Digi Bundle

How Did Digi Company Revolutionize the IoT Landscape?

Embark on a journey through the Digi SWOT Analysis and discover the fascinating Digi history. From its humble beginnings in 1985 as a developer of serial interface boards, Digi International has transformed into a global leader in the Internet of Things (IoT). Explore the Brief Digi overview and uncover the key milestones that shaped this technology pioneer.

Understanding the Digi timeline is crucial for investors and strategists alike. This Digi Company overview will delve into the company's strategic shifts, exploring how it adapted to technological advancements and capitalized on the burgeoning IoT market. Learn about the Digi founder and the evolution that led to its current market position.

What is the Digi Founding Story?

The story of the Digi Company begins in 1985. It was the brainchild of John Schinas, a former rocket scientist. He had a vision to revolutionize how businesses connected and communicated.

The company's early days were focused on providing cost-effective solutions for computer connectivity. Digi's history is marked by innovation and a keen understanding of market needs. The company's establishment was influenced by the growing need for efficient and affordable computer connectivity solutions in the mid-1980s.

The initial location of the company was in Eden Prairie, Minnesota. The company's first product was the 'DigiBoard,' an intelligent ISA/PCI board. The company's early funding provided capital for expansion and increased market visibility.

Digi Company was founded in 1985 by John Schinas. The company aimed to solve the problem of multiple computer users working off a single PC.

- John Schinas, a former rocket scientist, founded the company.

- The first product was the 'DigiBoard,' an intelligent ISA/PCI board.

- Initial funding came from a public offering in 1987.

- The company was originally located in Eden Prairie, Minnesota.

Digi's early days were marked by the introduction of the 'DigiBoard'. This product allowed multiple users to connect to a single PC. The company's initial public offering in 1987, along with a second one in 1989, provided the necessary capital for growth. This helped the company to establish itself in the market.

The company went public and started trading on NASDAQ. The company's evolution was driven by the need for efficient and affordable computer connectivity solutions. The company's early success laid the foundation for its future growth and expansion. For more information, check out this article about the Target Market of Digi.

