Compass Bundle

Can Compass Conquer the Real Estate Realm?

The real estate industry is undergoing a seismic shift, fueled by tech and changing consumer demands. Compass, Inc. has emerged as a major player, aiming to revolutionize the traditional brokerage model. This analysis dives deep into the Compass SWOT Analysis, exploring its competitive arena.

This exploration of the Compass competitive landscape will dissect its market position, pinpointing key rivals within the real estate market competition. We'll examine Compass's competitive advantage, assessing its strategies for acquiring market share and its financial performance compared to competitors. Understanding the competitive dynamics is crucial for anyone analyzing real estate companies and assessing the long-term viability of Compass in a fluctuating market.

Where Does Compass’ Stand in the Current Market?

The core operations of Compass revolve around providing a technology-driven platform for real estate agents. This platform assists agents in facilitating property transactions for clients, including buying, selling, and renting. Compass focuses on serving agents, equipping them with tools to enhance their service delivery and client interactions. The company's value proposition lies in its ability to offer agents a comprehensive suite of services, thereby improving their efficiency and client satisfaction.

Compass holds a significant position within the U.S. residential real estate market, particularly as the largest brokerage by sales volume. The company's financial performance reflects its market standing and strategic initiatives. Compass has expanded its geographic presence across 35 states and Washington D.C., with a strong focus on high-end markets. This strategic expansion and its technology-driven approach have allowed it to compete effectively in a dynamic market.

In Q4 2024, Compass achieved a quarterly market share of 5.06%, marking a year-over-year increase of 65 basis points. This growth demonstrates the company's ability to outperform the overall market, with its transactions increasing by 24.1% in Q4 2024, compared to a 6.8% market increase. For the full fiscal year 2024, Compass reported revenue of approximately $6.02 billion. The net loss for 2024 improved to $320.2 million, a significant reduction from a $601.1 million loss in the prior year, indicating ongoing efforts towards profitability. These improvements highlight the company's resilience and strategic adjustments in a competitive landscape.

Compass's market share in Q4 2024 was 5.06%, reflecting a 65 basis point increase year-over-year. The company's transactions grew by 24.1% in Q4 2024, significantly outpacing the market's 6.8% growth. This growth indicates strong market penetration and competitive advantage.

For the full year 2024, Compass reported approximately $6.02 billion in revenue. The net loss for 2024 was reduced to $320.2 million, a substantial improvement from the previous year's $601.1 million loss. These financial results show progress towards profitability.

In January 2025, Compass expanded its offerings by acquiring the exclusive worldwide right to operate, franchise, and license the Christie's International Real Estate brand. As of January 31, 2025, its mortgage business was licensed in 42 states and Washington D.C. These initiatives enhance its market presence.

Compass operates in 35 states and Washington D.C., with a strong focus on high-end markets. The company's strategy involves significant market expansion, successfully entering and growing in key metropolitan areas. This wide reach supports its competitive positioning.

Compass differentiates itself through its technology-driven platform and agent-centric approach, offering a comprehensive suite of tools and services. The company's focus on high-end markets and strategic acquisitions, like the Christie's International Real Estate brand, expands its reach and enhances its competitive positioning. The company's ability to adapt to market changes is crucial.

- Technology-driven platform for agents.

- Strategic expansion into high-end markets.

- Acquisition of the Christie's International Real Estate brand.

- Focus on agent support and service.

Understanding the Revenue Streams & Business Model of Compass is key to analyzing its competitive landscape. The company's performance and strategic moves highlight its efforts to maintain and strengthen its position in the real estate market.

