Compass Bundle

Can Compass Company Maintain Its Ascent in the Real Estate Market?

Driven by acquisitions and innovation, Compass SWOT Analysis has rapidly transformed the real estate landscape. Founded in 2012, Compass Company has become a leading force in the U.S. residential market. This article dives deep into Compass's ambitious growth strategy and future prospects.

With a remarkable 6.0% market share as of Q1 2025 and impressive financial results, including a 28.7% year-over-year revenue increase, understanding the future prospects of Compass Company is crucial. This exploration will analyze its expansion plans, technology strategy, and financial outlook. We'll also examine potential challenges and opportunities, providing a comprehensive market analysis of Compass Company's strategic initiatives and its overall business strategy.

How Is Compass Expanding Its Reach?

The Compass Company's growth strategy is heavily focused on expansion initiatives. These initiatives primarily involve strategic acquisitions and efforts to bolster its agent network and increase market penetration. The company aims to leverage its technology platform and increase its market share in key areas.

In 2024 and early 2025, the company demonstrated its commitment to growth through acquisitions and organic market share gains. This approach is supported by new features designed to enhance the real estate process and attract more users. The company's ability to attract and retain agents is a key component of its expansion.

The company's strategic initiatives are designed to drive growth in the competitive real estate market. These expansion plans include both acquiring existing brokerages and organically increasing its market share through innovative features and a strong agent network.

The company's expansion includes a sustained acquisition strategy. In April 2024, the company acquired Latter & Blum, a Louisiana-based brokerage. This was followed by the acquisition of Parks Real Estate, Tennessee's largest brokerage, in May 2024. These acquisitions are aimed at increasing market share in under-represented areas.

Attracting and retaining agents is crucial for the company's expansion. By the end of Q4 2024, the company reported 17,752 principal agents, a 20.9% increase year-over-year. The company maintained a strong agent retention rate of 96.9%. In Q1 2025, the company added 6,065 principal agents year-over-year.

The company is also focused on organic market share gains. In Q1 2025, its quarterly market share grew by 125 basis points year-over-year to a record 6.0%, with organic share up by 82 basis points. This growth is supported by its '30:30 share gain strategy,' which aims to capture 30% market share in the top 30 markets.

The company is expanding its offerings with new features designed to streamline the real estate process. Compass One, an all-in-one client dashboard launched nationally on February 3, 2025, connects buyers and sellers with their agents 24/7. The 'Make-Me-Sell' feature, which allows homeowners to share an aspirational price, had approximately 12,500 entries by the end of Q1 2025.

The company's growth strategy combines acquisitions, agent network development, and organic market share gains. The company is adapting to market changes by focusing on technology and innovative features.

- Acquisitions to expand market presence.

- Focus on agent retention and growth.

- Implementation of new features to enhance user experience.

- Strategic market share goals.