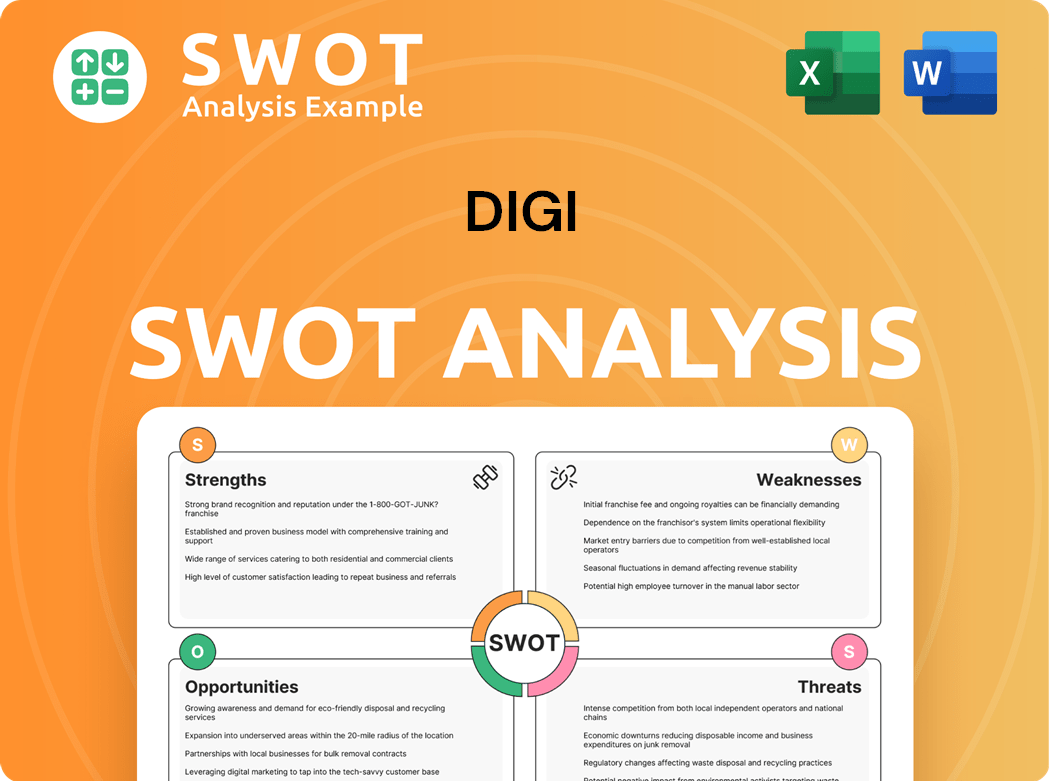

Digi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Digi?

The early years of Digi Company saw remarkable growth, establishing a strong foundation for future expansion. This period was marked by significant sales increases and strategic acquisitions that broadened its product offerings. The company quickly adapted to the evolving technological landscape, positioning itself as a key player in the connectivity solutions market. A brief Digi overview of this time reveals a company focused on innovation and market penetration.

Digi International experienced impressive sales growth in its initial years. Sales reached $3.5 million in 1987 and increased to $7.8 million in 1988. Following its initial public offering in 1989, sales surged to $14.6 million, and by 1990, they exceeded $23 million. This rapid expansion highlights the company's early success.

Digi Company quickly expanded its product offerings beyond serial cards. The company introduced a wide range of connectivity solutions, including network servers and remote access servers. This diversification allowed Digi to meet the growing demand for interconnected systems and adapt to technological advancements. The Digi history shows a company that was always looking for new opportunities.

Key acquisitions played a crucial role in Digi's early growth. In 1990, the company acquired PC Research and a division of Progressive Computing. The acquisition of Arnet Corp in 1991 further strengthened its product line. These strategic moves enabled Digi to expand its capabilities and market reach. For more information about the owners and shareholders, check out Owners & Shareholders of Digi.

Digi International expanded internationally early on, opening a German sales subsidiary in Köln in 1991. By 1993, Digi held a leading 25% market share in the I/O market. The company's strong position in the LAN and WAN connectivity markets was a testament to its successful business strategy. This early expansion set the stage for future growth.

