Crawford Bundle

Who Really Owns Crawford & Company?

Uncover the intricate web of ownership behind Crawford & Company, a global leader in claims management. Understanding the Crawford SWOT Analysis reveals how its ownership structure impacts its strategic direction and market performance. From its humble beginnings to its current status as a publicly traded entity, the evolution of Crawford Company's ownership is a fascinating story.

Founded in 1941 by Jim Crawford, the company's journey from a small operation to a global player with over 9,000 employees is a testament to its resilience. As of March 31, 2025, Crawford Company reported impressive revenues, highlighting the importance of understanding its ownership structure, including key personnel and major investors. This exploration will shed light on the Crawford Company owner, its shareholders, and how these dynamics have shaped its trajectory.

Who Founded Crawford?

The story of Crawford & Company begins in 1941 with its founder, Jim Crawford. He established the company in Columbus, Georgia. His vision was to create an independent claims-adjusting firm, offering a cost-effective alternative to in-house adjusters for insurance companies. The principles of honesty and integrity were central to his approach.

Jim Crawford, formerly a claims manager at an insurance company, launched the business. While specific details about the initial ownership structure are not publicly available, the company's foundation was built on Jim Crawford's dedication. He aimed to provide efficient and thorough claims handling.

Early success was marked by expansion. By 1967, Crawford & Company had grown to include operations across the United States, Canada, Puerto Rico, and England. This growth reflected the company's early commitment to a broad reach and service.

Jim Crawford's vision was to provide a cost-effective and efficient alternative to in-house adjusters.

In 1946, Jim Crawford established an internal training program. This later evolved into Crawford Educational Services.

By 1967, the company had expanded its operations across the United States, Canada, Puerto Rico, and England.

The company was founded on principles of honesty and integrity. The motto was 'Top Quality, Promptly'.

The company aimed to handle claims thoroughly and efficiently.

The early growth demonstrated the founding vision for broad reach and service.

The initial ownership of Crawford & Company was centered around Jim Crawford. He emphasized continuous training and development, which set an industry standard. The company's early success is a testament to its foundational principles. For more insights into the competitive environment, consider reading about the Competitors Landscape of Crawford.

- Jim Crawford, the founder, established the company in 1941.

- The company's first office was located in Columbus, Georgia.

- Crawford & Company's early focus was on providing a cost-effective claims-adjusting service.

- The company's early expansion included operations in multiple countries.

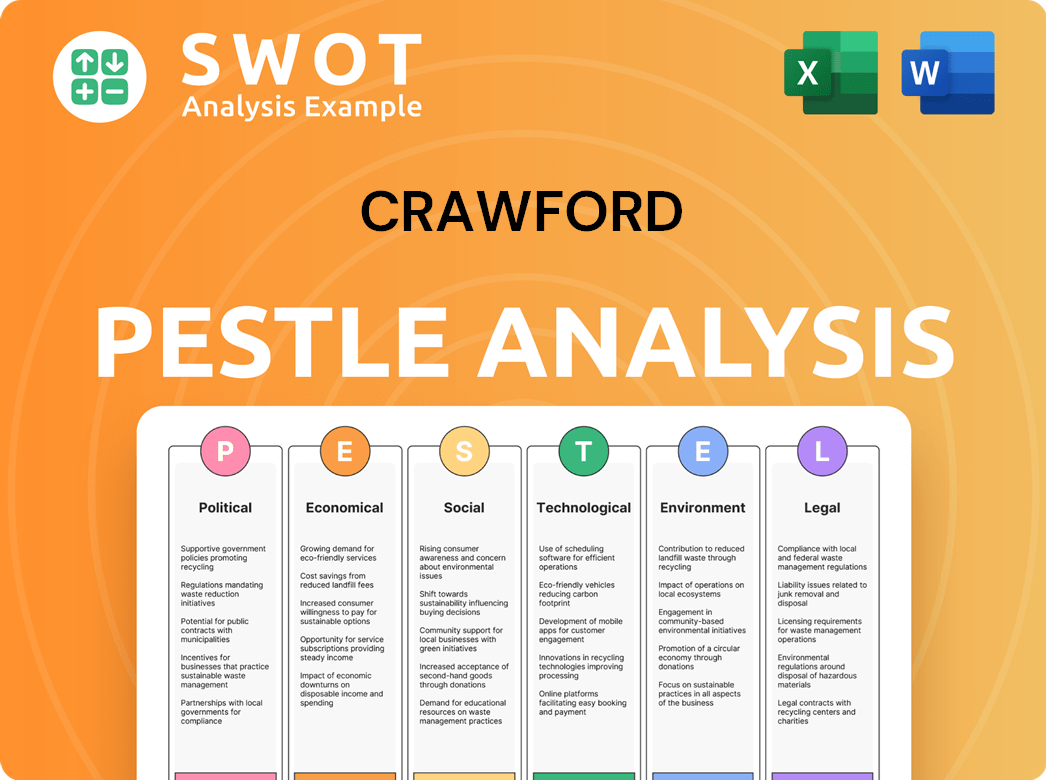

Crawford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Crawford’s Ownership Changed Over Time?

