Dana Bundle

How Well Does Dana Company Know Its Customers?

In the rapidly evolving automotive landscape, understanding customer demographics and target markets is no longer optional—it's essential for survival. Dana Incorporated, a century-old power-conveyance and energy-management solutions provider, is navigating this transformation. But who exactly are Dana's customers, and how is the company adapting to meet their changing needs?

This exploration of Dana SWOT Analysis will delve into the intricacies of Dana Company's customer demographics and target market analysis, providing insights into its strategic shifts and future growth prospects. We'll examine market segmentation, consumer profile characteristics, and the demographic data that shapes Dana's decisions. By understanding the target market of Dana Company, we can better assess its ability to capitalize on opportunities, such as the growing demand for electrification technologies, and anticipate future challenges.

Who Are Dana’s Main Customers?

Understanding the Customer Demographics and Target Market Analysis of Dana Incorporated is crucial for investors and stakeholders. Dana operates primarily within a Business-to-Business (B2B) model, focusing on serving major vehicle and machinery manufacturers. This strategic focus shapes its customer profile, which is defined by the industries it serves rather than traditional consumer demographics.

Dana's primary customer segments include light vehicle, commercial vehicle, and off-highway markets, although the company is strategically divesting its Off-Highway business to concentrate on light and commercial vehicles. This shift aims to streamline operations and capitalize on higher-growth potential within the on-highway segments. The company's Target Market Analysis is therefore closely tied to the automotive and industrial equipment sectors.

The company's customer base is composed of global automotive OEMs (Original Equipment Manufacturers) and industrial equipment manufacturers. The commercial vehicle segment, supported by e-commerce logistics and infrastructure spending, remains a resilient market. Dana's Power Technologies segment, which includes electrification products, is being integrated into the Light Vehicle Drive Systems and Commercial Vehicle Drive and Motion Systems segments in 2025 to enhance efficiency and customer service. This focus on electrification highlights Dana's adaptation to evolving market demands.

Dana's market segments are primarily divided into light vehicle, commercial vehicle, and off-highway. The company is strategically focusing on light and commercial vehicles. This Market Segmentation helps to tailor products and services to specific customer needs within each segment. The Light Vehicle Drive Systems and Commercial Vehicle Drive and Motion Systems segments are key areas of focus.

In 2024, Dana's sales were distributed with 48% from North American operations and 52% from international operations. The geographical distribution of sales is a key factor. While North American sales increased by 5%, sales in Europe decreased by 12%. This highlights the impact of external trends on specific segments and the company's responsiveness.

Dana is divesting its Off-Highway business to concentrate on core on-highway end markets. The company is adapting to industry trends, such as electrification, and integrating its Power Technologies segment. These shifts are designed to improve efficiency and customer service. For more insights into Dana's strategy, consider reading about Owners & Shareholders of Dana.

Dana's Target Market needs include reliable and efficient drivetrain and power technologies. The company's customers want innovative solutions that meet the evolving demands of the automotive and industrial sectors. Dana's focus on electrification and integration of its Power Technologies segment aligns with these needs.

Dana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Dana’s Customers Want?

The customers of Dana Incorporated, predominantly vehicle and machinery manufacturers, prioritize efficiency, performance, sustainability, and reliability when selecting components. Their decisions are influenced by long-term partnerships, technological advancements, and the ability to meet industry standards, especially regarding emissions and fuel efficiency. Understanding these needs is crucial for a comprehensive target market analysis.

Psychologically, customers seek high-quality, durable, and innovative solutions to enhance their end-products' competitiveness. Practically, they value the integration capabilities of Dana's systems, cost-effectiveness, and robust after-sales support. This focus on customer needs drives the company's product development and market strategies, making it essential to examine the customer demographics.

Dana addresses a significant unmet need: the increasing demand for electrification solutions. As the automotive industry transitions to hybrid and electric vehicles, Dana's expertise in electrodynamic systems becomes critical. The company's strategic alignment with these trends underscores the importance of understanding the consumer profile and adapting to evolving market demands.

