Computershare Bundle

How Did Computershare Rise to Global Dominance?

Ever wondered how a small Australian startup transformed into a global powerhouse managing billions in assets? The story of Computershare SWOT Analysis is a compelling narrative of innovation and strategic expansion. From its roots in 1978 Melbourne, this company revolutionized financial administration, leaving an indelible mark on the global market. Dive into the fascinating Computershare history and discover its remarkable journey.

The Computershare company began by offering computer bureau services, quickly gaining a foothold in the share registry sector. This early focus on stock transfer and share registry services laid the foundation for its future success. Through strategic acquisitions and a commitment to technological advancement, Computershare expanded its corporate services, becoming a critical player in the financial world and impacting how companies interact with their shareholders.

What is the Computershare Founding Story?

The story of the Computershare company began in 1978 in Melbourne, Australia. The company's origins lie in providing computer services to businesses, but it quickly found its niche. This brief history of Computershare highlights its evolution from a small Australian firm to a global leader.

Initially, the focus was on general computer services. However, the company soon recognized an opportunity in the share registry sector. This shift marked the beginning of Computershare's specialization in providing advanced computer bureau services to Australian share registrars.

Computershare's early success was built on its ability to handle high-integrity data management and high-volume transaction processing. This specialization allowed Computershare to develop technology that reduced costs and simplified processes for its clients.

Computershare was founded in 1978 in Australia, initially offering general computer services before specializing in share registry services.

- The company's early focus was on providing specialist computer bureau services.

- This specialization addressed the growing need for efficient shareholder record management.

- Computershare's technology minimized risk and reduced costs for clients.

- The late 1970s in Australia saw increasing adoption of computer technology, aiding Computershare's growth.

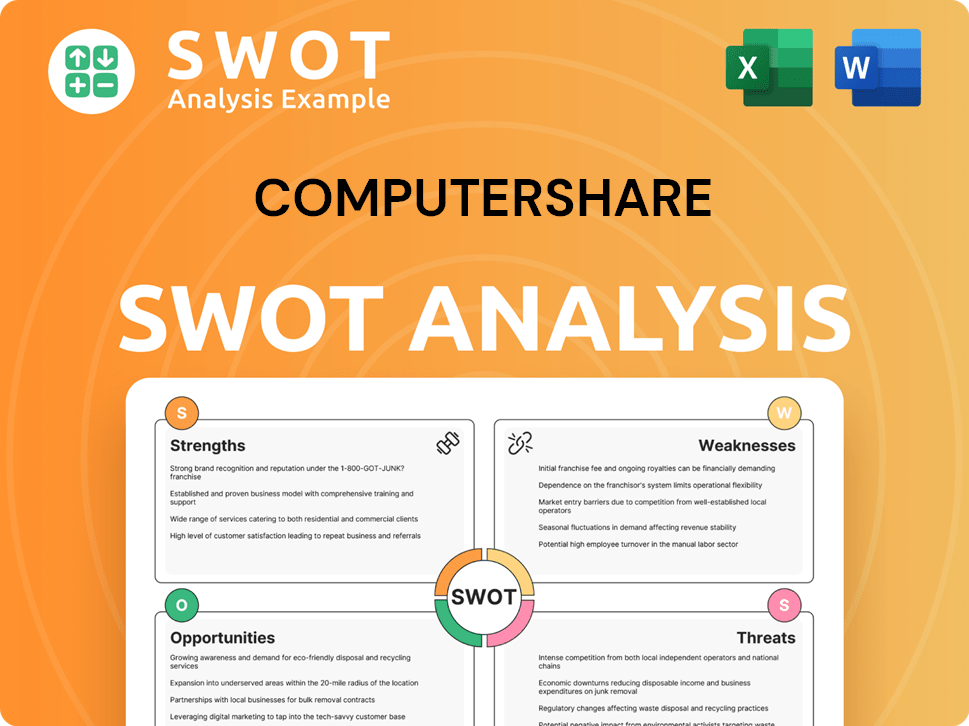

Computershare SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Computershare?

The early growth of the Computershare company was built on providing computer bureau services to Australian share registrars. This initial success allowed for the expansion of its service offerings, setting the stage for its future as a global leader. By the time it listed on the Australian Securities Exchange (ASX) in 1994, Computershare had a market capitalization of AUD 36 million, managed approximately 6 million shareholder accounts, and employed around 50 staff.

The mid-1990s marked the beginning of Computershare's international expansion strategy. The company entered the UK market in 1995 and New Zealand in 1997. A significant move came in 1998 with the acquisition of the Royal Bank of Scotland's transfer agency business. This strategic move strengthened its presence in the UK and facilitated entry into South Africa and Ireland.