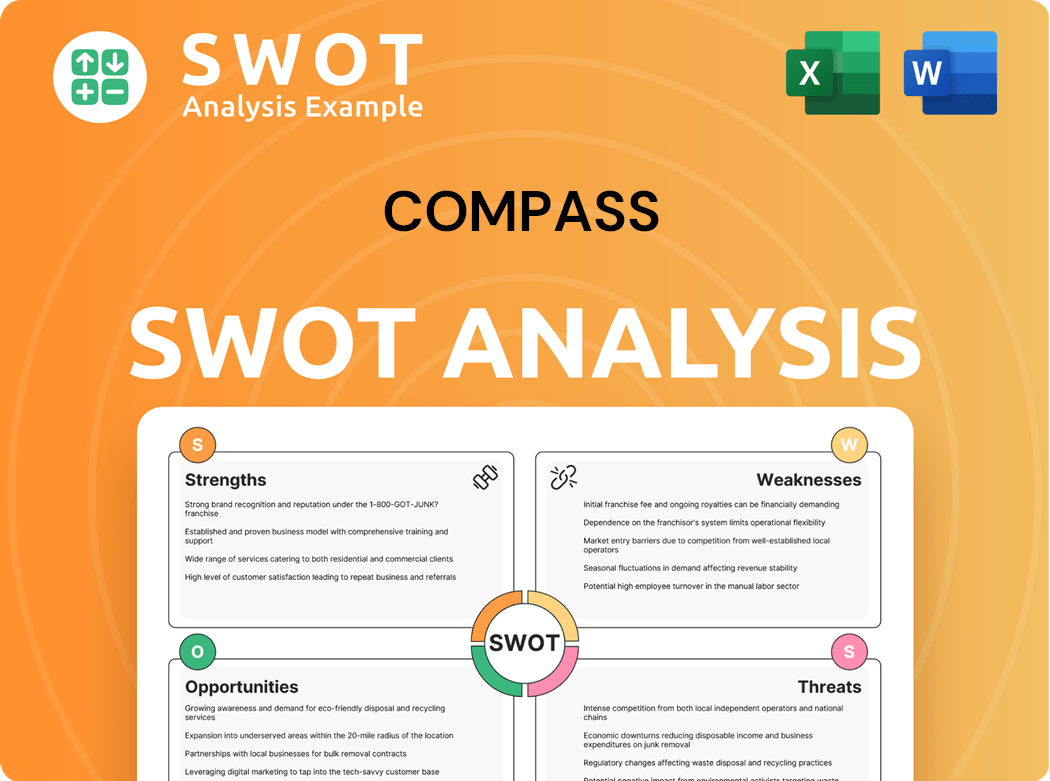

Compass SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Compass?

The Growth Strategy of Compass involves navigating a dynamic competitive landscape. The real estate market is fiercely contested, with various players vying for market share in 2024 and beyond. Understanding the key competitors is crucial for evaluating Compass's position and potential for growth.

The competitive landscape for Compass is diverse, encompassing both traditional brokerages and tech-enabled real estate platforms. These competitors employ various strategies, including pricing, agent commission structures, technological offerings, and geographic reach. This analysis is essential for understanding Compass's strengths, weaknesses, and overall competitive advantage in the real estate market.

Major direct competitors include eXp Realty (EXPI), Anywhere Real Estate Inc. (HOUS), and Keller Williams. These companies challenge Compass through various strategies, including pricing, agent commission structures, technological offerings, and geographic reach. Traditional brokerages, often with long-standing local presence and established agent networks, compete on brand recognition and deep community ties. Newer tech-driven companies, like Redfin, often emphasize lower commission rates or a more direct, technology-centric approach for consumers.

eXp Realty operates on a cloud-based platform, offering a virtual environment for agents and clients. They often attract agents with a commission structure that includes revenue-sharing and stock options. eXp Realty has experienced significant growth in recent years, expanding its agent base and geographic footprint.

Anywhere Real Estate Inc., formerly known as Realogy, is a large, traditional brokerage with a vast network of agents and brands. They compete on brand recognition and a comprehensive suite of services. Anywhere Real Estate Inc. has a significant market share, but faces the challenge of adapting to changing market dynamics and technological advancements.

Keller Williams is a major player in the real estate market, known for its agent-centric model and training programs. They compete on agent support and a strong brand presence. Keller Williams has a large agent network and a focus on technology to support its agents.

Redfin is a tech-focused brokerage that emphasizes lower commission rates and a direct, technology-centric approach for consumers. They compete on price and technology. Redfin has gained market share through its online platform and user-friendly tools.

