Compass Bundle

How Does Compass Company Thrive in Real Estate?

Compass Inc. has revolutionized the real estate landscape, swiftly becoming a dominant force since its 2012 founding. Its innovative technology-driven platform has propelled it to the forefront, making it the largest residential real estate brokerage in the U.S. by sales volume. This growth has been fueled by a unique approach that empowers agents and redefines the buying and selling experience.

With a record 6.0% market share in Q1 2025 and a substantial revenue of $1.4 billion, understanding Compass SWOT Analysis is key. This analysis will explore how Compass Real Estate operates, examining its core operations, value proposition, and the competitive advantages that have solidified its position. We'll delve into how Compass Agents leverage the Compass Platform to enhance client experiences and drive market share gains, providing insights into the company's sustained growth and profitability, and answering questions like "How does Compass Company make money?" and "Is Compass a good brokerage?"

What Are the Key Operations Driving Compass’s Success?

The core of How Compass Works lies in its dedication to empowering real estate agents through a comprehensive, tech-driven platform. This approach allows the company to streamline and improve agents' business operations. Their primary offerings include real estate brokerage services for both buyers and sellers, a proprietary technology platform tailored for agents, and supplementary services like mortgage, title, and escrow.

The primary customer base for Compass is its network of real estate agents. These agents use the platform to serve buyers and sellers, which ultimately simplifies real estate transactions for the end consumers. The company focuses on providing agents with the tools and support they need to succeed, which in turn benefits the clients they serve.

The company's operational processes revolve around agent recruitment and retention, continuous technology development, robust marketing and branding, and data analytics. Compass attracts agents by offering a competitive commission structure, advanced technology, and extensive support and training. This helps to build a loyal and productive workforce. The company has invested approximately $1.6 billion in developing its technology platform.

Compass focuses on attracting and retaining top real estate agents by offering competitive commission structures and comprehensive support. This includes advanced technology, training programs, and marketing services designed to enhance their productivity and client service. The goal is to create a supportive environment that fosters agent loyalty and success.

A significant portion of Compass's resources is dedicated to the continuous development of its technology platform. This platform integrates various tools, including CRM, marketing tools, data analytics, and transaction management. Recent innovations include AI-powered tools like 'Likely to Sell' for lead identification, designed to enhance agent efficiency.

Compass invests heavily in marketing and branding to establish a strong market presence and support its agents. This includes creating high-quality marketing materials, developing effective advertising campaigns, and building a recognizable brand identity. These efforts are designed to attract clients and enhance agent success.

Data analytics plays a crucial role in Compass's operations. The company uses data to gain insights into market trends, client behavior, and agent performance. This data-driven approach helps optimize strategies, improve decision-making, and provide agents with valuable information to better serve their clients.

The supply chain and distribution networks are primarily built around its vast network of real estate agents and its digital platform. This agent-centric approach, combined with its advanced technology, makes its operations unique compared to competitors. For instance, the recently launched Compass One platform offers clients a curated dashboard with customized timelines, market analyses, and document access, providing 24/7 transparency throughout the real estate journey. This integrated ecosystem translates into significant customer benefits by simplifying complex transactions, saving agents considerable time (estimated at 15-20 hours per week for teams), and enhancing overall client satisfaction. To understand how Compass positions itself against other companies, you can explore the Competitors Landscape of Compass.

The Compass Platform provides numerous benefits to both agents and clients, streamlining the real estate process and enhancing the overall experience. The platform offers a centralized hub for managing all aspects of a real estate transaction, from initial contact to closing.

- Efficiency: Saves agents significant time by automating tasks and providing integrated tools.

- Transparency: Offers clients real-time access to information and updates throughout the transaction.

- Data-Driven Insights: Provides agents with valuable market data and analytics to better serve clients.

- Support: Offers comprehensive training and support to agents, helping them succeed.