The company continued its global expansion, entering Hong Kong in 1999 and the US and Canadian markets in 2000. In the US and Canada, it began offering corporate trust, escrow, and debt management services. Germany followed in 2001, and India in 2004. These moves broadened Computershare's global footprint, establishing its position as a key player in the corporate services sector.

Key acquisitions were crucial to Computershare's growth. The acquisition of Georgeson in 2003, a proxy solicitation specialist, was important. It also expanded into new product categories, such as tenancy deposits in the UK in 2007, and acquired customer communication solutions company QM Technologies (AU) in 2008. Further acquisitions, like I-nvestor in 2009, and National City's investor services business, underscored its aggressive growth strategy.

This sustained expansion, both geographically and in service offerings, transformed Computershare from a domestic Australian company into a leading global financial administration provider. By 2024, Computershare had a market cap of AUD 23.47 billion, managing over 75 million customer records with over 14,000 staff globally. This growth highlights its impact on the share registry and corporate services industries.

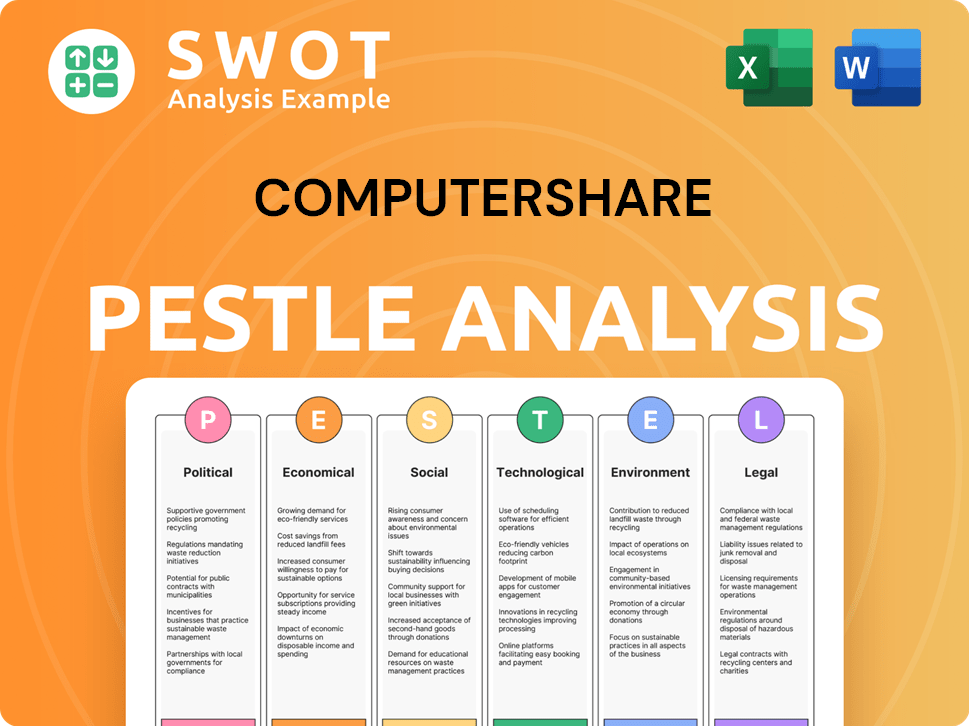

Computershare PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Computershare history?

The Computershare company's journey, from its beginnings to its current global presence, is marked by significant milestones that have shaped its evolution in the share registry and corporate services industries. This brief history of Computershare highlights its key achievements and strategic moves over the years.

| Year | Milestone |

|---|---|

| 1978 | Founded in Melbourne, Australia, as a stock transfer company. |

| 1994 | Expanded internationally, marking the beginning of Computershare's global presence. |

| 2000 | Listed on the Australian Securities Exchange (ASX), significantly boosting its profile and resources. |

| 2001 | Acquired EquiServe, a major move that expanded its operations in the United States. |

| 2006 | Entered the FTSE 100, reflecting its substantial market capitalization and influence. |

| 2021 | Acquired Wells Fargo Corporate Trust business for $750 million in the United States, expanding its corporate trust services. |

| April 2024 | Agreed to acquire BNY Trust Company of Canada, further growing its corporate trust and employee share plan businesses. |

Computershare has consistently focused on leveraging technology to enhance its services and adapt to market changes. A key innovation has been the development and rollout of its market-leading technology, such as EquatePlus, which has created new client opportunities.