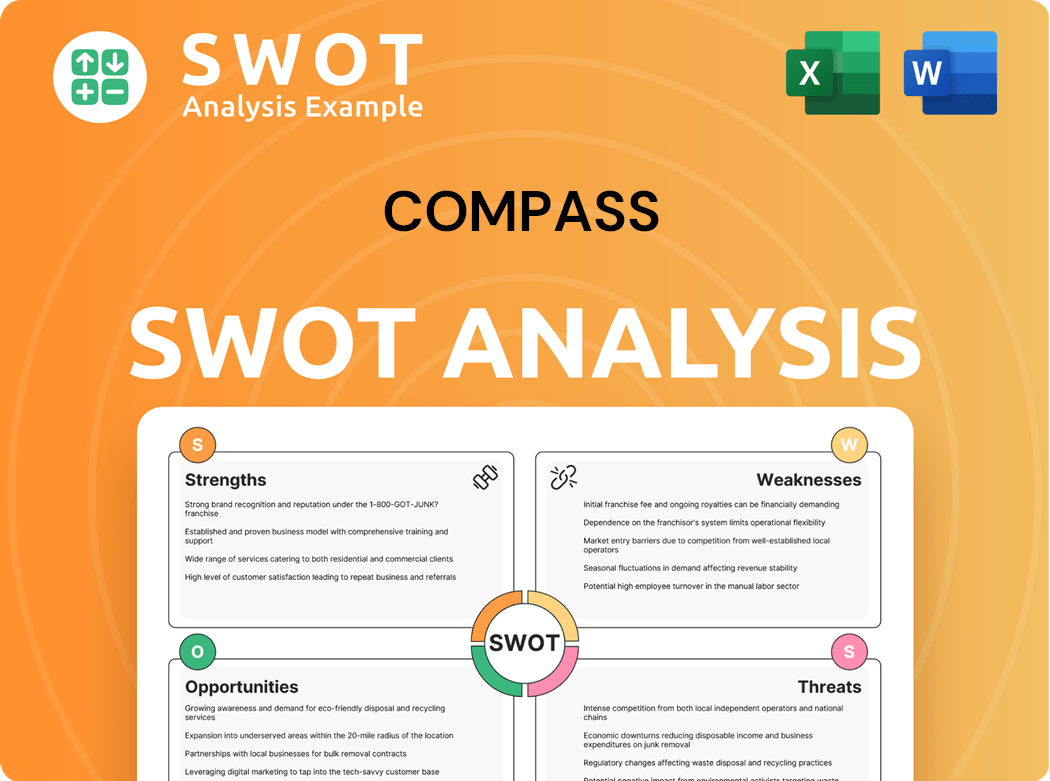

Compass SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Compass Invest in Innovation?

The core of the Target Market of Compass's growth strategy lies in its commitment to innovation and technology. This approach is designed to enhance the real estate experience for both agents and clients. By focusing on a unified platform, the company aims to streamline processes, improve efficiency, and foster stronger relationships.

This strategy is supported by significant investments in technology infrastructure. The company’s dedication to digital transformation is evident in its continuous development and rollout of new tools and features. The goal is to create a seamless, user-friendly experience that sets it apart in the competitive real estate market.

The company has invested a reported $1.6 billion in its technology platform. As of fiscal year 2024, over $900 million has been allocated to research and development, highlighting the importance of innovation in its business strategy.

Launched nationally in February 2025, Compass One is a client-facing platform. It offers 24/7 transparency and connects clients with their agents throughout the real estate journey. This platform integrates features like customized dashboards, market analyses, and transaction tracking.

Launched in late 2024, 'Compass Reverse Prospecting' provides homesellers with real-time insights into buyer interest. This feature helps sellers to understand the market demand for their properties.

'Compass Make-Me-Sell' allows homeowners to gauge market interest for an aspirational selling price. By Q1 2025, the platform had garnered 12,500 entries, showing its appeal to homeowners.

The company rolled out 'One-Click Title & Escrow (T&E) Integration' for iOS devices in Q1 2025. This feature aims to increase attach rates for these services, streamlining the transaction process.

The platform incorporates proprietary data, analytics, artificial intelligence (AI), and machine learning. These technologies simplify agent workflows and deliver recommendations, enhancing efficiency and decision-making.

These innovations directly support growth objectives. They enhance agent productivity, improve client satisfaction, and streamline the overall real estate process. This positions the company as a leader in real estate technology.

The company's technology-driven approach provides several strategic advantages. These initiatives aim to improve agent productivity and client satisfaction, which are crucial for sustained growth and future prospects.

- Enhanced Agent Productivity: Streamlined workflows and AI-driven tools allow agents to focus on client relationships and deal closures.

- Improved Client Satisfaction: Transparency, market insights, and transaction tracking enhance the client experience.

- Competitive Differentiation: The integrated platform and continuous innovation set the company apart in the market.

- Data-Driven Decision Making: Proprietary data and analytics provide valuable insights for agents and clients.