The evolution of Crawford & Company's ownership structure is marked by its transition to a publicly traded entity. The company went public in 1968, listing its shares on the New York Stock Exchange (NYSE) under the symbols CRD-A and CRD-B. This move allowed for broader investment and signaled a shift in the company's capital structure. The company's market capitalization was approximately $484 million as of June 13, 2025, with roughly 49.5 million shares outstanding, reflecting its current valuation in the public market.

A notable feature of Crawford & Company's ownership is its dual-class share system. This structure includes Class A Common Stock (CRD-A) and Class B Common Stock (CRD-B). The Class B shares hold the exclusive voting rights on most shareholder matters, which concentrates control within specific ownership groups. The Board of Directors may issue equal or greater dividends on Class A shares compared to Class B shares. As of May 23, 2025, the closing stock price for CRD-B was $9.99, indicating its market value.

| Stakeholder | Shares Held | Percentage of Ownership |

|---|---|---|

| Jesse Crawford | 12,956,597 | 67.78% |

| Renaissance Technologies LLC | 647,110 | 3.385% |

| The Capital Management Corp. | 572,895 | 2.997% |

Key stakeholders significantly influence Crawford Company ownership. Jesse Crawford holds a substantial stake, with a 67.78% ownership through 12,956,597 shares. Institutional investors also play a role, with Renaissance Technologies LLC holding 3.385% (647,110 shares) and The Capital Management Corp. owning 2.997% (572,895 shares). The company's total debt outstanding was $246.6 million as of March 31, 2025, an increase from $218.1 million at the end of 2024. This financial information provides insight into the company's financial health and obligations.

Crawford Company's ownership structure is characterized by a dual-class share system and significant insider ownership. This structure impacts voting rights and control within the company. The company's financial performance and debt levels are also important factors to consider when analyzing its ownership and overall health.

- The company went public in 1968, listed on the NYSE.

- Jesse Crawford holds a majority stake, influencing company decisions.

- Institutional investors also hold significant shares.

- The company has a dual-class share structure, impacting voting rights.

Crawford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Crawford’s Board?

The current board of directors of Crawford & Company plays a crucial role in the company's governance. As of June 11, 2025, the board includes Jesse C. Crawford Jr. as Non-Executive Chair, and Rohit Verma as President and Chief Executive Officer and a member of the board. Other board members include Dame Inga Beale, Cameron Bready, Fred R. Donner, Lisa Hannusch, Joel Murphy, and Rahul Patel. Amy Shore was also elected as an independent director, effective June 25, 2024, bringing extensive governance experience. Joel Murphy was also appointed as an independent director effective June 25, 2024.

The board's composition reflects a blend of experienced professionals from various backgrounds, ensuring diverse perspectives in decision-making. The presence of both executive and independent directors helps maintain a balance between operational expertise and objective oversight. This structure is designed to promote effective corporate governance and protect shareholder interests. For more information on the company's strategic direction, you can refer to the Growth Strategy of Crawford.

| Board Member | Title | Date of Appointment |

|---|---|---|

| Jesse C. Crawford Jr. | Non-Executive Chair | June 11, 2025 |

| Rohit Verma | President and Chief Executive Officer | N/A |

| Dame Inga Beale | Director | N/A |

| Cameron Bready | Director | N/A |

| Fred R. Donner | Director | N/A |

| Lisa Hannusch | Director | N/A |

| Joel Murphy | Independent Director | June 25, 2024 |

| Rahul Patel | Director | N/A |

| Amy Shore | Independent Director | June 25, 2024 |

The voting structure at Crawford & Company is primarily determined by the Class B Common Stock (CRD-B) holders, with each share entitling the holder to one vote. In contrast, Class A Common Stock (CRD-A) holders generally lack voting rights, except as specified in the company's articles of incorporation. This dual-class structure grants significant control to Class B shareholders, including Jesse C. Crawford Jr. There are no cumulative voting rights for the election of directors for holders of Common Stock. Corporate actions like mergers or reclassifications require an affirmative vote of at least 75% of the outstanding Class A Common Stock shares, voting separately, unless the consideration for both classes is identical.

The voting power is concentrated in Class B shares, giving significant control to specific shareholders.

- Class B shares have one vote per share; Class A shares generally do not.

- Mergers and reclassifications require a 75% vote from Class A shareholders under certain conditions.

- The board is responsible for electing directors at the annual meeting.

- Shareholders can remove directors with or without cause at a special meeting.

Crawford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Crawford’s Ownership Landscape?

