Digi Bundle

How Does Digi Company Thrive in the IoT Realm?

Digi International is making waves in the Internet of Things (IoT) arena, consistently demonstrating its prowess through innovative solutions and strategic market maneuvers. In Q2 2025, Digi showcased impressive financial results, exceeding revenue and earnings expectations, solidifying its position as a key player. This performance highlights the company's robust market presence as a premier provider of essential IoT products, services, and solutions globally.

To truly grasp the dynamics of Digi SWOT Analysis, one must understand how Digi Company operations function, from its diverse product offerings to its strategic initiatives. This exploration will uncover the intricacies of Digi's business model, examining how it leverages its platform and services to generate revenue and sustain growth. Understanding the benefits of Digi Company and its features is key to appreciating its impact on the industrial IoT market and beyond, including its customer support contact and data privacy policy.

What Are the Key Operations Driving Digi’s Success?

The core operations of the Digi Company revolve around providing a wide array of IoT connectivity products and services. These offerings are designed to ensure secure and reliable communication, especially in demanding environments. Their focus spans various industries, including industrial automation, smart cities, healthcare, and retail, making them a versatile player in the IoT market. Understanding how Digi Company works involves examining its comprehensive approach to delivering value through hardware, software, and services.

The value proposition of the Digi Company centers on delivering solution-oriented approaches that provide quick returns on investment (ROI) for its customers. This is achieved through remote monitoring, enhanced machine uptime, and seamless integration and analytics. This focus on tangible customer benefits, coupled with a comprehensive ecosystem of hardware, software, and services, distinguishes Digi in the competitive IoT market. The company's operational processes are designed to support these offerings effectively.

The company's operations encompass the design, development, and manufacturing of hardware, along with robust software and service development. Strategic partnerships, such as the collaboration with TELCLOUD for channel expansion, are also key. The Digi Company services include both hardware sales and recurring revenue from extended warranties and remote management platforms. The IoT Solutions segment drives growth through recurring revenue from platforms like SmartSense and Ventus, which provide data-driven monitoring solutions.

Digi's operational processes include the design, development, and manufacturing of hardware. This is coupled with robust software and service development. The company focuses on creating a comprehensive ecosystem to meet diverse customer needs.

The company generates recurring revenue from extended warranty offerings and remote management platforms. The IoT Solutions segment provides data-driven monitoring solutions, such as SmartSense and Ventus. These platforms contribute to the company's sustained growth.

Digi's supply chain and distribution networks are vital for delivering products globally. The company actively manages inventory levels to optimize efficiency. Inventory ending Q2 2025 was at $39 million, down from $53 million at September 30, 2024.

Strategic partnerships play a crucial role in Digi's operations, such as the collaboration with TELCLOUD. These partnerships help expand market reach and enhance service offerings. These collaborations are part of the company's growth strategy.

Digi's approach provides quick ROI through remote monitoring, machine uptime, and integration and analytics. This focus on tangible customer benefits and a comprehensive ecosystem differentiates Digi in the competitive IoT market. The company's emphasis on customer value is a key part of its business model.

- Solution-oriented approaches that deliver quick ROI.

- Comprehensive ecosystem of hardware, software, and services.

- Strong focus on customer benefits and tangible outcomes.

- Strategic partnerships for market expansion and service enhancement.

Digi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Digi Make Money?

Understanding the revenue streams and monetization strategies of the Digi Company is crucial for assessing its financial health and growth potential. The company primarily generates revenue through its IoT Product & Services and IoT Solutions segments. Analyzing these segments reveals how Digi Company operations translate into financial performance and long-term sustainability.

The company's approach to monetization focuses on both product sales and recurring revenue models. This dual strategy allows Digi Company to capture value from both initial hardware purchases and ongoing service subscriptions. The shift towards recurring revenue is a key indicator of the company's strategic direction and financial stability, as it provides a more predictable income stream.

In the second fiscal quarter of 2025, Digi Company reported a total revenue of $105 million.

This segment includes hardware sales and recurring revenue from extended warranties and remote management platforms. Revenue in Q1 2025 was $77.8 million, influenced by a decline in one-time sales. However, recurring revenue is a growing component.

ARR for the IoT Product & Services segment reached $28 million by the end of Q2 2025. This represents a 22% increase from the prior fiscal year, highlighting the growth in recurring revenue streams. This is a key indicator of the company's shift towards a more predictable revenue model.

This segment focuses on managed services like SmartSense and Ventus, contributing significantly to recurring revenue. Revenue for Q2 2025 was $26.7 million, with all growth driven by recurring revenue. This segment is a crucial driver of the company's financial performance.

