Crawford Bundle

Can Crawford Company Continue Its Claims to Global Leadership?

Crawford & Company, a titan in claims management, is charting its course through a rapidly evolving landscape. Founded in 1941, the company has grown from a simple idea to a global powerhouse, serving clients worldwide. But what does the future hold for this industry leader?

This analysis dives deep into the Crawford SWOT Analysis, exploring Crawford Company's innovative growth strategy and its future prospects. We'll examine its strategic planning, including market analysis and business development initiatives, to understand how it plans to stay ahead. Ultimately, understanding Crawford Company's approach is crucial for anyone interested in the future of claims management and the company's potential for international expansion and long-term growth plans.

How Is Crawford Expanding Its Reach?

The Growth strategy of Crawford Company centers on expanding its market presence, diversifying revenue streams, and adapting to industry changes. This approach includes a history of strategic acquisitions, with a significant number of deals completed to enhance its capabilities and reach. These initiatives are designed to position the company for sustained growth and resilience in a dynamic market environment.

Crawford Company's focus on operational excellence and customer experience is a key part of its strategy for business development. This involves strengthening client relationships and providing support during both stable and challenging times. By investing in its offerings and adapting to market needs, the company aims to solidify its position and achieve its future prospects.

The company's recent activities, especially in 2024, showcase its commitment to growth. The acquisitions of Tecse, Inarges, and Cortes y Botella, completed in November 2024, are prime examples of its expansion efforts. These moves, spanning eight countries with a strong presence in Australia and the United States, demonstrate a clear strategy for geographical and service line expansion.

Crawford Company has a history of strategic acquisitions, with approximately 15 completed acquisitions. The average value of these acquisitions is around $53.9 million, indicating a significant investment in growth. This approach is a key part of their strategic planning.

The acquisitions of Tecse, Inarges, and Cortes y Botella in November 2024 spanned eight countries, with a strong presence in Australia and the United States. This expansion strategy aims to broaden the company's geographical footprint and increase its market reach. For more details, check out the Marketing Strategy of Crawford.

Crawford Company is committed to enhancing the customer experience across all its offerings. This includes strengthening relationships with clients and becoming a key partner during both stable and extreme weather events. This focus is crucial for long-term success.

The company emphasizes operational excellence as part of its growth strategy. This involves continuous improvement in processes and service delivery to maintain a competitive edge. This focus is essential for achieving sustainable growth.

Crawford Company is focusing on several key areas to drive future growth. These include expanding its presence in the Lloyd's and London markets and developing its proposition for corporate clients. These initiatives are designed to capitalize on emerging opportunities and strengthen its market position.

- Entering new markets to increase its global footprint.

- Diversifying revenue streams through a wider range of services.

- Investing in the Lloyd's and London markets to expand its global reach.

- Developing its proposition for corporate clients to capture new opportunities.

Crawford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Crawford Invest in Innovation?

The Crawford Company is actively embracing innovation and technology to fuel its growth strategy, particularly focusing on digital transformation and the integration of cutting-edge technologies. This approach is crucial for navigating the evolving market landscape and ensuring sustained success. The company's commitment to technological advancements aligns with its broader strategic planning goals.

Crawford Company recognizes the importance of adapting to changing customer needs and preferences. This includes leveraging technology to enhance customer experience and streamline operations. The company's strategic initiatives are designed to improve efficiency and provide better services.

Crawford Company's future prospects are closely tied to its ability to harness the power of technology and innovation. By investing in these areas, the company aims to improve its market share and maintain a competitive edge. This proactive stance positions Crawford Company for long-term growth and sustainability.

Crawford Company anticipates significant expansion in AI's role in automating claims processes in 2024 and beyond. This will revolutionize claims management and support climate risk mitigation. CEO Rohit Verma highlighted that clarity and confidence in AI's usability will drive its adoption.

AI agents will increasingly handle calls through intent identification and workflow triaging in call centers. This will improve efficiency and customer service. This technology will help streamline operations and improve customer satisfaction.