Computershare has invested heavily in technology to streamline stock transfer processes and improve efficiency. This includes online platforms for shareholder communication and voting.

The development and implementation of EquatePlus has strengthened Computershare's market position. It provides a comprehensive platform for managing employee share plans.

The company has embraced digital solutions for shareholder meetings and communications. This has enhanced accessibility and engagement.

Computershare has continuously improved its data security measures to protect shareholder information. This includes advanced encryption and cybersecurity protocols.

Automation of key processes has reduced costs and improved accuracy. This includes automated dividend payments and proxy voting.

User-friendly client portals have been developed to provide real-time access to information. This enhances transparency and client satisfaction.

Computershare has faced various challenges, including adapting to evolving regulatory landscapes and addressing technological shifts. The company's call in February 2023 for an investigation into the ASX concerning the collapsed CHESS project highlights the need for adaptability.

Adapting to changing regulations across multiple jurisdictions has been a constant challenge. Compliance requirements vary significantly by region.

The rapid pace of technological change requires continuous investment and adaptation. This includes cybersecurity threats and data privacy concerns.

Navigating market downturns and economic uncertainty has tested Computershare's resilience. Strategic acquisitions and divestitures have been key.

Competition from other share registry and corporate services providers requires continuous innovation. Differentiation and client service are crucial.

The COVID-19 pandemic accelerated the shift towards digital communications. This required rapid adaptation of shareholder meeting formats.

Operational risks, including data breaches and system failures, pose ongoing challenges. Robust risk management is essential.

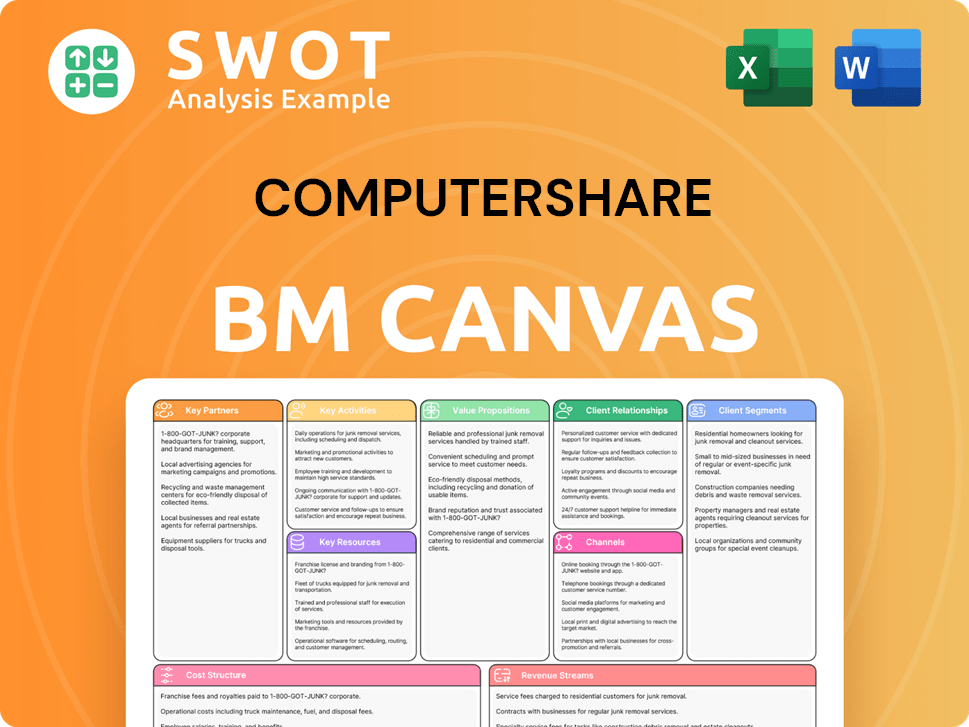

Computershare Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Computershare?

The Computershare company has a rich history, evolving from a small Australian firm to a global leader in share registry and corporate services. Founded in 1978, the company has expanded its services and geographic reach through strategic acquisitions and organic growth. This journey reflects a commitment to innovation and adapting to the changing needs of the financial markets.

