Computershare Bundle

Decoding Computershare: How Does It Really Work?

Ever wondered who manages the intricate dance of shares and shareholder communications? Computershare, a global powerhouse founded in 1978, is a key player in the financial world, handling everything from share registries to employee equity plans. With a vast global presence and over 12,000 employees, this company is a critical link between businesses and their investors.

Computershare's Computershare SWOT Analysis reveals the company's strengths in providing essential investor services and its strategic approach to navigating the complexities of the financial landscape. Understanding the Computershare company and its diverse Computershare services, including its role as a stock transfer agent, is vital for anyone looking to understand how shares are transferred, dividends are managed, and shareholder interactions are facilitated. This analysis will explore the inner workings of Computershare and its impact on the market.

What Are the Key Operations Driving Computershare’s Success?

The core operations of the Computershare company revolve around providing essential services to the financial and corporate sectors. Its primary value proposition lies in streamlining complex financial processes, offering a range of services that enhance efficiency and compliance. This includes managing shareholder records, facilitating corporate actions, and administering employee share plans.

The company's integrated approach allows it to offer comprehensive solutions, from initial public offerings (IPOs) to ongoing shareholder management. By leveraging technology and its global presence, Computershare services enable clients to navigate the complexities of the financial landscape with greater ease and confidence. The company's ability to handle cross-border transactions and adhere to regulatory requirements across multiple jurisdictions further enhances its value.

The company's business model is built on long-term contracts and high client retention rates, which provide a stable revenue stream. Its extensive experience in integrating businesses, especially in the increasingly global securities industry, sets it apart. This translates into secure and efficient online platforms for shareholder management and streamlined financial administration for its clients.

This includes register maintenance, corporate actions, and stakeholder relationship management. The company supports companies through IPOs, manages shareholder registers, and facilitates proxy voting. In 2023, the company processed over $2.7 trillion in corporate actions globally.

Administers employee share schemes and provides support to employees holding shares. The company's employee share plans managed over $190 billion in assets as of 2023. This service helps companies manage their equity compensation programs efficiently.

Offers trust and agency services related to the administration of debt securities. This includes services related to the administration of debt securities. In 2023, the company's Corporate Trust division administered over $10 trillion in debt securities.

Provides document composition, printing, and electronic delivery services. These services are crucial for shareholder communications and regulatory compliance. In 2023, the company delivered over 1.5 billion communications.

Computershare offers secure and efficient online platforms for shareholder management and streamlined financial administration. Its global reach and regulatory expertise facilitate seamless cross-border transactions. The company's comprehensive services and technological investments ensure high accuracy and efficiency.

- Secure online portals for shareholder management.

- Streamlined financial administration.

- Global reach and regulatory expertise.

- Efficient processing of corporate actions.

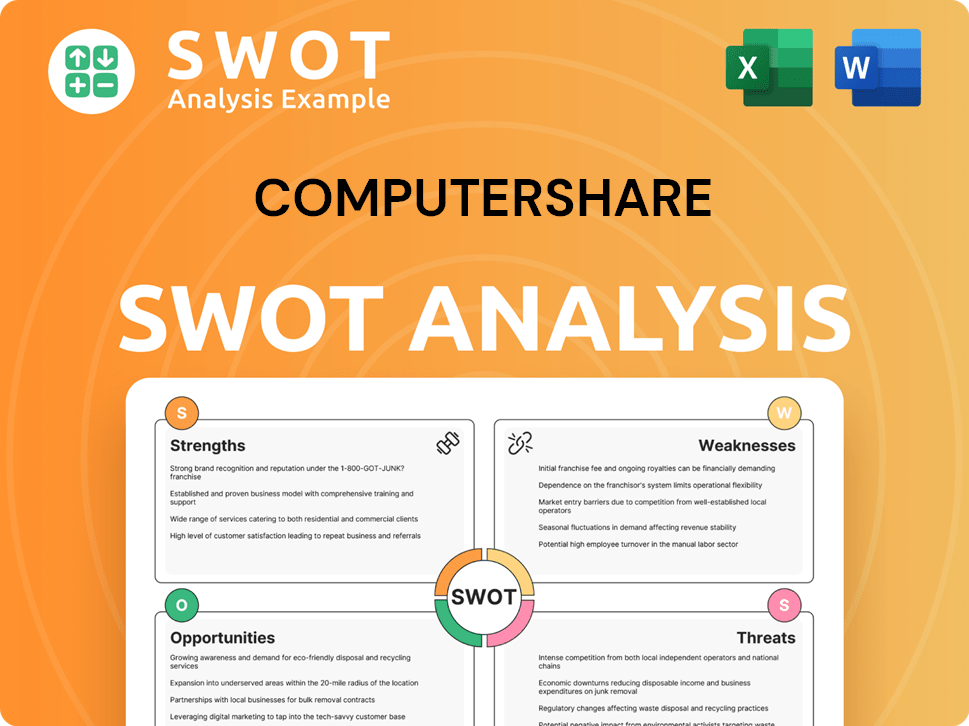

Computershare SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Computershare Make Money?

