Crawford Bundle

How Did Crawford Company Revolutionize Claims Management?

Discover the fascinating Crawford SWOT Analysis and the remarkable journey of Crawford & Company, a global leader in claims management. Founded in 1941, this company's story is one of innovation and strategic expansion. From its origins in Columbus, Georgia, to its current global presence, Crawford & Company has consistently adapted to meet the evolving needs of the insurance industry.

The History of Crawford Company is a testament to its adaptability and forward-thinking approach. Initially conceived to streamline claims processing, the company quickly expanded its services and global footprint. Understanding the Crawford Company founding date and early strategies provides valuable insights into its enduring success and impact on the industry. The Brief history of Crawford Company garage doors and its evolution over time is a compelling narrative of business acumen.

What is the Crawford Founding Story?

The story of the Crawford Company begins in Columbus, Georgia, on May 27, 1941. Jim Crawford, the founder, saw an opportunity to streamline the insurance claims process, leading to the creation of what would become a significant player in the industry. This brief history of Crawford Company highlights its origins and early strategic decisions.

Jim Crawford, with his background as an insurance claims manager, recognized that individual insurance companies were inefficiently managing their claims. He envisioned a more effective model, drawing inspiration from observing how milk trucks operated. This insight set the stage for an independent firm capable of handling claims for multiple insurers, offering both cost savings and improved speed.

Jim Crawford established the company with a focus on independent claims adjusting services for property and casualty, and workers' compensation claims. The company's early success was built on core principles and a commitment to quality.

- The company's foundation rested on three key principles: 'Honesty and integrity above all,' 'Hard work pays,' and 'Knowledge and creativity are power.'

- The company's slogan, 'Top Quality, Promptly,' underscored its dedication to thorough and timely claims handling.

- The initial business model was designed to serve all major insurance carriers, offering a more cost-effective and efficient alternative to their internal claims operations.

- While specific details on initial funding sources are not readily available, the company's rapid expansion suggests a successful early establishment.

Crawford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Crawford?

The early years of the Crawford Company, following its 1941 founding, were marked by significant expansion across the United States. The company quickly established itself, moving its headquarters to Atlanta by 1947. This growth included the establishment of offices in every U.S. state by 1974. This period set the stage for the company's future leadership in the industry.

A key development was the creation of an internal employee training program in 1946, which later became Crawford Educational Services. This program set an industry standard for claims adjustment education. The company's commitment to training helped build a skilled workforce to support its growing operations. This focus on education was a strategic move to ensure quality service as the company expanded its reach.

International expansion began in 1957 with an office in London, followed by offices in Vancouver and Toronto by 1967. The company also broadened its service offerings beyond property and casualty, introducing rehabilitation, risk management, and catastrophe support services. This diversification allowed the company to serve a wider range of clients and adapt to changing market needs. The introduction of new services was a key strategy for sustainable growth.

A pivotal moment was Crawford becoming a publicly traded company in 1968, issuing 225,000 shares of common stock at $16 per share. In 1971, the company revolutionized the industry with the introduction of MAYDAY, a 24/7 claims referral service. This innovation solidified its position as a leader in claims solutions. The public offering provided capital for further expansion and innovation, fueling its growth trajectory.

The company continued to expand through acquisitions, such as the 1950 purchase of L.C. Arney, an independent adjusting company, for $7,000. By the end of the 1970s, Crawford operated 70 offices and offered a comprehensive package of claims administration services. This proactive approach to market needs and commitment to setting industry benchmarks laid the foundation for its global leadership. For more insights into the company's ownership structure, you can explore Owners & Shareholders of Crawford.

