Digi Bundle

Who are Digi's Customers?

In the ever-evolving landscape of the Internet of Things (IoT), understanding customer demographics and the target market is crucial. For Digi Company, a leader in IoT connectivity, knowing its customer base is fundamental to its strategic direction and market success. This exploration will delve into Digi's customer profile, providing insights into its market positioning and growth strategies.

From its origins in machine-to-machine (M2M) communication to its current focus on diverse IoT applications, Digi Company has consistently adapted to market changes. The company's impressive growth, highlighted by a record $123 million in annual recurring revenue (ARR) in Q2 2025, demonstrates the importance of effective Digi SWOT Analysis and understanding customer needs. This analysis will cover Digi's customer age range, income levels, buying habits, and geographic locations, providing a comprehensive market analysis.

Who Are Digi’s Main Customers?

Understanding the customer base of the Digi Company involves recognizing its focus on business-to-business (B2B) solutions. The company's primary customer segments are defined more by industry, application, and the scale of their IoT deployments rather than traditional demographic factors like age or income. This approach is typical for companies that provide specialized technology and services to other businesses.

Digi's target market is highly diversified, spanning several sectors. These include industrial automation, smart cities, healthcare, and transportation. This broad reach allows Digi to serve a wide range of needs, from wireless temperature monitoring to employee task management. This diversification is a key aspect of their market strategy, enabling them to adapt to various industry trends and opportunities.

The company's strategic direction emphasizes recurring revenue models. This shift highlights a move towards long-term relationships with customers who require ongoing services and support for their IoT deployments. The company's goal to grow its ARR to $200 million by 2028 further underscores this focus, indicating a commitment to providing comprehensive solutions and building lasting customer relationships.

This segment focuses on distinct communications products and development services. It generates the majority of Digi's revenue. Recurring revenue growth in this segment is driven by subscription-based extended warranties and remote management platforms.

This segment offers services like wireless temperature and environmental condition monitoring, as well as employee task management. It has seen significant growth in recurring revenue, particularly with offerings like SmartSense and Ventus. In Q1 2025, the IoT Solutions segment's recurring revenue increased by $2.1 million.

Digi's customer base is primarily composed of businesses across various industries, with a focus on mission-critical IoT connectivity products and services. The company's strategic focus is on expanding its recurring revenue streams, particularly within its IoT Solutions segment. This approach aims to foster long-term customer relationships and provide ongoing support for IoT deployments, as highlighted in the Marketing Strategy of Digi.

- In Q1 2025, the IoT Solutions segment's recurring revenue increased by $2.1 million, contributing to an ARR of $93 million, up 9% from the prior fiscal year.

- The IoT Product & Services segment also saw recurring revenue growth of $0.5 million in Q1 2025, with its ARR increasing by 17% to $27 million.

- Digi aims to grow its ARR to $200 million by 2028, emphasizing its strategic direction towards recurring revenue models.

- The company's customer focus delivered solution success across a range of vertical industries, including financial institutions, green energy companies, lottery providers, and agriculture organizations.