The ARR for the IoT Solutions segment reached $95 million by the end of Q2 2025. This represents a 9% increase from the prior fiscal year. The growth in this area demonstrates the company's success in expanding its service offerings.

Digi Company's total ARR reached $123 million at the end of Q2 2025. This represents a 12% increase year-over-year. This overall growth in ARR demonstrates the company's success in building a sustainable and predictable revenue model.

The company has introduced bundled services like Digi 360 and Digi LifeCycle Assurance. These offerings combine hardware, software, and services to optimize IoT investments. The company aims to grow ARR and Adjusted EBITDA to $200 million within the next four years.

Digi Company's revenue strategy is centered on a mix of product sales and recurring revenue, with a strong emphasis on the latter. This approach enhances financial predictability and contributes to improved gross profit margins. The company's focus on bundled services and strategic acquisitions further supports its growth objectives.

- The IoT Product & Services segment generates revenue from hardware and recurring services.

- The IoT Solutions segment provides managed services and is a significant driver of recurring revenue.

- Total ARR reached $123 million by the end of Q2 2025, indicating strong growth in recurring revenue.

- Bundled services like Digi 360 and Digi LifeCycle Assurance are key monetization strategies.

- The company aims to grow ARR and Adjusted EBITDA to $200 million within the next four years.

Digi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Digi’s Business Model?

Understanding the operational dynamics of the Digi Company involves examining its significant milestones, strategic maneuvers, and competitive advantages. A key focus has been expanding recurring revenue streams, especially through platforms like SmartSense and Ventus. This approach has fueled substantial growth, with Annual Recurring Revenue (ARR) increasing by 12% year-over-year in Q2 2025, reaching $123 million. The company has set an ambitious goal to achieve $200 million in ARR and Adjusted EBITDA within the next four years.

Digi's strategic moves include launching new solution initiatives such as Digi 360 and Digi LifeCycle Assurance in 2024. These initiatives offer comprehensive packages of hardware, software, and services to streamline IoT deployments and maximize customer ROI. Furthermore, the company's commitment to cybersecurity is underscored by its status as a CVE Numbering Authority (CNA) since March 2025. These efforts highlight Digi's dedication to providing integrated solutions and maintaining high standards of security.

The company has also faced challenges, including macroeconomic volatility and potential tariff impacts, particularly in the APAC region. Despite these hurdles, Digi has shown resilience, maintaining strong demand across most regions, with approximately 70% of its business in North America. The company has also made strides in reducing net debt, with a $25 million reduction in Q2 2025, improving its financial stability.

Digi's key milestones include the expansion of recurring revenue models and the launch of new solution initiatives. The company has shown significant growth in Annual Recurring Revenue (ARR). Digi also became a CVE Numbering Authority, highlighting its commitment to cybersecurity.

Strategic moves involve focusing on recurring revenue and launching comprehensive IoT solutions. The company aims to achieve $200 million in ARR and Adjusted EBITDA in the next four years. Recent launches include a full-suite solution for industrial infrastructure management.

Digi's competitive advantages stem from its diverse IoT portfolio and focus on recurring revenue. The company's strong financial performance and commitment to innovation further contribute to its resilience. Digi's ability to adapt to new trends and competitive threats is also a key factor.

In Q2 2025, Digi's ARR grew by 12% year-over-year. The company has reduced net debt by $25 million. Digi's financial health is supported by its strong performance in key areas, including net income and cash flow from operations.

Digi Company's operations are characterized by a strategic focus on recurring revenue models and comprehensive IoT solutions. The company's diverse IoT portfolio, including cellular routers and embedded modules, serves a wide range of sectors. Understanding Competitors Landscape of Digi can provide additional context on the company's market position.

- Expansion of recurring revenue through platforms like SmartSense and Ventus.

- Launch of new solutions like Digi 360 and Digi LifeCycle Assurance.

- Commitment to cybersecurity through CVE Numbering Authority status.

- Focus on reducing net debt and maintaining financial stability.

Digi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Digi Positioning Itself for Continued Success?

Within the dynamic landscape of the Internet of Things (IoT), Digi Company's position is notably strong. The company has carved out a niche by focusing on solution-oriented approaches, which has resonated well with clients across various sectors, including industrial automation and smart cities. This strategic focus has contributed to consistent growth, as demonstrated by the increasing Annualized Recurring Revenue (ARR).

However, Digi Company faces several challenges. Macroeconomic uncertainties, like inflationary pressures and supply chain disruptions, could impact customer spending and operations. The industrial IoT market's competitive nature requires continuous innovation. Furthermore, cybersecurity threats are a growing concern, with the rise of connected devices increasing the risk of cyberattacks and data breaches.