The Computershare company generates revenue through a diverse business model. This includes service fees, technology solutions, and interest income, with a strong emphasis on recurring revenue streams. For the fiscal year ending June 30, 2024, Computershare reported annual revenue of $2.97 billion USD, reflecting a 5.84% growth.

Key revenue streams include core fees from registry maintenance and governance services, transactional fees from activities like employee plan transactions, event fees from corporate actions, and margin income from interest earned on client funds. The company's diversified model, with approximately 86% of its revenue being recurring, provides a stable financial base. Innovative monetization strategies include platform fees, bundled services, and tiered pricing, which capitalize on the comprehensive nature of its offerings.

In the half-year ending December 31, 2024, the company's sales were $1.47 billion USD, an increase from $1.38 billion USD a year prior. The focus on core businesses has improved revenues across all lines, including Register Maintenance, Corporate Actions, and Governance Services. While IPO and M&A volumes were lower in the first half of FY24, this was offset by larger average deal sizes and higher fees.

Understanding the financial performance and revenue drivers of Computershare is crucial for investors and stakeholders. The company's revenue model is built on several key components.

- Core Fees: These fees, which include registry maintenance and governance services, generated $1.52 billion USD in FY24.

- Transactional Fees: Fees from activities like registry maintenance and employee plan transactions contributed $440.99 million USD in FY24.

- Event Fees: Derived from corporate actions and stakeholder relationship management, these fees were $175.58 million USD in FY24.

- Margin Income: This significant contributor to earnings is derived from interest earned on client funds held in trust. Margin income reached $780.70 million USD in FY24, an increase from $722.83 million USD in FY23. Margin income was also up 7.3% to $832.1 million USD in FY24. As of December 2024, client balances were around $76 billion USD.

- The Computershare services also include corporate trust services and bankruptcy administration.

- For further insights into the company's strategic growth, you can explore the Growth Strategy of Computershare.

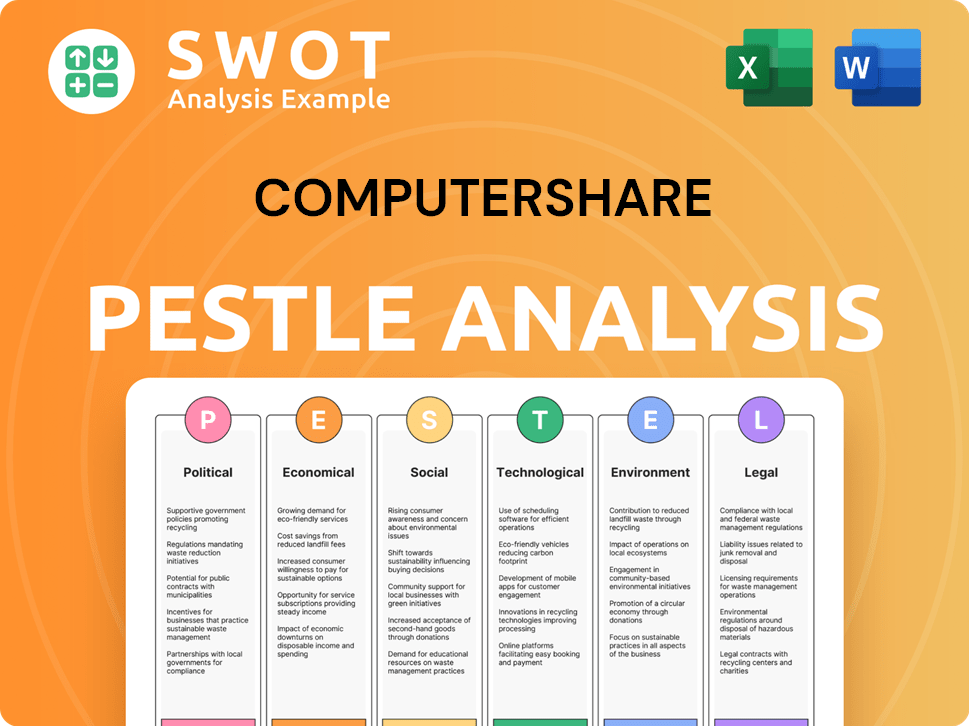

Computershare PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Computershare’s Business Model?