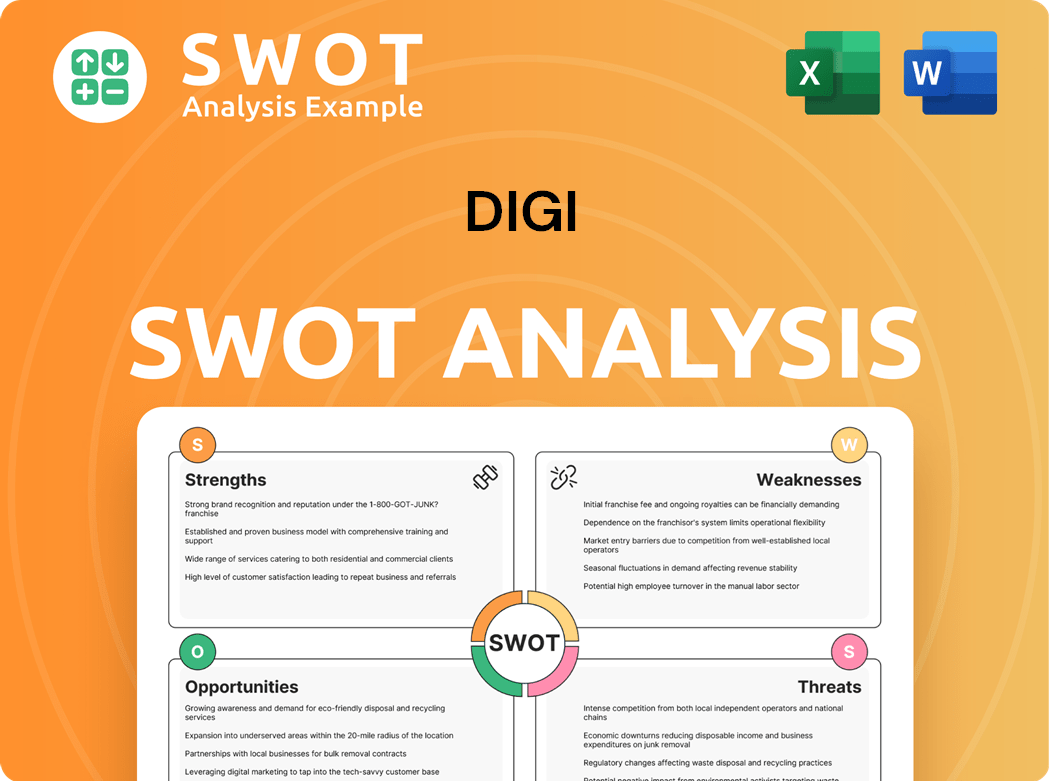

Digi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Digi’s Customers Want?

Understanding the customer needs and preferences is crucial for Digi's growth strategy. Their customers are primarily driven by the need for reliable, secure, and scalable IoT connectivity solutions. These solutions must deliver a tangible return on investment (ROI).

Purchasing decisions are influenced by the criticality of the application, the need for robust security features, ease of deployment and management, and the ability to integrate with existing infrastructure. For example, the launch of Digi 360 in 2024, which included purpose-built routers, software, and services like Digi Remote Manager, highlights the company's focus on simplifying IoT complexity for its customers.

Customers seek solutions that address common pain points such as managing large-scale device deployments, ensuring continuous uptime, and securing sensitive data. Digi's industrial infrastructure solutions and VPN services are tailored to provide instant control and enhanced security, directly addressing these concerns.

Customers prioritize solutions that offer high reliability and robust security features to protect their data and ensure continuous operation. This is especially critical in applications where downtime can be costly or dangerous.

Ease of deployment and management is a key factor. Customers want solutions that are simple to set up, configure, and maintain, reducing the burden on their IT staff and minimizing operational costs.

Scalability is essential for accommodating future growth. Customers need solutions that can handle increasing numbers of devices and data volumes without requiring significant infrastructure overhauls.

Customers prefer solutions that integrate seamlessly with their existing infrastructure. This minimizes disruption and ensures that new technologies can work effectively with legacy systems.

Cost-effectiveness is a constant consideration. Customers seek solutions that provide a good return on investment, balancing initial costs with long-term operational expenses and the value delivered.

With increasing regulatory requirements, customers need solutions that ensure compliance with data privacy and security standards. This is particularly important in industries with strict regulations.

Market trends and customer feedback significantly influence product development. The rise of AI in IoT (AIoT) and the increasing complexity of regulatory landscapes are key factors shaping customer preferences.

- AIoT Integration: The growing demand for smarter, self-learning IoT devices, driven by AI, is a major trend. Customers are seeking AI capabilities for predictive maintenance and autonomous decision-making.

- Regulatory Compliance: The need for solutions that ensure data privacy and compliance is increasing. This affects how Digi develops its secure and compliant offerings.

- Enhanced Features: Customers expect continual enhancements to configuration, deployment, and system-wide security and firmware updates.

- Focus on 'Always-On' Infrastructure: The demand for network resilience, particularly through Opengear solutions, remains critical.