Dana's expertise in electrodynamic systems is crucial for the shift towards hybrid and electric vehicles. This includes motors, inverters, controllers, and e-sealing/e-thermal solutions.

Dana's product development is directly influenced by feedback and market trends. The company focuses on technological innovation in powertrain systems, vehicle dynamics, and thermal management to meet evolving customer needs.

Purchasing behaviors are often influenced by long-term strategic partnerships. These partnerships are essential for integrating Dana's components into the manufacturing processes of its customers.

Dana's customers are driven by technological advancements, which impact their purchasing decisions. This includes the integration capabilities of Dana's systems into their manufacturing processes.

Customers must meet stringent industry standards and evolving regulatory requirements. This includes those concerning emissions and fuel efficiency, which influence their choices.

Robust after-sales support is a key practical driver for customers. This support ensures the longevity and reliability of Dana's components within their products.

Dana's focus on electrification is evident in its financial projections, with approximately $1 billion in EV sales anticipated for 2024. The company's hybrid transmission recently won its 10th PACE Award, highlighting its significance and expected growth. For more insights, consider reading about the Marketing Strategy of Dana. Dana's integrated approach allows it to provide complete e-Propulsion systems across various mobility markets, reflecting its commitment to meeting the evolving needs of its customers and the broader shift towards sustainable transportation. This highlights the importance of understanding the company's market segmentation strategies.

Dana's customers, primarily vehicle and machinery manufacturers, have specific needs and preferences that drive their purchasing decisions.

- Efficiency and Performance: Customers seek components that enhance the efficiency and performance of their end products.

- Sustainability: There's a growing demand for environmentally friendly solutions, driving the need for electrification technologies.

- Reliability: Customers prioritize reliable components that ensure the longevity and dependability of their products.

- Technological Innovation: Customers are looking for advanced technological solutions that can integrate seamlessly into their manufacturing processes.

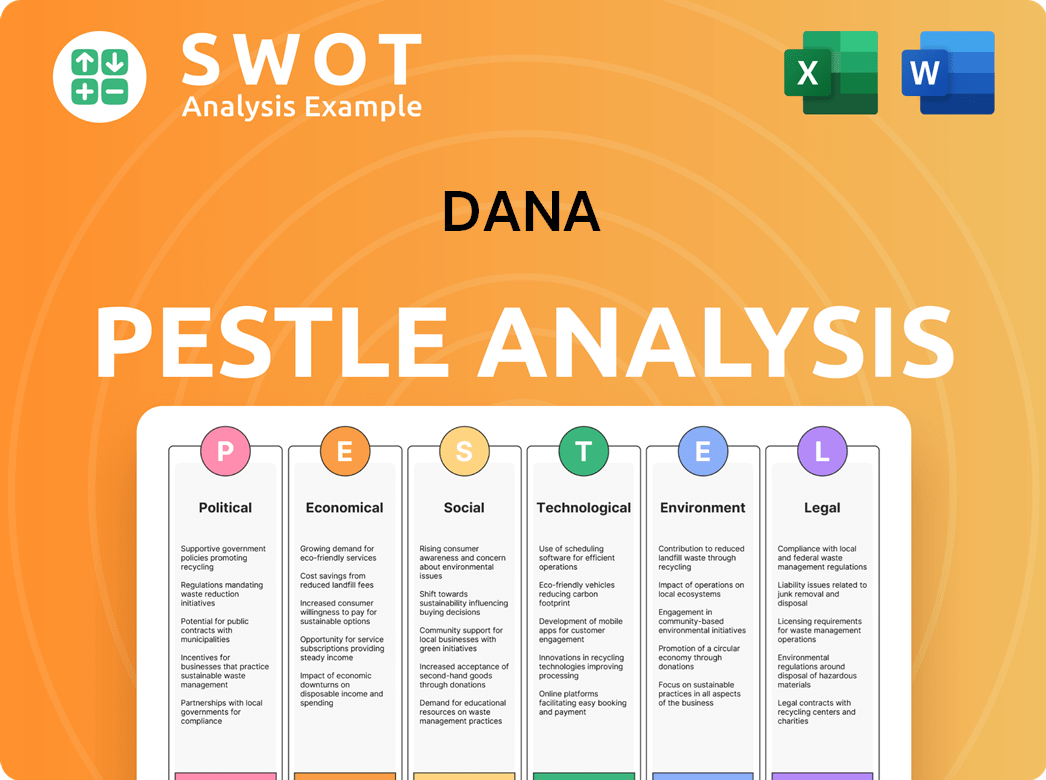

Dana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Dana operate?