Digi Company holds a solid position in the IoT connectivity sector, serving industries like industrial automation and healthcare. Their solution-oriented approach has led to consistent growth in Annualized Recurring Revenue (ARR). Approximately 70% of Digi's business is concentrated in North America, highlighting a strong regional presence.

Key risks include macroeconomic volatility, such as inflationary pressures, impacting customer spending. Weakness in the APAC region is a concern for future revenue growth. The competitive landscape and cybersecurity vulnerabilities also pose significant challenges. Potential tariff impacts and supply chain disruptions remain persistent challenges.

Digi Company is focused on expanding recurring revenue models and pursuing solution-oriented acquisitions. The company expects to be net cash positive by the end of the fiscal year. Innovation roadmaps include the continued development of its Digi X-ON edge-to-cloud IoT platform. The company is also committed to environmental responsibility.

Digi Company is expanding its recurring revenue models and pursuing solution-oriented acquisitions. The company is focused on developing its Digi X-ON edge-to-cloud IoT platform. Digi expects to be net cash positive by the end of the fiscal year. They are also committed to environmental responsibility.

In Q2 2025, Digi Company's ARR reached $123 million, marking a 12% year-over-year increase. The company aims to grow ARR and Adjusted EBITDA to $200 million within the next four years. These targets reflect Digi Company's commitment to sustained growth and market leadership.

- Focus on expanding recurring revenue.

- Strategic acquisitions to boost solutions.

- Continued development of the Digi X-ON platform.

- Commitment to environmental sustainability.

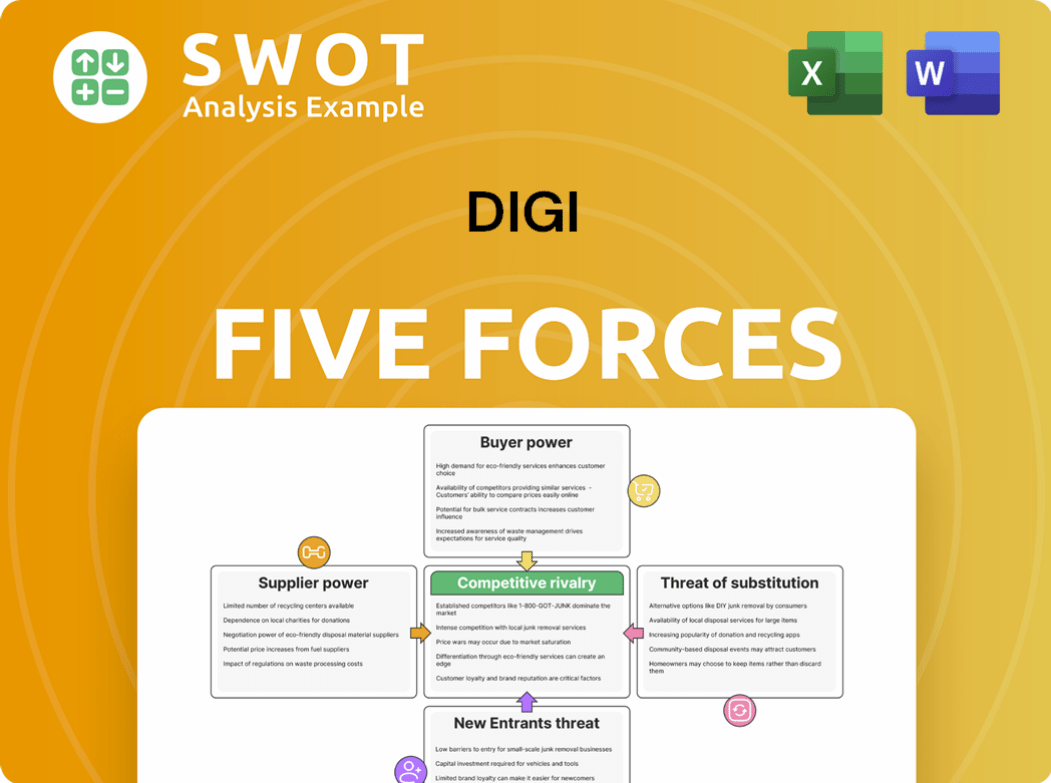

Digi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Digi Company?

- What is Competitive Landscape of Digi Company?

- What is Growth Strategy and Future Prospects of Digi Company?

- What is Sales and Marketing Strategy of Digi Company?

- What is Brief History of Digi Company?

- Who Owns Digi Company?

- What is Customer Demographics and Target Market of Digi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.