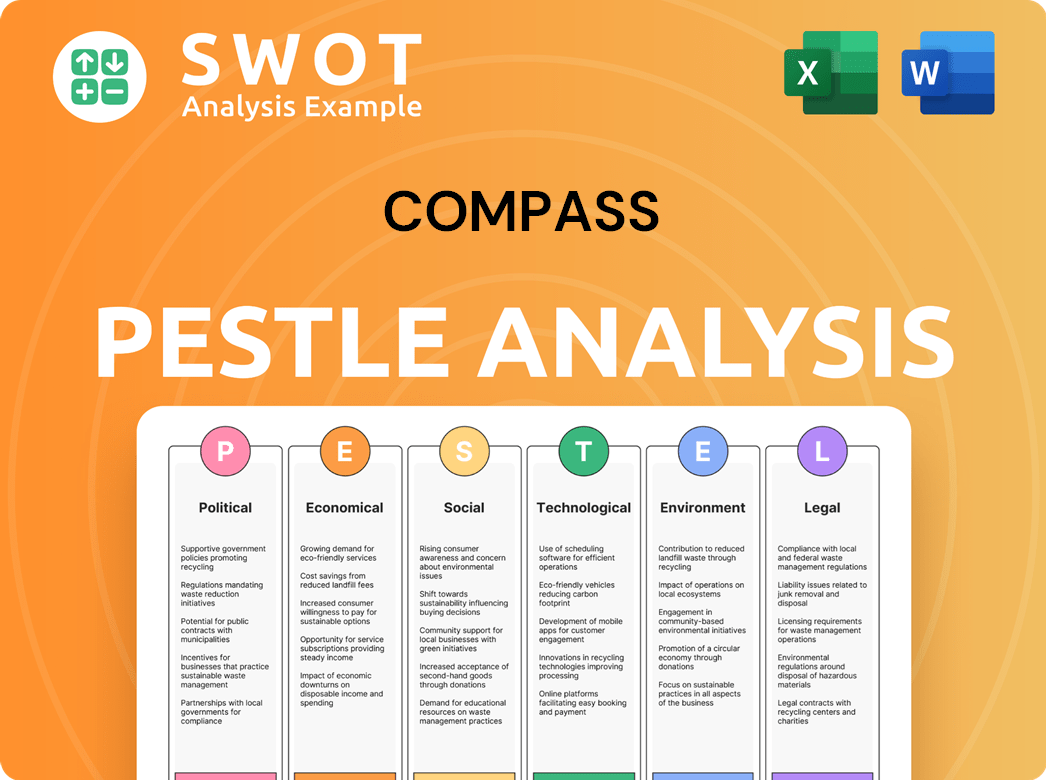

Compass PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Compass’s Growth Forecast?

The financial outlook for the Compass Company in 2025 indicates a focus on revenue growth and achieving profitability. The company's Growth strategy is centered on expanding its market presence and improving operational efficiency. This is a critical time for the Compass Company as it navigates the dynamic real estate market and pursues its Future prospects.

In Q1 2025, the Compass Company demonstrated significant progress. Revenue increased by 28.7% year-over-year, reaching $1.4 billion. This growth was fueled by a 27.8% increase in transactions, outpacing the market decline. The company's financial performance reflects its commitment to its Business strategy and long-term goals.

The Compass Company's Q1 2025 results also showed improvements in profitability. The GAAP net loss improved substantially to $50.7 million, a significant improvement from a net loss of $132.9 million in Q1 2024. Adjusted EBITDA reached $15.6 million, a positive shift compared to a negative $20.1 million in the prior year. These figures highlight the Company performance and its ability to adapt to market changes.

Compass Company has provided positive guidance for Q2 2025, projecting revenue between $2.0 billion and $2.15 billion. This reflects confidence in the company's ability to sustain its growth trajectory. The projected adjusted EBITDA guidance is between $115 million and $135 million.

For the full year 2025, Compass Company anticipates maintaining positive free cash flow. Non-GAAP OPEX for the full year is expected to be between $1.017 billion and $1.042 billion. Analysts predict the company could turn a profit of approximately $51 million, indicating a positive financial outlook.

The acquisition of Christie's International Real Estate, which closed in January 2025, is expected to boost market presence. This strategic move is part of Compass Company's expansion plans and is designed to strengthen its position in the real estate market. This should improve the Compass Company market share and growth.