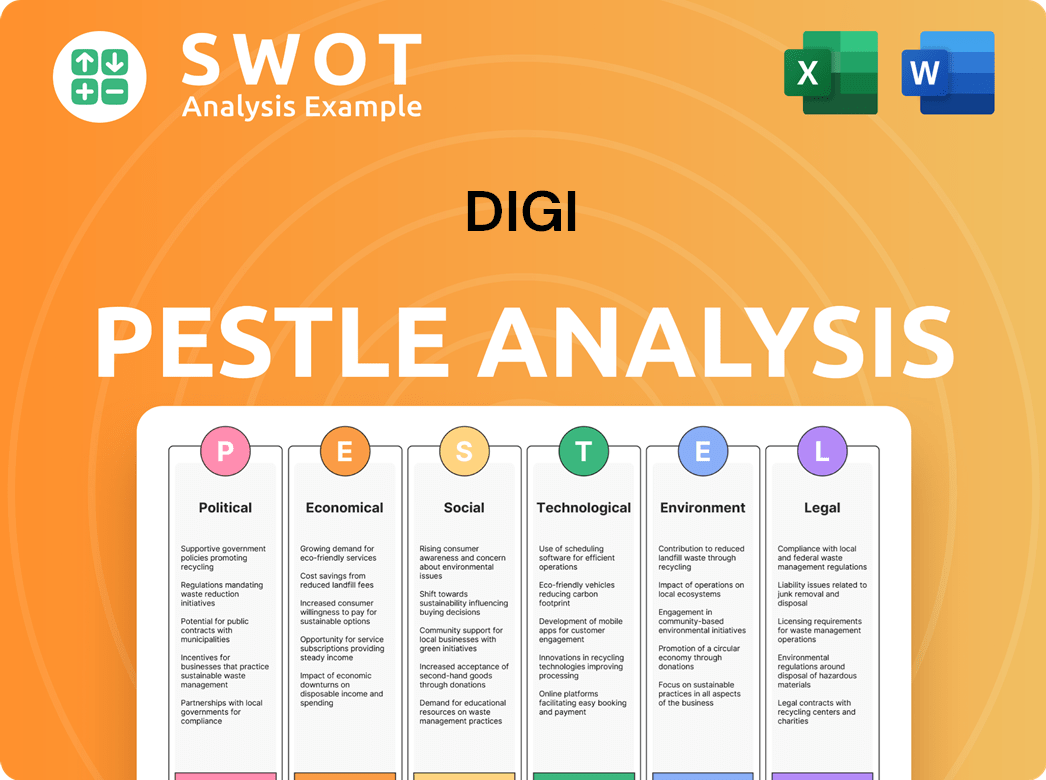

Digi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Digi operate?

The geographical market presence of Digi Company is global, with operations spanning across the United States, Europe, the Middle East, Africa, and other international regions. The company strategically positions itself to serve a diverse clientele. Digi's approach involves tailoring its offerings and marketing strategies to suit the specific needs of different regional markets.

A significant portion of Digi's revenue comes from its IoT Products & Services segment, with a substantial amount originating from North America. This region is a critical market for Digi, representing approximately 70% of its business. The company's strong presence in North America highlights its success in this area.

Digi is actively expanding its international reach, demonstrating a commitment to global growth. This expansion is supported by strategic financing agreements focused on network improvement and expansion in key European markets. This expansion is driven by the potential for higher average revenue per user (ARPU) in Western European markets; for example, Digi's ARPU in Spain was €8.70 in 2024, compared to €4.40 in Romania.

North America is a primary market for Digi Company. The region accounts for a significant portion of the company's revenue. Digi's success in North America is a key factor in its overall market performance.

Digi actively expands its presence in EMEA (Europe, Middle East, and Africa). Channel partners play a crucial role in driving growth. The company adapts its solutions to meet regional needs.

Weakness in the Asia-Pacific (APAC) region has been noted amid macroeconomic volatility. Despite this, Digi continues its commitment to international expansion. This is evident through strategic financing agreements.

Digi localizes its offerings and marketing to succeed in diverse markets. Channel partners are crucial for growth in global IoT ecosystems. This approach allows the company to tailor solutions to regional needs.

Digi's strategy includes expanding its global footprint. The company's commitment to international expansion is clear. Digi's goal is to increase its presence in key markets.

- Expansion in Europe, with strategic financing.

- Focus on higher ARPU markets.

- Partnerships with channel partners for localized solutions.

- Addressing weaknesses in the APAC region.

