Computershare Bundle

How Does Computershare Navigate the Cutthroat Financial Services Arena?

Computershare, a global force in investor services, plays a critical role in the financial ecosystem. From its humble beginnings in Australia, the company has evolved into a major player, offering a comprehensive suite of services that support businesses worldwide. Understanding the Computershare SWOT Analysis is key to grasping its strategic positioning.

This exploration of the Computershare competitive landscape is vital for investors and strategists alike. We'll dissect the Computershare competitors, analyze its Computershare market analysis, and evaluate its strategic strengths within the ever-changing Computershare industry. This analysis will help you understand Computershare services and assess its Computershare financial performance in comparison to its rivals, offering a comprehensive overview of its market position.

Where Does Computershare’ Stand in the Current Market?

Computershare holds a significant position in the investor services industry, particularly in share registry and corporate actions. The company is recognized as a leading global provider. It offers a range of services, including share registry, employee equity plans, stakeholder communications, and corporate governance solutions. This positions it as a key player for publicly listed companies, private businesses, and government entities.

The company has strategically diversified its offerings beyond its core share registry business. This expansion includes mortgage servicing in the U.S., class action administration, and bankruptcy services. This diversification helps capture new revenue streams and reduces risks associated with relying on a single service line. Its global footprint, with operations across North America, Europe, Asia, and Australia, allows it to serve multinational clients effectively.

For the first half of fiscal year 2024, Computershare reported a management earnings per share (EPS) of 75.3 US cents, reflecting a 28% increase. Management operating profit for the same period was US$568.6 million, up 22%. These figures highlight its strong financial health and operational efficiency. The company continues to explore growth opportunities in emerging markets and through digital offerings to maintain its competitive edge in the Growth Strategy of Computershare.

While specific global market share figures for 2024-2025 are not readily available in consolidated reports, Computershare is widely recognized as one of the largest providers globally. The company is often cited as a leader in key markets such as Australia, the UK, and North America. This strong market position is a key factor in the overall Computershare competitive landscape.

Computershare's services include share registry services, employee equity plans, stakeholder communications, and corporate governance solutions. These services cater to a diverse customer base, from publicly listed companies to government entities. Understanding these services is crucial for a comprehensive Computershare market analysis.

In the first half of fiscal year 2024, Computershare demonstrated robust financial performance. Management EPS increased by 28%, and management operating profit rose by 22%. This financial strength supports the company's ability to invest in growth and maintain its competitive edge within the Computershare industry.

Computershare maintains a significant global footprint, with operations across North America, Europe, Asia, and Australia. This global presence allows the company to serve multinational clients effectively. This extensive reach is a key aspect of the Computershare competitive landscape.

Computershare's strengths include its dominant market position in share registry services, diversified service offerings, and a strong global presence. The company's financial performance, as demonstrated by the 28% increase in EPS, further solidifies its position. These factors contribute to its competitive advantages.

- Dominant market position in share registry.

- Diversified service offerings, including mortgage servicing.

- Strong global presence with operations across multiple continents.

- Robust financial performance with increasing EPS and operating profit.