In 2024, revenue was reported as $5.61 billion to $5.64 billion, up from previous forecasts. The company achieved positive free cash flow in every quarter of 2024. These achievements highlight the Compass Company's ability to adapt to market changes and its Competitive advantage.

The Compass Company faces several challenges, including the need to sustain profitability and adapt to the evolving real estate market. However, the company also has significant opportunities, such as leveraging technology and expanding its global presence. Understanding these challenges is crucial for the Future of real estate market.

- Sustaining Revenue Growth: Maintaining the impressive revenue growth achieved in Q1 2025 will be a key challenge.

- Achieving Profitability: The company must continue to improve its financial performance to achieve sustained profitability.

- Market Dynamics: Adapting to changes in the real estate market, including interest rate fluctuations and economic conditions.

- Technology Integration: Leveraging technology to enhance services and improve operational efficiency.

- Expansion: Expanding its global footprint and increasing market share.

For further insights into the Compass Company's operations and performance, consider reviewing the information available at Owners & Shareholders of Compass.

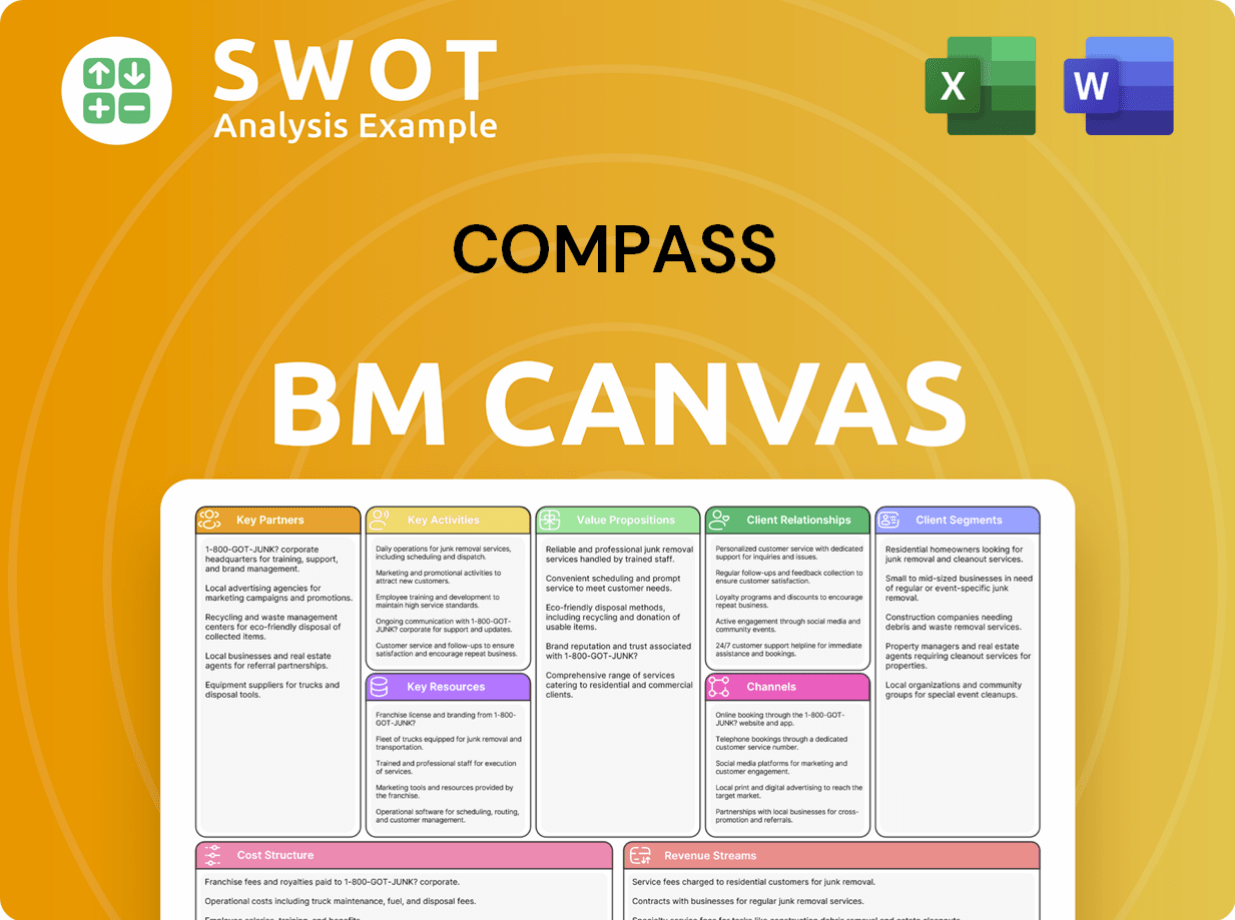

Compass Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Compass’s Growth?

The Marketing Strategy of Compass faces several potential risks and obstacles that could impact its future growth. These challenges range from market volatility and intense competition to operational and regulatory hurdles. Understanding these risks is crucial for evaluating the company's long-term prospects and its ability to execute its growth strategy effectively.

One of the primary concerns for Compass is the inherent volatility of the real estate market. This volatility is influenced by economic conditions, interest rates, and consumer confidence. High mortgage interest rates, for instance, can negatively affect the U.S. real estate industry, potentially leading to decreased transaction volumes and impacting Compass's financial performance. Prolonged market fluctuations could pressure its EBITDA and earnings per share, requiring careful financial planning and strategic adjustments.

Market competition also presents a significant obstacle. The real estate brokerage market is highly fragmented, and Compass faces intense competition from both established players and emerging competitors. The company must continuously innovate and differentiate itself to maintain its market share and attract clients. Additionally, regulatory changes and industry antitrust litigation pose legal and financial risks that could affect future income and necessitate increased financial reserves.