Crawford Company has joined organizations endorsing the 'Code of Conduct for the Use of AI in Claims' in the UK. This aims for fairness, transparency, and accountability in AI deployment. The company is also developing its own internal conduct code for AI.

The company's internal conduct code for AI emphasizes meticulous review of machine-generated decisions by professionals. This is to prevent inaccuracies and bias. This approach ensures responsible and ethical AI implementation.

Crawford Company anticipates increased reliance on predictive modeling and analytics to enhance preparedness and response capabilities for flood risks in 2025. AI models will become more widespread for forecasting climate patterns and extreme weather events. This will improve risk management.

Wearables, including smart helmets, sensors, and monitors, are expected to play an increasingly influential role in workplace safety in 2025. This technology will help reduce workplace accidents and improve safety protocols. This will enhance overall operational efficiency.

Crawford Company is committed to improving its technological capabilities to enhance the customer experience. Data is considered the cornerstone of claims development. Crawford's role as stewards of loss data will become increasingly critical to ensure effective and accurate collection processes. This focus on data will support the company's Brief History of Crawford and its ongoing growth strategy.

- Crawford Company is investing in AI-driven automation to streamline claims processing, aiming for a 20% reduction in processing time by 2026.

- The company plans to increase its use of predictive analytics for risk assessment by 30% in 2025, improving its ability to manage and mitigate climate-related risks.

- Crawford Company is allocating $50 million towards technology upgrades and digital transformation initiatives over the next three years.

- The company aims to enhance customer satisfaction scores by 15% by 2025 through improved digital interfaces and personalized services.

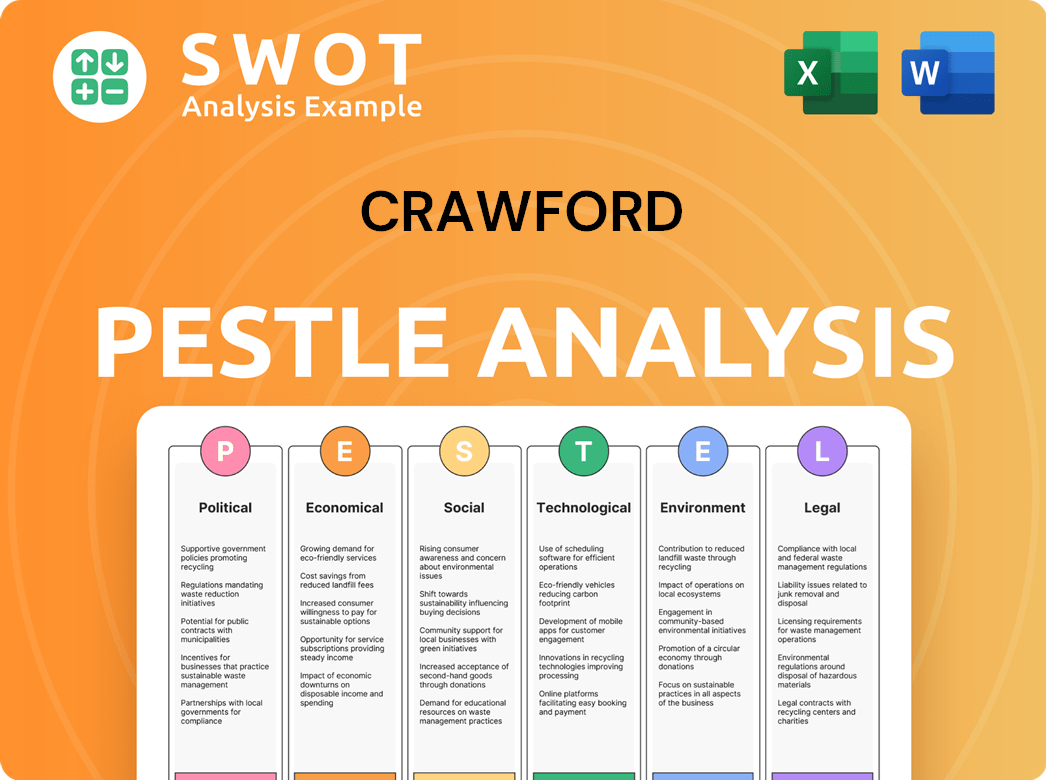

Crawford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Crawford’s Growth Forecast?

