Dana Bundle

How Does Dana Incorporated Stack Up Against Its Rivals?

Dana Incorporated, a titan in power-conveyance solutions, is navigating a dynamic automotive and industrial sector. With a focus on electrification and advanced driveline systems, the company is strategically positioned. Understanding the Dana SWOT Analysis is crucial to grasp its competitive standing.

This exploration of the Dana Company competitive landscape will dissect its market position and the strategies it employs to stay ahead. We'll analyze Dana's business rivals, its market share, and how it adapts to industry shifts. This deep dive provides essential insights for anyone tracking Dana Incorporated's market analysis and its future trajectory.

Where Does Dana’ Stand in the Current Market?

Dana Incorporated holds a significant market position across its served segments: light vehicle, commercial vehicle, and off-highway markets. The company is a major global supplier of driveline, electrification, and thermal-management solutions. Its primary product lines include axles, driveshafts, transmissions, and e-propulsion systems, serving a diverse customer base from automotive OEMs to heavy-duty equipment manufacturers.

Geographically, Dana has a robust global presence, with manufacturing, engineering, and sales operations spanning North America, South America, Europe, Asia, and Africa. This allows it to serve regional and global customers effectively. The company has strategically shifted its positioning, with a strong emphasis on electrification to capitalize on the industry's move towards sustainable mobility. This includes significant investments in e-axles, e-transmissions, and battery cooling systems.

Dana reported sales of $10.6 billion for the full year 2023, demonstrating its substantial scale within the industry. This financial strength, combined with its strategic focus on electrification, allows Dana to maintain a competitive edge and invest in future technologies. Dana holds a particularly strong position in the off-highway and commercial vehicle segments, where its robust and durable driveline solutions are highly valued. While facing intense competition in the light vehicle segment, its innovative e-mobility offerings are strengthening its foothold in this evolving market.

Dana consistently ranks among the top global suppliers in its core markets. Specific market share figures for 2024-2025 are subject to ongoing market analysis. The company's strong position is supported by its diverse product portfolio and global presence.

Dana's financial health reflects its scale and operational efficiency. Full-year 2023 sales reached $10.6 billion. This financial strength allows for continued investment in research and development, particularly in electrification technologies.

Dana is heavily investing in e-axles, e-transmissions, and battery cooling systems. This strategic shift positions Dana as a key enabler of electric vehicle (EV) and hybrid vehicle adoption. This focus is crucial for long-term growth.

Dana boasts a robust global presence with operations across multiple continents. This allows it to serve a diverse customer base, including major automotive OEMs and heavy-duty equipment manufacturers. Dana's global reach is a key competitive advantage.

Dana's competitive advantages include its strong market position in off-highway and commercial vehicle segments, its focus on electrification, and its global manufacturing and distribution network. The company faces challenges in the highly competitive light vehicle segment, requiring continuous innovation and strategic partnerships.

- Dana's robust driveline solutions are highly valued in the off-highway and commercial vehicle markets.

- The company's strategic investments in e-mobility are strengthening its foothold in the light vehicle segment.

- Dana's global presence allows it to serve customers worldwide effectively.

- For more details about the company, you can read the article about Owners & Shareholders of Dana.

Dana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Dana?

The competitive landscape for Dana Incorporated is multifaceted, encompassing both established players and emerging competitors, particularly in the evolving automotive industry. Understanding the dynamics of the Dana Company competitive landscape is crucial for stakeholders. The company faces competition across its diverse product lines, including driveline systems, sealing products, and thermal management technologies, each with its unique set of rivals and market challenges.

The rise of electric vehicles (EVs) and the shift towards sustainable transportation solutions have significantly altered the competitive dynamics. This shift brings new players into the arena and forces existing companies to adapt and innovate. The Dana Incorporated market analysis reveals a complex interplay of traditional automotive suppliers and technology-focused companies, all vying for market share in a rapidly changing environment. A comprehensive understanding of these competitive forces is essential for strategic decision-making.

The Dana business rivals include a mix of established automotive suppliers and emerging players. These companies compete in various segments, including driveline systems, sealing products, and thermal management technologies. Competition is intensifying due to the rise of electric vehicles (EVs) and the growing demand for sustainable transportation solutions. The company's strategic positioning and market strategies are continuously evolving to address these challenges and opportunities.

Direct competitors in the driveline segment include Meritor (now part of Cummins), ZF Friedrichshafen AG, and American Axle & Manufacturing (AAM). These companies offer similar products and services, competing for market share in both light and heavy-duty vehicle markets. The competition is fierce, with each company striving to innovate and gain a competitive edge.