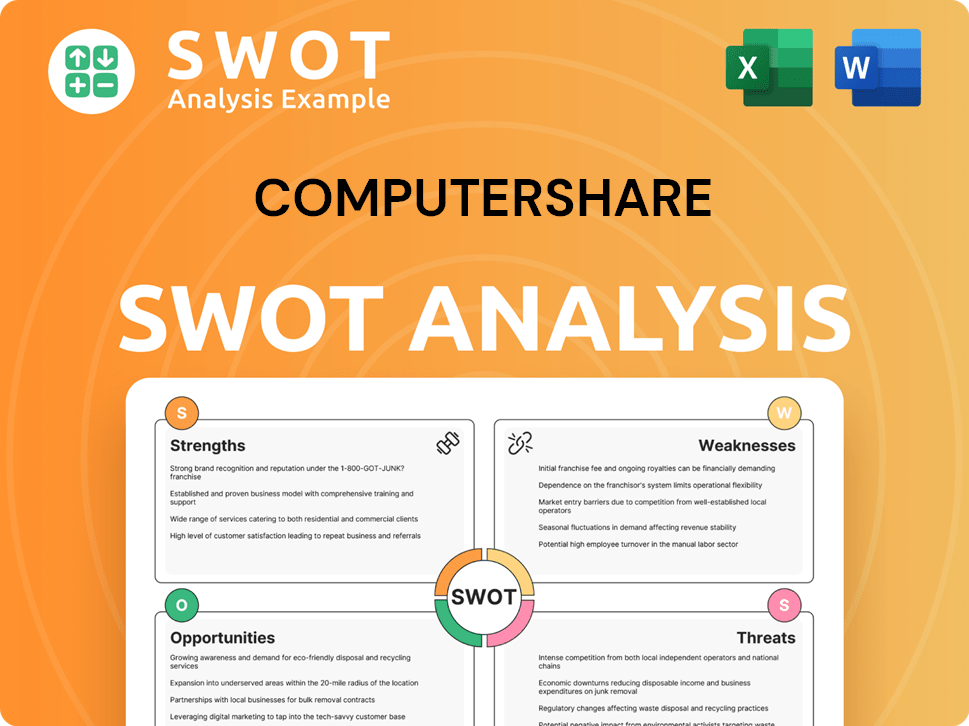

Computershare SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Computershare?

Understanding the Growth Strategy of Computershare requires a close look at its competitive environment. The Computershare competitive landscape is shaped by a diverse array of players, from direct rivals offering similar services to indirect competitors and emerging FinTech companies. This analysis is crucial for investors, financial professionals, and business strategists evaluating the company's market position and future prospects. A thorough Computershare market analysis reveals the strengths, weaknesses, opportunities, and threats (SWOT) that define its competitive standing.

The Computershare industry is dynamic, with mergers, acquisitions, and technological advancements constantly reshaping the competitive dynamics. Companies must continually invest in technology and cybersecurity to meet evolving client demands and regulatory requirements. The competitive environment is further intensified by the need for continuous investment in technology and cybersecurity to meet evolving client demands and regulatory requirements. This constant evolution necessitates a detailed examination of its key competitors to understand the competitive pressures and strategic responses.

The Computershare services span share registry, corporate actions, employee equity plan administration, and more, leading to a broad competitive field. This includes established players and innovative FinTech firms. Analyzing these competitors helps in understanding the company's market share, competitive advantages, and potential areas for growth. This involves evaluating their services, financial performance, and strategic initiatives to assess their impact on the overall competitive landscape.

Direct competitors offer similar services, primarily in share registry and corporate actions. These companies compete head-to-head for the same clients, particularly in the areas of share registration, proxy services, and shareholder communications.

Indirect competitors provide specialized services that may overlap with Computershare's offerings. These include companies focused on employee equity plan administration, corporate governance, and FinTech solutions. These firms often target specific niches within the broader market.

Key players include Broadridge Financial Solutions, Equiniti, and Link Group. These companies have significant market share and a global presence. The competitive landscape is further influenced by the strategies and performance of these major players.

Companies like Fidelity Stock Plan Services and Morgan Stanley at Work (formerly Solium) offer comprehensive solutions. These firms compete in the employee equity plan administration sector, providing services that overlap with Computershare's offerings.

Law firms, consulting agencies, and technology providers specializing in GRC software offer alternative options. These entities compete by providing services related to corporate governance, risk management, and compliance.

Emerging FinTech players introduce innovative digital platforms and automated solutions. These companies may disrupt traditional service models, particularly in areas like digital shareholder engagement and proxy voting.

A detailed Computershare competitor strengths and weaknesses analysis is crucial for understanding its market position. Assessing the Computershare market share analysis involves comparing its performance with key rivals. Evaluating the Computershare vs. Broadridge Financial Solutions and Computershare vs. Equiniti Group dynamics provides insights into their respective strengths and weaknesses. This comparison helps in identifying areas where Computershare can improve and capitalize on its competitive advantages.

- Broadridge Financial Solutions: A major player in investor communications and technology, Broadridge offers a broad suite of services that overlap with Computershare's, particularly in proxy services and shareholder communications. In 2024, Broadridge reported total revenues of approximately $6.5 billion.

- Equiniti: Prominent in the UK, Equiniti provides share registration, employee benefits, and pension administration services. Equiniti's revenue for 2024 was around £600 million.

