Crawford Bundle

Unveiling the Inner Workings of Crawford Company: How Does It Thrive?

Ever wondered how the insurance industry's claims get managed with such precision? Crawford & Company, a global force, is at the heart of this process, streamlining claims management and offering crucial outsourcing solutions. Understanding the Crawford SWOT Analysis is key to grasping its strategic positioning and market dynamics. This exploration dives deep into the mechanics of a company that significantly impacts the global insurance ecosystem.

This analysis is crucial for those seeking to understand Crawford Company's operations, from its core services to its financial performance. We'll explore the Crawford Company business model, uncovering how it generates revenue and maintains its competitive edge. Whether you're an investor, a potential client, or simply curious about the industry, this examination of Crawford Company services will provide valuable insights into its structure and processes.

What Are the Key Operations Driving Crawford’s Success?

Crawford Company delivers value by offering claims management and outsourcing solutions. Its core services include property and casualty claims management, workers' compensation claims management, and related services like third-party administration (TPA).

The company serves a broad customer base, including insurance companies, self-insured corporations, and government entities globally. Crawford Company operations involve a network of adjusters, claims professionals, and technology platforms to handle various claims.

Technology is central to its operations, with investments in AI-powered tools to enhance claims processing efficiency and client communication. Crawford Company business leverages a vast network of independent contractors, vendors, and internal resources.

Crawford Company services include property and casualty claims management, workers' compensation claims management, and related services. The company also provides third-party administration (TPA), adjusting services, and catastrophe claims handling.

Operational processes involve a robust network of adjusters, claims professionals, and technology platforms. In property and casualty claims, adjusters conduct on-site inspections and assess damages. In workers' compensation, the company manages the entire claims lifecycle.

Technology development is central, with investments in AI-powered tools and digital platforms. The supply chain includes independent contractors, vendors, and internal resources. Strategic partnerships further enhance capabilities.

Customer benefits include reduced claims cycle times, lower administrative costs, improved fraud detection, and enhanced policyholder satisfaction. This differentiates Crawford Company in the market. For additional insights, you can read about the Marketing Strategy of Crawford.

Crawford Company structure and operations provide rapid resource deployment in response to large-scale events. This agility and effectiveness set them apart from competitors. The company's commitment to innovation and customer satisfaction drives its success.

- Global Network: A worldwide network of adjusters and claims professionals.

- Technology Integration: Use of AI and digital platforms to improve efficiency.

- Comprehensive Services: Offering a wide range of claims management and outsourcing solutions.

- Customer Focus: Prioritizing reduced cycle times and enhanced policyholder satisfaction.

Crawford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Crawford Make Money?

The primary revenue streams for Crawford & Company business are derived from service fees related to claims management and outsourcing solutions. These services include handling property and casualty claims, managing workers' compensation claims, providing catastrophe services, and offering third-party administration (TPA) services. The fees are structured based on the volume and complexity of claims, the length of service contracts, and the specific services provided.

Crawford Company operations generate revenue through a combination of fee structures. These include fixed fees, per-claim charges, and percentage-based fees tied to the value of claims processed. During catastrophe events, they utilize surge capacity services, which significantly contribute to revenue. The company also focuses on bundling services to offer comprehensive solutions, enhancing client relationships and increasing value.

Crawford Company services have been expanding into technology-driven solutions, potentially creating new revenue streams through software-as-a-service (SaaS) models and data analytics. This shift reflects a move towards leveraging technology to improve efficiency and broaden service lines beyond traditional claims adjusting. The company's adaptability is a key factor in its continued success. For more insights, consider reading about the Growth Strategy of Crawford.

Crawford Company employs various fee structures to generate revenue.

These include fixed fee arrangements, per-claim charges, and percentage-based fees.

The specific fee structure depends on the type and complexity of the services provided.

During catastrophe events, Crawford Company utilizes surge capacity services.

This involves deploying additional adjusters and resources to handle a high volume of claims.

These services can significantly contribute to the company's revenue during these times.

Crawford Company is expanding its technology-driven solutions.

This includes exploring new revenue streams through SaaS models and data analytics.

Technology enhances efficiency and creates new service lines.

Crawford Company bundles services to provide comprehensive solutions.

This approach fosters deeper client relationships.

It also increases the overall value proposition.

Crawford Company offers third-party administration (TPA) services.

These services are a key component of its revenue streams.

TPA services involve managing various aspects of claims processing.

The volume of claims managed directly impacts revenue.

Higher claim volumes often lead to increased revenue.

The efficiency of claims processing is crucial for profitability.

Crawford Company's revenue is driven by several key factors.

- Volume and complexity of claims managed.

- Duration of service contracts.

- Specific services rendered, including catastrophe response.

- Adoption of technology-driven solutions.