The acquisition of Meritor by Cummins has created a more integrated competitor with expanded capabilities. This merger enhances Cummins' position in the commercial vehicle market, posing a significant challenge to Dana. Such strategic moves reshape the competitive landscape, requiring Dana to adapt and innovate to maintain its market position.

The rise of electric vehicles has introduced new competitors, including Bosch and EV-focused startups. These companies specialize in electric powertrains and components, directly competing with Dana's electrification efforts. The shift towards EVs is a significant factor shaping the Dana industry overview.

Vehicle manufacturers are increasingly insourcing the production of electric driveline components, posing an indirect competitive threat. Securing supply contracts with major OEMs for new EV platforms is crucial, with technology and cost efficiency being key factors. This competition highlights the importance of innovation and strategic partnerships.

Bosch offers a wide range of e-mobility solutions, including electric motors and inverters. This broad portfolio allows Bosch to compete directly with Dana in the electrification space. Bosch's diversified offerings provide it with a competitive advantage in the evolving automotive market.

The competitive landscape is dynamic, with mergers, acquisitions, and technological advancements constantly reshaping the industry. Understanding these factors is essential for assessing Dana Corporation competitors and their impact on the market. The ability to adapt and innovate is crucial for success in this environment.

The competitive landscape is shaped by factors such as technological innovation, cost efficiency, and the ability to secure supply contracts. The Dana market share is influenced by its ability to adapt to the changing automotive industry, particularly the rise of electric vehicles. The company faces several challenges in maintaining its market position.

- Technological Advancements: Keeping pace with rapid technological changes in electric powertrains and components.

- Cost Competitiveness: Offering competitive pricing while maintaining profitability.

- Supply Chain Management: Ensuring a resilient and efficient supply chain to meet demand.

- Strategic Partnerships: Forming alliances to access new technologies and markets.

- Market Expansion: Entering new markets and expanding its product portfolio.

- Mergers and Acquisitions: Adapting to the changing competitive landscape through strategic moves.

For a deeper dive into how the company approaches its market strategy, consider reading about the Marketing Strategy of Dana.

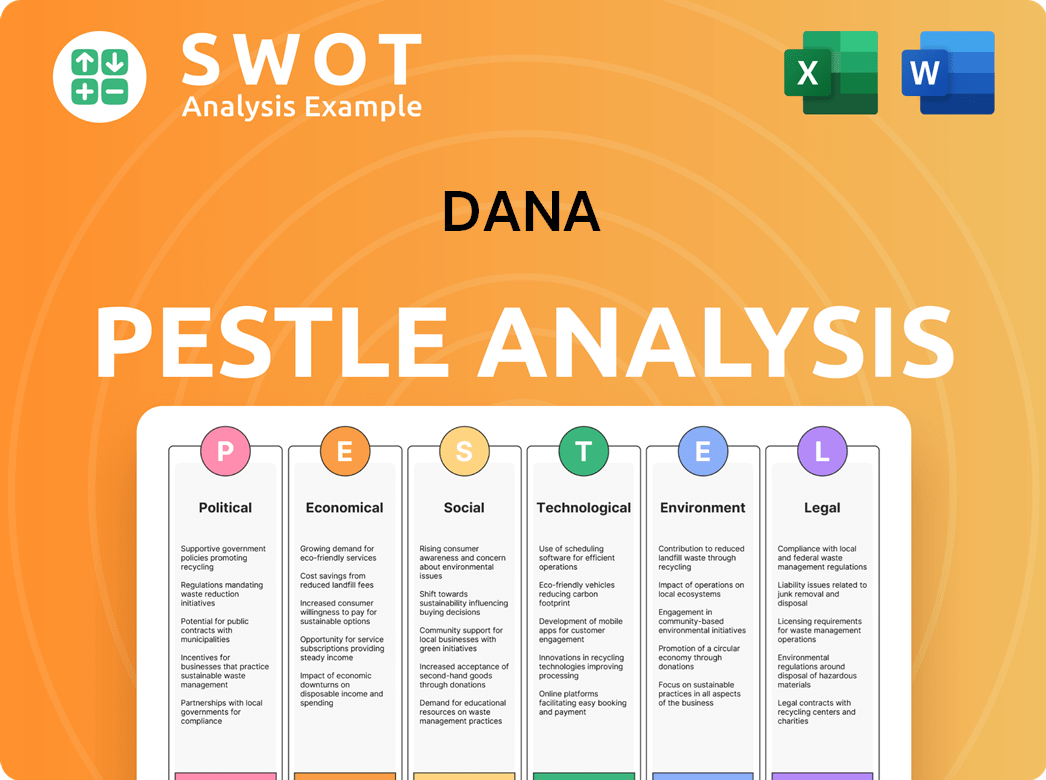

Dana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Dana a Competitive Edge Over Its Rivals?