The geographical market presence of the company is substantial, with operations spanning across 30 countries on six continents. This widespread reach highlights its commitment to serving a global customer base and adapting to diverse regional demands. In 2024, the company's sales were distributed with 48% from North American operations and 52% from international operations, showcasing a balanced approach to market diversification.

North America remains a significant market for the company, experiencing a 5% increase in sales in 2024. However, the company also has a strong footprint in international regions. It's important to note that sales in Europe decreased by 12% in 2024. This decline was primarily due to weaker demand in the construction/mining and agricultural equipment markets, indicating the impact of localized market conditions and industry-specific fluctuations.

The company is strategically adapting its geographical focus to optimize its global operations. The planned divestiture of its Off-Highway business, which has a significant European presence, is a move to streamline operations. This strategic shift allows the company to concentrate on core on-highway markets. The company's ongoing investment in electrification technologies positions it to capitalize on the global shift towards electric vehicles, particularly in high-growth regions like Europe and Asia, where EV adoption rates are accelerating. Understanding Dana's brief history can provide context for its current market strategies.

The North American market is a key area for the company, contributing a significant portion of its sales. The 5% sales increase in 2024 demonstrates the continued importance of this region. This growth reflects the company's strong position and ongoing investments in the area.

The European market faced challenges in 2024, with a 12% decrease in sales. This decline was mainly due to reduced demand in the construction/mining and agricultural equipment sectors. The company is adjusting its strategies to address these regional fluctuations.

The company's planned divestiture of its Off-Highway business is a strategic move to streamline operations. This will allow the company to focus on core on-highway markets. This focus will help it capitalize on growth opportunities within the light and commercial vehicle sectors.

The company is investing in electrification technologies to capitalize on the global shift towards electric vehicles. This is particularly important in high-growth regions like Europe and Asia. This investment is crucial for future growth.

Localizing offerings and marketing strategies is crucial for success in diverse markets. This ensures that its drive and motion systems, electrodynamic technologies, and thermal and sealing solutions meet specific regional demands. The company adapts to local needs.

The company's approach to geographical market presence involves market segmentation. This helps in understanding the needs of different customer demographics. This allows for targeted strategies.

Dana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Dana Win & Keep Customers?

The customer acquisition and retention strategies of Dana Incorporated are centered around its business-to-business (B2B) model, targeting long-term relationships with vehicle and machinery manufacturers. These strategies emphasize sustained technological innovation, strategic partnerships, and a strong focus on product performance and reliability. Dana's approach is deeply rooted in providing advanced solutions, particularly in electrification technologies, aiming to meet the evolving needs of its Original Equipment Manufacturer (OEM) customers.

Dana's primary customer acquisition methods involve direct engagement with engineering and procurement teams of major global manufacturers. Leveraging its reputation and history since 1904, the company builds trust and credibility to secure new business. Customer retention is fostered through superior product quality, robust after-sales support, and collaborative product development. Dana's commitment to sustainability and ethical business practices further strengthens customer loyalty.

Dana's sales tactics are designed to build and maintain relationships with key decision-makers within the automotive and machinery industries. The company's success is reflected in its financial performance, including a three-year new business sales backlog of $650 million, with $150 million anticipated in 2025. This demonstrates effective acquisition strategies and ongoing efforts to expand its customer base.

Dana consistently invests in research and development to offer cutting-edge solutions. A key focus is on electrification technologies, which attract OEMs transitioning to electric and hybrid vehicles. This focus on innovation is a core element of its customer acquisition strategy.