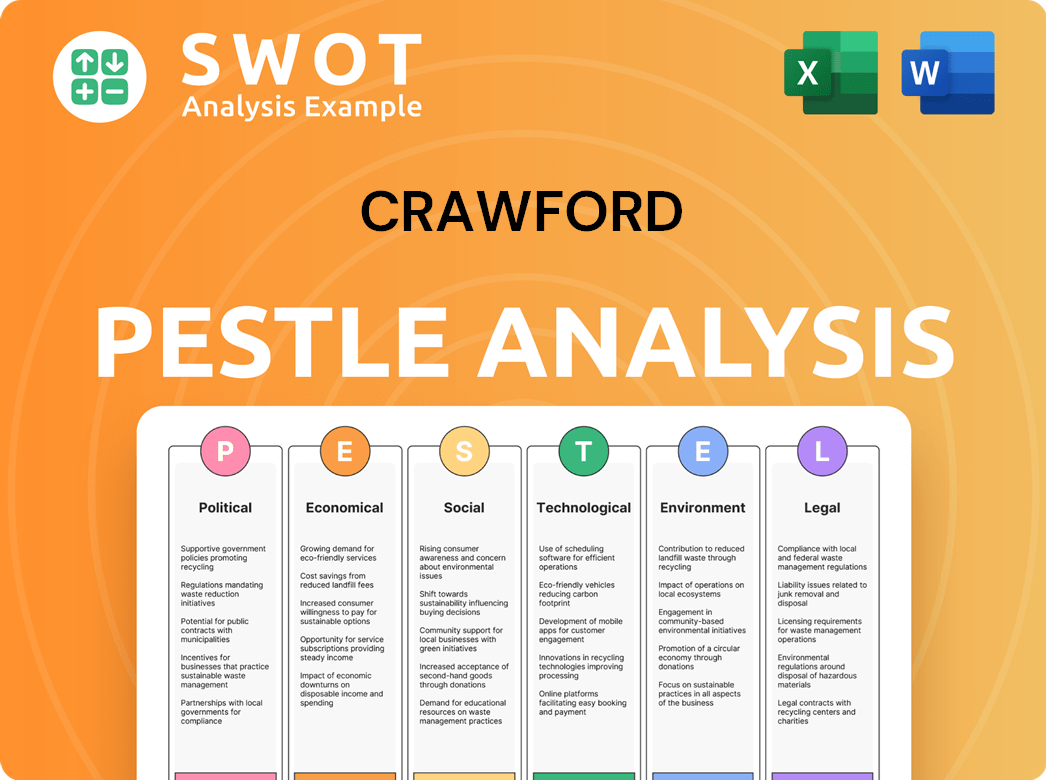

Crawford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Crawford history?

The Crawford Company has a rich history of Crawford, marked by significant achievements and strategic expansions. The company's journey includes a series of strategic moves, acquisitions, and adaptations to maintain its position in the market. The Crawford Company has consistently evolved to meet the changing demands of the industry.

| Year | Milestone |

|---|---|

| 1971 | Introduction of MAYDAY, a 24/7 claims referral service, revolutionized the industry. |

| 1990s | Acquired Graham Miller Group, Brocklehurst Group, and Thomas Howell Group to bolster global presence. |

| 2006 | Acquisition of Broadspire Management Services, Inc. expanded workers' compensation and liability claims management services. |

Crawford Company's innovations have been pivotal in shaping the industry. The introduction of MAYDAY was a groundbreaking service. The company continued to expand its service offerings to include rehabilitation, risk management, and catastrophe support.

MAYDAY, launched in 1971, was a pioneering 24/7 claims referral service. This innovation set a new standard in the industry for accessibility and responsiveness.

Beyond traditional property and casualty claims, Crawford Company expanded its service catalog. This included offerings in rehabilitation, risk management, and catastrophe support to meet diverse client needs.

Crawford Company established Crawford University. This initiative provided continuous training, becoming an industry standard for professional development.

The company made strategic acquisitions, such as Adjusters Canada Inc. and Broadspire Management Services, Inc. These moves expanded its market reach and service capabilities.

Crawford Company has faced various challenges, including market downturns and increased competition. In the early 1980s, increased price competition among property and casualty insurers impacted independent adjusters. The company responded by diversifying its services and emphasizing continuous training.

Crawford Company faced challenges during market downturns, particularly in the early 1980s. Increased price competition among property and casualty insurers impacted the independent adjusters.

Competitive threats prompted Crawford Company to diversify its services. This included expanding into rehabilitation, risk management, and catastrophe support.

Periods of severe weather, such as multiple hurricanes in 1985 and major events like Hurricanes Hugo and Jerry, increased demand. The company responded by enhancing its catastrophe services.

The company undertook restructuring and rebranding efforts, such as realigning business segments in 2006. These efforts aimed to integrate acquired operations and improve efficiency.

Crawford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Crawford?

The Marketing Strategy of Crawford has evolved since its founding. The company's history is marked by significant milestones, from its establishment in 1941 to its continued growth and innovation in the claims management sector. This timeline highlights key events in the evolution of the Crawford Company.