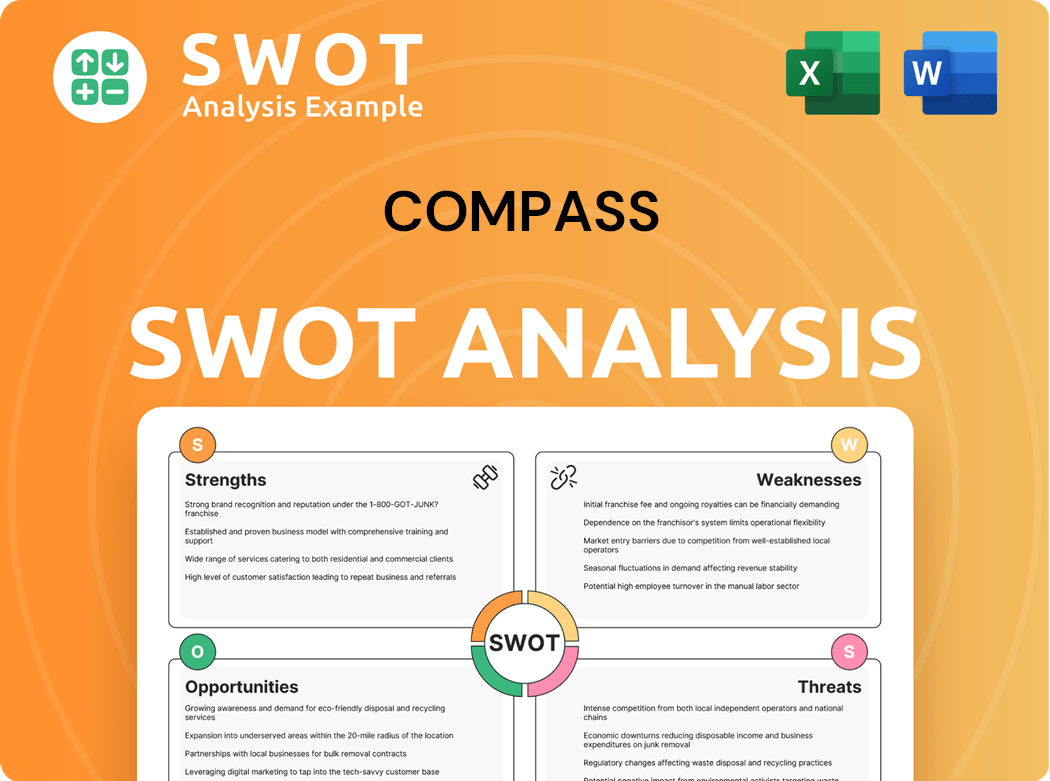

Compass SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Compass Make Money?

The primary revenue stream for Compass Company is generated through commissions from real estate transactions. It leverages its technology platform to support agents in facilitating the buying, selling, and renting of properties. This commission-based model is the main source of income for the company.

In Q1 2025, Compass reported a revenue of $1.4 billion, which represented a significant 28.7% year-over-year increase. For the full fiscal year 2024, the company's annual revenue reached approximately $6.02 billion, reflecting a 13.18% increase compared to the previous year, showcasing its growth trajectory.

Beyond commissions, Compass also earns revenue from ancillary real estate services. These services include title, escrow, and mortgage solutions, with plans to expand these offerings to diversify its income streams. The company's monetization strategies include a competitive commission structure to attract a larger agent base.

Here are the key strategies Compass uses to generate revenue and monetize its services, focusing on its commission structure, platform fees, and expansion into ancillary services.

- Commission-Based Model: The core revenue comes from commissions earned on real estate transactions facilitated by Compass Agents.

- Ancillary Services: Revenue is generated from title, escrow, and mortgage solutions, with plans to expand these offerings.

- Competitive Commission Structure: Offers higher commission splits to attract and retain agents compared to traditional brokerages.

- Platform Fees: Utilizes platform fees, and may explore bundled services or tiered pricing models.

- Integration of Services: Focuses on integrating mortgage, escrow, and title businesses into its CRM platform to capture associated fees.

- Strategic Partnerships: Leverages acquisitions and partnerships, such as with Christie's International Real Estate, to expand market reach.