Dana Incorporated's competitive advantages are rooted in its proprietary technologies, extensive global network, and enduring customer relationships. These elements position the company favorably within the Dana Company competitive landscape. A significant strength lies in its intellectual property, particularly in advanced driveline systems and electrification technologies.

The company's strategic investments in research and development are substantial, with $246 million allocated in 2023. This funding supports the development of innovative products like Spicer Electrified™ e-axles and e-transmissions, crucial for the electric vehicle market. Furthermore, Dana's global manufacturing footprint, strategically located near major automotive hubs, enhances efficiency and supports a robust supply chain. The company's long-standing relationships with leading global OEMs are another key advantage, built on trust and a proven track record.

These deep partnerships facilitate collaborative product development, ensuring Dana meets evolving customer needs and industry standards. However, Dana faces ongoing challenges from imitation and technological shifts, necessitating continuous investment in R&D and strategic partnerships to maintain its leading edge. The sustainability of these advantages depends on Dana's ability to innovate and adapt to the rapid changes in the automotive and industrial sectors. For more insights, you can explore a detailed analysis of Dana Incorporated market analysis.

Dana's competitive edge is significantly bolstered by its proprietary technologies, especially in driveline systems and electrification components. The company's dedication to innovation is evident in its consistent R&D spending, which totaled $246 million in 2023. This investment supports the development of advanced products like e-axles and e-transmissions, crucial for the electric vehicle market, setting Dana apart from its Dana Corporation competitors.

Dana's extensive global manufacturing network, strategically positioned near major automotive and industrial hubs, provides substantial economies of scale. This network allows for efficient localized production and delivery, supporting a robust supply chain. The company's global presence enables it to respond quickly to customer demands and mitigate supply chain disruptions, which is a key aspect of the Dana industry overview.

Dana's long-standing relationships with leading global OEMs are a critical competitive advantage, built on trust, reliability, and a history of delivering high-quality solutions. These deep partnerships, often spanning decades, facilitate collaborative product development. Dana leverages these relationships to ensure its offerings meet evolving customer needs and industry standards, which significantly impacts its Dana market share.

In 2023, Dana's financial performance reflected its strategic focus on innovation and market expansion. The company's investments in R&D, totaling $246 million, underscore its commitment to staying ahead of the curve. Dana's strategic moves, including acquisitions and partnerships, are aimed at strengthening its position in the evolving automotive and industrial sectors, directly influencing its standing among Dana business rivals.

Dana faces challenges from imitation and rapid technological shifts, necessitating continuous investment in R&D and strategic partnerships. The sustainability of its competitive advantages hinges on its ability to innovate and adapt to the accelerating pace of change in the automotive and industrial sectors. Dana's strategies for growth include expanding its product portfolio and global market presence, especially in the commercial vehicle market.

- Continuous investment in R&D to stay ahead of technological advancements.

- Strategic partnerships and alliances to expand market reach and capabilities.

- Focus on the electric vehicle market with innovative driveline solutions.

- Adaptation to the changing automotive industry through product diversification.

Dana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Dana’s Competitive Landscape?

The Growth Strategy of Dana is deeply intertwined with the evolving dynamics of the automotive and industrial sectors. The company faces a competitive landscape shaped by rapid technological advancements, shifting consumer preferences, and stringent regulatory demands. Understanding the industry's trajectory, potential challenges, and emerging opportunities is crucial for assessing Dana's strategic positioning and future prospects.

The primary factors influencing the Dana Company competitive landscape include the increasing adoption of electric vehicles (EVs), the drive for enhanced efficiency and sustainability, and the integration of digital technologies. These trends present both risks and opportunities for Dana Incorporated market analysis, requiring the company to adapt and innovate to maintain its competitive edge. The analysis of Dana business rivals is essential for understanding its strategic positioning.

The automotive industry is undergoing a significant transformation driven by electrification, with global EV sales expected to reach approximately 14 million units in 2024, according to the International Energy Agency. This shift is pushing companies like Dana to develop and offer advanced e-propulsion systems and battery cooling solutions. Digitalization and automation are also reshaping manufacturing processes, improving efficiency and productivity.

