Computershare Bundle

Can Computershare Continue Its Dominance in the Investor Services Sector?

Computershare's recent share buyback program isn't just a financial maneuver; it's a bold statement about its future. Founded in 1978, this global leader has transformed share registry services and now manages millions of accounts worldwide. But what's next for this industry giant?

This analysis dives deep into Computershare SWOT Analysis, exploring its growth strategy and assessing its future prospects. We'll examine how Computershare plans to leverage technology and expand its services to maintain its competitive edge. Understanding the company's strategic initiatives and its position in the market is key to evaluating its long-term potential within the dynamic landscape of the financial services industry.

How Is Computershare Expanding Its Reach?

The Computershare growth strategy focuses on expanding its market reach and diversifying revenue streams. This involves both geographical and service-based expansion, aiming to capitalize on emerging market opportunities and evolving client needs. The company's strategic initiatives are designed to enhance its position in the financial services sector and drive long-term value for its stakeholders.

Computershare's future prospects are closely tied to its ability to adapt to industry changes and technological advancements. The company is actively investing in digital platforms and exploring opportunities in new market segments, such as private markets. Mergers and acquisitions also play a key role in its growth strategy, allowing it to acquire specialized capabilities and expand its client base.

The company's strategic goals include increasing market share and deepening client relationships. By focusing on innovation, strategic acquisitions, and global expansion, Computershare aims to maintain its competitive edge and deliver sustainable growth in the coming years.

Computershare is focusing on geographical expansion, particularly in emerging markets. This strategy involves tailoring services to local regulatory environments and client needs. The company is targeting Asian markets to leverage its global expertise and secure new corporate clients.

Computershare is continually enhancing its suite of solutions through the development of new digital platforms. These platforms are designed for shareholder engagement and corporate governance. The company is also exploring opportunities in the private markets sector.

Mergers and acquisitions are a core part of Computershare's growth strategy. These acquisitions enable the company to acquire specialized capabilities and expand its client base. Recent acquisitions have focused on bolstering employee equity plan administration capabilities.

The company aims to access new customer segments and deepen existing client relationships. Computershare targets specific milestones, such as increasing its market share in key service lines. These initiatives are driven by regulatory shifts and technological advancements.

Computershare's expansion strategy includes geographical growth, particularly in Asia, and product enhancements like new digital platforms. The company is also active in mergers and acquisitions to broaden its service offerings and client base. These initiatives are designed to drive long-term growth.

- Geographical expansion into emerging markets.

- Development of new digital platforms for shareholder engagement.

- Exploration of opportunities in private markets.

- Strategic mergers and acquisitions to acquire new capabilities.

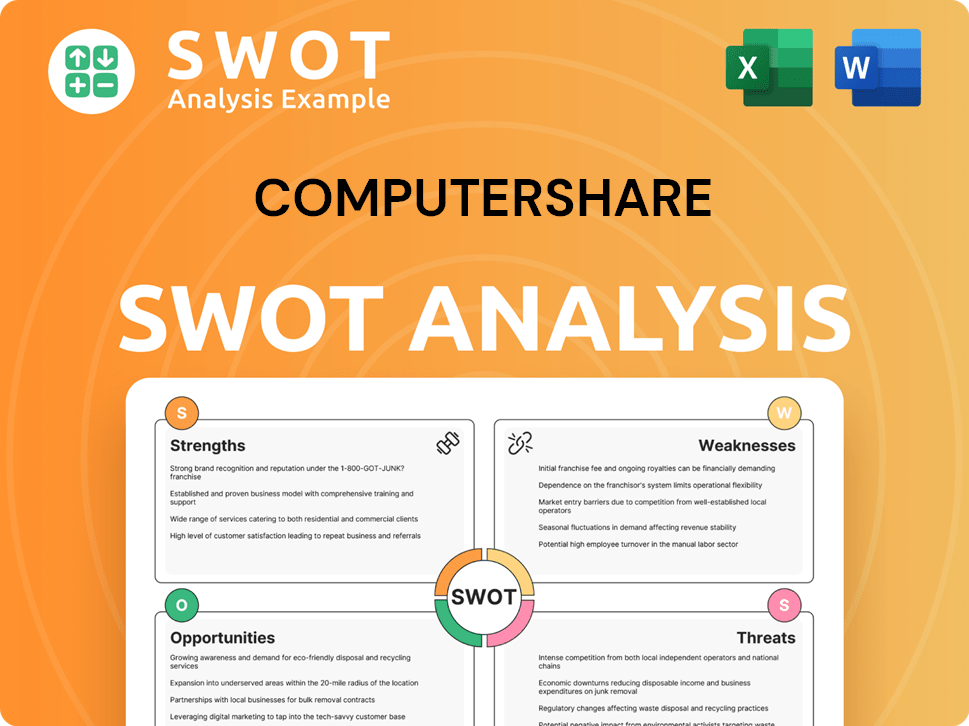

Computershare SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Computershare Invest in Innovation?