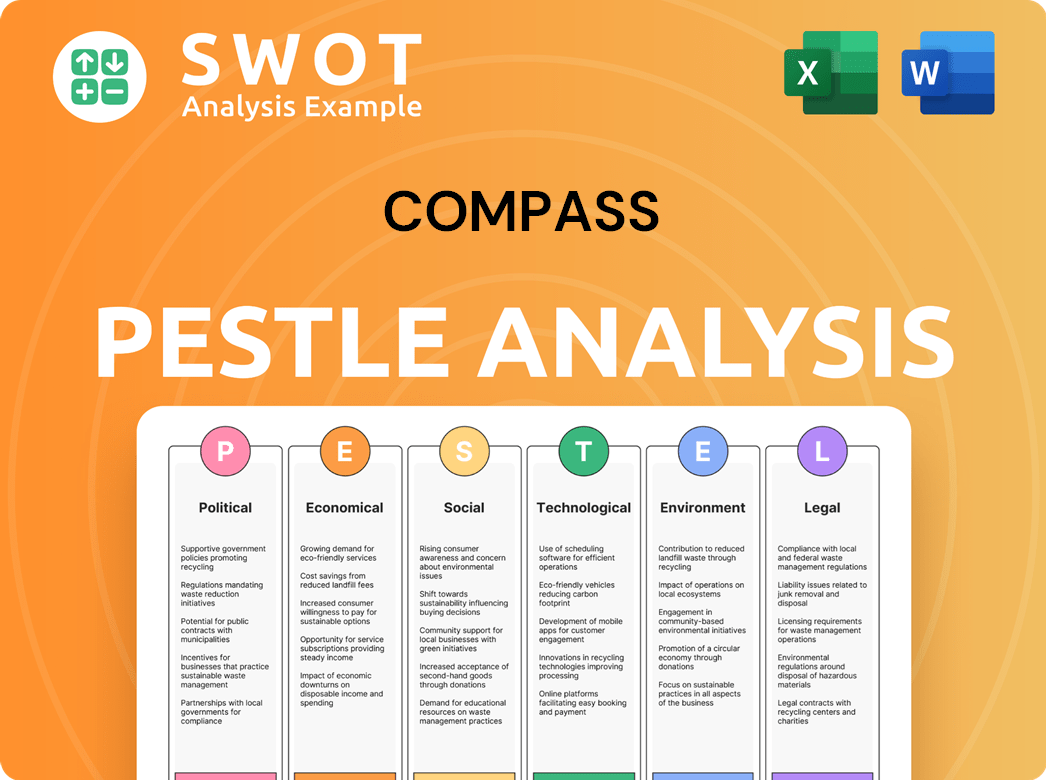

Compass PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Compass’s Business Model?

Since its inception in 2012, the growth of the Compass Company has been marked by several key milestones. The launch of its initial real estate technology platform in 2013 was a pivotal step, followed by aggressive expansion into new markets. This strategic approach solidified its position in the real estate sector.

Significant strategic moves include substantial funding rounds, such as the $400 million Series F funding in 2018, which valued the company at $4.4 billion. More recently, in January 2025, Compass acquired a company with the exclusive worldwide right to operate, franchise, and license the Christie's International Real Estate brand. The launch of Compass One in February 2025, a client-facing version of its end-to-end technology platform, represents a significant step in enhancing client transparency and agent-client relationships.

The company's competitive edge is rooted in its innovative technology platform, strong brand identity, and agent-centric approach. The large and growing network of experienced real estate agents, coupled with access to extensive data and analytics, further strengthens its market position. Compass continues to adapt by investing in technological advancements, expanding into high-growth markets, and exploring diversification into ancillary services.

In 2013, the company launched its first real estate technology platform. Expansion into new markets like Miami and Boston in 2014, and Chicago, Los Angeles, and San Francisco in 2016 accelerated market penetration. The introduction of the Compass Concierge program in 2017 further demonstrated its commitment to innovation.

The company secured $400 million in Series F funding in 2018, valuing it at $4.4 billion. In January 2025, Compass acquired the worldwide rights to the Christie's International Real Estate brand. The launch of Compass One in February 2025 enhanced client transparency and agent-client relationships.

The company's competitive advantages include its innovative technology platform and strong brand identity. Its agent-centric approach, comprehensive support, and training provide a distinct edge. A large network of experienced real estate agents and access to extensive data strengthen its market position.

The company has faced high operational costs and intense competition. Economic downturns and regulatory changes also pose risks. Compass has responded by focusing on cost discipline and leveraging its structural advantages. The company continues to adapt by investing in technological advancements and expanding into high-growth markets.

The company’s approach to the market involves a blend of technological innovation and agent support, aiming to provide a seamless experience for both agents and clients. The company's focus on luxury real estate and its expansion into high-growth markets reflect its strategic vision. Compass is working to improve its market share.

- The company’s technology platform integrates various tools for agents.

- The agent-centric approach provides comprehensive support and training.

- The company focuses on luxury real estate and high-growth markets.

- The company is adapting to market challenges through cost discipline and innovation.