Zillow is primarily a real estate marketplace, but also competes in the brokerage space with its iBuying program (though this has been scaled back) and agent services. They compete on consumer reach and data-driven insights. Zillow has a massive online presence and a wealth of real estate data.

Many local and regional brokerages compete on deep community ties and personalized service. These brokerages often have strong relationships with local clients and a focus on specific geographic areas. The competitive landscape is also influenced by mergers and acquisitions.

The real estate market is highly competitive, and mergers and alliances can significantly impact competitive dynamics. Emerging players are also disrupting the traditional landscape with innovative business models and technological solutions. Market share figures for 2024 and 2025 are dynamic, but it's important to note that the competitive landscape is constantly evolving.

- Market Share Fluctuations: The real estate market sees constant shifts in market share among major players.

- Technological Advancements: Technology plays a crucial role in the competitive landscape, with companies investing heavily in digital tools and platforms.

- Economic Trends: Economic factors, such as interest rates and housing inventory, significantly influence the competitive dynamics.

- Agent Recruitment and Retention: Attracting and retaining top agents is a key competitive advantage.

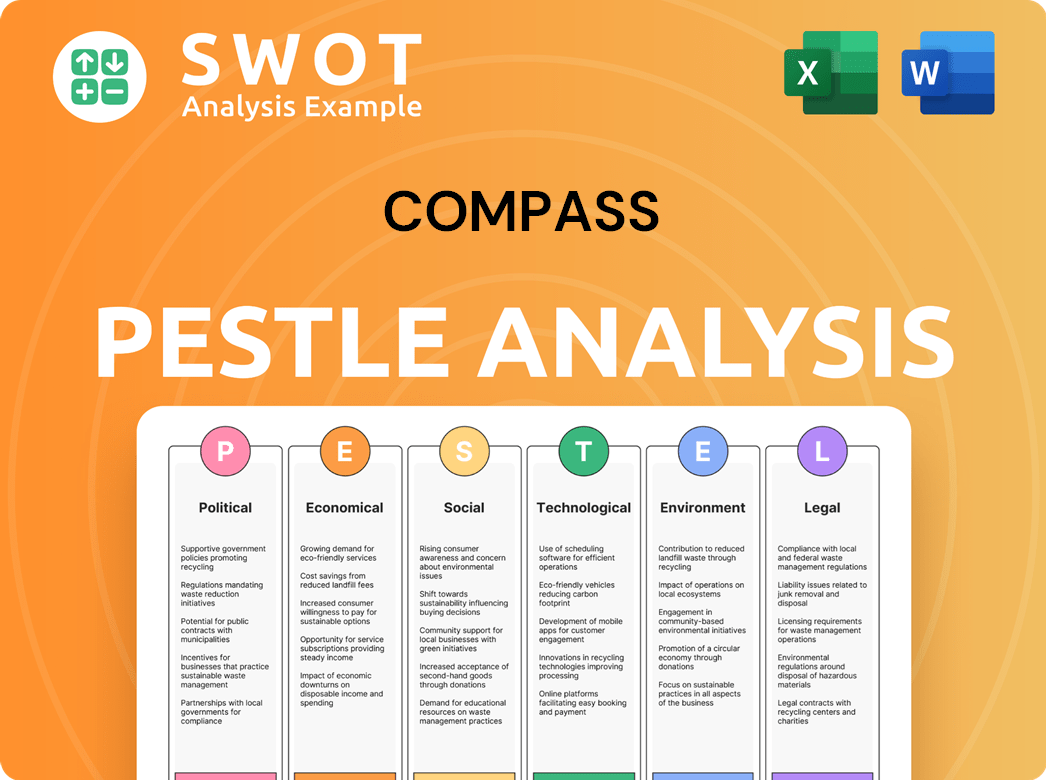

Compass PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Compass a Competitive Edge Over Its Rivals?

The competitive landscape for the real estate market is dynamic, with several players vying for market share. Understanding the competitive advantages of companies like Compass is crucial for investors and industry analysts. This involves assessing their strategies, market positioning, and ability to adapt to changing economic conditions.

