Dana Bundle

How has Dana Inc. shaped the mobility landscape?

Journey back in time to 1904, when Dana Incorporated revolutionized vehicle design with a groundbreaking invention. From its humble beginnings, Dana has evolved into a global powerhouse, constantly adapting and innovating within the dynamic automotive industry. Discover the pivotal moments that define Dana Company history and its lasting impact on how we move.

This exploration into the brief history of Dana Company's founding will uncover how Clarence W. Spicer's vision transformed into a global enterprise. Learn about Dana Corporation's early years and development, including its pivotal role in the automotive industry and beyond. Furthermore, we'll examine the company's Dana SWOT Analysis to understand its current standing and future prospects in the competitive landscape of Dana automotive and Dana manufacturing.

What is the Dana Founding Story?

The story of Dana Incorporated, or Dana Inc, begins in the early days of the automotive industry. It's a tale of innovation, starting with a single, brilliant invention that would reshape how vehicles are built and how they perform. This brief history of Dana Company's founding is a testament to the vision of its founder and the impact of its products.

Clarence W. Spicer, an engineer and inventor, laid the groundwork for what would become a global leader in vehicle components. His patented universal joint was the spark that ignited the company's journey. The company's early years and development were marked by a relentless pursuit of better solutions for a rapidly evolving industry.

The company's story is one of adaptation and growth, from its humble beginnings to its current status as a major player in the automotive and off-highway vehicle sectors. Key milestones in Dana Corporation's history reflect its commitment to innovation and its ability to anticipate the needs of its customers.

Dana Incorporated, initially known as the Spicer Universal Joint Manufacturing Company, was founded on April 1, 1904, by Clarence W. Spicer in Plainfield, New Jersey. Spicer's patented encased universal joint was a game-changer, offering a more efficient power transmission solution than the existing sprocket and chain systems.

- In its first year, Spicer's universal joints were shipped to the Corbin Motor Company.

- The company was formally incorporated in 1905.

- The name changed to Spicer Manufacturing Company in 1909.

- Charles Dana joined the company in 1914, and the company was renamed Dana Corporation in 1946.

The focus on innovation continued to drive the company forward. Dana Company's involvement in the automotive industry expanded as it developed and manufactured a wide range of components. The company's evolution over time saw it diversify its product offerings and expand its global footprint. Today, Dana Company's current operations and locations span the globe, serving customers in various sectors.

The company's early success was built on its core product. While specific initial funding sources are not detailed, the demand for Spicer's invention in the growing motor vehicle industry fueled the company's early growth. The company's ability to adapt and innovate has been a key factor in its longevity and success. For a deeper dive into the company's strategic direction, consider reading about the Growth Strategy of Dana.

Dana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Dana?

The early years of the company, initially known as Spicer Universal Joint Manufacturing Company, laid the foundation for its future. This period saw the company rapidly expanding its product range and market presence. Key to this growth was a strategic focus on meeting the evolving needs of the automotive industry. This expansion was a key step in solidifying its position in the automotive supply chain.

In 1914, the company began manufacturing complete axles, which significantly broadened its importance to automotive manufacturers. This move was a pivotal step in establishing its role within the automotive supply chain. The expansion beyond universal joints marked a significant shift in the company's strategy, focusing on becoming a key supplier to the burgeoning automotive industry. This diversification helped to solidify its position in the market.

By 1922, the company was listed on the New York Stock Exchange, reflecting its growing financial success. International expansion began in 1925 with an investment in its English licensee, Hardy, later renamed Hardy Spicer. This marked the initial steps into global markets, a strategy that would become a cornerstone of its long-term growth. Further acquisitions, such as Perfect Circle Company in 1963 and a significant stake in Turner Manufacturing in 1972, enhanced its capabilities.

Strategic acquisitions, including the Perfect Circle Company in 1963 and a significant stake in Turner Manufacturing in 1972, enhanced the company's capabilities. These mergers and acquisitions allowed the company to offer a more comprehensive range of products and services. The company's growth was driven by a continuous effort to meet evolving customer needs through better designs, materials, and products, even amidst challenges.

As of 2024, the company's sales distribution showed 48% from North American operations and 52% from international operations, highlighting its global reach. This distribution underscores the company's strong international presence and its ability to adapt to various markets. To understand the competitive landscape, you can explore the Competitors Landscape of Dana.