Computershare's journey has been marked by significant milestones and strategic shifts, shaping its operational and financial performance. A pivotal event in FY24 was the successful integration of the Wells Fargo Corporate Trust, acquired in 2021. This integration was a major undertaking, demonstrating the company's ability to assimilate large acquisitions.

Further solidifying its position, Computershare agreed to acquire BNY Trust Company of Canada in April 2024, with completion expected in FY25. This move, along with the May 2023 acquisition of SunDoc Filings, highlights the company's ongoing efforts to expand its service offerings. A key strategic decision was the sale of its US Mortgage Services business in May 2024 to Rithm Capital for US$720 million, allowing Computershare to focus on its core, capital-light businesses with global growth potential.

In December 2024, Computershare announced the acquisition of ingage IR Limited, a provider of investor relations and engagement software, followed by the January 2025 acquisition of CMi2i, a capital markets intelligence and guidance provider. These acquisitions demonstrate the company's commitment to enhancing its services and staying at the forefront of industry trends. These strategic moves are aimed at improving the company's competitive edge in the market.

The completion of the Wells Fargo Corporate Trust integration in FY24 was a major achievement. The acquisition of BNY Trust Company of Canada in April 2024, expected to finalize in FY25, is another key milestone. The sale of the US Mortgage Services business in May 2024 for US$720 million allowed the company to focus on core businesses.

The acquisition of ingage IR Limited in December 2024 and CMi2i in January 2025 are strategic moves to enhance service offerings. The company is adapting to market changes by investing in technology like EquatePlus for Employee Share Plans. These moves are aimed at expanding its market presence and service capabilities.

Computershare's global presence and diversified services provide a strong competitive advantage. Its decades of experience and regulatory expertise are key differentiators. The ability to integrate businesses and achieve cost efficiencies sustains its business model. The company's focus on data integrity and privacy is critical for secure operations.

The company faced challenges, such as subdued levels of new debt issuance impacting Corporate Trust performance. It focused on recovery in activity levels in the second half of FY24. The company's ability to adapt and respond to market dynamics is crucial for its continued success. The company is constantly adapting to the market changes.

Computershare's competitive advantages include its global presence, diversified service offerings, and robust technological infrastructure. The company's experience as a global financial record keeper and its regulatory expertise provide a significant edge. Its ability to acquire and integrate businesses into its proprietary share registry system further sustains its business model. To learn more about how the company operates, you can read this article: Computershare's operations.

- Strong global presence and diversified services.

- Robust technological infrastructure and data integrity.

- Strategic acquisitions to enhance service offerings.

- Focus on capital-light core businesses.

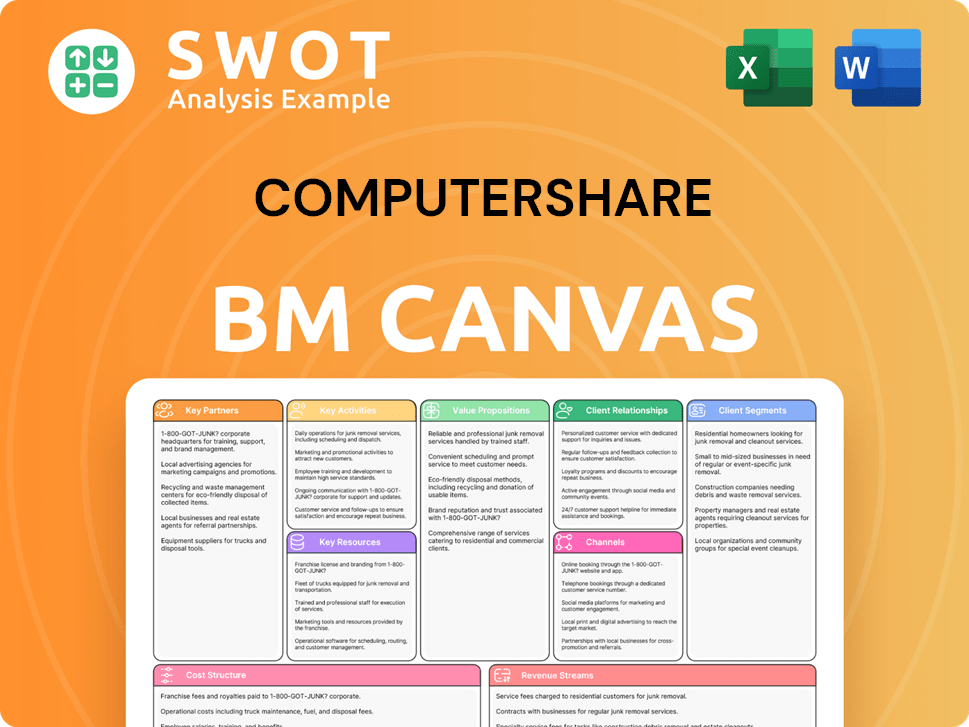

Computershare Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Computershare Positioning Itself for Continued Success?