The real estate market's sensitivity to economic factors, interest rates, and consumer confidence poses a significant risk. High mortgage rates can decrease transaction volumes, impacting revenue. Prolonged volatility could pressure EBITDA and earnings per share, affecting the Compass Company's financial health.

The fragmented real estate brokerage market means intense competition. Competitors offering similar proprietary tools like Reverse Prospecting and Compass Private Exclusives are a threat. Maintaining market share requires continuous innovation and differentiation to attract clients.

Ongoing industry antitrust class action litigation presents substantial legal risks. These could lead to financial settlements, impacting future income. Navigating regulatory changes requires careful financial planning and proactive legal strategies for Compass Company.

Managing rising operational expenses, particularly commissions, is a key challenge. Commissions and related expenses accounted for 81.6% of revenue in Q1 2025. Maintaining cost discipline is crucial for sustainable growth and profitability.

Integrating acquisitions, such as Christie's International Real Estate, carries execution risks. These risks can lead to increased operational costs and complexities. Successful integration is vital for realizing the full potential of these strategic moves for Compass Company.

Supply chain disruptions and geopolitical uncertainties can indirectly affect the real estate sector. These broader economic challenges could impact Compass Company's operations. Monitoring these factors and adapting strategies is crucial for resilience.

Operational challenges encompass managing rising expenses, particularly commissions, which accounted for 81.6% of revenue in Q1 2025. Integration of acquisitions like Christie's International Real Estate also introduces execution risks. Broader economic challenges, such as supply chain disruptions and geopolitical uncertainties, can indirectly affect the real estate sector. Compass Company assesses these risks through ongoing monitoring and aims to mitigate them through diversification and disciplined cost management.

Market volatility, influenced by economic conditions and interest rates, presents significant financial risks. High mortgage interest rates can decrease transaction volumes, impacting revenue and potentially pressuring EBITDA and earnings per share. Prolonged market fluctuations necessitate careful financial planning and strategic adjustments to ensure sustained company performance. The Compass Company must adapt its strategies to navigate these challenges effectively.

Compass Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Compass Company?

- What is Competitive Landscape of Compass Company?

- How Does Compass Company Work?

- What is Sales and Marketing Strategy of Compass Company?

- What is Brief History of Compass Company?

- Who Owns Compass Company?

- What is Customer Demographics and Target Market of Compass Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.