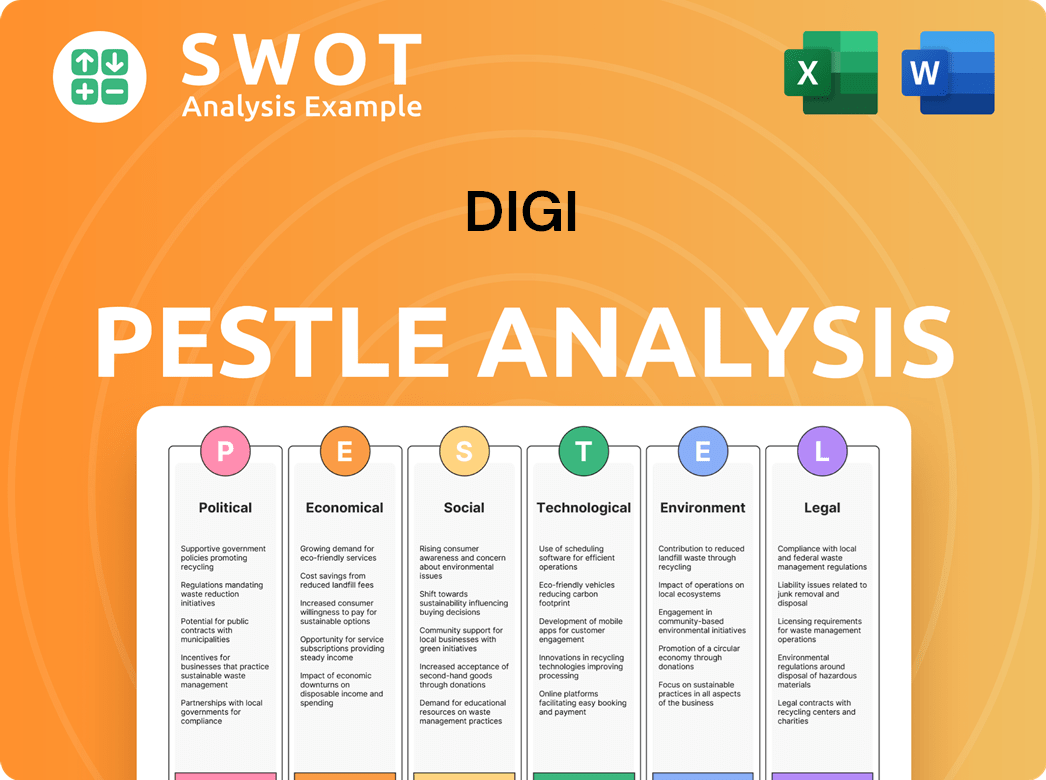

Digi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Digi history?

The Digi Company has a rich Digi history, marked by significant milestones that have shaped its evolution. From its early days to its current standing, the company has consistently adapted to the changing telecommunications landscape. This brief Digi overview highlights key achievements and strategic shifts that have defined its journey.

| Year | Milestone |

|---|---|

| 2000s | Strategic shift towards wireless technology and embedded systems, recognizing the growing demand for wireless communication solutions and the Internet of Things (IoT). |

| 2006 | Acquisition of MaxStream, enhancing wireless expertise. |

| 2012 | Acquisition of Etherios, expanding cloud computing services. |

| 2019 | Acquisition of Opengear, a provider of secure infrastructure management solutions. |

| 2021 | Acquisition of Haxiot and Ctek, bolstering wireless connection services and remote monitoring capabilities. |

| 2024 | Achieved a record end-of-quarter Annual Recurring Revenue (ARR) of $116 million, representing approximately 27% of its revenues in fiscal year 2024. |

Innovation has been a cornerstone of the Digi Company. The launch of Digi XBee modules, with over 25 million units shipped, showcases its impact on the IoT landscape. The company's focus on developing comprehensive IoT solutions, driven by strategic acquisitions, has transformed it from a component provider into a solutions provider.

The company's strategic emphasis on wireless technology and embedded systems has been a key innovation. This focus has allowed it to capitalize on the growing demand for wireless communication solutions and the Internet of Things (IoT).

The development and widespread adoption of Digi XBee modules represent a significant innovation. With over 25 million units shipped, these modules have had a substantial impact on the IoT landscape.

Digi's strategic acquisitions, such as MaxStream, Etherios, Opengear, Haxiot, and Ctek, demonstrate its commitment to innovation. These acquisitions have expanded its capabilities and product offerings, transforming it into a comprehensive IoT solutions provider.

The acquisition of Etherios in 2012 expanded Digi's offerings to include cloud computing services. This move was a strategic step towards providing more comprehensive solutions to its customers.

The acquisition of Opengear in 2019 brought secure infrastructure management solutions into Digi's portfolio. This added another layer of value to its offerings, particularly for businesses needing robust network management.

The company's shift towards recurring revenue models, as evidenced by its growing Annual Recurring Revenue (ARR), is a key innovation. This helps to mitigate fluctuations in transactional sales and provides a more stable revenue stream.

Despite its successes, the Digi Company has encountered various challenges. The competitive landscape, including established players and emerging startups, has presented ongoing hurdles. Market downturns and global economic conditions, especially in industrial markets, have also impacted sales cycles. For a deeper dive into the Digi's business strategy, you can explore the Marketing Strategy of Digi.

The company faces competition from both established players and emerging startups. This competitive environment requires continuous innovation and strategic adaptation to maintain market share and growth.

Market downturns and global economic headwinds, particularly in industrial markets, have affected sales cycles. These challenges necessitate agile responses and diversified revenue streams.