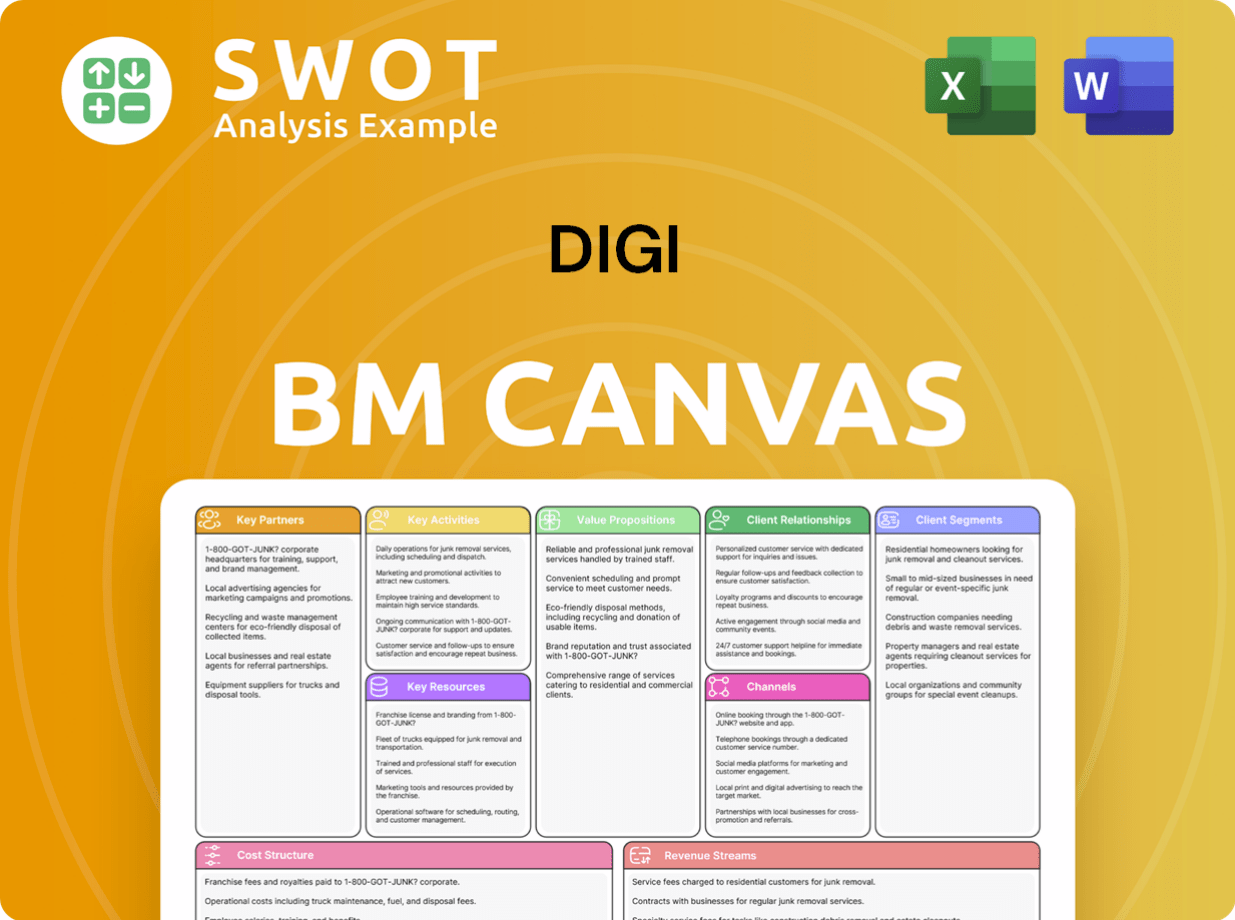

Digi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Digi Win & Keep Customers?

The company focuses on both acquiring new customers and retaining existing ones through a multi-faceted strategy. A significant aspect of its approach is the emphasis on Annual Recurring Revenue (ARR), which reached a record $123 million in Q2 2025, marking a 12% year-over-year increase. This focus indicates a shift towards long-term relationships.

For customer acquisition, the company prioritizes high-value customers, often leveraging its global channel partner program. These partners are key to expanding connected technologies and delivering value across various regions. Participation in industry events like ENTELEC 2025 and IoT Solutions World Congress 2025 also helps showcase innovations and attract new clients. In 2024, new customers included financial institutions, green energy companies, and agriculture organizations, demonstrating a broad acquisition across diverse verticals.