Analyzing the Owners & Shareholders of Compass provides insights into its strategic direction and financial performance. This analysis includes examining its technology platform, agent-centric model, brand recognition, and acquisition strategies. These factors contribute to its competitive edge in the real estate market.

Several key elements differentiate Compass in the competitive landscape. These include its proprietary technology, agent-centric approach, and strategic acquisitions. The company's ability to leverage data analytics and marketing tools further enhances its competitive position. These advantages are critical for understanding its market share and overall performance.

Compass's technology platform offers a comprehensive suite of tools designed to boost agent productivity and client satisfaction. This platform integrates customer relationship management (CRM), marketing tools, and data analytics. The platform enables agents to streamline operations and focus on client relationships, offering a competitive advantage.

The agent-centric approach, which includes comprehensive support and training, fosters a loyal agent network. Offering a competitive commission structure with higher splits compared to many traditional brokerages attracts top talent. This model is a key differentiator in the competitive real estate market.

The company has strong brand recognition, particularly in the luxury real estate market, which helps attract both agents and clients. The acquisition of Christie's International Real Estate in January 2025 further strengthens Compass's position in the luxury segment. This strategic move expands its global referral network.

Compass leverages proprietary data, analytics, artificial intelligence, and machine learning. This helps deliver high-value recommendations for its agents and their clients. These tools enhance the agent's ability to serve clients effectively and make informed decisions in the real estate market.

Compass differentiates itself through its proprietary technology platform and agent-centric model. The company's focus on technology, data analytics, and strategic acquisitions enhances its market position. These advantages have evolved with continuous investment in technology and strategic acquisitions.

- Technology Platform: Provides agents with a comprehensive suite of tools.

- Agent-Centric Model: Offers support, training, and competitive commission splits.

- Brand Recognition: Strong presence, especially in the luxury market.

- Data and Analytics: Leverages proprietary data for high-value recommendations.