- Link Group: Based in Australia, Link Group offers share registry, superannuation, and fund administration services. Link Group's revenue for 2024 was approximately AUD $1.2 billion.

- Market Share Dynamics: The share registry market is highly competitive, with significant players vying for market share. The exact market share percentages vary by region and service line, but these three companies are among the leaders.

- Technology and Innovation: The Computershare impact of technology on competition is significant. Companies that invest in digital platforms and automated solutions gain a competitive edge. The Computershare proxy voting services competitors are increasing their digital capabilities.

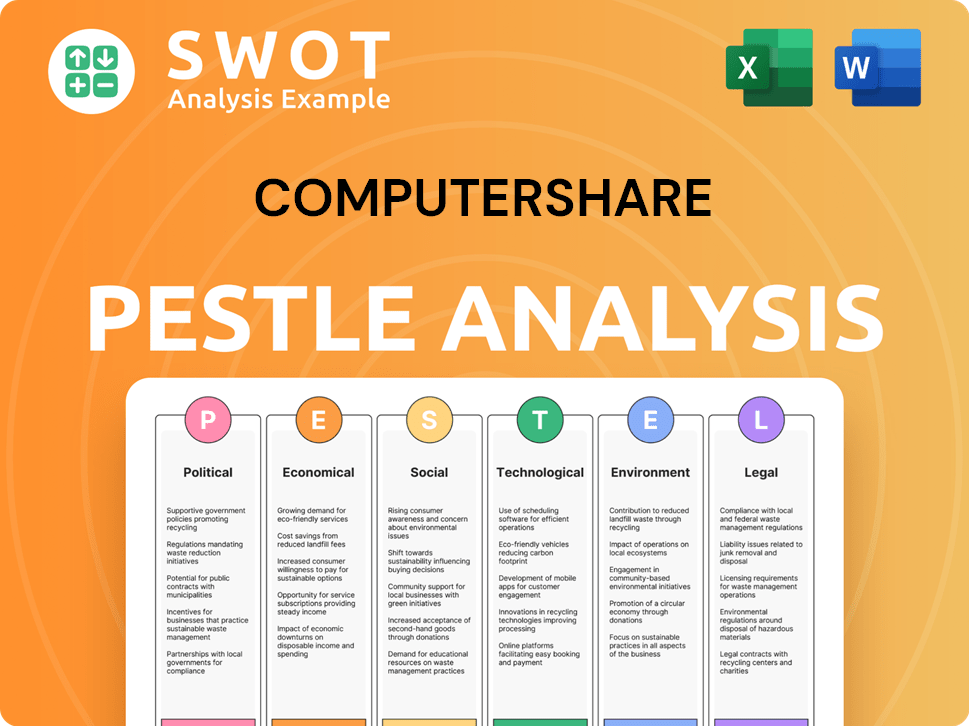

Computershare PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Computershare a Competitive Edge Over Its Rivals?

The competitive landscape for Computershare is shaped by its strong competitive advantages, which have allowed it to maintain a leading position in the investor services sector. A Brief History of Computershare reveals the company's evolution and strategic moves that have solidified its market presence. These strengths are crucial when considering Computershare's market analysis and its position relative to its competitors.

Computershare's success is built on its global scale and reach, allowing it to serve multinational corporations effectively. Its deep expertise and established relationships within the financial ecosystem, combined with a comprehensive suite of services, create a 'one-stop-shop' solution. Furthermore, the company benefits from significant economies of scale, proprietary technology, and a strong brand reputation, all contributing to its enduring competitive edge.

The company's ability to handle high transaction volumes securely and accurately is a key differentiator. While technology continues to evolve, Computershare's significant investments in its platforms create a strong competitive moat. This is particularly important in a highly regulated and sensitive industry, where reliability and service excellence are paramount. These factors are crucial when assessing the competitive landscape and the strengths of Computershare's competitors.

Computershare's extensive global footprint allows it to serve clients across multiple jurisdictions efficiently. This widespread presence creates a significant barrier to entry for smaller competitors. This global reach is a key factor in Computershare's competitive advantages and its ability to compete in the Computershare industry.

Decades of experience have given Computershare invaluable institutional knowledge in share registry management and regulatory compliance. Long-standing relationships with major corporations and regulatory bodies foster trust and sticky client relationships. This expertise is vital when considering Computershare's services and its competitive standing.