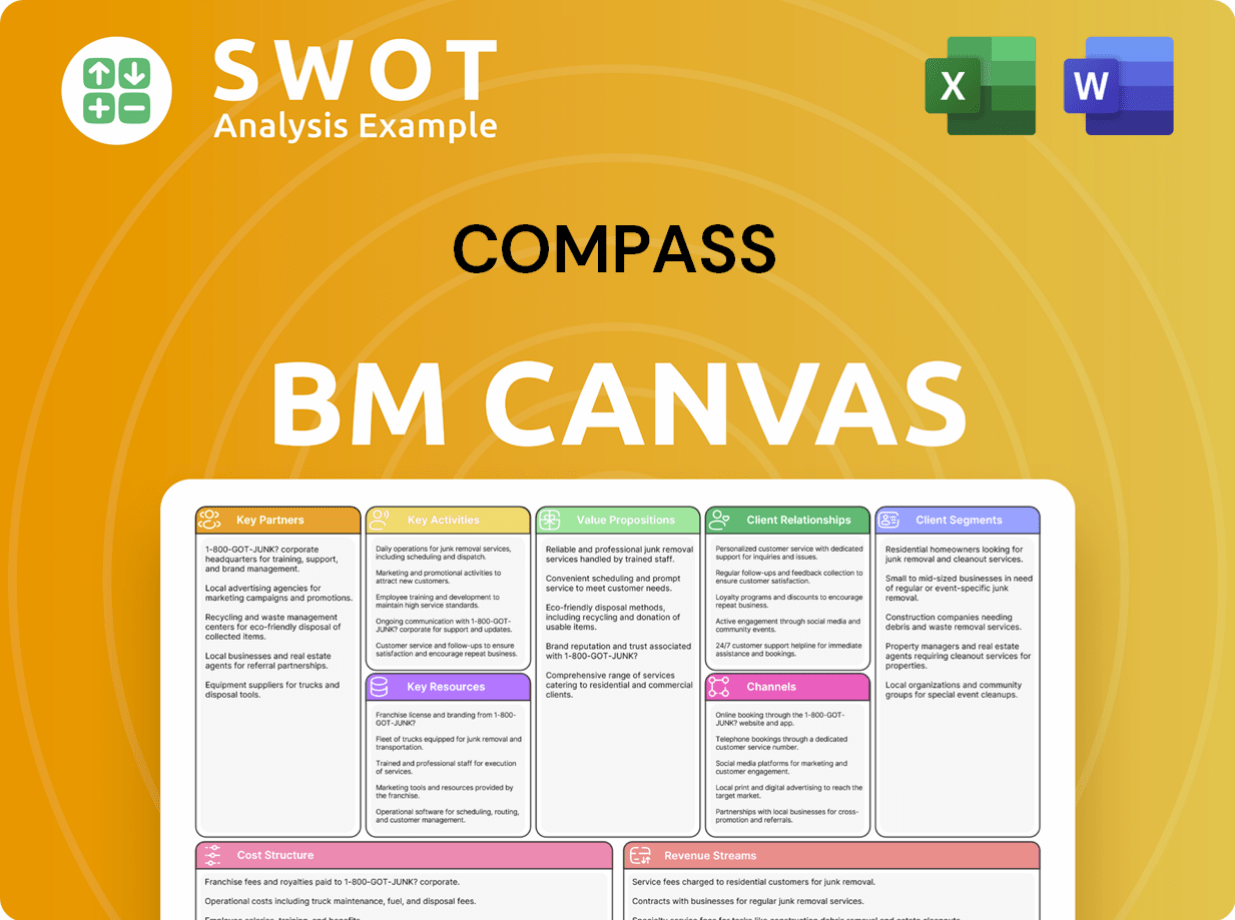

Compass Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Compass Positioning Itself for Continued Success?

The real estate market is highly competitive, and the company has positioned itself as a major player. By sales volume, it is the largest residential real estate brokerage in the U.S. In Q4 2024, the company held a market share of 5.06%, and this increased to a record 6.0% in Q1 2025.

The company's success stems from its focus on agent-centric technology and a strong brand identity. This has helped in building customer loyalty and expanding its reach across major metropolitan areas. To learn more about its origins, you can read a Brief History of Compass.

Several factors could impact the company's operations. Market volatility, including economic downturns, housing inventory fluctuations, and interest rate changes, poses a risk. Antitrust litigation and high operational costs also present challenges. Changes in commission structures could also impact revenue and agent retention.

The company's future depends on strategic technology investments and market expansion. It aims to outpace market growth and anticipates being free cash flow positive for the full year 2025. Key initiatives include enhancing its technology platform and targeting a 30% market share in the top 30 U.S. markets by the end of 2026.

The company plans to leverage its proprietary technology platform and national scale. It aims to capture significant upside as the market recovers. This involves continued agent recruitment and retention, technological innovation, and potential diversification into ancillary services.

- Continued enhancement of its technology platform.

- Full launch of the 'Compass Make-Me-Sell' tool in late Q1 2025.

- Goal of reaching 30% market share in the top 30 U.S. markets by the end of 2026.

- Focus on agent recruitment and retention.

Compass Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Compass Company?

- What is Competitive Landscape of Compass Company?

- What is Growth Strategy and Future Prospects of Compass Company?

- What is Sales and Marketing Strategy of Compass Company?

- What is Brief History of Compass Company?

- Who Owns Compass Company?

- What is Customer Demographics and Target Market of Compass Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.