Customer retention is a priority, with strategies including comprehensive solutions that offer quick ROI. Post-purchase engagement, loyalty programs, and personalized experiences are also crucial. Data analytics and CRM systems are used to track customer behavior and tailor marketing campaigns. The company's commitment to continually enhancing its existing portfolio, including its Digi Accelerated Linux operating system (DAL OS) and Digi Remote Manager (Digi RM), ensures that solutions meet evolving customer requirements for security and updates, fostering long-term loyalty.

The company targets high-value customers through its global channel partner program. These partners are essential for expanding connected technologies and delivering value across different regions. This approach ensures a targeted and efficient customer acquisition process.

Participation in industry events like ENTELEC 2025 and IoT Solutions World Congress 2025 serves as a platform to showcase innovations. This helps attract new clients and demonstrates the company's commitment to staying at the forefront of technological advancements.

The company provides comprehensive solutions designed to offer a quick return on investment for customers. This includes packages like the Digi 360 package for cellular customers, which helps optimize IoT investments. Such solutions enhance customer satisfaction and retention.

Data analytics and CRM systems play a crucial role in tracking customer behavior. This enables the company to identify potential churn risks and tailor marketing campaigns effectively. This data-driven approach enhances customer engagement and retention.

The company's robust financial health, with $26 million in cash flow from operations in Q2 2025, also supports its customer acquisition and retention strategies. This financial strength allows the company to reduce debt and pursue strategic acquisitions, which can further enhance its solution offerings and customer value. For a deeper understanding of the business model, consider reading about the Revenue Streams & Business Model of Digi.

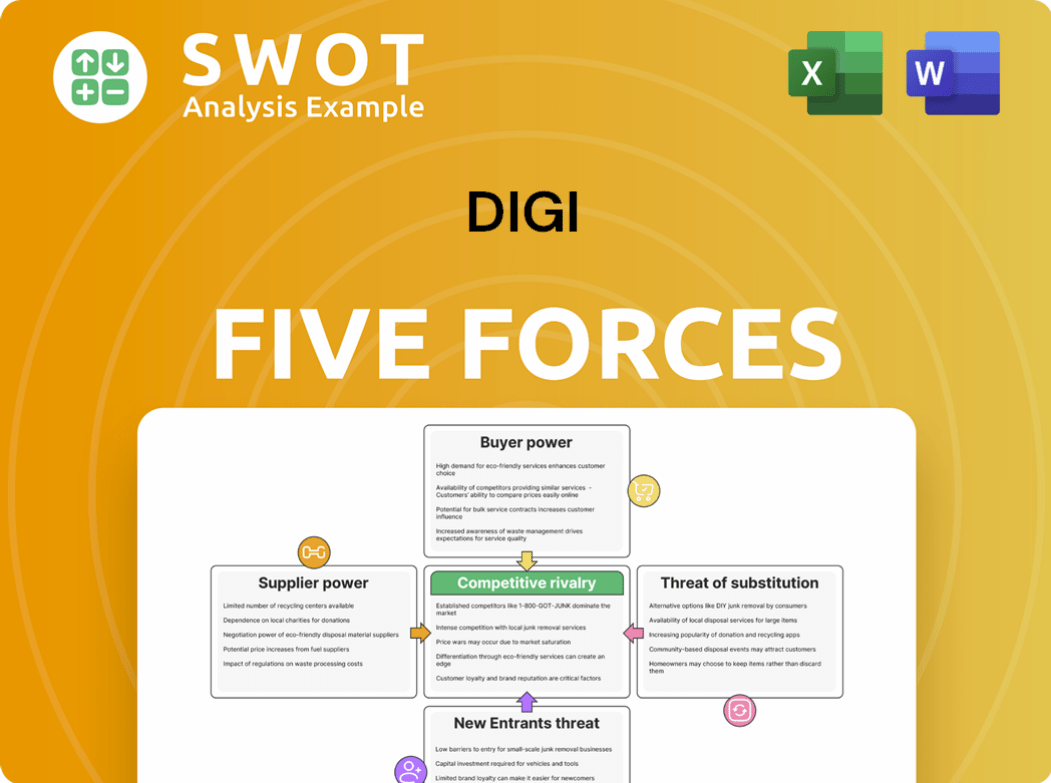

Digi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Digi Company?

- What is Competitive Landscape of Digi Company?

- What is Growth Strategy and Future Prospects of Digi Company?

- How Does Digi Company Work?

- What is Sales and Marketing Strategy of Digi Company?

- What is Brief History of Digi Company?

- Who Owns Digi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.