Computershare offers a 'one-stop-shop' solution, including share registry, employee equity plans, and stakeholder communications. This comprehensive approach is difficult for specialized competitors to replicate. This broad service offering is a key component of Computershare's market share analysis.

High fixed costs for technology platforms and compliance infrastructure are spread across a vast client base, allowing for efficient operations. Proprietary technology platforms handle high transaction volumes securely and accurately. These economies of scale contribute to Computershare's financial performance and competitive advantages.

Computershare's competitive advantages are rooted in its global presence, deep expertise, and comprehensive services. These strengths are further enhanced by economies of scale and proprietary technology, creating a robust competitive moat. Understanding these advantages is crucial for a thorough Computershare competitive landscape analysis.

- Global Presence: Serving clients across multiple jurisdictions efficiently.

- Expertise: Extensive institutional knowledge in share registry management.

- Comprehensive Services: A 'one-stop-shop' solution for various needs.

- Economies of Scale: Efficient operations due to a large client base.

- Technology: Proprietary platforms handling high transaction volumes.

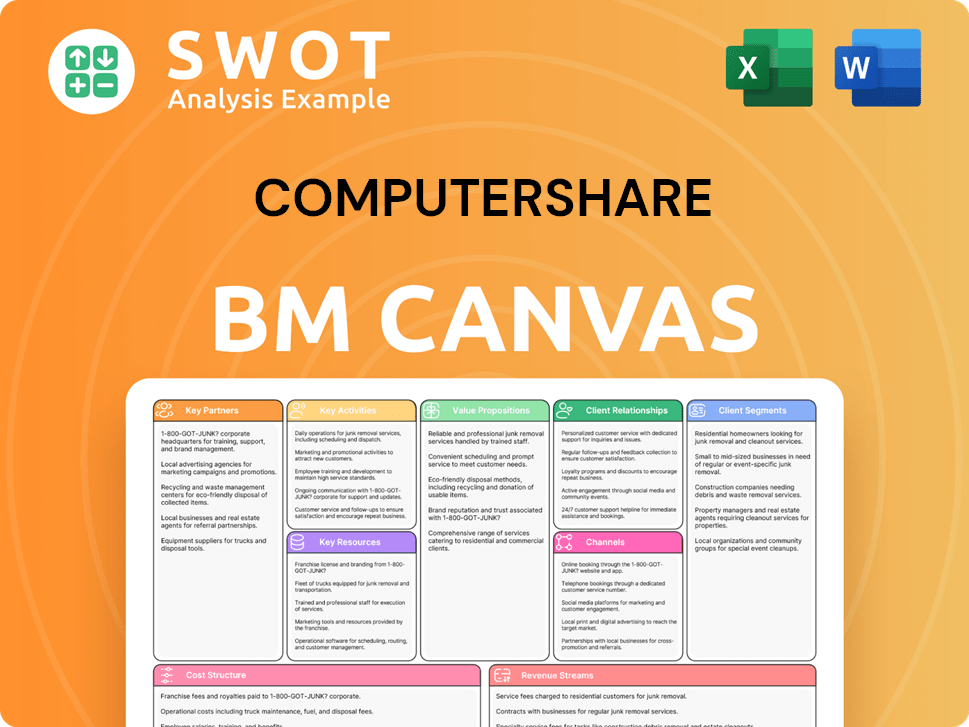

Computershare Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Computershare’s Competitive Landscape?

The Computershare competitive landscape is significantly influenced by industry trends, regulatory changes, and economic shifts. The company's position is shaped by its ability to adapt to technological advancements, navigate complex regulatory environments, and manage global economic uncertainties. Understanding these dynamics is crucial for assessing Computershare market analysis and its future growth potential.

Risks include the emergence of disruptive FinTech startups and increased competition from existing rivals. However, Computershare also has opportunities in expanding into emerging markets and forming strategic partnerships. The company's strategic focus on operational efficiency and client-centric solutions will be crucial in maintaining its competitive position and capitalizing on future growth avenues.

Computershare industry is experiencing rapid digitalization and automation. Demand for digital shareholder engagement, online proxy voting, and real-time access to investor data is increasing. Continuous investment in advanced platforms and cybersecurity is essential. This presents both opportunities and challenges for companies in the sector.