While Q1 fiscal 2025 revenue was $104 million, a 2% decrease, the net income improved to $10 million from a $3 million net loss in the prior fiscal year. This highlights the need for strategic financial management.

The company's strategic shift towards high-margin subscription-based revenues is a response to challenges. This approach aims to stabilize revenue and improve profitability in a dynamic market.

The industrial market's economic fluctuations have had an impact on sales cycles. This underscores the importance of diversifying the customer base and product offerings.

The company has responded to challenges through strategic pivots, such as focusing on high-margin subscription-based revenues and emphasizing its solution-oriented approach. Adaptability is key to navigating a rapidly evolving market.

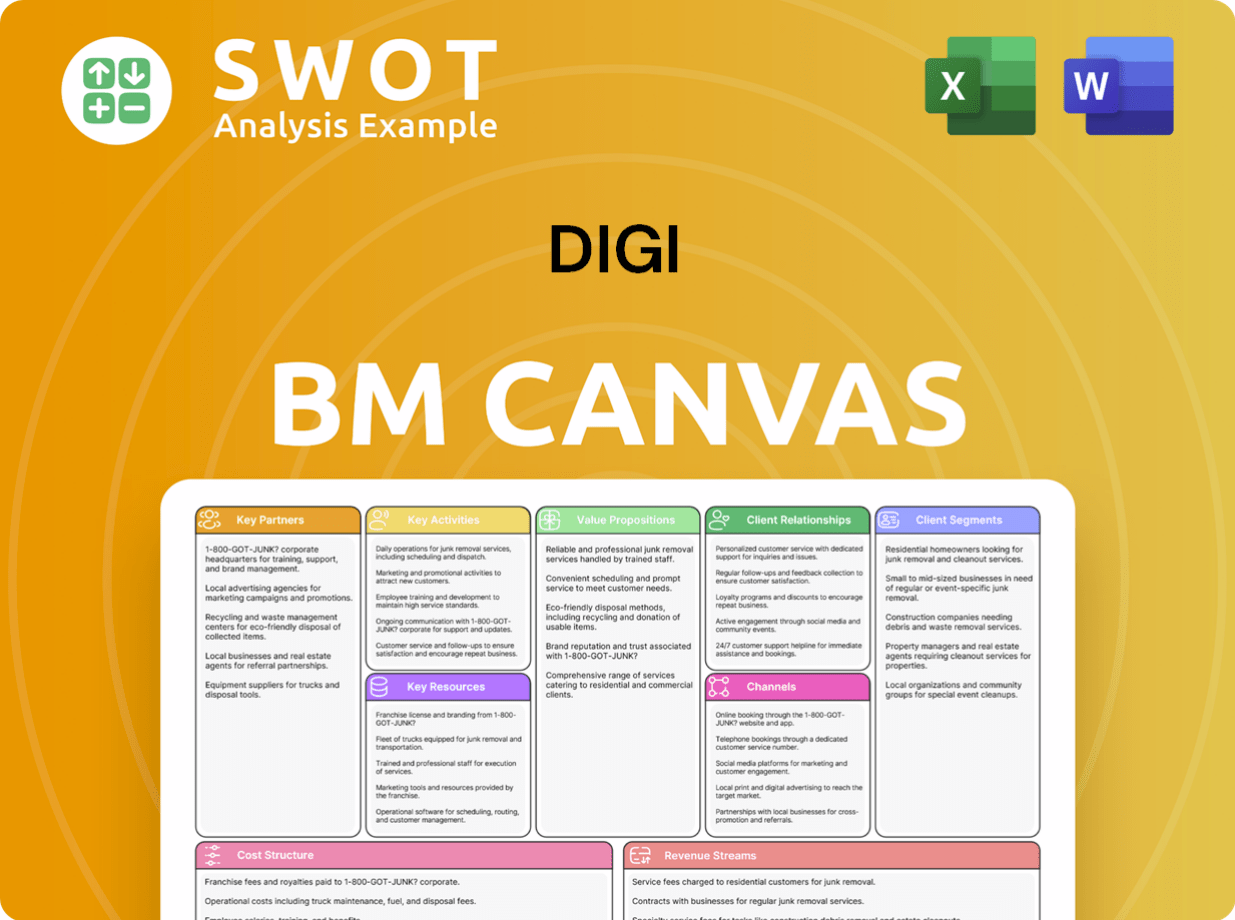

Digi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Digi?