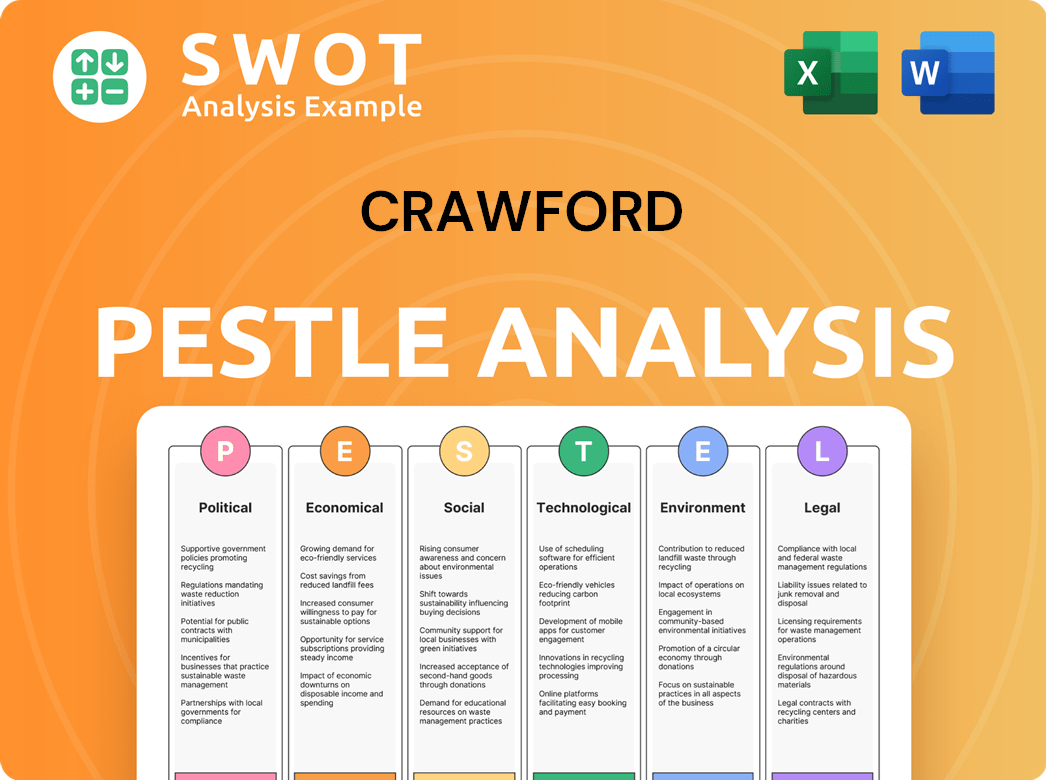

Crawford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Crawford’s Business Model?

The evolution of Crawford & Company, a key player in the claims management sector, has been marked by strategic initiatives and significant milestones. These developments have shaped its operations and financial performance, allowing it to adapt to changing market dynamics. The company's focus on technological advancements and global expansion has been instrumental in maintaining its competitive edge.

Crawford & Company's strategic moves, particularly its investment in digital transformation, have been pivotal. This includes the integration of AI and machine learning to automate and enhance claims processing. Furthermore, its global expansion through acquisitions and partnerships has broadened its service capabilities and geographical reach. These moves have positioned Crawford & Company to meet the evolving needs of its clients effectively.

Crawford & Company's competitive advantages are underpinned by its strong brand recognition and extensive network. The company's ability to manage a vast volume of claims efficiently, coupled with its technological advancements, further enhances its market position. This strategic approach ensures Crawford & Company remains a leader in the claims management industry, continuously adapting to new trends and client demands.

Crawford & Company has achieved several key milestones that have shaped its business. Significant expansions and acquisitions have broadened its global footprint, enabling it to serve a wider range of clients. Continuous technological advancements, including AI-driven claims processing, have improved efficiency and client satisfaction.

Strategic moves by Crawford & Company include a strong emphasis on digital transformation, particularly the implementation of AI and machine learning tools to streamline claims processing. The company has also focused on expanding its global presence through strategic acquisitions and partnerships. These moves aim to enhance operational efficiency and improve client service.

Crawford & Company's competitive edge is built on a strong global brand, economies of scale, and an extensive network of experienced professionals. The company's continuous investment in advanced technology, such as AI-powered platforms, further enhances its ability to deliver superior service. This approach allows Crawford & Company to maintain its leadership position in a dynamic industry.

Crawford Company operations are characterized by a focus on efficiency and client satisfaction. The company uses advanced technology to streamline claims processing, enhancing accuracy and speed. Its global presence and extensive network of professionals allow it to handle a wide range of claims efficiently. To understand more about their target market, you can read Target Market of Crawford.

Crawford & Company's success is driven by several key advantages that set it apart in the claims management industry. These advantages include a strong global brand, a vast network of experienced professionals, and continuous investment in advanced technology to improve operational efficiency and client service.

- Global Brand Recognition: Decades of building trust and confidence with clients worldwide.

- Economies of Scale: The ability to manage a large volume of claims efficiently and cost-effectively.

- Technological Integration: Continuous implementation of AI and data analytics to enhance operational efficiency.

- Expertise and Network: An extensive network of experienced adjusters and claims professionals.

Crawford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Crawford Positioning Itself for Continued Success?