Computershare's growth strategy is heavily influenced by its dedication to innovation and technology. The company consistently invests in technological advancements to improve its services and create new solutions. This focus is crucial for maintaining its competitive edge and meeting the evolving needs of its clients and stakeholders.

The company's approach to technology is multifaceted, encompassing both internal developments and strategic collaborations. This blend allows Computershare to stay at the forefront of technological trends while efficiently managing resources. The aim is to provide more efficient, secure, and sophisticated services, thereby attracting new clients and retaining existing ones.

Computershare's commitment to innovation is evident in its continuous improvements to data security and digital service delivery. These efforts underscore its leadership in the investor services sector and contribute directly to its future prospects.

Computershare actively utilizes digital transformation and automation to streamline operations. This includes the implementation of robotic process automation (RPA) to enhance efficiency in back-office functions. These initiatives lead to cost reductions and improved service delivery.

The company explores the integration of artificial intelligence (AI) and machine learning (ML). This is aimed at providing predictive analytics for clients and enhancing fraud detection. It also personalizes stakeholder communications.

Computershare collaborates with external innovators and fintech companies. These partnerships are designed to co-develop solutions and gain access to emerging technologies. This approach allows for staying ahead of technological advancements.

Ongoing enhancements are made to online shareholder portals to improve user experience. These portals are designed to be more intuitive and comprehensive. This improves shareholder engagement and satisfaction.

Computershare is developing secure blockchain-based solutions for registry services. The goal is to improve transparency and efficiency. This technology has the potential to revolutionize certain aspects of the business.

Continuous improvements in data security and digital service delivery are a priority. These improvements are key to maintaining trust and providing reliable services. This is a core aspect of Computershare's innovation strategy.

Computershare's consistent investment in technology and innovation is a key driver of its growth strategy. The company's ability to adapt and integrate new technologies is crucial for its long-term success. By focusing on digital transformation, automation, and strategic partnerships, Computershare is well-positioned to maintain its leadership in the investor services sector. For a broader view of the competitive environment, consider exploring the Competitors Landscape of Computershare.

Computershare's technology strategy is centered on several key areas to drive growth and efficiency. These initiatives are designed to improve client services and operational capabilities.

- Robotic Process Automation (RPA): Streamlining back-office operations to reduce costs.

- Artificial Intelligence (AI) and Machine Learning (ML): Implementing predictive analytics and enhancing fraud detection.

- Blockchain Technology: Developing secure solutions for registry services to improve transparency.

- Online Shareholder Portals: Continuously improving user experience and functionality.

- Data Security: Maintaining robust security measures to protect client data.

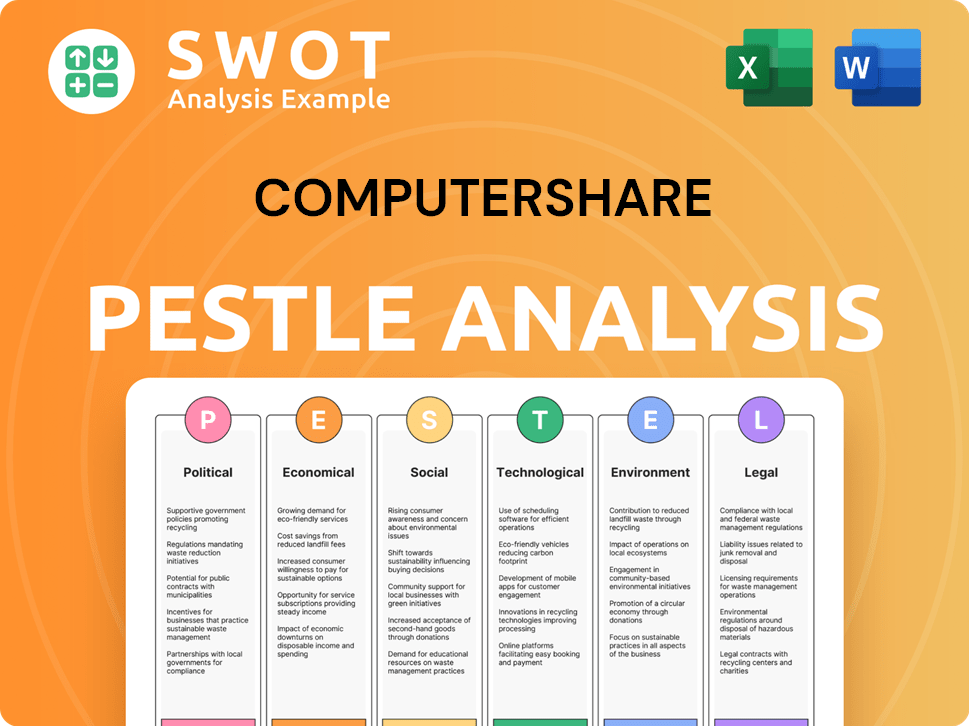

Computershare PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Computershare’s Growth Forecast?