The company forms strategic alliances to enhance its market position and customer offerings. These partnerships enable Dana to provide vertically integrated e-Propulsion systems, positioning it as a critical supplier in the evolving mobility landscape.

Dana emphasizes superior product quality and robust after-sales support. These are crucial for customer retention, providing a strong foundation for long-term relationships. The company's focus on reliability builds trust and loyalty.

Dana engages directly with engineering and procurement teams of major global manufacturers. This direct approach allows for tailored solutions and fosters strong relationships. This is a key element of how Dana acquires new customers.

Dana's target market analysis reveals a focus on large-scale vehicle and machinery manufacturers. The company’s customer base includes global OEMs that require advanced drivetrain and e-Propulsion systems. Revenue Streams & Business Model of Dana demonstrates how the company's business model supports these strategies, ensuring they continue to meet the evolving needs of its target market. The company's commitment to cost-savings initiatives, targeting $300 million in total savings by 2026, also benefits customers through improved cost structures and competitive pricing. Dana’s efforts to streamline operations, including integrating the Power Technologies segment, aim to enhance its go-to-market approach and serve customers more efficiently.

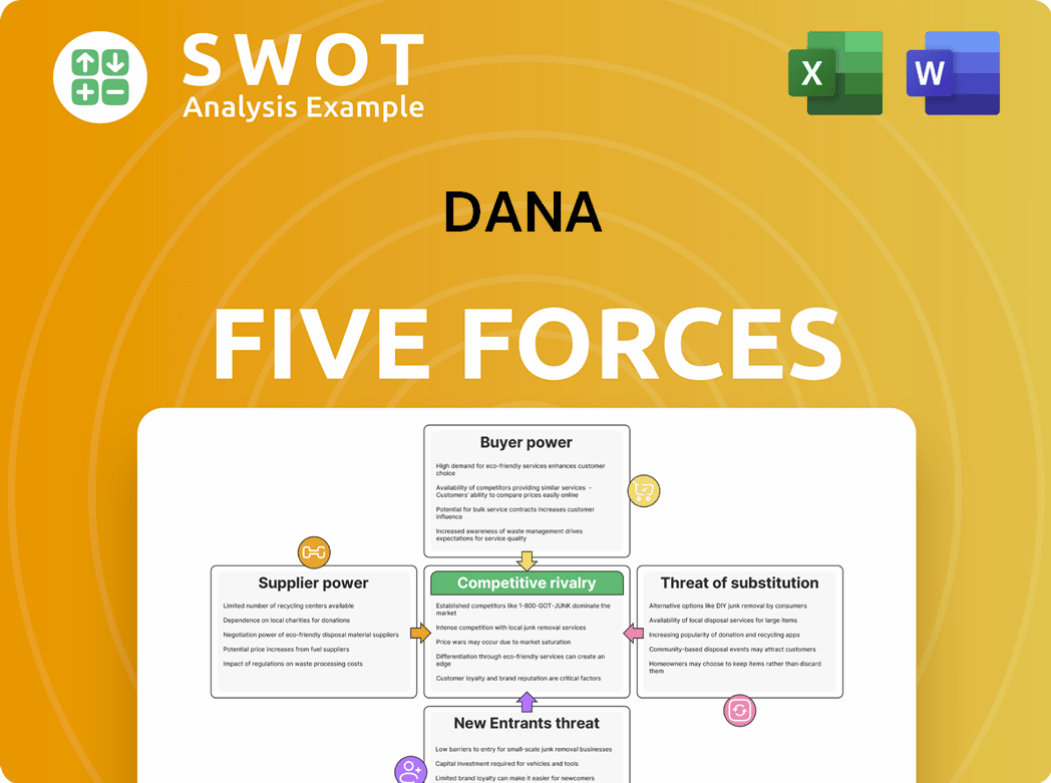

Dana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dana Company?

- What is Competitive Landscape of Dana Company?

- What is Growth Strategy and Future Prospects of Dana Company?

- How Does Dana Company Work?

- What is Sales and Marketing Strategy of Dana Company?

- What is Brief History of Dana Company?

- Who Owns Dana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.