In the past few years, the ownership profile of Crawford & Company, also known as Crawford Company, has seen some interesting developments. For the first three months of 2025, the company did not repurchase any shares of CRD-A or CRD-B. However, in the same period of 2024, Crawford repurchased 85,632 shares of CRD-B at an average cost of $8.56 per share, totaling $3.9 million. This indicates a strategic approach to share buybacks, varying over time.

The company's equity buyback plan has been extended, with the current plan set to expire on December 31, 2025. This decision reflects the company's ongoing strategy regarding its capital structure and its commitment to providing value to its shareholders. Understanding the trends in Crawford Company ownership can be vital for investors. To learn more, you can read about the Marketing Strategy of Crawford.

| Metric | Details | Year |

|---|---|---|

| Revenue Before Reimbursements | Increased 3% to $312.0 million | Q1 2025 |

| Net Income | $6.7 million | Q1 2025 |

| Share Repurchases (CRD-B) | 85,632 shares | 2024 |

| Average Cost Per Share (CRD-B) | $8.56 | 2024 |

Leadership and industry trends also play a role in understanding the company. Rohit Verma has served as President and Chief Executive Officer since May 2020. The average tenure of the management team is 4.5 years, and the board of directors has an average tenure of 5.7 years. Industry trends include the consolidation of general contracting firms and the growing influence of technology in the insurance sector. In 2025, there is an expectation of increased awareness of flood risks, leading to changes in the property and casualty market, and an increased demand for captive insurance.

Share repurchases, like those in 2024, can signal confidence in the company's financial health. They can also boost shareholder value by reducing the number of outstanding shares.

The average tenure of the management team and board suggests stability. This can provide confidence in the company's strategic direction and operational execution.

Crawford Company operates within a dynamic industry. Trends like consolidation and technological advancements influence its strategies. The company has to adapt to stay competitive.

The increase in revenue before reimbursements in Q1 2025 indicates positive financial performance. This can be a key indicator of the company's success.

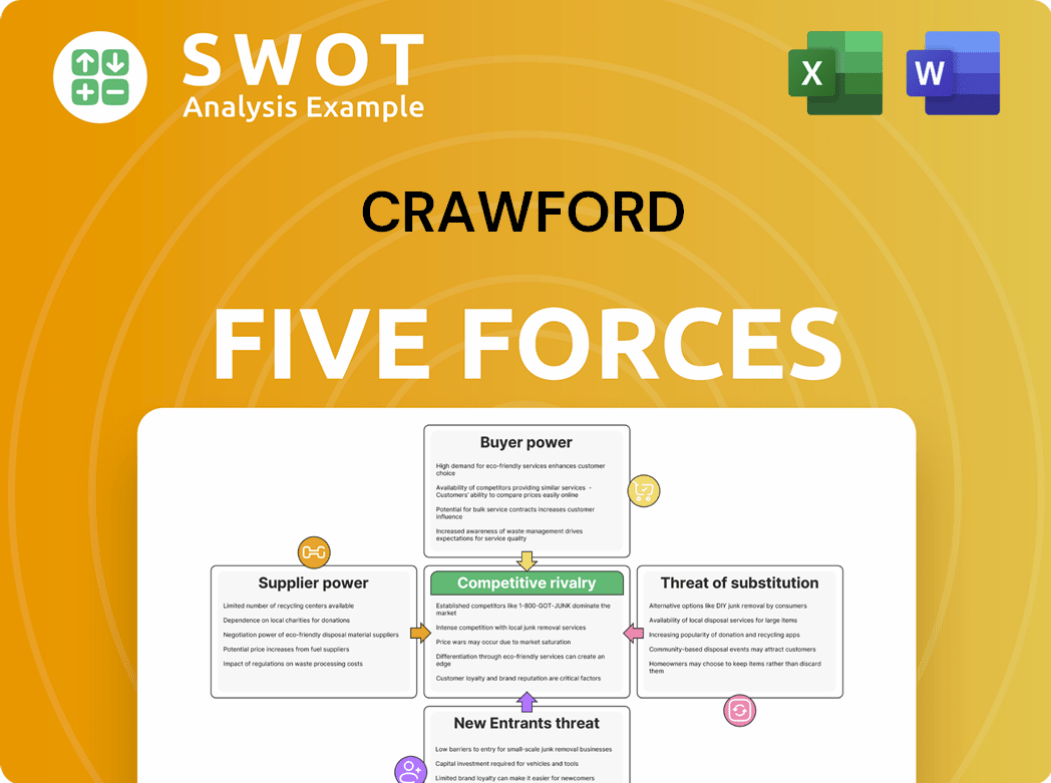

Crawford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Crawford Company?

- What is Competitive Landscape of Crawford Company?

- What is Growth Strategy and Future Prospects of Crawford Company?

- How Does Crawford Company Work?

- What is Sales and Marketing Strategy of Crawford Company?

- What is Brief History of Crawford Company?

- What is Customer Demographics and Target Market of Crawford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.