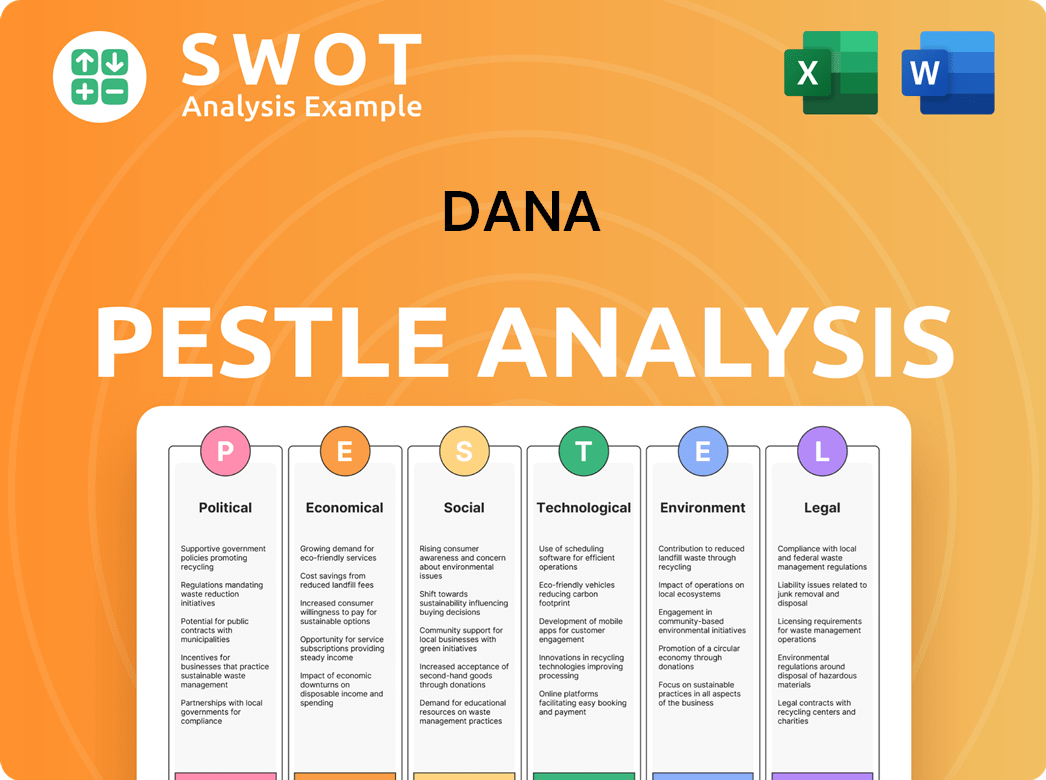

Dana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Dana history?

The Dana Company history is marked by significant milestones, reflecting its growth and adaptation in the automotive and industrial sectors. These achievements highlight the company's strategic direction and its impact on vehicle technology and global markets.

| Year | Milestone |

|---|---|

| 2021 | Established an e-Propulsion Center in Italy, showcasing its commitment to electric vehicle technology. |

| 2024 | Named among the 'World's Most Ethical Companies' by Ethisphere, demonstrating its commitment to ethical business practices. |

| 2025 | Recognized as one of 'America's Most Responsible Companies' by Newsweek, highlighting its dedication to corporate social responsibility. |

| April 2025 | Earned an Automotive News PACE Award for its Graziano™ Modular High-Performance Hybrid 8-speed Dual Clutch Transmission, emphasizing its innovation in advanced propulsion systems. |

Dana has consistently demonstrated its commitment to innovation, particularly in advanced propulsion systems. The company's focus on electric vehicle technology, as seen with its e-Propulsion Center, and its development of the Graziano™ Modular High-Performance Hybrid transmission, underscore its dedication to leading-edge solutions for the automotive industry.

Dana has invested heavily in electric vehicle technology, establishing an e-Propulsion Center in Italy to support its advancements in this area.

The company's Graziano™ transmission, recognized with an Automotive News PACE Award, showcases its innovation in advanced propulsion systems.

Dana has made significant contributions to drivetrain systems, enhancing vehicle performance and efficiency.

Dana has developed hybrid systems to improve fuel economy and reduce emissions.

Dana is focused on the development of advanced propulsion systems to meet the changing demands of the automotive industry.

Dana offers a range of off-highway solutions for various industrial applications.

Despite its achievements, Dana has faced significant challenges, including financial difficulties and market-related setbacks. The company has responded with strategic restructuring and cost-saving measures to navigate these obstacles and maintain its market position.

In 2006, Dana filed for bankruptcy, which led to the cancellation of 150 million shares of stock in 2007.

In the first quarter of 2024, Dana experienced a $29 million loss related to a terminated agreement to sell its non-core European Off-Highway hydraulics business.

The company's 2024 financial results showed a net loss of $57 million, compared to a net income of $38 million in 2023, due to restructuring charges and lower demand.

Dana has implemented a cost-savings plan targeting $225 million in savings for 2025, part of a larger $300 million initiative through 2026.

The company is streamlining its organizational structure into two segments: Light Vehicle Systems and Commercial Vehicle Systems.

Dana is pursuing the sale of its Off-Highway business to focus on core on-highway markets.

Dana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Dana?