Crawford & Company holds a strong position in the global claims management industry, with a significant market share and established relationships with major insurance carriers and self-insured entities worldwide. Its global reach and comprehensive services set it apart from smaller competitors, fostering strong customer loyalty. The company's ability to handle complex claims across various geographies contributes to its competitive advantage.

Despite its market position, Crawford faces risks such as regulatory changes, new competitors, technological advancements, and evolving consumer preferences. The increasing frequency of catastrophic events also poses operational and financial challenges. These factors require Crawford to continually adapt and innovate to maintain its market position and profitability.

Crawford & Company is a leading player in the global claims management sector, serving a diverse clientele of insurance companies and self-insured entities. Its extensive international presence and comprehensive service offerings provide a competitive edge. The company’s strong customer relationships and reputation for reliability contribute to its sustained market leadership.

Crawford faces risks including regulatory changes, the emergence of tech-driven competitors, and the need to adapt to changing consumer preferences. The increasing frequency of catastrophic events poses financial and operational challenges. These factors necessitate continuous innovation and strategic adjustments to maintain Crawford's competitive position.

Crawford & Company is focused on strategic initiatives to drive revenue growth, including investments in advanced analytics and digital platforms. The company aims to expand its services and leverage its global network, focusing on client-centric solutions. The future outlook emphasizes technological integration and operational excellence to maintain its competitive edge. Read more about Brief History of Crawford.

Crawford Company's business revolves around providing claims management services globally. This includes loss adjusting, managed care, and other related services for insurance companies and self-insured entities. The company's operations are structured to deliver efficient and accurate claims processing, adapting to market trends.

Crawford Company's strategic focus includes technological integration, operational excellence, and client-centric solutions to drive profitable growth. The company is investing in advanced analytics and digital platforms to improve efficiency and accuracy in claims processing. This allows Crawford Company to adapt to changing market trends.

- Investment in advanced analytics and AI to enhance claims processing.

- Expansion of service offerings to meet evolving client needs.

- Leveraging global network for growth in emerging markets.

- Commitment to innovation and client-centric solutions.

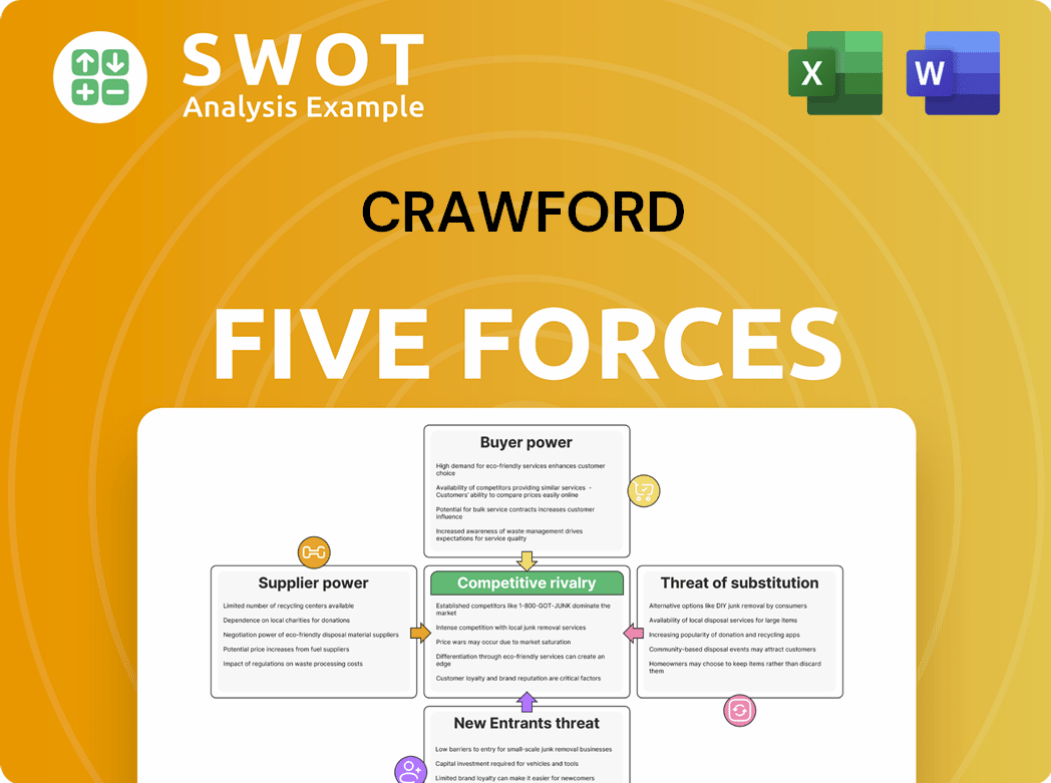

Crawford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Crawford Company?

- What is Competitive Landscape of Crawford Company?

- What is Growth Strategy and Future Prospects of Crawford Company?

- What is Sales and Marketing Strategy of Crawford Company?

- What is Brief History of Crawford Company?

- Who Owns Crawford Company?

- What is Customer Demographics and Target Market of Crawford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.