The Digi history is marked by significant technological advancements and strategic acquisitions, evolving from its founding in 1985 to a leader in IoT solutions. This journey, from its early days to its current focus, showcases the company's adaptability and forward-thinking approach in a rapidly changing technological landscape, impacting the telecommunications sector significantly.

| Year | Key Event |

|---|---|

| 1985 | Digi International is founded in Eden Prairie, Minnesota. |

| 1989 | The company goes public on the NASDAQ and reorganizes as a Delaware corporation. |

| 1991 | Acquires Arnet Corp for $5 million and opens a German sales subsidiary. |

| 2000s | Shifts strategic focus towards wireless technology and embedded systems. |

| 2006 | Acquires wireless technology company MaxStream for $38.8 million, expanding its wireless product line. |

| 2012 | Acquires Etherios, a cloud computing services provider. |

| 2017 | Acquires SMART Temps and TempAlert, providers of temperature and task management. |

| 2019 | Acquires Opengear, a secure infrastructure management solutions provider. |

| 2021 | Acquires Haxiot and Ctek, enhancing wireless connection services and industrial controls. |

| May 2024 | Prevails in a patent infringement case, with a U.S. District Court invalidating patent claims against its products. |

| November 2024 | Reports Q4 fiscal 2024 results, with revenue of $105 million and record end-of-quarter ARR of $116 million. |

| January 2025 | Launches SmartSense VOYAGE for real-time supply chain visibility and Digi X-ON, an edge-to-cloud IoT solution. |

| February 2025 | Reports Q1 fiscal 2025 results, with revenue of $104 million and ARR reaching $120 million, an 11% increase year-over-year. |

| March 2025 | Introduces advancements in serial device management with updated Digi Navigator and new Digi Connect EZ with Power over Ethernet (PoE). |

| May 2025 | Reports Q2 fiscal 2025 results, with revenue of $105 million and record end-of-quarter ARR of $123 million, a 12% increase year-over-year. |

| June 2025 | Launches a full-suite solution for industrial infrastructure management, combining the new Digi Axess mobile app with the Digi Axess VPN Service. |

Digi Company aims to double its Annual Recurring Revenue (ARR) and Adjusted EBITDA to $200 million within five years. The company is focused on high-value solutions in the industrial IoT sector, which is projected to dominate the IoT market by 2025. Strategic acquisitions remain a top capital priority to accelerate growth.

The company anticipates ARR to grow approximately 10% year-over-year in fiscal 2025, while revenue is projected to be approximately flat. Digi plans to retire all debt by the end of calendar year 2025, strengthening its balance sheet. Recent financial results show a strong performance, with Q2 fiscal 2025 revenue at $105 million and ARR reaching a record $123 million.

The company is well-positioned to capitalize on industry trends such as the increasing adoption of 5G technology, automation, and smart devices. Digi's technology advancements, including the launch of SmartSense VOYAGE and Digi X-ON, showcase its commitment to innovation. The company's forward-looking statements highlight its resilience and adaptability.

Digi's evolution includes strategic acquisitions like MaxStream, Etherios, and Opengear, which have expanded its product offerings and market reach. The company's history is marked by key milestones, including its initial public offering and significant shifts in strategic focus. These acquisitions have enhanced its capabilities in wireless technology and IoT solutions.

Digi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Digi Company?

- What is Growth Strategy and Future Prospects of Digi Company?

- How Does Digi Company Work?

- What is Sales and Marketing Strategy of Digi Company?

- What is Brief History of Digi Company?

- Who Owns Digi Company?

- What is Customer Demographics and Target Market of Digi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.