The financial outlook for Computershare is positive, driven by a strong focus on revenue growth and maintaining healthy profit margins. The company's strategic initiatives and operational efficiency are key factors in its projected growth. A deep dive into Mission, Vision & Core Values of Computershare reveals the company's commitment to long-term value creation, which is reflected in its financial strategies.

For the fiscal year 2024, Computershare anticipated management EPS growth of approximately 15% to 18%, signaling confidence in its market position and operational effectiveness. This projection is supported by robust performance in its core business segments and the anticipated benefits from recent strategic actions. The company's financial performance is compared favorably to industry benchmarks, indicating effective management and a resilient business model.

Computershare's commitment to capital allocation supports its growth ambitions, focusing on reinvesting in technology and strategic acquisitions while also returning value to shareholders through dividends and share buybacks. The company's financial narrative emphasizes sustainable growth, prudent financial management, and a commitment to delivering long-term shareholder value, positioning it well for future expansion.

Computershare's revenue growth is a key indicator of its financial health. The company's ability to increase revenue, driven by demand for its services, is a positive sign. Successful integration of acquired businesses also contributes to revenue growth.

Maintaining healthy profit margins is crucial for Computershare's financial outlook. The company aims to balance revenue growth with cost management to ensure profitability. Efficient operations and strategic pricing strategies contribute to achieving this goal.

Computershare's capital allocation strategy involves reinvesting in technology and strategic acquisitions. This supports the company's long-term growth and competitiveness. Shareholder value is also enhanced through dividends and share buybacks.

Effective debt management is a priority for Computershare. The company aims to maintain a healthy balance sheet. This prudent financial management supports its ability to invest in growth opportunities and withstand economic challenges.

Computershare's financial performance is measured by several key metrics. These metrics provide insights into the company's financial health and growth potential. Strong performance in these areas indicates effective management and a resilient business model.

- Management EPS Growth: Projected to be approximately 15% to 18% for fiscal year 2024.

- Underlying EBIT Growth: Increased by 25% to 30% in constant currency for the first half of fiscal year 2024.

- Net Debt to EBITDA Ratio: 1.9x as of December 31, 2023, indicating a healthy balance sheet.

- Revenue Growth: Driven by increased demand for services and successful acquisitions.

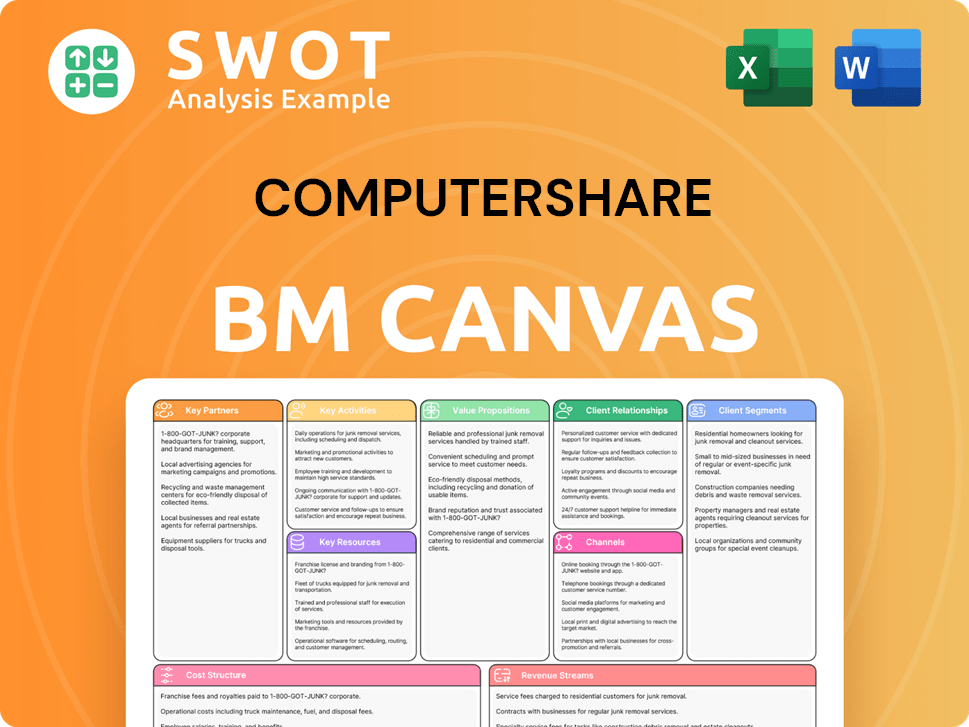

Computershare Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Computershare’s Growth?