Potential threats include FinTech startups offering niche solutions and increased competition. Economic shifts and geopolitical uncertainties can impact capital markets. Stricter corporate governance requirements and evolving data privacy regulations also pose challenges. The company must adapt to these changes to maintain its market position.

Growth opportunities lie in expanding into emerging markets and offering new digital products. Strategic partnerships and enhanced compliance solutions can also drive growth. Diversification into areas like mortgage servicing provides resilience. The company's focus on innovation is key.

Computershare's strategic focus includes operational efficiency and technological innovation. Client-centric solutions and a strong global presence are also critical. Adaptability and a proactive approach to market changes are essential for sustained success in the Computershare competitive landscape.

Computershare competitors face similar challenges and opportunities, including technological advancements, regulatory changes, and global economic shifts. The company's ability to differentiate itself through service offerings, technological capabilities, and strategic partnerships is crucial for maintaining a competitive edge. For example, the company's focus on digital transformation and client-centric solutions is a key differentiator in the market. For deeper insights, you can refer to an article discussing the company's overall performance and strategy, providing additional context for understanding the Computershare services and market position.

The competitive landscape is shaped by technology, regulatory compliance, and global presence. Companies must invest in digital platforms and cybersecurity. Compliance with evolving regulations is crucial.

- Technological Innovation: Investing in digital platforms, online voting, and data analytics.

- Regulatory Compliance: Adapting to stricter corporate governance and data privacy regulations.

- Global Presence: Expanding services in emerging markets and managing geopolitical uncertainties.

- Strategic Partnerships: Forming alliances to broaden service portfolios and enhance market reach.

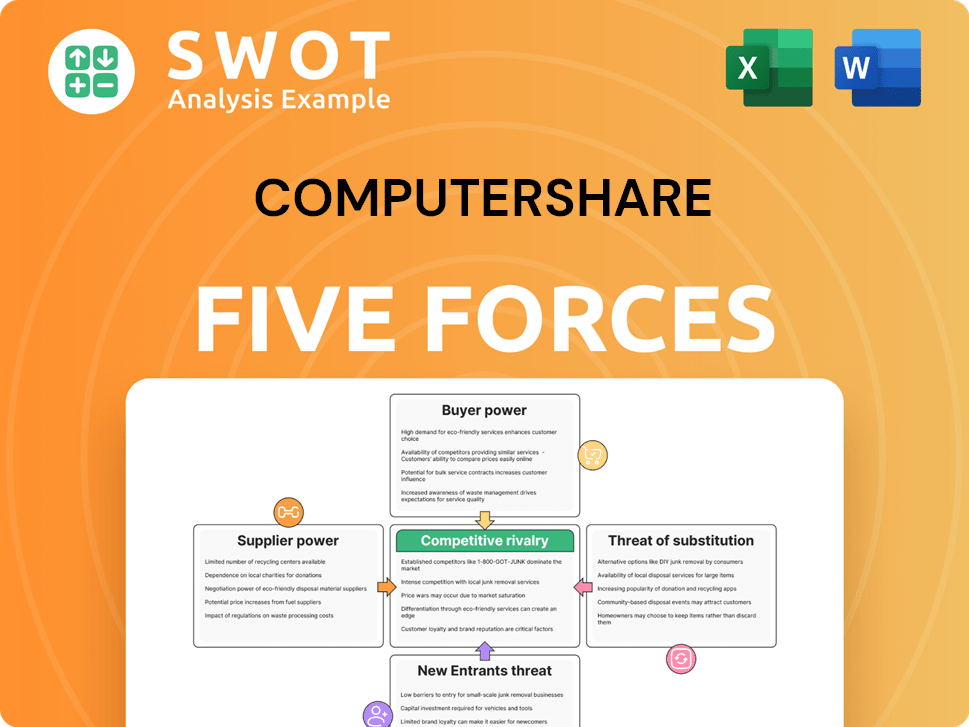

Computershare Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Computershare Company?

- What is Growth Strategy and Future Prospects of Computershare Company?

- How Does Computershare Company Work?

- What is Sales and Marketing Strategy of Computershare Company?

- What is Brief History of Computershare Company?

- Who Owns Computershare Company?

- What is Customer Demographics and Target Market of Computershare Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.