The Dana Company history is marked by significant shifts and innovations in the automotive and industrial sectors. From its inception in the early 20th century to its current focus on e-mobility and core on-highway markets, the company has consistently adapted to industry changes.

| Year | Key Event |

|---|---|

| 1904 | Clarence W. Spicer established his company in Plainfield, New Jersey, based on his patented encased universal joint. |

| 1905 | Spicer Universal Joint Manufacturing Company was incorporated. |

| 1914 | The company began producing complete axles. |

| 1925 | Spicer expanded internationally with a holding in its English licensee, Hardy, renamed Hardy Spicer. |

| 1946 | The company was renamed Dana Corporation, after Charles A. Dana. |

| 1967 | Dana conducted early experiments with driveline concepts for electric vehicles. |

| 2006 | Dana filed for bankruptcy. |

| 2018-2019 | Dana acquired a majority stake in TM4 Inc., SME Group, and Oerlikon Group's Drive Systems segment, bolstering its e-mobility and driveline offerings. |

| 2021 | Dana established an e-Propulsion Center in Italy and expanded its e-Mobility offerings. |

| 2024 | Preliminary full-year sales were approximately $10.3 billion, with an adjusted EBITDA of $885 million. |

| January 2025 | Dana announced a $300 million annualized total cost-reduction savings target through 2026 and provided preliminary 2024 financial results and 2025 guidance. |

| February 2025 | Dana reported a 2024 net loss of $57 million and adjusted EBITDA growth of $40 million. |

| April 2025 | Dana reported Q1 2025 net income of $25 million on sales of $2.35 billion and reaffirmed its 2025 adjusted EBITDA guidance of $925 million to $1,025 million. |

| May 2025 | Dana was recognized as '2025 Educational Partner of the Year' by HDA Truck Pride. |

Dana is concentrating on its core on-highway markets and divesting its Off-Highway business. This strategic move aims to improve cost structure and operational efficiency, reflecting the company's commitment to adapting to evolving market trends.

The company projects 2025 sales between $9.525 billion and $10.025 billion. Adjusted EBITDA is expected to be between $925 million and $1,025 million, representing a 10% margin. Free cash flow is targeted between $175 million and $275 million.

Dana continues to invest in e-mobility solutions, as seen through acquisitions and the establishment of an e-Propulsion Center. This focus aligns with the growing demand for electric vehicle components and systems, showing the company's forward-thinking approach.

Dana aims for a $300 million annualized total cost-reduction savings target through 2026. This initiative highlights the company's efforts to streamline operations and enhance profitability, ensuring long-term financial health and competitiveness in the Dana automotive industry.

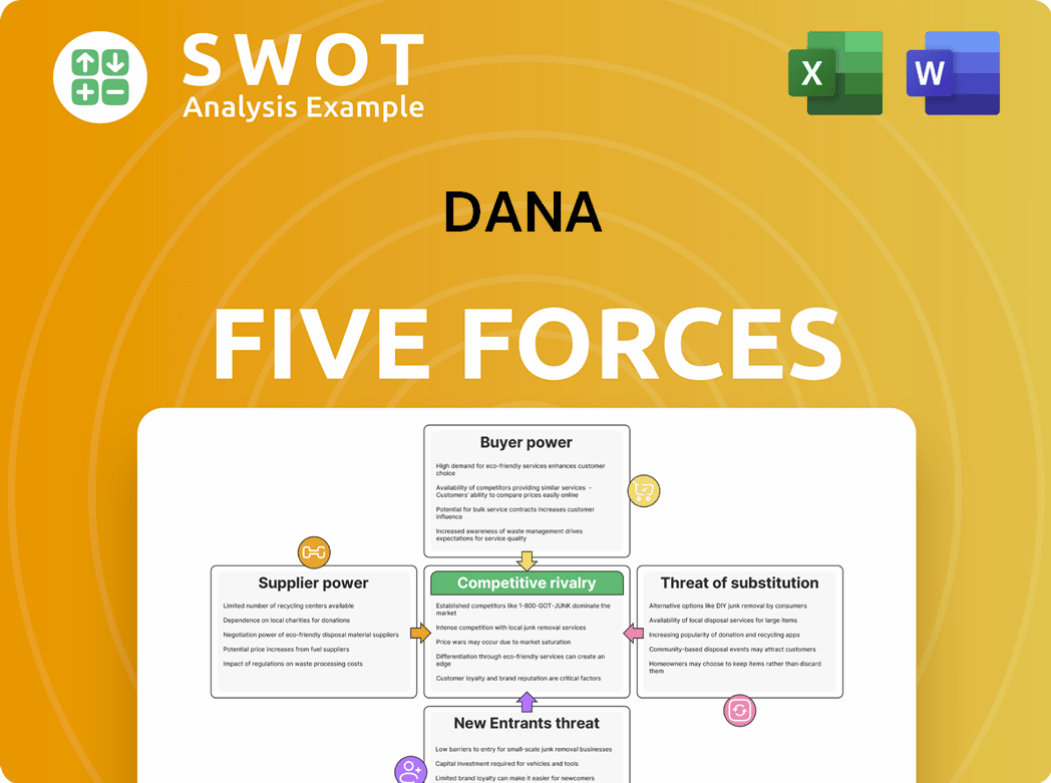

Dana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Dana Company?

- What is Growth Strategy and Future Prospects of Dana Company?

- How Does Dana Company Work?

- What is Sales and Marketing Strategy of Dana Company?

- What is Brief History of Dana Company?

- Who Owns Dana Company?

- What is Customer Demographics and Target Market of Dana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.