The financial outlook for Crawford & Company appears positive, with demonstrated growth and strategic initiatives. The company's performance in early 2025, as well as its achievements in 2024, suggest a strong foundation for continued expansion. Understanding the financial trajectory is key to assessing the overall growth strategy and future prospects of the company.

In the first quarter of 2025, Crawford & Company experienced revenue growth and improved profitability. This positive trend, combined with strategic investments, positions the company well for sustained success. The financial data highlights the company's ability to adapt and thrive in the market.

For a deeper dive into the company's operations, consider exploring Revenue Streams & Business Model of Crawford.

Revenues before reimbursements in Q1 2025 increased by 3% to $312.0 million, up from $301.7 million in Q1 2024. This indicates a positive start to the year, with increased sales contributing to the company's financial growth. This growth is a key indicator of the company's ability to execute its growth strategy.

Consolidated operating earnings increased by 47% year-over-year in Q1 2025, with a 170-basis-point improvement in the consolidated operating margin. Net income for Q1 2025 was $6.7 million, or $0.13 per diluted share. This demonstrates improved operational efficiency and profitability.

For the full year 2024, revenues before reimbursements reached a record $1.293 billion, a 2% increase from $1.267 billion in 2023. Broadspire segment revenues reached a new annual record of $388.1 million, increasing 9.1% from 2023. This showcases the company's ability to achieve consistent revenue growth.

Full year 2024 net income was $26.6 million. Platform Solutions revenues in the fourth quarter of 2024 were up 55.1% to $57.6 million, driven by increased weather-related activity. This indicates the company's resilience and ability to capitalize on market opportunities.

As of March 31, 2025, consolidated cash and cash equivalents totaled $57.4 million, increasing from $55.4 million at December 31, 2024. Total debt outstanding as of March 31, 2025, was $246.6 million, compared to $218.1 million at December 31, 2024. These figures reflect the company's current financial health and its approach to managing debt.

- Cash and Equivalents: $57.4 million as of March 31, 2025.

- Total Debt: $246.6 million as of March 31, 2025.

- 2024 Revenue: $1.293 billion.

- 2024 Net Income: $26.6 million.

Crawford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Crawford’s Growth?

Examining the potential risks and obstacles is crucial for understanding the Crawford Company's growth strategy and future prospects. Several factors could hinder the company's ability to achieve its goals, impacting its financial performance and market position. These challenges require careful consideration and proactive management to ensure sustainable business development.

The Crawford Company faces various strategic and operational risks that could affect its future prospects. These risks range from external factors, such as unpredictable case volumes tied to weather events, to internal challenges, including talent scarcity and the need for continuous innovation. A thorough market analysis is essential for navigating these complexities.

The company's revenue is significantly influenced by the frequency and severity of weather-related claims and natural disasters, which are difficult to forecast accurately. While increased activity can boost revenue, a quiet storm season, as seen in parts of 2024, can lead to decreased staff utilization and lower revenues in segments like North America Loss Adjusting and Contractor Connection. For more information on the company's target market, consider reading this article: Target Market of Crawford.

A significant portion of revenue depends on weather-related claims, which are hard to predict. Quiet storm seasons can lead to lower revenues and decreased staff utilization. This unpredictability directly impacts financial planning and strategic planning.

Rapid AI advancements require constant investment and adaptation. Concerns about privacy and efficacy may slow the adoption of new AI tools. The cyber insurance market faces complexities in aligning supply with demand.

The insurance industry faces talent scarcity, necessitating coordinated efforts to retain and attract employees. Addressing this issue is crucial for maintaining operational efficiency and supporting Crawford Company's growth strategy. Initiatives should be sector-wide.