The future of Computershare, despite its robust growth strategy, faces several potential risks and obstacles. Market competition and evolving regulations pose significant challenges. Furthermore, the rapid pace of technological advancements requires continuous innovation to avoid obsolescence.

Internal resource constraints and the increasing complexity of global financial markets add to the challenges. The company must navigate these hurdles to maintain its growth trajectory and market position. Adapting to remote work models during the global pandemic showcased the resilience of its digital infrastructure.

Emerging risks, such as cybersecurity threats, demand ongoing vigilance and investment in robust security measures. The company’s ability to adapt to these challenges will be critical for its long-term success and its future prospects. Understanding the Revenue Streams & Business Model of Computershare is crucial in assessing these risks.

Computershare faces intense competition from established players and fintech startups. This competitive landscape impacts its market share and growth potential. The company must continually innovate and differentiate its services to stay ahead.

Changes in regulations across different jurisdictions present a continuous risk. Compliance with new data privacy rules and corporate governance requirements can be costly. Adapting to these changes is essential for Computershare's global operations.

Rapid technological advancements, particularly in blockchain and AI, require constant innovation. Computershare must invest heavily in technology to avoid obsolescence. Staying ahead of the curve is crucial for its long-term success.

Internal resource constraints, such as the availability of skilled talent, can hinder strategic initiatives. Securing and retaining specialized technology professionals is vital. Effective resource management is key for Computershare's growth.

Cybersecurity threats pose a significant and growing risk. The increasing complexity of global financial markets exacerbates these risks. Robust security measures and expert personnel are essential for protecting customer data.

Fluctuations in financial markets can impact Computershare's business. Economic downturns and market instability can affect its revenue streams. Diversification and risk management are crucial for mitigating these impacts.

Computershare mitigates risks through a diversified service portfolio, reducing reliance on any single market or service line. This strategy helps to cushion the impact of economic downturns or regulatory changes in specific areas. Diversification is a key element of their Computershare business model.

Comprehensive risk management frameworks, including scenario planning and continuous monitoring of regulatory environments, are employed. This proactive approach helps to address potential challenges effectively. These frameworks are crucial for Computershare's strategic initiatives.

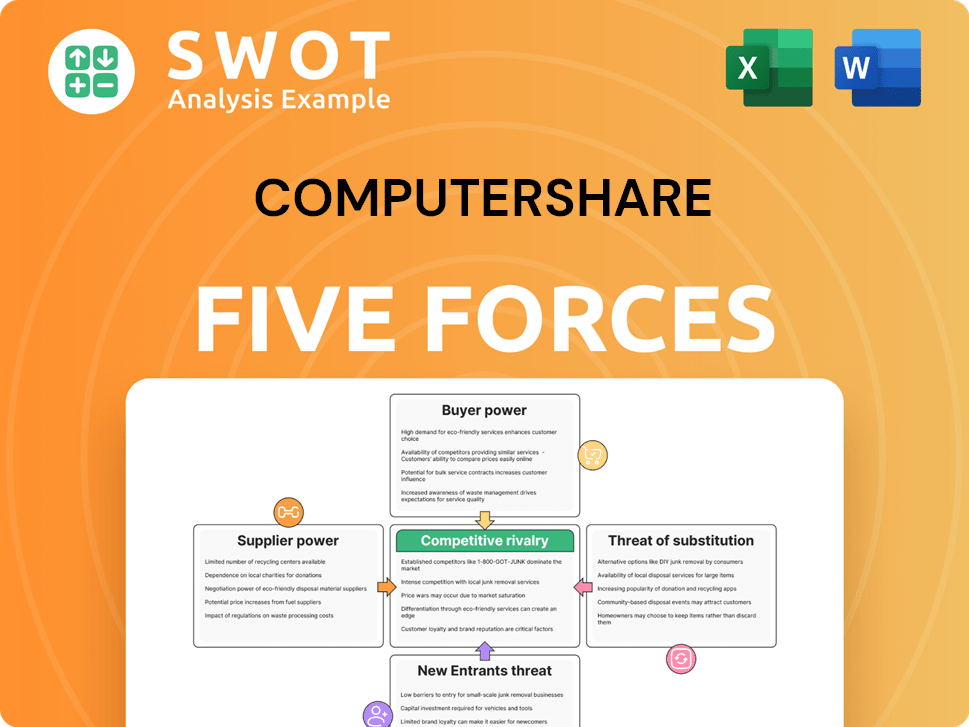

Computershare Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Computershare Company?

- What is Competitive Landscape of Computershare Company?

- How Does Computershare Company Work?

- What is Sales and Marketing Strategy of Computershare Company?

- What is Brief History of Computershare Company?

- Who Owns Computershare Company?

- What is Customer Demographics and Target Market of Computershare Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.