| Year | Key Event |

|---|---|

| 1978 | Computershare was founded in Melbourne, Australia, initially offering computer services to businesses. |

| 1994 | The company listed on the Australian Securities Exchange (ASX) with a market cap of AUD 36 million. |

| 1995 | Computershare entered the UK market, marking its first international expansion. |

| 1997 | The company expanded into New Zealand. |

| 1998 | Computershare acquired Royal Bank of Scotland's transfer agency business and entered the South African and Irish markets. |

| 2000 | The company entered the US and Canadian markets, also expanding into corporate trust services. |

| 2003 | Computershare acquired Georgeson, strengthening its position in proxy solicitation and corporate governance. |

| 2005 | The company acquired Equiserve. |

| 2012 | Computershare acquired Shareowner Services from Bank of New York Mellon. |

| 2018 | The company completed the acquisition of Equatex Group Holding AG, a European shares plan business. |

| 2021 | Computershare acquired Wells Fargo Corporate Trust business for $750 million. |

| October 2023 | Computershare sold its mortgage services unit in the U.S. for US$ 720 million. |

| April 2024 | The company agreed to acquire BNY Trust Company of Canada. |

| September 2024 | Computershare published its Annual Report 2024, highlighting strong financial results for FY24 with management earnings per share (EPS) of 117.63 cps. |

| February 2025 | Computershare reported strong financial results for the first half of 2025, with increased revenues and earnings across all core business lines, and upgraded FY25 guidance, expecting management EPS of around 135 cps, an increase of approximately 15% on the previous year. The company also announced a 12.5% increase in its interim dividend to AUD 45 cents per share. |

| June 2025 | Computershare's market capitalization is AUD 23.47 billion. |

Computershare's future is driven by its capital-light model, strategic investments, and focus on core businesses, including Issuer Services, Corporate Trust, and Employee Share Plans. The company is positioned for sustained growth in these areas.

The company anticipates growth in market debt issuance volumes, which will positively impact its Corporate Trust business. Ongoing digital transformation and investments in end-to-end digital platforms are expected to enhance scalability and reduce operational dependencies.

Computershare's strong balance sheet and high cash conversion provide flexibility for further innovation, organic expansion, and strategic acquisitions. This financial strength supports its long-term growth strategy.

Analyst sentiment remains positive, projecting Computershare to reach AUD 51.19 per share by the end of 2025, underpinned by recurring revenue streams and global market leadership. This positive outlook reflects confidence in the company's future.

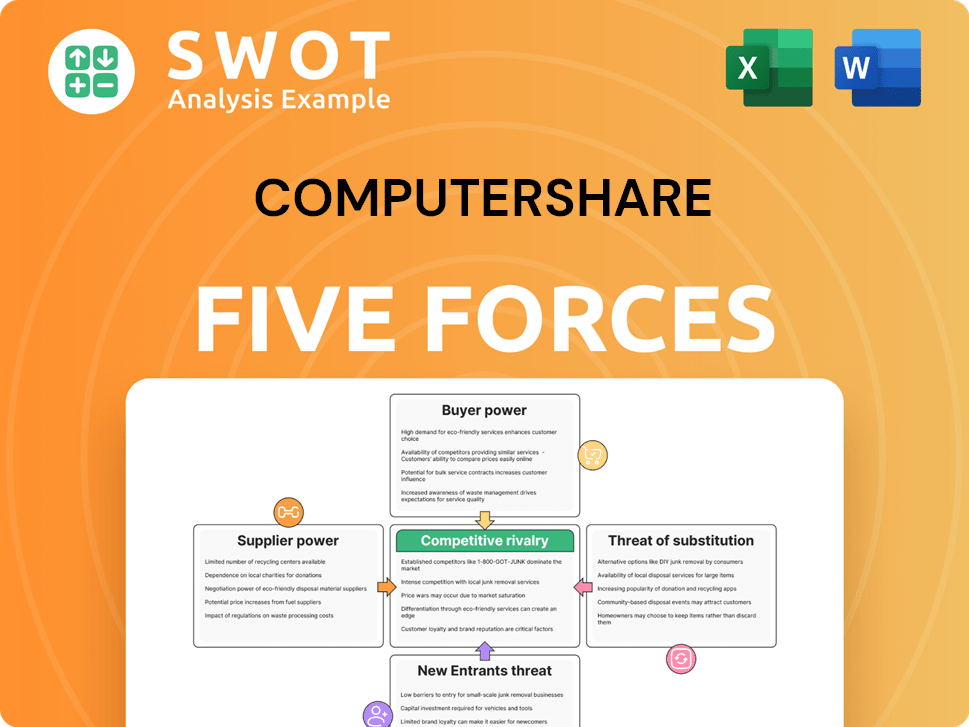

Computershare Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Computershare Company?

- What is Growth Strategy and Future Prospects of Computershare Company?

- How Does Computershare Company Work?

- What is Sales and Marketing Strategy of Computershare Company?

- What is Brief History of Computershare Company?

- Who Owns Computershare Company?

- What is Customer Demographics and Target Market of Computershare Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.