Dana Corporation competitors face challenges such as intense price competition, rapid technological obsolescence, and the need to attract and retain skilled engineering talent. The rise of new market entrants from the tech sector and the potential for OEMs to insource certain technologies add to the competitive pressure. Changing business models, like the growth of mobility-as-a-service, may also impact demand for traditional driveline components.

Significant growth opportunities exist in expanding Dana's electrification portfolio for both on-highway and off-highway applications, particularly in emerging markets. Strategic partnerships with technology companies and startups can enhance capabilities and market reach. Dana's focus on operational efficiency and strategic acquisitions further supports its growth trajectory.

Dana is actively investing in research and development, pursuing strategic acquisitions, and focusing on operational efficiency to remain competitive. The company is pivoting towards high-growth, high-value electrification solutions. This strategy aims to solidify its leadership in the next generation of mobility and industrial equipment. Dana is also working to increase its market share in the commercial vehicle market.

Dana's competitive advantages in off-highway vehicle components and its global market presence are crucial for its success. The company's research and development spending, which was approximately $240 million in 2023, supports its innovation efforts. The company's product portfolio and its competitors' offerings are constantly evolving, necessitating continuous adaptation.

- Adapting to the changing automotive industry is key.

- Strategic partnerships can enhance Dana's capabilities.

- Focusing on operational efficiency is critical.

- Continuous investment in R&D is essential for staying ahead.

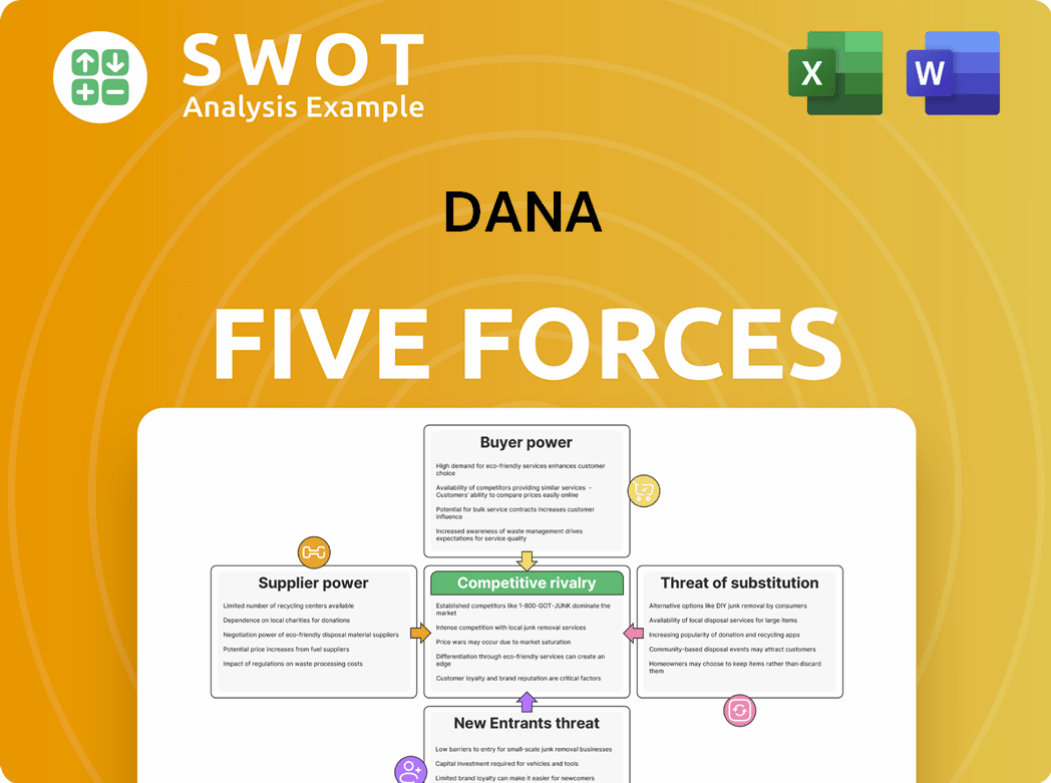

Dana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dana Company?

- What is Growth Strategy and Future Prospects of Dana Company?

- How Does Dana Company Work?

- What is Sales and Marketing Strategy of Dana Company?

- What is Brief History of Dana Company?

- Who Owns Dana Company?

- What is Customer Demographics and Target Market of Dana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.