A potential $5.0 million negative impact from a foreign tax authority's new guidance poses a financial risk. This could affect the company's financial condition and requires careful monitoring and mitigation strategies to ensure Crawford Company's long-term financial performance and future outlook.

Ongoing challenges include intense market competition and the need for continuous innovation and differentiation. The company must continually enhance its offerings to maintain a competitive edge and drive Crawford Company's market expansion strategies.

The complexities within the cyber insurance market, including intricate wordings and recovery uncertainties, present challenges. These factors can impact the ability to align supply with demand effectively. The cyber market is expected to reach $20 billion in the US by the end of 2025.

Effective strategic planning is essential to mitigate risks and capitalize on opportunities. This includes developing strategies to manage fluctuating case volumes, adapting to technological changes, and addressing talent shortages. Regular market analysis will help refine these strategies.

Prudent financial management is vital to address potential financial impacts from tax regulations. This includes proactive measures to minimize any adverse effects and ensure the Crawford Company's financial stability. The company must also focus on Crawford Company's financial performance and future outlook.

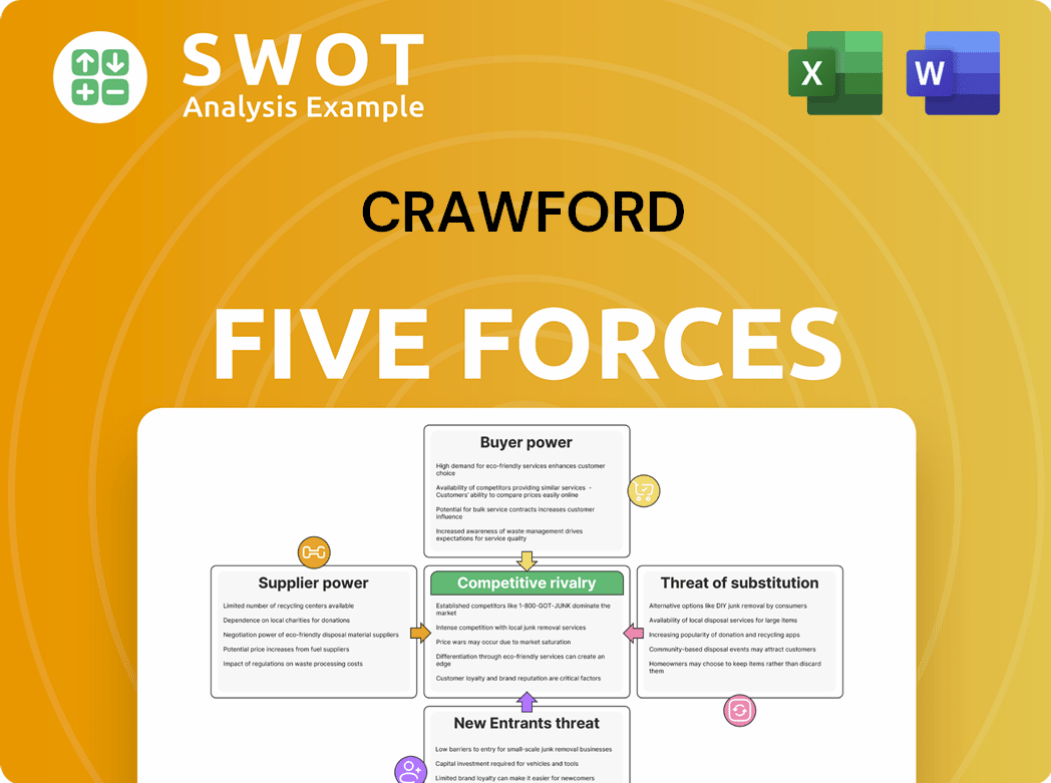

Crawford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Crawford Company?

- What is Competitive Landscape of Crawford Company?

- How Does Crawford Company Work?

- What is Sales and Marketing Strategy of Crawford Company?

- What is Brief History of Crawford Company?

- Who Owns Crawford Company?

- What is Customer Demographics and Target Market of Crawford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.