Let's examine the industry position, risks, and future outlook of the Computershare company, a major player in the financial administration sector. The company provides a range of services, including share registry, employee equity plans, and corporate trust services. Understanding these aspects is crucial for anyone interested in the financial services landscape, especially when considering the company's role in the market and its potential for growth.

Computershare services a vast network of over 25,000 firms globally. The competitive environment is diverse, yet the company distinguishes itself through its extensive service offerings, long-term contracts, high client retention, and expertise in integrating different businesses. This strong position allows the company to navigate the complexities of the financial market while maintaining a solid base of operations.

Computershare holds a leading position in the global financial administration sector, particularly in transfer agency and share registration. It services over 25,000 firms worldwide, showcasing its extensive reach and influence within the industry.

Key risks include regulatory changes and intense competition, which could impact the company's operations. Changes in interest rates and client trading volumes can affect revenue, as can sudden declines in market values of securities.

The company has a positive outlook for FY25, anticipating growth in its core businesses. Strategic initiatives include technology investments to boost customer value and efficiency. The company aims to achieve 30% EBIT margins and 25% ROIC through the cycle, excluding M&A.

Computershare is committed to investing in technologies to enhance customer value and gain additional efficiency. They also plan to pursue further acquisitions to strengthen their core businesses. For further insights, consider reading a brief history of Computershare.

The company's outlook for FY25 includes affirming guidance for management EPS to be around 126 cents per share, up 7.5% year-on-year. They expect momentum in core businesses and benefits from their hedging strategy.

- Momentum in core businesses and further recovery in event-based activities.

- Benefits from its hedging strategy and lower debt costs.

- Cost savings to drive future earnings growth.

- Maintaining a strong balance sheet.

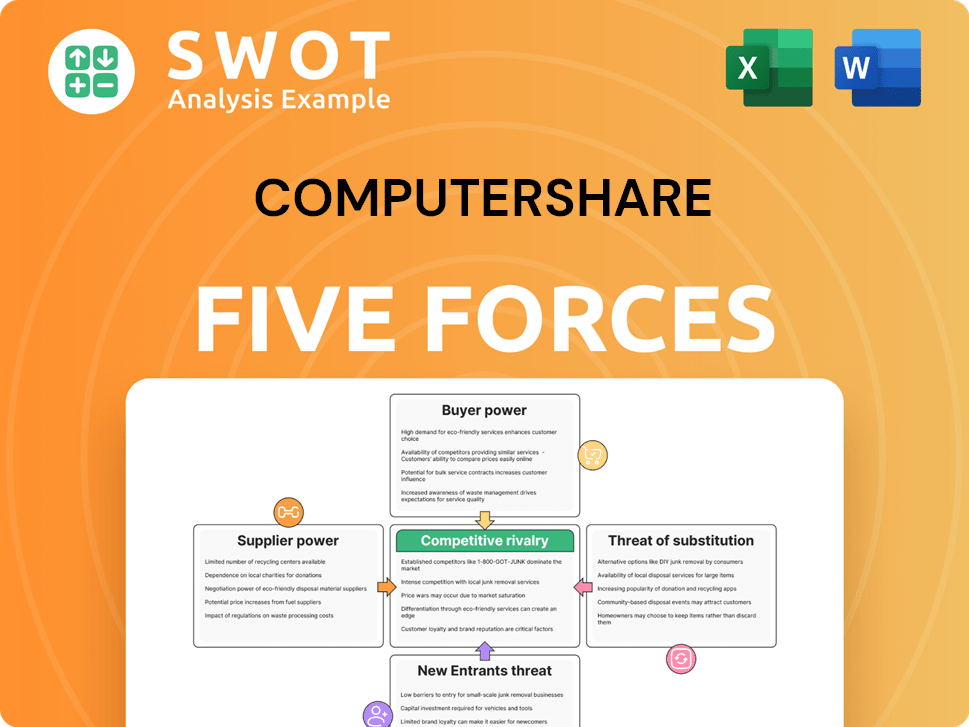

Computershare Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Computershare Company?

- What is Competitive Landscape of Computershare Company?

- What is Growth Strategy and Future Prospects of Computershare Company?

- What is Sales and Marketing Strategy of Computershare Company?

- What is Brief History of Computershare Company?

- Who Owns Computershare Company?

- What is Customer Demographics and Target Market of Computershare Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.