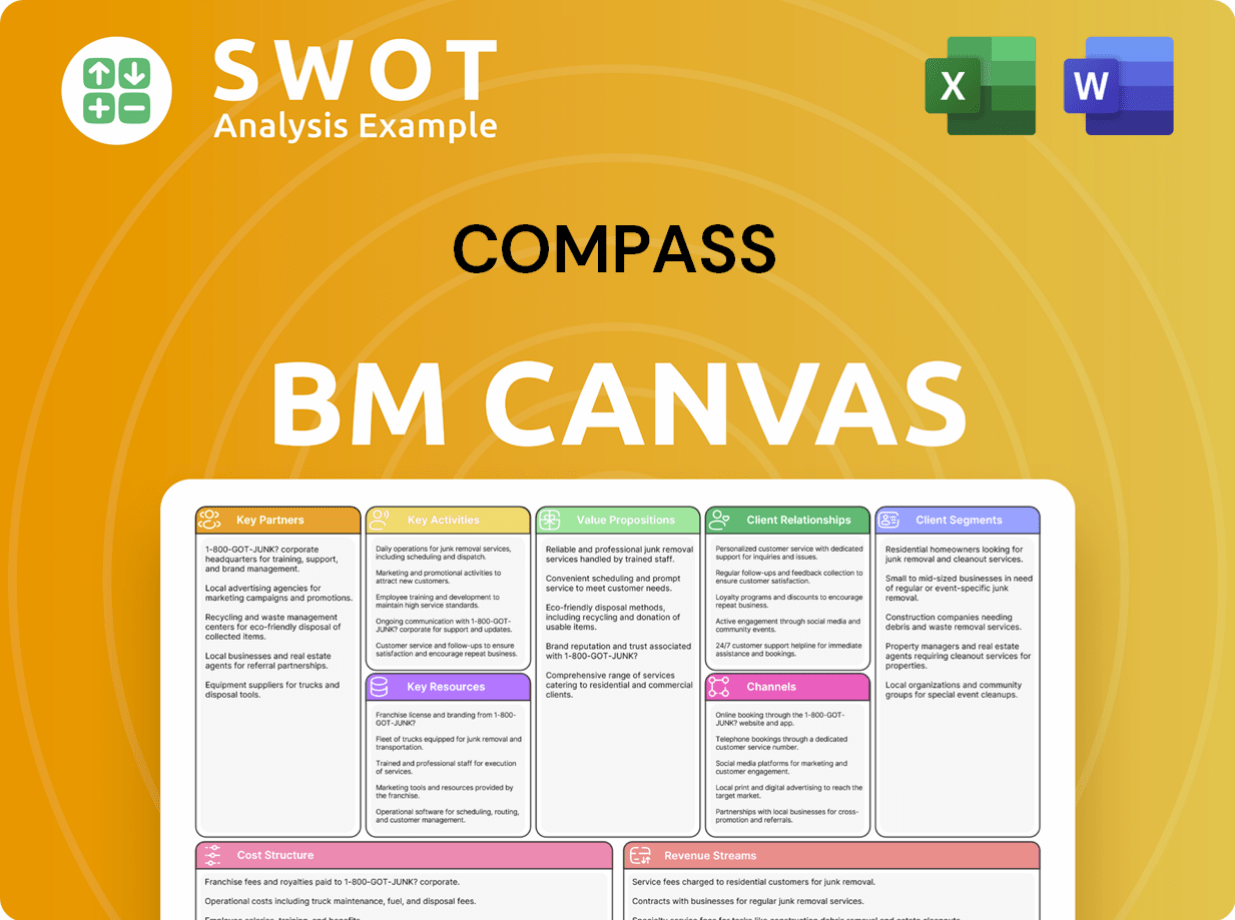

Compass Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Compass’s Competitive Landscape?

The real estate industry is currently undergoing significant transformations, driven by technological advancements, shifting consumer behaviors, and fluctuating economic conditions. These factors shape the Compass competitive landscape, influencing its strategies and market position. The company's ability to adapt to these evolving dynamics will be crucial for its future success. Understanding the Compass company analysis requires a close look at these industry trends.

Real estate market competition is intensifying, with both traditional and technology-driven brokerages vying for market share. Economic uncertainty, including rising interest rates and low inventory, poses immediate challenges, impacting revenue streams. However, the long-term outlook remains positive, with opportunities for expansion and innovation. Navigating these complexities is key to understanding Compass's future trajectory.

Technological advancements, such as AI and data analytics, are reshaping the industry. Evolving consumer preferences demand enhanced digital experiences and personalized services. Economic conditions, including interest rate fluctuations and housing inventory levels, significantly impact market activity.

Managing high operational costs associated with technology and support services is a key challenge. Reliance on agent performance and the intense competition from both traditional and tech-driven brokerages present significant hurdles. Potential regulatory changes and market volatility add further complexity.

The overall real estate market is expected to grow, providing opportunities for client base expansion. Continued investment in technological advancements can enhance offerings and improve efficiency. Diversification into ancillary services like property management or mortgage services could create additional revenue streams.

Compass aims to leverage its structural advantages, including its technology platform, national scale, and network of top agents. The company has an ambitious goal of reaching 30% market share in the top 30 U.S. markets by the end of 2026. The reverse prospecting tool provides a competitive advantage for seller agents.

Compass is investing heavily in technology, with an additional $100 million planned for 2024 to make Compass.com a primary listing platform. The company has expanded into mortgage services, being licensed in 42 states and Washington D.C. as of January 2025. Understanding the competitive strategies of Compass is essential for evaluating its market position.

- Focus on technological innovation to enhance agent and client experiences.

- Expansion of ancillary services to diversify revenue streams.

- Strategic partnerships and acquisitions to strengthen market presence.

- Targeted marketing campaigns to increase brand awareness. For more details, check out the Marketing Strategy of Compass.

Compass Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Compass Company?

- What is Growth Strategy and Future Prospects of Compass Company?

- How Does Compass Company Work?

- What is Sales and Marketing Strategy of Compass Company?

- What is Brief History of Compass Company?

- Who Owns Compass Company?

- What is Customer Demographics and Target Market of Compass Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.