| Year | Key Event |

|---|---|

| 1941 | Jim Crawford opens the first office in Columbus, Georgia. |

| 1946 | Jim Crawford establishes an employee training program, later becoming Crawford Educational Services. |

| 1947 | Company headquarters move to Atlanta. |

| 1950 | First acquisition of L.C. Arney expands operations to Baton Rouge, Louisiana. |

| 1957 | International expansion begins with the opening of an office in London. |

| 1968 | Crawford becomes a publicly traded company. |

| 1971 | Introduction of MAYDAY, a 24/7 claims referral service, revolutionizes the industry. |

| 1974 | Crawford establishes an office in every U.S. state. |

| 1981 | Risk Control Group launches Crawford into risk management services. |

| 1990s | Decade of global expansion through acquisitions including Graham Miller Group, Brocklehurst Group, and Thomas Howell Group. |

| 1999 | Acquisition of Contractor Connection adds managed repair services. |

| 2006 | Acquisition of Broadspire Management Services, Inc., significantly expands workers' compensation and liability claims management. |

| 2014 | Acquisition of GAB Robins further bolsters global specialty claims services. |

| 2021 | Crawford & Company celebrates its 80th anniversary. |

In Q1 2025, Crawford reported revenues before reimbursements of $312.0 million, a 3% increase from the prior year. Net income rose to $6.7 million. Consolidated adjusted operating earnings increased by 47%, and adjusted EBITDA rose by 30% in Q1 2025. These figures demonstrate a strong start to the year.

Crawford is focused on expanding its technology-driven claims processing solutions. The company also plans to strengthen its international presence in key markets. These initiatives are designed to drive continued revenue growth and profitability.

The industry is experiencing a heightened awareness of flood risks, increasing the use of predictive modeling and analytics. AI models are being adopted to forecast climate patterns and extreme weather events. Wearables are playing a bigger role in workplace safety.

Crawford anticipates continued revenue growth and profitability in 2025, driven by investments in talent and technology. The company is committed to operational excellence and innovation. Crawford's focus remains on providing efficient and high-quality claims solutions globally.

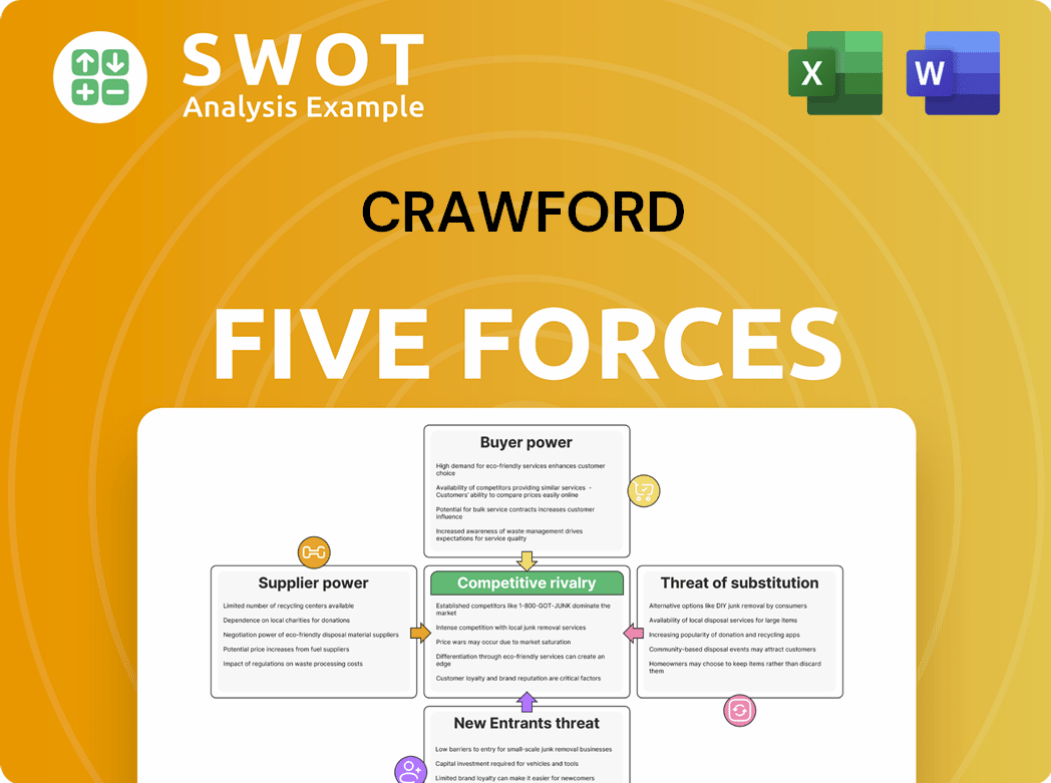

Crawford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Crawford Company?

- What is Growth Strategy and Future Prospects of Crawford Company?

- How Does Crawford Company Work?

- What is Sales and Marketing Strategy of Crawford Company?

- What is Brief History of Crawford Company?

- Who Owns Crawford Company?

- What is Customer Demographics and Target Market of Crawford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.