address issues related to agent support and service costs.

The company experienced market downturns, such as during the COVID-19 pandemic, which resulted in workforce reductions and adjustments to financial incentives.

Facing competition from established real estate firms, including legal challenges related to database access and exclusive listings, which were confidentially settled.

Issues such as agents being charged for basic services like DocuSign and Adobe, indicating areas for improvement in agent support and cost management.

A 15% workforce layoff in March 2020 was a direct response to market challenges and economic uncertainty during the early stages of the COVID-19 pandemic.

Despite facing significant challenges, the company demonstrated resilience, ending 2020 with a 56% higher revenue, reaching $3.7 billion compared to the previous year.

The company adapted its business model from solely rentals with salaried agents to focusing on sales with independent agents, demonstrating adaptability.

To understand more about the company's strategic approach and its target audience, you can read about the Target Market of Compass.

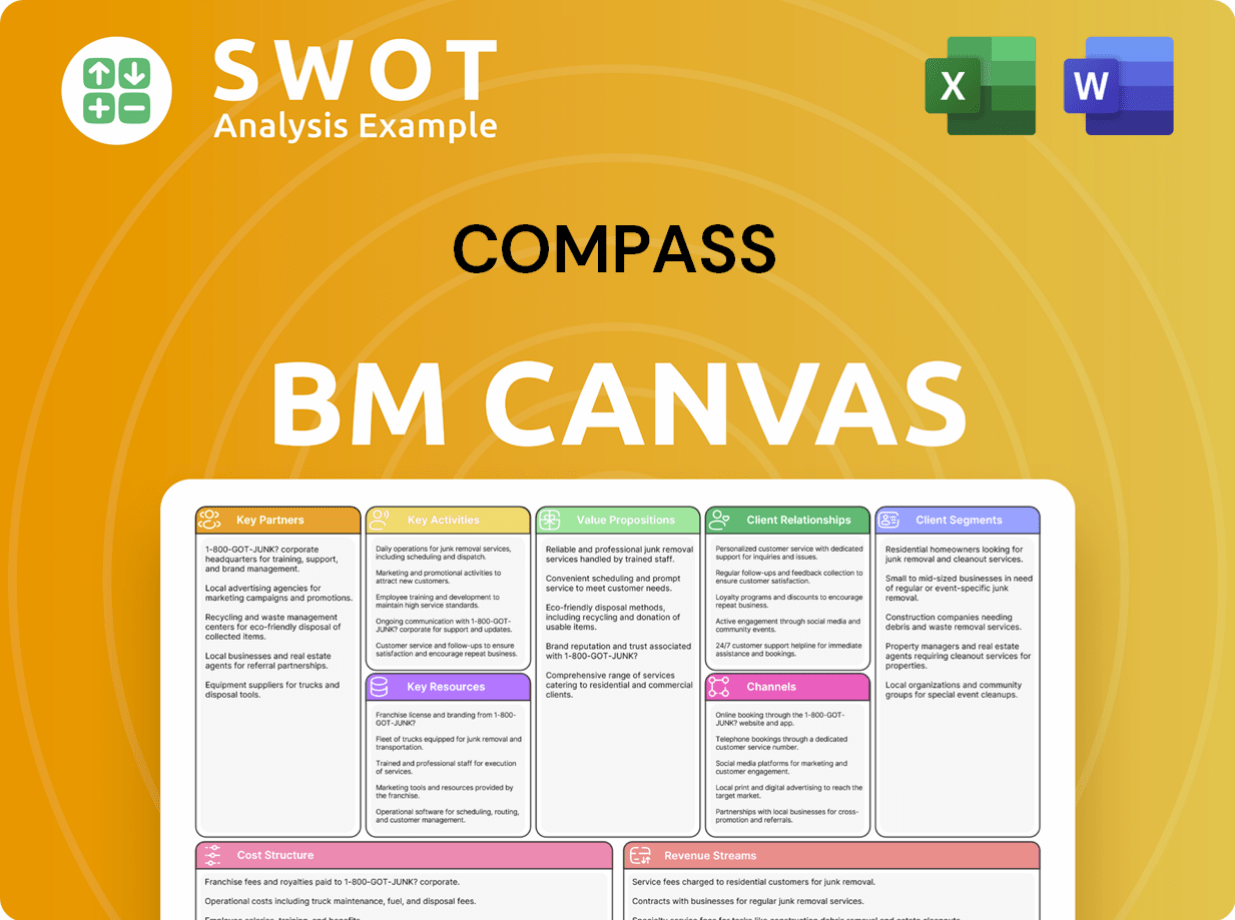

Compass Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Compass?

The Growth Strategy of Compass began in October 2012 when it was founded as Urban Compass, Inc. in New York City. The company quickly secured funding and expanded its services and geographical reach. Over the years, it has grown through strategic acquisitions and technological advancements, culminating in its Initial Public Offering (IPO) in April 2021 and recent acquisitions in 2024. This rapid expansion highlights the evolution of the Compass company and its impact on the real estate market.

| Year | Key Event |

|---|---|

| October 2012 | Founded as Urban Compass, Inc. in New York City. |

| 2012 | Secured $8 million in seed funding. |

| May 2013 | Launched its initial rental-focused service. |

| January 2014 | Pivoted business model to include sales and independent agents. |

| 2014 | Expanded operations to Miami and Boston. |

| 2015 | Raised $50 million in Series C funding. |

| 2016 | Acquired new real estate firms and expanded to Chicago, Los Angeles, and San Francisco. |

| January 2017 | Operated in 9 U.S. markets with 1,300 agents. |

| 2017 | Launched the Compass Concierge program. |

| December 2017 | Received $450 million investment from SoftBank Vision Fund. |

| 2018 | Raised $400 million in Series F funding, valuing the company at $4.4 billion. |

| 2019 | Expanded to Washington, D.C. and other major markets. |

| April 1, 2021 | Became a public company via an Initial Public Offering (IPO). |

| April 2024 | Acquired Louisiana-based brokerage Latter & Blum. |

| May 2024 | Acquired Tennessee's largest brokerage Parks Real Estate. |

| December 2024 | Announced acquisition of Christie's International Real Estate and @properties for $444 million. |

| Q4 2024 | Reported revenue of $1.4 billion, up 26% year-over-year, and a national market share of 5.06%. |

| Q1 2025 | Reported revenue of $1.4 billion, up 28.7% year-over-year, with total transactions increasing by 27.8% and a record national market share of 6.0%. |

The Compass company is focused on continued strategic technology investments and market expansion. It intends to leverage data analytics, virtual and augmented reality, and AI-powered tools. The goal is to provide more personalized insights and streamline the real estate process, enhancing the user experience.

The company expects to be free cash flow positive for the full year 2025, with a non-GAAP OPEX range of $1.017 billion to $1.042 billion. Leadership anticipates widening the gap against the industry in 2025 due to its proprietary technology platform and national scale.

The company is expanding its ancillary services, such as in-house mortgage and title services. Growth strategies include entering new markets, expanding in existing ones, product innovation, and strategic partnerships. This approach supports its vision of empowering agents and simplifying real estate through technology.

With a record national market share of 6.0% in Q1 2025, the company is positioned for further growth. The company's focus on technology, strategic acquisitions, and agent empowerment has solidified its position in the real estate market, with revenue up 28.7% year-over-year in Q1 2025.

Compass Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Compass Company?

- What is Growth Strategy and Future Prospects of Compass Company?

- How Does Compass Company Work?

- What is Sales and Marketing Strategy of Compass Company?

- What is Brief History of Compass Company?

- Who Owns Compass Company?

- What is Customer Demographics and Target Market of Compass Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.